GCP Infrastructure

Investment companies | Annual overview | 30 January 2024

Don’t look back in anger

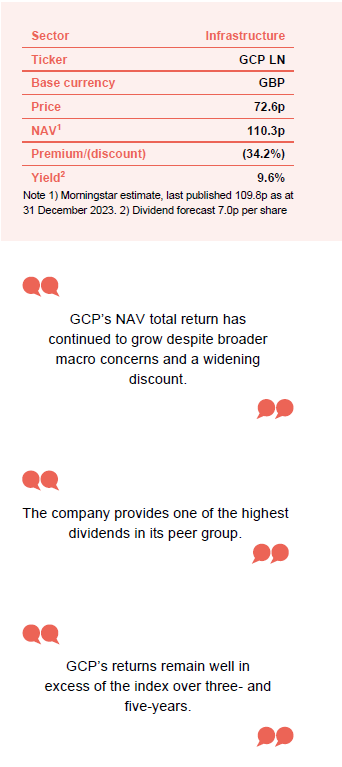

There is no doubt that 2023 was a challenging year for GCP and the broader infrastructure sector as a confluence of factors weighed on performance, particularly the rapid increase in interest rates. Despite this, the company was still able to generate positive NAV returns thanks to inflation linkages and contracted earnings, which helped offset the impact of rising discount rates. Disappointingly, negative sentiment continued to weigh on the company’s shares, with the share price discount to net asset value (NAV) widening to a record low, despite the stability of the underlying portfolio.

Promisingly, we have seen a decisive change in sentiment for the better as inflation has begun to moderate, with the headline rate falling from 11.1% to 4.0% in the UK over the past year.

In the short term, the trust’s fortunes may be heavily influenced by the direction of interest rates and inflation. However, we believe that it is time that the stability of GCP’s cash flows and a bumper dividend yield of almost 10% attracted attention once again.

Public-sector-backed, long-term cashflows from loans used to fund UK infrastructure

GCP aims to provide shareholders with regular, sustained, long-term distributions and to preserve capital over the long term by generating exposure primarily to UK infrastructure debt and related and/or similar assets that provide regular and predictable long-term cashflows.

At a glance

Fund profile

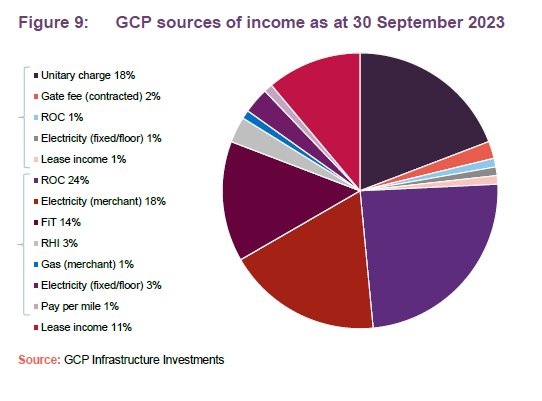

GCP Infrastructure Investments Limited (GCP) is a Jersey-incorporated, closed-ended investment company whose shares are traded on the main market of the London Stock Exchange. GCP aims to generate a regular, sustainable, long-term income while preserving investors’ capital. The fund’s income is derived from loaning money at fixed rates to entities which derive their revenue – or a substantial portion of it – from UK public-sector-backed cashflows. Wherever it can, it tries to secure an element of inflation-protection.

Regular, sustainable, long-term income

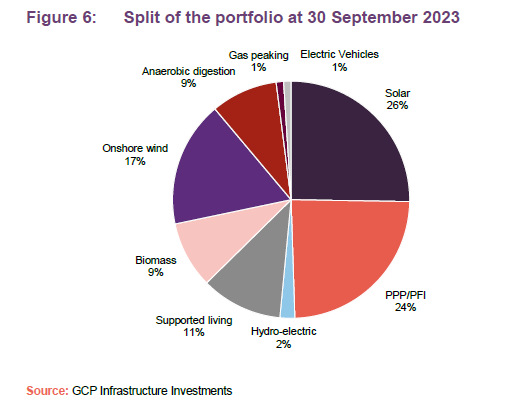

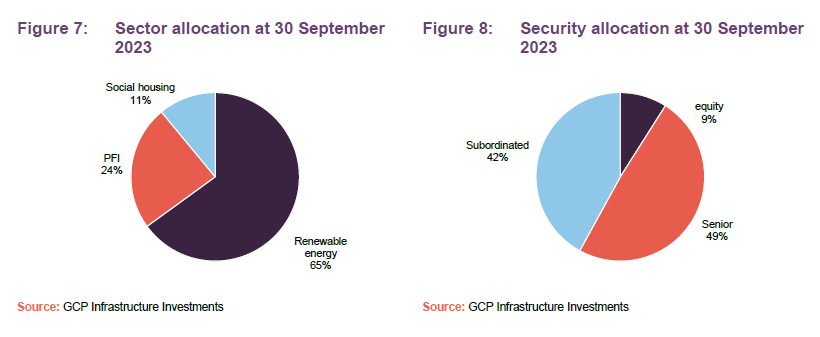

In practice, GCP is diversified across a range of different infrastructure sectors, although its focus has shifted more towards renewable energy infrastructure over the last few years. It has exposure to renewable energy projects (where revenue is part subsidy and part linked to sales of power), PFI/PPP-type assets (whose revenue is predominantly based on the availability of the asset) and specialist supported social housing (where local authorities are renting specially-adapted residential accommodation for tenants with special needs).

Renewable energy projects, PFI/PPP-type assets and specialist supported social housing

Annual results – 30 September 2023

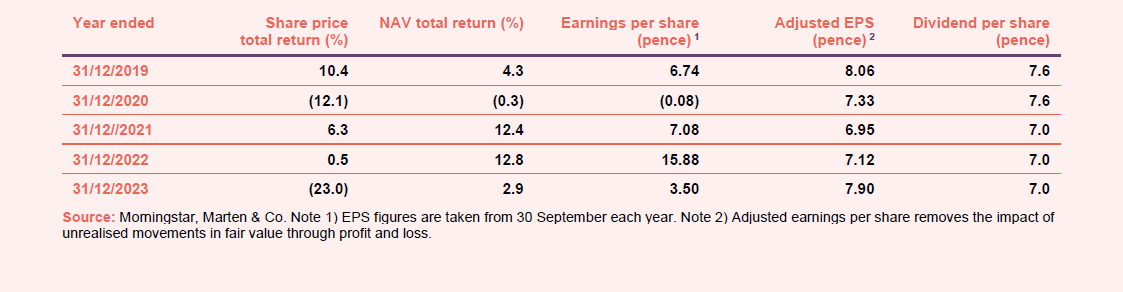

GCP published its annual results on 13 December 2023. Over the 12-month period to 30 September 2023, GCP’s NAV per share fell from 112.80p to 109.79p, a drop of 2.6% while shares fell from 97.8p, to 67.70p, a drop of 30.7%. Total NAV return was 3.7% while shareholder total return was -25.2%. At the end of the period, the discount widened to 38.3%, which had improved to 34.2% at the time of publication.

