Ducks in a row

Lar España Real Estate has lined up its ducks ready for a growth push, having trod water successfully through the COVID-19 pandemic. The group has made significant headway in improving the environmental, social and governance (ESG) credentials of its more than €1.4bn shopping centre and retail park portfolio, so much so that it was able to refinance its borrowings through the issue of two ‘green’ bonds worth €700m, substantially lowering its cost of debt while increasing its maturity. It has also sold a non-core portfolio at a premium to book value and is now looking to sell further assets and recycle the capital into net asset value (NAV) and earnings accretive investments.

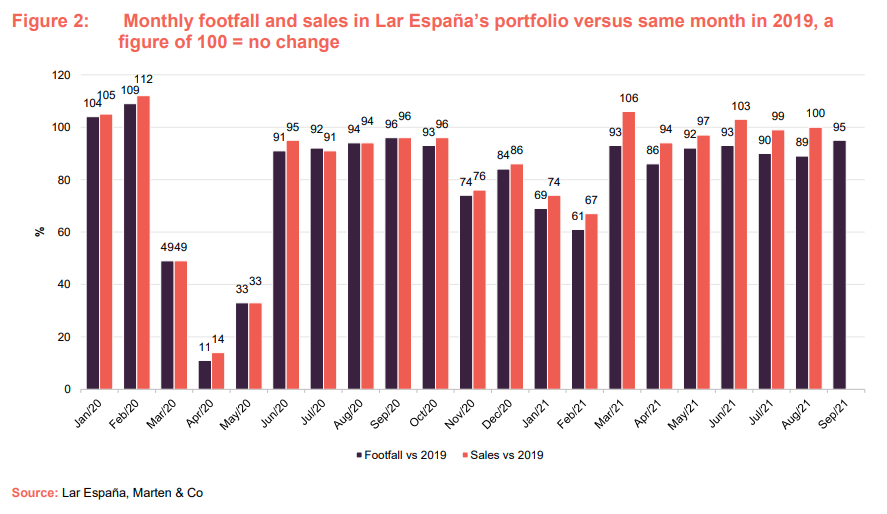

The value of Lar España’s portfolio fell just 0.4% in the first half of 2021 and the manager is confident of valuation uplifts in the near-term as the investment market returns to normal. The dominant nature of the group’s assets is reflected in the recovery of sales and footfall across its centres, which are 100% and around 90% of 2019 levels.

Exposure to Spanish retail

Lar España Real Estate aims to grow its EPRA net tangible assets (NTA) through active asset management of Spanish commercial real estate and deliver high returns primarily through the payment of considerable annual dividends.

At a glance

Share price and discount

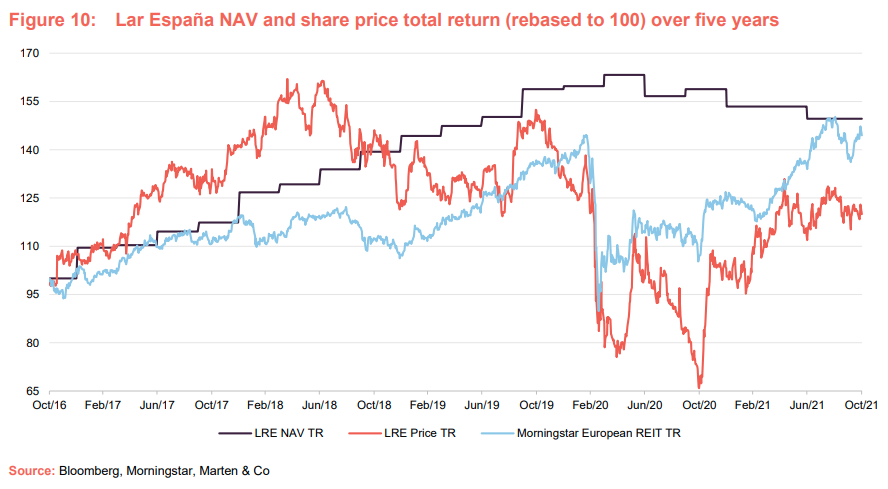

Lar España has traded at a discount to NAV since its inception in 2014. This fell to a historic low of 70% following the outbreak of COVID-19, with Spain being one of the hardest hit countries in Europe. It has since narrowed to 47.9% as footfall and sales figures have rebounded.

