GCP Infrastructure

Investment companies | Annual overview | 07 February 2023

Green is good

GCP Infrastructure (GCP) has seen an improvement in the tailwinds supporting its investment thesis, whereby the rise in UK inflation and power prices has driven a substantial, positive uplift in GCP’s NAV. This uplift has more than made up for the negative impact of the UK government’s levy on energy producers. GCP has also improved the quality of its ESG disclosures.

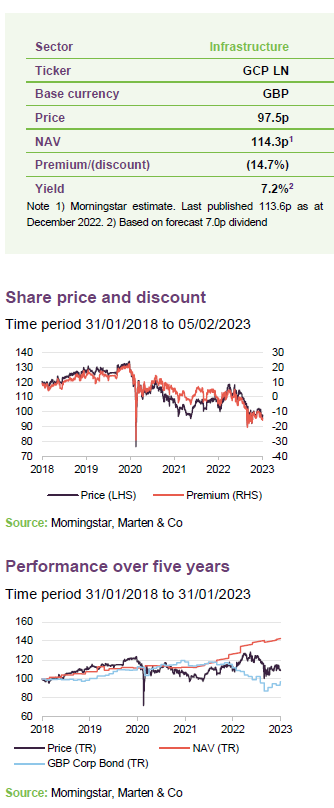

However, GCP has moved to trade on a historically wide discount, currently 14.7%. This may be a reflection of the wider pressure on bond yields that has been felt globally, although as a result, GCP now offers one of the highest yields of its peer group.

Public-sector-backed, long-term cashflows from loans used to fund UK infrastructure

GCP aims to provide shareholders with regular, sustained, long-term distributions and to preserve capital over the long term by generating exposure primarily to UK infrastructure debt and related and/or similar assets which provide regular and predictable long-term cashflows.

GCP primarily targets investments in infrastructure projects with long-term, public-sector-backed, availability-based revenues. Where possible, investments are structured to benefit from partial inflation-protection.

Fund profile

GCP offers a portfolio of renewable energy, social, and PFI/PPP type investments; under pinned by reliable, long-term income. With the ESG credentials of GCP being clear.

GCP Infrastructure Investments Limited (GCP) is a Jersey-incorporated, closed-ended investment company whose shares are traded on the main market of the London Stock Exchange. GCP aims to generate a regular, sustainable, long-term income while preserving investors’ capital. The fund’s income is derived from loaning money at fixed rates to entities which derive their revenue, or a substantial portion of it, from UK public-sector-backed cashflows. Wherever it can, it tries to secure an element of inflation-protection.

In practice, GCP has exposure to renewable energy projects (where revenue is part subsidy and part linked to sales of power), PFI/PPP-type assets (whose revenue is predominantly based on the availability of the asset) and specialist supported social housing (where local authorities are renting specially-adapted residential accommodation for tenants with special needs).

The investment adviser

Gravis Capital Management Limited (Gravis) is the fund’s AIFM and investment adviser. It is also investment manager of GCP Asset Backed Income, and advises VT Gravis Clean Energy Income Fund, VT Gravis UK Listed Property Fund, VT Gravis UK Infrastructure Income Fund and VT Gravis Digital Infrastructure Income Fund. At 31 December 2022, it had assets under management of approximately £3bn.

Philip (Phil) Kent is the lead fund adviser, and is supported by an extensive team which includes Rollo Wright (Gravis’s CEO, who was co-lead manager until May 2018) and Max Gilbert. Stephen Ellis, who co-founded Gravis, provides strategic advice.

Phil joined Gravis from Foresight Group, where he had responsibility for waste and renewable projects, including large waste wood combustion projects and a pipeline of anaerobic digestion projects across the UK. His 11-year experience of the energy sector includes periods at Gazprom Marketing and Trading (latterly in its Clean Energy team) and PA Consulting’s Energy practice.

More information on the team is provided on page 12.

At 30 September 2022, the directors of the investment adviser – together with their family members – held 952,614 shares in GCP.

Quarterly update as at 31 December 2022

Over the three months ended 31 December 2022, GCP’s NAV rose by 0.79p to 113.59p. The accompanying statement noted that the general recent rise in overall market electricity prices had resulted in increased actual and forecast cash distributions to the company from its renewables investment portfolio, with increased long term prices being the primary driver and short term price decreases being partially offset by the company’s hedging arrangements.

Changes to power price forecasts added 2.00p to the NAV and an uplift in forecast inflation (based on OBR figures) added a further 0.50p. Offsetting that, the impact of the UK government’s electricity generator levy was to take 0.93p off the NAV. In addition, other valuation changes took off a further 0.78p.

Notable portfolio activity over the quarter included £46.4m advanced to support the prepayment of third-party debt secured against a portfolio of solar assets and a portfolio of renewable and PPP assets.

Results for the financial year ending 30 September 2022

NAV rose by 8.5% over the financial year ending 30 September 2022.

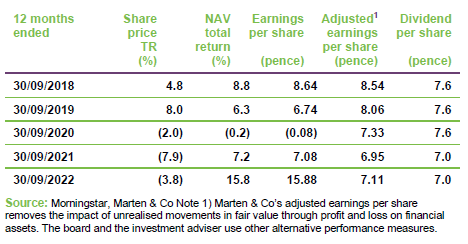

Over the six months ended 30 September 2022, GCP’s NAV rose by 8.5% to 112.80p. The NAV total return for the year was 15.8% and in share price terms the return was 3.9%.

Total dividends for the year were 7.0p per share, in line with the previous financial year, so that GCP is trading at a yield of 7.2% (as of 03 February 2023). The same target dividend of 7.0p has been reaffirmed for the forthcoming financial year. Over the period, on the board’s adjusted earnings basis, dividend cover was 1.19 times.

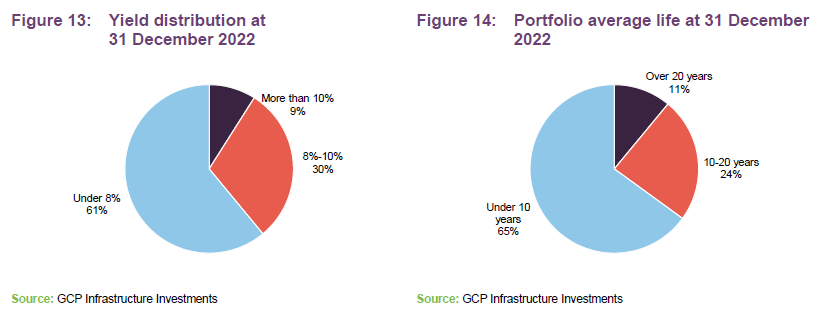

GCP currently has 48 holdings within its portfolio with a weighted average life of roughly 10 years. The investment advisor continues to diversify the different types of assets underpinning the trust’s revenues. To that end the team made two small but meaningful investments in the electric vehicle and flexible energy generations sectors, the first of their kind within GCP.

Other notable investment activity over the financial year includes the completion of a refinance of a waste wood biomass project in Northern Ireland, and the disposal of GCP’s interest in an offshore wind farm.

The two main positive factors affecting the NAV were rising power prices and higher inflation, which contributed the bulk of GCP’s positive revaluation. The UK government’s new energy levy, coupled with the rise in discount rates (related to higher interest rates), were a drag on GCP’s asset valuation over the period. Each of these is discussed in more detail in this note.

Market outlook

GCP’s investment advisers have outlined a variety of prevailing macro factors that are influencing the outlook for the wider renewable energy sector; a mixture of both positive and negative factors which may offer greater upside potential, but also heightened volatility.

Energy profits levy

GCP has already accounted for the energy generator levy.

One directly-disruptive change that has occurred over GCP’s financial year has been the implementation of an energy profits levy (windfall tax) by the UK government on the profits made by energy generators. We outlined such a possibility in our last note, given the combination of an unfunded government budget, increased profits within the renewable energy generation sector and the UK government’s fiscal deficit. Whilst there was a previous uncertainty around if and how such a policy would take shape, the Sunak government has now legislated for its implementation.

The levy applies from 1 January 2023 and runs until 31 March 2028. Non-fossil fuel generators generating electricity from nuclear, renewable, biomass, and energy from waste sources are required to pay a tax of 45% of their excess revenue from sales of power generated in the UK above a level of £75/MWh from 2023 to April 2024, and thereafter adjusted each year in line with the change in inflation (as measured by CPI) on a calendar-year basis.

The definition of revenue includes the impact of any hedging or forward sales of power, and excludes income from FiTs, the sale of ROCs, and capacity market payments. It will not apply to electricity generated and used under a private wire arrangement or “behind the meter” generation that is not exported. The levy does not apply to revenues derived from battery storage, and sites that incorporate both renewable energy generation and battery storage will have to separate power generated from power re-exported to the grid for the purposes of calculating the levy.

The tax does not apply to generators whose in-scope generation output of electricity is less than 50GWh per year (reduced from 100GWh at the time of the autumn statement) and also does not apply to the first £10m of excess revenue. The levy is administered via the corporation tax system and paid by the responsible company in a group of companies.

At its 30 September 2022 year end, the GCP team assessed the impact on a conservative basis and believed that it would take 1.5p per share off the NAV. The impact is offset by the wider macro tailwinds, which we outline subsequently in this note.