Total income for the period was £35.6m

Dividends continued to run at an annualised pace (adjusted to reflect a full year of returns) of 7.0p per share, so that GCP is trading at a weighted average annualised yield of 9.6%. On the fund’s adjusted earnings basis, dividend cover was 1.2 times. GCP does not compare its returns with those of a benchmark index, but the sterling corporate bond index is a useful comparison, and this returned 8.1% over the same period.

Obviously, it has been a challenging 12 months for GCP as rising yields and broader economic uncertainty have weighed on returns. However, despite the negative headline performance, the company has continued to execute well, delivering a positive NAV total return while maintaining its successful capital recycling programme. This has led to a material reduction in leverage and the authorisation of a £15m buyback programme. Given the extent of the share price discount, the board views this as the best way to maximise shareholder value under current conditions. We discuss this in more detail on page 6.

Attribution and performance

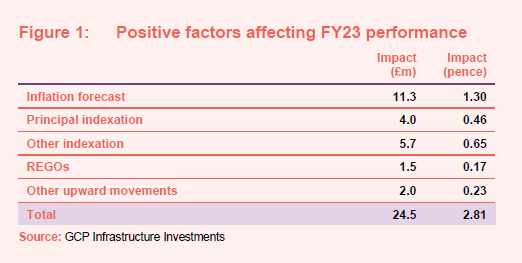

Regarding GCP’s NAV returns, inflation uplifts provided the bulk of the positive contribution as shown in Figure 1. REGOs (renewable energy guarantees of origin) also provided positive uplifts as higher forecasts and spot prices were locked in.

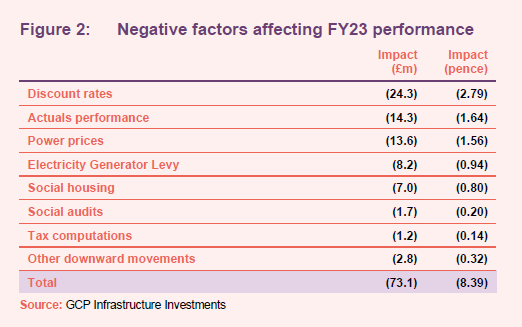

On the downside, rising discount rates clearly had the largest impact. As noted, lower-than-forecast renewables generation also caused a considerable drag, particularly from the company’s hydro and wind assets. Despite energy prices falling from their highs, the Electricity Generator Levy (a recently introduced tax on the extraordinary returns of electricity generators) continued to weigh on the NAV, along with other negative effects from social housing and a number of smaller impacts.

Mergers off

As discussed in our last note, in the summer of 2023, the company announced a potential three-way combination between it, GCP Asset Backed Income (GABI), and RM Infrastructure Income (RMII). RMII terminated talks early in September 2023 and has opted for a managed winddown of its business.

Later that month, following extensive consultation with both sets of shareholders, GCP Infrastructure announced that there was a significant minority of GABI shareholders that were opposed to the proposal. The company called off the proposed combination, with the board taking the view that without the support of all shareholders, it would be difficult to fully achieve the scheme’s intended purposes.

Capital recycling programme

Economic conditions, as described below, led the advisers to direct their focus towards GCP’s capital recycling programme in 2023, with the aim of improving the resilience and operational efficiency of the portfolio. The programme has been in operation over the last 18 months, and the company has now set a conditional target of releasing £150m (roughly 15% of the portfolio) to rebalance sector exposures, apply funds towards a material reduction in the revolving credit facility (RCF), and facilitate a return of at least £50m in capital to shareholders before the end of 2024.

As we outline in detail in the portfolio section of the report on page 13, the refinancing of two existing loan notes secured against two waste-wood biomass projects provided the bulk of funding for adjustments made since our last note. The refinancing generated £50m in net cash and led to a 1.2 pence per share uplift to the company’s NAV. This and other realisations help to highlight the fund’s conservative approach to valuation (discussed on page 15). The proceeds were used to pay down some of the company’s RCF. As of December 2022, this facility stood at £154m, but the adviser had reduced this to £104m as of 30 September 2023.

In March 2023, the company authorised a buyback programme for up to £15m, which over the financial year ended on 30 September 2023 (FY23) led to £10.6m in repurchases at an average price of 78.16p per share. Post financial year end, the company repurchased a further £2.2m at an average price of 63.47p per share.

Weighing the immediate NAV return of repurchasing shares at current discounts against the returns available on new investments, buybacks are seen as an increasingly effective strategy. This certainly makes sense under current conditions, but it is also positive to see that the advisers remain cognisant of the long-term need for new sustainable infrastructure investments. These are becoming increasingly attractive, given higher rates of return now available in the market. Managing these allocations will be crucial for driving the fund’s long-term performance.

The advisers are considering reducing exposure to supported living and some more equity-like risk associated with some renewable assets

Looking ahead, the advisers have also balanced their desire to raise cash with current market pricing, making changes only when they view deal-pricing as being attractive. Over the longer term, they are also using current economic conditions as an opportunity to restructure the portfolio in a way that increases its resilience and capital stability. This includes a focus on reducing the duration of the portfolio, through the reduction of its supported living exposure, while also moving away from equity-like risk associated with some of its renewable assets.

Market backdrop

Higher interest rates have weighed heavily on the infrastructure sector

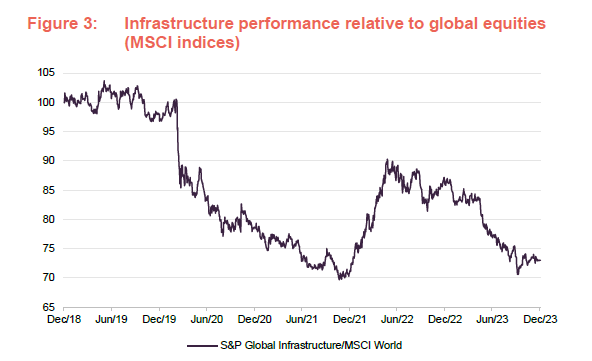

The last 12 months have not been kind to the infrastructure sector as Figure 3 shows. The inflationary surge and ensuing tightening of financial conditions over 2023 weighed heavily on an industry typically characterised by high upfront capital requirements and stable long-term cashflows.

Throw in competition from ‘risk free’ money market funds and generally more defensive positioning overall, and you end up with a scenario where investors have exited the listed infrastructure sector in droves. Such has been the effect of these dynamics that discounts on funds are comparable to those seen during the global financial crisis.

Interest rate outlook

Whilst fundamentally many of the companies have continued to perform well, with all but one of the constituents of the infrastructure sector delivering positive NAV returns, share price growth remains tied to the trajectory of long-term interest rates which in the space of 18 months jumped some 300 basis points (often abbreviated to bp, 1 bp = 0.01%, so 300bps = 3%). Promisingly, during the last quarter of 2023 we started to see a change of direction as the rate of inflation began to moderate. In the UK the headline inflation rate has dipped from 11.1% to 4%, and globally, we have seen a dramatic pivot from what had become an almost universal picture of rising interest rates.

