Baillie Gifford UK Growth Trust

Investment companies | Annual Overview | 26 September 2023

A recipe for a rerating?

A comparison of Baillie Gifford UK Growth Trust (BGUK) against its peers suggest that it is the most growth-orientated fund in the group, and so it has likely faced particularly strong headwinds during the last 18 months, as investors have favoured value and defensive stocks.

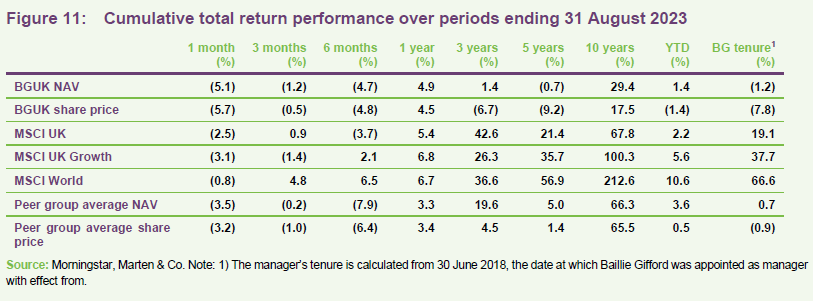

Despite these challenges, BGUK has provided an NAV total return of 4.9% over the last year (peer group average of 3.3%) and its managers say that, at an operational level, its companies continue to perform well. The managers reiterate their long-term confidence in the portfolio, and whilst noting recession risk has increased, they comment that BGUK’s companies are financially sound and have resilient balance sheets.

Both the UK and growth stocks appear cheap, and BGUK is trading at a discount significantly above its longer-term average. This could be a recipe for a strong rerating if the outlook improves, potentially aided by the fact that there are signs that inflation is coming under control.

Focused portfolio of UK growth equities

BGUK aims to achieve capital growth by investing in a concentrated portfolio (35–65 companies) of UK equities, with the aim of providing a total return in excess of the FTSE All-Share Index. The portfolio will predominantly comprise constituents of the FTSE 350 Index, but where appropriate, it may also include constituents of other indices, convertible securities, and equity-related derivatives for efficient portfolio management purposes. BGUK may also invest up to 10% of its total assets in unlisted investment opportunities (at the time of initial investment).

Fund profile

Focused UK growth equities portfolio

Further information can be found at Baillie Gifford’s website: www.bailliegifford.com.

BGUK aims to achieve capital growth predominantly by investing in a portfolio of UK equities, with the aim of providing a total return in excess of the FTSE All-Share Index. The company invests in a relatively concentrated portfolio of between 35 and 65 companies, the majority of which are constituents of the FTSE 350 Index.

The managers take a stock-picking approach, and the size of individual stock holdings depends on the managers’ degree of conviction, not the stock’s weight in any index. BGUK may, if appropriate, use convertible securities, and equity-related derivatives for efficient portfolio management purposes.

Baillie Gifford took over the management of BGUK’s portfolio at the end of June 2018 and has been managing it for just over five years now.

About the managers

Well-resourced investment team.

Baillie Gifford has 177 investors/analysts, spread across 22 teams, most of whom are based in its Edinburgh office. It is structured as a partnership and encourages a collegiate approach to managing money, although it allows its portfolio managers the freedom to have the final say about their portfolios. It managed or advised on about £230.3bn at the end of June 2023, of which £13.2bn was invested in UK equities. BGUK is co-managed by Iain McCombie and Milena Mileva (see page 28 for brief biographies of the managers).

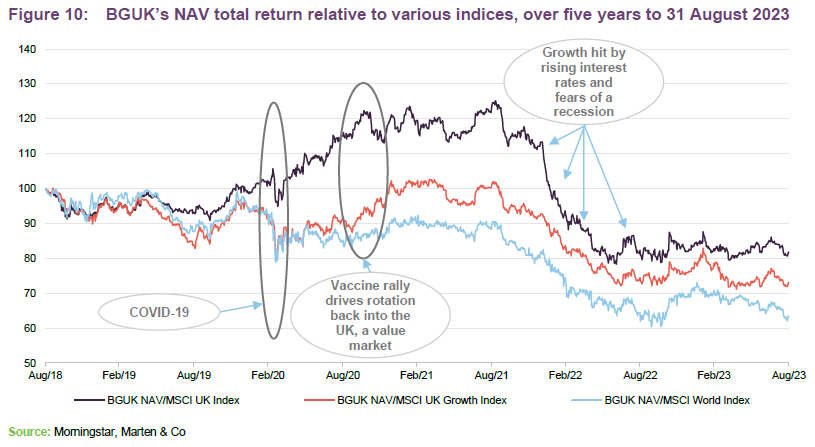

Constructed without reference to a benchmark

BGUK’s benchmark is the FTSE All-Share Index, although the portfolio is not constructed with reference to this or any other benchmark index. We have substituted the MSCI UK Index for the All-Share in this report and have also included comparisons against the MSCI UK Growth Index and the MSCI World Index.

Mangers’ view

Tough environment for growth continues

The pace of interest rate increases may slow as inflation appears to be coming under control.

In our last note, we discussed the impact that rising interest rates, designed to choke off rising inflation, appeared to be having on the ratings and outlook for growth stocks in the UK, which BGUK’s managers described as a perfect storm. Moving on a year, and while economic growth remains fractionally positive, interest rates have moved higher. Now, there is the potential that the pace of increases might slow as inflation appears to be showing signs of coming under control, but the UK economy appears to be teetering on the edge of a recession. Yield curves, for example, are inverted (traditionally a strong predictor of an oncoming recession) and recent PMI data, which has seen sharp shifts downwards for both manufacturing and services, indicates a similar view. Against this backdrop, investors still seem to be focused on a relatively narrow group of ‘safe stocks’ while avoiding growth stocks (unless they are linked to AI) and favouring value in the process.

The managers say that at an operational level, BGUK’s companies continue to perform well.

BGUK’s managers say that, at an operational level, its companies continue to perform well in aggregate. They comment that, in some areas, such as for a selection of its financials holdings, these have even benefitted from a higher-interest-rate environment. However, broadly speaking, rising interest rates tend to be negative for equities, as investors switch into bonds and cash deposits that are attracting higher returns. Growth equities (where a larger proportion of their value is being more heavily discounted from the future) appear to still be at the sharper end of the malaise.

A bias to mid and smaller companies has been unhelpful.

BGUK’s managers say that its relative bias towards mid- to smaller companies has continued to be a headwind as these have generally been more affected. Also, as discussed in the peer group section on page 19 onwards, BGUK has possibly faced the strongest headwinds, given that it has the strongest growth focus within its peer group.

In comparison, the broader UK market has seen some benefit from its significant exposure to banks and oil stocks, which have generally performed well, while BGUK’s relative performance has likely suffered because of its more limited exposure to these areas.

Market is not discriminating between good and bad companies, which creates opportunities.

Turnover has remained low. The managers feel that the market has continued to derate both good and bad companies with little discrimination between the two, but note that this has the potential to throw up opportunities for longer-term patient investors. The managers continue to have long-term confidence in the trust’s underlying assets and, although nothing is immune in a recessionary environment, they believe that BGUK’s companies should do better than most as they are financially sound and have resilient balance sheets.

Mangers’ long-running themes remain intact

As we have discussed previously, BGUK managers are looking for companies that have a number of key attributes (see page 7). Given their bottom-up approach, they do not set out to have exposure to a particular theme, however when looking across the portfolio it is possible to group holdings into broad themes the managers are excited about.

The key themes are detailed below but, to recap on their approach, the managers like tech generators or tech-enabled companies, as well as companies that are R&D-driven, as they believe that significant value can be created with innovation. The managers say that, whilst growth remains under a cloud, their long-term outlook hasn’t changed and so their key categories and the underlying trends that support them are unchanged.

The managers are focused on the long-term opportunity and are avoiding the distractions of short-term market noise.

Growth financials continue to be a significant part of the portfolio, reflecting what the managers say are the strong secular growth opportunities available here (for example, with an ageing population, the move away from defined-benefit pensions schemes and the trend towards self-investment). It is perhaps no surprise that the managers are sticking to their knitting and are continuing to focus on the long-term opportunity and say that they are avoiding the distractions of short-term market noise.

Key portfolio areas are as follows (figures as at 30 April 2023):

- Growth financials (6.8%) – Hargreaves Lansdown, Legal & General, AJ Bell, Hiscox, St James’s Place, Helical, Wise, Prudential, IG Group, Lancashire Holdings, Just Group and IntegraFin (these names are unchanged versus a year earlier).