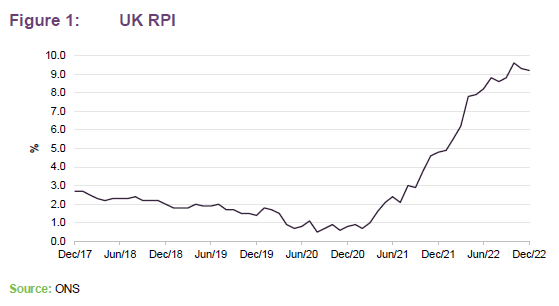

Continuing inflation

One of the common themes of this market backdrop will be the continuing impact of the dominant trends of our last note. Inflation, for example, is a tailwind for GCP, given that approximately half of its investments have some form of inflation linkage. From an asset allocation perspective, GCP offers investors a way to purchase an inflation-linked fixed-income strategy without purchasing conventional inflation-linked bonds, which offer lower returns.

We note that higher inflation also has some negative effects, as it has driven up both O&M and component costs for various forms of energy generation, and may also have some impact on input costs for anaerobic digestion and biomass plants, which we detail in the risk section later in this note. Ultimately however the GCP team believe that the overall impact of inflation will continue to be positive for the value of the trust.

Peak power prices

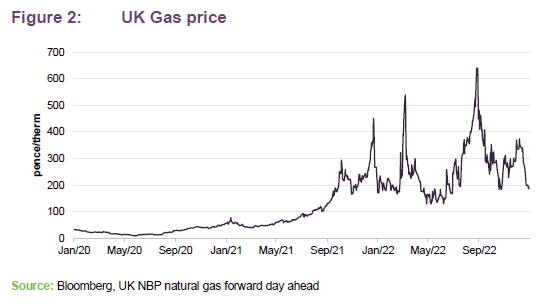

Rapidly rising power prices and inflation rates have been a major boon to GCP.

Going hand-in-hand with UK inflation are higher power prices. Currently, the direction of UK power prices appears to be primarily driven by the spot price of gas, which has steeply increased over 2022 due to the advent of the Ukrainian conflict. However, prices have fallen substantially since our last note, helped by European economies successfully sourcing alternatives to Russian gas, and relatively warm weather.

However, while power prices have fallen since our last note, they remain high relative to their pre-2022 levels. Whilst the shift from Russian gas has helped alleviate the near-term extremes that we have seen, gas prices may remain elevated from their pre-war levels, given that there has also been a growth in the global demand for gas in general, driven by a revitalisation of economies post-COVID-19, particularly in Asia.

The rise in electricity prices over 2022 has been the dominant driver in positive revaluation for GCP over their financial year.

Interest rates

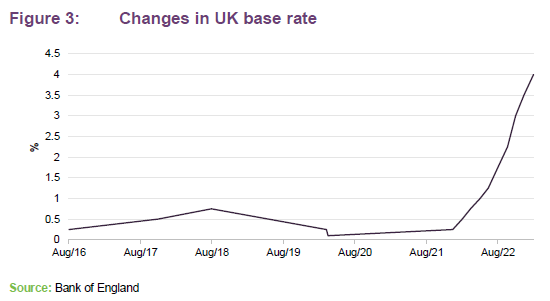

One consequence of higher inflation tends to be higher interest rates, with the Bank of England continuing in its attempts to rein in UK inflation. As can be seen in

Figure 3, the rate of increase in the UK base rate has only accelerated since our last note; this now sits at 4.0%. Rising interest rates can have negative implications for GCP’s returns on existing investments, both through rising discount rates as well as the increased cost of debt.

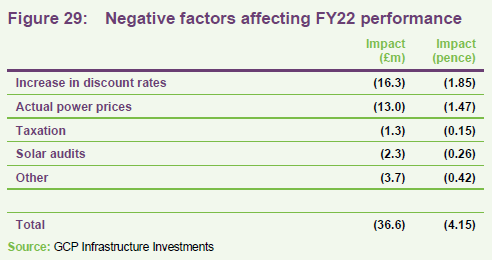

GCP’s independent valuer, Mazars, has made adjustments that raise the weighted average discount rate on GCP’s portfolio by about 30 basis points, equal to a negative 1.85p per share impact.

The team has ensured that when GCP has exposure to floating rate borrowings (for example, via mezzanine finance), it has hedged this exposure. More detail is provided in the gearing section on page 34.

Structural opportunities remain

Away from the distractions of macroeconomics, the strategy ought to be helped by the UK’s possibly structural shift towards more renewable energy production, as well as the evolving global energy markets. GCP should benefit from the structural opportunities presented by the UK government’s legally-binding commitment to achieve carbon neutrality by 2050, and its interim target of reducing emissions by 78% by 2035 (in accordance with the UK’s sixth Carbon Budget set in 2021), which will possibly increase the amount of financing required for renewable energy and infrastructure projects over coming years. As a result, government support schemes for renewable infrastructure and energy efficiency may continue for some time.

Despite the recent tailwinds, GCP will continue to benefit from the long-term trends supporting renewable and social infrastructure spending.

GCP could also assist in providing financing solutions to numerous societal concerns that can only be addressed with additional investment, such as the need to house a growing and ageing UK population, through its social housing investments. The GCP advisory team has, in its recent annual report, outlined five distinct societal and environmental challenges that present GCP with possible future investment opportunities. Not all of these opportunities are likely to manifest as tangible investment opportunities for GCP over the near-to-medium term, however, given either the lack of private investment opportunities currently (as is the case with the need to bolster flood defences), or investment opportunities arising in what the adviser believes to be overly competitive markets, such as digitalisation. The team believes that over the next two to three years, the most attractive investment opportunities will be associated with decarbonisation, addressing high energy prices and energy security of supply.

Unlisted advantages

While we outline the details of the advisory team’s investment approach in our next section, it may be worth outlining the practical advantages of GCP’s investment philosophy.

Irrespective of the nature of the underlying cashflows – be they inflation linked or otherwise – the large majority of its revenues are backed by public-sector cashflows. Furthermore, whilst GCP cannot be assigned a credit rating in the same manner as a conventional debt strategy, the state-backed nature of its underlying revenues has the capacity to take a large amount of the credit risk off the table. By focusing primarily on infrastructure debt, the cash flows are often highly predictable, which (outside of periods of energy price weakness), allows for good risk management by GCP’s advisers as its investee companies have greater visibility of their cash flows when compared to a non-infrastructure debt issuer, whose earnings are far more sensitive to broader economic activity and the skill of their management teams.

However, that is not to say that GCP is not without risk, as it has been forced to either restructure debt or take on equity stakes in companies during periods of financial difficulty, with examples given later in this note. In practice there has been a 0.18% aggregate downwards revelations to GCP’s NAV, annualised since its IPO in July 2010. Nevertheless, GCP’s ability to take a pragmatic position during these moments is an advantage of its closed-ended structure. Rather than running into difficulty due to rigid investment restrictions, as an open-ended fund might, GCP is afforded the freedom to resolve these situations in shareholders’ best interests, even if that means holding onto non-debt investments until they can be disposed of at more attractive valuations.

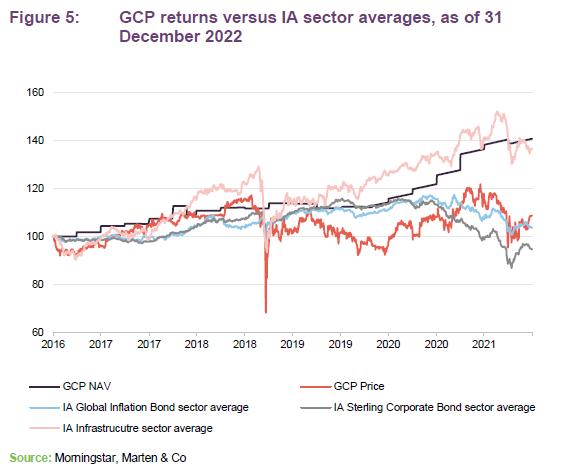

Figure 5 shows the relative NAV performance of GCP versus those of three apparently-closely-related Investment Association (IA) sectors (which represent a large number of UK-listed open-ended investment strategies) – infrastructure equity, sterling denominated corporate bonds, and global inflation linked debt. As can be seen in Figure 5, GCP’s NAV returns have kept pace with those of infrastructure equity, despite the additional risk protection provided by its place in the capital structure of the underlying investments.

GCP’s share price returns have, however, shown a greater correlation to bond portfolios.

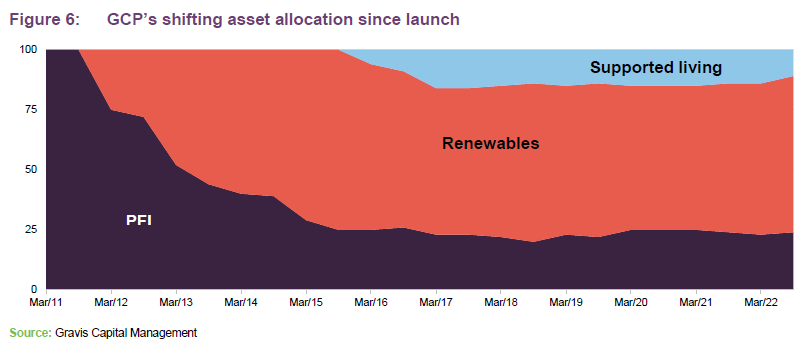

Portfolio evolution

GCP’s diversification continues to improve, with its advisors looking to reduce the portfolio’s risk profile thanks to the recent tailwinds.