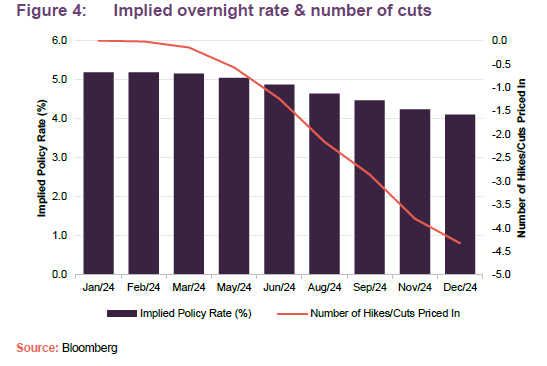

As Figure 4 highlights, markets are pricing in a total of four interest rate cuts over 2024 in the UK, forecasting an implied rate around 4.1% down from 5.2% currently. The impulse to reduce rates in the US is even more drastic with six cuts priced in and with the policy rate expected to fall from 5.3% to 3.8%. Of course, such estimates should be taken with a large pinch of salt, but based on current inflation and growth data, it does seem reasonable to assume that the general trajectory is down. Objectively, the market views falling interest rates as good news for stocks. However, it is important to make the distinction between disinflation driven cuts and cuts which stem from concerns around growth. In the US, where growth remains above trend, it appears to be the former; however, with GDP forecasts in the UK barely above zero, it’s hard to make the same judgment here.

Falling rates make GCP’s 10% yield all the more compelling

Despite this, for the infrastructure sector and GCP in particular, falling rates (or even a scenario where they are no longer rising) should be supportive regardless of the fundamental driver. For one thing, the psychological impact will likely stem the flow of capital leaving the sector, much of which has been driven purely by sentiment. As yields fall, this also makes the almost 10% dividend yield offered by GCP even more compelling, especially in conjunction with the share price discount to NAV. We have already seen some evidence of this, with GCP’s discount falling from around 40% to 35% as UK gilt yields fell almost 80bps in December 2023.

Portfolio composition supports re-rating

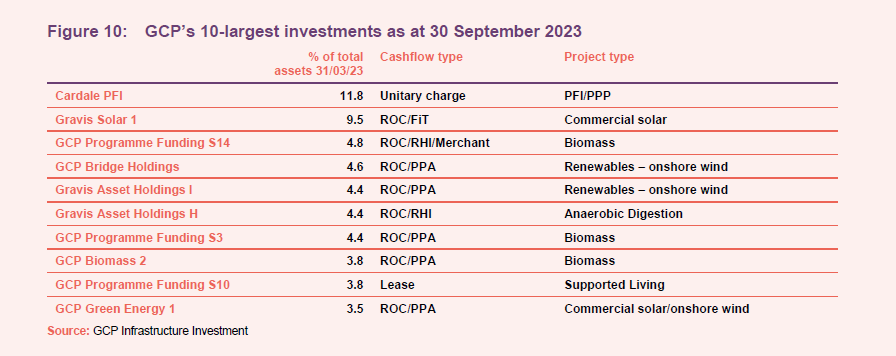

Supporting a further re-rating of the GCP portfolio is the composition of its revenues. Whilst, generally speaking, rate cuts driven by slowing growth would lead to a fall in corporate profits, almost two-thirds of GCP’s investments are exposed to regulated and/or contracted cashflows, de-risking returns through highly visible and increasingly stable earnings.

In addition, while power prices (which are an important component of profitability for GCP’s renewables investments) have fallen from their peak, they have undergone a structural reset since the pandemic, and are expected to stay higher for longer due to increasing capital costs and general uncertainty surrounding energy infrastructure and thermal supply.

The infrastructure developments required to meet the UK’s renewable transition targets have been a key area of focus for GCP adviser Phil Kent, who continues to see a considerable disconnect between the government’s stated aims for infrastructure investment and what is actually being built. More recently, the Committee for Climate Change has expressed concerns about the pace of change required to meet the UK’s legally binding net zero targets. In the short term, this is likely to support the price of renewable energy sold by the company’s existing portfolio of borrowers, and it should create further investment opportunities for the company going forward.

Inflation linkages

In addition to the structural rise in power prices, around 41% of the portfolio benefits from some form of inflation protection (such as contracts pegged to inflation), which explains a large portion of its recent NAV resilience (as in Figure 1 on page 5). This is spread across both the company’s social housing portfolio and a large portion of its renewable assets. Mechanisms vary across the different asset classes. Collectively, over FY23, these linkages contributed around £21m worth of NAV uplift, and in the adviser’s view, remain a greatly underappreciated component of the portfolio. Total portfolio sensitivities to various factors, including changes in inflation expectations, are discussed in more detail on page 15.

Risk analysis

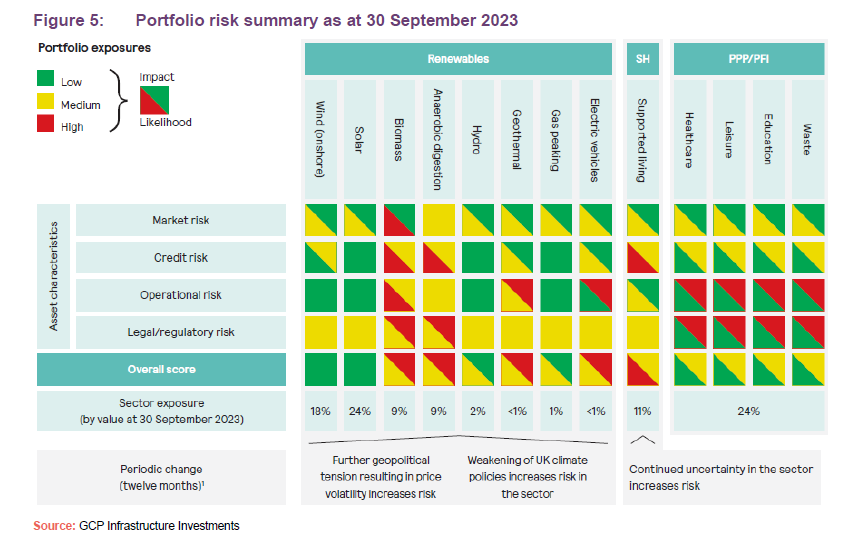

Each year in the company’s annual report, GCP’s investment adviser, Gravis Capital, releases a risk matrix which highlights its perception of risks across the various asset classes that GCP invests in. This is shown in Figure 7.

As of 30 September 2023, Gravis noted that there has been an increase in risk across all four asset characteristics from the previous year. The major contributors to this were:

- Renewable energy: Electricity prices have decreased over the year, but volatility has persisted, which has also contributed to higher inflation throughout the year. The company has exposure to electricity to prices and inflation as part of its renewables portfolio, and the higher price environment has been beneficial to the assets.

