Focused on the future

In January, we explained why Saba Capital’s proposals were not in the best interest of Herald Investment Trust (HRI) shareholders and urged a vote against them. Most investors agreed, resulting in a clear rejection of Saba’s proposals.

Although Saba remains a shareholder and brings some uncertainty, HRI continues to benefit from its closed-ended structure, allowing long-term investment in early-stage technology companies. The portfolio has gained from its exposure to Artificial Intelligence (AI), and the managers see further potential as this trend expands to more innovative smaller firms.

HRI is also increasing its international investments, with North America now its largest regional holding. This shift reflects tougher conditions in the UK and more attractive opportunities abroad.

Small-cap technology, telecommunications and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia and technology. Investments may be made across the world, although the portfolio has traditionally had a strong position in UK stocks.

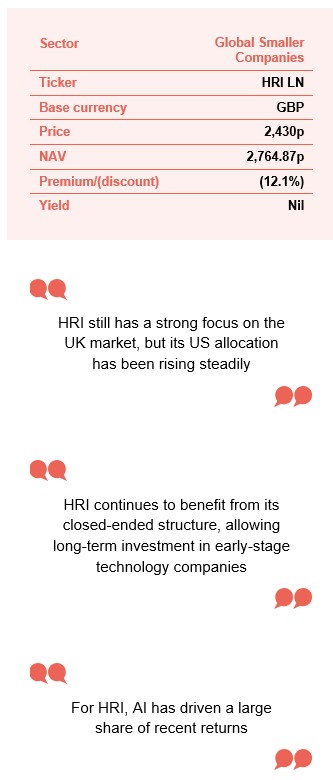

At a glance

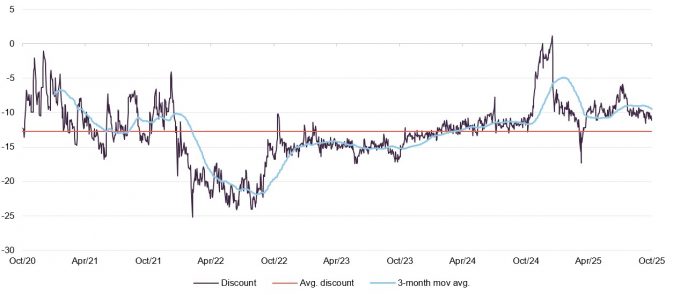

Share price and discount

Over the five years to 31 December 2024, HRI traded at an average discount of 12.9%. In the last 12 months, this narrowed to an average discount of 8.7%, ranging from a 17.3% discount to a 1.1% premium.

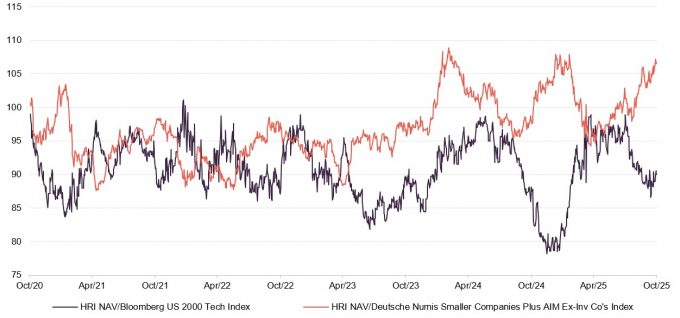

Time period 31 October 2020 to 13 November 2025

Source: Bloomberg, Marten & Co

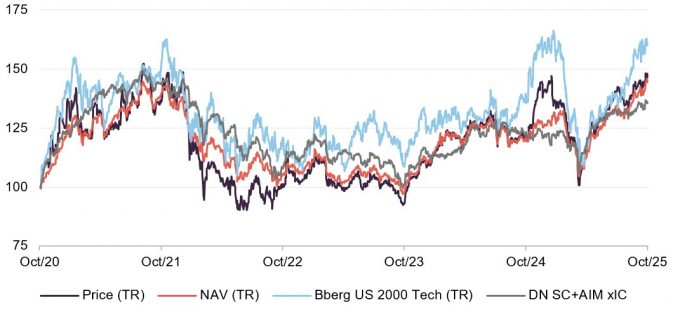

Performance over five years

HRI has outperformed the Deutsche Numis Smaller Companies plus AIM ex-Investment Companies Index (which tracks UK small caps) in NAV terms over five years. After a weaker period in 2023 and early 2024, HRI delivered strong absolute returns in 2024 and into 2025, improving its long-term relative NAV performance.

Time period 31 October 2020 to 31 October 2025

Source: Bloomberg, Marten & Co

| 12 months ended | Share price total return (%) | NAV total return (%) | Deutsche Numis ex IC plus AIM (%) | B’berg US 2000 Tech TR (%) |

|---|---|---|---|---|

| 31/10/21 | 36.0 | 39.0 | 43.5 | 50.0 |

| 31/10/22 | (26.6) | (24.3) | (24.9) | (19.5) |

| 31/10/23 | (6.4) | (6.8) | (5.9) | (9.0) |

| 31/10/24 | 28.9 | 21.7 | 20.0 | 23.1 |

| 31/10/25 | 20.4 | 21.0 | 11.0 | 19.5 |

Saba threat defeated; HRI looking to the future

In our January update, we explained how Saba Capital, a US hedge fund, had built a large stake in HRI and called for the removal of the entire board and investment manager, to be replaced with Saba’s own nominees. We argued these proposals were not in shareholders’ best interests and advised voting against them.

