Dual-use SpaceTech: a strategic shift, not a short-term trend

An increase in global defence spending – with NATO countries meeting and, in some cases, exceeding previous commitments – appears to have raised the priority of SpaceTech for both governments and prime contractors. SSIT’s managers say this policy shift is feeding through to the commercial market and this is a strategic shift, not a short-term trend. Capital markets also appear to be opening for SpaceTech, with investment volumes returning to near-2021 levels – $10.4bn in Q3 2025 versus an all-time high of $10.9bn in Q2 2021.

Seraphim Space Investment Trust (SSIT) has significant exposure to dual-use SpaceTech. It has reported a year of NAV growth, supported by valuation uplifts across several core holdings. Several of SSIT’s companies have shown increased revenue traction. This could trigger a narrowing of SSIT’s current mid-30s discount.

The world’s first listed SpaceTech fund

A diversified, international portfolio of predominantly growth-stage, privately-financed ‘SpaceTech’ businesses that have the potential to dominate their field and are category leaders with first mover advantages in areas such as global security (defence), climate and sustainability, connectivity, autonomous mobility, telecommunication and smart cities.

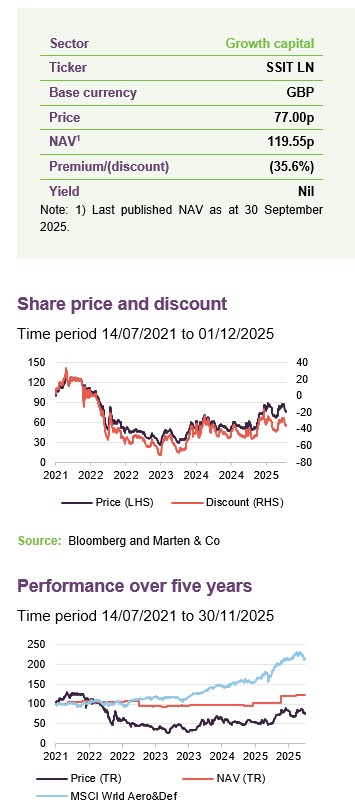

| Year ended | Share price total return (%) | NAV total return (%) | MSCI World Aerospace and Defence TR (%) |

|---|---|---|---|

| 30/11/2022 | (59.5) | 1.0 | 20.0 |

| 30/11/2023 | (30.8) | (8.1) | 9.1 |

| 30/11/2024 | 74.3 | (2.6) | 31.0 |

| 30/11/2025 | 29.1 | 27.2 | 35.5 |

Source: Bloomberg and Marten & Co

Fund profile

More information is available on the trust’s website investors.seraphim.vc

SSIT states that it aims to generate capital growth over the long term through investment in a diversified international portfolio of SpaceTech businesses (which SSIT defines as entities that rely on space-based connectivity and/or precision, navigation, and timing signals or whose technology or services are already addressing, originally derived from, or potentially benefiting, the space sector).

SSIT was launched in July 2021, meeting its capital raise target, and began operations with cash of approximately £178.4m. Total assets at the end of September 2025 were £283.6m.

SSIT’s AIFM is Seraphim Space Manager LLP (Seraphim).

Measuring success

SSIT is targeting annualised NAV returns of 20% over the long term. The trust has no formal index benchmark. For the purposes of this note, it has been compared with the MSCI World Aerospace and Defence Index. The company also compares itself to the MSCI World Aero and Defence Index.

Manager’s view

The demand backdrop for SpaceTech appears to have continued to strengthen since the previous publication on SSIT, with a shift in global defence spending and procurement behaviour likely contributing. NATO members are now committing to higher levels of defence expenditure, with Germany signalling €34bn of dedicated space investment through 2030. This level of commitment suggests that space is becoming a more central consideration in national security planning.

Against this backdrop, the manager notes that contract flow appears to be accelerating towards the more mature end of the commercial space market: SSIT’s portfolio company ICEYE alone has secured six multi-sovereign awards in the space of six months, several of which run into nine figures.

The manager believes this change in procurement dynamics is being mirrored in public markets. Large US and European aerospace and defence companies have seen their share prices re-rate, as investors appear to be increasingly pricing in long-duration defence programmes and the criticality of space-based capabilities. SSIT’s discount has narrowed, though the manager observes that compressions may be short-lived, as some analysts continue to benchmark the trust against broader private equity vehicles where discounts remain significantly wider.