- Supported living: The leases on the underlying properties have inflation linkage and, as such, the rents charged to registered providers (RPs – the entities that lease the properties that GCP has helped finance, that are then occupied by tenants in need of supported living accommodation) have increased during the year. The underlying RPs have to agree with local authorities that they can pass on the rent increases. With higher inflation there is more pressure on local authorities to minimise such rental increases.

- Renewables: The supply chains for spare and replacement parts have continued to be impacted by global labour and supply chain challenges. The company has suffered from delays of this nature during the year; for example, where a network operator had a fire on its site and had to cease operations on the wind farm until repairs were completed.

- Renewables: There is uncertainty regarding potential future government intervention in the energy market, therefore forecast power prices may not be realisable in reality. The implementation of the Electricity Generator Levy (which aims to capture for taxpayers some of the windfall that renewable generators got as power prices rose in response to higher natural gas prices) in January 2023 has impacted the short-term profitability of certain assets in the portfolio. The levy will be in place until 31 March 2028.

Asset allocation

As of 30 September 2023, there were 51 investments in GCP’s portfolio. Two small investments have been made since we last published our last note, in electric vehicle (EV) car leasing and solar carports. However, as we have noted, the bulk of the activity within the portfolio was focused on restructuring existing positions and freeing up funds for share buybacks. The average annualised portfolio yield over the financial year was 7.9%, and the portfolio had a weighted average life of 10 years.

Whilst there have been limited structural changes since our last note, the company has been proactive at refinancing several positions that the advisers viewed as being attractively valued in the current market. This has led to a reduction in Biomass exposure (see page 13). Onshore wind exposure also fell, while exposure to solar assets and PPP/PFI increased marginally.

The advisers continue to view renewable energy exposure as the foundation of the portfolio. As of 30 September 2023, the sector generated 66% of GCP’s income, and we expect that this will increase going forward.

As we have highlighted in previous notes, the advisers do not intend to grow GCP’s exposure to the supported living sector, as a result of concerns raised in respect to governance and financial viability. In fact, as part of the portfolio optimisation strategy, they are actively seeking to return capital by reducing these investments. Regarding PFI/PPP, there are no material new projects expected to be procured in the medium term, with this type of revenue-supported mechanism falling out of favour in the UK.

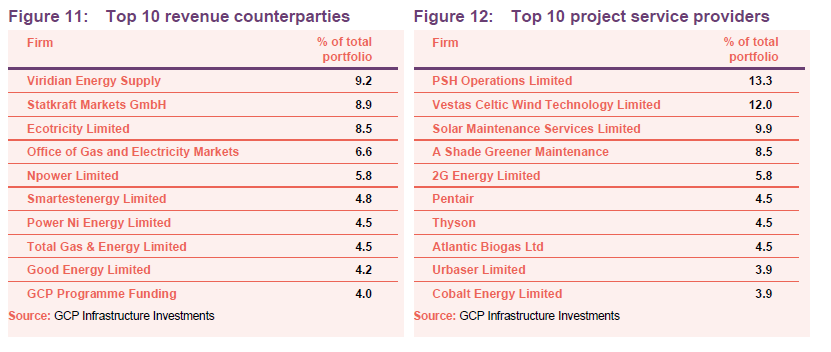

Top 10 investments

Changes within the list of GCP’s top 10 largest investments since our last note have been minor, with GCP Programme Funding S14 replacing GCP Programme Funding S8 in the list.

Recent investment activity

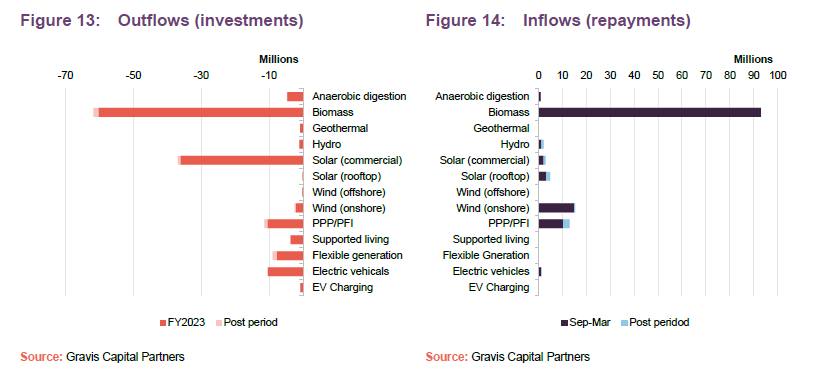

As we have highlighted, since our last note the company has concentrated on advancing its capital recycling programme, which the advisers view as the best course of action given financing costs and current discounts.

The company completed the refinancing of two existing loans secured against two waste wood biomass projects valued at about £85m and committed to a new £50m loan note as part of a syndicated facility supporting the same and one additional biomass project. This generated £50m of net cash proceeds that was used to repay the company’s revolving credit facility (RCF) which now stands at £104m, having peaked at £154m in December 2022. After fees and valuation impacts, this led to a 1.2 pence per share uplift to the company’s NAV.

Two new loans were made totalling £9.2m, including a £7.5m senior loan to purchase a fleet of electric taxis.

Portfolio investments of £129.5m were put towards restructuring and management. This was offset by repayments of £128.0m, giving net investments in the existing portfolio of £1.5m.

Figures 13 and 14 show the full breakdown of GCP’s recent investment activity over the 12 months to 30 September 2023, and several small additions made after the period end.

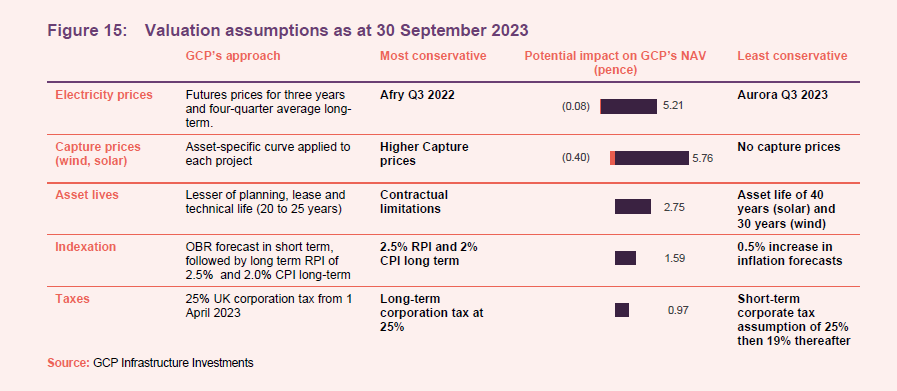

Conservative assumptions

Figure 15 summarises the key assumptions used in forecasting cash flows from renewable assets in which the company is invested, and the range of assumptions that the investment adviser observes in the market. As we have highlighted in several of our prior notes, GCP’s advisers take a conversative approach, valuing companies towards the lowest value methodologies available to them.

For example, when it comes to asset lives, GCP assumes lives of 20–25 years while at least one competitor is assuming asset lives of 40 years for solar and 30 years for wind.

The net effect of this is that, were GCP to assume the most conservative assumptions in every category, the end-September NAV of 109.79p would be reduced to 109.31p. By contrast, were GCP to assume the least conservative assumptions in each category, the NAV would have been 126.07p.