- Market share gainers (19.1%) – Ashtead, Bunzl, 4imprint, Inchcape, Volution Group and Howden Joinery (HomeServe has left this group due to its takeover).

- Big brands (11.5%) – Games Workshop, Diageo and Burberry (these names are unchanged).

- R&D innovators (9.8%) – Genus, Wayve, Abcam, Oxford Nanopore, Exscientia, Creo Medical and Renishaw (these names are unchanged versus a year earlier).

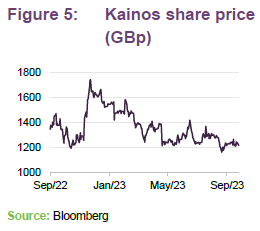

- The digital enterprise (7.6%) – Kainos, FDM, Softcat, Molten Ventures and FD Technologies (as discussed on pages 9 and 10, Softcat and Kainos are new additions).

- The digital consumer (7.5%) – Rightmove, Boohoo.com, Farfetch, Naked Wines, Games Workshop, Auto Trader, Diageo and Burberry (Just Eat takeaway.com has been exited in its entirety).

- Niche industrials (7.4%) – Victrex, Bodycote, Halma, and PageGroup (these names are unchanged versus a year earlier).

- Data, data everywhere (6.2%) – RELX and Experian (Euromoney Institutional Investor exited the portfolio due to a takeover).

- Commodities (2.5%) – Rio Tinto (unchanged – our previous notes have included a discussion of the rationale underpinning the Rio Tinto holding, which readers way wish to review although, to recap, the managers think Rio has a portfolio of high-quality assets that will benefit from growing demand for their commodities).

Investment philosophy and process

The underlying approach

Markets are inefficient at pricing long-term growth.

Baillie Gifford believes that markets are inefficient at pricing long-term growth, especially over a time horizon of at least five years, and that this creates an opportunity to generate alpha. For this reason, it aims to encourage a culture of long-term thinking within the firm. Baillie Gifford believes that there is persistence of good company management, business models and stock prices. This translates into a culture of ‘sticking with the winners’.

Three-stage team-based approach

As an investment house, Baillie Gifford has a strong emphasis on using a team-based approach, as it believes that teams make better decisions than individuals. The managers say that integral to this is a culture of debate, with a challenge-driven mentality across the firm. Baillie Gifford could perhaps be considered as effectively being made up of a small number of investment teams with different strategies.

The UK equities team uses a consistent three-stage approach that comprises:

- discovery;

- debate; and

- discount.

There are two lead portfolio managers on the team: Iain McCombie (the head of the team) and Milena Mileva (BGUK’s co-managers – see page 28 for their biographies). The team also has a head of research, a permanent investment analyst as well as a number of graduates from the company’s graduate programme (these rotate every 12 months). In addition, the team has two dedicated ESG analysts who are embedded within the UK team’s investment framework.

Stage 1 – Discovery

This is the idea-generation part of the process. Every six weeks the team has their prospects meeting, which sets the research agenda for the following six weeks (the UK stock universe is 500+ stocks and the team has a priority list of around 200 companies). Baillie Gifford holds the view that it is important for both portfolio managers and analysts to carve out time to do their own research. This is part of their objectives and helps to keep them accountable for their investment decisions (as discussed below, while there is considerable debate around stocks, the lead portfolio managers make the final decision).

For the prospect meeting, team members bring along ‘half-formed’ ideas to discuss (an analyst or PM may have seen something that has caught their eye and open it up to the wider group). The discussion is open-minded and constructive. Baillie Gifford does not believe in coverage for the sake of having coverage. For example, even if a stock is large, the team will not cover it unless it has a credible long-term growth investment case. That’s not to say that the team does not keep an eye on the broader market; they will look at such stocks when looking at the competitive landscape, for example.

In the discovery stage, the team can draw on external research providers and other in-house teams, but Baillie Gifford tries to encourage analysts to hunt for new ideas. They are encouraged to follow their enthusiasms and look at things they are drawn to and are excited about. The managers say that this frees the analysts, who are all generalists, allowing them to get a broader perspective. It is noteworthy that the analysts are not divided along sector lines and there is no concept of ‘maintenance research’ at Baillie Gifford. When the team is talking to companies, the conversations with their management teams focus on the long-term prospects of the business.

Iain and Milena are able to draw on the resources of the whole investment team when analysing companies, and can sit in on meetings with companies outside their geographic remit. They say that this is especially beneficial when trying to identify how companies compare with competitors domiciled in other markets.

Stage 2 – Debate

The debate stage is said to be the most important stage of the investment process. It is structured around a concise investment note which, for the UK equities team, is limited to a maximum of three pages, to keep the arguments focused with a clear recommendation at the end (there is, however, no limit on the number of supporting pages that can be attached to the back of the note). Notes are structured around Baillie Gifford’s five-question framework:

- Edge – why is a stock interesting? This focuses on the industry background, company-specific factors, competitive position and key issues pertinent to the investment case.

- Growth – what will it look like in five years? This focuses on sales, profit margins and the capital allocation.

- Sustainability – what are the governance and sustainability considerations not considered elsewhere in the report? This focuses on management alignment, board structures and sustainable business practices.

- Valuation – should we own it? This focuses on the company’s valuation, the reasons why a company should trade well, and the likely valuation in five years and beyond.

- Discipline – what would make us sell? This focuses on the key risks and any non-negotiables of the investment case.

In addition, another member of the team will be appointed to play the role of devil’s advocate ahead of the discussion. The purpose of this is to uncover assumptions and challenge these so that ultimately a superior recommendation can be reached. One member of the team takes detailed minutes of these discussions, which provide an anchor for the team for future discussions. Specifically, these minutes record the risks identified around a stock as well as the reasons for selling. The team say that this is important, as it acts as a barrier to analysts and portfolio managers from shifting the goalposts on stocks over time, forcing them to retain their objectivity.

Stage 3 – Decision

In terms of portfolio construction, whilst the team actively discusses all of the stocks, the final decision as to what enters the portfolio is down to the lead manager or managers of the respective portfolios. This is designed to give individual accountability on top of the team discussion.

Sell discipline

In terms of sales, loss of faith in a company’s management is an instant trigger for a sale. The managers also sell if they feel that a business model is not working, or if the market has caught up with their expectations for a company.

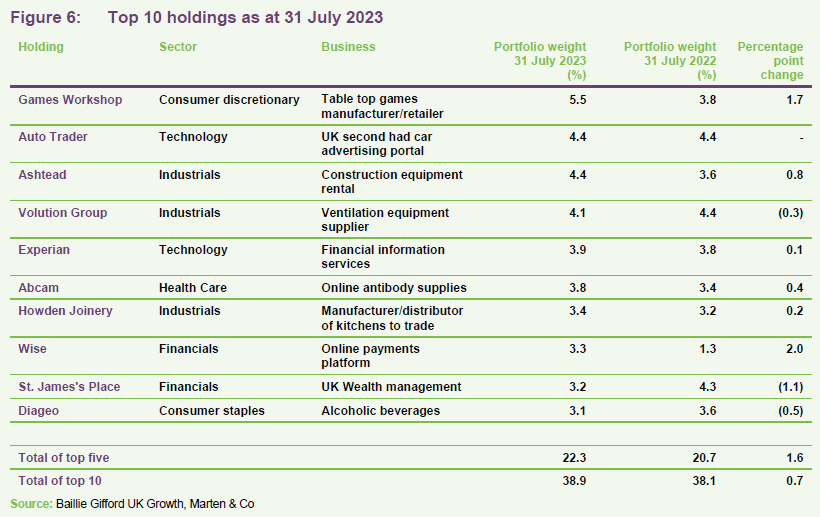

Asset allocation

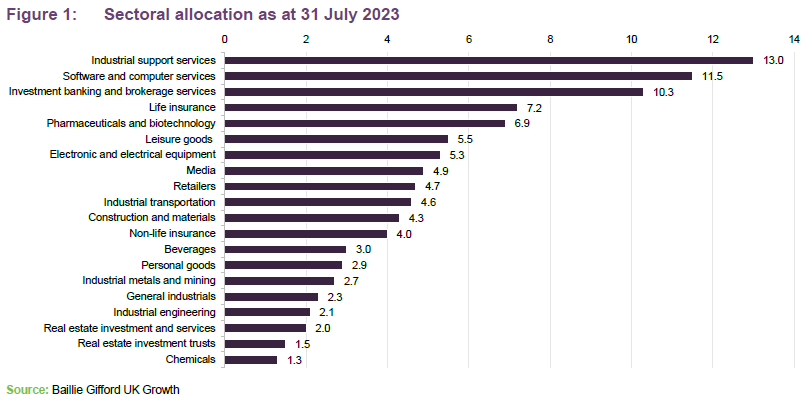

As at 31 July 2023, BGUK’s portfolio had 45 holdings, an decrease of three over the previous 12 months. As illustrated in Figure 6, the portfolio is reasonably concentrated with the top 10 issues accounting for 38.9% of BGUK’s total assets as at 31 July 2023; an increase of 0.8 percentage points over the previous 12 months.