According to the manager, the underlying investment environment appears materially healthier than in recent years. Space-sector investment volumes have returned close to prior highs, with a more balanced deal profile: instead of a small number of billion-dollar rounds, the market is now characterised by a larger number of $200m–300m raises, often associated with defence applications. The manager states that China has also become a much more active investor in SpaceTech, and expects this to broaden further over the next three years. The manager notes that the IPO window has re-opened for SpaceTech companies, with both Firefly Aerospace’s 2025 debut – at $868m the largest space IPO to date – and Voyager Technologies’ successful listing. SSIT’s manager sees this as an encouraging sign for potential exits across the portfolio.

From a thematic standpoint, the manager highlights Intelligence, Surveillance and Reconnaissance (ISR) and in-space security as areas of significant demand, particularly in Europe. Europe launched just one defence satellite in 2024 compared with more than 100 each from the US and China, which the manager states underlines the scale of the capability gap.

As European governments seek to address this shortfall, portfolio companies such as ICEYE, HawkEye 360 and SatVu are well-positioned to benefit, in the manger’s view. It also points to growing interest in resilient satcom, next-generation navigation (where Xona is emerging as a private provider) and long-duration space power solutions such as those being developed by new holding Zeno Power.

Within the portfolio, the manager reports continued growth in value versus cost across both private and listed holdings, supported by a series of full or partial realisations of Astroscale, AST, Arqit, and Spire Global. The manager states that proceeds have been recycled into new private opportunities more directly aligned with defence-driven demand.

The manager acknowledges challenges. US budget turbulence has delayed certain government payments and contract awards, which may have temporarily slowed commercial momentum for some US-exposed businesses, including antenna and groundsegment providers such as ALL.SPACE. However, the manager believes the opportunity set is strengthening. The manager expects contracting momentum in Europe and Japan to accelerate, views M&A from re-rated defence prime contractors as increasingly likely, and states that the IPO market now appears open for high-quality assets.

The increasing frequency of constellation deployments appears to be enabling the commercial use of high-revisit Earth observation (multiple images per day) and LEO-based navigation, with large consultancies now presenting these use-cases to corporate boardrooms. Approximately 80% of portfolio revenues are currently derived from defence use-cases. The manager expects this to shift to a predominantly commercial mix over the next five years, as revisit rates approach near-real-time and demand for space-derived datasets increases.

The manager states that SSIT is positioned at the intersection of three trends: defence modernisation, AI-enabled analytics, and the industrial adoption of space-derived data. The manager believes that the portfolio’s recent contract flow and private market resilience provide early evidence of this alignment.

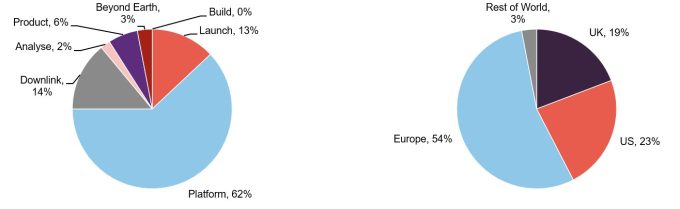

Asset allocation

At 30 June 2025, SSIT held 25 direct investments with a total fair value of £259.8m, up from £201.5m a year earlier, reflecting both valuation gains and selected follow-on investments. The portfolio remains concentrated, with the top 10 holdings accounting for 82.7% of NAV, compared with 84.0% at 30 June 2024. Figure 1 below shows that SSIT provides exposure across a range of SpaceTech subsectors. SSIT’s manager states that the portfolio is focused on companies that are considered to be at the top of their field and that have strong growth potential. Rather than taking a broad-brush approach, SSIT’s investments are carefully chosen for the quality and leadership. Spreading investments across subsectors and countries helps to mitigate risk, the manager adds.

Platform businesses represent 62% of NAV, which SSIT’s manager says reflects its emphasis on companies building constellations or space-based infrastructure with operating leverage, such as ICEYE’s SAR constellation and Xona’s emerging LEO PNT (position and timing) network. SSIT’s portfolio also includes exposure to areas such as product-layer analytics and emerging “beyond Earth” applications.

Figure 2 shows the portfolio’s geographical split as at 30 June 2025, indicating that the portfolio appears to have diversification and does not appear to be heavily dependent on any one jurisdiction.