Such an approach is admirable as it reduces the likelihood and severity of any unexpected shocks to GCP’s NAV, e.g. a sharp reversal in wholesale gas prices. It also raises the possibility of NAV uplifts from portfolio disposals. Note that valuation metrics do not affect either the dividend pay-out or the share price yield.

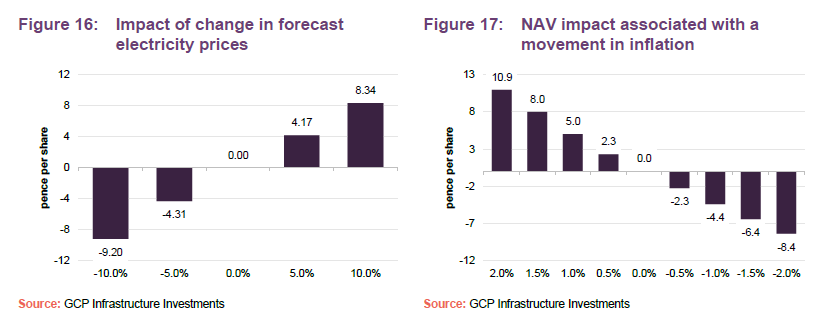

Sensitivities

The investment adviser also provides a sensitivity analysis for its cash flows. Figures 16 and 17 show the impact of changes in power prices and changes in its base case inflation forecast.

Performance

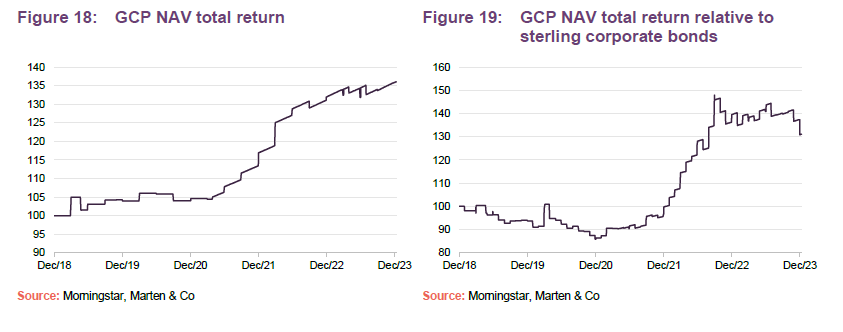

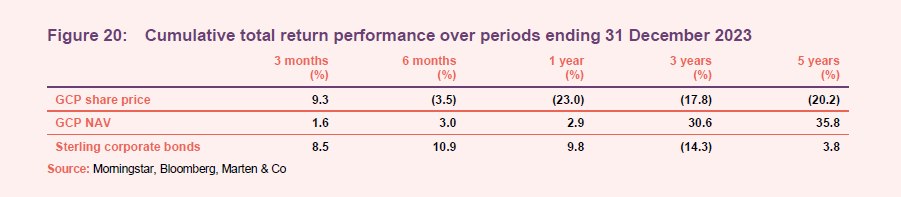

As Figure 18 shows, GCP’s NAV total return has continued to grow despite broader macro concerns and a widening discount.

The NAV rallied strongly on the back of rising power prices through 2021 and 2022, and while these have moderated, they remain well above post-COVID levels and should continue to drive performance going forward.

Figure 19 shows the performance of the fund compared to the sterling corporate bond index. This figure provides another illustration of the tangible returns generated by the GCP portfolio above direct market comparables. Returns have moderated slightly as global bonds have rallied (loosening financial conditions) on the back of falling inflation; however, as Figure 20 highlights, GCP’s returns remain well in excess of the index over three- and five-year periods. These dynamics are also likely to be beneficial for the company’s share price going forward.

Peer group

Up-to-date information on GCP and its peers is available on the QuotedData website

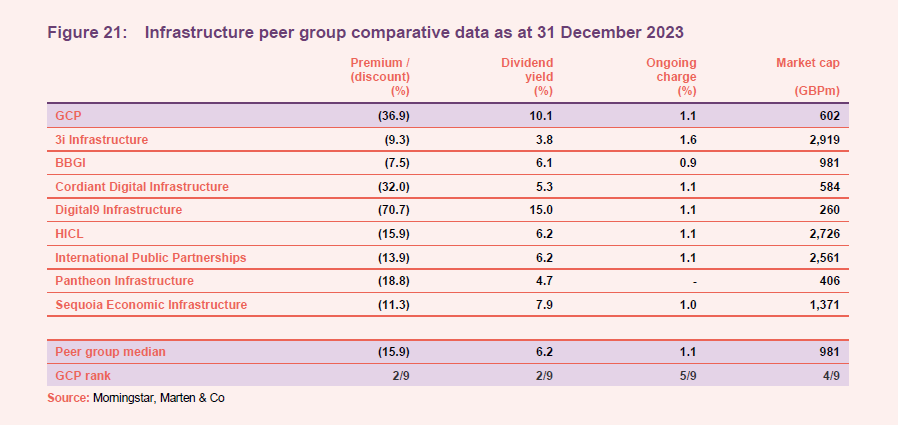

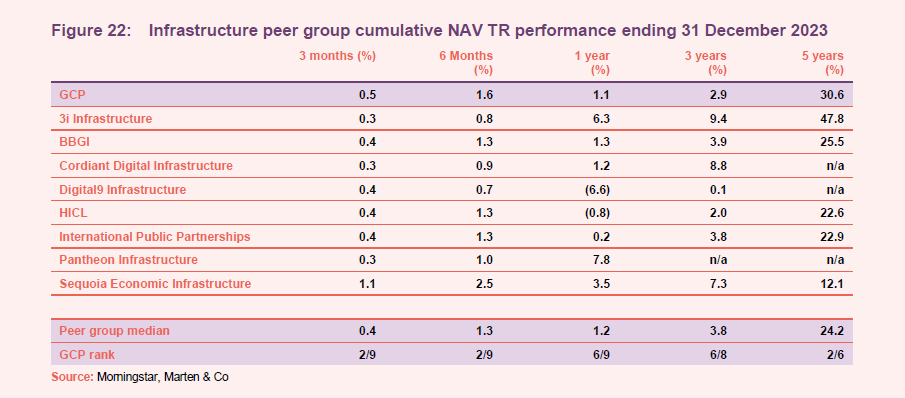

GCP sits within the AIC’s infrastructure sector, which is made up of three funds that invest predominantly in public/private partnership project equity (BBGI, HICL and International Public Partnerships), two funds that have more revenue exposure to demand driven assets (3i Infrastructure and Pantheon Infrastructure), two digital infrastructure funds (Cordiant Digital Infrastructure and Digital 9 Infrastructure) and one fund (Sequoia Economic Infrastructure, which – like GCP – invests primarily in infrastructure debt, but using a much broader definition of what constitutes infrastructure). We have excluded the Infrastructure India fund due to its risk profile, which does not align with the rest of the sector.

