Pantheon Infrastructure

Investment companies | Initiation | 17 March 2023

Reliable income streams with inflation protection

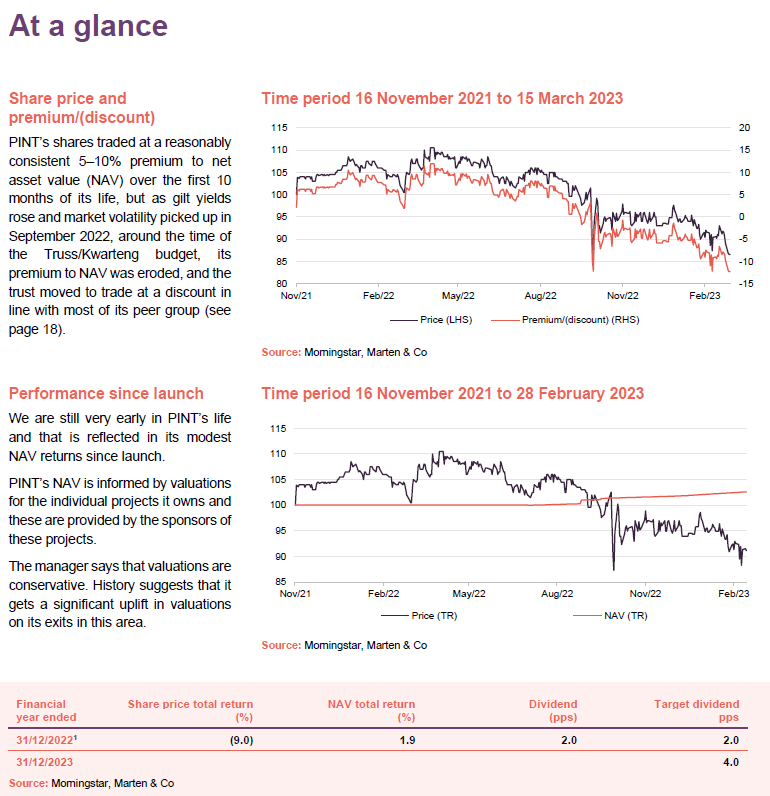

Since its launch in November 2021, Pantheon Infrastructure (PINT) has been busy assembling a diverse portfolio of 11 investments in infrastructure projects, located in developed markets. The majority of these have explicit inflation-linkage built into their structure or implicit protection through regulation or market position. In addition, the company is substantially hedged against foreign exchange movements. Whilst it is still early days for the trust, the NAV has made positive progress.

PINT’s ambition is to generate NAV total returns of between 8% and 10% per annum over the long term. This is intended to come in the form of both capital and income growth. For this financial year, the trust is targeting a dividend of 4p per share.

PINT still has about £72m of funds available to deploy into new investments (see page 16). The manager says that the tailwinds that support the demand for new infrastructure, and the growth opportunities that accompany it, remain strong across all the sub-sectors the company is active in. Once PINT’s discount is eliminated, we would expect to see the company grow through share issuance.

Global high-quality infrastructure with strong ESG credentials

PINT aims to provide access to a globally diversified portfolio of high-quality infrastructure assets, primarily in developed OECD markets, which will generate sustainable attractive returns over the long term. It targets co-investment assets that have strong ESG credentials and underpin the transition to a low-carbon economy.

Fund profile

More information is available at the fund’s website: pantheoninfrastructure.com.

PINT is targeting NAV total returns of 8–10% per annum from a portfolio of infrastructure assets that offers the prospect of some capital growth as well as an attractive level of income. PINT makes co-investments in infrastructure assets alongside leading investors in these areas (sponsors), leveraging their additional expertise and experience. It invests globally, with a primary focus on developed markets, with the majority of its investments in Europe and North America.

Digital, renewables and energy efficiency, power and utilities, transport and logistics.

Its initial focus is on digital infrastructure (data centres, fibre networks, mobile telecom towers and the like); renewables and energy efficiency (wind, solar, sustainable waste powered electricity generation, smart meters); power and utilities (energy utilities – transmission and distribution, water and conventional power generation); and transport and logistics (ports, rail, roads and airports).

In its prospectus, PINT also included the potential for social infrastructure (such as education, healthcare, government and community buildings) but these assets are typically lower returning.

The board believes that PINT can offer investors stable, predictable cash flows, an inflation hedge, embedded downside protection, and sub-sector diversification.

Investment manager

Pantheon has around $88bn of assets under management, including $20bn in global infrastructure.

PINT’s AIFM is Pantheon Ventures (UK) LLP (Pantheon). Pantheon is a leading global private equity, infrastructure & real assets, private debt and real estate investor with 40 years’ experience sourcing and executing private market investment opportunities on behalf of clients. Pantheon had around $88.9bn in assets under management and advice (as at 30 September 2022), around $20bn of which was managed by its global infrastructure team. It employs over 460 staff, including more than 140 investment professionals, across offices in London, San Francisco, New York, Chicago, Hong Kong, Seoul, Bogotá, Tokyo, Dublin, Berlin, and a presence in Tel Aviv.

Well-resourced team of more than 30 investment professionals.

The global infrastructure team is composed of more than 30 investment professionals. The investment committee has an average of around 21 years’ experience. More information on the team is provided on page 21.

Between 2015 and September 2022, the global infrastructure team generated a gross IRR (internal rate of return) of 14.1% and net IRR of 12.3% on its infrastructure co-investments (the net return was calculated by adjusting for a notional 1.5% annual management charge to reflect PINT’s likely ongoing charges ratio)[1]. Note, PINT’s actual ongoing charges ratio for the accounting period that ended on

31 December 2022 was 1.02% as no management fee was paid on undeployed cash until 75% of the net issue proceeds were deployed (in Q3 of 2022).

([1] Performance data as of 30 September 2022. Performance data includes all consummated infrastructure co-investments approved by the Global Infrastructure and Real Assets Committee (“GIRAC”) since 2015, when Pantheon established its infrastructure co-investment strategy. Notional net performance is based on average annualised fee of 1% of NAV and an assumed 50 basis points (0.5%) per annum of additional operating costs. However, this assumed figure is an estimate for illustrative purposes only. Pro forma results have inherent limitations and as such, should not be relied on as an indication of what actual performance would have been for the time period shown or may be in the future.)

The opportunity

Making infrastructure accessible.

Investors in the London-listed investment companies market have been able to allocate to the infrastructure sector for over 15 years. The sector provides liquid access to what otherwise would be an asset class that was inaccessible for most investors.

Predictable, reliable cash flows.

Often with inflation-linkage.

Infrastructure investing offers access to predictable, reliable cash flows underpinned by regulation, hedges or long-term contracts with government-backed and financially-secure counterparties.

Infrastructure investments may provide a natural hedge to rising inflation, benefiting from inflation-linked contracts, regulatory allowances, and price-inelastic demand (scenarios where it is possible to raise prices without affecting demand for a product or service). Infrastructure assets often have monopolistic characteristics that create natural advantages for investors, and their critical nature means that in market stress scenarios they may be sold to recover value for investors.

Pantheon favours businesses underpinned by long-term contracts with high-quality counterparties. For example, in PINT’s data centre businesses, the customers are large hyperscale customers, that may include Amazon Web Services and Microsoft Azure.

Avoiding highly-leveraged investments.

The vast majority of PINT’s investments have some underlying leverage (debt). However, PINT will tend to only invest in equity. Deals may have no leverage at the outset but may take on debt at a later stage – for example, build-out strategies. Backing lower-leveraged businesses with strong balance sheets provides further downside protection. Excessive leverage would be a reason to turn down a deal.

