Addressing the discount

On 26 November, Caledonia Investments (CLDN) released interim results covering the six-month period ended 30 September 2024. We provide some analysis of these in this note. There was a welcome narrowing of the share price discount to net asset value (NAV) over the period. However, the market turmoil that accompanied the UK budget and the US election has since reversed this, leaving CLDN trading on an excessively wide discount of 37.9%.

The board believes that CLDN’s share price undervalues the quality of its portfolio and long-term track record, and we wholeheartedly agree with this. Understandably, the board and management are keen to do what they can to tackle the discount (see page 3), and NAV-accretive share buybacks play an important part in this. The company is asking shareholders to approve measures to enable their continued use (see page 5). Large independent shareholders were consulted ahead of this and presumably are supportive of the idea. We would encourage shareholders to back the proposal.

Inflation-beating returns

CLDN’s aim is to generate long-term compounding real returns that outperform inflation by 3%-6% over the medium to long term, and the FTSE All-Share index over 10 years.

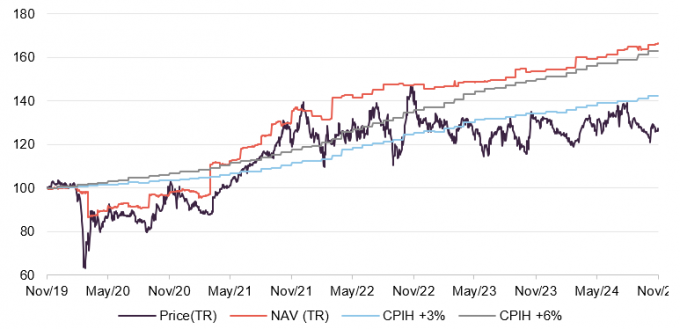

At a glance

Share price and discount

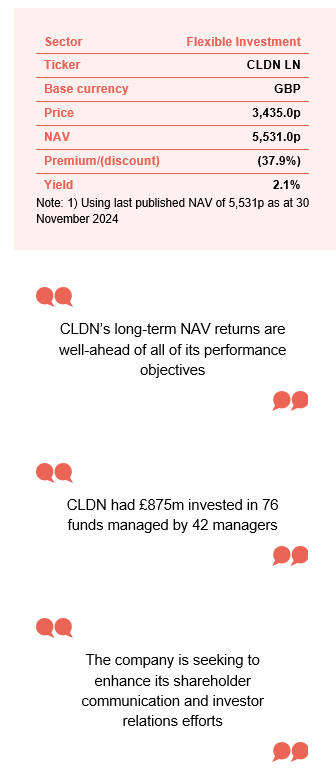

Over the 12 months ended 30 November 2024, CLDN’s discount moved within a range of 41.6% to 30.6% and averaged 35.4%. At 6 December 2024, CLDN was trading on a discount of 37.9%. Share buybacks are an important element of CLDN’s approach to managing its discount and it will be asking shareholders to approve a Rule 9 waiver which allows the Cayzer family concert party to increase the percentage shareholding without being forced to make a takeover bid.

Time period 30 November 2019 to 06 December 2024

Source: Morningstar, Marten & Co

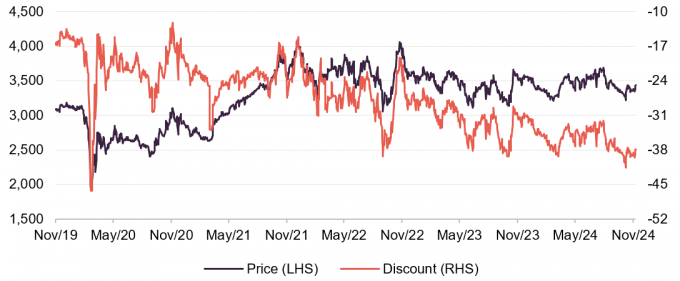

Performance over five years

CLDN’s long-term NAV returns are well-ahead of all of its performance objectives. However, a widening discount has held back its share price returns. For its most redent interim results period – the six months ended 30 September 2023 – CLDN’s NAV total return was 0.5%. This was held back by adverse currency moves, which took off £104m or 3.6% from the NAV, along with a write down in the value of Cooke Optics.

