Lar España Real Estate

Real estate | Annual overview | 17 May 2024

10-up and more growth to come

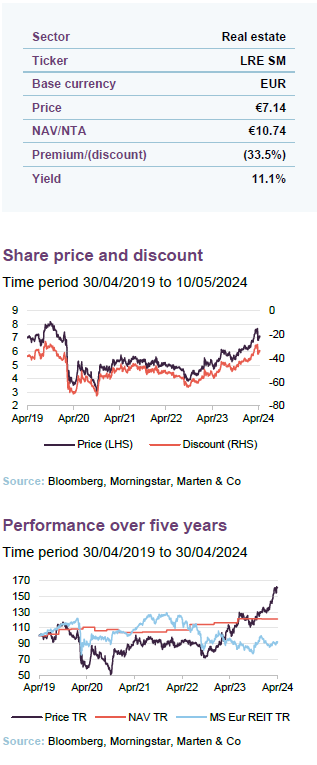

Lar España Real Estate celebrated its 10-year anniversary last month, and despite facing some potentially crippling challenges to its Spanish retail portfolio in that time – including the COVID-19 pandemic and now a higher interest rate environment – it has consistently posted strong shareholder returns. Its 10-year NAV total return is 57.2%, putting it among the upper echelons of the European retail players. Extraordinary rental growth from its portfolio of ‘dominant’ shopping centres and retail parks (gross rental income was up 13.5% in 2023) contributed to record earnings and has allowed the company to declare the largest annual dividend in its history.

There is more to come, too. It has a substantial war chest following the sale of two assets (above book value) last year and is targeting under-managed shopping centres where it can extract hidden value. Although all the attributes we look for in a top property company are there (including a conservative and cheap debt profile), the company’s share price languishes on a 33.5% discount. We believe a further narrowing of this (having come in from over 50% last year) is warranted.

Exposure to Spanish retail

Lar España Real Estate aims to grow its EPRA net tangible assets (NTA) through active asset management of Spanish commercial real estate, and deliver high returns primarily through the payment of considerable annual dividends.

Fund profile

The company’s website is larespana.com

Lar España Real Estate is a SOCIMI (the Spanish equivalent of a listed Real Estate Investment Trust (REIT)) that has been listed on the Madrid Stock Exchange since 5 March 2014.

Lar España was the very first Spanish SOCIMI to be floated. It was also the first listing on the Madrid Stock Exchange for three years, and the first listing of a real estate company in seven years. It was founded at the bottom of the Spanish property cycle when real estate prices were at record lows and the real estate market was entering a new cycle.

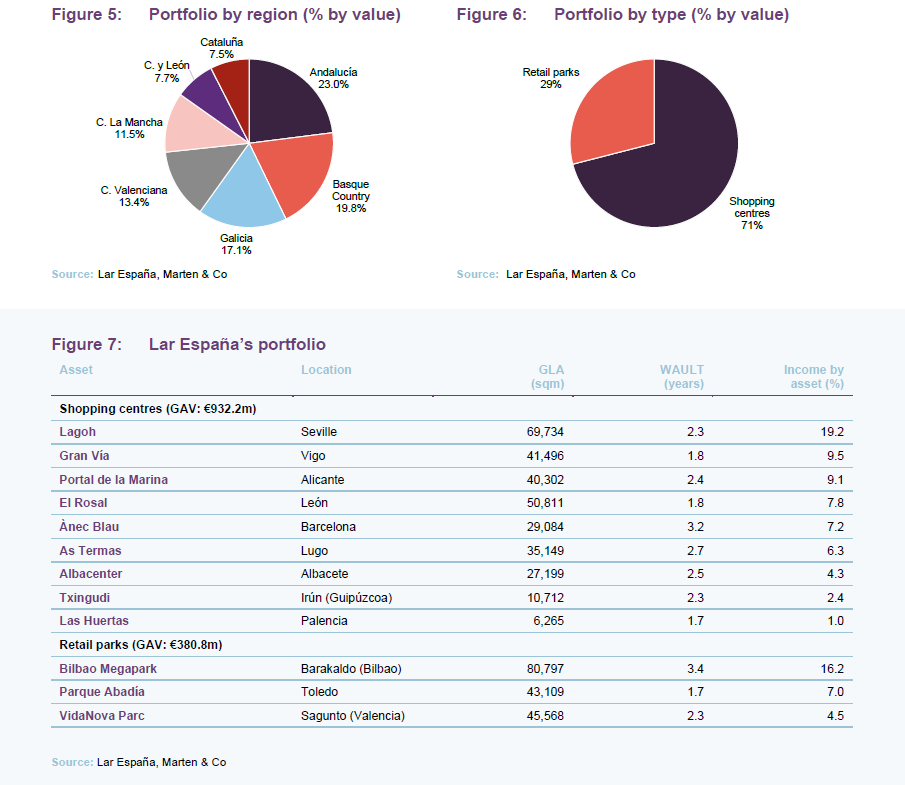

The company is focused on investment in real estate assets throughout Spain, in the retail sector. It aims to deliver high returns for its shareholders through the payment of considerable annual dividends and create value by increasing the company’s EPRA net tangible asset (NTA) through active asset management. The group’s portfolio comprises nine shopping centres and three retail parks and was valued at just over €1.313bn on 31 December 2023.