Figure 1 provides a breakdown of the portfolio by sector as at the end of July 2023 and illustrates the diverse nature of the investment ideas within the portfolio, which has been a feature since Baillie Gifford took over management in 2018. We would remind readers that while this may provide a useful illustration, the allocations are a result of the managers’ stock selection decisions and will change based on these, rather than big macro views. In addition, readers should note that there are large chunks of the market to which BGUK offers no exposure, although this might be expected of a concentrated growth portfolio that is not constructed with respect to a benchmark.

Perhaps reflecting the long-term approach that the managers follow, portfolio turnover tends to be very low (5.1% for the last financial year and 5.3% for the year prior) and so the allocations displayed in Figure 1 tend to change gradually. Given the managers’ focus on maintaining a focused portfolio of individual growth ideas, the active share tends to be high (it is currently around 85%, which is in line with its long-term average).

Portfolio characteristics

As illustrated in Figure 2, BGUK has a markedly different portfolio to the benchmark. As we have previously noted, BGUK’s portfolio tends to trade at a significant premium to the benchmark, have a superior return on equity and much lower debt levels. As illustrated in Figure 3, BGUK’s portfolio continues to have a strong bias to mid-cap and small-cap stocks when compared to the benchmark. This is not something that its managers set out to achieve, but is a result of their stock selections and, moreover, reflects where the managers believe that they have been able to find the best opportunities. Details of these characteristics were also included in our September 2022 note, and comparison of Figures 2 and 3 with their earlier versions shows that both the valuation differentials and market cap characteristics are comparable to a year prior.

New additions and exits

Arguably reflecting the managers’ low-turnover approach, the number of stocks entering and exiting the portfolio in a given year tends to be limited. For example, during the year ended 30 April 2023, two new positions were added: Softcat and Kainos (down from five for the previous year), while two positions were exited in their entirety: HomeServe and Just Eat Takeaways (down from three positions for the prior year). There were just five notable additions to positions during the year: Experian, Wise, AJ Bell, IntegraFin and Bodycote. The two new positions, which are discussed below, are both in IT services.

The HomeServe disposal, which was highlighted in our September 2022 note as a possible exit, was the result of what the managers describe as an opportunistic takeover by Brookfield Partners. Although BGUK’s managers felt that the company should have commanded a higher price, HomeServe’s founder and major shareholder accepted the bid, which they say made it hard to fight.

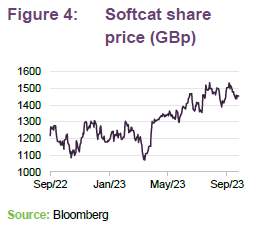

Softcat – differentiated by strong culture and low attrition rates

Softcat (www.softcat.com) is a value-added reseller of IT infrastructure (both software and hardware), primarily to SMEs in the UK. It has around 12,500 customers, including BGUK’s manager, who says that the holding benefits from the long-term structural trend of growing IT expenditure.

BGUK’s managers say that hardware and software sales are both people businesses and Softcat benefits from having a strong corporate culture. This means that its rate of staff attrition is very low, which the managers consider sets it apart from its peers in an industry where employee turnover tends to be high, given a strong focus on sales culture. They say that this continuity allows Softcat to foster much more regenerative customer relationships, allowing it to drive forward its sales to existing customers over time.

Kainos – digital transformation consultancy

Kainos (www.kainos.com) is a provider of IT consultancy services whose business is split into three different operating divisions: digital services, Workday services, and Workday products (Workday is a system that helps companies to manage their payrolls, benefits, HR and employee data and Kainos was one of the first Workday partners). Primarily, the business is focused on helping its customers to implement digital transformation projects to allow their businesses to function more effectively. Kainos also offers HR software that can improve efficiency by replacing on-premise staff with what it describes as ‘intelligent automation’.

Whilst – in an environment of growing IT needs – this a growth business, BGUK’s managers comment that Kainos is well-positioned to help its customers find efficiencies which are even more important when the economic backdrop becomes more challenged. This gives its earnings defensive characteristics, they note. The managers comment that Kainos’s underlying markets are growing nicely, and have done so consistently, and that, like Softcat, Kainos benefits from a strong corporate culture, which allows it to leverage its existing customer relationships in a similar way. BGUK’s managers comment that both Softcat and Kainos are genuine growth companies that are investing in the UK despite the bigger picture, and they will come out on the other side stronger, in their view.

Top 10 holdings

Howden Joinery and Wise have moved up into the top 10.

Figure 6 shows BGUK’s top 10 holdings as at 31 July 2023 and how these have changed over the 12 months. Reflecting the managers’ long-term, low-turnover approach, most of the top 10 portfolio holdings will likely be familiar to regular followers of BGUK’s portfolio announcements.

New entrants to the top 10 are Howden Joinery and Wise. Names that have moved out of the top 10 are Rightmove and Renishaw.

We discuss some of these developments in the next few pages.

Games Workshop (55%) – sticky revenues following pandemic with strong potential from licensing IP

Games Workshop (games-workshop.com) is a British manufacturer of products for playing fantasy tabletop games using figurines that the customer paints themselves. It is perhaps best known for its Warhammer and Warhammer 40,000 series of products.

The company was a pandemic beneficiary (a lot of people got into games and hobbies during the lockdowns) and Games Workshop had been expected to give back some of this performance, but BGUK’s managers comment that this has not happened and the increased revenue and earnings have proved to be sticky. The company has invested to support its long-term growth, bringing production and distribution closer together, so BGUK’s managers believe it is getting much better engagement with its customers and, reflecting this, is getting good traction overseas, particularly in China and Japan.

The company’s licensing business, which the managers say is very high-margin, is doing well (there are plans for Amazon to do a TV series based on Warhammer). BGUK’s managers believe that, if this is well executed, it will elevate the brand and create a virtuous circle driving sales. However, they caution that the company needs to be careful as this is outside of its core business and could weaken the brand if not done properly. Nonetheless, they think that the company’s IP is very deep and appealing (the Warhammer IP has been particularly helpful to the share price), and the company has pricing power. The company is also undertaking a product refresh and is making its products easier to access.

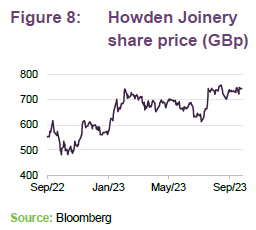

Howden Joinery (3.4%) – continues to build on record revenues despite more challenging market backdrop

Howden Joinery (howdens.com) is a manufacturer and distributor of kitchens and other joinery products (for example doors, skirting boards, architrave, mouldings and floors) to the building trade in the UK. Founded in 1995 with just 14 depots, the company now has 821 depots in the UK and 67 in Europe. It attributes the strength of its growth to its trade-only model, which it says ensures that its products are fitted to a high standard.

The company, which the managers describe as a long-term growth success story, posted record revenue of £2.3bn for 2022, up 10.8% on 2021 and despite a more-challenging marketplace in 2023, posted first-half revenue growth of 1.5% year-on-year to £926.9m. The UK business delivered revenue growth of 0.6% and the international business delivered 33.6%, with an overall gross profit margin of 61%. Operating costs remained at comparable levels, with efficiency savings offsetting cost inflation.

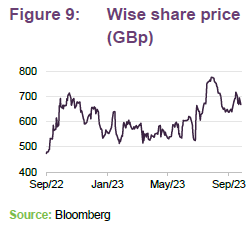

Wise (3.3%) – disintermediating global money-transfer services

We discussed Wise (wise.com) in our September 2022 note, highlighting it as a new addition to the portfolio which the managers had taken the opportunity to add following a significant derating (see page 14 of that note). The stock has recovered somewhat since, but as is illustrated in Figure 9, the share price has exhibited some volatility and the managers have continued to make what they describe as opportunistic purchases on share price weakness. To recap, Wise is a London-based fintech company that provides an online platform to send and receive money internationally at low cost, thereby disintermediating the international money-transfer services of the traditional banks that have historically charged a premium for this relatively simple service.

