Decision time

Shareholders in Polar Capital Global Healthcare (PCGH) are being asked to approve changes aimed at improving the trust’s future prospects. These include lower fees, a better structure, and regular five-yearly opportunities for all investors to exit.

There is also an immediate exit option. Investors must decide whether to stay invested. However, with PCGH trading close to its asset value, those wanting to sell have already had the chance to do so in the market. We believe now is not the time to leave the healthcare sector, which remains undervalued but promising. In fact, we would consider increasing our investment.

Long-term capital growth from healthcare stocks

PCGH aims to deliver long-term capital growth to its shareholders by investing in a diversified global portfolio of healthcare stocks.

At a glance

Share price and discount

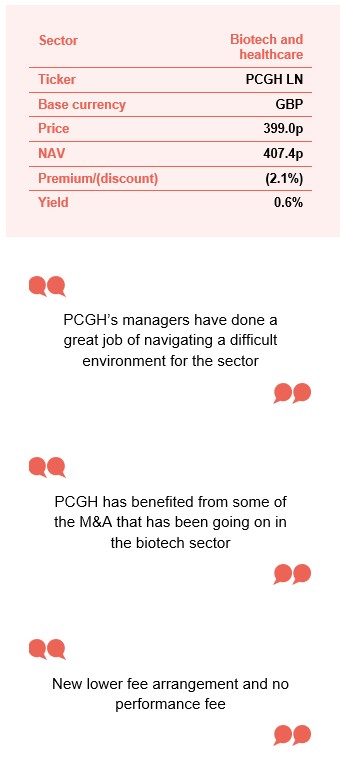

Over the 12 months ended 31 October 2025, PCGH’s share price discount to net asset value (NAV) moved within a range of 9.1% to 1.0% and averaged 4.6%. At 11 November 2025, PCGH was trading on a discount of 2.1%.

PCGH’s sector-leading long-term returns (it has the highest 10-year returns of any trust in the AIC’s biotechnology and healthcare sector over the past 10 years) ought to be enough to merit a high rating.

Time period 31 October 2020 to 11 November 2025

Source: Bloomberg, Marten & Co

Performance over five years

In our view, PCGH’s managers have done a great job of navigating a difficult environment for the sector.

In recent months, PCGH has benefited from some of the M&A that has been going on in the biotech sector and the start of improving sentiment towards the sector. The managers are optimistic about the future.

Time period 31 October 2020 to 31 October 2025

Source: Bloomberg, Marten & Co. Benchmark is MSCI All Countries World Index Healthcare Index in sterling

| 12 months ended | Share price total return (%) | NAV total return (%) | MSCI ACWI Healthcare total return (%) | MSCI ACWI total return (%) |

|---|---|---|---|---|

| 31/10/2021 | 31.8 | 24.4 | 21.7 | 30.5 |

| 31/10/2022 | 9.0 | 7.9 | 10.2 | (4.1) |

| 31/10/2023 | (5.6) | (4.4) | (7.3) | 4.8 |

| 31/10/2024 | 24.5 | 21.7 | 13.0 | 26.0 |

| 31/10/2025 | 5.3 | 0.2 | (2.0) | 20.6 |

Fund profile

PCGH aims to generate capital growth through investments in a global portfolio of healthcare stocks which is diversified by geography, industry subsector and investment size.

More information is available on the trust’s website polarcapitalglobalhealthcaretrust.co.uk

PCGH started life in 2010 as Polar Capital Global Healthcare Growth and Income Trust with an issue of ordinary shares and subscription shares. The subscription shares were exercised in full in July 2014 and this distorts the trust’s NAV returns for that early period. In June 2017, the trust was reconstructed and adopted its current name. About 26.3m shares were bought back and 27.8m shares issued around that time.

The team has considerable real-world experience of the pharma and biotech industry

PCGH’s investment manager and AIFM is Polar Capital LLP. The lead managers on the trust are James Douglas and Gareth Powell (more information on the managers is available on page 15). The management team has considerable real-world experience of the pharma and biotech industry, which should help inform their investment decisions.

PCGH’s performance is benchmarked against the total return of the MSCI ACWI Healthcare Index (in sterling).

Liquidity event

An end to PCGH’s fixed life structure

100% tender offer now at NAV less costs

PCGH currently has a fixed life, meaning a liquidation vote would take place at its 2026 AGM unless shareholders approve new proposals. The board aims to avoid this by offering a liquidity event now, along with changes to improve PCGH’s structure. These changes need shareholder approval to update the company’s Articles of Association.