Saba’s proposals were resoundingly defeated by HRI’s shareholders

At the general meeting on 22 January 2025, shareholders decisively rejected Saba’s proposals, with 65.1% voting against and a high turnout of 80.6%. Excluding Saba’s own votes, only 0.15% of other shareholders supported the proposals. At the March AGM, 99.9% of non-Saba votes backed the trust’s continuation. Other investment trusts targeted by Saba also strongly rejected its resolutions.

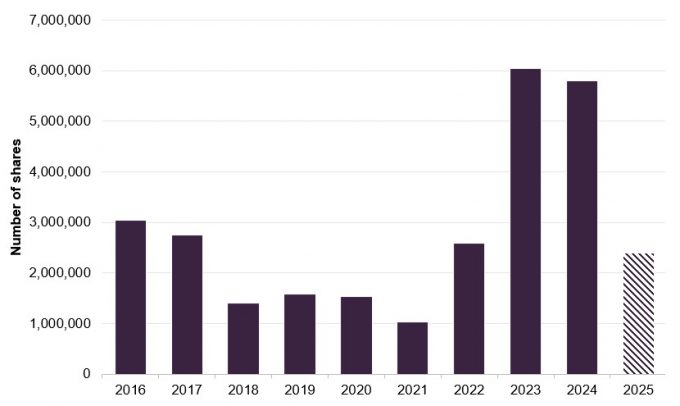

Although the immediate threat has passed, Saba still holds 25.1% of HRI’s shares and a further 5.6% of voting rights through other instruments, giving it over 30% of total voting rights. However, it is not required to make a takeover offer, as this threshold was crossed passively due to HRI’s share buybacks.

Saba has not communicated future plans for its stake, but it has been reported that it may launch an ETF focused on investment companies trading at wide discounts, which could include its HRI holding. We will monitor developments closely.

Meanwhile, Katie Potts and her team continue to manage HRI’s unique portfolio within the UK investment landscape.

Market update

Trump’s Liberation Day tariff announcements led to market upheaval

Our last note was published five days before Donald Trump began his second term as US president. Since then, his actions have dominated events, especially the impact of his “Liberation Day” tariff announcements in April. Trump introduced a baseline 10% tariff on all countries, with extra tariffs based on each country’s trade deficit with the US.

Since April, events have been unstable. A week after the announcement, sharp swings in equity, currency, and bond markets led the White House to pause the extra tariffs above the 10% base for 90 days.

Since then, the administration has focused on bilateral trade deals. In May, the UK agreed a deal with a baseline 10% tariff, while in July the EU reached a framework with most goods facing 15% tariffs. In August, Trump announced a further 90-day pause on broad tariffs against China until 10 November as talks continue.

The outlook remains uncertain, even for the US president. Despite this, markets have recovered. The S&P 500 has not only erased its losses since April but is now at an all-time high. The FTSE 100 is also strongly up for the year, near record levels.

For HRI, the performance of smaller company indices is more relevant. Figure 1 shows the Bloomberg US 2000 Technology (US small- and mid-cap tech) and Deutsche Numis Smaller Companies Plus AIM Ex Inv Cos (bottom 10% of the UK market). Both followed a similar pattern to large-cap indices: falling early in the year, particularly after “Liberation Day”, then steadily recovering. Technology stocks saw a sharper drop due to supply chain issues and market sentiment, especially among growth stocks. As sentiment improved since April, the Bloomberg US 2000 Technology index has rebounded strongly.

Figure 1: Markets year-to-date to 3 November 2025, indices rebased to 100

Source: Bloomberg, Marten & Co

A mixed inflation and interest rate picture

Away from tariffs, investors have continued to focus on the future direction of inflation and interest rates.

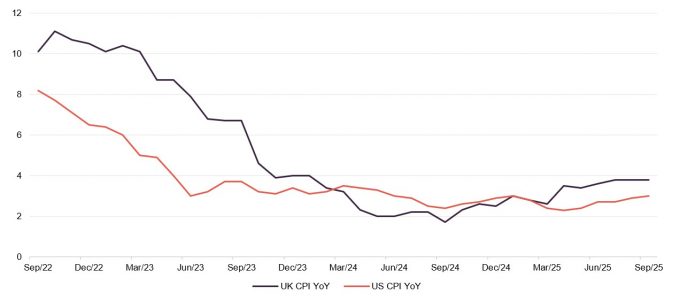

Figure 2: Inflation over three years to 30 September 2025

Source: Bloomberg, Marten & Co

As shown in Figure 2, inflation has dropped sharply in both the US and UK in recent years, allowing central banks to start cutting interest rates. However, inflation is still higher than before 2022 and remains above the 2% target in both countries. In the UK, CPI has recently climbed to nearly 4%. As a result, the Bank of England kept its base rate at 4% in November, moving cautiously despite weak growth. The Federal Reserve cut its main rate by 0.25% at its latest meeting, only the second cut in 2025, which has disappointed investors and President Trump.

Persistent inflation is still a risk for stock markets, especially for smaller companies and the technology sector, both important for HRI. These shares depend heavily on future earnings and growth, which are affected by current interest rates. High rates could limit further gains, especially if rate cuts are slower than expected or if rates need to stay high to control inflation.

Technology sector – large cap stocks driven by momentum, and AI

Investors remain positive on the technology sector, mainly due to the ongoing AI trend. AI continues to drive growth, with only a brief pause from the uncertainty of “Liberation Day” tariffs, which mostly affected larger companies. Demand for cloud, semiconductors, and software remains strong, while there has been a notable rise in the number of sectors and services being impacted.

HRI – capitalising on themes within technology

HRI has a strong track record of taking advantage of key trends in the technology sector, such as software as a service (SaaS). The current portfolio and recent trades show exposure to several themes that are important in today’s market.