BGUK’s managers continue to think Wise’s strong customer proposition provides a long runway for continued market share gains in what is a large, global, cross-border market. As we have previously discussed, BGUK’s managers have known the stock for some time (it was held in Baillie Gifford’s private company portfolios prior to its IPO) and consider that the company has continued to develop well.

Performance

Up-to-date information on BGUK and its peers is available on the QuotedData website.

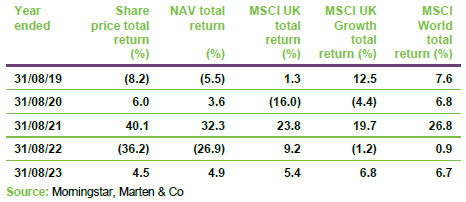

The team at Baillie Gifford have been managing BGUK’s portfolio for over five years, having assumed responsibility for it with effect from 30 June 2018. A lot has happened during that time (Brexit, which officially went live in January 2020; the onset of COVID-19, with a subsequent growth rally and volatility as markets reacted to news on progress with vaccines; the invasion of Ukraine, with its impact on European energy markets in particular; and, more recently, significant interest rate rises in response to rapidly rising inflation).

As we have discussed previously, BGUK’s NAV total return outperformed that of the broader UK market (as measured by the MSCI UK Index) both in the run-up to COVID and then during the growth rally that followed, where it benefitted significantly.

The outperformance of the UK market broadly stabilised following the vaccine rally in November 2020 and BGUK held on to this outperformance (albeit with marked periods of out- and under-performance as market sentiment in response to progress with removing restrictions) until growth stocks sold off in response to rising interest rates which, when coupled with rising energy prices – particularly in the aftermath of the invasion of Ukraine – led to major fears of a recession.

Inflation has shown signs of abating, bringing the potential for a slowdown and eventually a reversal of interest rate rises, but recession risk appears to remain, and growth still seems to be under a cloud. Current valuations could be interpreted as suggesting the market continues to price in particularly negative outcomes for growth stocks. However, as we have previously discussed, if the interest rate and growth outlook turn out to be better than the market is currently expecting, this might trigger a rotation back into growth, which could be sharp.

As we have discussed in our prior notes, many of the factors that were previously tailwinds for the strategy appear to have become headwinds. However, BGUK’s managers think that, perhaps more than ever, markets are failing to price long-term growth prospects properly. If they are correct, this could create particularly strong opportunities to generate alpha and, based on its long-term fundamental investment process, BGUK’s managers remain convinced of the merits of the trust’s portfolio. If the economy continues to stabilise, and these stocks recover as the managers envisage, now might prove to be a very attractive entry point.

Results for the year ended 30 April 2023

For the year ended 30 April 2023, BGUK provided NAV and share price total returns of 1.1% and -1.3% respectively, both significantly behind the returns on the broader MSCI UK index (8.3%) and the MSCI UK Growth Index (8.5%). It was also noticeably below the return of its All-Share benchmark, which BGUK’s annual report says returned 6.0%. However, this is a marked improvement on the prior year where BGUK provided NAV and share price total returns of -16.0% and -27.9% respectively, both significantly behind the returns on the broader MSCI UK index (15.6%) and the MSCI UK Growth Index (8.4%). It was also behind of its All-Share benchmark, which BGUK’s annual report says returned 8.7% for the year ended 30 April 2022.

During the 2022 year, the divergence in performance between companies perceived as being either growth or value was particularly stark and, while this headwind appears to have lessened significantly during the 2023 financial year, it has persisted and looks to be the most significant factor impacting BGUK’s NAV performance. There were also some company-specific issues, although perhaps no more than might usually be expected.

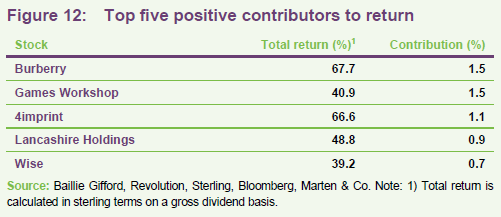

Top positive contributors to performance for the year to 30 April 2023

Figure 12 provides the top five contributors to performance for the year ended

30 April 2023. Burberry, 4imprint and Lancashire Holdings are discussed below, while Games Workshop and Wise are discussed in the asset allocation section on pages 11 and 12 respectively.

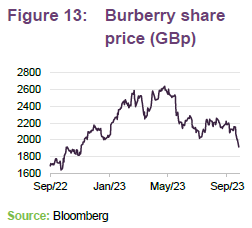

Burberry – repositioning as an luxury brand

The luxury goods sector suffered heavily during the period of COVID restrictions as many consumers shelved unnecessary expenditure. China, an important market for Burberry (uk.burberry.com), was an additional challenge, as its lockdowns were prolonged. However, BGUK’s managers say that, more recently, Burberry and its peers have benefitted as expenditure on luxury goods has seen a strong resurgence as economies have re-opened.

The managers observe that Burberry has faced some difficulties in recent years. However, they comment that the company gained a new CEO in March 2022 in the form of Jonathan Akeroyd, who has an ambitious plan to boost the brand to the level of its European rivals (aiming to double revenue in the process). As part of this plan, a new creative director, Daniel Lee, was brought in during October 2022, and he has been making significant changes, with the aim of moving Burberry from being an accessible brand to being an aspirational luxury brand. As part of this, discounting both in its own stores and in third-party stores has been phased out. BGUK’s managers say that this has been a painful process, but they believe it is the right long-term strategy for the company as they think it will allow Burberry to drive organic growth and increase margins, which are still lower than those of its peers. The managers are cautious on the stock and are watching to see that the long-term margin story comes through.

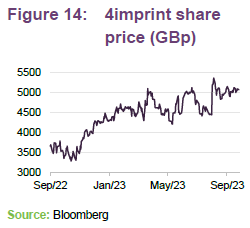

4imprint – increased marketing efficiency is transformative

4imprint (4imprint.com) is a direct marketer of promotional merchandise for corporates. It describes itself as the world’s leading distributor of promotional gifts and has operations in the US, UK and Europe, with the vast majority of its sales in the US.

BGUK’s managers say that 4imprint has really exceeded expectations. Its key US market is highly fragmented, but 4imprint has differentiated itself by being very good at marketing its own offering, over a number of years. In 2018, the company began to focus heavily on brand development, allocating significant spend to advertising itself, and it did not cut the budget during COVID. This, the managers say, has allowed it to take advantage of opportunities available at a time when other players were slashing their advertising, with the result that their marketing efficiency has improved dramatically. Consequently, as many smaller operations went under during lockdown, 4imprint was able to grab a lot of market share, which has allowed its business to grow, creating further marketing synergies in the process, in the managers’ view. BGUK’s managers say that in this business, the big costs are marketing (mostly digital) and personnel costs. The market share gains have helped, but the managers say that the increased marketing efficiency (revenue achieved per marketing dollar spent) has been transformative.

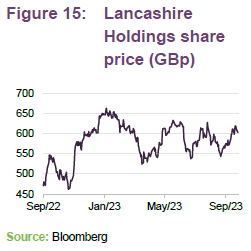

Lancashire Holdings – benefitting from hardening market

Lancashire Holdings (lancashiregroup.com) is a specialty insurance company that is focused on short-tail specialty reinsurance risks within four general segments: property, energy, marine and aviation.

BGUK’s managers describe the company as a very good underwriter in its specialty lines, highly disciplined in its underwriting (it does not lower its prices to chase volume), which makes it a very good allocator of capital in an industry that is traditionally not. Because of this, the managers consider it to be a good ‘through-the-cycle’ holding.

At present, the insurance market is hardening, which means insurers are increasing premiums, tightening terms and reducing coverage and so the company should be benefitting from a much better pricing environment.

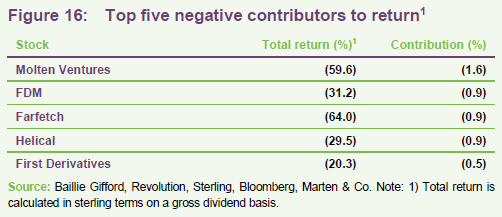

Top negative contributors to performance for the year to 30 April 2023

Figure 16 provides the top five detractors from for the year ended 30 April 2023. Molten Ventures, FDM, Farfetch, Helical and First Derivative are discussed below.