Since our last note, median discounts in the infrastructure sector have come down from 19% to 16%, reflecting improving global sentiment around the trajectory of interest rates; however, they still remain deeply depressed compared to historic averages. Unfortunately for GCP, its discount remains almost twice the peer group median, which is another indication that the selloff has clearly gone well beyond the mechanical impact of rising rates and, as we have noted on several occasions, is certainly not a fair reflection of the quality of the assets within its portfolio.

Whilst the level of GCP’s discount remains frustrating, the NAV continues to grow, modestly outperforming the wider peer group over the last six months. In the short term, sentiment can often drive prices, as we have seen recently for GCP. However, in the longer term, fundamentals remain the key and we would expect this ongoing execution to eventually result in a considerable re-rating of the company’s shares, reflecting the underlying quality of the company’s portfolio.

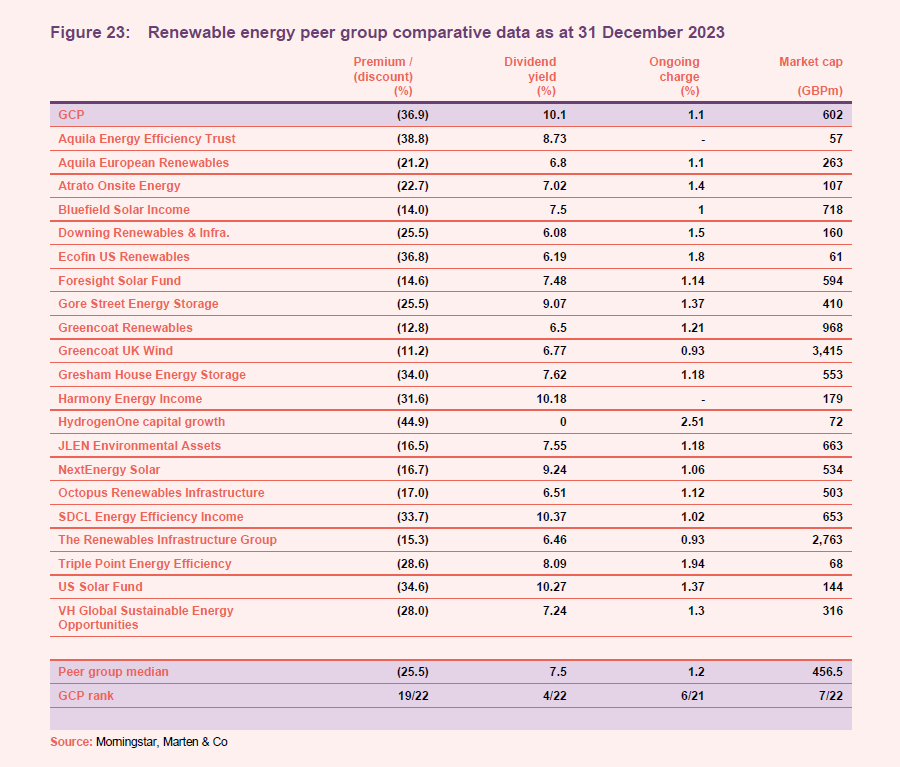

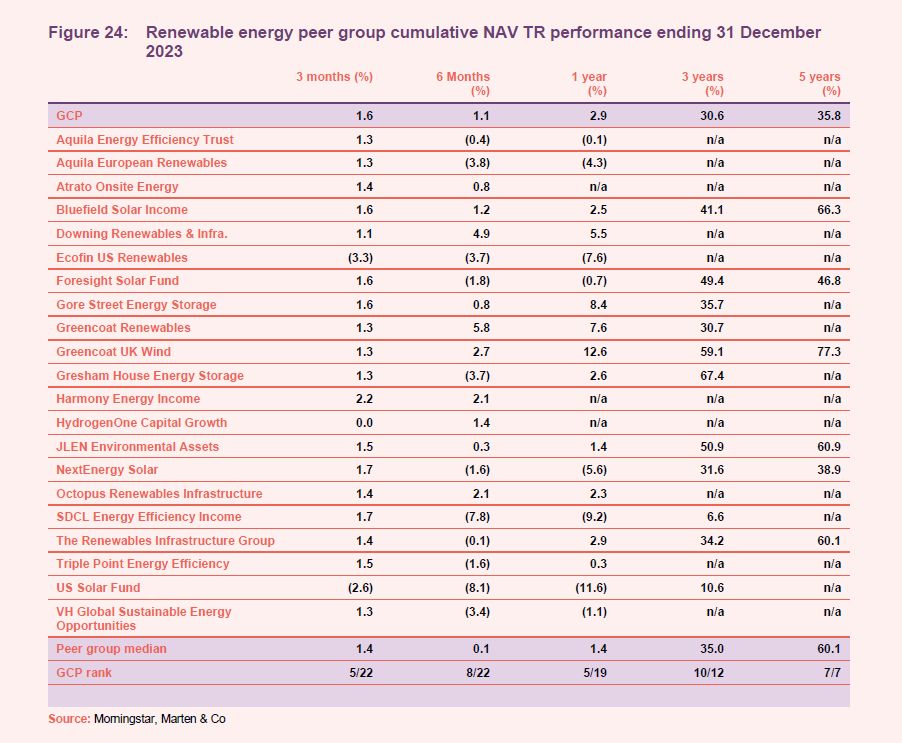

Alternative peer group – renewable energy funds

In light of the increasing importance of renewable energy within GCP’s portfolio, we feel it is also relevant to compare the company to the constituents of the renewable energy infrastructure sector, shown in Figure 23. However, it is worth noting that this encompasses a diverse range of funds which are not all directly comparable to GCP such as Ecofin US Renewables and the US Solar Fund, which have much-longer-term PPAs and are therefore less exposed to energy price volatility. GCP’s asset base also differs widely from the energy storage funds – Gore Street, Gresham House and Harmony – and the energy efficiency funds – Aquila, SDCL and Triple Point.

We think the best comparators are probably Bluefield Solar, Foresight Solar, Greencoat UK Wind, JLEN Environmental, NextEnergy Solar, Octopus Renewables and The Renewables Infrastructure Group.

What is immediately clear is the divergence in discounts across the two sectors, with renewable energy trading on a median discount of 25.5% compared to 15.9% for the infrastructure sector. This explains some of the variance in GCP’s discount relative to its immediate peer group, given its considerable exposure to renewable assets.

Even so, GCP’s discount remains towards the bottom of the renewables peer group, trading alongside some of the more speculative assets in the sector, despite its focus on stability and long-term capital preservation. The company also provides one of the highest dividends and lowest charges.

The key takeaway from these comparisons is that GCP’s discount is a clear outlier when compared to both peer group medians. This remains in stark contrast to its recent history, with the company trading on a premium of almost 20% leading up to the pandemic. Several factors have been put forward to explain the drivers of the company’s discount since then.

For one, GCP’s conservatively valued NAV appears to have dragged down its returns relative to the peer group median, while the company also suffers from its bias to debt rather than equity. Compounding this is the equity-like exposure that the fund does have being hit hard by the perception of falling returns, relative to electricity prices, as well as the Electricity Generators Levy. Compared to its immediate infrastructure peer group, exposure to renewables – which have been one of the hardest-hit sectors in the investment trust universe – have also had a negative impact.