The manager – Grupo Lar

Grupo Lar has €3.9bn AUM in five countries

Lar España is exclusively managed by Grupo Lar, a private Spanish real estate company that has more than 53 years’ experience in the sector. It has expertise in development, investment and asset management and boasts a large team of professionals that actively manage its portfolio to maximise operational efficiency.

Grupo Lar is 100% owned by the Pereda family and has 270 employees in five countries. It has €3.9bn of assets under management spread across five countries in Europe and the Americas, diversified across the residential, retail, offices and industrial sub-sectors. It has established joint venture partnerships with several prominent international investors including Green Oak, Grosvenor, Goldman Sachs, Henderson Global Investors and Ivanhoe Cambridge.

Market overview

GDP growth of 2.5% in 2023, considerably outpacing the rest of Europe

Spain’s economy is growing far quicker than its European peers, with GDP expanding 2.5% in 2023 compared to 0.5% in both the eurozone and the EU. GDP growth is expected to moderate to 1.7% in 2024 and 2% in 2025, but this again surpasses the EU’s projected average of 0.9% and 1.7%, respectively.

On the inflation outlook, Spain’s consumer price inflation rate rose to 3.2% year-on-year in March 2024, edging up from February’s six-month low of 2.8%. Core inflation, which excludes volatile components such as food and energy, tapered to 3.3%, the lowest level since February 2022.

Average headline inflation is anticipated to be 3.2% for 2024, slightly above the EU average of 3%, but is expected to decline to 2.1% in 2025, falling below the average for the EU of 2.5%.

Private consumption, as well as investment, were the key drivers of GDP growth throughout 2023, and are set to sustain the economic expansion this year. Private consumption is expected to be supported by further real income gains for households and by the partial use of the still high level of household savings.

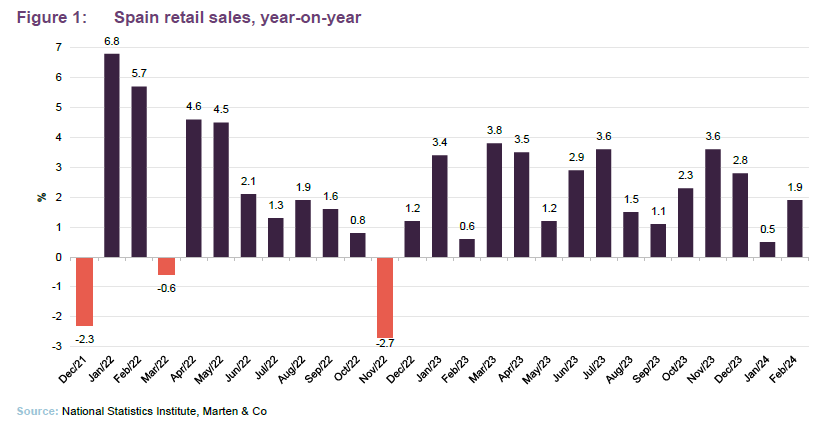

15 consecutive months of retail sales growth

Retail sales soared by 1.9% year-on-year in February 2024, marking the 15th consecutive month of growth, as shown in Figure 1. Retail sales growth was driven by sales of non-food products (up 4.7%). Sales also rebounded for food, beverages and tobacco – up 1.3% versus a drop of 1.0% in January.

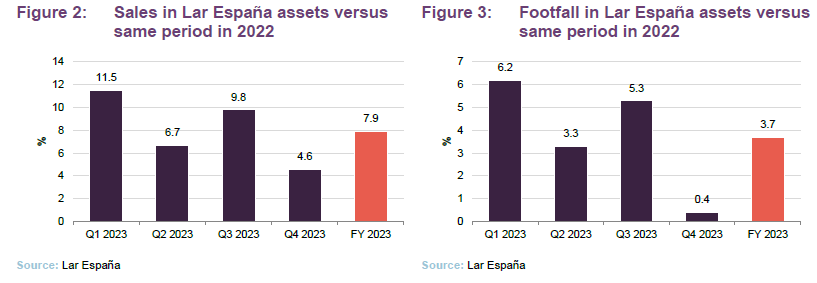

The national uplift in retail sales was also reflected across Lar España’s assets, with sales in its shopping centres and retail parks up 7.9% over the year, as shown in Figure 2, reaching €1,057.8m. Footfall was also up across the year, shown in

Figure 3, with 76.2m visits to its assets.

The strong operational performance of Lar España’s portfolio, which boasts 97.1% occupancy and 99% rent collection rate (in-depth detail on the portfolio can be found on page 9), was the foundation for another set of exceptional results. The company reported a 13.5% increase in total revenues to €95m (16.3% on a like-for-like basis) in the year to 31 December 2023. This contributed to an almost doubling of recurring net profit, which excludes the accounting effect of valuations, to €77.2m, 91.6% more than the €40.3m posted in 2022.