Time period 30 November 2019 to 30 November 2024

Source: Morningstar, Marten & Co

| 12 months ended | Share price total return (%) | NAV total return (%) | Inflation – CPIH (%) |

|---|---|---|---|

| 30/11/2020 | (1.4) | (2.1) | 0.6 |

| 30/11/2021 | 20.5 | 38.2 | 4.6 |

| 30/11/2022 | 16.2 | 9.0 | 9.4 |

| 30/11/2023 | (5.1) | 4.1 | 4.2 |

| 30/11/2024 | (3.2) | 8.4 | 3.3 |

Real, absolute returns, over the long term

Objective

Growing the real value of net assets and dividends

In line with its strategic objectives of growing the real value of its net assets and dividends, while managing investment risk for long term wealth creation, CLDN has set itself the target of generating long-term compounding real returns that outperform inflation by 3%-6% over the medium to long term, and the FTSE All-Share Index over 10 years.

Meeting its objectives

The performance objectives have been achieved comfortably, and on the dividend front, CLDN has grown its dividend well ahead of inflation. It is a leading AIC dividend hero (a title awarded to investment companies that have increased dividends for at least consecutive 20 years), having grown its dividend each year for the last 57 years.

However, it is important to stress that none of the portfolio is managed to beat a benchmark – that is simply not how the CLDN approach works. For example, the equity managers buy companies that they believe will generate long-term compounding returns, not companies that everyone else is buying just because they dominate an index.

Founding family’s significant stake nurtures a culture of long-term thinking

CLDN has a rich history, having evolved from a family-run shipping business established in the late 1800s to a broadly diversified global investment trust today. It offers something akin to a family-office service (wealth management typically for a single family) but makes it available to shareholders of all sizes. The founding Cayzer family owns about 49.5% of the company and is a supportive shareholder. This has nurtured a culture of long-term thinking and an entrepreneurial environment, but with a measured approach to risk. The team’s incentive structure is designed to align it with shareholders.

Experience has shown the CLDN team that investing in companies and allowing them to drive value, rather than focusing on short-term trading, delivers very good returns.

CLDN’s investment approach was covered in our initiation note – Time, well invested

CLDN’s capital is invested across three pools – each has a strategic allocation and target return. The three investment strategies deliberately address large markets, which CLDN expects will offer attractive long-term opportunities. A comprehensive description of CLDN’s investment approach was provided in our initiation note.

Addressing the discount

CLDN’s discount is wider than it has been at any time over the past decade other than the brief COVID-related panic

Over the 12 months ended 30 November 2024, CLDN’s discount to NAV moved within a range of 41.6% to 30.6% and averaged 35.4%. At 6 December 2024, CLDN was trading on a discount of 37.9%. The board and the managers feel that this discount is excessive and is not reflective of the quality of the portfolio or the trust’s long-term track record. We wholeheartedly agree with this.

As we show in Figure 14 on page 12, even after the bout of high inflation that we experienced over the past few years, CLDN’s NAV returns are well ahead of even its most challenging target of inflation plus 6% per annum. However, CLDN’s discount is wider than it has been at any time over the past decade, other than the brief COVID-related period of panic in markets in March 2020.

Delivering on its long-term objectives is an important part of this, but the company is also seeking to enhance its shareholder communication and investor relations efforts. To that end, it is planning a series of events spotlighting each of the three pools, starting with Private Capital on 22 January 2025.

Figure 1: CLDN discount over the five years ended 30 November 2024

Source: Morningstar, Marten & Co

In the fight against discount volatility, one other weapon in trusts’ armoury is buying back shares. CLDN bought back 746,963 shares at an average discount of 34.8% over the six-month period ended 30 September 2024. This has the twin benefits of providing liquidity for exiting CLDN shareholders, and enhancing the NAV for those that remain; buybacks added 25.6p to the NAV over the period. A further 238,538 shares have been repurchased since end September.

Figure 2: CLDN share buybacks by month

Source: Caledonia Investments

Rule 9 waiver

CLDN wants to continue to buy back shares, but to do so, it needs to address a pressing issue. It is convening a meeting to ask shareholders to approve a ‘Rule 9 waiver’ (an exemption under the Takeover Code allowing certain shareholding increases without triggering a mandatory takeover bid).