Performance

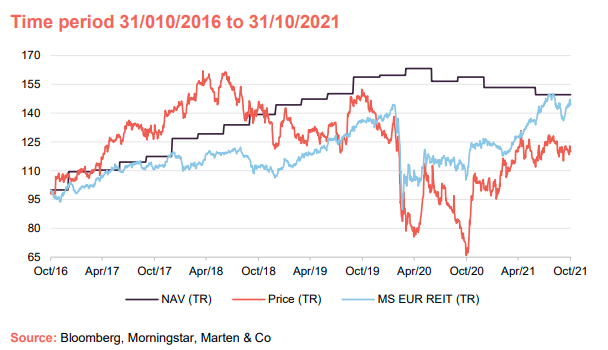

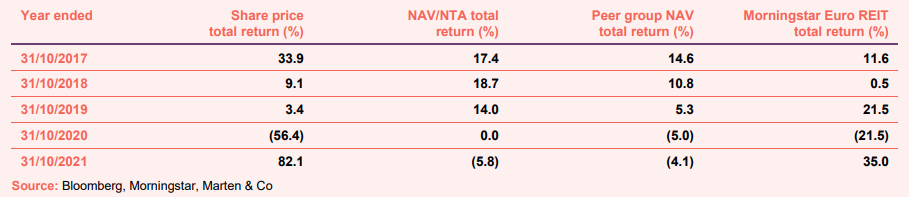

Lar España’s NAV grew strongly from launch as it bought properties and implemented value accretive asset management initiatives. The value of its portfolio has held up relatively well during the pandemic due to the dominant nature of the assets. Nevertheless, the fall in portfolio value has seen its NAV total return drop off. Over five years it has returned 49.6%.

Fund profile

Lar España Real Estate is a SOCIMI (the Spanish equivalent of a listed Real Estate Investment Trust (REIT)) that has been listed on the Madrid Stock Exchange since 5 March 2014.

Lar España was the very first Spanish SOCIMI to be floated. It was also the first listing on the Madrid Stock Exchange for three years, and the first listing of a real estate company in seven years. It was founded at the bottom of the Spanish property cycle when real estate prices were at record lows and the real estate market was entering a new cycle.