AI – not just a mega-cap story

The AI theme is benefitting smaller companies, which are often on lower valuations

AI is currently the main theme in the technology sector. Most investment still goes to the biggest US companies – the “Magnificent Seven” of Alphabet, Meta, Microsoft, Tesla, NVIDIA, Apple, and Amazon – but smaller companies are also benefiting. Sometimes this is due to positive investor sentiment, but in other cases, it’s because these smaller firms play a key role in AI. While large company valuations often look high, there are often better opportunities among smaller firms.

For HRI, AI has driven a large share of recent returns. From 1 January 2020 to 30 June 2025, HRI made total gains of £497m, with 45% of this coming from just four stocks – Super Micro Computer, BE Semiconductor Industries, Fabrinet, and Celestica – out of a portfolio of more than 300 companies. All four help provide the infrastructure needed for AI.

Celestica, HRI’s largest holding, has shown particularly strong performance and highlights this trend.

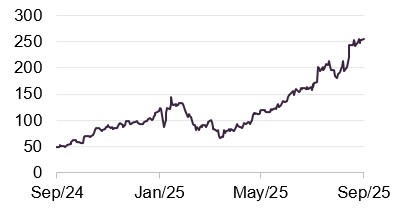

Celestica Inc

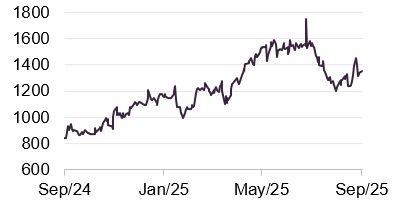

Figure 3: Celestica Inc (USD)

Source: Bloomberg

Celestica (www.celestica.com) is a Canadian-American technology manufacturer focused on hardware platforms and supply-chain services. The company’s share price has surged over the past year, as shown in Figure 3.

Celestica has benefited from strong demand for AI infrastructure, shifting from a modest electronics firm to a key supplier for the AI and hyperscaler market. The main driver of this growth is its Connectivity & Cloud Solutions (CCS) business, which focuses on AI networking, cloud infrastructure, and computer hardware. The company’s strengths include partnerships with hyperscalers and expertise in designing and manufacturing server infrastructure.

In its latest quarterly update, Celestica reported 21% year-on-year revenue growth and raised its guidance, with most gains coming from the CCS business.

Investing across the phases of AI adoption

Since the emergence of AI as an investable theme, attention has mainly been on infrastructure and supply chains, such as large language models, GPUs, accelerators, and networking. HRI’s portfolio is exposed to this trend through companies like Celestica, Fabrinet, and Super Micro Computer.

HRI’s managers now see the AI focus shifting from infrastructure to data and applications, with more companies benefiting as new customer-facing, revenue-generating products appear. With lower implementation costs, companies that own valuable data are seeing the most benefit. HRI’s portfolio includes several businesses involved in this next stage of AI, such as Five9 and Sidetrade.

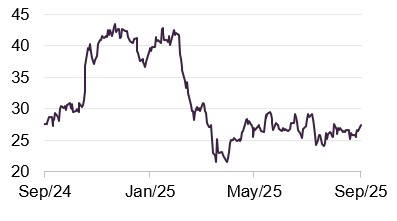

Five9

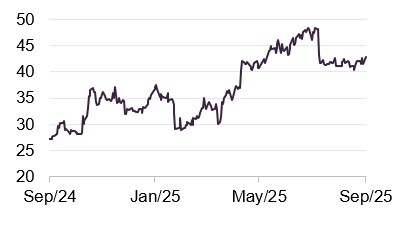

Figure 4: Five9 (USD)

Source: Bloomberg

Five9 (www.five9.com) is a major US provider of cloud-based contact centre software. Its platform helps companies manage customer interactions across voice, chat, email, SMS, and social media, with built-in analytics and AI to boost efficiency and service quality. Five9 benefits from the move away from traditional on-site systems to AI-powered cloud solutions.

Five9’s shares dropped sharply in recent years, but saw a strong rebound at the end of 2024 due to excitement over its platform, solid double-digit revenue growth, and activist calls for higher margins and strategic changes. This rally was short-lived, as shares fell again from February, reflecting weaker sector sentiment and concerns about profitability and cash flow after Five9 repaid large convertible notes, reducing its cash reserves. A disappointing second-quarter 2025 earnings report, management changes, and continued activist pressure added to the uncertainty.

Despite these challenges, Five9 reported record revenue of just over $1bn for the last full year, up about 14% from the previous year. Management expects further growth in 2025, supported by strong demand for AI features. For HRI, Five9 provides exposure to a global leader in cloud communications and customer experience technology with a recurring revenue model.

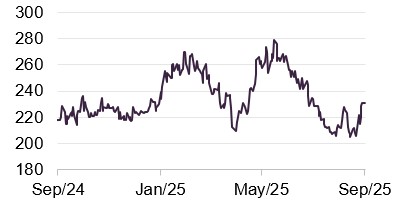

Sidetrade

Figure 5: Sidetrade (EUR)

Source: Bloomberg

Sidetrade (www.sidetrade.com) is a French software company that provides AI-powered order-to-cash solutions, helping customers improve cash collection and working capital. Its cloud platform uses predictive analytics and machine learning to forecast payment behaviour, automate tasks, and give better cash-flow visibility.

The company serves clients across manufacturing, technology, media, and professional services, benefiting from the shift towards digital cash management.