CLDN’s 18 December vote would facilitate further share buybacks

The Cayzer family interests are considered to be a ‘concert party’ (a group of shareholders acting in agreement regarding control of a company). It currently controls 49.49% of CLDN’s shares. Ordinarily, at its AGM CLDN would ask shareholders to approve a Rule 9 waiver which allows the concert party to increase the percentage that it owns without being forced to make a takeover bid (the Takeover Code says that if you own between 30% and 50% of a company and increase your percentage holding, you are forced to bid for it). The only issue with the normal AGM resolution is that the maximum percentage that the concert party can end up owning this way is 49.9%, which the concert party’s holding is already close to.

This new vote, which will be held on 18 December at 2pm at Caledonia’s offices, would allow the concert party to hold more than 50% without triggering a bid. Clearly the concert party is conflicted on this, and so it will not vote its shares.

We believe that it makes sense for CLDN to be able to continue to make these repurchases, which are very NAV-accretive for remaining shareholders. It is right that the concert party members are not exercising their votes in this matter. We think it is in all shareholders’ interests to approve the resolution. Before publishing the circular, CLDN carried out a consultation exercise with a significant proportion of independent shareholders who have historically voted at previous general meetings. It seems likely to us that they were supportive of the idea.

At the meeting, Caledonia will also ask shareholders to approve buybacks of up to 5% of its current shares in issue.

Asset allocation

Figure 3: Split of portfolio by type as at 30 November 2024

Source: Caledonia Investments. Note 1) average over 10-year period ended 30 September 2024

As one might expect, given the long-term investment approach, CLDN’s asset allocation at end November 2024 is not much changed from the position at end June (the data that we used in our initiation note). However, the net cash position had fallen from 7% to 5%.

Figure 4: Split of portfolio by geography as at 30 November 2024

Figure 5: Split of portfolio by sector as at 30 November 2024

Source: Caledonia Investments

Source: Caledonia Investments

Top 10 holdings

Figure 6: CLDN 10-largest holdings as at 30 November 2024

| Business | Value (£m) | % of NAV 30/11/24 | % of NAV 30/06/24 | Change (%) | |

|---|---|---|---|---|---|

| Cobepa | Investment company | 181.4 | 6.0 | 6.0 | – |

| Stonehage Fleming | Family office services | 181.2 | 6.0 | 5.7 | 0.3 |

| AIR-serv Europe | Forecourt vending | 174.2 | 5.8 | 5.8 | – |

| Liberation Group | Pubs, bars and inns | 148.0 | 4.9 | 4.6 | 0.3 |

| HighVista Strategies | Funds of funds | 132.5 | 4.4 | 4.8 | (0.4) |

| Oracle | Software | 97.1 | 3.2 | 3.0 | 0.2 |

| Watsco | Ventilation products | 84.7 | 2.8 | 2.7 | 0.1 |

| Microsoft | Software | 84.5 | 2.8 | 3.0 | (0.2) |

| Philip Morris | Tobacco and smoke-free products | 76.7 | 2.6 | n/a | n/a |

| Axiom Asia Funds | Funds of funds | 76.3 | 2.5 | 2.7 | (0.2) |

| Total | 42.1 |

Source: Caledonia Investments

The only change to the top 10 since we last published is that Cooke Optics has dropped off the list (for the reasons outlined on page 14) to be replaced by Phillip Morris, a pre-existing holding whose share price is over 30% higher than it was at end June 2024 (the data that we used in the initiation note).

Public companies

Figure 7: Pool Corp (USD)

Source: Bloomberg

Within the public companies pool, CLDN made one new investment in the capital portfolio. Pool Corp (poolcorp.com), the world’s largest wholesale distributor of swimming pool and related outdoor living products. It operates approximately 440 sales centres in North America, Europe, and Australia. The management team at Watsco, a long-standing position in CLDN’s portfolio, recommended that the CLDN team consider meeting the management team at Pool Corp (the former CEO of Pool Corp worked at Watsco in the 1990s). COVID travel restrictions led to a surge in demand for private pools, which pulled-forward demand. The slowdown in sales that followed this period weighed on Pool’s share price. The CLDN team feels that the stock is now trading at an attractive valuation.

