Henderson Smaller Companies has published results covering the 12 months ended 31 May 2024. Over the period, the trust generated a NAV return of 14.5%, trailing the benchmark by 3.7 percentage points but outperforming the sector average of 14.1%. The discount narrowed a little (from 13.2% to 11.5%) meaning that shareholders got a return of 17.3%. The dividend was increased by a penny to 27.0p. That was covered by revenue of 29.85p. The company bought back 196,665 shares for cancellation.

Extracts from the manager’s report

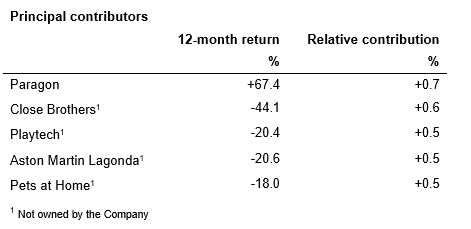

Paragon Banking is a speciality lender with a primary focus on providing buy-to-let mortgages to professional landlords. The company enjoys a very strong capital position, enabling it to pay higher dividends whilst buying back some of its own stock. Regulations on complex underwriting and the sophistication of its underwriting capability have allowed Paragon to grow market share from non-bank lenders which have suffered in this rising rate environment. As interest rates have risen Paragon has been able to grow its net interest margin leading to strong earnings growth.

Close Brothers is a specialist financial services company involved in lending, asset management services and securities market making. The company was hit by an FCA review into the historic provision of loans in the auto finance market which could require Close to make substantial provisions to cover customer redress. The Company did not own a position in this stock.

Playtech develops software platforms and content for the online, mobile and land-based gaming industry. Although operational performance has been solid the company has been hit with a legal dispute with its Mexican JV partner leading to the non-payment of fees to Playtech. The Company did not own a position in this stock.

Aston Martin Lagonda is a manufacturer of luxury automobiles. Operational weakness, high leverage and a requirement to bolster the balance sheet by share issuance impacted the share price over the period under review. The Company did not own a position in this stock.

Pets at Home is a leading UK retailer of pet products and provider of veterinary services. As the Covid-induced boom in pet ownership has subsided, growth in its retail business has slowed, compounded by a problematic move into a new distribution centre which has caused stock availability issues. Additionally, sentiment around the veterinary business has been impacted by a Competition and Markets Authority enquiry into the wider industry. The Company did not own a position in this stock.

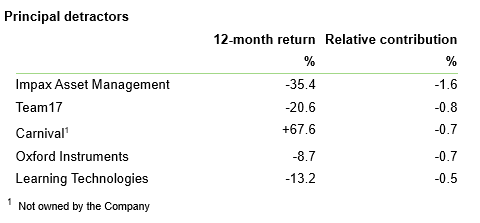

Impax Asset Management is an environmentally and socially responsible focused asset manager based in the UK. The company has delivered impressive earnings growth over the last five years from a combination of asset inflows and positive market performance. The last 12 months have been more challenging, primarily due to higher interest rates and the derating of growth companies that it typically invests in. The business has also experienced mild outflows. This combination of outflows and challenging investment performance has put pressure on company profitability. Nevertheless, the strength of the brand and long-term track record provides us with confidence about the growth opportunities at the company over the medium term.

Team17 is a developer and publisher of video games for PCs, consoles and mobile devices. The company focuses on the independent games market and selectively works with developers and third parties to launch new content on multiple platforms. The group has a strong long-term performance record driven by new releases and monetisation of the backlog of portfolio games. More recent trading has been challenging with profitability impacted by a poor release schedule and higher than expected costs. Looking ahead, this business has several levers to return to its historical earnings growth and we remain confident on its medium-term outlook.

Carnival is a global provider of cruise ship holidays. Strong demand from consumers, particularly in the US, plus lower fuel costs saw profitability expand which drove strong share price performance. The Company did not own a position in this stock.

Oxford Instruments is a manufacturer of advanced instrumentation equipment. The company benefits from servicing a number of high-growth industries such as semiconductors, quantum computing, life sciences and advanced materials. In addition, its ‘Horizon’ programme of business improvement has driven sales, profit and margin growth. The company has a very strong balance sheet and, given a positive long-term outlook for its end markets, it is well placed for the long term. In the short term some end-market weakness, particularly in semiconductors, more stringent licence controls on exports to China and some supply chain issues have led to slower growth and share price underperformance.

Learning Technologies is a provider of software and services to the learning and human resource development market. Lower demand for its services, caused by constrained corporate spending due to global economic weakness, has seen growth at the company slow and profit forecasts missed. These issues are cyclical rather than structural and the company should return to growth once economic conditions improve.

HSL : Henderson Smaller Companies lags rising market