EPRA net tangible assets (NTA) was down slightly over the year to €10.74 per share, while the value of its portfolio was down 2.4% to €1,313m.

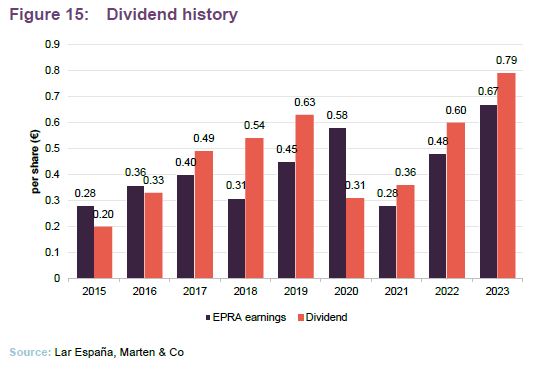

Largest dividend in history of company

A dividend for the year of €0.79 per share has been approved – the largest in its history, representing a total distribution of €66.2m and a dividend yield of 11.1% on the company’s share price at 10 May 2024. This is made up of 100% of ordinary EPRA earnings in 2023 (€0.67 – also the highest in its history and up 39.6% on 2022) plus half of the capital gains obtained from the disposal of the two retail park assets last year. The payment of the dividend would bring total distributions in the company’s 10-year history to €391.2m.

The company says that the strong performance data stems from the quality of Lar España’s portfolio of properties, which are mostly categorised as ‘dominant’ – large centres, in large catchment areas with little competition. The effort rate – a key retail performance metric that measures the ratio between the total cost to the retailer (including rent and charges) and the turnover generated at the property (also known as the occupancy cost ratio) – was at a comfortable level of 10.2%.

To highlight the strength of the portfolio and appeal to retailers, the company carried out 179 lease agreements during the year (19 new lettings, 50 re-lettings and 110 renewals), which achieved an average rental uplift of 8.1% (excluding the inflation-linked uplifts baked into the leases).

Investment and leasing market

Investment levels remain subdued, but leasing market buoyant

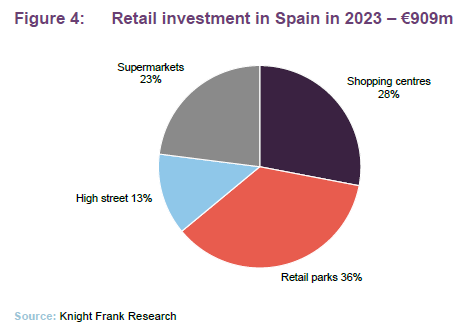

Investment activity across the Spanish retail property sector was subdued in 2023, reflecting the higher interest rate environment. Just over €900m was transacted in 2023, according to Knight Frank, which is almost 50% less than in 2022. The retail park sub-sector saw the most activity, with a doubling of deals value to more than €300m, accounting for 36% of retail property transactions. Investment activity for shopping centres accounted for just 28% of transactions by value, reflecting the greater financing required for these typically larger deals. The malaise in the shopping centre investment market meant that prime yields moved out 50bps to 7.75% in the final quarter of 2023, according to Knight Frank. Prime yields in the retail park sub-sector were stable at 6.5%. The company says that it has witnessed a marked uplift in activity so far in 2024.

As was borne out in Lar España’s results, the retail leasing market is performing strongly across Spain. Within the company’s portfolio, 179 lease agreements were completed during 2023, achieving a remarkable 8.1% uplift to previous rents. This is excluding the impact of CPI inflation-linked uplifts that are written into the leasing contracts. This contributed to a pronounced uplift in gross rental income of 13.5% (or 16.3% on a like-for-like basis excluding two assets that were sold in the year).

Few structural challenges

No over-supply of retail space in Spain

The relative buoyancy of the Spanish retail market stems from the fact that it has not had to grapple with the same structural challenges that the UK and US markets have had to contend with.

The oversupply issues that have negatively impacted on retail rents in the UK and US (and which are still being worked through by repurposing excess retail space into other uses such as residential and leisure) are less prominent in Spain. The country’s density of shopping centre space per inhabitant is 0.34 sqm, according to the Caixabank 2021 Retail sector report, which is well below the figure in the US of 2.35 sqm per inhabitant and the 0.43 sqm in the UK. This overhang of supply has contributed to a shopping centre vacancy rate in the UK of almost 20% at the end of 2023 (according to Savills Research). In Spain, the shopping centre vacancy rate is below 15% (and in line with the European average). Within Lar España’s shopping centre portfolio, the vacancy rate is just 3.5% (1.8% across its retail park portfolio, and 2.9% overall) – reflecting the dominant nature of the assets.

Online retail penetration rates in Spain expected to reach 8% in 2024, far below other European countries

Another structural trend that has dominated the retail landscape over the past decade has been online retailing. Again, this has been less prevalent in Spain than in other markets, especially in the US and the UK where online retailing as a percentage of total retail sales has hit 30%. The company believes that for many reasons online penetration rates in Spain will not hit anywhere near these levels.