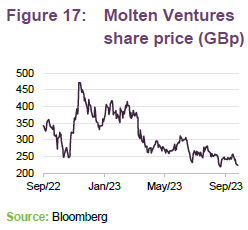

Molten Ventures – c.40% discount to NAV

Molten Ventures (moltenventures.com) is a closed-end investment company focused on providing venture capital to UK and European technology companies. It is an early-stage investor, participating in series A fundraising rounds and onwards (these funding rounds generally follow “seed funding”) and, in BGUK’s managers’ view, has a generally good track record of growing its NAV and achieving good realisations with its investments. It has a broad remit within the tech space, with investments spanning hardware, software, consumer technology and healthcare.

BGUK’s managers comment that private companies have been very out of favour and Molten’s share price is now trading at a significant discount to NAV, despite the vast majority of its core portfolio performing in line or better than expectations. They point out that access to capital is key and they are reassured by the fact that the vast majority of Molten’s core portfolio has over 18 months of cash.

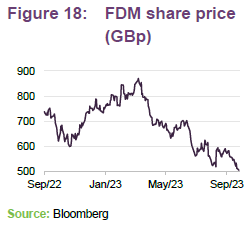

FDM – growing IT talent for its clients

FDM (fdmgroup.com) describes itself as a global leader in the recruit-train-deploy sector. BGUK’s managers think that FDM has a very interesting long-term growth model that benefits from long-term structural trends. Companies increasingly need to allocate expenditure to IT (for example, for data, analytics, cloud and cyber security), creating significant demand for IT talent, but there is a significant shortage of expertise, in the managers’ view. They also comment that it is also difficult to grow IT talent internally if it is not your main business focus, but companies still need skilled IT staff.

FDM’s solution is to provide free IT training to graduates, ex-services personnel and people returning to work. Then FDM places them with a blue-chip client for a two-year period. The training is conducted jointly with the client so that the consultant gets the key skills they will need for the role. After two years, the customer can then internalise the resource. This approach significantly de-risks the hiring process for FDM’s clients, while the consultants get free training, are paid while they train and have opportunities opened up to them that they would be unlikely to have received otherwise.

BGUK’s managers comment that, whilst the business continues to function well, FDM’s share price has retrenched significantly (see Figure 18). Its client base is dominated by financial services companies (banks, asset managers and insurers), which tend to have large IT systems with a perpetual stream of consultant projects and BGUK’s managers say that this significant financials exposure has given the market concerns, despite this not as yet showing up in its numbers.

They also comment that a further consideration surrounds its change of approach to the UK, which is its biggest market. The UK was the only market in which FDM has not historically paid consultants during the training period, but the company has now decided to do this, which is expected to have an impact on the company’s margins. BGUK’s managers say that FDM has historically earned a high-20s margin on its UK business and that, even after paying consultants during the training period, it is still a good low-20s margin. Paying staff not only ensures greater loyalty, but also lifts the barriers to entry for other potential entrants, in their view. The managers say that this is in the long-term interests of the business, noting that the additional cost is not huge, as training usually takes a couple of months.

Another consideration is that the company has taken the decision to remove the bonded period (previously, consultants had to pay back the training costs if they left within two years), following pressure from activists. However, if consultants leave early, this could disrupt clients and could place an increased cost on FDM if it has to train more consultants. However, BGUK’s managers think that the risks associated with this are small and manageable.

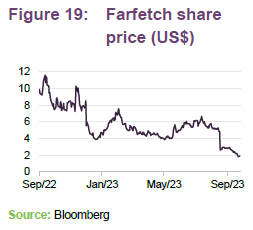

Farfetch – market waiting for improved profitability

Farfetch (farfetch.com) is an online fashion platform. It does not own the inventory that it sells, but instead offers products from close to a thousand brands and stores (including Burberry, Dolce & Gabbana, Gucci, Prada). In common with other fashion retailers such as Boohoo (also a BGUK holding), Farfetch benefitted from a very strong period of demand post-COVID, but has struggled more recently as this rolled over (China is also a significant market and suffered from extended lockdowns), and has also been forced to exit its Russian business.

BGUK’s managers recognise that the business has had some longer-term issues (the shares dropped some 45% on the 18 August when it announced its second-quarter results, missing revenue estimates, with retailers cutting back on wholesale orders for the autumn due to excess inventory leftover from the summer, plus less-buoyant luxury goods markets in the US and China – key geographies for the company) but consider that the company has evolved significantly, having invested heavily (mostly in technology) to establish the online marketplace. The company’s revenue has increased substantially, although improved profitability is yet to come through. BGUK’s managers believe the market is waiting to see if this occurs as the company continues to scale, but they think that its strong balance sheet will allow it to weather short-term volatility.

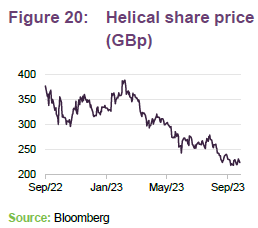

Helical – prime, energy-efficient real estate at a large discount

Helical (helical.co.uk) is a London-focused property investment company that describes itself as creating sustainable and inspiring workplaces which are technologically smart, rich in amenities and promote employee wellbeing.

Interest rates have risen significantly as central banks have sought to bring inflation under control, which has led to softening prices in almost all property subsectors as well as widening discounts on the investment companies that invest in property. Helical has been no exception and was trading at an 54% discount to its most recent NAV as at 25 September 2023. BGUK’s managers think that this provides a compelling opportunity. The managers consider that Helical is a high-quality real estate business (it is invested in prime real estate that is energy-efficient) and they have no long-term concerns with the stock, taking the view that the current challenges are purely cyclical.

First Derivative – benefitting from AI

First Derivative Technologies (fdtechnologies.com) is an IT consulting company that is structured around three key divisions: KX (which is focused on time-series and streaming analytics and benefits from a partnership with Amazon web services), First Derivative (its consulting and services business), and MRP (a predictive account-based marketing platform).

The company has been growing strongly and has benefitted from a surge of interest in AI, but BGUK’s managers comment that this growth has not been without pain, as the company has struggled to maintain consistent profitability.

They comment that, as an early-stage technology business, its share price has been volatile this year, however its latest set of full-year results were encouraging. They add that it signed a promising agreement with Microsoft Azure and is making good progress on its transition to an annual recurring revenue model. BGUK’s managers think that this is a sensible long-term strategy and should improve the quality of the company’s underlying earnings but are cognisant that risks remain around the execution of the plan.

Peer group

Please click here to visit QuotedData.com for a live comparison of the UK All Companies peer group.

BGUK is a member of the UK All Companies sector, which comprises eight members. All of these are illustrated in Figures 22 through 26. When we last published, there were nine members, but as we observed in our September 2022 note, Independent subsequently left the peer group when its merger with Monks completed. Members of UK All Companies will typically have:

- over 80% invested in in quoted UK shares;

- an investment objective/policy to generate majority of returns from capital growth.

- a majority of investments in medium- to giant-cap companies;

- a majority of expenses allocated to capital; and

- a UK benchmark.

It is worth noting that, whilst the peer group is fundamentally capital-growth-focused, the Baillie Gifford approach is characterised by a particularly strong emphasis on growth, which is a differentiating factor when comparing BGUK to its peers, as illustrated in the next section.

A range of styles within the peer group

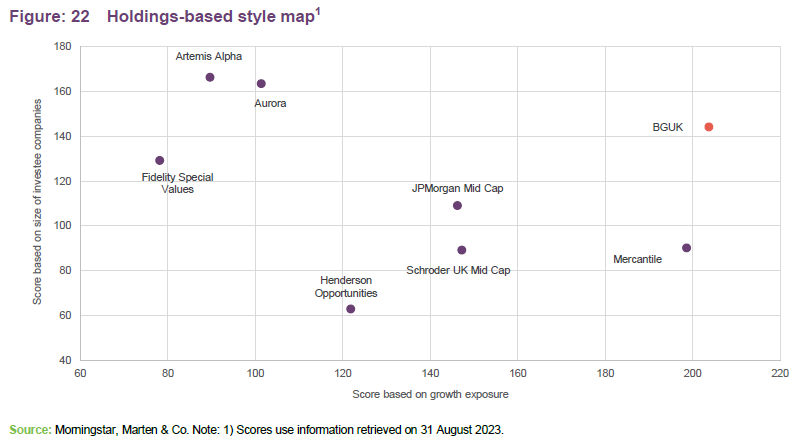

The map in Figure 22 provides a graphical representation of BGUK’s investment style versus its UK All companies peers.