Pantheon aims to invest in businesses with established consumer bases and limit potential technology, and construction risk. The majority of Pantheon’s investments have been in operational projects or in mixed portfolios with advanced pipelines of new-build projects. Pantheon believes that focusing on these investment attributes can lead to more stable cash flows and considerable downside protection for investors.

Infrastructure investments are often backed by critical assets, and contractual structures with high quality counterparties which offer further downside protection.

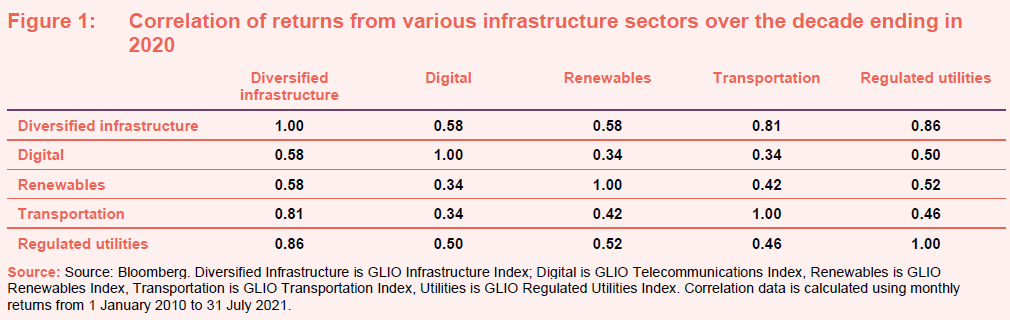

Uncorrelated returns

Revenue streams from infrastructure are relatively insensitive to economic cycles, are less correlated with listed equity and debt investments and less volatile, which makes it a useful diversifier for portfolios. By blending a range of different types of infrastructure within PINT’s portfolio, the manager should be able to further reduce the volatility of returns.

Size of the opportunity

In many OECD countries, successive governments have underinvested in infrastructure over many decades. Couple that with the considerable investment needed to decarbonise economies (with legally binding net zero greenhouse gas emissions targets in many countries), and adapt to a digital age, and the investment opportunity runs into the trillions of dollars.

Digital infrastructure

Technological advances require significant upgrades to existing digital infrastructure. The advent of 5G is enabling the “Internet of Things”, which is driving significant growth in mobile data consumption. More data, the growth of cloud computing and societal changes (such as the boom in working from home) need support in the form of high-speed networks and data centres.

Whilst the opportunity is considerable, Pantheon notes that increased interest in the sector has led to more competition and rising valuations, which warrants a selective approach to investing. The manager says that investment in fibre offers a relatively attractive risk/reward opportunity currently, but it stresses the importance of backing teams with a good track record of delivery. It also notes a need to ensure that the supply chain is reliable if projects are to come in on time and on budget. Conversely, digital towers traditionally provide resilient revenues in times of economic stress, while a focus on hyperscale data centre investments comes with significant scale benefits, and these are built to meet customer demand rather than speculatively.

Renewables and energy efficiency

The pressing need to tackle climate change is driving investment in renewable generation capacity and energy efficiency projects. Smart infrastructure including advanced meter infrastructure and sustainable waste treatment will also play a critical role in the transition to a circular economy. When evaluating potential investments in this segment, merchant power revenues (sales of power in the open market) are heavily discounted to stress-test the viability of the investment case.

Power and utilities

As renewables play an increasingly important role in energy generation, transmission infrastructure needs to adapt. Energy storage is needed to help address the intermittency of renewable generation and balance the supply of power with demand, while flexible generation (such as gas peaking plants and battery storage facilities) will play an important role. Transmission networks need to be upgraded to be more flexible, less centralised, robust, and smarter. Gas utilities will also need to adapt to facilitate the supply and demand dynamics of renewable natural gas and hydrogen.

Transport and logistics

The transport and logistics sector needs to be decarbonised too. However, there are other reasons to make this an area of focus for PINT which include: relatively rapid shifts towards e-commerce, the need to build more resilient and most-likely shortened supply chains, and upgrades to aging infrastructure. COVID disruption highlighted weaknesses in the globalisation/just in time logistics model. The trend for reshoring (bringing manufacturing back to the country where goods are consumed) is creating additional demand for transport and logistics services in what are often relatively high wage economies, thereby pushing up costs.

Growth of both capital and income

The majority of the assets in the listed infrastructure space produce steady and attractive income streams but offer little prospect of capital growth (more information on PINT’s listed peer group is provided on page 18).

PINT has a higher total return target than most traditional infrastructure funds.

PINT is one of the newest additions to the sector. It is differentiated by its focus on both income and capital growth, with a higher total return target than most traditional infrastructure funds, which comes at the expense of a slightly lower initial dividend yield. It also offers a more diverse portfolio than the two relatively-recently launched digital infrastructure funds (see page 19).

To achieve its objective, more of the infrastructure in PINT’s portfolio has an economic exposure than an equivalent PPP-type focused investment fund would. Such investments are more complex; they may involve businesses carved out from larger groups or aggregation/build-out type strategies, for example. The underlying managers have more work to do beyond the rather more passive income collection of a traditional infrastructure fund.

In anticipation of a slowing economy, the manger has targeted long term secular themes since launch to minimise PINT’s sensitivity to economic growth.

The attractions of a co-investment approach

Investing alongside experts in their sectors, but without additional fees.

A crucial differentiating factor for PINT when comparing it to its peers is PINT’s focus on making co-investments alongside the leading global players (sponsors) in the infrastructure market. This opens up a wealth of opportunities and allows PINT to leverage the sponsor’s expertise without the additional fees that would be incurred if it was making investments into those sponsors’ limited partnership vehicles. As is commonplace with co-investments, most deals are offered with no ongoing management fee nor carried interest.

Using this approach gives Pantheon greater control over PINT’s asset allocation and allows it to allocate to the best sponsors in each subsector. Co-investments can provide access to nascent and emerging sectors that may otherwise be underweight positions or possibly not accessible within primary or secondary investment opportunities.

For the sponsors, attracting co-investment money to their deals allows them to diversify the portfolios of their funds. PINT’s manager expects to see continued expansion of the already sizeable infrastructure co-investment market ($13bn in 2020).

Investment process

PINT’s board of directors (see page 25) sets the strategic direction of the fund but is not involved in day-today portfolio management decisions, which are delegated to the manager. In practice, the only situation where PINT’s manager would need to seek prior board approval, before making an investment, is if a deal would see PINT holding a single asset that would account for more than 12.5% of the portfolio. For an asset that would account for more than 15% of the portfolio, shareholder approval would also need to be sought.

Pantheon is selective about the sponsors that it works with.

The wider Pantheon business has relationships with a number of sponsors and may make primary commitments to their funds. A long list of potential sponsors has been whittled down to about 50 that the manager is actively working with, most of which will be well-known names. The sponsors bring potential co-investment opportunities to them. Sponsors that PINT has already invested alongside include KKR, Apollo and Macquarie.

PINT is more than a provider of finance. It often gets involved at a relatively early stage in the process and shadows the due diligence activities of the sponsor. It helps that PINT is often investing alongside other Pantheon funds, which are making primary (investments in brand new funds), secondary (buying stakes in existing funds) and co-investments. Collectively, they can write meaningful cheque sizes of about $200m, whereas PINT is writing cheques in the £20m–£50m range. Scale and the ability to execute quickly are important.

- Sponsors may invite Pantheon to underwrite a deal prior to the sponsor’s final bid submission. This necessitates the ability to lead independent due diligence on an asset, something that Pantheon is equipped to handle given the depth of resource it has available to it and its long experience in the sector.

- Sponsors may seek to syndicate a portion of an agreed deal to a targeted group of investors. Again, in advance of this, Pantheon may have been invited to participate in the due diligence process.