Online retail sales are expected to rise to 18% of total sales in 2024 (from 10% in 2021). However, outside of the big two Spanish cities of Madrid and Barcelona, online retailing penetration rates will remain at very low rates, the company believes, due to a number of factors including poor infrastructure and the geographical landscape obstructing the effective operation of online retail. Due to these barriers, the company says that the vast majority of online retailing will be fulfilled through click-and-collect at current retail stores. The company has taken steps to make its assets omnichannel – meaning they serve both traditional retail and online retailing. Initiatives include:

- Click & Shop – a website where retailers in the shopping centre can promote their products and discounts, enabling customers to buy products online and collect in store.

- Lar Conecta – an initiative that gives stores access to each shopping centre’s digital communication channels and their online traffic (Lar España’s shopping centre website has 1,400,000 visits and a social media following of more than 500,000) helping them to promote their brands and increase sales.

- WhatsApp Shopping – giving customers the chance to access personal shopping and style advice through WhatsApp, as well as real-time information on product specifications and availability and the option to collect purchases in-store or have them delivered to their homes.

Other ‘smart’ technology initiatives produce customer analytics to drive business development and gain a deeper understanding of the customer behaviour, spending and profiles.

Investment process

Lar España’s investment strategy focuses entirely on retail properties in Spain. It identifies assets that are poorly-managed and that have strong upside potential, especially shopping centres where there is an opportunity to reposition them.

The company’s investment policy is mainly focused on:

- strategic assets in the shopping centre and retail parks sub-sectors, with strong growth potential;

- ‘dominant’ retail assets in their catchment area that offer significant upside via asset management, avoiding locations where there is greater competition; and

- risk diversification through a portfolio of assets located across Spain.

Focus on ‘dominant’ centres in large catchment areas

Lar España favours what it calls ‘dominant’ retail assets. In the shopping centre sub-sector, that means the malls having a catchment area of around 350,000 to 400,000 people and no significant competing retail schemes. To be considered as dominant, the assets also must have a gross leasable area above 40,000 sqm, at least 4m visitors per year (footfall), above 90% occupancy levels, and have at least five critical retail operators. Seven of the nine shopping centres in Lar España’s portfolio are classified as dominant.

In the retail park sub-sector, ‘dominant’ is defined as at least 20,000 sqm in gross leasable area, 3m visitors per year, and above 90% occupancy levels. All of Lar España’s retail parks are also classified as dominant. More information on Lar España’s portfolio is on page 9.

Repositioning assets

After identifying and acquiring assets with strong upside potential, Lar España aims to add significant value through investment in major refurbishments. Works carried out will depend on each individual asset, but will generally include the reconfiguration of space to maximise natural light, and the incorporation of new food courts, expanded leisure offering, improved outdoor/public realm, and an enhanced fashion/shopping quarter. The company may also opt to redevelop an asset, as was the case with its Lagoh shopping centre in Seville (more details on page 10), which delivered an 8% yield on cost.

The majority of its portfolio has been refurbished or developed in the last five years. Lar España’s portfolio has increased in value by 54.0% (as at 31 December 2023) versus the acquisition price.

ESG

Portfolio obtained a score of 85/100 for ESG credentials, 15% ahead of index average score

ESG is a cornerstone of Lar España’s investment policy. Refurbishments and developments are all completed to the highest sustainability credentials. The company obtained a rating in the Global Real Estate Sustainability Benchmark (GRESB) assessment of 85 out of 100 for 2023, which is a 55% increase on its 2019 score. GRESB is the global ESG benchmark and reporting framework for the property sector, both listed and non-listed, and is one of the world’s leading sustainability indices. The company’s score is 15% higher than the average score in the index, which is made up of more than 1,000 participating companies. 100% of the portfolio is BREEAM-certified, with an ‘excellent’ or ‘very good’ rating on 98% of the portfolio (by value).

Substantial progress has been made in reducing energy consumption and carbon emissions from the portfolio over 2023. Electricity consumption was down 9.8% compared to the same period in 2022. Meanwhile, fuel consumption was down 15.5%. Overall, energy consumption fell 13.3% on a per visitor basis and 10.3% per sqm.

‘Green leases’, whereby the tenant is incentivised to meet sustainability and energy usage targets, are applied on 27% of the portfolio (up from 10% at the end of 2022). This figure is expected to continue to grow as leases are renewed and new lettings signed.

Reflecting the progress made at portfolio level, and the company’s strong corporate governance, the global MSCI ESG index upgraded Lar España’s rating from ‘BBB’ to ‘A’ in 2023, placing it in the top 18% of real estate companies included in the index.