If approved, PCGH will make a 100% tender offer, allowing shareholders to sell some or all of their shares for cash at the net asset value (NAV) as of 27 November 2025, minus tender costs (including stamp duty), capped at 1% of NAV. Shares bought back in the tender could be resold at a price below NAV but always above the tender price, if shareholders agree.

Tendered shares can be resold

100% exit opportunities every five years from 2031

Additional 100% tender offers will take place every five years, with the next due by 31 March 2031.

A shareholder meeting is set for 27 November 2025. If you hold shares, it is important to vote, and your investment platform may require you to submit your vote before the 25 November deadline.

Resetting the structure

In addition to giving the trust an indefinite life, shareholders are being asked to approve some other changes to the Articles of Association.

- As per the current practice, they formalise that all of the directors will have to submit themselves for re-election at every AGM.

- There are changes to the rules around how general meetings are conducted, permitting, where deemed appropriate, online attendance or even entirely virtual meetings, for example (which would have been useful during the pandemic).

- The rules around how to treat untraceable shareholders and permissions for scrip dividends.

- There are new rules around how US investors may be identified and treated – to avoid falling foul of US securities regulations.

New lower fee arrangement and no performance fee

The manager has agreed to scrap the performance fee and to replace it with a new base management fee structure that introduces a tiered arrangement. The fee would be reduced from a flat 0.75% fee to 0.70% on the first £500m and 0.65% on any balance. The basis for the calculation remains on the lower of PCGH’s market cap and NAV. This is a structure that we favour as it better aligns the manager with shareholders.

Based on the NAV at the end of September 2025 and assuming a 5% discount, PCGH estimates that the new fee structure would have saved shareholders over £212k per annum.

Buybacks to control discount volatility

The regular exit opportunities should be helpful when it comes to PCGH keeping its discount under control. However, the board will also use share buybacks with the aim of managing PCGH’s discount volatility and, to the extent that it can, keeping it at an appropriately narrow level (not defined).

When it comes to managing the portfolio, the investment objective will remain unchanged. One tweak to the investment approach is that the majority of assets will remain invested in large capitalisation companies, with up to 30% of the portfolio invested in small/mid capitalisation companies – those with a market capitalisation below $10bn at the time of investment. This replaces the idea of the trust having distinct growth and innovation pools of investments, where “growth” and “innovation” were defined in part by the size of the company.

The trust will hold up to 65 companies, as before, maintaining its high conviction approach.

Roughly 10% gearing in normal market conditions

The trust will use gearing. This will remain capped at 15% of NAV at the time that it is taken out, but investors should expect gearing to be around 10% in normal market conditions.

Minimum size

Minimum £270m of NAV immediately after tender

At the time of publication, PCGH’s NAV was £494m. The board believes that to be viable the company should have a minimum NAV of £270m following the initial tender. If the tender looks set to shrink the company below this minimum level, the board may decide to withdraw the tender offer and put forward a proposal to liquidate the company instead.

At QuotedData, we think the trust could easily be viable below £270m of assets, but this is the board’s decision, having engaged with shareholders.

PCGH ought to grow rather than shrink

As we set out in the next section, we also think there is a strong case for shareholders hanging onto their existing positions and even considering adding to them.

Market background – sector looks oversold

Figure 1: MSCI ACWI Healthcare index over five years in sterling

Figure 2: Healthcare relative to world index

Source: Bloomberg

Source: Bloomberg, Marten & Co. MSCI ACWI Healthcare Index relative to MSCI ACWI

The sector has trailed a rising market by some distance, fortunately PCGH has outperformed

The sector has trailed a rising market by some distance, fortunately PCGH has outperformed

Figure 1 shows that the healthcare sector has seen only modest growth over the past five years. However, PCGH’s shares have delivered about twice the return of the sector index in this time.

Figure 2 highlights the main point: healthcare has lagged behind the wider market on various measures. The sector is currently out of favour with investors, as confirmed by fund flow data. This suggests it may not be the right time to exit the sector; in fact, it could be worth considering increasing your investment.

We think that now is not the right time to be thinking about exiting the sector

The sector’s challenges started when biotech stocks fell after interest rates rose, along with a correction following the earlier enthusiasm around COVID vaccine successes.