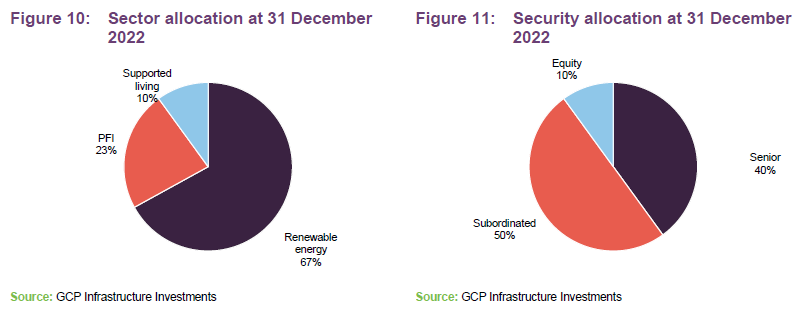

In an earlier note we explored the evolution of GCP’s portfolio since its inception, with new asset classes being added over time. The most obvious change has been the shift towards renewables, which now account for the majority of GCP’s portfolio (some two-thirds). It will always be the intention of the advisory team to seek diverse opportunities for GCP, both in terms of tapping into the most attractive risk-reward opportunities and to ensure that GCP continues to diversify its underlying cash flows.

New types of investment

Over the financial year, GCP made two small investments in new asset types, one being into a fleet of electric taxis, and the other a flexible energy producer. Electric taxis offer a novel, differentiated way to gain exposure to the decarbonisation theme outlined earlier. GCP will act as financier to a leasing company to purchase a fleet of black cabs to be leased out to operators. The cashflows that GCP will receive are effectively asset-backed straight payments and unlinked to any variable metric such as inflation. GCP’s advisors have also structured the deal in a way that protects them as lenders, where if the operator were to enter financial difficulty, then the lease can easily be transferred to another operator, substantially reducing counter-party risk.

Given the increase in yields, the advisory team feels that the risk-return profile of GCP’s pipeline of potential investments has become increasingly favourable, thus posing the question of whether GCP should increase its returns and retain the historical level of risk or reduce risk for similar levels of return as the existing portfolio. The advisory team has indicated that it will likely take the opportunity to reduce GCP’s future risk profile, rather than chase higher returns. To that end, it has also indicated that it may sell down the portfolio’s small equity exposure, recycling it into lower risk debt assets.

Investment process

Restrictions

GCP is predominantly investing in public sector banked projects, and renewable opportunities.

GCP invests at least 75% of total assets, directly or indirectly, in investments with exposure to infrastructure projects with the following characteristics (core projects):

- pre-determined, long-term, public-sector-backed revenues;

- no construction or property risks; and

- benefit from contracts where revenues are availability-based.

In respect of core projects, the company focuses predominantly on taking debt exposure (on a senior or subordinated basis) and may also obtain limited exposure to shareholder interests (equity).

The company may also invest up to 25% of total assets (at the time the relevant investment is made) in non-core projects. These might include:

- taking exposure to projects that have not yet completed construction;

- projects in the regulated utilities sector; and

- projects with revenues that are entirely demand-based or private-sector-backed (to the extent that the investment adviser considers that there is a reasonable level of certainty in relation to the likely level of demand and/or the stability of the resulting revenue).

There is no – and it is not anticipated that there will be any – outright property exposure (except potentially as additional security).

No more than 10% in value of its total assets (at the time the relevant investment is made) will consist of securities or loans relating to any one individual infrastructure asset (having regard to risks relating to any cross default or cross collateralisation provisions).

The portfolio should be diversified by asset type and revenue source.

Structural gearing of investments is permitted up to a maximum of 20% of NAV at the time that the debt is drawn down.

The investment adviser

Phil Kent leads the team that works on GCP, but the investment adviser has significant resources working on the fund.

Beth Watkins, Max Gilbert and Robin Olsen are analysts dedicated to GCP. GCP and GCP Asset Backed Income share an origination team of five, including Phil Kent. Members of staff monitor loans, keeping in regular contact with borrowers and monitoring covenants, and an administration team helps process payments. Matteo Quatraro is commercial director at Gravis, looking after GCP’s renewable energy investments, with assistance from Ben Rider, Technical Asset Manager.

GCP lends money to a relatively narrow group of sectors. The investment adviser may consider other infrastructure sectors or renewable technologies, but considerable due diligence is required before investing in new areas. As stated above, to be eligible as a core investment, a loan must have some backing from public-sector cashflows. This rules out unsubsidised solar and wind farms (which derive their revenue largely from PPAs), for example.

GCP is operating in relatively small markets. Some new business comes from direct approaches. Much of it is the result of introductions from lawyers and advisers with whom the investment adviser has worked before. Not much proactive marketing is necessary and the investment adviser steers clear of competitive auctions.

Ideally, returns on loans will have some inflation-linkage, but this is not always available. Even where it does exist in the portfolio, the relationship between returns and inflation may not be linear. Some loans have clauses that trigger higher rates if inflation spikes above a certain threshold, for example.

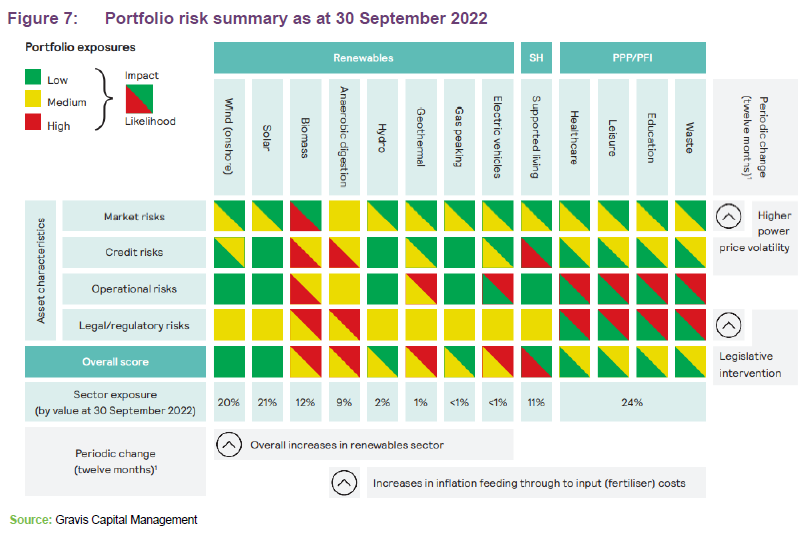

Exposures informed by rigorous risk analysis

While there is a possibly defensive element to GCP’s risk profile – thanks to the combination of regulated, often sticky nature of the underlying cashflows and the diverse range of revenues sources – a detailed understanding of GCP’s underlying risk exposures is still a necessity for the team. The approach is intended to be a cautious one; senior debt is favoured over subordinated debt when first making a foray into a sector, for example.

Gravis has compiled a matrix of their perception of risks across the various asset classes that GCP invests in.

In the adviser’s estimation, there has been an across-the-board increase in risk across all four asset characteristics over the financial year. It says that the major contributors to this are:

- the UK government’s announcement of a levy on the profits made by electricity generators, which we described earlier in this note. This has clearly increased the legal and regulatory risk for any strategy exposed to UK electricity generators;

- volatility increasing in parallel, despite the higher wholesale prices for electricity. This has led to greater uncertainty to the long-term outlook for the UK power prices, as well as the overall market structure going forward;

- anaerobic digestion projects having been hit by higher input costs – particularly fertiliser – which has hit profitability;

- the collapse in the wider renewable energy sector of a number of electricity suppliers that acted as off-takers for renewable projects, due to the costs associated with hedging their energy prices. Fortunately, GCP has no direct exposure to any impacted supplier; and

- the wider renewable energy sector having also been hit by the global supply chain issues, with there being less availability of replacement parts. However, this has yet to materially impact output levels.

Independent board sign-off every investment decision

Separate internal and external committees sign off on proposed investments.

Once the investment case has been established, potential investments are first submitted to an internal credit committee consisting of Nick Parker and Rollo Wright (all founders of Gravis Capital Management and members of its board of directors).

However, the final decision on each investment is the responsibility of the GCP board’s investment committee, made up of non-executive directors, independent of Gravis (see page 34). They will have been made aware of potential investments well before the formal business of the investment committee. The investment adviser says that the questions that they raise and the opinions that they put forward are invaluable to the investment process.

Every investment is through a loan to an intermediate company

GCP’s loans carry fixed interest rate coupons, albeit with some inflation protection. The company is permitted to use interest rate hedging. Where GCP holds subordinated debt, the investment adviser ensures that the senior debt ranking above it has been, where appropriate, hedged against movement in interest rates, through the use of interest rate swaps.