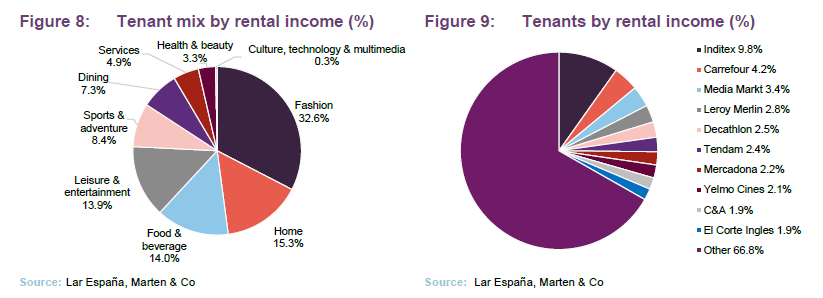

Asset allocation

Lar España’s portfolio was valued at €1.313bn on 31 December 2023. It comprises nine shopping centres and three retail parks. It has a diverse range of tenants, as shown in Figures 8 and 9, with more than 1,000 leases and an occupancy rate of 97.1%. Its top 10 tenants account for 33.2% of the company’s rental income, while 60% of leases have expiries beyond 2027. The portfolio has a WAULT of 2.5 years.

Lagoh shopping centre

The largest asset in Lar España’s portfolio, the company bought the site of the Lagoh shopping centre in March 2016 for €38.5m and completed the development of the 69,734 sqm mall in 2019. It opened its doors in September 2019 and is home to a range of retailer and leisure brands. The centre comprises 148 stores.

It is located in the centre of Seville, the fourth-largest city in Spain, which has a population of 676,000 and 1.5m in the Greater Seville metropolitan area. Despite the demographics, the Lagoh shopping centre is the first dominant shopping centre in the Greater Seville area.

The brand-new shopping centre was designed with technology and sustainability at its core. Technology initiatives at the mall include a sensor system that monitors visitors’ flow around the centre and use of space, which can inform prime footfall areas and marketing decisions. Sustainability features include solar panels providing low-carbon electricity and geothermal technology. Energy provided to the whole complex is 100% renewable and the scheme has been awarded the BREEAM Sustainability Building Certification. The scheme was awarded the Best Shopping Centre in Spain award by the Spanish Association of Shopping Centres.

Bilbao Megapark retail park

Megapark is the largest retail complex in the Basque Country and the fourth largest in Spain, covering a total area of 128,000 sqm, of which Lar España owns 80,797 sqm. It is the only retail park within a radius of 400 kilometres and is the leading scheme in the Bilbao area, with a catchment area of more than 2.2m people.

Developed in 2007, Lar España bought its holdings in two separate deals in 2015 and 2017 for a combined €178.7m.

Comprised of 81 retail units and 8,200 car parking spaces, Megapark is home to leading international retailers, such as Ikea, Mediamarkt and Leroy Merlin, and hosts the cinema with the highest box-office turnover in the Basque Country.

Gran Vía shopping centre

Located in the largest city in the Pontevedra province, Vigo, the Gran Vía shopping centre has 41,496 sqm of lettable space and is the main shopping centre serving 482,100 people in the catchment area. The mall opened in 2006 and was acquired by Lar España in September 2016 for €141m.

It comprises 121 retail units that are let to a mix of international brands and Spanish companies, including Zara, H&M, Massimo Dutti and Carrefour.

Asset rotation progressing

After the sale of two mature retail park assets – Vistahermosa and Rivas Futura – for €129.1m in July 2023, the company’s portfolio asset rotation strategy is well underway. It now has around €240m in cash reserves and is looking at new acquisitions, as well as possible further sales of mature assets. The thinking is that there is limited value creation potential from established assets where asset management initiatives had already taken place. Therefore, acquisition targets will be those where the company believes it can add value – either through the leasing of vacant space, refurbishments, or extensions.

The company says that it will be selective, targeting assets that fit its investment criteria (large, dominant centres in their catchment area). It is analysing dozens of assets across Spain in the shopping centre sub-sector, where it says yields are higher than in the retail park sub-sector (7.75% versus 6.5%, according to Knight Frank) and which are often under-managed, and hidden value exists. There are around 70 shopping centre assets in the country that fit its investment criteria – 40,000 sqm in size, in a catchment area of at least 400,000 people and with at least 4m visits a year. The company believes that the investment market will continue to evolve and buying opportunities should present themselves.

Performance

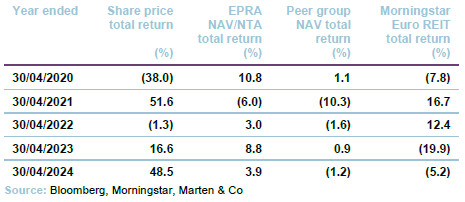

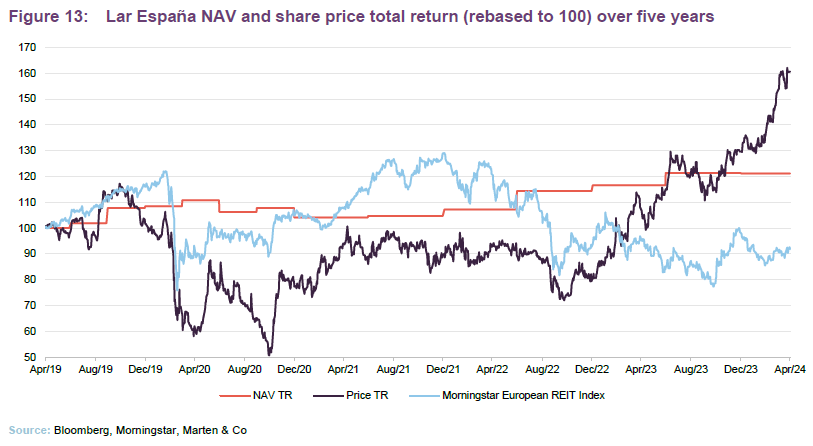

Lar España has posted a NAV total return of 21.2% over a five-year period

Lar España’s EPRA NAV/NTA total return has grown strongly since its launch due to acquisitions and value accretive asset management initiatives, such as refurbishments and redevelopments, as well as a strong dividend policy. Inevitably, the value of its portfolio fell during the pandemic, but held up relatively well due to the dominant nature of the assets and consistently high occupancy rates. The EPRA NTA has recovered strongly in the last year and over five years it has returned 21.2%.