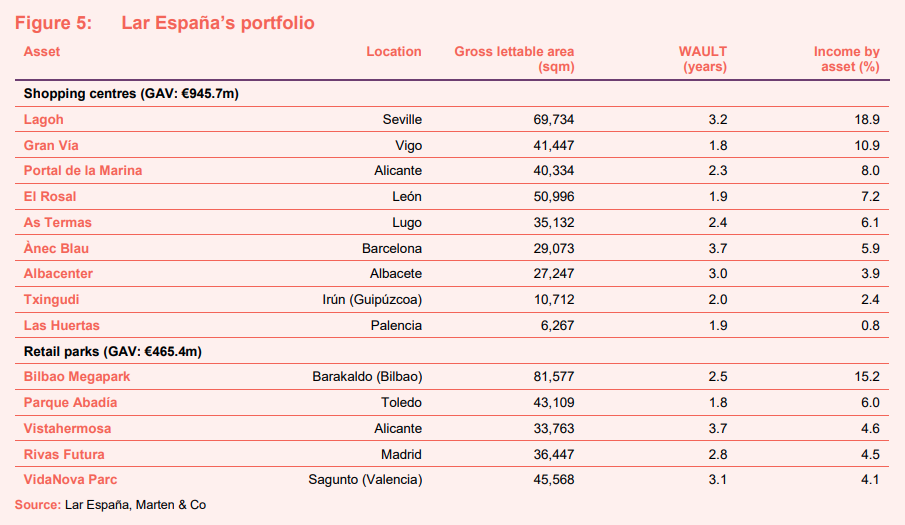

The company is focused on investment in real estate assets throughout Spain, in the retail sector. It aims to deliver high returns for its shareholders through the payment of considerable annual dividends and create value by increasing the company’s EPRA net tangible assets through active asset management. The group’s portfolio comprises nine shopping centres and five retail parks and was valued at just over €1.4bn on 30 June 2021.

Lar España is exclusively managed by Grupo Lar, a real estate company that has extensive experience in the sector. It boasts a large team of professionals that actively manage the portfolio to maximise its operational efficiency.

Retail in Spain

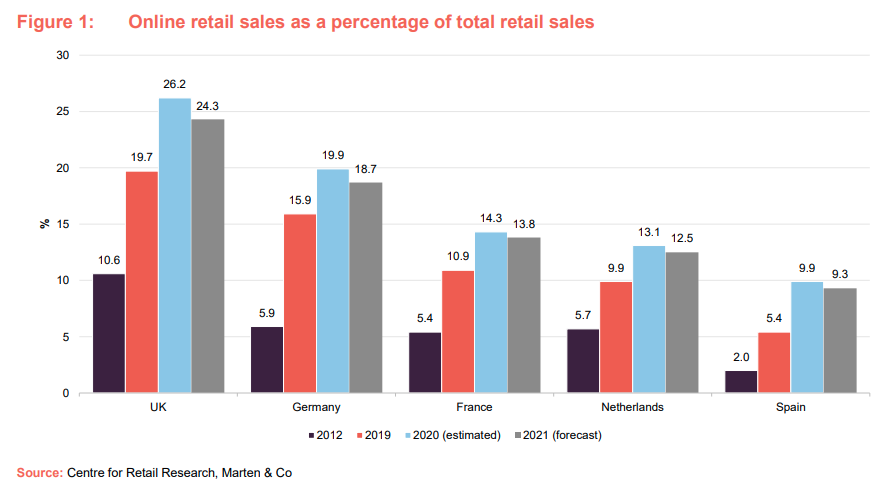

The impact of online retailing on the Spanish retail sector is not as severe as that which has been witnessed in the UK – where online penetration rates (retail sales as a percentage of overall retail sales) have grown exponentially over the past few years, accelerating during the COVID-19 pandemic and resulting in shrinking demand for physical retail space. In Spain, online penetration rates are far lower, as shown in Figure 1. This could be interpreted as online retailing having greater growth potential and future impact on the physical retail sector. Lar España’s manager, however, believes that outside of Madrid and Barcelona, online retailing penetration rates remain very low (below 5%). This is despite the response to the pandemic closing all but essential retail for large parts of the past 18 months. This, the manager says, may be down to a number of factors including poor infrastructure obstructing the effective operation of online retail.

The manager believes that many challenges to online retailing have yet to be considered or worked out, including how to deal with returns in a cost-effective manner, and sustainability issues. In any event, the manager says that more mature markets like the UK and Germany have given retailers and retail landlords in Spain unique insight into the future of retailing and a head-start in getting the infrastructure in place. The manager describes Lar España as an omnichannel business, meaning the assets in its portfolio serve both traditional retail and online retailing. As has been seen in other countries, click & collect will play an integral role in the online retail model in Spain, the manager says. Retailers using their store estates to fulfil online orders is not only more cost efficient but drives footfall and additional sales.

Inditex, one of the largest fashion groups in the world with brands including Zara, has invested heavily into its online platform and focused on occupying larger flagship stores that act as both shop and distribution hub. When before it would use 90% of the space as retail and 10% as storage, it is now looking at layouts more like 50/50. The manager says that the company is paying the same rent on the storage space as it does on the retail space.

