September 2024

Winners and losers in August 2024

| Best performing funds in price terms | (%) |

|---|---|

| PRS REIT | 15.4 |

| Triple Point Social Housing REIT | 8.4 |

| Safestore Holdings | 7.2 |

| Residential Secure Income | 6.4 |

| Capital & Regional | 5.8 |

| Primary Health Properties | 4.8 |

| CLS Holdings | 4.5 |

| Big Yellow Group | 4.3 |

| IWG | 4.2 |

| Sirius Real Estate | 3.9 |

Source: Bloomberg, Marten & Co

Best performing funds

The customary summer lull in activity in the real estate sector was evident during August, with news flow at a trickle. This was mirrored in share prices, with the average movement over the month of +0.3%. Once again corporate activity was the main driver behind the largest share price outlier, this month PRS REIT. Its share price bounced at the end of the month as shareholders requisitioned the board calling for two directors, including the chairman, to be replaced (see page 3 for more details). The share price of Triple Point Social Housing REIT responded positively to its board’s announcement that it was making progress with its investment manager review and the news that the fund had replaced a struggling tenant in rental arrears (see page 4 for more information). Residential Secure Income was perhaps boosted by the new Labour government’s ambitious house building target, which is set to provide a substantial tailwind for the affordable housing sector in which it operates. Capital & Regional continues to be the subject of takeover talks, with two parties running the numbers on the company (see page 3). Meanwhile, Primary Health Properties saw an uptick in its share price perhaps on hopes that a new health secretary will ease the bottleneck in primary health centre development.

| Worst performing funds in price terms | (%) |

|---|---|

| Grit Real Estate Income Group | (8.8) |

| NewRiver REIT | (5.4) |

| SEGRO | (4.9) |

| Ground Rent Income Fund | (4.5) |

| Great Portland Estates | (3.9) |

| Helical | (3.8) |

| Shaftesbury Capital | (3.5) |

| Urban Logistics REIT | (3.2) |

| Panther Securities | (3.2) |

| Real Estate Investors | (2.9) |

Source: Bloomberg, Marten & Co

Worst performing funds

Some real estate heavyweights suffered share price losses in August despite the interest rate cut at the start of the month. The largest negative share price movers in the month, however, was led by pan-African investor and developer Grit Real Estate, with shareholders yet to get behind its renewed strategy focused on diplomatic housing development. With takeover negotiations for Capital & Regional seemingly progressing well, NewRiver REIT’s share price fell perhaps due to the effects of merger arbitrage trades. SEGRO, the largest UK listed real estate company by some margin with a market cap of around £12bn, saw its share price fall almost 5% and it is now negative in the year to date. London office developer

Great Portland Estates and West End landlord

Shaftesbury Capital – both stalwarts of the FTSE 250 index – also suffered share price erosion during the month as positive momentum over interest rate cuts was not maintained. Ground Rents Income Fund continued its run of share price losses as it stumbles towards a difficult wind down. The value of its portfolio continues to be negatively impacted by reforms in the leasehold sector. Another FTSE 250 constituent, Urban Logistics REIT, suffered a 3.2% fall as the market awaits positive updates on earnings growth.

Valuation moves

| Company | Sector | NAV move (%) | Period | Comments |

|---|---|---|---|---|

| Target Healthcare REIT | Healthcare | 1.6 | Quarter to 30 June 24 | Portfolio valued at £908.5m, up 0.8% like-for-like |

| Alternative Income REIT | Diversified | 0.4 | Quarter to 30 June 24 | Property values increased 0.1% to £102.7m |

| Custodian Property Income REIT | Diversified | (0.3) | Quarter to 30 June 24 | Portfolio value of £579.6m remained flat on a like-for-like basis |

| Residential Secure Income | Residential | (0.6) | Quarter to 30 June 24 | 0.4% decrease in like-for-like investment property values to £315m |

| abrdn Property Income Trust | Diversified | (4.1) | Quarter to 30 June 24 | Portfolio value down 0.5% to £405.5m. NAV impacted by estimated costs of wind down |

| abrdn European Logistics Income | Europe | (4.3) | Quarter to 30 June 24 | Portfolio valuation increased 0.2% to €607.4m. NAV impacted by cost of managed wind down |

| Impact Healthcare REIT | Healthcare | 2.6 | Half year to 30 June 24 | Like-for-like property values increased 2.9% to £670.1m |

| Empiric Student Property | Student accommodation | 1.7 | Half year to 30 June 24 | Portfolio valuation increased to £1,134.9m reflecting a 1.3% net like-for-like increase |

| Tritax Big Box REIT | Logistics | 1.2 | Half year to 30 June 24 | Portfolio now valued at £6.4bn following M&A activity. Up 0.7% on like-for-like basis |

| Derwent London | Offices | (2.7) | Half year to 30 June 24 | Portfolio valued at £4.8bn, an underlying decrease in value of 1.7% |

| Capital & Regional | Retail | (3.4) | Half year to 30 June 24 | 0.8% increase in like-for-like valuations over to £374.9 m |

| CLS Holdings | Offices | (10.1) | Half year to 30 June 24 | Portfolio valuation down 4.1% to £1,910.4m |