In the income portfolio, CLDN also added Sage (sage.com), a leader in accounting, financial, HR and payroll technology for small and mid-sized businesses, and Croda (croda.com), a speciality chemicals company supplying ingredients to life sciences and consumer care businesses (already held in the capital portfolio).

Sales were made of BAT (tobacco) from the capital portfolio, and DS Smith (packaging) and Pennon (water and waste) from the income portfolio.

At the recent interim results presentation, CLDN took the opportunity to highlight some of the investments in its portfolio – one for each of the three pools.

Fastenal (public companies pool)

Fastenal (fastenal.com) is a supply chain management company – supplying fasteners, safety supplies, and other product lines (eight smaller product categories, such as tools, janitorial supplies, and cutting tools) – for a range of industrial businesses in North America.

Figure 8: Fastenal (USD)

Source: Bloomberg

Fastenal is a company that the CLDN team had followed closely from 2017 and liked, but during the market panic of March 2020, CLDN saw an opportunity to pick up a stake at an attractive valuation. At that time, Fastenal was introduced to both the income and capital portfolios. Whilst the position has been top-sliced (partially sold to reduce exposure), the team sees the potential for the stock to remain in CLDN’s portfolio for some time yet.

CLDN’s team says that Fastenal is a well-run business with a strong balance sheet. Over the 10-year period to end 2023, Fastenal grew sales at 7% CAGR and diluted earnings per share by 9.3%. It achieved this while maintaining operating margins above 20%. The company pays ordinary dividends and special dividends, and has also been buying back stock.

Part of the attraction is that it has a de-centralised management structure, which gives greater incentives and flexibility to local management to optimise customer relationships. Since 2015, the business has had a strong focus on opening locations embedded within or close to customers’ facilities. In response to customers’ needs, Fastenal has also been expanding outside its core markets of USA, Canada, and Mexico (156 locations at end 2023 outside of North America versus 3,263 within North America, of which 2,783 were in the USA).

Funds pool

At end September 2024, CLDN had £875m invested in 76 funds managed by 42 managers.

Over the six months ended 30 September 2024, CLDN invested £67m (77% of that into North American funds and the balance into Asian funds).

CLDN made $130m of new commitments during this period, of which $110m was to North American funds, and $20m to an existing Asian manager.

Figure 9: Split of funds pool as at 30/09/2024

Figure 10: Split of funds pool by maturity

Source: Caledonia Investments

Source: Caledonia Investments

Distributions totalled £75m, split roughly in line with 63%:37% split shown in Figure 9. After a period of subdued realisations, CLDN says that its North American managers are cautiously optimistic on the prospect of a continued recovery in the pace of exits. The weighted average portfolio age is 4.1 years in North America and 4.8 years in Asia.

Available liquidity comfortably exceeds CLDN’s uncalled commitments

Total uncalled commitments amounted to £399m at end September 2024. Against that, CLDN has a newly-enlarged revolving credit facility (this has been increased by £75m to £325m, but is currently undrawn) and had overall liquidity at end September 2024 of £460m.

Decheng Capital (funds pool)

Just under half (48%) of CLDN’s growth/VC exposure is to the biotech/healthcare market. This is an area that has lagged the wider market in recent years, largely in response to rising interest rates which dampened enthusiasm for unprofitable, cash-consumptive businesses such as early-stage biotech companies. However, as large pharmaceutical companies look to replace revenues from drugs that are coming off patent, the likelihood of M&A activity in the sector increases. This could mean that we are entering a bumper period (one that sees a relatively high number of deals at attractive prices for the sellers) for exits from this part of the portfolio.

Decheng Capital is a specialist life sciences and healthcare investor with offices in California’s Silicon Valley (where it is headquartered), Shanghai, and New York, and AUM (assets under management) of $2.1bn. It was founded by Dr. Min Cui in 2012 and has since backed 73 firms in areas such as biopharma, diagnostics and tools, medical devices, and services. It looks for strong management teams with a proven track record, and a clear value proposition for potential acquirors.