The Y-axis (or vertical axis) is a size score – the larger the score, the larger the underlying investments in the portfolio, while the X-axis (or horizontal axis) is a measure of the growth and value factors (the larger the score, the more growth orientated the trust’s portfolio).

Looking at Figure 22, it is clear that, versus its peers, BGUK is the most growth-orientated strategy (technically, the cut-off in Morningstar’s scoring system for growth is scores above 200, and so Mercantile – which scores a close second to BGUK – is not strictly a growth strategy). BGUK’s size exposure is towards the larger end of the peer group, although there is clear distance between BGUK and both Aurora and Artemis Alpha, possibly reflecting the fact that BGUK operates with more of an all-cap strategy than these funds.

A range of styles within the peer group

It is also apparent from Figure 22 that the UK All Companies sector offers a range of different propositions, in terms of their value-growth tilt and size bias. Fidelity Special Values, Artemis Alpha and Aurora have a much stronger bias towards value, while Henderson Opportunities, Schroder UK Mid Cap, Mercantile and JPMorgan Mid Cap’s portfolios are focused further down the market cap scale, particularly Henderson Opportunities.

BGUK also ranks as one of the most consistent strategies amongst its peers for both the style of its investment approach and its preferred market cap. Based on the last three years of data, BGUK has one of the lowest standard deviations for both its style score and size score, beaten only by Fidelity Special Values, reflecting the strength of commitment by the managers to their approach to all-cap growth investing.

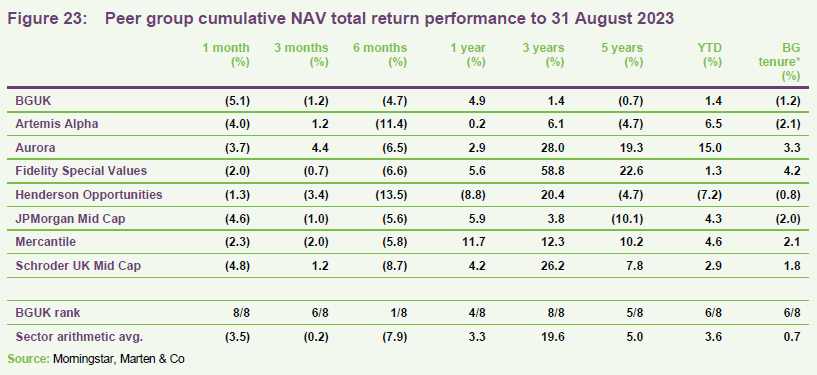

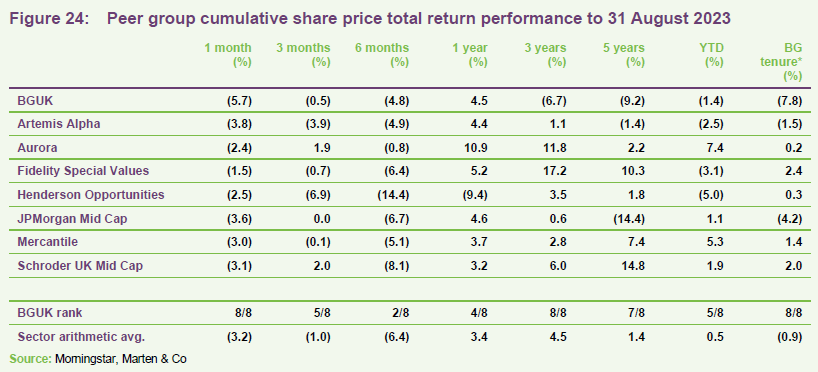

Peer group performance

As highlighted in the performance section above, Baillie Gifford took over the management for BGUK at the end of June 2018 following a period of poor relative performance under the previous manager, and so has managed the portfolio for a little over five years now. This has been a particularly challenging period for markets in general, but particularly for BGUK and its growth-orientated peers as interest rates have risen in response to rising inflation.

All of these funds have suffered from marked falls in their NAVs over the last 18 months or so, which have eaten into the longer-term performance records of all of the funds (pulling down previously good returns for periods of three years and above). However, as noted above there is the potential for marked recoveries if the economic outlook improves. There is also a possibility that quality growth stocks could navigate an inflationary environment better than some value positions, particularly those in commoditised industries that are unable to pass on cost increases, which might be beneficial to BGUK in particular given its growth bias.

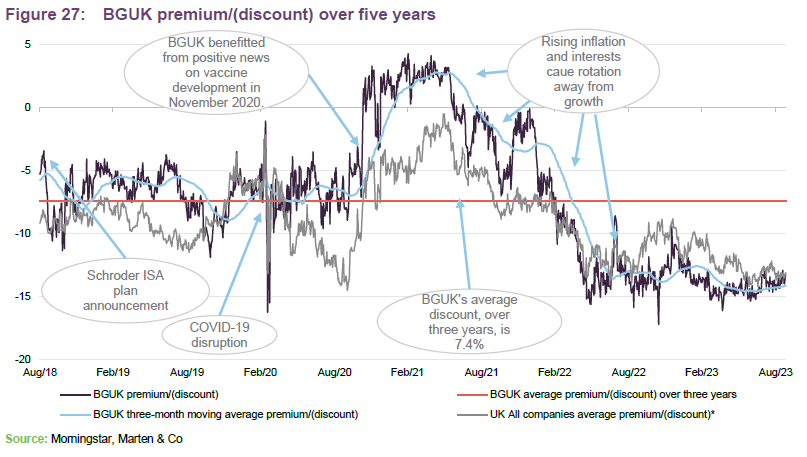

Comparing Figures 23 and 24, it can be seen that the differences in returns are quite variable, reflecting discount volatility during the periods. As illustrated in

Figure 27 on page 25, the sector’s discount has, for example, over the last 12 months moved from a mid-teens discount to a high-single digit discount and back to a mid-teens discount, with considerable volatility along the way. As we have previously discussed, BGUK’s managers have a long-term investment style and so long-term horizons may be superior for assessing the strategy. However, we also recognise that the current pressures on growth strategies appear to have affected BGUK more than its peers, and so this may limit the usefulness of the comparison.

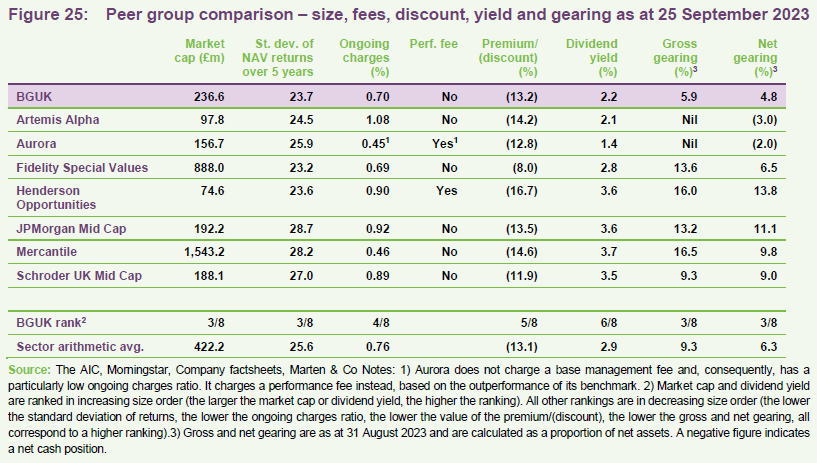

As is illustrated in Figure 25, BGUK remains the third-largest fund in the peer group in terms of market capitalisation, although the average is distorted by the behemoth that is Mercantile. BGUK’s market cap is around 56% of the sector average but is around 24% above the sector median.

Most members of the peer group have experienced market falls in their market capitalisations since we last published, although the fall is much less than reported in our previous note (the sector average – excluding Independent which has left the sector – has fallen from £424.1m to £422.2m). This has once again been through a combination both of falling NAVs (as investors have continued to rotate away from growth at the margin), a modest widening of discounts (from an average of 12.1% when we last published – excluding Independent) and, in some cases, share repurchases (BGUK, Artemis Alpha, JPMorgan Mid Cap and Mercantile have all provided support to shareholders by repurchasing shares recently).

While BGUK ranks fifth in terms of its discount (which is around 0.1 percentage points wider than the sector average), discounts across the sector are reasonably comparable (between 11.9% and 14.6%), with the exception of Fidelity Special Values, which is the most expensive of the group by around 390bp.