A trend has also emerged for pure-play online retailers, such as Amazon and AliExpress (part of the Alibaba group – the Chinese online retail giant), to open physical stores, which the manager believes highlights the importance of an omnichannel strategy. While Amazon has moved into several retail units in the US and the UK, AliExpress opened its first store in Spain in the summer of 2020 and opened a physical store in Lar España’s Lagoh Shopping Centre in 2021.

Lar España has carried out refurbishments across a significant portion of its malls and retail parks to make them fit for omnichannel retailing, and boosted leisure provisions to drive footfall and dwell time. The manager says that store location is as important as ever, with retailers focused on the highest footfall locations where they can engage with consumers to showcase their brand. Dominant shopping centres, located in a large catchment area, are important for retailers as they move to an omnichannel strategy, it states.

Seven of the nine shopping centres in Lar España’s portfolio are classified as dominant, with catchment areas around 350,000 to 400,000 people and no significant competing retail schemes. To be considered as dominant, the assets must have a gross leasable area above 40,000 sqm, at least 4m visitors per year (footfall), above 90% occupancy levels, and have at least five critical retail operators. All of Lar España’s retail parks are also classified as dominant (here, the definition of dominant is at least 20,000 sqm, 3m visitors per year, above 90% occupancy levels). More information on Lar España’s portfolio is on page 7.

Portfolio performance during COVID

The COVID-19 pandemic had a devastating impact on the retail, leisure and hospitality sectors in Spain in 2020 and the early part of this year, as the government imposed lockdowns in a bid to stem the tide of cases and deaths. However, the rollout of the vaccination programme meant a reopening of non-essential retail was possible in March 2021, with other restrictions such as mask wearing mandatory.

In the first half of the year Lar España recorded 33.1m visits, representing a 28% uplift in like-for-like footfall compared with the same period in 2020. This performance puts it ahead of its retail peers, with the ShopperTrak index recording a 21% increase on 2020. In terms of sales, the first six months of 2021 saw a total of €377.5m spent in Lar España’s properties, which is 38% higher than last year’s figure. Making a fair comparison between 2021 and 2020, when both periods had some form of differing lockdowns and restrictions, is hard. A better comparison of the bounce back in footfall and sales is with the first six months of 2019. Despite the various restrictions in place during the first six months of 2021, especially notable in the first two months, footfall is down 16% and sales down just 8%.

The level of footfall and sales bounce back experienced after both the first national state of emergency, which lasted from 14 March to 21 June 2020 and involved a full lockdown or non-essential retail, and the second state of emergency, which consisted of partial lockdowns between 25 October 2020 to 6 May 2021, gives the manager confidence in the strength of the portfolio.

The company has worked closely with its tenants throughout the period and in the early months of the pandemic to reach an agreement on rent under conditions that the manager says represent a great commitment on both sides. As part of negotiations, rent-free periods were given in return for extensions to the lease term. As a result, occupancy has remained high and at 30 June 2021 was at 95%.

The group completed 35 lease operations in the first half of this year (21 renewals, five relocations/re-lettings and nine new lettings). These renewals and lettings were at a 2.1% premium to the previous rental levels, excluding non-comparable operations.

Portfolio valuation holding up

In half year results, Lar España reported a 0.4% fall in the value of its portfolio, on a like-for-like basis in the six months to 30 June 2021, to €1,411m. This slight decrease, versus an average fall of 2.1% among its peers, was down to the portfolio’s estimated rental value (ERV) being maintained over the period – €96.484m at 31 December 2020 compared to €96.433m at 30 June 2021 – as confidence and transactional evidence returned to the lettings market.