- PINT may also participate in general syndication opportunities. These are offered to a sponsor’s existing fund investors – which would normally preclude PINT from being involved in the process, but Pantheon’s considerable limited partnership (LP) investments made by other funds that it manages mean that it is offered opportunities that can be passed on to PINT.

Only about 6% of deals screened will make it into portfolios.

Historically, 79% of co-investments closed by Pantheon have been in co-sponsor and targeted syndication processes, where Pantheon has been the sole investor alongside the sponsor, or one of a small syndicate. As at 31 December 2022, Pantheon said that, since 2015, it had screened 728 infrastructure co-investment opportunities (about $70bn of investment capacity), of which the team had executed 52 transactions worth about $4.4bn, a conversion rate of about 6%.

Some of the deals that PINT is doing are into entities that Pantheon has been exposed to for some time, but where top-up investment opportunities exist. This can arise where other funds have reached the end of their investment period, for example. It means that PINT has exposure to some more mature assets than it otherwise would have done. Vertical Bridge and Vantage (see pages 14 and 15) are examples of these types of asset.

Pantheon allocates between funds on a pro-rata basis, taking into account each client’s target allocation to a particular type of investment. An internal investment committee signs off on the allocation and there exists a separate risk committee.

Members of the investment team are infrastructure investment specialists across all sub-sectors. They tend to have relationships with certain sponsors. Ideas are proposed to the committee and, if approved at the first stage, the investment is subjected to more intense due diligence before being resubmitted to the committee for final approval.

One of the screens that potential investments must clear is the environmental, social and governance (ESG) screen. There are specific exclusions (see the separate section on PINT’s approach to ESG on page 10). However, deals may also be turned down for other considerations – perceived social problems, for example.

Investments are made with a five-to-seven-year time horizon. The manager turns down deals with no clear path to exit – if PINT is to continue to provide investors with capital growth, it needs to be able to recycle the capital invested in more mature slower growth investments back into those with superior growth prospects, rather than just collecting an income.

Investment restrictions

PINT is subject to the following investment restrictions (all measured at the time of investment):

- no single investment will represent more than 15% of gross asset value (GAV);

- no more than 20% of GAV in investments where the underlying infrastructure asset is located in a non-OECD country; and

- no more than 30% GAV invested alongside funds or accounts of any single sponsor (other than Pantheon).

In addition, PINT will not invest in infrastructure assets whose principal operations are in any of the following restricted sectors:

- coal (including coal-fired generation, transportation and mining);

- oil (including upstream, midstream and storage);

- upstream gas;

- nuclear energy; and

- mining.

Some look-through exposure to restricted sectors is permitted as long as the revenues from this area are not more than 15% of the revenue from a single investment and not more than 5% of the whole portfolio. There would also have to be an expectation that these restricted revenues were declining over time.

ESG

PINT is an Article 8 fund.

PINT is an Article 8 (light green) product under SFDR[1]. An Article 8 fund is one which promotes, among other characteristics, environmental or social characteristics, or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices.

Pantheon has been integrating responsible principles into its investment process for many years; it was the second private equity firm globally to sign the UN Principles for Responsible Investment in 2007, joining the UN PRI steering committee in 2009.

In 2020 the UN PRI awarded Pantheon an A+ rating for infrastructure, and for strategy and governance. In 2021, Pantheon became a signatory for the TCFD[2].

Pantheon conducts due diligence on and engages with sponsors to promote the importance of ESG. When performing due diligence on potential investments, potential concerns are flagged for consideration to Pantheon’s global infrastructure and real assets committee (GIRAC), and international investment committee (IIC).

Pantheon works with third parties such as RepRisk both in the due diligence phase and when monitoring assets in the portfolio. Another third-party, ERM, has been engaged to develop a climate change sector risk analysis to identify physical and transition risks as well as opportunities across Pantheon’s infrastructure portfolios.

Pantheon is also a signatory of the Women in Finance Charter and emphasises partnerships that target gender, LGBTQ+ and under-represented groups, including with 100 Black Interns, Sponsors for Educational Opportunity, Women in Alternative Assets, PEWIN, Level 20, Mindful Business Charter, and Out Investors.

([1] Sustainable Finance Disclosure Regulation: Requires that financial services providers and owners of finance products analyse and disclose environmental, social and governance (ESG) considerations in a public way.

[2] Task Force on Climate-Related Financial Disclosures: a guidance framework that helps companies disclose climate-related financial risks to investors, lenders, and insurers.)

Hedging

PINT may hedge its exposure to currency, interest rates, inflation and power prices for the purposes of efficient portfolio management. However, derivatives may not be used for speculative purposes. Regarding currency risk, in order to limit the potential impact on the net asset value from material movements in major foreign exchange rates, PINT has implemented a structured foreign exchange hedging programme. This aims to reduce (rather than eliminate) the impact of movements in major foreign exchange rates on the sterling NAV.

PINT’s borrowing facility (see page 22) allows it to borrow in currencies other than sterling as part of its currency hedging strategy. However, there is no obligation on PINT to hedge its currency exposure.

Any hedging activity will be reviewed by the directors on a regular basis.

Internally, the investment manager has a policy that not more than 25% of the NAV is unhedged back into sterling.

Asset allocation

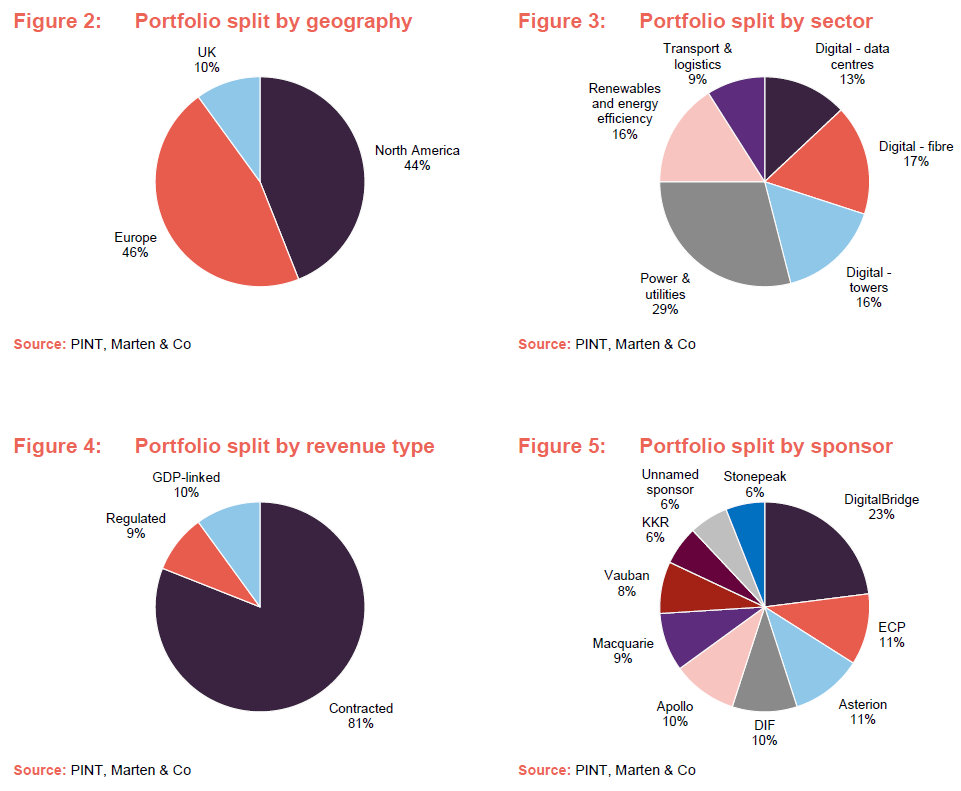

PINT set out to assemble a portfolio of eight to 12 assets within nine to 12 months from its initial admission and has achieved that. The following charts are based on PINT’s annual results presentation using data as at 24 February 2023. They include a commitment of £25m to a US renewables asset with an unnamed sponsor which is in legal closing.