Source: Marten & Co

Corporate activity in August

PRS REIT received a requisition notice from a group of shareholders (comprising Harwood Capital Management, Waverton Investment Management, CCLA Investment Management, Alder Investment Management and CG Asset Management – representing 17.3% of issued share capital), requesting the board convenes a general meeting for shareholders to vote to remove the chairman Stephen Smith and non-executive director David Francis and replace them with Robert Naylor and Christopher Mills. Shareholder’s concerns stem from what it views as the board’s inaction to narrow its wide discount and the extension of the investment management contract in July with little consultation with shareholders. A sub-committee (formed of those board members not named in the requisition notice) has been formed to engage with shareholders.

Hammerson and PIMCO Prime Real Estate arranged a €350m non-recourse term loan of up to seven-years secured on Dundrum Town Centre, a shopping/leisure complex in south Dublin. The lenders were Rothesay, BNP Paribas and Deka, and Hammerson’s share of the asset is 50%. The loan is repayable on or before September 2031 at an all-in interest cost expected to be about 5.5%. Hammerson’s reported LTV at 30 June 2024 will be unchanged and average maturity of its debt extends from 2.2 to 2.9 years.

Triple Point Social Housing REIT’s investment grade credit rating was reaffirmed by Fitch Ratings. The company’s long-term Issuer Default Rating remains ‘A-‘ and a senior secured rating of ‘A’ is maintained for the group’s existing loan notes. The outlook has been revised from stable to negative to reflect prolonged rent arrears from two registered providers (one of which has been resolved – see page 4), and the risk that the independent review of the investment management arrangements could result in a change of investment manager.

Regional REIT repaid in full the £50m retail bond, which matured on 6 August 2024 using the proceeds of its £110.5m rights issue. Following the repayment of the bond, the company’s borrowings reduce to £353.3m, with a weighted average cost of capital of 3.4%. An additional £26m from the capital raising proceeds will be used to reduce bank facilities further, which will result in the LTV decreasing to 41% from 57% prior to the fund raising.

Tritax EuroBox announced that Brookfield Asset Management has been granted an extension to announce a firm intention to make an offer to 23 September, while discussions with other potential buyers of the business were ongoing.

The two parties that have expressed an interest in acquiring shopping centre owner Capital & Regional – NewRiver REIT and private equity company Praxis Group – were given extra time to firm up their intentions to 12 September.

August’s major news stories – from our website

- Assura acquires £500m UK private hospital portfolio

Assura agreed a deal to acquire Northwest Healthcare Properties’ UK private hospital portfolio for £500m. To fund the deal for the 14-asset portfolio, the company plans to issue Northwest £100m in shares, refinance £266m of debt, draw down £80m from its revolving credit facility and use £54m of cash. The deal adds almost £30m to Assura’s rent roll, with the leases subject to annual inflation-linked uplifts.

- Triple Point Social Housing REIT replaces struggling tenant

Triple Point Social Housing REIT completed the transfer of all 38 properties previously leased to struggling housing association Parasol (representing 9.7% of the rent roll) to Westmoreland Housing Association. Parasol had been paying just 60% of full lease rent. Following the completion of the transfer, the company said that it expects rent collection to increase to between 75% to 85% of the existing lease rent during a 12-month stabilisation period and thereafter up to at least 90%. This should help ensure that dividends paid by the company are fully covered by earnings.

- abrdn Property Income Trust makes first sale of managed wind down

abrdn Property Income Trust sold Bastion Point, a single-let industrial unit in Dover that is let to the Secretary of State for Housing Communities and Local Government, for £9.475m. It is the first sale since shareholders voted to proceed with a managed wind down of the company. The sale price was in line with the end June 2024 valuation and reflected a net initial yield of 6.1%.