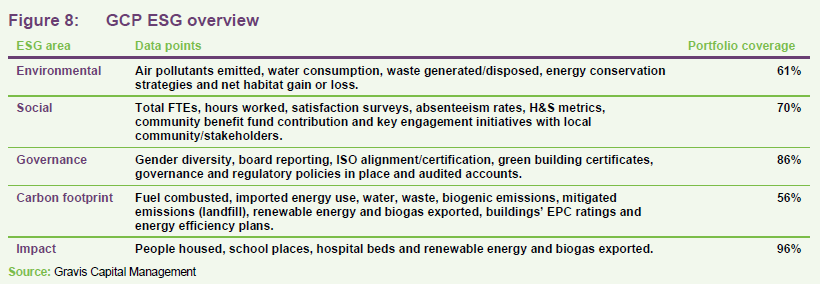

ESG evolution

GCP has made substantial strides in improving the ESG data it discloses.

With respect to ESG, almost everything purchased by GCP likely contributes to a sustainable future or better society in some way. In its 2022 FY, GCP carried out an extensive project to develop, quantify and finalise material ESG metrics from the underlying portfolio for the 12-month period to 30 June 2022. All of this data was generated in-house by Gravis, liaising with each asset operator. GCP appointed MJ Hudson as its external consultant to advise on the project and aid in establishing a reporting framework under the guidance of SASB, GRESB, and the UN SDGs – major global ESG standards. We cover GCP’s general approach to ESG integration in our prior note, a process which we remind readers includes an intention to run GCP’s operations on a carbon-neutral basis by 2023. A summary of the data gathered by the new project is presented in Figure 8.

Environmental

GCP currently has 65% of its portfolio invested in renewable energy projects. GCP’s investments in renewable assets provide alternative energy sources to fossil fuels. Additionally, biomass and anaerobic digestion projects within the portfolio recycle many types of waste to produce sustainable fertilisers. Given that the majority of GCP’s assets are invested in renewable infrastructure projects, GCP’s largest positive benefits are environmental. These benefits include:

- 1,429 GWh of renewable energy exported by GCP’s portfolio assets;

- The equivalent of 438,000 homes powered by renewable assets; and

- 48% of GCP’s assets report energy conservation plans.

GCP and the investment advisor are also seeking to encourage – if not dictate – the decarbonisation of existing buildings, including energy efficient retrofit programmes. One possible future example is the addition of hydrogen production to optimise an existing wind farm within GCP’s portfolio.

Social

GCP’s investments in renewables, PPP/PFI and social housing projects either directly or indirectly improve the wider UK society. In the case of social housing, the benefits are clear as it directly addresses the shortfall of specialist supported living accommodation, and GCP’s investment activities also create job opportunities in supply chains to the benefit of local communities across the UK, an indirect advantage.

Within its PPP/PFI assets, GCP can demonstrate investments which have directly impacted UK society, such as financing 49 schools and thereby offering c.26,000 school places, and 41 healthcare facilities, providing beds to c.2,000 patients. GCP’s reported social outcomes are as follows:

- £2.8m in contribution of renewables portfolio to CBF’s since IPO;

- 3,119 people housed in supported accommodation; and

- £166.7m invested in supported living projects since IPO.

Governance

The adviser aims that the implementation of high-quality governance policies is ubiquitous across all of GCP’s investments. Nonetheless, the investment adviser engages with the underlying assets’ boards in order to improve and enhance the governance at the portfolio level, where they see fit. Governance at the SPV level was a particular focus for the year; the investment adviser specifically focused on the gender composition of the boards of GCP’s SPVs, and a number of female directors were appointed, with the previous directors resigning their appointment. High-level outcomes from the governance policies of GCP are:

- 45% gender diversity of SPV company boards;

- 34% of portfolio assets visited in the year by value; and

- 92% of SPV’s with governance policies.

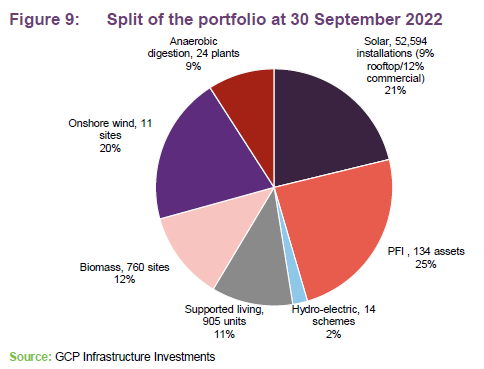

Asset allocation

At the end of September 2022, there were 48 investments in GCP’s portfolio, producing an annualised yield of 8.0% and with an average life of 10 years. The major change since we last published the note has been the inclusion of an 11% exposure to direct equity. This is split between a 7% exposure to anaerobic digestion firms and 4% to biomass (relating to a waste wood power station in Northern Ireland).

Other major changes include the disposal of the trust’s offshore wind investment which we discussed in our last note. The sale represented a c.12% premium to the year-end fair value.

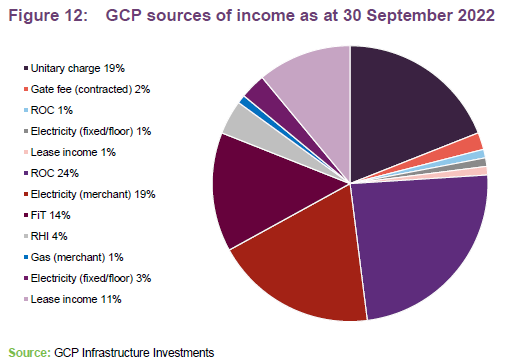

Figure 12 provides more information on GCP’s sources of income.

The majority of GCP’s sources of revenue can be viewed as being predictable and stable. Exposure to merchant electricity and gas accounted for just 20% of GCP’s revenue at end September 2022.

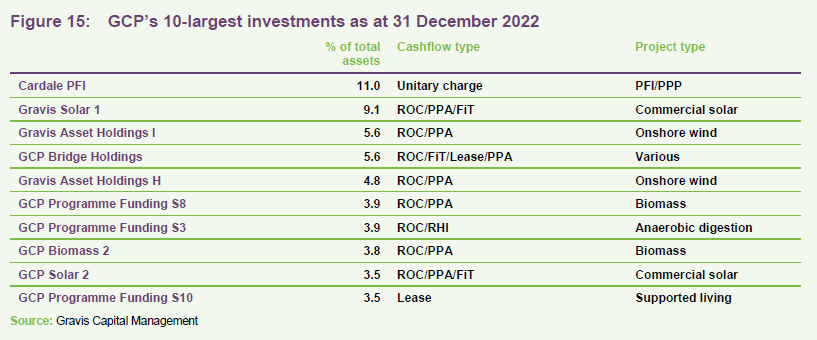

Top 10 investments

Transactions that occurred in the final quarter of 2022 increased the exposure to Gravis Solar 1 and led GCP Solar 2 and GCP Programme Funding S10 to replace GCP Green Energy 1 and GCP Rooftop Solar Finance in this table since we last published.

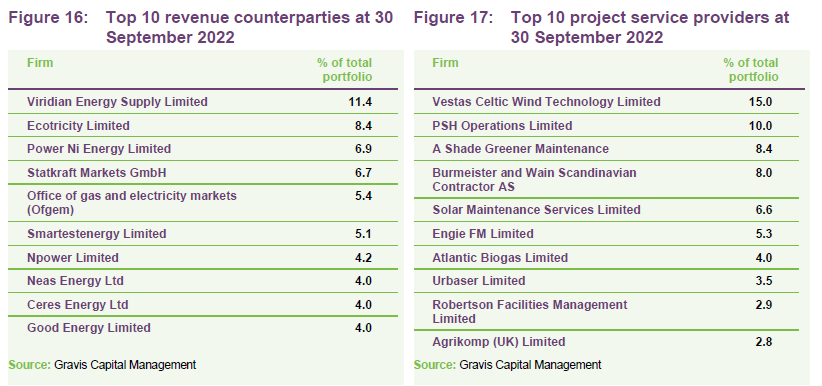

The major change since our last note has been the loss of Bespoke Supportive Tenancies Limited from the top revenue counterparties, which represented 6.8% of the portfolio as of 31 March 2022. The position fell from the ranking after a successful £83.1m refinance, moving from a senior to a subordinated position.

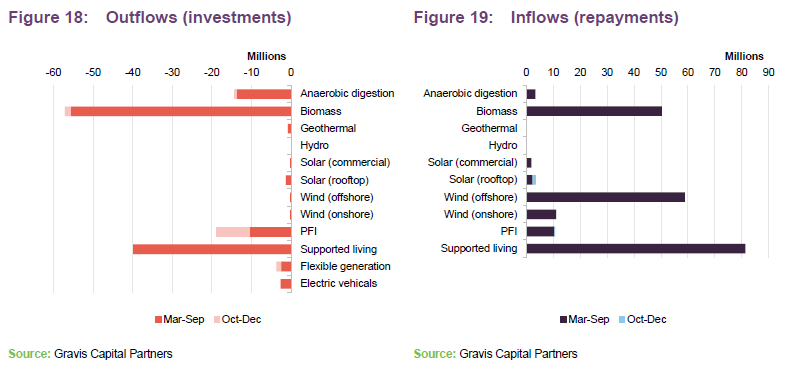

Recent investment activity – to 30 September 2022

Figures 18 and 19 show the recent investment activity within GCP’s portfolio up to the end of September 2022. The disposal of GCP’s offshore wind investment, as well as the various transactions within the biomass and supported living sectors are evident, some of which we have commented on in this note. Though small, the new investments into the flexible generation and electric vehicle sectors are also observable.