Sidetrade has achieved consistent double-digit revenue growth, mainly from rising subscription income and strong international sales, especially in North America and the UK. Its margins and recurring revenues support a solid balance sheet and strong cash generation. Sidetrade offers exposure to a specialist global leader in AI financial software, with high customer retention and a subscription-based model.

Exposure to companies benefiting from increased defence spending

While AI attracts much investor attention, there are other growth areas in technology. For HRI, these include robotics and machine vision with companies like Ouster and Advantech, as well as space technology through Spire Global, Filtronic, and Lumibird.

Defence is also increasingly important due to global instability, including conflicts in the Middle East and eastern Europe. The war in Ukraine has highlighted the role of drones, autonomous systems, and laser technology, creating opportunities for smaller defence suppliers. Two strong performers in this area over the past year are Cohort in the UK and Leonardo DRS in the US.

Cohort

Figure 6: Cohort (GBP)

Source: Bloomberg

Cohort (www.cohortplc.com) is a UK defence technology group supplying specialist products and services in electronic warfare, surveillance, communications, and training. Through six subsidiaries, it provides advanced solutions to the UK Ministry of Defence and international clients, covering areas like counter-drone systems, autonomous maritime technology, and secure communications. Cohort is benefitting from higher demand for advanced defence and networked warfare solutions.

The company has shown solid growth in recent years, helped by a strong order book and rising overseas sales. Recent contract wins in naval electronic warfare and surveillance, along with long-term service deals, give good revenue visibility. Its diversified portfolio and focus on high-value, niche segments of the defence market allow it to compete effectively against larger companies while maintaining attractive margins.

HRI’s managers think Cohort is well placed to benefit as the UK and its allies increase defence spending and focus on modernisation. This trend is expected to continue, with NATO countries recently agreeing to raise defence spending to 3.5% of GDP, which is much higher than current levels for most members.

Leonardo DRS

Figure 7: Leonardo DRS (USD)

Source: Bloomberg

Leonardo DRS (www.leonardodrs.com) is a US defence technology company focused on advanced sensors, network computing, force-protection systems and integrated mission solutions for the US military and allies. This positions it well in fast-growing areas like autonomous operations and next-generation communications.

It is a majority-owned subsidiary of Leonardo S.p.A., the Italian aerospace and defence group, which holds about 73% of the US business. While DRS is listed on NASDAQ, it benefits from its parent’s global research, development and international reach. This structure lets Leonardo DRS access US defence contracts and keep security clearances as an American company, while also drawing on its parent’s expertise.

Leonardo DRS has reported steady growth, backed by a strong order backlog and involvement in key US defence areas like electronic warfare and naval power systems. Recent contract wins for advanced sensor and computing programmes highlight its strength in mission-critical technologies.

Asset allocation

HRI’s portfolio now has a higher allocation to the US than the UK, a big change from previous years

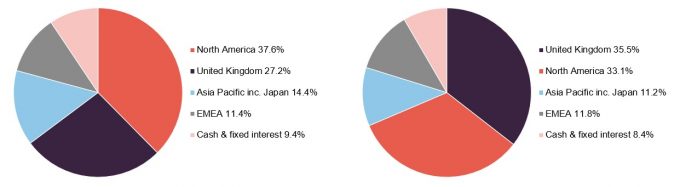

We have often discussed HRI’s reduced UK allocation and increased North American exposure. As Figures 8 and 9 show, this trend has continued over the past six months, with North America now making up a larger share than the UK. This is a notable change from December 2021, when HRI’s UK allocation was more than double that of North America (47.7% vs 22.3%).

This shift reflects both stronger US performance, especially in technology, and more attractive opportunities in North America. The UK market continues to decline, with more investor money moving overseas and fewer companies choosing to list in London, creating a cycle that reinforces itself.

In technology, the US has led the way in the AI boom. While the biggest gains have gone to the largest companies, known as the “Magnificent Seven”, smaller firms have also benefited. As discussed elsewhere in this report, many of HRI’s top performers have seen strong returns thanks to AI.

Katie notes that HRI currently has slightly more US exposure than preferred. However, the North American allocation also includes key Canadian holdings, such as Celestica, the fund’s largest position, and Israeli companies listed in the US like Freightos and JFrog.

Only about half of the reduced UK allocation since November has been shifted to North America, with the rest reinvested in Asia Pacific. The EMEA allocation remains largely unchanged.

About 30% of HRI’s European portfolio has exited in the past year due to private equity takeovers, limiting the ability to increase European exposure. These takeovers, often at 30-50% premiums, were seen as fair given company prospects. The largest was Esker, sold for €1.62bn, with HRI receiving £22m in cash. Much of the proceeds from these sales has funded share buybacks. The managers would prefer higher allocations to both Europe and Asia.

While geographical allocation is important, the team highlights that most holdings generate global revenues, not just from their listing country. They prefer global businesses for their competitiveness.

Despite keeping cash levels broadly flat, the team remains active in managing liquidity.

Figure 8: Geographic allocation as at 30 September 2025*

Figure 9: Geographic allocation as at 30 November 2024*

Source: Herald Investment Management *Note: as a proportion of gross assets

Source: Herald Investment Management *Note: as a proportion of gross assets

Top 10 holdings

Figure 10 shows HRI’s top 10 holdings as at 30 September 2025 and how these have changed since our last note (which used data as at 30 November 2024).

Celestica is still the largest holding, with the top six mostly unchanged except for Trustpilot, which has dropped to eighth place after a sharp fall in its share price. Lower down, three new names appear in the top 10: Silicon Motion Technology, Nordic Semiconductor, and Volex. Silicon Motion Technology was discussed in detail in our June 2024 note, while Nordic Semiconductor and Volex are covered below. None of these are new investments for HRI; the team usually starts with smaller positions and increases them as their confidence in the investment grows.