President Trump’s election win, his stance on drug pricing, the appointment of Robert F Kennedy Junior as Secretary of Health and Human Services, and several negative Executive Orders have hurt sentiment in the sector. Money has also shifted out of biotech into AI-related stocks.

Biotech valuations – recovery may have begun thanks to a pick-up in M&A

Recently, biotech shares have begun to recover, helped by a wave of mergers and acquisitions. PCGH has benefited from takeover bids for Merus and Avidity Biosciences, both at over 40% premiums to their share prices.

The managers believe this trend will continue. The industry is fragmented, and pharmaceutical companies face a patent cliff as top-selling drugs lose protection and face cheaper competition. These cash-rich firms need new products and are turning to biotech companies for acquisitions.

Innovation continues apace and new therapies are being approved

Innovation is also picking up in therapeutics and medical devices. Examples include the success of GLP-1 agonists for obesity, new devices for atrial fibrillation, the first drugs to slow Alzheimer’s progression, and new treatments for COPD– more commonly known as smokers’ cough.

Despite concerns, the FDA is still approving new drugs at a similar pace to last year. Although its workforce was cut, about a quarter have been rehired, and the agency is using AI to speed up approvals.

The political clouds are clearing and/or priced in

Political risks are easing, though RFK Junior’s vaccine scepticism remains a challenge for some companies. Medicaid cuts from the One Big Beautiful Bill will reduce healthcare demand, but this is now reflected in valuations.

In May, Trump signed an Executive Order requiring Americans to pay no more for drugs than patients in G7 countries, the Netherlands, and Switzerland, and called for a system to sell drugs at these prices direct to consumers. US drug prices are often higher than elsewhere, which was seen as a major negative. In September, it was announced that imported branded drugs would face 100% tariffs unless made in the US.

However, drug companies are now reaching compromises with the government, helping the sector’s recent rally.

Companies are tackling the disparity between US drug prices and those in other countries

Pfizer was the first to reach an agreement with the government, promising to offer Americans drug prices similar to those in other developed countries and to price new medicines in line with key markets. Revenue from selling drugs at higher prices in G7 countries, the Netherlands, and Switzerland will be brought back to the US to help lower domestic prices. Pfizer will also join a new direct-to-consumer platform, TrumpRx.gov, allowing US patients to buy medicines at a significant discount. The company secured a three-year period without tariffs while it invests in US manufacturing.

AstraZeneca has followed with a similar plan, offering lowest international prices to Medicaid patients and selling drugs and devices like asthma inhalers on TrumpRx.

PCGH’s managers note that most major pharmaceutical firms have announced large investments in US facilities, likely exempting them from the 100% tariff. They expect some short-term pressure on earnings from these policies, but believe greater clarity could eventually improve investor sentiment and boost sector valuations.

Long-term drivers remain intact

The managers’ positive outlook for the sector is based on a long-term rise in the use of healthcare services and products. This is driven by factors such as ageing populations, growth in emerging markets, and, in the short term, the need to reduce waiting lists built up during the pandemic. NHS England reports 7.4 million patients were waiting to start treatment at the end of August 2025, compared to about 4 million before the pandemic and 2 million in 2009.

Demographics

The world’s ageing population is driving higher demand for healthcare. UN projections show the number of people over 75 will rise from 31 million to 51 million in North America, and from 71 million to over 100 million in Europe between 2025 and 2040 (see Figure 3). This age group requires much more healthcare than younger people. At the same time, companies are addressing the gap between US drug prices and those in other countries.

Figure 3: UN population projection data by age and by region 2025–2040

Source: UN Department of Economic and

A 2019 UK Health Security Agency study, using Office for Budget Responsibility data, found that people are living longer but spending more years in poor health. This trend is increasing healthcare costs, as shown in Figure 4.

Figure 4: Healthcare spending over an individual’s lifetime

Source: OBR

Economics – the potential within emerging markets

As countries become wealthier, they tend to spend a higher share of income on healthcare, although the amount varies depending on the healthcare system in place. In Asia, especially China, the number of people over 75 is set to rise sharply, from 179 million in 2025 to 341 million by 2040, according to the same data used for Figure 3. Figure 5 shows the share of GDP spent on healthcare in some of the world’s most populous countries. While there are some exceptions, there is a clear difference between developed and emerging countries.