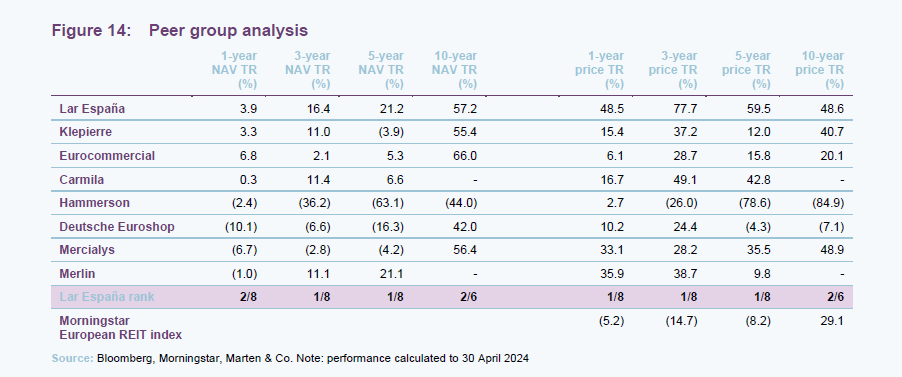

Peer group analysis

We have put together a comparison of Lar España’s listed peers in Europe, including pan-European and country-specific retail landlords and a Spanish peer. The peer group we have assembled consists of: Klepierre, Eurocommercial and Carmila (which are pan-European); Hammerson (UK), Deutsche Euroshop (Germany) and Mercialys (France), which are country-specific; and Merlin (which owns Spanish real estate predominantly in the office sector). We have also used the Morningstar European REIT Index as a comparator on share price returns.

Figure 14 shows Lar España’s short- and long-term performance versus its peers. It ranks among the top two over every time period in NAV terms, which has been reflected in its share price recovery over the past five years.

Dividend

Lar España’s shareholders approved the payment of the highest ordinary dividend in the company’s 10-year history of €0.79 per share for 2023 (to be paid in May 2024), equating to a dividend yield of 12.9% based on the share price at 31 December 2023. The dividend is made up of 100% of ordinary EPRA earnings in 2023 (€0.67 – also the highest in its history and up 39.6% on 2022) plus 50% of the capital gains obtained from the disposal of the two retail park assets last year.

The company pays a dividend once a year, in accordance with the SOCIMI rules, and has consistently distributed a high level of dividend to shareholders since its launch. Following the payment of the 2023 dividend, it would have paid out €391.2m to shareholders through dividends over its 10-year history.

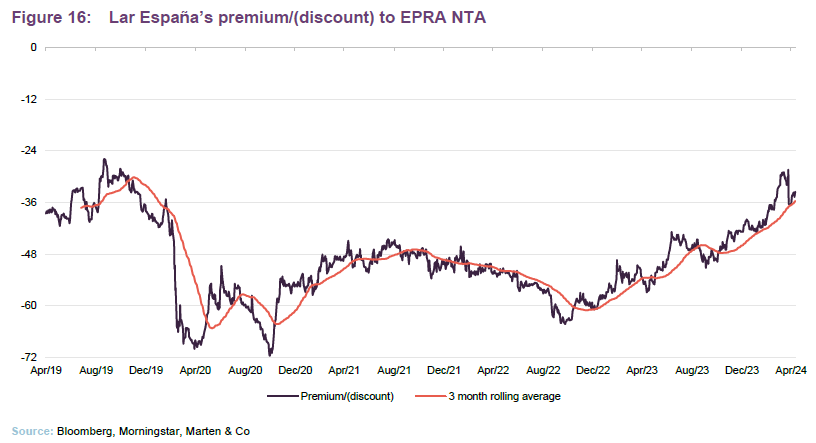

Premium/(discount)

Lar España’s shares have been trading at a very wide discount to EPRA NAV/NTA for the past five years. Its discount plunged from an already wide level at the onset of the COVID-19 pandemic in early 2020 and has only really started to recover over the past 12 months. However, its share price still lingers at a discount of 33.5% at 10 May 2024. We believe that the discount could continue to narrow given the company’s impressive dividend history, the quality nature of the portfolio, strong performance metrics, and the potential for further earnings and valuation gains from the deployment of capital into value-add assets.