- Phoenix Spree Deutschland makes progress with condominium sales

Phoenix Spree Deutschland continued to make progress with its strategy to sell individual apartments at wide premiums to their valuation. The average price for the 15 condominium sales made in the first half of 2024 stood at a 23% premium to the average per sqm valuation of the portfolio as a whole.

- CLS makes London office letting

CLS Holdings let 12,052 sq ft of office space at Artesian, 9 Prescot Street in London, to Médecins Sans Frontières (UK) on a 10-year lease. It is anticipated the lease will commence in December 2024 following the completion of fitting out works to be undertaken by CLS.

- Home REIT continues portfolio auction…

Home REIT sold a further 101 properties at auction for £18.5m, at a 4.8% premium to the draft August 2023 values. Since August 2023, the company has completed on the sale of 987 properties and exchanged on a further 315 properties for a total of £181.2m.

- … and sees lease surrenders of non-performing tenant

Home REIT reached an agreement with Mansit Housing CIC, a non-performing tenant, for the surrender of its leases on 68 properties (around 4% of its portfolio). The majority of the properties are occupied by private rented sector tenants on Assured Shorthold Tenancies.

Managers views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

Tritax Big Box REIT – Colin Godfrey, chief executive:

The first half of 2024 saw 11.7 million sq ft of take up across the UK, up from 10.0 million sq ft in H1 2023. Leasing deals continue to take time to complete, but second quarter activity (7.3 million sq ft of take up across 25 deals) was particularly strong with several large commitments closing.

Market activity remains broad-based across both building size and occupier type. Occupier demand is diverse with retailers (both online and omnichannel) and 3PLs (third-party logistics operators) active in the market. Manufacturing demand remains prominent, accounting for 25% of activity in the last 12-months.

Alongside the increase in take up, both space-under-offer and requirements (which reflect potential near-term demand) remain healthy. CBRE reported 12.1 million sq ft under offer at Q2 2024, up from 11.1 million at Q4 2023. Savills’ requirements index has increased with an uptick in enquiries for large units. Meanwhile, our own occupier enquiry hub remains close to record levels with a mix of interest by size, sector and location. Companies continue to look to evolve their supply chain networks. In doing so, they are generating new and additional demand for logistics buildings.

In addition to the structural drivers (growth of ecommerce, supply chain resilience and optimisation, and ESG) that continue to support our sector, the improving macroeconomic backdrop is expected to lead to increased levels of take up going forward. The new government’s ambition is to kickstart economic growth and focus on housebuilding. This has the potential to positively impact us as firstly, logistics will be an important enabler of UKs economic growth and secondly, with Savills research suggesting new housing creates additional demand for logistics space, and the UK government aiming to deliver 1.5 million new homes over the next five years, we believe this could further support demand in the sector.

Market vacancy, which reflects ready-to-occupy space, stood at 5.6% at the end of the period, up from 5.1% at Q4 2023. Vacancy comprises both second-hand space and developments that complete on a speculative basis. Here, the trend remains positive with speculative space under construction declining further across H1 2024 and new speculative starts remaining well below 2021/2022 levels.

Total space under construction, which also includes build-to-suit projects, stood at 18.9 million sq ft at H1 2024, down from 21.4 million sq ft at Q4 2023.

Prime headline rents increased across the period but at a lower rate than in recent years. MSCI UK Distribution Warehouse ERVs increased by 2.0% in H1 2024 (H1 2023: 4.0%).

CBRE prime market yields remained flat across the period at 5.25%, but Savills have in recent weeks moved their prime yield in by 25bps to 5.0%. H1 2024 transaction volumes totalled £2.5bn (H1 2023: £4.1bn). Market activity picked up in Q2 2024 following a quiet first quarter, but there has been a general lack of stock available to purchase and an absence of large or portfolio deals. Investor conviction in the sector remains high with surveys continuing to highlight logistics as a favoured destination for capital. Existing owners are, however, choosing to hold onto logistics assets given their ongoing conviction in the sector and attractive returns available following a period of repricing.

Student accommodation

Empiric Student Property – Duncan Garrood, chief executive:

Student accommodation continues to be highly sought after by both existing and new investors, with UK purpose-built student accommodation (PBSA) specifically attracting interest from global capital interest. Relative to 2023, investment in PBSA has bounced back in the first half of the year, with CBRE reporting £2.1bn of investment into the sector in 2024 to date, three times higher than the same period in 2023. The abolition of Multiple Dwellings Relief (MDR) came into effect on 1 June 2024 and has resulted in pricing for some assets being impacted by up to 4.0% by virtue of increased stamp duty charges. This will likely impact pricing of transactions into the second half of 2024.