Figure 10: Top 10 holdings as at 30 September 2025

| Holding | Sector | Country | Allocation 30/09/25 (%) | Allocation 30/11/24 (%) | Percentage point change |

|---|---|---|---|---|---|

| Celestica Inc | Tech hardware and semiconductors | US | 4.2 | 2.3 | 1.9 |

| Fabrinet | Tech hardware and semiconductors | US | 2.7 | 2.3 | 0.4 |

| BE Semiconductor Ind. | Tech hardware and semiconductors | Netherlands | 2.0 | 1.9 | 0.1 |

| Pegasystems Inc | Software & computer services | US | 1.9 | 1.7 | 0.6 |

| Silicon Motion Technology | Tech hardware and semiconductors | US | 1.9 | 1.2 | 0.7 |

| Diploma | Support services | UK | 1.8 | 2.0 | (0.2) |

| Super Micro Computer | Tech hardware & equipment | US | 1.8 | 1.6 | 0.2 |

| Trustpilot | Software & computer services | UK | 1.4 | 2.2 | (0.8) |

| Nordic Semiconductor | Tech hardware and semiconductors | Norway | 1.4 | 0.8 | 0.6 |

| Volex | Tech hardware & equipment | UK | 1.3 | 1.3 | – |

| Total of top 10 | 20.4 | 18.5 | 1.9 |

Nordic Semiconductor

Figure 11: Nordic Semiconductor (NOK)

Source: Bloomberg

Nordic Semiconductor (www.nordicsemi.com) is a Norwegian company based in Trondheim that designs semiconductors, focusing on ultra-low power wireless technology for the Internet of Things (IoT). Its products include system-on-chips, system-in-packages, and connectivity solutions.

Nordic Semiconductor stands out for its strength in short-range wireless, especially Bluetooth LE, which is widely used in consumer electronics, healthcare, and smart home devices. Its nRF51 and nRF52 series helped it gain a strong position in low-power wireless markets. More recently, Nordic has expanded into longer-range and more connected applications. The company also acquired Memfault, a cloud service provider and former partner, to strengthen its cloud-based device management services.

Recent share price growth is due to strong financial results. In Q2 2025, the company reported revenue of $164m, up 28% year-on-year, and core EBITDA of about $21m, ahead of analyst forecasts. Demand has increased in Nordic Semiconductor’s main markets, helped by new products and expansion into new radio standards and longer-range connectivity.

Volex

Figure 12: Volex (GBP)

Source: Bloomberg

Volex (www.volex.com) is a UK-based manufacturer focused on power and data connectivity for essential uses. The company operates through five main divisions, producing durable wiring harnesses, printed circuit board assemblies, and integrated systems for equipment makers and contractors.

As shown in Figure 12, Volex’s share price drift down over the year, drop sharply, then recover strongly. This happened during President Trump’s “Liberation Day” tariff announcements, which later softened and influenced the share price.

There were also company-specific factors. After half-year results in November, investor sentiment worsened. Revenue rose about 30% year-on-year, but earnings per share increased only 2%, and net debt reached $205m. Unsolicited takeover bids for TT Electronics raised concerns about overpaying and adding more debt, though these bids failed.

Full-year results in June reassured investors. Volex reported over $1bn in revenue and its first underlying operating profit above $100m, with operating margins around 10%. This supported the share price recovery.

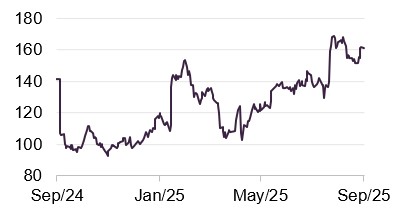

Performance

As shown in Figures 13 and 14, HRI has outperformed the Deutsche Numis Smaller Companies plus AIM ex-Investment Companies Index (which tracks UK small caps) in NAV terms over five years. After a weaker period in 2023 and early 2024, HRI delivered strong absolute returns in 2024 and into 2025, improving its long-term relative NAV performance. However, the strong gains made at the start of the COVID pandemic are no longer included in the five-year figures, making recent performance look less impressive than in previous reports.

Against the Bloomberg US 2000 Technology Index, HRI’s NAV performance has been more mixed. It was broadly in line until a recent divergence, with periods of both outperformance and underperformance over five years. The overall underperformance compared to US small-cap tech stocks is mainly due to the stronger performance of US tech companies. International peers are compared in terms of both size and performance. As shown on pages 9-10, HRI still has a strong focus on the UK market, but its US allocation has been rising steadily.

Figure 13: HRI’s NAV total return relative to relevant indices, over five years to 31 October 2025

Source: Bloomberg, Marten & Co

Figure 14: Cumulative total return performance over periods ending 31 October 2025

| 1 month (%) | 3 months(%) | 6 months (%) | 1 year (%) | 3 years(%) | 5 years(%) | |

|---|---|---|---|---|---|---|

| HRI NAV | 4.2 | 7.7 | 28.2 | 21.0 | 37.3 | 44.4 |

| HRI share price | 1.6 | 1.8 | 25.2 | 20.4 | 45.3 | 45.0 |

| Deutsche Numis Smaller Cos plus AIM ex IC | 0.4 | 2.5 | 14.4 | 11.0 | 25.4 | 35.1 |

| Bloomberg US 2000 Technology | 5.0 | 17.9 | 39.2 | 19.5 | 33.8 | 61.5 |

Dividend

HRI mainly aims for capital growth, with dividends making up a small part of returns. As a result, it only declares dividends when needed to keep its investment trust status. In practice, no dividend has been paid since 2012.