In its prospectus, PINT indicated that between 5% and 15% of its portfolio might be invested in Asia Pacific/rest of the world. Otherwise, the geographic distribution of the portfolio is as expected. The portfolio has greater exposure to digital infrastructure than flagged at IPO (where the upper bound for this exposure was around 35%). Social/other exposure was indicated at 5–15% at that time, but as yet, PINT has not made an investment in that area.

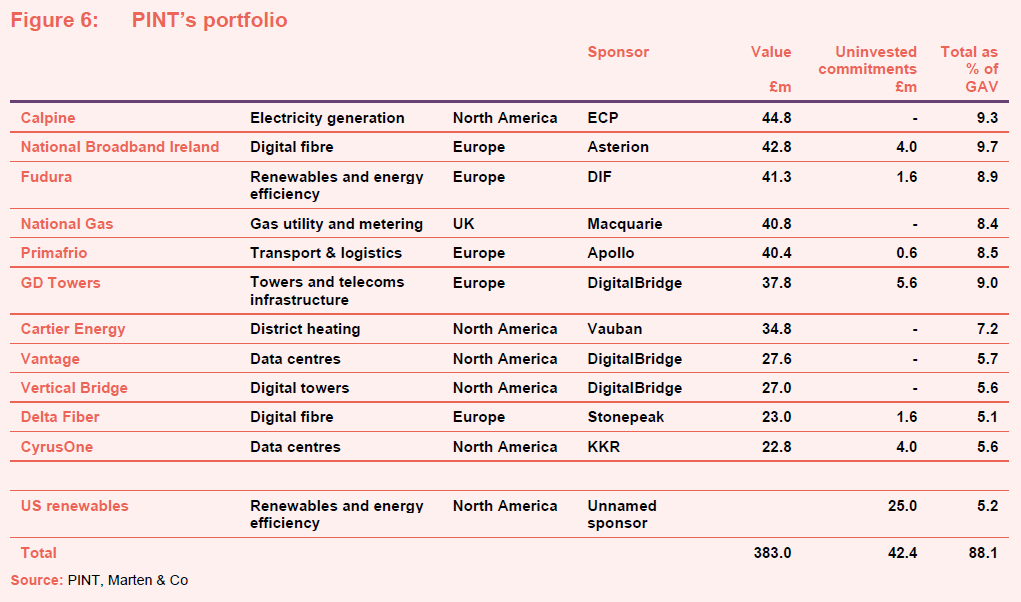

Portfolio

At 24 February 2023 PINT had committed £400m to 11 assets, and a further £25m investment, in the US renewables asset referred to above, was in legal closing.

Calpine

Calpine (calpine.com) describes itself as America’s premier competitive power company, but the tag line says “creating power for a sustainable future”. The company operates 80 power plants across 25 US States, Canada and Mexico, with about 26GW of capacity, enough to power about 20m homes. The core of its business is a fleet of gas turbine power plants. However, the attraction for PINT is that Calpine is using cash flows from these legacy assets to fund renewables investment including CHP, geothermal, solar and battery storage. That renewables portfolio now has about 1GW of operational assets.

Pantheon is keen to avoid exposing PINT to excessive levels of commodity price risk. Calpine’s gas purchases are contracted, and they have fixed term power prices for the next couple of years. It sells power into the grid at merchant prices, but has some corporate power purchase agreements (PPAs) too.

Part of Pantheon’s investment thesis is that the business will be re-rated as the balance of the portfolio shifts towards renewables. It anticipates a five-to-seven-year holding period for the investment while this plays out.

The sponsor in this case is Energy Capital Partners (ECP). It took the business private in August 2017, paying $17bn. PINT’s investment comes as part of a continuation fund with $1.6bn in capital commitments, which was anchored by Pantheon and Phoenix Insurance. The continuation fund bought a stake in Calpine from ECP III and ECP IV.

National Broadband Ireland

National Broadband Ireland (NBI nbi.ie) is a PPP-type deal with a public sector counterparty. The project needs an element of subsidy because it is rolling out rural broadband, reaching 96% of Ireland’s land mass; a clear social good.

The sponsor, Asterion Industrial Partners, is invested in the project alongside Granahan McCourt (the investment vehicle of Granahan McCourt Capital and Tetrad Corporation) and the project’s management team.

The target is to deliver high-speed broadband (guaranteed minimum speeds of 500Mb) to around 560,000 premises (1.1m people). Pantheon notes that part of the attraction of the deal is that there is little risk of overbuild, given that the investment would be unprofitable without subsidy. As yet, the project is unlevered, but debt will be incorporated within the capital structure as the project progresses. The plan envisages a seven-to-eight-year build period and NBI will be responsible for the management of the new national broadband network for at least the next 25 years.

Primafrio

Primafrio (primafrio.com) offers freight transport logistics services across Spain and the rest of Europe. Its temperature-controlled distribution services are used to transport cargo such as fruits, vegetables, other food products, and pharmaceuticals.

Primafrio was established in 2007. Apollo bought a stake in the business in March 2022, with the ambition of accelerating its growth and building out its infrastructure network. At that time, the company had a fleet of over 2,300 vehicles and more than 45 logistics centres in more than 25 countries.

The team feels that Primafrio’s network would be hard to replicate and the consumption of products carried by Primafrio is not much affected by the health of the economy. In addition, the value of a load far exceeds the cost of transport, increasing the price elasticity of Primafrio’s services. The manager notes that the business performed well in recent crises.

The founding family retains a significant stake, and it wants to use Apollo’s capital to grow the business. Pantheon feels that the company will be a more sellable asset when the plans come to fruition. Primafrio is growing organically and by acquisition. The general lack of availability of credit that has been prevalent since interest rates started to rise is reducing competition for acquisitions.

Fudura

Fudura (fudura.nl/en) is an energy infrastructure business based in the Netherlands. Its B2B smart metering, transformers and monitoring services are used to ensure the smooth running of electricity networks serving around 22,000 business customers. In March 2022, DIF Capital Partners, through DIF Infrastructure IV, bought out the Fudura business from Enexis Group alongside PGGM Infrastructure Fund.

DIF saw an opportunity to broaden its services within the energy transition, offering services such as the delivery of solar panels, batteries, electric vehicle chargers and electric heating solutions.

Cartier Energy

In May 2022, Vauban Infrastructure Partners bought a portfolio of eight district heating and cooling systems across five States in the Northeast and Midwest of the US to create Cartier Energy.

These assets – Detroit Thermal Energy in Michigan; the CHCP plant at Montclair State University in New Jersey; Hartford Steam and Fuel Cell, Midtown Thermal in Atlantic City, New Jersey; Wilmington District Energy and Dover Energy in Delaware; and Industrial District Energy Assets in New Jersey and Massachusetts – serve a diverse customer base across the higher education, healthcare, commercial, manufacturing, hospitality, government, and retail sectors. Vauban is leveraging expertise gained from owning and managing similar systems in Europe. Operations and maintenance (O&M) of the facilities is being performed by DCO Energy, which developed some of these assets.

Vertical Bridge

Founded in 2014, Vertical Bridge (verticalbridge.com) owns and operates telecom towers; small cell infrastructure such as billboards, retail stores, rooftops, towers; Edge computing; and in-building wireless services. It is one of the largest private companies operating in this area within the US.