The supply of new beds is forecast to increase in 2024, with best estimates indicating the delivery of circa 12,500 beds on average over the next four years. In the medium term, new supply remains heavily constrained with construction cost viability remaining challenging in all but the strongest markets, impacted by land value, planning, enhanced building safety standards and higher debt costs. The constrained supply is also being compounded by the falling number of Houses of Multiple Occupation (HMOs) with a range of factors forcing private landlords from the market. Since 2016, the stock of private rental properties has decreased by almost 10%, with the UK’s HMO supply decreasing by 146,000 beds over the past four years.

Demand for UK higher education is normalising post pandemic but remains very strong. UCAS, which represents around 90% of total applications, recently published application data to June 2024 in respect of the 2024/25 academic year. Applications for higher tariff institutions, to which we are primarily aligned, have continued to grow, increasing 0.4% year-on-year. Lower tariff institutions have experienced a further decline in applications, dropping 3.7%, further demonstrating a continued flight to quality.

International applicants have fallen by 1.9%, with the largest declines seen in applicants from Nigeria and India, a large constituent of this decline arising from dependant applications. This follows a tightening of rules for dependant family visas for masters students, a change which has not impacted us due to the single occupancy nature of the majority of our sites. Applications from China, the USA, Canada and the UAE continued to report modest increases. Non-EU international applicants remain 40% higher than their pre-pandemic level.

Domestically, applications have reduced by 1.6% compared to 2023, driven by a 4.9% decline in mature student applications. Applications from 18-year-olds are up 0.6% and are forecast to continue growing until 2030 due to the increasing size of the qualifying cohort.

The UK remains within the top four most-favoured international destinations for students originating from the USA, China and India and continues to perform well on relative affordability when compared with many other sought-after international destinations for higher education. Demographically, to date, we have experienced an increase in demand from international students which does demonstrate the resilience of the UK’s international student market.

These strong trends contributed to sector wide rental growth of 8% for the 2023/24 academic year, with Glasgow experiencing the strongest rental growth of all the major markets at 19%. For the 2024/25 academic year, expectations for continued rental growth, in addition to anticipated cuts to the base rate of interest, have held prime regional yields stable across the sector during the first half of 2024.

Diversified

Custodian Property Income REIT – Richard Shepherd-Cross, investment manager:

After a period of stabilisation, the trajectory of valuations appears to be turning positive and the company, together with its peers, has a more optimistic outlook.

Investors in listed real estate have reason to be optimistic with falling vacancy rates, rental growth and discounted share prices creating generous dividend yields and room for share price recovery. Along with the recent cut in interest rates which we expect to support valuations further, we believe this could be a very opportune time for investors to re-engage with real estate.

LSH’s recent UK Investment Transactions report recorded a 12% increase in UK transaction volumes for the six months to 30 June 2024, albeit this is still below the five-year average. CBRE’s UK Mid-Year Market Outlook reported stronger signs of a turning point for real estate noting inflation is on target and cost of living pressures have moderated, creating space for consumer demand to rebound. Overall, according to this report, the economic backdrop is positive for both occupiers and investors.

Offices

Derwent London- Paul Williams, chief executive:

The UK economic environment continued to improve through the first half of the year (H1) having begun to recover late last year. With inflation now in line with the Bank of England’s 2% target following a substantial reduction from its peak of 11% in October 2022, the UK base rate was cut by 25 basis points in August to 5.0%, and there are further cuts on the horizon.

The five-year swap rate has responded favourably and is now 3.6%. Further declines in the cost of debt and improving availability should be expected to encourage a recovery in investment activity. At £1.9bn, transaction volumes in H1 were 65% below the 10-year H1 average. However, since the start of H2, enquiry levels are picking up with CBRE reporting £19.2bn of global equity targeting London offices.

In February, we highlighted with our 2023 full year results that “valuations are now approaching this cycle’s lows”. In H1, the pace of MSCI capital value declines slowed to 2.1%. Looking forward we expect a recovery in capital values, principally driven by rental growth.

The central London office market has strengthened further with the key occupier themes continuing to be quality, location and amenity. At the same time, existing supply that satisfies these requirements is limited and the market development pipeline is constrained, driving rental growth for the best space.

The imbalance between supply and demand across the London office market remains pronounced. Grade A vacancy is 1.8% and there are only 7.3m sq ft of speculative development completions due by the end of 2027. While leasing transactions are taking longer, the increase in space under offer suggests the lower take-up in H1 should be temporary.