Capital structure and life

Simple capital structure

HRI has one class of ordinary share in issue. It can gear up to 50% of net assets

HRI has a straightforward capital structure with only one type of ordinary share listed on the London Stock Exchange’s main market. As of 13 November 2025, there were 47,858,467 shares in issue, with none held in treasury.

The trust can borrow up to 50% of its net assets but currently has no borrowings. Its previous £25m revolving loan facility with RBS expired on 31 December 2019 and was not renewed. As of 30 September 2025, HRI held net liquid assets equal to 9.4% of total net assets, split between cash and government bonds.

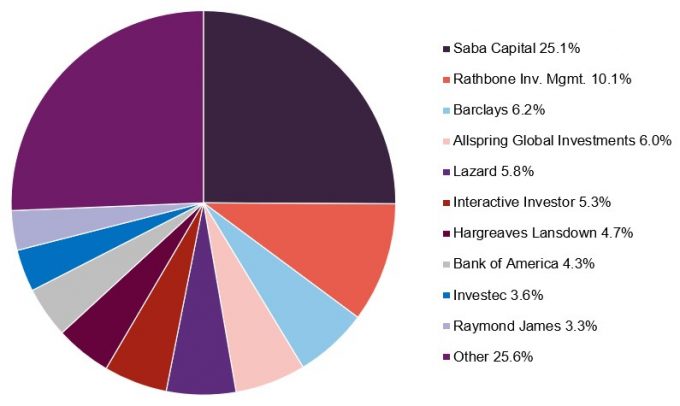

Major shareholders

Figure 17: Major shareholders as at 3 November 2025

Source: Bloomberg

Saba Capital is still the largest shareholder in HRI. In addition to its direct shareholding, it has further voting rights through other financial instruments. As of 8 July, these gave Saba an additional 5.6% of total voting rights.

Barclays and Bank of America have also increased their HRI holdings recently, possibly linked to Saba’s use of financial instruments.

Unlimited life with three-yearly continuation votes

HRI does not have a set end date, but shareholders can vote every three years on whether the trust should continue. The next vote will take place at the AGM in March 2028.

Board

HRI’s board has five non-executive directors

HRI’s board has five non-executive directors, all independent of the investment manager. Andrew Joy became chairman in April 2023, succeeding Tom Black, who retired at the AGM that month.

James Will stepped down as a non-executive director at the March 2025 AGM, with Henrietta Marsh taking over his senior independent director role.

Figure 18 shows the current board, including each member’s service length and shareholdings. All directors retire and stand for re-election each year, in line with board policy.

Recent share purchase and disposal activity by directors

Christopher Metcalfe has added to his personal holding of HRI shares

As shown in Figure 18, all directors except Priya Guha have personal investments in the trust, which helps align their interests with shareholders. No directors have bought HRI shares in the past 12 months, with the last purchase being Christopher Metcalfe’s additional 2,200 shares on 1 August 2024, following his initial 3,000-share purchase. No directors have sold any shares in the past year.

Figure 18: Board members – length of service and shareholdings

| Director | Position | Date of appointment | Length of service (years) | Annual fee (GBP) 1 | Shareholding 2 | Years of fee invested3 |

|---|---|---|---|---|---|---|

| Andrew Joy | Chairman | 1 October 2022 | 3.0 | 43,950 | 6,000 | 3.4 |

| Stephanie Eastment | Chair of the audit committee | 1 December 2018 | 6.8 | 35,575 | 3,200 | 2.2 |

| Henrietta Marsh | Senior independent director | 1 September 2019 | 6.1 | 29,950 | 1,000 | 0.8 |

| Priya Guha | Director | 13 December 2023 | 1.8 | 29,950 | – | – |

| Christopher Metcalfe | Director | 24 April 2024 | 1.4 | 20,714 | 5,200 | 6.2 |

| Average (service length, annual fee, shareholding, years of fee invested) | 3.8 | 32,028 | 3,080 | 2.5 | ||

Board diversity

Two out of the three most-senior board positions is held by a woman

Three of the five board members are women. Women hold two of the three most senior roles (chair of the audit committee and senior independent director), while the chairman is a man.

Currently, four board members are White British or other White, and one is from a minority ethnic background. Board appointments are based on merit, but the board is committed to considering a diverse range of candidates, assessing them against objective criteria and recognising the value of diversity in gender, background, experience, and knowledge.

Andrew Joy (chairman)

Andrew is well known for his deep knowledge of the financial sector and high-growth smaller companies. He co-founded Cinven, a major private equity firm investing in Europe and the US, and has served as chairman or director of many growth companies over the past 30 years. He is a senior advisor at Stonehage Fleming, chairs the investment committee at FPE Capital, and is a trustee of several charities. He was also chairman of The Biotech Growth Trust Plc.

Stephanie Eastment (chair of the audit committee)

Stephanie is a chartered accountant and company secretary with over 30 years’ experience in financial services, particularly in investment trusts. She is a member of the AIC’s Technical Committee. Stephanie qualified with KPMG and held accounting and compliance roles at Wardley and UBS before joining Invesco Asset Management in 1996 as Manager, Investment Trust Accounts. When she left Invesco in July 2018, she was Head of Specialist Funds Company Secretariat and Accounts. Stephanie is currently the senior independent director of Murray Income Trust Plc, audit chair and non-executive director of Impax Environmental Markets plc and Alternative Income REIT plc, and a non-executive director of RBS Collective Investment Funds Limited.