Developments over Q4 2022

Over the final quarter of 2022, GCP made five investments totalling £54.6m. This included £46.4m advanced to support the prepayment of third-party debt secured against a portfolio of solar assets and a portfolio of renewable and PPP assets, a further £7.2m advanced to flexible generation and storage projects, and further advances of £1.0m across two portfolios of anaerobic digestion plants.

Pipeline of potential new investments

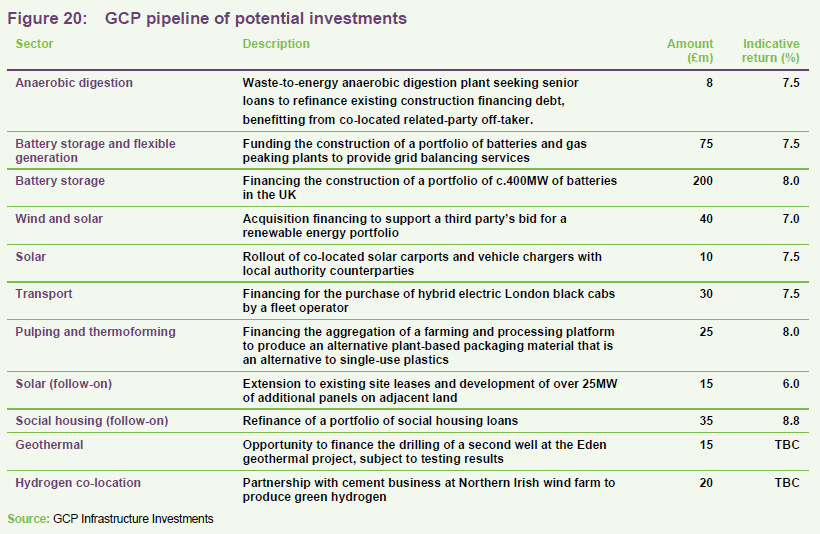

At 30 September 2022, GCP’s adviser had an active pipeline of around £388m of potential new investment opportunities and £85m in follow on opportunities under consideration (totalling £473m) that it felt would provide further diversification and support to the dividend.

These offered annualised indicative returns ranging between 6.0% and 8.5%, and were in a range of sectors, offering the chance to further diversify GCP’s revenue streams.

The largest nominal opportunity present was the possible battery storage portfolio that the advisors are currently working on, representing over half of the nominal value of the potential new deals. This may be particularly important for diversifying GCP’s portfolio, given the nominal size of the deal, but also the fact that battery storage would be a new type of revenue for the trust. Battery storage is particularly important in diversifying GCP’s existing energy generation exposure, as storage assets benefit from volatility in prices which are typically the result of the intermittency of renewable generation.

Valuation

Each quarter, the investment adviser and a third-party valuation agent (Mazars LLP) reassess the fair value of GCP’s financial assets. Values are based on discounted cash flows, where asset-specific market discount rates are applied to the contractual cash flows of each asset.

The valuation agent decides what the discount rates should be, taking into account:

- UK interest rates;

- changes in spreads for similar credits;

- observable yields on other comparable instruments;

- investor sentiment, activity and pricing in the primary and secondary markets for infrastructure investments; and

- changes to the economic, legal, taxation or regulatory environment.

The expected operational performance of the asset is factored into the valuation. Other factors, such as power prices and inflation rates, are factored in where appropriate. The valuations are reviewed by the investment adviser and the board. The directors review and approve the quarterly NAV before publication.

Conservative assumptions

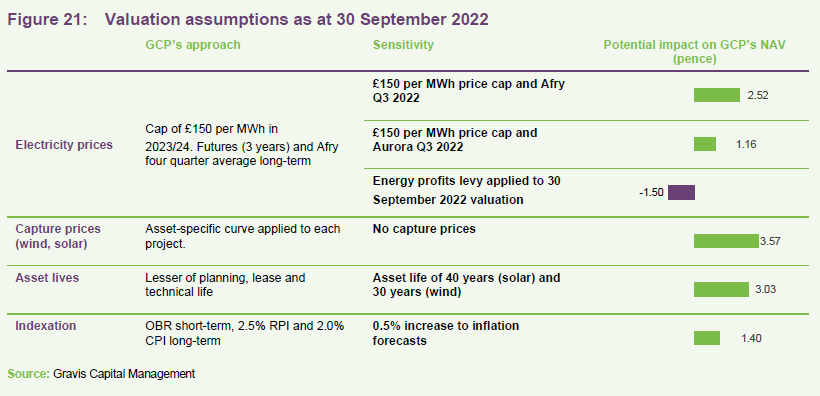

The below table shows how GCP’s advisors are approaching their current valuations assumptions. We describe some of the macro drivers behind their shifts earlier in the note.

As we have highlighted in many of our prior notes, GCP’s advisers aim to take a conversative approach to valuations, valuing companies towards the lowest value methodologies available to them. Such a conservative approach is admirable, as it reduces the likelihood and severity of any unexpected shocks to GCP’s NAV, e.g. a sharp reversal in wholesale gas prices. Note that valuation metrics do not affect the dividend pay-out nor the share price yield.

Sensitivities

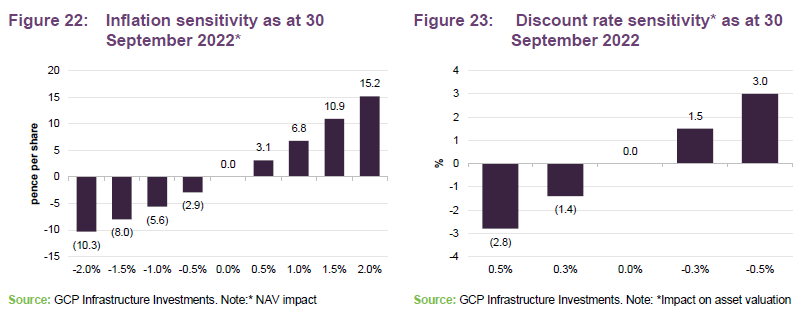

The investment adviser provides sensitivity analysis to a range of factors. Figure 22 and shows the impact of changes in inflation, while Figure 23 shows the sensitivity of GCP’s NAV per share to changes in the weighted average discount rate.

Performance

Performance

NAV progression

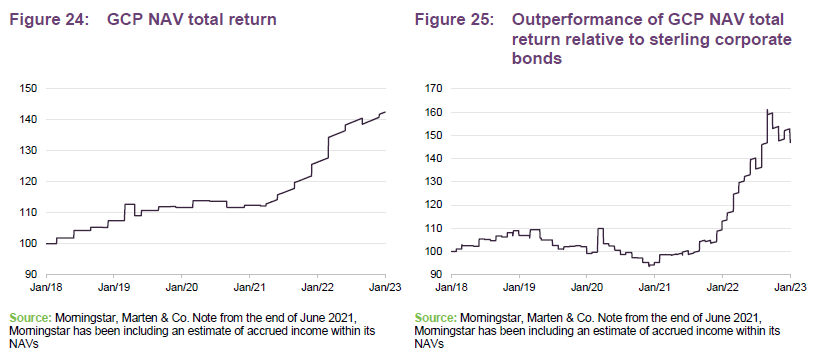

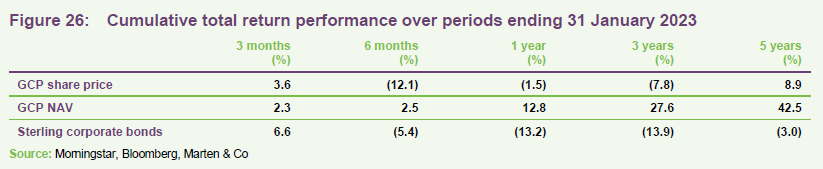

GCP does not have a formal benchmark, but the board chooses to compare its returns to those of a sterling corporate bond index, and we have done so here.

The uplift in power prices and inflation over 2022 can be clearly seen from the above figures. GCP’s NAV returns over 2022 were the highest generated over the prior four years. The impact is even more stark when compared to bonds, which have seen their market values fall thanks to rising interest rates but are not able to capitalise on inflationary forces in the same way as GCP has.

The factors affecting GCP’s returns over the final quarter of 2022 were discussed on pages 4 and 5. The next section shows the influences on its returns over the 12 months ended 30 September 2022.

Results for the year ended 30 September 2022

GCP has seen a substantial positive revaluation over its 2022 financial year.