Overall vacancy has levelled off at 8.3%, with the West End at 4.5% and the City at 10.8%. According to CBRE, lower quality, second-hand space comprises over two-thirds of supply. The Grade A vacancy rate in the West End is only 1.2% and in the City is 2.1%. The central London development pipeline is constrained, with 12.6m sq ft of space under construction and due to complete by 2027. Of this, 42%, or 5.3m sq ft, is pre-let or under offer, rising to 54% for projects due to complete in H2 2024. In line with longer-term trends, pre-letting levels in the West End (23%) are below the City (62%).

Take-up in the second quarter, which was 20% higher than Q1, benefited from some large financial pre-lets in the City, and since the start of H2 the West End has seen some of the space under offer convert with the completion of several substantial pre-lets, including BDO. Occupier enquiry levels remain high across a broad range of sectors backed up by active demand rising 14% through H1 to 11.2m sq ft, 56% above the five-year average.

Liquidity across the market has been focused on smaller lot sizes where there is less of a requirement for leverage. With £1.9bn of transactions completing in H1, below the long-term average, the average lot size was only £29m. The availability of debt has begun to improve in recent months. The first cut in base rates saw the five-year swap rate fall back to 3.6%. In a global context, London continues to enjoy a reputation as a safe haven. As a result, sentiment is improving and a rising number of investors are switching from a ‘wait and see’ approach to being more acquisitive.

Prime yields were unchanged in H1. At 4.0%, West End yields have increased 75bp compared to June 2022 while City yields have moved out 200bp to 5.75%.

CLS Holdings – Fredrik Widlund, chief executive:

There are signs of improvements in the real estate investment market and leasing activity continues to be positive as occupiers are increasingly prepared to commit to the right locations and buildings. The bifurcation seen in the last few years has carried on with stronger demand for centrally located and/or higher quality offices, while more peripheral office locations or lower quality buildings continued to decline.

The investment market improved in the first half of 2024, albeit from historically low numbers, but an increase compared to the same period last year and certainly the second quarter of 2024 was more active with buyers slowly returning to the market. As we have seen in past cycles, the UK entered the downturn earlier and is now ahead in its recovery while Germany and France are a bit further away.

Real estate research notes

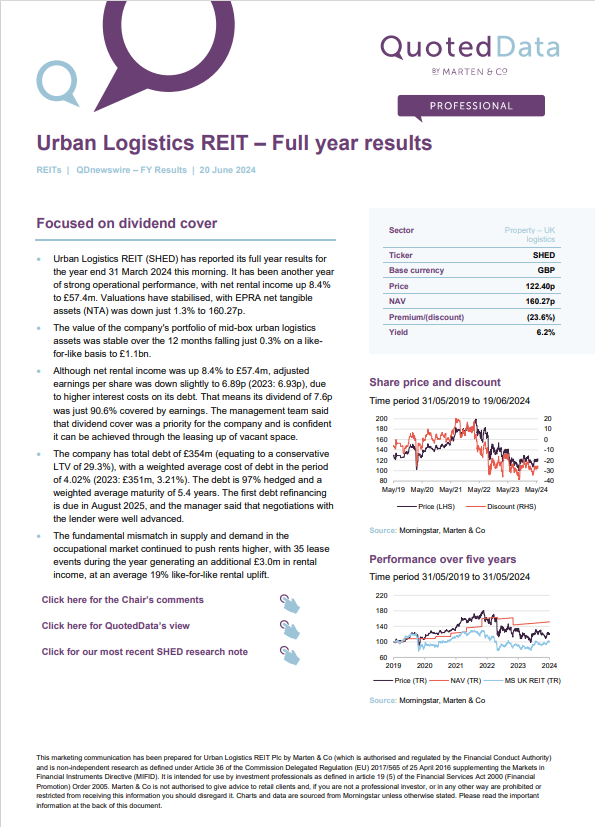

A result analysis note on Urban Logistics REIT (SHED). The company reported resilient performance in a rising interest rate environment, with its focus on growing earnings to provide dividend cover.

An annual overview note on Lar España Real Estate (LRE SM). Impressive rental growth allowed the company to declared the largest dividend in its 10-year history.

An annual overview note on Grit Real Estate Income Group (GR1T). Its latest act of corporate engineering has opened the door for new NAV and earnings accretive developments.

An update note on Tritax EuroBox (EBOX), which is sailing in calmer waters as demonstrated by a portfolio valuation that has changed little and a 30% uplift in earnings that now fully covers its 8.6%-yielding dividend.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.