Henrietta Marsh (senior independent director)

Henrietta has extensive experience in fund management, focusing on UK small-cap and private equity investment. From 2005 to 2011, she was AIM fund manager at Living Bridge Equity Partners, following 14 years at 3i, where she managed the 3i Smaller Quoted Companies Trust Plc from 1997 to 2002. Earlier in her career, she worked at Morgan Stanley and Shell. More recently, she has taken on non-executive roles, serving on the boards of discoverIE plc, Alternative Networks plc, Electric Word plc, and Gamma Communications plc, where she was senior independent director.

Priya Guha MBE (director)

Priya has extensive experience in the global technology sector, working in both public and private organisations. She currently holds several roles across the industry. She has broad experience in global and UK technology and innovation, serving as a non-executive director at UK Research & Innovation and Digital Catapult. She is also on the Investment Governance Board at Future Planet Capital, a UK venture capital fund, and advises several start-ups including Gallos Technologies. In addition, she is a non-executive director at Reach PLC, where she chairs the sustainability committee.

Christopher Metcalfe (director)

Christopher has extensive investment management experience, with previous roles at Newton Investment Management (2006–2017), Schroder Investment Management (1995–2006), and Henderson Administration Group (1985–1994). He is currently chairman of Martin Currie Global Portfolio Trust, senior independent non-executive director at JP Morgan US Smaller Companies Investment Trust, and a non-executive director of Columbia Threadneedle UK Capital and Income Investment Trust. He was also a non-executive director of abrdn Smaller Companies Income Trust until its merger with Shires Income in December 2023.

Management team

Katie Potts

Katie is the managing director and also the lead fund manager for HIML. She established HIML in December 1993 to manage HRI, which was launched in Katie is the managing director and lead fund manager at HIML, which she founded in December 1993 to manage HRI, launched in February 1994. She studied Engineering Science at Oxford on a GKN Group scholarship. Katie spent five years at Baring Investment Management before joining S.G. Warburg Securities’ UK electronics research team in 1988. Her team was consistently top-ranked in the Extel survey, and she was named top analyst by finance directors polled by The Treasurer magazine. She also covered accounting issues at S.G. Warburg.

Katie is supported by a team of nine investment professionals in the UK and one at HRI’s US affiliate.

Fraser Elms

Fraser Elms joined HIML in May 2000. He is the deputy manager of HRI and has lead responsibility for managing HIML’s Asian portfolios. Prior to joining HIML, Fraser was a technology analyst with Dresdner Kleinwort Benson, where he covered the European technology sector. Before this he worked at Prudential for three years as member of a team of three UK unit trust fund managers that managed £5bn in equities, with Fraser having lead responsibility for three funds collectively worth £400m. He graduated from Lancaster University with a degree in Economics and initially joined Prudential as a product manager for their unit trusts, before completing an MSc in Investment Analysis at the University of Stirling and re-joining Prudential in an investment role. Fraser covers the semiconductor sector.

Taymour Ezzat

Taymour joined HIML in November 2004. He has responsibility for the European portfolio and analytical responsibility for the media sector. Previously he spent a year appraising several venture capital opportunities for E.D. Capital Partners. Prior to that, Taymour had spent six years at Northcliffe Newspapers, the regional newspapers division of Daily Mail & General Trust (DMGT), latterly as Finance Director of its electronics publishing arm, after working for Reuters in London and Eastern Europe for four years. He qualified as an accountant with Price Waterhouse and studied Economic History at the London School of Economics and Political Science. He was also a portfolio manager on the venture funds (which were wound up in H1 2023) sitting on the venture committee and taking lead responsibility for a number of the investments in the venture portfolios.

Hao Luo

Hao joined HIML in 2004 and works with Fraser Elms on managing the Far East portfolios. He also has analytical responsibility for the manufacturing sector globally. Hao obtained a BA in Economics from Hunan University in China and a Masters degree in Finance from Manchester University, and worked for J&A Securities in Shanghai from 2000-2002. He is a CFA charterholder.

Peter Jenkin

Peter joined HIML as an analyst in 2015. He covers the software sector and contributes to the overall investment selection. Previously, Peter worked jointly on the European portfolio, but now has responsibility for HRI’s North American portfolio. Before joining HIML, he studied Construction Engineering Management at Loughborough University.

Danny Malach

Danny joined HIML in 2016. He was the lead dealer for the fund and in 2022 began working as an analyst on the UK team. He has analytical responsibility for computer gaming and IT services companies globally. Danny has a CFA qualification.

Fati Naraghi

Fati joined HIML towards the end of 2019 to focus on the Herald Worldwide Technology Fund and to cover some of the larger technology companies. Prior to joining HIML, she spent 20 years at Newton Investment Management, where she was responsible for the global tech sector. Fati has a PhD in Communications Systems and is qualified as an AWS Cloud Practitioner.

Matthew Lloyd

Matthew joined HIML in 2019 as a portfolio assistant and analyst. He has analytical responsibility for Alternative Energy and began working with the Asia team in 2020. Matthew has a MEng in Mechanical Engineering.

James de Jonge

James joined HIML in 2022 as an analyst on the UK portfolio, and was subsequently given analytical responsibility for the defence and medical technology sectors worldwide. Before joining the team at Herald, he managed the audits of FTSE-listed commodities trading and renewables infrastructure clients at Deloitte. James is a qualified accountant and a CFA Level 3 candidate.