In the whole of 2020, Lar España’s portfolio fell in value by 4.9%, versus a fall of around 10% among its peers, which the manager says reflected the quality nature of the assets. As investment transactions in the shopping centre and retail park sectors pick up in the rest of 2021 and into 2022, the manager expects yield compression within the portfolio resulting in valuation gains.

Asset allocation

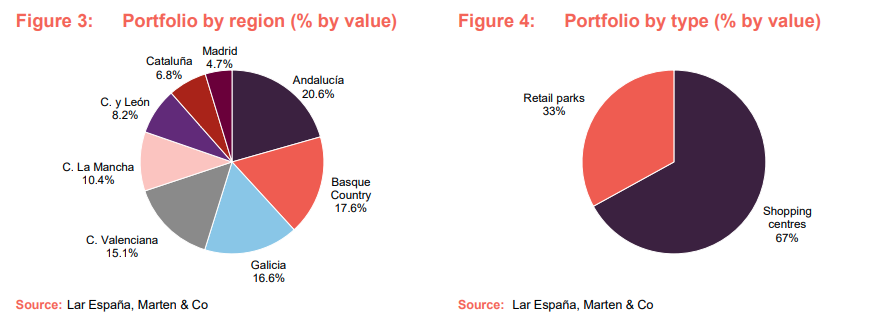

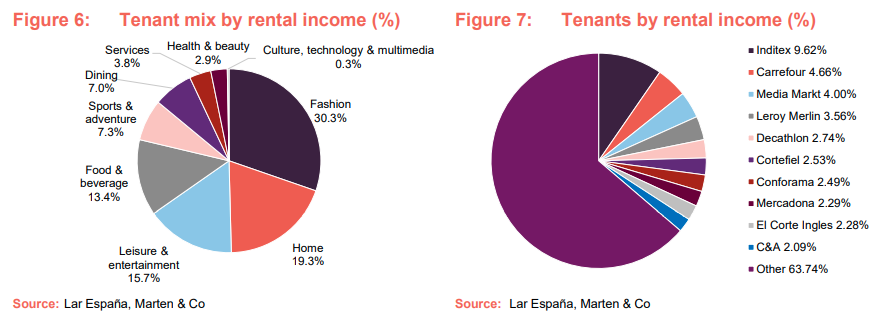

Lar España’s portfolio was valued on 30 June 2021 at just over €1.4bn. It comprises nine shopping centres and five retail parks. It has a diverse range of tenants, as shown in Figures 6 and 7, with an occupancy rate across the portfolio of 94.7%. Its 10 main tenants account for 36% of the company’s rental income, while 65% of leases had expiries beyond 2024. The portfolio has a weighted average unexpired lease term (WAULT) of 2.6 years.

Lagoh shopping centre

The largest asset in Lar España’s portfolio, the company bought the site of the Lagoh shopping centre in March 2016 for €38.5m and completed the development of the 69,734 sqm mall in 2019. It opened its doors in September 2019 and is home to a range of retailer and leisure brands. The centre comprises 148 stores.

It is located in the centre of Seville, the fourth-largest city in Spain, which has a population of 676,000 and 1.5m in the Greater Seville metropolitan area. Despite the demographics, the Lagoh shopping centre is the first dominant shopping centre in the Greater Seville area.

The brand-new shopping centre was designed with technology and sustainability at its core. Technology initiatives at the mall include a sensor system that monitors visitors’ flow around the centre and use of space, which can inform prime footfall areas and marketing decisions. Sustainability features include solar panels providing low-carbon electricity and geothermal technology. Energy provided to the whole complex is 100% renewable and the scheme has been awarded the BREEAM Sustainability Building Certification.

Bilbao Megapark retail park

Megapark is the largest retail complex in the Basque Country and the fourth largest in Spain, covering a total area of 128,000 sqm, of which Lar España owns 81,577 sqm. It is the only retail park within a radius of 400 kilometres and is the leading scheme in the Bilbao area, with a catchment area of more than 2.2m people.