Figure 5: OECD data on healthcare spending as a percentage of GDP for selected countries

Source: OECD, data is last available for that country – ranging between 2022 and 2024

Asset allocation

PCGH’s managers have built the portfolio around several key themes reflecting their sector outlook. Beyond innovation, mergers and acquisitions, and increased utilisation, they focus on access and affordability, especially regarding generics and biosimilars. According to a report by the Association for Accessible Medicines and the IQVIA Institute, generics and biosimilars have saved the US healthcare system $3.4 trillion over the past decade. These drugs make up 90% of prescriptions but only 12% of total drug spending.

Emerging markets are expected to see higher healthcare spending as incomes rise and the middle class grows. Data suggests China’s healthcare spending per person will increase by 7.7% a year from 2014 to 2040, while India’s will rise by 5.5% a year.

Machine learning and artificial intelligence are already improving productivity in diagnostics, radiology, care coordination, and robotic surgery. As these technologies develop, they could have a major impact on health screening and drug discovery.

Figure 6: Portfolio by sector as at 30 September 2025

Figure 7: Portfolio sector weights relative to benchmark as at 30 September 2025

Source: Polar Capital

Source: Polar Capital

Figure 8: Portfolio by country as at 30 September 2025

Figure 9: Portfolio country weights relative to benchmark as at 30 September 2025

Source: Polar Capital

Source: Polar Capital

At the end of September 2025, there were 34 positions in PCGH’s portfolio, and it had an active share of 75.4% relative to its benchmark. On a market cap basis, 26% of the portfolio was in mega-caps ($100bn+), 49% exposure in large-cap ($10bn–$100bn), 18% in mid-cap ($5bn–$10bn), and 5% in small-cap (under $5bn). About 2% of the portfolio was in cash.

The portfolio has a longstanding underweight exposure to pharmaceuticals (reflecting the potential negative impact of patent expiries) and notable overweight exposures to healthcare equipment and biotech.

Top 10 holdings

Since we last published, using data as at the end of July 2025, Genmab, Teva Pharmaceuticals, Exact Sciences, and Sandoz have moved up into PCGH’s top 10 holdings to replace Argenx, Intuitive Surgical, United Health Group, and Ascendis Pharma.

Figure 10: PCGH 10-largest holdings as at 30 September 2025

| Stock | Sector | Country | % at 30/09/25 | % at 31/03/25 | % change |

|---|---|---|---|---|---|

| Eli Lilly | Pharmaceuticals | United States | 7.1 | 8.8 | (1.7) |

| AstraZeneca | Pharmaceuticals | United Kingdom | 6.1 | 4.6 | 1.5 |

| Abbott Laboratories | Healthcare equipment | United States | 5.0 | 4.0 | 1.0 |

| UCB | Pharmaceuticals | Belgium | 3.8 | 3.7 | 0.1 |

| Genmab | Biotechnology | Denmark | 3.6 | – | 3.6 |

| Thermo Fisher Scientific | Life sciences tools and services | United States | 3.4 | – | 3.4 |

| Teva Pharmaceuticals | Pharmaceuticals | Israel | 3.3 | – | 3.3 |

| Sandoz | Pharmaceuticals | Switzerland | 3.3 | 2.2 | 1.1 |

| Exact Sciences | Biotechnology | United States | 3.2 | 1.6 | 1.6 |

| Edwards Lifesciences | Healthcare equipment | United States | 3.1 | – | 3.1 |

| Total | 41.8 |

Genmab (genmab.com) is a biotechnology company with a focus on antibodies and their use to tackle areas of disease (primarily in oncology). It has two approved products – one focused on metastatic cervical cancer and the other on lymphoma – seven in Phase 3, five in Phase 2, seven in Phase 1, and a number of pre-clinical programmes.

Teva Pharmaceuticals (tevapharm.com) has a strong presence in generics and biosimilars, and is redeploying cash flow into developing its own new therapeutics. Newer products – including a therapy for tardive dyskinesia and chorea associated with Huntingdon’s disease, one targeted at preventing migraines, and another for schizophrenia – are helping to drive revenue growth.

Exact Sciences (exactsciences.com) is developing tests to improve cancer diagnosis, including tests for colorectal and breast cancer.

Sandoz (sandoz.com) is a leading player in generics and biosimilars. Third quarter figures released at the end of October showed mid-single-digit revenue growth (a trend that it expects to persist for the full year), helped by growing sales of biosimilars, which account for 30% of its sales. Full year margins are expected to be 21%–22%.