Fees and costs

Grupo Lar’s current investment manager agreement (IMA) ends on 31 December 2026, having been renegotiated in 2021. Grupo Lar is entitled to a fixed annual base fee set at 0.62% of Lar España’s EPRA NTA. Previously, the base fee was the higher of €2m or 1% of EPRA NTA up to €1bn and 0.75% over €1bn.

A performance fee is paid annually to the manager based on Lar España’s EPRA NTA and share price performance over the year, subject to maximum amount of 1.5 times the annual base fee, with a hurdle of 8.5%. This is calculated as 8% of the growth in EPRA NTA beyond the 8.5% annual increase and 2% of the amount beyond the 8.5% annual increase in the market capitalisation. 80% of the performance fee will be calculated based on growth in NAV per share and the remaining 20% will be calculated based on the company’s share price. The performance fee will be payable, at the discretion of the company, in cash or treasury shares valued at their closing price at an agreed date.

Grupo Lar was paid a total of €8.937m in 2023 (a base fee of €5.669m and a performance fee of €3.268m – all accrued from the market cap growth over the year). This was more than the €5.471m paid in 2022 (base fee of €5.391m and a performance fee of €0.08m).

Under the IMA, an additional performance fee is paid to Grupo Lar when the company undertakes new asset development or extension work on its current assets, calculated as a percentage of the total capex of the project (excluding land costs). The rate is 4% of total costs up to €40m and 3% of total costs above €40m. Refurbishments are not included. In 2023 no additional performance fee was paid.

Capital structure and life

As at 10 May 2024, Lar España had 83,692,969 ordinary shares in issue and no shares held in treasury. The company’s financial year end is 31 December and AGMs are usually held in April, with the most recent held on 25 April 2024.

Debt facilities

Total debt of €651m, cash of €244m and a net LTV of 31.0%

The majority of Lar España’s debt is made up of two bonds. It raised €700m through the issuance of two unsecured senior green bonds in 2021 (€400m in July and €300m in October). The €400m bond matures in 2026 and has a fixed annual coupon of 1.75%, while the €300m bond has a fixed annual coupon of 1.84% and matures in 2028.

During 2023, Lar España bought back €119m of bonds. It bought back €110m in January of that year at a discount of 18%, while a further €9m was repurchased later in the year at an average 16% discount. A total of €107m was amortised from the €400m bond issue, while €12m was redeemed from the €300m issue. This leaves the total value of bonds in circulation of €581m.

The company also has €70m of corporate green loans, which mature in 2026 and 2027. Lar España’s debt is 100% unsecured at a fully-fixed rate, with the average maturity of its debt now 3.8 years and the average cost of debt 1.8%. The rating agency Fitch renewed its investment grade or BBB (stable) rating to both Lar España and the green bond issues in July 2023.

The group’s total debt stands at €651m, with €244m in cash reserves. This equated to a net loan to value (LTV) ratio of 31.0% at the end of 2023. Any future acquisitions will result in a reduction in cash reserves and an uplift in the LTV. The company says that it plans to keep this within the range of 35% and 39%.

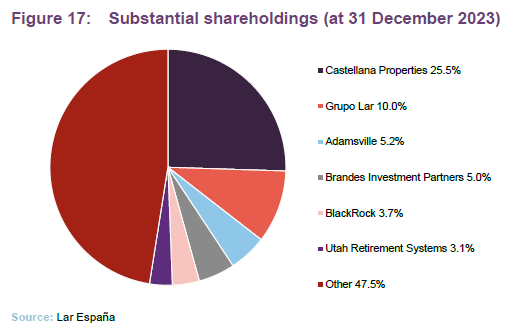

Major shareholders

South African fund Vukile Property, through its Spanish subsidiary Castellana Properties (a REIT also specialising in shopping centres), acquired a 21.7% stake in the company in January 2022 and topped up its shareholding later that year.

Management team

Lar España is exclusively managed by Grupo Lar, as mentioned earlier. A management team of four people runs Lar España under a collective agreement.

Jon Armentia

Jon is the corporate director and chief financial officer of Lar España. He joined in 2014, having been chief financial officer of Grupo Lar since 2006, covering the retail sector. Previously he worked at Deloitte (formerly Arthur Andersen) for four years. Jon has a Bachelor’s Degree in Business Management and Administration from Universidad de Navarra and a General Management Program (PDG) from IESE and has over 20 years of experience in audit, finance and real estate, having participated in several committees and boards of directors.

Susana Guerrero

Susana is the legal manager and vice-secretary of the board of directors of the company. She joined Lar España in November 2014 and previously worked as a corporate and M&A lawyer at Uría Menéndez for 10 years. She has extensive experience in corporate governance, serving as secretary of the board of directors at companies across a range of different sectors. Susana is currently deputy director of the ESADE Center for Corporate Governance and head of its opinion and public debate area. She studied law at the Complutense University in Madrid and has an LLM in Business Law from Instituto de Empresa.

Hernán San Pedro

Hernán is the head of investor relations (IR) at the company, having joined in January 2016. Previously he worked at Grupo Sacyr Vallehermoso as head of IR, Skandia-Old Mutual Group and Banco Santander. Hernán studied law at Universidad San Pablo CEU (Madrid), holds an MTA from Escuela Europea de Negocios and has over 30 years of experience in different positions in the financial, insurance, construction and real estate sectors.