In August 2021, DigitalBridge bought a controlling interest in the company. At that stage, Vertical Bridge had over 308,000 owned or master-leased sites, including over 8,000 towers across the US. Today, the number of sites has grown to over 500,000 and the number of towers exceeds 11,000.

The roll-out of 5G and the growth of the Internet of Things provide a fair tailwind for the growth of the business.

CyrusOne

CyrusOne (cyrusone.com) has a network of more than 50 carrier-neutral data centres across North America and is expanding into Europe. The business is focused on the hyperscale market, with customers such as AWS and Azure. It was an early investor in the sector, with a history that goes back to 2001.

CyrusOne’s centres are location-sensitive as latency requirements mean that positioning a centre close to a population centre is important. However, it does not operate centres in the ultra-low latency segment.

Customer relationships have evolved to become long-term partnerships; there is low customer churn. It has a high customer concentration, but these are typically AAA-rated businesses.

CyrusOne provides the building, fibre connectivity, power, security and cooling. Energy cost is typically a pass-through. It does not own the machines, so there is low technology risk.

In March 2022, KKR and Global Infrastructure Partners took the business private in a $15bn deal. KKR said at the time that it saw significant opportunity for CyrusOne to build on its market-leading position at a rapid pace. Pantheon suggests that part of the attraction for CyrusOne was its ability – post-deal – to tap into the considerable capital needed to meet its expansion targets. It also notes that the listed universe of data centre businesses is shrinking; this is a good example of an attractive, growing sector that is hard for investors in public equity markets to access.

Delta Fiber

Delta Fiber (deltafiber.nl/en) is a Dutch telecom company with the potential to serve around 1m households and companies in the Netherlands through existing fibre connections, and with ambitions to expand that to 2m by 2025 (covering about a quarter of the country). It is making about 30,000 new connections each month.

EQT bought two businesses – DELTA in February 2017 and CAIW in January 2018 – and merged them. In October 2021, Stonepeak (PINT’s sponsor for this investment) and EQT Infrastructure V bought Delta Fiber from EQT Infrastructure III.

Vantage

Vantage Data Centers (vantage-dc.com/) operates 26 centres across 18 markets. Over the course of 2022, it began developing four new campuses in Montreal, Berlin, Frankfurt and South Africa and opened 13 data centres across North America, EMEA (Europe, the Middle East and Africa) and Asia Pacific. This activity was supported by more than $3bn of debt and equity financing raised throughout the year, including $368m in green loans to advance sustainable developments in Quebec City, Canada, and Northern Virginia.

Interestingly, from an ESG perspective, the company is trialling sustainability and decarbonisation solutions, including the use of waste heat. In Zurich, for example, it is exporting waste heat into the local district heat network for use by adjacent buildings.

In 2017, DigitalBridge acquired Vantage Data Centers for an enterprise value of more than $1bn from buyout firm Silver Lake Partners. Since then, considerable capital has been deployed on the expansion of the business, both organically and by acquisition.

National Gas

In March 2022, National Grid announced that it was selling a 60% equity interest in its UK gas transmission and metering business to a consortium comprised of Macquarie Asset Management and British Columbia Investment Management Corporation.

Macquarie has identified the potential for hydrogen to play a role in the UK’s energy mix and see opportunities to grow the RAB (regulated asset base) to achieve that goal. As a first step, National Gas’s FutureGrid project is constructing a test facility from decommissioned assets that will be used to carry out a wide range of hydrogen tests in an offline environment.

Pantheon makes the point that transmission is a small component of gas bills, which suggests that the extra capital investment requirement can be met without putting too much additional strain on consumers.

National Gas’s network comprises about 7,660km of high-pressure pipe and 23 compressor stations connecting to eight distribution networks and other third-party independent systems. It also owns and operates the largest owner of traditional gas meters in the UK, with approximately 8.4m domestic and commercial meters (as of March 2021).

GD Towers

On 31 January 2023, PINT announced that it had committed to invest about €49.2m (£43.2m) in telecommunications infrastructure operator GD Towers, through a co-investment vehicle managed by affiliates of DigitalBridge.

GD Towers is one of the largest independent tower and telecommunications infrastructure operators in Western Europe. It has a portfolio of about 40,000 sites across Germany (c.33,000) and Austria (c.7,000), which provide the infrastructure for mobile network operators to offer telecoms services to end-customers.

GD Towers has been carved out of the infrastructure network owned by Deutsche Telekom, which, following the transaction, will remain a 49% shareholder and anchor tenant through a long-term (around 30 years) master lease agreement. GD Towers further benefits from multiple complementary tailwinds, including regulatory-driven 5G coverage requirements and growing end-user demand for mobile 5G coverage.

Pantheon believes that GD Towers is a highly attractive portfolio of core digital infrastructure assets in Europe, that should benefit from strong downside protection as a result of the robust indexing and contracted nature of its cash flows.

DigitalBridge and Brookfield agreed to pay the equivalent of an enterprise value of €17.5bn for a 50% stake in the business last July, and the deal has just completed.

Deutsche Telekom and its Austrian subsidiary Magenta Telekom have secured reciprocal contractual commitments from GD Towers for around 5,400 new sites through 2026 (underpinning the growth of the investment) and prioritised capacity for radio access network modernisation through 2028.

Pipeline

At the end of December 2022, PINT had cash and equivalents of £182.9m and an undrawn revolving credit facility of £62.5m. Against that, it had commitments and investments in legal closing totalling £101.2m and was holding specific cash buffers totalling £72.2m to cover forecast operating costs, dividend payments, foreign exchange (FX) hedge settlements due (based on mark-to-market valuations), an allowance for emergency co-investment capital across the portfolio, allowances for FX movements on undrawn non‑sterling commitments, and amounts held against the company’s FX hedging positions (calculated relative to notional amounts and contractual maturity). Net, therefore, PINT had £72m of funds available for further investment.

In September 2022, PINT described a medium-term pipeline of four transactions in preliminary diligence of about £170–200m and a further four transactions in screening, totalling about £150–£220m (which may have included GD Towers). The C share issue that PINT launched in September 2022 to address that pipeline did not proceed due to unfavourable market conditions. However, the opportunity set available to PINT remains considerable. The pipeline is dynamic and deal availability is not an issue with Pantheon seeing opportunities across all of their target spaces.

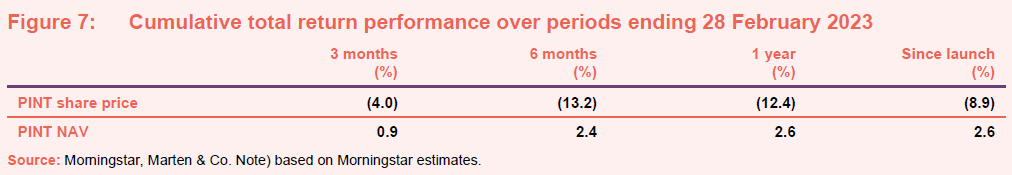

Performance

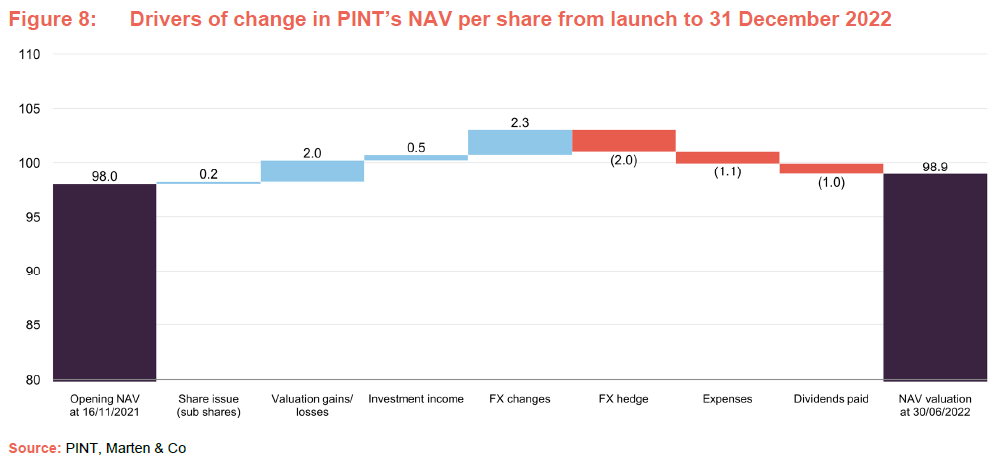

PINT’s first NAV was announced in respect of its 30 June 2022 valuation date and, following this, NAVs are being calculated and announced on a quarterly basis. At 31 December 2022, PINT’s NAV was 98.9p per share and it had paid its first dividend of 1p per share.