Relative positioning

PCGH’s managers have provided data on the portfolio’s 10 largest over- and underweight positions compared to the benchmark. The underweights mainly show PCGH’s preference against large US pharmaceutical companies, many of which face patent expiries and pressure from US government drug pricing policies. Most of these stocks have been covered in this or previous reports. Notably, Penumbra and Centene are new additions to these lists.

Figure 11: Top 10 overweights

| Stock | % at 30/09/25 |

|---|---|

| UCB | 3.35 |

| Genmab | 3.35 |

| Exact Sciences | 3.16 |

| AstraZeneca | 3.02 |

| Teva Pharmaceutical | 3.00 |

| Sandoz | 2.97 |

| Penumbra | 2.87 |

| Centene | 2.85 |

| Ascendis Pharma | 2.85 |

| H Lundbeck | 2.80 |

| Total | 30.23 |

Figure 12: Top 10 underweights

| Stock | % at 30/09/25 |

|---|---|

| Johnson & Johnson | (5.81) |

| AbbVie | (5.33) |

| UnitedHealth | (4.08) |

| Roche | (3.13) |

| Novartis | (3.12) |

| Merck & Co | (2.75) |

| Amgen | (1.98) |

| Pfizer | (1.89) |

| Boston Scientific | (1.88) |

| Gilead Sciences | (1.80) |

| Total | (31.76) |

Most of these stocks have been discussed in this or prior notes (see page 18 for a list of these). Two we would highlight this time as they are relatively new entrants to these lists are Penumbra and Centene.

Penumbra

Figure 13: Penumbra (USD)

Source: Bloomberg

Penumbra (penumbrainc.com) is a medical device company specialising in cardiovascular and neurovascular treatments, such as clot removal and stopping bleeding. It is launching several new products.

In the third quarter, revenue grew 21% year-on-year. Gross margins reached 67.8%, with a target of over 70% next year. The company expects full-year sales just under $1.4bn, about 15% higher than last year. PCGH’s managers note that mechanical thrombectomy is one of the fastest-growing areas in healthcare equipment, and Penumbra is a leading player in this market.

Centene

Figure 14: Centene (USD)

Source: Bloomberg

Centene (centene.com) is a US healthcare company offering services to Medicare, Medicaid, and privately insured patients. It provides care for people with age-related and chronic conditions, disabilities, and also runs pharmacy, dental, optical, and clinical support services.

PCGH managers believe Centene could see a rerating if it recovers operationally faster than expected, following recent margin and earnings pressures.

Performance

Figure 15: PCGH NAV total return performance relative to benchmark over five years

Source: Bloomberg, Marten & Co

In our view, PCGH’s managers have done a great job of navigating a difficult environment for the sector and Figure 15 illustrates that.

In recent months, PCGH has benefited from some of the M&A that has been going on in the biotech sector and the start of improving sentiment towards the sector. The managers are optimistic about the future.

Figure 16: Total return performance for periods ending 31 October 2025

| 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | Since 31 July 2019 (%) | |

|---|---|---|---|---|---|---|

| PCGH price | 16.9 | 18.0 | 5.3 | 23.7 | 77.7 | 77.2 |

| PCGH NAV | 14.7 | 13.1 | 0.2 | 16.5 | 56.4 | 66.5 |

| Benchmark | 9.7 | 5.8 | (2.0) | 2.7 | 37.7 | 50.3 |

| MSCI ACWI | 9.4 | 23.8 | 20.6 | 59.3 | 99.4 | 103.4 |

| NASDAQ Biotech | 21.3 | 28.5 | 13.9 | 17.0 | 34.2 | 57.4 |

Managers

PCGH’s co-managers are James Douglas and Gareth Powell. They form part of an eight-strong team.

Gareth Powell

Gareth joined Polar Capital in 2007 to set up the Healthcare team. Prior to Polar Capital, he worked at Framlington, where he began his career in investment management in 1999. Soon afterwards, he joined the Healthcare Team and helped launch the Framlington Biotech Fund, which he managed from 2004 until his departure.

Gareth took a Masters in Biochemistry at Oxford, during which time he worked at Yamanouchi, a leading Japanese pharmaceutical company (later to become Astellas). As well as this, he worked for the Oxford Business School and various academic laboratories including the Sir William Dunn School of Pathology and the Wolfson Institute for Biomedical Research.

Gareth is a CFA Charterholder.

James Douglas

James joined Polar Capital in September 2015 and was appointed co-manager for PCGH in August 2019.