The company’s focus on the UK may have also contributed, taking into account the economy’s well-documented struggles with inflation, and growth, which have compounded the detrimental effects of 2022’s mini-budget debacle (a controversial and ultimately unsuccessful plan to stimulate growth delivered in 2022).

In our view, the confluence of all of these factors have built up a significant amount of negative sentiment toward GCP which has become self-re-enforcing. 2023 was, in many ways, defined by market irrationality, which can cause prices to become far removed from the fundamental realities. Unfortunately, this has been the case for GCP.

Thankfully, this has had little impact on the underlying operation of the company, as highlighted by its ongoing NAV returns. Whilst in the short term, market sentiment remains tied to the trajectory of interest rates, we believe that it remains only a matter of time before the stability of its cash flows and a dividend yield of close to 10% begins to attract attention once again, particularly if inflation/interest rates continue to trend lower.

Quarterly dividend

Dividends are declared and paid quarterly. Shareholders are able to elect to take their dividend as scrip (in shares rather than cash). In its 2023 financial year, GCP’s target dividend remained stable at 7.0p in line with its previous two financial years.

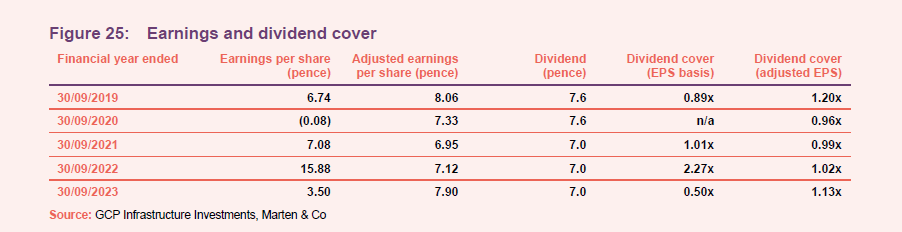

Dividend cover

Loans made by the company are valued on a discounted cash flow basis. When a loan is first made, it is typically valued using the interest rate charged to the borrower. However, loans are often revalued by the valuation agent to reflect changes in the market rate of interest or for project specific reasons, for example.

As market rates of interest have fallen since GCP was launched, higher values have been attributed to many of the loans that it has made, uplifting the NAV. That has the effect of pulling forward the recognition of income from these loans and, on an IFRS accounting basis, reduces GCP’s earnings per share and dividend cover in subsequent years (a pull-to-par effect). For this reason, the board and the investment adviser have calculated a range of alternative performance measures. In addition, the adviser cautions that looking at measures of cashflow coverage of the dividend can be misleading. Interest accrued on loans can either be paid in cash or added to the outstanding principal and repaid when the loan matures (payment in kind or PIK). This gives rise to timing differences that affect cashflow dividend coverage measures.

Figure 25 shows GCP’s dividend cover ratios on two bases – normal (IFRS) earnings cover, and an adjusted figure which strips out the impact of unrealised fair value adjustments on the company’s earnings, and better contrasts GCP’s revenue and dividend payout.

We note that the increase in the unadjusted earnings per share (EPS) coverage through FY2022 reflects a substantial increase in the unrealised value of GCP’s assets.

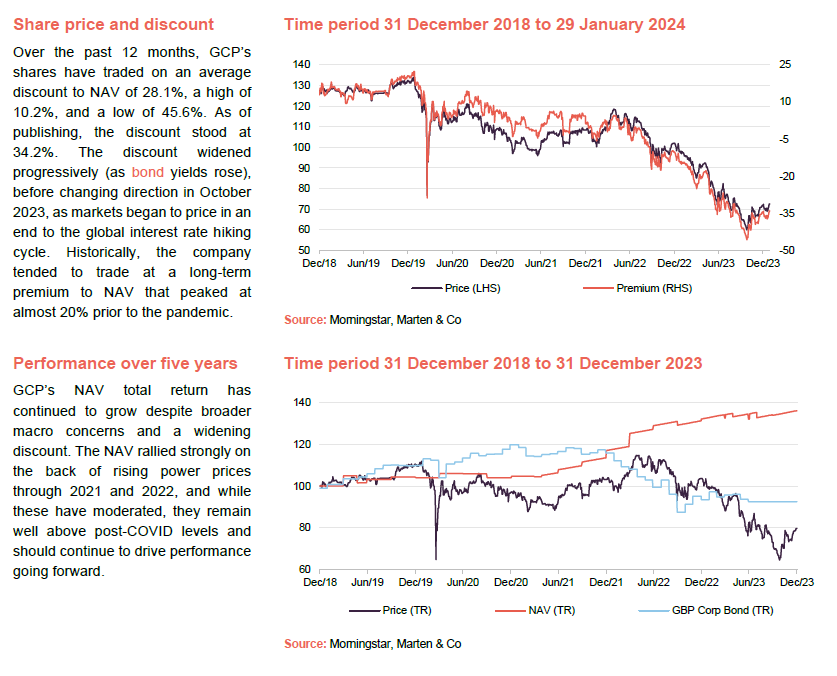

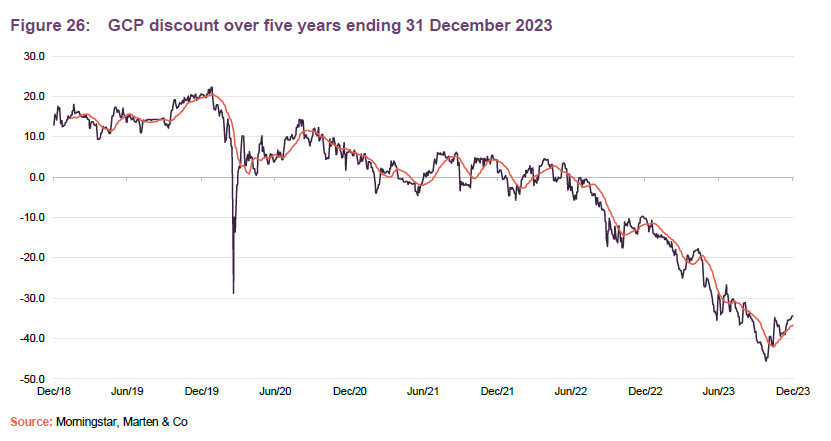

Emergence of a wide discount

Over the past 12 months, GCP’s shares have traded on an average discount of 28.1%, a high of 10.2%, and a low of 45.6%. As of publishing, the discount stood at 34.2%. As Figure 26 shows, this has widened progressively (as bond yields rose), before inflecting in October as markets began to price in an end to the global hiking cycle. The depth and duration of the current discount is a dramatic switch from historical averages, with the company previously trading at a long-term premium that peaked at almost 20% prior to the pandemic.