We are still very early in PINT’s life and that is reflected in its modest NAV returns since launch.

PINT’s NAV is informed by valuations for the individual projects provided by the sponsors, and these tend to be calculated at the end of the second and fourth quarters of the calendar year. PINT’s accounting periods reflect this.

The weighted average discount rate on the portfolio (used to calculate the NAV) at the end of December 2022 was 14.2%, slightly higher than the weighted average sponsor case IRR of the portfolio of 13.9% due to some modest increases in discount rates across the digital infrastructure sector, and the effect of undrawn commitments.

The manager says that valuations are conservative. History suggests that it gets a significant uplift in valuations on its exits in this area.

Figure 8 shows the drivers of PINT’s NAV return since launch.

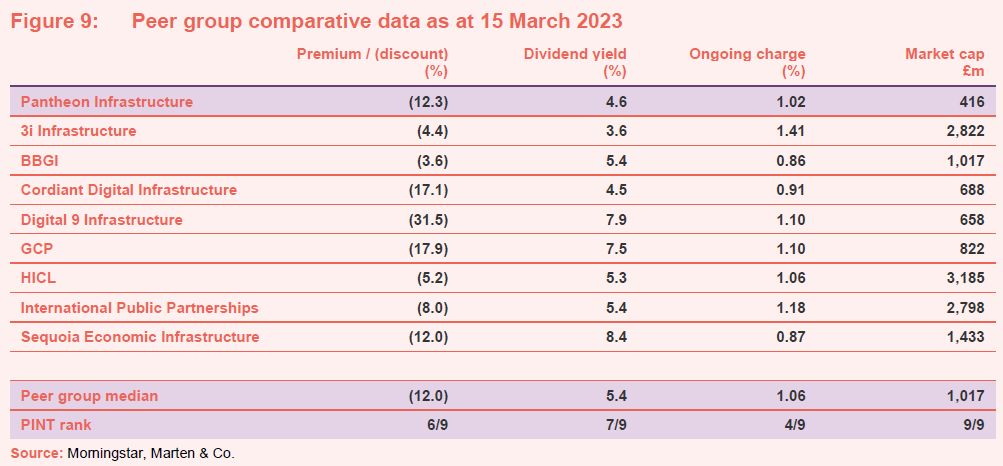

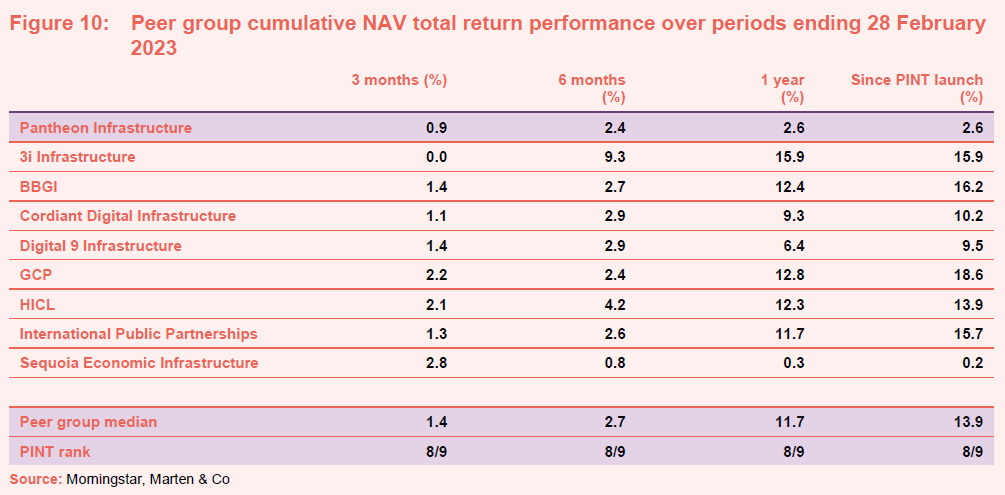

Peer group

Up to date information on PINT and its peer group is available on the QuotedData website.

PINT is a member of the AIC’s infrastructure sector and this is the peer group that we have used for the purposes of this report. We have excluded Infrastructure India, which has a very different mandate and track record from the rest of the sector. PINT is the most recent addition to this peer group and, at present, the smallest. Two of the members – GCP Infrastructure and Sequoia Economic Infrastructure Income – tend to invest in debt securities rather than equity, which has an influence on their returns, although GCP Infrastructure’s relatively high exposure to renewables also has an impact on its returns.

Two of PINT’s peers – Cordiant Digital Infrastructure and Digital 9 Infrastructure – are focused on digital assets and so have some overlap with PINT’s area of focus, but both have less diversified portfolios.

Of the remaining funds, PINT is more akin to 3i Infrastructure than the other funds in this group – which tend to have more PPP-type infrastructure exposure producing higher income but lower levels of capital growth.

As we have noted above, it is still early days for PINT’s portfolio and we would caution against drawing any conclusions from PINT’s returns relative to the rest of the peer group, which have more mature portfolios. Nevertheless, the table in

Figure 10 is included for the sake of completeness.

Dividends

PINT is paying dividends on a semi-annual basis with dividends typically declared in respect of the six-month periods ending 30 June and 31 December and paid in September or October and March or April, respectively.

For its first accounting period, ending 31 December 2022, PINT was targeting a dividend of 2p per share, payable in two instalments. The first of these, a 1p dividend, was paid in October 2022 and a second 1p dividend has been declared and is payable on 31 March 2023.

Targeting 4p dividend for its 2023 financial year.

For its 2023 financial year the target is 4p per share and then the board will target a progressive dividend policy thereafter.

Although at the end of December 2022 the company’s revenue account was in deficit (the revenue return for its first accounting period was -0.58p per share), shortly after listing the share premium account was cancelled and became a capital redemption reserve, from which dividends can be paid. As the portfolio matures, we would expect that all dividends will be covered from revenue after expenses.