CLDN first looked at Decheng in 2013, backed Decheng’s second fund in 2016, and has backed three more funds since, as Figure 11 shows.

Figure 11: Decheng funds backed by CLDN

| Decheng fund | II | III | IV | V |

|---|---|---|---|---|

| Vintage year | 2016 | 2018 | 2021 | 2024 |

| Fund size | $303m | $470m | $673m | $700m1 |

| CLDN commitment | $12m | $18m | $15m | $20m |

| Net money multiple2 | 2.2x | 1.7x | 1.1x | n/a |

Source: Caledonia Investments. Note 1) this is the target size. Note 2) as at 30 September 2024

Part of the attraction for CLDN is Decheng’s ability to target opportunities in both the US and China, two of the world’s largest healthcare markets.

To date, Decheng has backed 23 $1bn plus businesses. One of its biggest wins came in April this year when Vertex Pharmaceuticals announced a $4.9bn deal to acquire Alpine Immune Sciences. Vertex was attracted by a promising kidney therapy (targeting a condition called IgA nephropathy) that Alpine was developing.

Alpine Immune Services was founded in 2015 and listed in 2017 through a reverse merger (when a private company merges with a public company to become publicly traded, avoiding the cost and complexity of an IPO) with Nivalis Therapeutics. Decheng led a $25.3m fundraise for the company at $5.37 per share in 2019 (Min Cui joined its board at this time) and supported it with additional capital in 2021 and 2022, becoming its largest shareholder with an 11% stake.

Overall, Decheng realised $428m or 8.2x its investment, which works out as a 75% internal rate of return (IRR) over its 5.5-year holding period. CLDN’s look-through share of the proceeds was £11.4m.

Figure 12: Alpine Immune Sciences (USD)

Source: Bloomberg

Private capital pool

At the end of September 2024, CLDN had £848m invested in nine predominantly UK-focused private companies. Five of these accounted for around 90% of that value. CLDN said that these businesses were valued at between 9x and 14.5x EV/EBITDA. In keeping with its investment approach, leverage on these businesses was a modest 2x–2.5x EBITDA.

DTM (private capital pool)

CLDN’s latest private capital investment was DTM, the UK’s leading provider of tyre management services to operators of vehicle fleets. Founded in 2004 and headquartered in Blackpool, it offers customers a truly national service. On acquisition, CLDN said that DTM had over 100 employees and serves c.250 fleet customers with c.285,000 vehicles and c.1,300,000 tyres under management. All of DTM’s tyres are recycled or reused, which contributes towards customers’ net zero targets. The business has delivered 15% CAGR in revenue over the past 15 years.

Customers have access to DTM’s scalable proprietary technology platform, which allows them to improve fleet efficiency and provides them with a complete audit trail for compliance purposes. Customer turnover is low. DTM benefits from its scale, negotiating directly with tyre manufacturers and wholesalers.

CLDN’s team likes the DTM management team. The CEO (since July 2022) is Leigh Goodland. He joined from NRG Riverside, the UK’s largest municipal and specialist fleet hire company, where he was group sales director, and has considerable experience of other vehicle fleet businesses, including almost 10 years at MAN Truck & Bus UK Limited.

A new chair, David Brennan, was appointed early in October. He has extensive experience in senior roles within the UK fleet sector, including Lease Plan and Nexus Vehicle Rental, alongside 12 years working with private equity and private equity-backed businesses

CLDN invested £55m to acquire a majority stake in DTM (the balance is held by members of DTM’s management team). CLDN says that the business has been trading in line with expectations. There are opportunities to expand organically and further efficiencies that can be achieved to improve profitability. There is also an opportunity to expand into adjacent services and geographies.

Performance

CLDN’s performance is not benchmarked against any peer group, and we have not sought to do so in this note.

As a reminder, CLDN has set itself the target of generating long-term compounding real returns that outperform inflation by 3%-6% over the medium to long term, and the FTSE All-Share Index over 10 years. For the purposes of this report, we have substituted the HSBC FTSE All-Share Index Fund Class C accumulation units, which seeks to track the returns of the FTSE All-Share Index, for that index. As a measure of inflation, we have used UK CPIH, which is the consumer prices index including owner-occupiers’ housing costs.