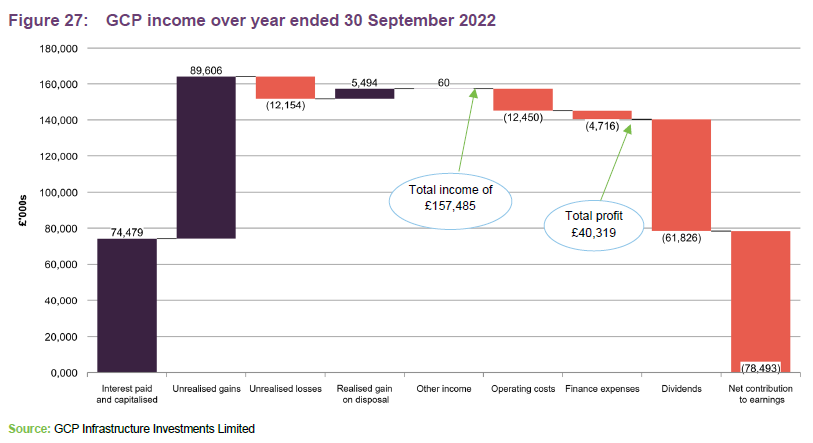

GCP announced a profit of £62.4m for the year ended 30 September 2022. The main drivers of this were the combination of higher energy prices and inflation (the latter of which is partially dependant on the former). Operating costs of £12.5m were slightly above the £10.6m figure for the 2021FY, with financing expenses also rising slightly over the year.

Over the financial year, GCP’s NAV rose to 112.80p per share (ending 30 September 2022), up from 103.92p for the prior year.

We have discussed the impact of the timing of interest accruals on GCP’s results in past notes. £15.9m of interest was accrued but not received/PIK’d during the financial year. In addition, within the cash flow statement, £9.7 of loan interest was capitalised and wrapped up into the amounts settled as part of final loan repayments or disposal proceeds of investments, and a further £13.4m of capitalised loan interest came alongside ongoing debt repayments. More information is given on page 25.

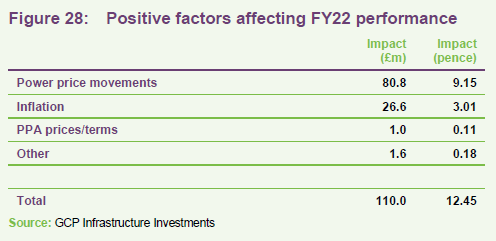

Net unrealised gains of £77.5m include £80.8m from power price movements, and £26.6m from higher inflation, offset by a £16.3m impact from higher discount rates and a £13.0m adjustment to reflect actual sales of power (see Figure 28 below).

Factors affecting performance over the year ended September 2022

As Figure 28 shows, over the 12 months ended 30 September 2022, GCP’s performance was overwhelmingly driven by the upward movements in power prices and the increase in UK inflation. We note that the hedges that were previously in place (as we described in our last note) have not had a material impact on the trust’s performance, where they had previously been a drag. The team continues to operate price hedges within the portfolio in order to manage risk.

Payments in kind

Some borrowing entities in GCP’s portfolio do not produce regular cashflows to support regular interest payments. Consequently, a proportion of GCP’s interest payments are scheduled to be capitalised – treated as payments in kind (PIK). In addition, from time-to-time GCP may be exposed to some borrowers who find themselves unable to meet scheduled interest payments for a limited period, but are nevertheless expected to service their loans over the life of the underlying asset. Figure 30 shows the breakdown between scheduled and unscheduled PIKs at 30 September 2022.

The unscheduled PIKs relate principally to:

- solar subordinated loans in lock-up as part of the audit by Ofgem. This is related to the accreditation and ongoing compliance of nine ground-mounted commercial solar projects, with Ofgem revoking one of the ROCs pending the outcome. The team expect this to be resolved soon and this should thus reduce the PIK burden.

- The biomass refinance also contributed to the high near term PIK burden given the unexpected nature of the refinancing following its financial difficulty. The senior debt lockup has meant that cash has not been able to be withdrawn from the company.

Peer group

Up-to-date information on GCP and its peers is available on the QuotedData website.

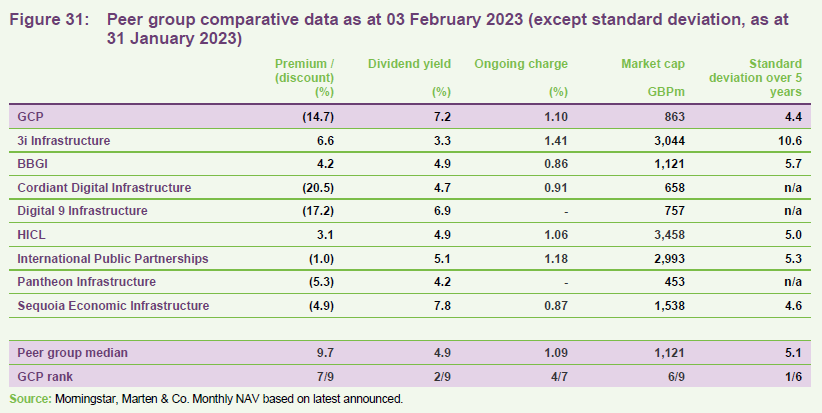

GCP is a constituent of the AIC’s infrastructure sector alongside four funds (3i Infrastructure, BBGI, HICL and International Public Partnerships) which invest primarily in public/private partnership project equity, two digital infrastructure funds (Cordiant Digital Infrastructure and Digital 9 Infrastructure), and two funds (Pantheon Infrastructure and Sequoia Economic Infrastructure) that have adopted a broad definition of infrastructure including digital infrastructure and renewables. Like GCP, the Sequoia fund invests primarily in debt. We have excluded Infrastructure India (which has a very different risk/reward profile to the rest of the peer group) for the purposes of this note. GCP is the only fund in this peer group focused exclusively on the UK.

GCP trades on the widest discount of the ‘conventional’ (non-digital) infrastructure trusts. GCP’s recent NAV growth has not been reflected in its discount, which widened over the latter half of 2022. GCP’s focus on the UK may have been a problem, given the volatility created by the mini budget, to which other infrastructure peers are less exposed. The ongoing solar audit may have also had an impact at the margin. GCP’s charges are close to the middle of this peer group, and its market cap near the bottom third. Though at £863m it is by no means a small trust.

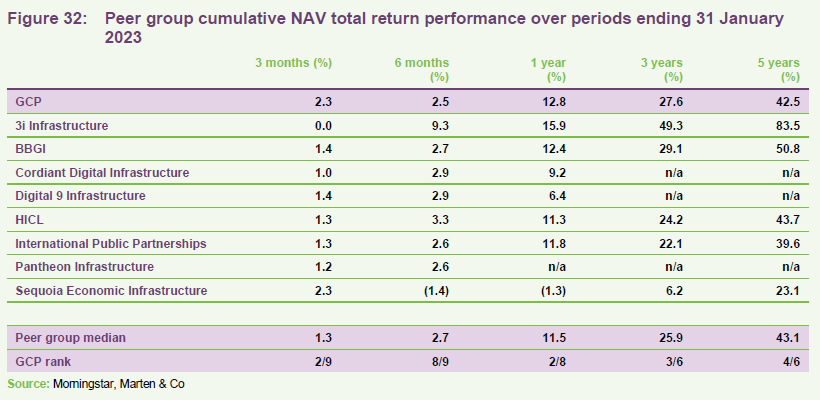

Figure 32 compares the performance of the funds in this peer group. GCP’s NAV returns have been towards the top of the peer group over the last year. 3i Infrastructure takes on more risk than competing funds. With that exception, the long-term returns of the peer group are quite similar. GCP’s returns may possibly reflect its conservative approach towards calculating its NAV and its asset mix.

GCP versus renewable energy infrastructure funds

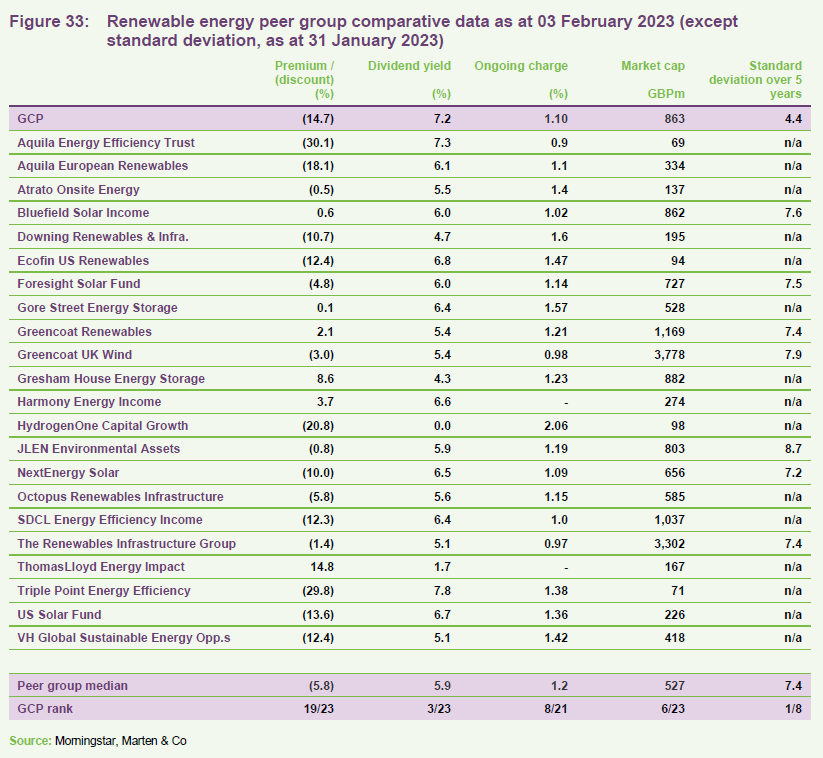

We have also compared GCP to the constituents of the renewable energy sector.