Bob Johnston

Bob was recruited in 2016 to establish a US office for HIML. He has more than 20 years’ experience in the technology sector on the sell-side, and has worked with the HIML team for roughly 15 years. Most recently, Bob was with technology specialist Pacific Crest. He previously also worked for Hambrecht & Quist and SoundView Technology Group. Bob has taken on responsibility for telecommunications, networking and security analysis. US companies do not come to the UK as they used to, and Herald feels it necessary to have a US presence to enable maintenance of frequent contact with companies.

Fund profile

More information can be found at the trust’s website: www.heralduk.com.

Established in 1994, HRI invests worldwide in small technology, communications, and multimedia companies to achieve capital growth. It is the only listed fund of its kind. While the trust invests globally, it still has a strong, though reduced, focus on the UK, setting it apart from other global technology funds that usually favour the US.

New investments usually have a market value of $5bn or less, often much smaller at entry. If successful, these can grow significantly. This long-term approach means the trust’s portfolio turnover is low. Given the risks and lower liquidity of small-cap investing, HRI holds a highly diverse portfolio, typically over 250 investments, to help manage risk.

Experience is important in markets such as these

Katie Potts has managed HRI since launch, demonstrating the value of experience in these markets. Before founding the fund, she was a respected technology analyst at SG Warburg (later UBS). She leads a skilled team of nine professionals who now manage much of HRI’s portfolio.

Key team members include Fraser Elms, deputy manager since 2000, who covers Asian portfolios and semiconductors; Taymour Ezzat, who joined in 2004 and covers European investments and media; Hao Luo, also from 2004, who covers Asia and manufacturing; and Peter Jenkin, who joined in 2015 and covers North American and software investments.

Katie holds a large personal stake in the company and a significant minority share in the management company, aligning her interests with the fund’s success.

HRI’s closed-ended structure can be advantageous during market selloffs

The HRI team has managed several downturns well by selecting companies that can handle tough conditions. Its closed-ended structure allows HRI to take advantage of market opportunities, such as buying stocks at good prices, while open-ended funds may be forced to sell. Lately, HRI has kept a net cash position.

HRI’s focus on smaller companies and the management team’s expertise make it an important source of capital for listed technology firms seeking to grow. This is especially valuable during downturns and has helped HRI find opportunities to outperform when others cannot.

HRI provides a liquid way for investors to access this market segment and can complement investments in large-cap technology funds.

SWOT analysis

Figure 19: SWOT analysis for HRI

| HRI is a genuinely unique proposition, giving investors access to smaller technology companies in the UK and overseas in a liquid vehicle, which it would be hard to invest in otherwise. |

| A very long-term track record of strong performance and expertise. Katie Potts and her team are world leaders in investing in this specialist space. |

| This can be a very volatile sector, with big swings in the underlying company share prices. However, with more than 300 holdings, the portfolio is very well diversified. |

| No dividend is paid, making this an unsuitable trust for income-seeking investors. |

| We are likely to still be in the early stages of the AI megatrend, and there are signs that, as it broadens beyond the picks and shovels players, it could increasingly benefit smaller companies. |

| There are a number of themes aside from AI that are driving growth in the technology sector. Among these is the opportunity from increased defence spending across the Western world. |

| Saba Capital continues to own a significant stake in HRI, and its intentions at this stage are unclear. |

| Technology and smaller companies investing can be particularly vulnerable to increases in inflation and interest rate expectations, irrespective of the strength of underlying companies. |

Bull vs bear case

Figure 20: Bull vs bear case for HRI

| Performance | HRI has a very long-term track record, and this compares well to the most relevant indices. Katie Potts and her team have a well-earnt reputation of delivering for shareholders. | It is reasonable to compare HRI to the US technology market, particularly the MSCI ACWI Information Technology Index. Performance can look underwhelming given the dominance of US tech and HRI’s more global allocation. |

| Dividends | HRI focuses on capital growth rather than income, and will only declare a dividend where necessary to retain investment trust status. | HRI’s lack of dividend makes it unsuitable for income-seeking investors. |

| Outlook | There are signs that the opportunities in AI are broadening out to a new data and application layer. This should benefit many of the smaller companies in HRI’s universe. | If inflation returns, as there are signs of in the UK in particular, the higher interest rates that could result would act as a brake on the technology sector. |

| Discount | After the defeat of Saba, HRI again trades at a discount, which could narrow or even move to a premium if the market environment is positive and HRI’s numerous themes play out as the managers hope. | The most recent narrowing of the discount, and move to a slight premium, was largely due to the activist moves made by Saba, rather than anything more fundamental. Saba still has a substantial stake that, presumably, it will want to exit at some point. Such selling could weigh on HRI’s discount if it is not managed properly, although this would not be in Saba’s best interests either. |

Previous publications

Readers interested in further information about HRI may wish to read our previous notes. You can read the notes by clicking on them in Figure 21 or by visiting our website.

| Title | Note type | Date published |

|---|---|---|

| Invest in the future | Initiation | 16 August 2016 |

| Tech bids demonstrate value | Update | 20 December 2016 |

| Backing growing businesses | Update | 11 July 2017 |

| Who wants to be a billionaire? | Annual overview | 7 December 2017 |

| From small acorns…. | Update | 12 June 2018 |

| Shifting sentiment | Annual overview | 12 February 2019 |

| “Profits are only profits when they are realised” | Update | 8 October 2019 |

| Change is a coming | Annual overview | 4 April 2020 |

| Hot chips | Update | 5 November 2020 |

| The future is bright | Annual overview | 2 February 2022 |

| Efficiency Savings | Annual overview | 11 January 2023 |

| Patience and power | Update | 13 November 2023 |

| Heralding in the age of AI | Annual overview | 25 June 2024 |

| Vote against Saba to protect your investment | Update | 15 January 2025 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Herald Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.