CLDN’s long-term NAV returns are well-ahead of all of its performance objectives. However, a widening share price discount to NAV has held back its share price returns.

Figure 13: CLDN NAV total return performance relative to HSBC All-Share tracker and UK inflation (CPIH) over 10 years ended 30 November 2024

Source: Morningstar, Marten & Co

Figure 14: CLDN returns for periods ending 30 November 2024

| 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | 10 years (%) | |

|---|---|---|---|---|---|---|

| Share price | (5.9) | (3.4) | (3.2) | 6.7 | 26.8 | 95.2 |

| NAV | 1.1 | 4.0 | 8.4 | 23.0 | 66.5 | 149.9 |

| Inflation (UK CPIH) | 1.1 | 1.2 | 3.3 | 17.7 | 23.8 | 34.4 |

| HSBC FTSE All-Share tracker | (0.8) | 1.9 | 15.3 | 25.5 | 31.0 | 81.0 |

| Inflation plus 3% per annum1 | 1.8 | 2.7 | 6.3 | 28.0 | 42.6 | 79.1 |

| Inflation plus 6% per annum1 | 2.5 | 4.1 | 9.3 | 38.9 | 63.7 | 136.8 |

Source: Morningstar, Marten & Co. Note 1) Inflation figures to 31 October 2024

Results for six months ended 30 September 2024

Figure 15: GBP/USD exchange rate

Source: Bloomberg

The NAV total return for the period was 0.5%. This was held back by adverse currency moves, which took off £104m or 3.6% from the NAV, and a write down in the value of CLDN’s holding in Cooke Optics.

The interim dividend was hiked by 4.0% to 19.69p, further extending CLDN’s impressive 57-year record of consecutive dividend increases.

The currency move is mostly down to the weakness of the US dollar against the pound over the six months ended 30 September 2024 (52% of CLDN’s portfolio is exposed to the dollar). In the wake of Trump’s election, the dollar has rebounded, and this currency move has reversed, which will be reflected in the next set of results.

The aggregate of the investments made in the first half that we have referred to in previous pages was £227m, which exceeded realisations of £177m by £50m.

Figure 16: Contributions to returns by pool over H1

| Return(%) | Return excluding FX (%) | Yield on cost (%) | |

|---|---|---|---|

| Public companies | 7.0 | 11.6 | 3.5 |

| Funds | (2.4) | 3.6 | n/a |

| Private capital | (2.8) | (2.0) | 3.9 |

| Total portfolio return | 0.7 | 4.6 | 2.6 |

Source: Caledonia Investments

The public companies pool return can be further broken down into a 6.7% return for the capital portfolio and a 7.8% return for the income portfolio.

As Figure 16 shows, the funds pool was particularly affected by exchange rates. In local currencies, the North American positions returned about 5.3%, while the Asian positions returned 0.8%.

Within the private capital pool, with the exception of Cooke Optics, trading was said to be good.

COBEPA

Made a local currency return of 4.4% (1.6% in sterling). There is a fair degree of cash drag at work within its portfolio currently.

Stonehage Fleming

Made a return in the first half of 7.6% aided by good performance within each of its three main divisions (family office, investment management, and financial services).

AIR-serv

Made a return of 6.1% and provided CLDN with a £6.2m dividend over the first half. Trading is said to be ahead of expectations.

Liberation Group

Improvements are still being made to the Cirrus portfolio of pubs. CLDN has warned that the business will be impacted by changes announced in the recent Budget, with the hike in National Insurance being an obvious example. However, the return over the first half was the strongest of CLDN’s big private capital investments, coming in at 9.1%. Revenues from food, drink, and accommodation were all higher.

Cooke Optics

The valuation of this investment was written down from £110.7m to £50m. The statement says that the reduced valuation reflects continued uncertainty over the recovery of demand for the company’s cinematography lenses, following the 2023 Hollywood actors and writers’ strikes.

The prosumer range that we discussed in our last note is said to be in demand.

Previous publications

Readers may wish to refer to our initiation note – Time, well invested – which was published on 15 July 2024, and which contains much more information on CLDN’s investment approach and structure.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Caledonia Investments Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.