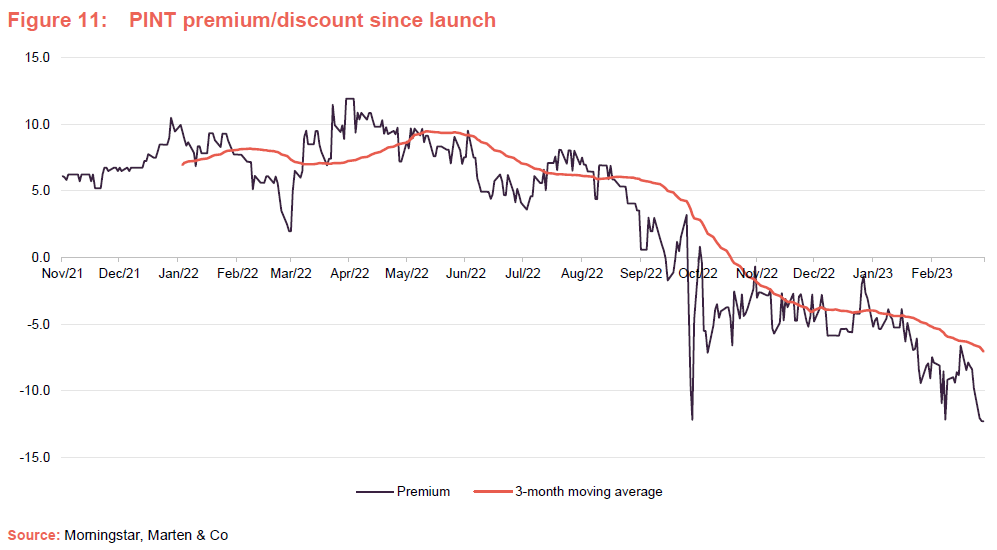

Premium/(discount)

Over the period since launch, PINT’s shares have traded as wide as a 12.3% discount to NAV and as high as an 11.9% premium. The average premium to NAV since launch has been 2.8%. At 15 March 2023, the shares were trading at a 12.3% discount.

PINT’s shares traded at a reasonably consistent 5–10% premium to NAV over the first 10 months of its life, but as UK government debt (gilts) yields rose and market volatility picked up around the time of the Truss/Kwarteng budget in September 2022, the premium was eroded, and the trust moved to trade at a discount in line with most of the sector.

Unfortunately, that scuppered an attempt to expand the trust. On 14 September 2022, PINT announced that it was seeking to raise up to £250m via an issue of C shares. That C share issue was postponed in the face of a deteriorating market. PINT’s share issuance programme, which would have permitted the issuance of a further 350m shares, closed on 12 October 2022. No resolution to permit the issue of shares is being put to shareholders at the upcoming AGM.

Nevertheless, the board’s and manager’s ambition is to continue to expand the trust and we expect that the idea will be revived when the discount has closed. A bigger trust would be more liquid and could have a more diverse portfolio. All things being equal, a larger fund should have a lower ongoing charges ratio, especially if the company grows beyond £750m when a lower tier of management fee takes effect (see below).

Since it emerged, PINT’s discount has been hovering around the 5% mark. In due course (the prospectus indicated from PINT’s fourth financial year onwards), the board intends to use excess cash flows from realised net gains to buy back shares for as long as the discount is persistently wider than 5%. That gives a good indication of the board’s view of what is an acceptable level of discount over the long term.

The directors already have powers to buy back up to 14.99% of PINT’s issued share capital, and the board is asking shareholders to renew this permission at the forthcoming AGM. Repurchased shares may be held in treasury and reissued. No reissues of shares will take place at a share price below the prevailing NAV unless those shares are first offered to shareholders on a pro-rata basis (thereby avoiding dilution of NAV for existing shareholders).

Fees and Charges

No fees on uninvested cash.

Now that more than 75% of the net issue proceeds have been invested, the investment manager is entitled to a fee of 1% per annum on the first £750m of NAV and 0.9% above. There is no performance fee.

PINT’s administrator is Link Alternative Fund Administrators Limited, its registrar is Link Group, and Link Company Matters Limited acts as its company secretary. BNP Paribas Securities Services acts as the company’s depositary. The auditor is Ernst & Young.

PINT’s prospectus suggested that the trust’s ongoing expenses in respect of overheads other than the management fee would be about 0.50% per annum.

For the accounting period ended 31 December 2022, the ongoing charges ratio was 1.02% as no management fee was paid on undeployed cash until 75% of the net issue proceeds were deployed – an approach that we welcomed. Thereafter, the ongoing charges fee might be closer to the 1.5% mark.

Capital structure

At its IPO, which was oversubscribed, PINT issued 400m ordinary shares at 100p per share and 80m subscription shares, issued to ordinary shareholders on a one-for-five basis. All the subscription shares have since been exercised at their exercise price of 101p per share, and as at 15 March 2023, PINT had 480,000,000 ordinary shares in issue and no other classes of share capital.

PINT will hold its first AGM on 30 March 2023.

Life

PINT has been established with an indefinite life, but shareholders will be offered the chance to vote upon the continuation of the trust at the AGM to be held in 2027 (five years after the IPO) and, if that is passed, the vote will be held every five years thereafter.

Gearing (borrowing)

PINT may gear up to 30% of NAV for either acquisitions or other uses, but gearing will not exceed 40% of NAV in aggregate.

PINT has a multicurrency revolving credit facility (RCF) for £62.5m with Lloyds Bank Corporate Markets Plc. The RCF is secured on certain assets of the company, and includes an uncommitted accordion feature (a provision that allows a borrower to expand the maximum amount allowed on a line of credit), which will be accessible subject to approval by additional lenders and is intended to increase over time in line with the PINT’s NAV and its borrowing policy.

The RCF incurs an initial margin of 2.85% per annum over the relevant currency benchmark rate or compounded reference rate on drawn amounts, reducing to 2.65% per annum once certain expansion thresholds have been met. A commitment fee of 1.00% per annum is payable on undrawn amounts, and the tenor of the RCF is three years, with the option to extend this further subject to lender approval.

At 30 September 2022, the RCF was undrawn, and we believe that is still the case.

Management team

Richard Sem

Richard is a partner and head of Europe in Pantheon’s Global Infrastructure and Real Assets Investment Team. He leads its European investment activity and is the investment manager on PINT, where he draws on the experience of the Pantheon team. He has 25 years of experience in infrastructure private equity, corporate finance and project finance at leading institutions including InfraRed Capital Partners, HSBC, ABN AMRO, and BNP Paribas. Richard’s experience spans investing in primary, secondary, co-investments and direct investments across all infrastructure subsectors and global OECD markets. He holds a BSc and MBA from Imperial College of Science, Technology and Medicine.

Andrea Echberg

Andrea is a partner and head of Pantheon’s Global Infrastructure and Real Assets Team. She is responsible for global infrastructure and real assets investments covering primary, secondary and co-investments, she is also a member of the International Investment Committee. Andrea has an engineering industry background followed by 21 years’ experience in the infrastructure finance and investment sectors. Prior to joining Pantheon, she led infrastructure direct and co-investment teams for Société Générale, Macquarie Capital and ABN AMRO delivering successful investments in both brownfield operating and greenfield PPP assets. She has a BEng in mechanical engineering from Imperial College of Science, Technology and Medicine.

Paul Barr

Paul is a partner in Pantheon’s Global Infrastructure and Real Assets Investment Team and a member of the Global Infrastructure and Real Assets Committee. He worked previously at GIC, from 2012, where he was senior vice president, Infrastructure with a global remit focusing on primary, secondary and co-investment opportunities. Paul also has expertise in infrastructure direct investing and infrastructure debt transactions. Prior to GIC, he worked at Challenger Infrastructure and Macquarie Capital. Paul studied Business at the University of Edinburgh. He is also a CFA Charterholder, a Chartered Accountant, and a Member of the Securities Institute.

Evan Corley

Evan is a partner in Pantheon’s Global Infrastructure and Real Assets Investment Team. Prior to joining Pantheon, he held positions at Polaris Venture Partners in Boston and JP Morgan in London. Evan received a BS from Boston University’s School of Management with a concentration in finance and a minor in economics.

Jérôme Duthu-Bengtzon

Jérôme is a partner in Pantheon’s Global Infrastructure and Real Assets Investment Team, where he focuses on the analysis, evaluation and completion of infrastructure & real assets transactions in Europe. He is also a member of Pantheon’s ESG Committee. Jérôme joined from Paris-based placement agent Global Private Equity, where he worked for over three years. He holds an MSc in telecommunications from ESIGELEC engineering school and a Masters in Business from the ESCP-EAP European School of Management.