Developed in 2007, Lar España bought its holdings in two separate deals in 2015 and 2017 for a combined €178.7m.

Comprised of 81 retail units and 8,200 car parking spaces, Megapark is home to leading international retailers, such as Ikea, Mediamarkt and Leroy Merlin, and hosts the cinema with the highest box-office turnover in the Basque Country.

Strong ESG credentials

In October, Lar España obtained a rating in the Global Real Estate Sustainability Benchmark (GRESB) assessment of 86 out of 100, which was a 25% increase on its score in 2020 and a 57% increase on its 2019 score. GRESB is the global ESG benchmark and reporting framework for the property sector, both listed and non-listed, and is one of the world’s leading sustainability indices. The average score among its thousands of participants is 73 out of 100.

Lar España decreased energy consumption and carbon emissions from its portfolio throughout the year, thereby improving its 2020 score of 69, through many initiatives including conducting waste management and energy efficiency plans, implementing a data automation programme across its portfolio that records energy consumption and emissions data and improving environmental requirements in refurbishment projects.

Around 90% of the group’s assets are BREEAM-certified, most with an ‘excellent’ or ‘very good’ rating, after the group renewed six certifications during the first half of 2021 achieving a higher rating than previously obtained. The group is also working on the certification of two remaining retail parks uncertified. The strength of the group’s ESG credentials enabled it to issue two ‘green’ bonds for a total of €700m (details of which are on page 13) that come with far more attractive interest rates.

Non-core asset disposal, new investments on the horizon

In February 2021, Lar España sold its supermarket portfolio, which was made up of 22 assets let to Eroski, for a total price of €59m. The sale price was 2.2% ahead of the last valuation of these assets made in June 2020 and represented a capital gain of 24% on the acquisition price paid by the company in March 2017. The portfolio had been on the market before the pandemic, but the sales process was halted when the pandemic struck. During this period, supermarket assets increased in value due to the resilient nature of the income and their status as essential retail. The manager says it decided to sell the supermarkets as they were not in line with its investment strategy and there was little chance of improving the rental income from them.

The manager says with the group’s strong cash position (it has €167.4m in the bank) and its debt refinancing strategy complete (detailed on page 13) it has turned its attention to new investments. It may look to sell some assets where it has completed its asset management strategy and reinvest the proceeds into new assets that fit its investment criteria (large, dominant centres that have capital and rental growth potential). It says it is analysing potential assets and may make investments in 2022.

Performance

Lar España’s NAV/NTA total return has grown strongly since its launch due to acquisitions and value accretive asset management initiatives, such as refurbishments and redevelopments, as well as a strong dividend policy. The value of its portfolio has held up relatively well during the pandemic due to the dominant nature of the assets and consistently high occupancy rates. Nevertheless, the fall in portfolio value and the impact on its earnings and dividend (more information on page 12) has seen its NAV total return drop off. Over five years it has returned 49.6%.