BGUK’s ongoing charges are modestly below the sector average for the peer group, despite the peer group average of 0.76% being pulled down by Aurora and Mercantile for reasons explained below. Interestingly, the sector average has increased by 7bp since we last published (our September 2022 note showed an average for the sector of 0.69%), which may be a reflection of a further pullback in most growth orientated strategies during the reporting periods for these trusts and possibly increased costs at the margin (a number of annual reports have recently cited an increase in costs due to the increased work required by auditors, for example). BGUK’s ongoing charges ratio remains below the sector median (0.80%), which has also increased since we last published (0.76%).

Aurora (one of the smaller funds in the sector, with a market cap less than half the size of BGUK’s) has a particularly low ongoing charges ratio because it does not charge a base management fee. Instead (unlike the overwhelming majority of its peers), it charges a performance fee to compensate. Following the departure of Independent from the sector (following its absorption into Monks), Aurora now has the lowest ongoing charges ratio although its lead is de minimis – just 1bp below the colossus that is Mercantile (this has an obvious size advantage – its market cap is 3.7 times the sector average).

Gearing is another consideration, and this can be more of a concern for investors when markets are at more elevated levels. BGUK’s gearing levels (data as at the end of July 2023) appear modest and noticeably below the sector averages (BGUK’s gross and net gearing figures are 59% and 58% of the sector averages respectively). Aurora continues to have net cash balance and the same now applies to Artemis Alpha. As we have noted previously, these trusts should be less exposed in the event that markets retrench, but may suffer more heavily from cash drag if markets move up.

When we last published on BGUK in September 2022, the trust was trading at a similar mid-teens discount to the level it is trading at today, having experienced a significant widening over the previous 12 months – a trend that it shares in common with its peers. The sector average has increased modestly since we last published – from 11.2% to 13.1%. As we have previously observed, the funds in the UK All Companies sector are capital-growth-focused and this has broadly been out of favour during the last 18 months as interest rates have increased in response to significantly higher inflation. Most trusts in the peer group have seen their discounts widen since we last published.

As noted above, BGUK, like most of the funds in this peer group, does not pay a performance fee. In common with its peers, within what is a capital-growth-focused sector, BGUK’s yield is low and remains fractionally below the sector average.

The volatility of BGUK’s NAV has tended to be one of the lowest in its peer group over the longer term, a feature that has been retained since the management contract moved to Baillie Gifford.

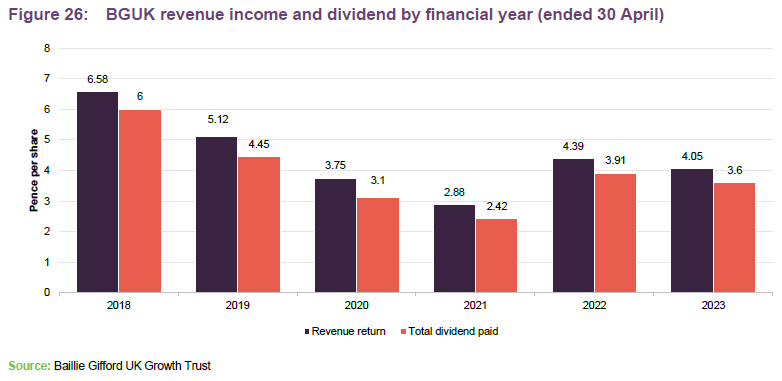

Dividend

BGUK’s investment strategy focuses on generating capital growth for shareholders and dividends are paid to the extent that they are required to maintain BGUK’s investment trust status. As such, while the UK has traditionally been one of the higher-yielding markets, dividends are likely to form a small component of shareholders overall returns and BGUK pays one dividend post the AGM each year. This is paid as a final dividend, following shareholders’ approval at the AGM (now usually in September). For example, for the year ended 30 April 2023, BGUK’s board is proposing the payment of a final dividend of 3.60p per share. This is equivalent to a yield of 2.2% on the trust’s share price of 157.60p per share as at

22 September 2023.

As we have previously noted, even during the down years, the trend has overwhelmingly been one of BGUK paying a covered dividend.

As Figure 26 shows, BGUKs revenue income has exceeded its dividend in recent years allowing the trust to build on its revenue reserve. As at 30 April 2023, BGUK had a revenue reserve of £15.1m or 10.04p per share (30 April 2022: £14.9m or 9.73p per share). BGUK is also permitted to pay dividends out of its capital profits.

Premium/(discount)

Discount remains wide as growth under pressure from higher interest rates

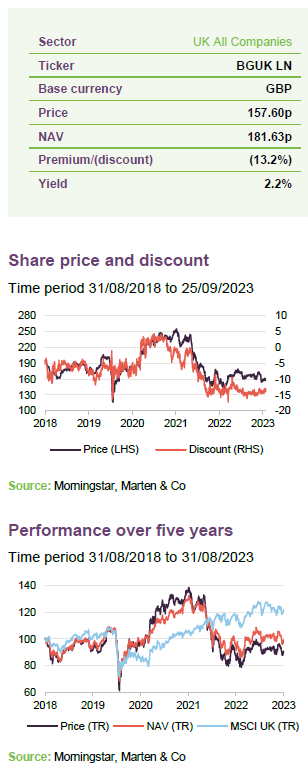

When we last published in September 2022, we commented that in a reversal of its fortunes seen in the aftermath of COVID, growth was out of favour and BGUK was trading at discounts close to its five-year high. Since that time, there have been some marked moves in the discount (over the last 12 months, BGUK has traded in between a discount low of 9.4% and a high of 17.2%, with an average of 13.8%) but, as illustrated in Figure 27, BGUK’s discount remains wide relative to history – as at 22 September 2023, BGUK was trading at a discount of 13.2%, which is four percentage points narrower than its five-year high of 17.2% and close to six percentage points wider than its three-year average of 7.4%). The position is similar for its peer group, whose average discount is also high relative to its own history and relatively close to its five-year high. The wider-than-average-discounts are perhaps a reflection of higher interest rates, designed to combat higher inflation, which tend to put pressure on growth strategies.

As we have discussed in previous notes, BGUK performed very strongly during the pandemic and so the initial widening was very short-lived, but the current discount level suggests that markets continue to price in negative outcomes for BGUK and the growth stocks that it holds, despite signs that inflation is receding, which should bring an end to interest rates rises, and possibly a reversal.

While recognising that the risk of a hard landing still remains, we observe that the managers are looking for growth stocks with an edge. These will tend to have a competitive advantage versus peers, and so should be better placed to weather the effects of a recession, on average. There is also the potential that, when the economic cloud lifts, there could be a sharp reversion of BGUK’s discount, as has been seen previously.

Further discussion of BGUK’s discount and the key developments highlighted in Figure 27 can be found in our previous notes, particularly on pages 20 to 22 of our August 2021 initiation note.

Share issuance and repurchases

BGUK has the authority to issue up to 10% of its issued share capital and repurchase up to 14.99% of its issued share capital, which gives it mechanisms through which it can moderate its premium or discount. The board says that it monitors the level of the company’s discount or premium to NAV and will authorise share buy backs when it considers it to be in shareholders’ best interests.

Whilst there is no formal discount target, the board takes into consideration the trust’s discount relative to its peers, the absolute level of discount, discount volatility and the long-term impact on liquidity from share repurchases. Recent experience suggests that it is happy to undertake repurchases in the 10–14% discount range. On the flip side, when BGUK is at a premium, the board appears to be happy to see the trust grow in a measured way, and it also appears to be prepared to provide liquidity at premiums in low single digits.

Fees and costs

Low base management fee of 0.5% per annum; no performance fee

BGUK’s management contract can be terminated at six months’ notice.

Under the terms of the investment management agreement, Baillie Gifford is entitled to receive a basic management fee of 0.5% per annum of the trust’s net total assets. The management fee is calculated and paid quarterly in arrears and there is no performance fee element. The management agreement can be terminated on six months’ notice by either side.

Secretarial and administrative services

In addition to being BGUK’s AIFM and investment manager, Baillie Gifford & Co also provides company secretarial and administrative services to the trust. The fees for all of these services are covered by the investment management fee discussed above.

The Bank of New York Mellon (International) Limited acts as both the depositary and custodian to the company. The fee arrangements for these are not disclosed, but are included within the trust’s other administrative expenses.

Allocation of fees and costs

In BGUK’s accounts, the investment management fees are allocated 30% to revenue and 70% to capital, reflecting the board’s expectation of the long-term split of revenue and capital returns. The ongoing charges ratio for the year ended 0 April 2023 was 0.70% (2022: 0.63%). As we noted in our September 2022 note, BGUK’s ongoing charges ratio had been on a falling trend during the previous three years (the year ended 30 April 2020 to 2022 inclusive) due to a combination of share issuance and capital growth. However, we noted that it might rise for the 2023 year as capital values have fallen. That said, if either BGUK’s discount narrows and it is once again able to issue shares, or there is a rebound in asset values, BGUK’s ongoing charges ratio could start to fall again.