Matt Garfunkle

Matt is a partner in Pantheon’s US Investment Team where he is actively involved in both the US private equity secondary investment activity as well as the US infrastructure and real assets investment activity. Matt joined Pantheon in July 1999, having worked the previous three years with Cambridge Associates in their Boston and Menlo Park offices. He received a BA in history and economics from Brown University, and is a CFA Charterholder.

Kathryn Leaf

Kathryn is a partner and Global Head of Real Assets, which includes infrastructure, real estate and other real assets. She is a member of Pantheon’s Partnership Board and International Investment Committee. Prior to joining Pantheon, Kathryn was with GIC Special Investments, before which she was responsible for direct investments at Centre Partners, a New York-based private equity firm. Kathryn began her career in Morgan Stanley’s investment banking division, where she pursued real estate investments. She has a Bachelor’s and a Master’s degree in modern languages from Oxford University.

Dinesh Ramasamy

Dinesh is a partner in Pantheon’s Global Infrastructure and Real Assets Investment Team where he focuses on the analysis, evaluation and completion of infrastructure and real asset investment opportunities in the US. Prior to joining Pantheon, he was a vice president in Goldman Sachs’ Global Natural Resources group where he executed on a variety of M&A and capital markets transactions across the infrastructure, power and utilities sectors. Previously, Dinesh was in the Power & Utilities group in the Investment Banking Division at RBC in New York. He holds a BS in Electrical and Computer Engineering from Cornell University and MBA from NYU’s Stern School of Business.

Ben Perkins

Ben is a principal in Pantheon’s Global Infrastructure and Real Assets team, where he is principally responsible for managing PINT. Prior to joining Pantheon, he worked in investment management roles at Gravis Capital Management, Hadrian’s Wall Capital and John Laing. Ben holds a BEng (Hons) in Manufacturing and Mechanical Engineering from the University of Warwick and has completed all three levels of the CFA qualification.

Harriet Alexander

Harriet is a vice president in Pantheon’s Global Infrastructure & Real Assets team, where she is responsible for investor relations and marketing activities related to PINT. Prior to joining Pantheon, she worked in the Infrastructure team at Federated Hermes. Harriet has also held investor relations, sales and marketing roles at King Street, Värde, Ashmore and UBS. She holds a Bachelor’s degree in International Management with French from the University of Bath.

Pantheon investment committees and sub-committees

Pantheon has an International Investment Committee, which is responsible for strategy and oversight of investment policies and procedures related to all of Pantheon’s investing activities. The IIC is composed of Pantheon’s most senior investment professionals and heads of Pantheon’s various investment strategies.

The IIC may delegate the final appraisal of investment opportunities to the Investment Management Committee (IMC).

The IMC is split into UK and US bodies (UK IMC and US IMC respectively) for regulatory reasons and consists of investment team partners from the IIC and the regional/strategy committees. The IIC focuses on its strategic and oversight roles, with supervision of the activities of the IMC.

Board

PINT’s board is comprised of four non-executive directors, all of whom are independent of the manager and do not sit together on other boards.

The total fees payable to the directors in any financial year are capped at £500,000.

Vagn Sørensen (chair)

After attending Aarhus Business School and graduating with an MSc degree in Economics and Business Administration, Vagn began his career at Scandinavian Airlines Systems in Sweden, rising through numerous positions in a 17-year career before becoming deputy CEO with special responsibility for Denmark. Between 2001 and 2006, he was president and chief executive officer for Austrian Airlines Group in Austria, a business with approximately €2.5bn of turnover, 8,000 employees and listed on the Vienna Stock Exchange. Vagn also served as chairperson of the Association of European Airlines in 2004. Since 1999, he has been a tier 1 senior industrial advisor to EQT, a private equity fund, and has been a non-executive director or chairman to a number of their portfolio companies. Since 2008, Vagn has been a senior advisor to Morgan Stanley Investment Bank.

Vagn is currently chairman of Air Canada (since 2017) and a non-executive director of CNH Industrial and Royal Caribbean Cruises. Notable previous non-executive appointments have included chairman of SSP Group (2006 to February 2020), chairman of Scandic Hotels AB (2007-2018), chairman of TDC A/S (2006-2017) and chairman of FL Smidth & Co (2009-2022).

Andrea Finegan

After graduating from Loughborough University, Andrea held investment banking roles at Deutsche Bank and Barclays Capital before joining Hyder Investments as head of its deal closing team. Between 1999 and 2007, she worked at Innisfree Limited, the investment manager of an £8bn infrastructure asset portfolio, latterly as board director and head of asset management. Andrea was subsequently chief operating officer, ING Infrastructure Funds and fund consultant to Climate Change Capital.

In 2012, Andrea joined Greencoat Capital LLP for the set up and launch of Greencoat UK Wind Plc, and then became chief operating officer until 2018, a position that included structuring and launching Greencoat Renewables Plc and a number of private markets solar energy funds.

Andrea is currently chair of the valuation committee of Greencoat Capital LLP, a role she has held since 2015, and independent consultant to the board of Sequoia Economic Infrastructure Income Fund Limited, working closely with the ESG & stakeholder committee and the risk committee. Previous roles included independent non-executive director of the Isle of Man Steam Packet Company Ltd and company secretary for Greencoat Renewables Plc, as well as numerous directorships of infrastructure companies in the capacity of the investment manager’s appointee. Andrea is a Fellow of the Institute of Directors.

Patrick O’Donnel Bourke (chair of the audit committee)

After graduating from Cambridge University, Patrick started his career at Peat Marwick, Chartered Accountants (now KPMG) and qualified as a Chartered Accountant. After that he held a variety of investment banking positions at Hill Samuel and Barclays de Zoete Wedd. In 1995, he joined Powergen Plc, where he was responsible for mergers and acquisitions before becoming group treasurer. In 2000, Patrick joined Viridian Group Plc as group finance director and later became chief executive, appointed by the private equity shareholder following take-over in 2006. In 2011, he joined John Laing Group, a specialist international investor in, and manager of, greenfield infrastructure assets, as CFO before retiring in 2019. While at John Laing, he was part of the team which launched John Laing Environmental Assets Group on the London Stock Exchange in 2014.

Patrick currently serves as chair of Ecofin US Renewables Infrastructure Trust Plc and as chair of the audit committee of Harworth Group Plc (a leading UK regenerator of land and property for development and investment). He was previously chair of the audit and risk committee at Calisen Plc (an owner and operator of smart meters in the UK) and chair of the audit committee at Affinity Water.

Anne Baldock

Anne graduated in law from the London School of Economics and was a qualified solicitor in England and Wales from 1984 to 2012. She was a partner at Allen & Overy LLP between 1990 and 2012, during which time she was managing partner, Projects Group London (1995-2007), a non-executive member of the firm’s global/main strategic board (2000-2006) and global head of projects, energy and infrastructure (2007-2012). Notable transactions included the Second Severn Crossing, Eurostar, the securitisation of a major UK water utility and several major PPP projects in the UK and abroad.

Anne’s current roles include senior independent director for the Restoration and Renewal Delivery Authority Limited (the delivery body created by parliament to deal with the restoration of the Houses of Parliament), senior independent director and chair of audit and risk committee for East West Railways Limited (the government-owned company constructing the new Oxford to Cambridge railway) and non-executive director of Electricity North West Limited. Amongst previous roles, Anne was non-executive director of Thames Tideway Tunnel, non-executive director of Hydrogen Group (AIM-listed) and trustee of Cancer Research UK.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Pantheon Infrastructure Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.