Fees and costs

The investment adviser receives an investment advisory fee of 0.9% a year of the NAV net of cash. This fee is calculated and payable quarterly in arrears. There is no performance fee. The investment adviser is also entitled to an arrangement fee of up to 1% (at its discretion) of the cost of each asset acquired by GCP. Gravis will generally seek to charge the arrangement fee to borrowers rather than to the company, where possible. To the extent that any arrangement fee negotiated by the investment adviser with a borrower exceeds 1%, the benefit of any such excess shall be paid to the company. The investment adviser also receives a fee of £70,000 (subject to RPI adjustments) a year for acting as AIFM, which was £83,000 for the 2023 FY, after adjustments.

The investment advisory agreement may be terminated by either party on 24 months’ written notice.

Apex Financial Services (Alternative Funds) Limited is GCP’s administrator and company secretary. Depositary services are provided by Apex Financial Services (Corporate) Limited. The fee for the provision of these services during the year was £1.034m (FY22 £1.021m).

The ongoing charges ratio for the year ended 30 September 2023 was 1.1%, unchanged from the prior year.

Capital structure and life

As of 31 December 2023, GCP has 884,797,669 ordinary shares outstanding, of which 16,985,019 are held in treasury. The company’s financial year end is 30 September and AGMs are held in February.

GCP is an evergreen fund with no fixed life and no regular continuation vote.

Gearing and derivatives

Structural gearing of investments is permitted up to a maximum of 20% of NAV immediately following drawdown of the relevant debt. At 30 September 2023, GCP’s net gearing was 10.8%.

As of 30 September 2023, the company has credit arrangements available £190m across five lenders: RBSI, Lloyds, AIB, Mizuho and Clydesale, At year end, £104m with a margin in place of SONIA +2.0%. The RCF is due to expire in March 2024. The investment adviser has liaised with the existing lending group to agree head of terms for a new reduced facility of £150m in line with the board’s stated intention to reduce leverage by the end of 2024.

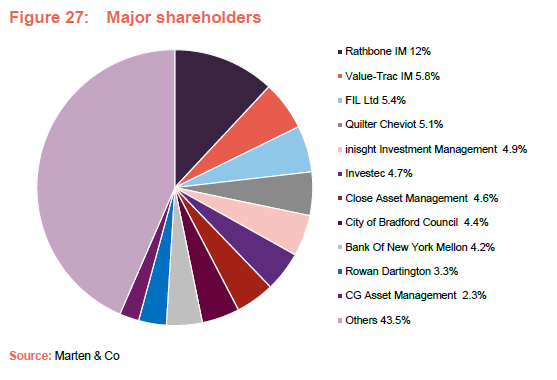

Major shareholders

Board

Currently, the board has six directors, all of whom are non-executive and independent of the investment adviser.

Andrew Didham (chairman)

Andrew Didham, a UK resident, is a Fellow of the Institute of Chartered Accountants in England & Wales. He is a senior executive director with extensive board-level experience within the Rothschild banking group. Andrew was group finance director for 16 years and a member of the group management of the worldwide Rothschild business, comprising investment banking, wealth management, asset management and merchant banking activities. He has broad non-executive director experience, being on the boards of IG Group Holdings Plc, Shawbrook Group Plc, Charles Stanley Group Plc, and formerly Jardine Lloyd Thomson Group Plc. Within Rothschild, he remains an executive vice chairman (a position he has held since 2012) and a non-executive member of NM Rothschild and Sons Limited. Formerly, he was a partner in the London office of KPMG with responsibility for the audit of a number of global financial institutions and assignments for various government and regulatory authorities.

Julia Chapman (senior independent director)

Julia Chapman, a Jersey resident, is a solicitor qualified in England & Wales and Jersey with over 30 years’ experience in the investment fund and capital markets sector. Having trained with Simmons & Simmons in London, she moved to Jersey to work for Mourant du Feu & Jeune (now known as Mourant) and became a partner in 1999.

Julia was appointed senior counsel to State Street following its acquisition of Mourant’s fund administration business in April 2010. She headed up a team supporting State Street’s European alternative investment services division. In July 2012, Julia left State Street to focus on the independent provision of directorship and governance services to a small number of alternative investment fund vehicles. Julia serves on the boards of three other Main Market listed companies: Henderson Far East Income Limited, BH Macro Limited and Sanne Group Plc.

Dawn Crichard (chair of the management engagement committee)

Dawn Crichard, a Jersey resident, is a Fellow of the Institute of Chartered Accountants of England and Wales with over 20 years’ experience in senior chief financial officer and financial director positions. Having qualified with Deloitte, she moved into the commercial sector and was chief financial officer of a large private construction group for 12 years. Dawn then worked with both private and listed clients in the hedge fund division of State Street. Following this, she was appointed as chief financial officer for Bathroom Brands Plc. In her current role as head of finance at a family office, she has been involved in establishing and overseeing high-value private expert funds. Her broad accounting and commercial experience includes establishing new group head offices, mergers, acquisitions, refinancing and restructuring.

Michael Gray (chair of the investment committee)

Michael Gray, a Jersey resident, is a qualified corporate banker and corporate treasurer. Michael was most recently the regional managing director, Corporate Banking for RBS International, based in Jersey, but with responsibility for The Royal Bank of Scotland’s Corporate Banking Business in the Crown Dependencies and British Overseas Territories.

In a career spanning 31 years with The Royal Bank of Scotland Group Plc, Michael has undertaken a variety of roles, including that of an auditor, and has extensive general management and lending experience across a number of industries. He is also a non-executive director of Jersey Finance Limited, the promotional body for the finance sector in Jersey, and a Main Market listed company JTC Plc, as well as other listed and private companies.

Steven Wilderspin (chair of the audit and risk committee)

Steven Wilderspin, a Jersey resident, is a Fellow of the Institute of Chartered Accountants of England & Wales. Since 2007, he has acted as an independent director on a number of public and private investment funds and commercial companies. In 2017, he retired as the chair of the audit and risk committee of 3i Infrastructure Plc after 10 years of service.

Steven is currently the chair of the risk committee of Blackstone Loan Financing Limited, chair of the audit and risk committee of HarbourVest Global Private Equity Limited, and a non-executive director of Phoenix Spree Deutschland Limited. Prior to 2007, he was a director at Maples Finance Jersey, with responsibility for their fund administration and fiduciary business. Steven began his career at PwC in London in 1990.

Alex Yew (independent director)

Alex Yew, a United Kingdom resident, is a qualified solicitor in Singapore and in England and Wales. Alex has more than 25 years of experience as a lawyer, banker and investor. Until recently, Alex was a senior adviser and a senior managing director at John Laing, an international investor in infrastructure and energy assets. He worked at John Laing for more than 14 years, during which time he held leadership positions in Project Finance, New Markets, Strategy, Partnerships, Latin America and Europe. He was also a member of the senior leadership team and the Investment committee. Prior to John Laing, Alex was a director in the infrastructure advisory team at CIBC World Markets in London as well as a banker and lawyer in Southeast Asia.

Previous publications

Readers interested in further information about GCP may wish to read our previous notes.

Figure 29: QuotedData’s previously published notes on GCP

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on GCP Infrastructure Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.