James has 24 years’ experience having worked in equity sales specialising in global healthcare at Morgan Stanley, RBS and HSBC, prior to joining Polar Capital. He also has equity research experience garnered from his time at UBS, where he worked as an analyst in the European pharmaceutical and biotechnology team. Before moving across to the financial sector, James worked as a consultant for EvaluatePharma.

James has a PhD and BSc (1st Class Hons) in Medicinal Chemistry from Newcastle University. He also holds the ACCA diploma in financial management (DipFM).

Deane Donnigan

Deane joined Polar Capital in June 2013 and is the lead manager of the Polar Capital Healthcare Discovery Fund.

Prior to joining Polar Capital, she began her career at the Medical College of Georgia, before becoming a clinical specialist in Drug Information and Adult Internal Medicine with Emory University Hospital in Atlanta, Georgia. After several years, she moved to the UK to join Framlington (now AXA Framlington) as an analyst for the healthcare unit trust, led by Anthony Milford. She went on to become lead portfolio manager of the Framlington Healthcare and Framlington Biotechnology funds. Deane is both a US and UK citizen.

Deane is a Doctor of Pharmacy (PharmD), Clinical Pharmacy, University of Georgia in conjunction with the Medical College of Georgia. She is also a board-certified and licensed pharmacist, ACCP board certified pharmacotherapy specialist, and is IMRO qualified.

David Pinniger

David joined Polar Capital in August 2013 as a portfolio manager within the Healthcare team, to launch the Polar Capital Biotechnology Fund. Prior to joining Polar Capital, David was portfolio manager of the International Biotechnology Trust at SV Life Sciences.

Previously, David spent three years working at venture capital firm Abingworth as an analyst managing biotechnology investments held across the firm’s venture and specialist funds, and four years at Morgan Stanley as an analyst covering the European pharmaceuticals and biotechnology sector.

David has a BA (1st Class Hons) in Human Sciences from the University of Oxford and is a CFA Charterholder.

Brett Pollard

Brett joined the Polar Capital Healthcare team in September 2021 and has 24 years of healthcare industry experience, 15 of which have been in healthcare investing.

After completing a PhD in Molecular Virology at the University of St. Andrews, he worked as a healthcare research analyst, covering stocks in pharmaceutical, biotechnology, medical device, and healthcare service subsectors. In 2008, he co-founded an in vitro diagnostics business where he initially led corporate and business development before taking on the role of chief operating officer.

After time spent in strategic advisory services, Brett moved back into corporate development and investor relations’ roles before joining the Polar Capital Healthcare team. His extensive industry and investment experience has allowed him to rapidly build up detailed coverage of the healthcare sector in emerging markets.

Brett studied cell and molecular biology at the University of St. Andrews, and has a PhD in molecular virology.

Tara Raveendran

Tara joined Polar Capital in September 2021 as a consultant focused on independent research for the team. Prior to joining Polar Capital, she was the head of Healthcare & Life Sciences Research at Shore Capital.

Previously Tara spent over 15 years working in equity research, specialising in European pharmaceuticals, biotechnology and medtech at Lehman Brothers and Jefferies. She has also worked with a number of healthcare-focused start-ups through her life sciences consultancy, SSquared Consulting, most recently working with the UK government’s Vaccine Taskforce.

Tara has a BSc in Biochemistry and a PhD in Structural Biology from Imperial College, London.

Leanne Smith

Leanne joined the Polar Capital Healthcare Team as an investment analyst in October 2024. She started at the company in 2021 in the Client Services team as part of the Investment 20/20 scheme. Leanne has a BA in Cells and Systems Biology from the University of Oxford and has passed Level 1 of the CFA.

Damiano Soardo

Damiano joined the Polar Capital Healthcare team as an investment analyst in October 2020. He started at the company in 2016 as part of the operations team before moving to the risk team in 2019. Prior to joining Polar Capital, he worked as a technical consultant at a fintech company. Damiano has an MSc in Mathematics and Foundations of Computer Science from the University of Oxford and is a CFA Charterholder.

Previous publications

Readers interested in further information about PCGH may wish to read our earlier notes. You can read the notes by clicking on them in Figure 18 or by visiting our website.

Figure 18: QuotedData’s previously published notes on PCGH

| Title | Note type | Publication date |

|---|---|---|

| Healthy returns and a rosy outlook | Initiation | 5 March 2024 |

| Vital signs are good | Update | 14 November 2024 |

| Recovery Play | Update | 20 August 2025 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Healthcare Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.