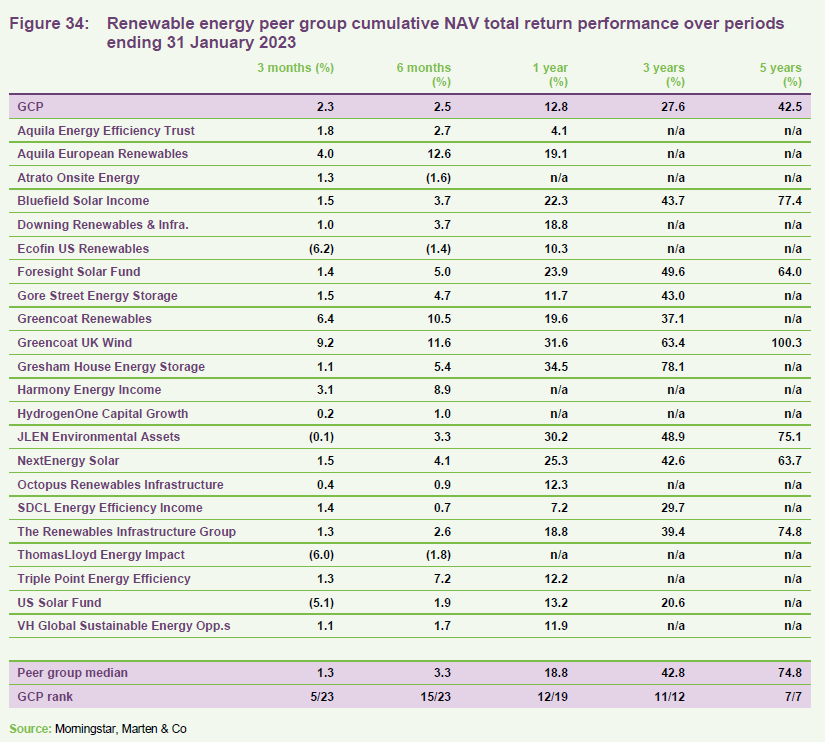

We feel that, given the increasing importance of renewable energy within GCP’s portfolio, it is relevant to compare GCP to the constituents of the renewable energy sector. The sector has been expanding rapidly and consequently many of these funds have not yet built up much of a track record.

The 22 constituents of the AIC’s renewable energy infrastructure sector include three funds (Gresham House Energy Storage, Gore Street Energy Storage and Harmony Energy Income) focused on investments in batteries.

Many (notably Aquila European Renewables, Ecofin US Renewables, Greencoat Renewables, Octopus Renewables Infrastructure, ThomasLloyd Energy Impact, US Solar, and VH Global Sustainable Energy Opportunities) are substantially invested outside the UK.

HydrogenOne Capital Growth is unique in its focus on capital growth rather than income, as well as the emergent green hydrogen sector.

In comparison with this peer group, GCP’s rating is once again out of step, and has one of the largest discount of the peer group. However, it ranks towards the best of the peer group by yield, charges and size, and once again offers the lowest volatility of NAV returns.

GCP’s focus on debt instruments rather than equity investments may account for its lower volatility of returns. This and the asset mix within its portfolio are most likely the chief influences on its performance relative to the renewable energy infrastructure peer group.

Quarterly dividend

Dividends are declared and paid quarterly. Shareholders are able to elect to take their dividend as scrip (in shares rather than cash).

GCP’s full year dividend of 7.0p per share is in line with its new policy.

In its 2021 financial year, GCP’s target dividend was reduced to 7.0p from 7.6p, reflecting the decline in acceptable rates of risk-adjusted returns available in an environment of ultra-low interest rates. The board and the adviser believe that at the new lower level of dividend, the current pipeline of investment opportunities is likely to enable GCP to reinvest capital and to support modest potential growth in the dividend. GCP’s recent full year dividend of 7.0p per share is in line with this new policy. Despite the cut in dividend, GCP’s yield still ranks amongst the highest of its peers.

Dividend cover

Loans made by the company are valued on a discounted cash flow basis. When a loan is first made, it is typically valued using the interest rate charged to the borrower. However, loans are often revalued by the valuation agent to reflect changes in the market rate of interest or for project specific reasons, for example.

As market rates of interest have fallen since GCP was launched, higher values have been attributed to many of the loans that it has made, uplifting the NAV. That has the effect of pulling forward the recognition of income from these loans and, on an IFRS accounting basis, reduces GCP’s earnings per share and dividend cover in subsequent years (a pull-to-par effect). For this reason, the board and the investment adviser have calculated a range of alternative performance measures.

Figure 35 shows GCP’s dividend cover ratios on two bases – normal (IFRS) earnings cover, and an adjusted figure calculated by Marten & Co that strips out the impact of unrealised fair value adjustments to financial assets on the company’s earnings. The substantial increase in the unadjusted EPS coverage reflects a substantial increase in the unrealised value of GCP’s assets.

For the year ended 30 September 2022, the dividend cover based on loan interest accrued was 1.19x and cash earnings cover was 0.96x.

The board and advisers use two other alternative performance measures, including two other measures of dividend cover. The first is based on loan interest accrued for the financial year (less total expenses and finance costs) and the second is a cash earnings cover calculated as the ratio of total cash received per share to the dividend per share. For the year ended 30 September 2022, the dividend cover based on loan interest accrued was 1.19x (FY21: 1.13x) and cash earnings cover was 0.96x (FY21: 0.72x). This measure does not assume any reinvestment of loans that have been repaid in the period.

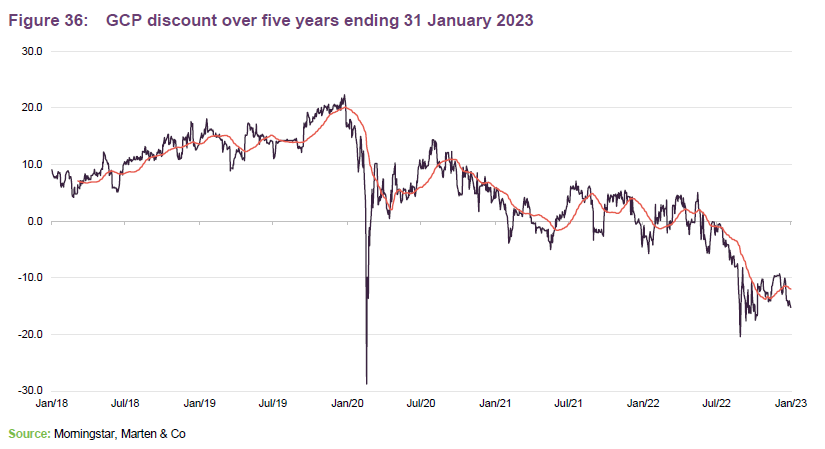

Premium rating

GCP has traded at a premium for most of the period since its launch. However, in the turbulent markets of the latter half of 2022, it moved to trade on a sustained discount.

This might be the results of the general attitude to risk that investors are taking currently; numerous investment trust sectors have experienced widening discounts. This includes a variety of private asset strategies, including both debt and equity strategies. The market also appears to be wary of anything out of the ordinary, and the ongoing Ofgem audit might fit that description. The adviser maintains that the likely impact is not material, as opportunities exist to seek redress from the vendors of projects that fail the audit. However, the dominant factor could be the higher prevailing interest rates which have led to a global sell off in nearly all fixed income assets and have put upward pressure on the discount rates used to calculate asset values within GCP’s sectors.

Over the year ended 31 January 2023, GCP’s shares traded within a range of a 20.4% discount to NAV to a 5.1% premium. Over that period the discount averaged 5.3%. At 3 February 2023, based on its year-end NAV, the shares were trading on a 14.7% discount.

In February 2022, shareholders approved the issuance of up to 10% of GCP’s then-issued share capital without pre-emption. They also approved the repurchase of up to 14.99% of the then-issued share capital. Repurchased shares could be held in treasury and reissued at the board’s discretion. The board does not issue shares in an attempt to moderate the premium.

Over the course of its financial year ending 30 September 2022, GCP issued 2,587,441 shares to satisfy demand for scrip dividends. No shares were repurchased.

Fees and costs

The investment adviser receives an investment advisory fee of 0.9% a year of the NAV net of cash. This fee is calculated and payable quarterly in arrears. There is no performance fee. The investment adviser is also entitled to an arrangement fee of up to 1% (at its discretion) of the cost of each asset acquired by GCP. Gravis will generally seek to charge the arrangement fee to borrowers rather than to the company where possible. To the extent that any arrangement fee negotiated by the investment adviser with a borrower exceeds 1%, the benefit of any such excess shall be paid to the company. The investment adviser also receives a fee of £70,000 (subject to RPI adjustments) a year for acting as AIFM, which was £74,000 for the 2022 FY, after adjustments.