Peer group analysis

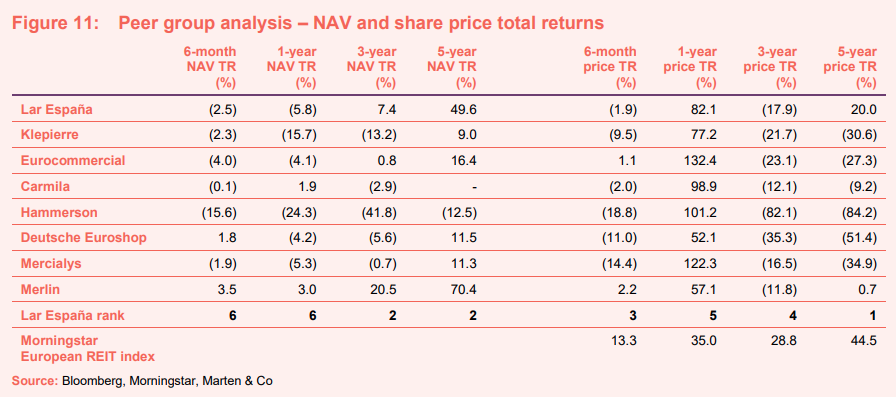

We have put together a comparison of Lar España’s listed peers in Europe, including pan-European and country-specific retail landlords and a Spanish peer. The peer group we have assembled consists of: Klepierre, Eurocommercial and Carmila – which are pan-European; Hammerson (UK), Deutsche Euroshop (Germany) and Mercialys (France) – which are country-specific; and Merlin – which owns Spanish real estate predominantly in the office sector. We have also used the Morningstar European REIT Index as a comparator on share price returns.

Figure 11 shows Lar España’s short- and long-term performance versus its peers. It has significantly outperformed most over a three-year and five-year period, in NAV terms.

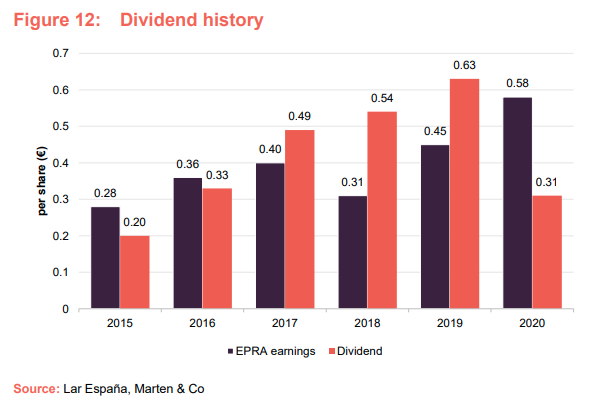

Dividend

Lar España pays a dividend once a year, in accordance with the SOCIMI rules. It has consistently distributed a high level of dividend to shareholders since its launch and declared and paid a dividend of €0.31 per share in May this year, corresponding to the performance in 2020, equating to a dividend yield of 5.8%. This was less than in previous years due to the impact of the pandemic on earnings in 2020. Next year, the group plans to distribute 50% of the capital gain it received from the €59m sale of its supermarket portfolio in addition to its ordinary annual dividend.

Lar España’s EPRA earnings per share were less than its total dividend payment in 2017, 2018 and 2019.

Bond issuances strengthen balance sheet

Lar España has raised €700m through the issuance of two unsecured senior green bonds this year (€400m in July and €300m in October). The €400m bond, which was more than four times oversubscribed, matures in 2026 and has a fixed annual coupon of 1.75%. The €300m bond, which five times oversubscribed, has a fixed annual coupon of 1.84% and matures in 2028. The rating agency Fitch assigned an investment grade or BBB (stable) rating to both Lar España and the green bond issues. The company will use the proceeds of the bonds to refinance the debt held on certain assets, bringing its debt structure to fully unsecured (not secured against a property). The refinancing also reduces the average cost of debt from 2.2% to 1.8% and extends the average debt maturity from 2.6 years to more than six years.

The €400m green bond will refinance €267m of debt that had been due to expire in 2022 and 2023. The company also launched a public offering to buy back the secured senior simple bonds, issued in February 2015 for a total of €140m, that matures in 2022. The second green bond will refinance €246m of mortgage debt.

After the bond issuances and refinancing, the company’s debt structure will be 100% unsecured. The group had net debt of €752.6m at 30 June 2021 and €167.4m in cash reserves, determining a loan to value (LTV) ratio of 41%.

In October 2021, the company completed its third share buyback programme, in which it acquired just over 3.9 million shares for a total of €20.8m and an average price of €5.27 per share. This was a 48.2% discount to its NAV at 30 June 2021. The manager says a fourth share buyback plan may be initiated in due course.

Previous publications

QuotedData published an initiation note on Lar España in December 2020. You can read the note, Built to last, by clicking the link.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Lar Espana Real Estate.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.