Jose Ignacio Domínguez

Jose Ignacio is the internal audit director of Lar España and joined the company in September 2021. He has extensive experience in several fields of private listed multinational companies, related to finance, internal audit, risk management and compliance and corporate governance. Previously, Jose Ignacio has worked for PriceWaterhouseCoopers, Fomento de Construcciones y Contratas, and more recently Grupo Ezentis. He graduated in Economics and Business Administration from the Complutense University of Madrid and the San Pablo CEU University College. He has a Postgraduate Master’s degree from the IESE Business School and is a member of the Official Register of Accounts Auditors of Spain, (ROAC) and certified by the Global Institute of Internal Auditors (IIA).

Board

The board currently comprises four non-executive, independent directors, two of whom were appointed on the company’s incorporation in 2014. In April this year, Alex Emmott resigned as a director as part of the board’s plan for the orderly and staggered renewal of the board. Alec had been a member of the board since its launch in 2014.

José Luis del Valle

José has extensive experience in the banking and energy sectors. From 1988 to 2002 he held various positions with Banco Santander, and in 1999 was appointed senior executive vice president and chief financial officer of the bank. Subsequently he was appointed chief strategy and development officer of Iberdrola, one of the main Spanish energy companies. José was also chief executive of Scottish Power between 2007 and 2008. He was until February 2023 chairman of WiZink Bank. He is currently a director at insurance group Ocaso, and the Instituto de Consejeros-Administradores. José has a Mining Engineering degree from Universidad Politécnica (Madrid, Spain), a Master of Science and Nuclear Engineering from the Massachusetts Institute of Technology (Boston, USA), and holds an MBA with High Distinction from Harvard Business School (Boston, USA).

Roger Cooke

Roger has more than 40 years of experience in the real estate sector, having started his career at Cushman & Wakefield in 1980. From 1995 until 2013, he served as chief executive of Cushman & Wakefield Spain, leading the company to attain a leading position in the sector. In 2017, Roger was awarded an MBE for his services to British businesses in Spain and to Anglo-Spanish trade and investment. He was previously the president of the British Chamber of Commerce in Spain and is currently chairman of the RICS in Spain and member of its European advisory board. He is also a member of the executive committee of the British Hispanic Foundation and editorial advisor to the property journal Observatorio Inmobiliario. Roger holds an Urban Estate Surveying degree from Trent Polytechnic University (Nottingham, UK) and is currently a Fellow of the Royal Institution of Chartered Surveyors (FRICS).

Isabel Aguilera

Isabel’s career has spanned various companies and sectors. She has served as president for Spain and Portugal at General Electric, general manager for Spain and Portugal at Google, chief operating officer at NH Hoteles Group, and chief executive for Spain, Italy and Portugal at Dell Computer Corporation. She is currently a director at Cemex Group, Oryzon Genomics and Clínica Baviera. Previous directorships include at Indra Sistemas, Banco Mare Nostrum, Aegon Spain, Laureate Inc., Egasa Group, HPS (Hightech Payment Systems) and Banca Farmafactoring. Isabel has a degree in Architecture and Urbanism from the Escuela Técnica Superior de Arquitectura of Seville, and a master’s degree in Commercial and Marketing Management from IE. She has completed the General Management Programme at IESE and the Executive Management of Leading Companies and Institutions Programme at San Telmo Institute. Isabel is currently an associate professor and consultant at ESADE and is also a director of the non-listed company Canal de Isabel II as well as Making Science (listed in the alternative market BME Growth).

Leticia Iglesias

Leticia has vast experience in both the regulation and supervision of securities markets and in financial services. She started her professional career in 1987, in the audit division of Arthur Andersen, and further developed her career in the Securities Exchange Commission of Spain. From 2007 to 2013 she was chief executive of the Spanish Institute of Chartered Accountants (ICJCE). From 2013 to 2017 she was a director at BMN, taking on roles in the executive committee as chair of the global risk committee and member of the audit committee. Leticia is currently a director at Abanca Bank, AENA SME, S.A., ACERINOX S.A, and at non-listed company Imantia Capital. She has a degree in Economics and Business Studies from Universidad Pontificia Comillas (ICADE) and is a member of the Official Registry of Auditors of Spain (ROAC). She is a patron of the PRODIS Foundation Special Employment Center and a board member of ICADE Business Club. She is also a member of the International Advisory Board of the Faculty of Business and Economics at ICADE.

Previous publications

QuotedData has previously published four notes on Lar España. You can read them by clicking the links below.

Figure 19: QuotedData’s previously published notes on Lar España

| Title | Note type | Publication date |

| Built to last | Flash note | 3 December 2020 |

| Ducks in a row | Flash note | 16 November 2021 |

| Dominant assets make a resilient business | Initiation | 14 March 2023 |

| Defying the retail gloom | Update | 19 October 2023 |

Source: Marten & Co

IMPORTANT INFORMATION

This marketing communication has been prepared for Lar España Real Estate by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.