The investment advisory agreement may be terminated by either party on 24 months’ written notice.

Apex Financial Services (Alternative Funds) Limited is GCP’s administrator and company secretary. Depositary services are provided by Apex Financial Services (Corporate) Limited. The fee for the provision of these services during the year was £1.0m (FY21 £962,000).

Valuation agent fees (for the independent third-party valuation agent, Mazars) totalled £290,000 for the year ended 30 September 2022 (FY20 £281,000).

The ongoing charges ratio for the year ended 30 September 2022 was 1.1%, unchanged from the prior year.

Capital structure and life

GCP has 884,797,669 ordinary shares outstanding and no other classes of share capital. The company’s financial year end is 30 September and AGMs are held in February, with the next scheduled for 15 February 2023.

GCP is an evergreen fund with no fixed life and no regular continuation vote.

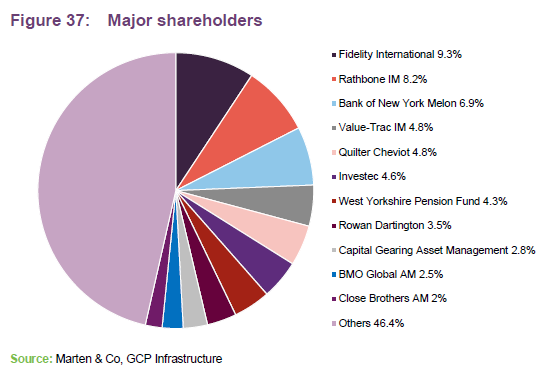

Major shareholders

Gearing and derivatives

Structural gearing of investments is permitted up to a maximum of 20% of NAV immediately following drawdown of the relevant debt. At 30 September 2022, GCP’s net gearing was 9%.

In March 2022 GCP increased the revolving credit facilities available to it from £165m to £190m. £165m is provided by RBSI, Allied Irish Bank, Lloyds, Clydesdale Bank, and Mizuho, and is repayable in March 2024. Interest is charged at a margin of 200bps over SONIA. £99m was drawn at 30 September 2022. A commitment fee of 0.7% is payable on undrawn amounts of the facilities.

GCP entered into a commodity swap agreement with Axpo Solutions AG on 13 July 2022, following the maturity of the previous swap agreement on 31 March 2021. The company has been granted a £50m credit line by Axpo Solutions AG to mitigate the need for regular cash flows associated with the hedge. The swap matures on 31 March 2023 and is for a notional 26,208MWh of power. The fixed price for that power as a result of the swap is £434.0/MWh. At 31 January 2023, the Electricity N2EX UK Power Index Day Ahead price was £131.2/MWh.

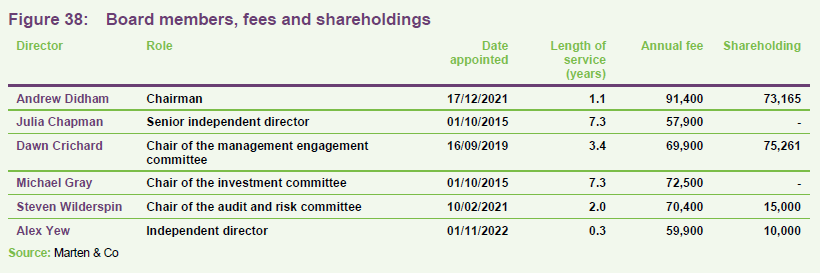

Board

Currently, the board has six directors, all of whom are non-executive and independent of the investment adviser.

Over the past financial year, Paul De Gruchy retired from the board, while Ian Reeves, the previous chairman, retired in October 2022. Two new directors –Andrew Didham and Alex Yew – have joined the board as replacements. Andrew Didham replaced Ian Reeves as chairman and chair of the Nomination committee, as well as being of a member of the Management Engagement committee and the Investment committee, and Alex Yew was appointed as a member of the Investment committee, the Management Engagement committee and the ESG committee.

There were also a number of internal shifts in the responsibilities of the board. Julia Chapman stepped down from the Investment committee and became a member of the Audit and Risk committee, while Dawn Crichard assumed the role of chair of the Management Engagement committee after Paul De Gruchy’s retirement.

Andrew Didham (chairman)

Andrew, a UK resident, is a Fellow of the Institute of Chartered Accountants in England & Wales. He is a senior executive director with extensive board level experience within the Rothschild banking group. Andrew was group finance director for 16 years and a member of the group management of the worldwide Rothschild business, which involved investment banking, wealth management, asset management and merchant banking activities. He has broad non-executive director experience, being on the boards of IG Group Holdings Plc, Shawbrook Group Plc, Charles Stanley Group Plc, and formerly Jardine Lloyd Thomson Group Plc. Within Rothschild, Andrew remains an executive vice chairman (a position he has held since 2012) and a non-executive member of NM Rothschild and Sons Limited. Formerly, he was a partner in the London office of KPMG with responsibility for the audit of a number of global financial institutions and assignments for various government and regulatory authorities.

Julia Chapman (senior independent director)

Julia, a Jersey resident, is a solicitor qualified in England & Wales and Jersey with over 30 years’ experience in the investment fund and capital markets sector. Having trained with Simmons & Simmons in London, she moved to Jersey to work for Mourant du Feu & Jeune (now known as Mourant) and became a partner in 1999.

Julia was appointed senior counsel to State Street following its acquisition of Mourant’s fund administration business in April 2010. She headed up a team supporting State Street’s European alternative investment services division. In July 2012, she left State Street to focus on the independent provision of directorship and governance services to a small number of alternative investment fund vehicles. Julia serves on the boards of three other Main Market listed companies: Henderson Far East Income Limited, BH Macro Limited and Sanne Group Plc.

Dawn Crichard (chair of the management enegagement committee)

Dawn, a Jersey resident, is a Fellow of the Institute of Chartered Accountants of England and Wales with over 20 years’ experience in senior chief financial officer and financial director positions. Having qualified with Deloitte, she moved into the commercial sector and was chief financial officer of a large private construction group for 12 years. Dawn then worked with both private and listed clients in the hedge fund division of State Street. Following this, she was appointed as chief financial officer for Bathroom Brands Plc. In her current role as head of finance at a family office she has been involved in establishing and overseeing high-value private expert funds. Dawn’s broad accounting and commercial experience includes establishing new group head offices, mergers, acquisitions, refinancing and restructuring.

Michael Gray (chair of the investment committee)

Michael, a Jersey resident, is a qualified corporate banker and corporate treasurer. Most recently he was the regional managing director, Corporate Banking for RBS International, based in Jersey, but with responsibility for The Royal Bank of Scotland’s Corporate Banking Business in the Crown Dependencies and British Overseas Territories.

In a career spanning 31 years with The Royal Bank of Scotland Group Plc, Michael has undertaken a variety of roles, including that of an auditor, and has extensive general management and lending experience across a number of industries. He is also a non-executive director of Jersey Finance Limited, the promotional body for the finance sector in Jersey, and a Main Market listed company JTC Plc, as well as other listed and private companies.

Steven Wilderspin (chair of the audit and risk committee)

Steven, a Jersey resident, is a Fellow of the Institute of Chartered Accountants of England & Wales. Since 2007, he has acted as an independent director on a number of public and private investment funds and commercial companies. In 2017, he retired as the chair of the audit and risk committee of 3i Infrastructure Plc after 10 years of service.

Steven is currently the chair of the risk committee of Blackstone Loan Financing Limited, chair of the audit and risk committee of HarbourVest Global Private Equity Limited, and a non-executive director of Phoenix Spree Deutschland Limited. Prior to 2007, he was a director at Maples Finance Jersey, with responsibility for their fund administration and fiduciary business. He began his career at PwC in London in 1990.

Alex Yew (independent director)

Alex, a United Kingdom resident, is a qualified solicitor in Singapore and in England and Wales. He has more than 25 years of professional experience as a lawyer, banker and investor. Until recently, Alex was a senior advisor and a senior managing director at John Laing, an international investor in infrastructure and energy assets. He worked at John Laing for more than 14 years, during which time he held leadership positions in Project Finance, New Markets, Strategy, Partnerships, Latin America and Europe. Alex was also a member of the senior leadership team and the Investment committee. Prior to John Laing, he was a director in the infrastructure advisory team at CIBC World Markets in London as well as a banker and lawyer in Southeast Asia.

Previous publications

Readers interested in further information about GCP may wish to read our previous notes (details are provided in Figure 39 below). You can read the notes by clicking on them in Figure 39 or by visiting our website.

Figure 39: QuotedData’s previously published notes on GCP

| Title | Note type | Date |

| Stable income, uncertain times | Initiation | 30 January 2020 |

| Rebased dividend | Update | 1 June 2020 |

| Compelling yield | Annual overview | 11 January 2021 |

| Penalised for being conservative? | Update | 1 July 2021 |

| The future is brighter and greener | Annual overview | 18 January 2022 |

| Improving outlook and room to grow | Update | 19 July 2022 |

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on GCP Infrastructure Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.