Capital structure and life

Simple capital structure

BGUK has one class of ordinary share in issue. It can gear up to 20% of net assets.

BGUK has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 25 September 2023, there were 160,917,184 in issue with 10,776,700 of these held in treasury and 150,140,484 in general circulation.

BGUK is permitted to borrow, although net gearing is not permitted to exceed 20% of total net assets. Within this, the board sets borrowing limits, which it reviews from time to time, aiming to ensure gearing levels are appropriate to market conditions. BGUK has a £30m one-year revolving credit facility with The Royal Bank of Scotland International that expires on 5 July 2024. As at 31 August 2022, BGUK had gross gearing of 5.9% and net gearing of 4.8%.

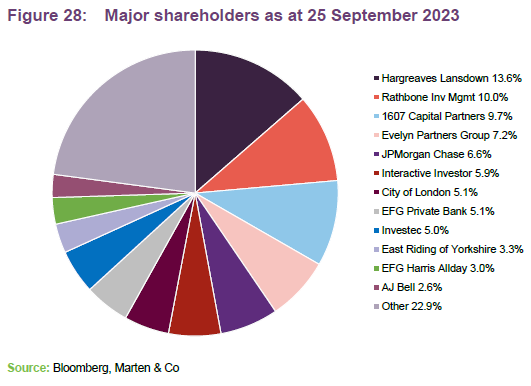

Major shareholders

BGUK’s share register has a strong retail element and, reflecting this, there are a significant number of trading platforms and private client wealth managers that are prominently visible within BGUK’s share register.

Unlimited life with a five-yearly continuation vote

BGUK does not have a fixed winding-up date, but every five years, shareholders are given the opportunity to vote on the continuation of the company as an investment company at the annual general meeting (AGM). This is a special resolution. If this resolution were not passed, the board would put forward proposals to liquidate or otherwise reconstruct or reorganise the company. BGUK shareholders approved the last continuation vote at the August 2019 AGM. The next continuation vote is scheduled for the company’s AGM in 2024.

Financial calendar

The trust’s year-end is 30 April. The annual results are usually released in June or July (interims in November or December) and its AGMs are usually held in September of each year. As discussed on page 24, BGUK pays one final dividend a year after the AGM if one is required to be paid.

Corporate history

Baillie Gifford has been managing BGUK for just over five years.

BGUK is a UK investment trust that was originally incorporated on

28 January 1994 as the Schroder UK Growth Fund Plc. The trust, which listed on the London Stock Exchange following its IPO on 10 March 1994, has a premium main market listing. On 13 April 2018, the trust’s board announced that it had decided to terminate the management arrangements with Schroder Unit Trusts Limited and appoint Baillie Gifford & Co Limited in their stead. Baillie Gifford was appointed with effect from 30 June 2018, with the trust changing its name to Baillie Gifford UK Growth Fund Plc at the same time. On 25 May 2021, the trust changed its name to Baillie Gifford UK Growth Trust Plc. Baillie Gifford has now been managing BGUK for just over five years.

Management team

Iain McCombie

Iain joined Baillie Gifford in 1994 and has spent the majority of his career as an investment manager in the UK equity team. He became a partner in 2005. Iain graduated with an MA in Accountancy from the University of Aberdeen, and qualified as a Chartered Accountant.

Milena Mileva

Milena joined Baillie Gifford in 2009 and is an investment manager in the UK equity team. She became a partner in 2022. Milena graduated with a BA in Social & Political Sciences from the University of Cambridge in 2007 and an MPhil in Politics from the University of Oxford in 2009.

Board

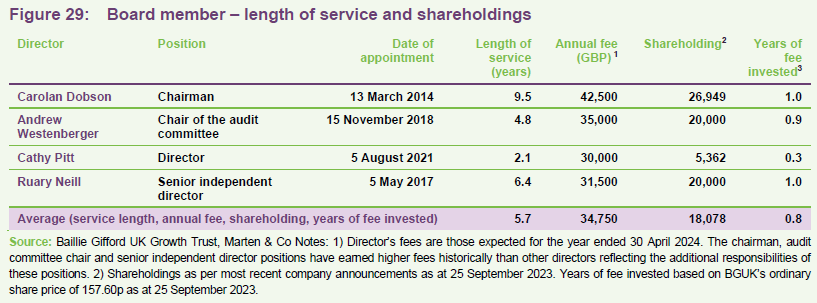

All directors stand for retire and stand for re-election annually.

BGUK’s board comprises four directors, all of whom are non-executive and considered to be independent of the investment manager. BGUK’s articles of association require that newly-appointed directors offer themselves for re-election at the next AGM. It is board policy that all directors retire and offer themselves for re-election at each AGM.

The average length of service is 5.7 years, with Carolan Dobson, the chairman, being the longest-serving director, with 9.5 years of service. Ms Dobson has indicated that she intends to step down from BGUK’s board no later than the 2024 AGM.

Other than BGUK’s board, its directors do not have any other shared directorships. The company’s articles of association limit the aggregate fees payable to the directors to a total of £200,000 per annum, with any increase requiring shareholder approval.

Recent share purchase and disposal activity by directors

There have been no purchases or sales of share by any of BGUK’s directors since we last published in September 2022. The last transaction by a director was Cathy Pitt’s inaugural purchase of BGUK shares (5,362 shares on 7 April 2022 at 185.42p per share). However, all of BGUK’s directors have personal investments in the fund, which might be viewed as favourable as it helps align directors’ interests with those of shareholders.

The levels of shareholdings of the remaining three directors’ shareholdings were unchanged over the year ended 30 April 2023 and all directors’ shareholdings have remained at the same levels so far for the current financial year.

The average interest is equivalent to 0.8 years or more of their fees, which is in line with its level when we last published. There has been a modest increase in directors’ fees during the intervening period (we estimate an average increase of 4.1%), and a similarly modest fall in share price, so that the overall impact has been quite limited.

Carolan Dobson (chairman)

Carolan has had a long career in fund management. She was previously head of UK equities at Abbey Asset Managers, and held a number of positions at Murray Johnstone, rising to be head of investment trusts, where she managed Murray Income Trust Plc.

Carolan was appointed to BGUK’s board in March 2014 and subsequently became chairman at the conclusion of the company’s AGM on 4 August 2016. She is also chairman of the nomination committee and of the management engagement committee. Carolan is also the chairman of Brunner Investment Trust Plc and Blackrock Latin American Investment Trust Plc. She was previously a director of Woodford Patient Capital Trust Plc (now Schroder UK Public Private Trust Plc), Aberdeen Smaller Companies Income Trust Plc and JPMorgan European Discovery Trust Plc.

Andrew Westenberger (chairman of the audit committee)

Andrew is a Chartered Accountant and is currently chief financial officer of Integro Insurance Brokers and Tysers, an independent specialist broker and risk management firm. He is also a non-executive director and trustee of the Chartered Institute of Securities and Investments. Previously, he was group finance director of Brewin Dolphin Holdings Plc and Evolution Group Plc. He has also held senior finance roles at Barclays Capital and Deutsche Bank.

Cathy Pitt (director)

Cathy is a consultant partner at CMS specialising in investment funds, with particular responsibility for investment companies. She has over 20 years’ experience as a senior corporate legal adviser in the investment management and investment trust sectors, with expertise in investment management regulation, investment company corporate affairs, capital markets and corporate governance. Cathy is also a non-executive director of Gresham House Energy Storage Fund Plc.

Ruary Neill (senior independent director)

Ruary has had a career in investment banking. He has worked for UBS Investment Bank in the UK, prior to which he spent several years in the financial sector working in Asian Equity Markets for UBS Investment Bank and Schroder Securities. Ruary is currently a director of JP Morgan Emerging Markets Investment Trust Plc and is a member of the Advisory Board, SOAS China Institute, London University.

Previous publications

Readers interested in further information about BGUK may wish to read our previous notes, which are detailed in the table below. You can read the notes by clicking on the links in the table or by visiting our website.

Figure 30: QuotedData’s previously published notes on BGUK

| Title | Note type | Publication date |

| Looking way beyond the now | Initiation | 18 August 2021 |

| Patience will be rewarded | Annual overview | 15 September 2022 |

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Baillie Gifford UK Growth Group Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.