Figure 1: SSIT portfolio by sub-sector as at 30 June 2025

Figure 2: SSIT portfolio by geography as at 30 June 2025

Source: Seraphim Space

Source: Seraphim Space

Recent investment activity

£14.2m invested over FY 2025

SSIT committed £14.2m to new and follow-on investments during the year, including a £5.8m follow-on into ALL.SPACE, a new £4.0m investment into Zeno, further funding for Xona and Skylo, and smaller follow-ons into ChAI and PlanetWatchers.

£1.5m invested over Q1 FY 2026

During the first quarter of FY2026 (ending 30 September 2025), SSIT made three follow-on investments totalling £1.5m. These were £1.1m into ALL.SPACE, £0.3m into QuadSat and £0.1m into Taranis. SSIT’s manager states that it is backing companies, with targeted follow-on investments, to help them reach key milestones.

Full exits of listed holdings – Arqit and Spire Global

Arqit (0.9% of SSIT’s NAV at the end of September 2025) was exited in full as the manager sold the position following a share price rally in early October 2025, with Arqit’s share price reaching levels last seen in February 2023. SSIT received £3.3m of proceeds at a sale price equivalent to 15% of the initial sterling cost of the holding.

Spire Global (0.8% of SSIT’s NAV at the end of September 2025) was fully exited in October 2025. SSIT received sale proceeds of £2.9m for the holding at a price equivalent to 29% of the initial sterling cost of the holding.

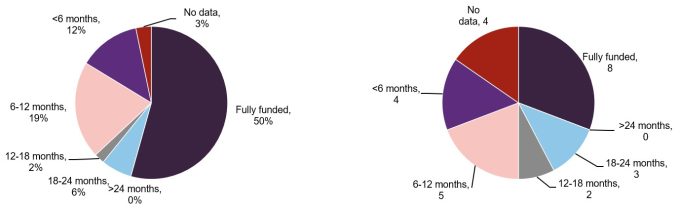

Portfolio cash runway and SSIT cash burn

Figures 3 and 4 show the breakdown of SSIT’s portfolio by funding requirements through to cash-flow break-even, in terms of fair value and number of companies respectively, as at 30 June 2025. These figures are based on the latest projections from the portfolio companies’ management teams at that time. In its Q1 results for FY2026, SSIT reported that roughly half of the portfolio (69% of fair value) had a cash runway considered robust by management, with 58% fully funded and a further 11% funded for 12 months or more from 30 September 2025. As at 30 September 2025, the company had £19.4m of cash reserves (30 June 2025: £21.5m), with a potential £8.7m of additional liquidity via holdings in listed companies. SSIT states that it is considered in its spend – for example, follow-on investments are very targeted – which, according to the company, helps mitigate the funding risk associated with its portfolio.

Figure 3: SSIT portfolio by funding duration as at 30 June 2025 (fair value)

Figure 4: SSIT portfolio by funding duration at 30 June 2025 (number of co.s)

Source: Seraphim Space

Source: Seraphim Space

US2.1bn was raised by SSIT’s portfolio companies during FY2025.

During the year to 30 June 2025, SSIT’s portfolio companies raised approximately $2.1bn, a marked increase on the c.$900m secured in the prior year. Around $390m of this was raised by private companies, with the remainder accounted for by listed holdings. Of the 10 private companies that completed rounds, around 60% were led by or saw substantial participation from external investors.

During the year to 30 June 2025, SSIT’s portfolio companies raised approximately $2.1bn, an increase on the c.$900m secured in the prior year. Around $390m of this was raised by private companies, with the remainder accounted for by listed holdings. Of the 10 private companies that completed rounds, around 60% were led by or saw substantial participation from external investors.

As highlighted elsewhere in this note, a number of SSIT’s core holdings appear to be demonstrating operational momentum, according to the manager, which adds that there are indications of improving revenue visibility and clearer pathways towards EBITDA profitability. Management believes that funding needs across the portfolio remain manageable.

During the period, several holdings transitioned from last-round or basket-based valuations to multiple-based approaches – most notably ICEYE, which experienced an uplift that SSIT’s manager says reflects increased bookings, revenue growth and emerging profitability.

Maturity profile

SSIT is a growth capital fund, and its portfolio is weighted towards businesses that have moved beyond the seed and series A stage. SSIT invests in companies that have commercialised, or are in the process of commercialising, their products and are achieving profitability. SSIT invests alongside Seraphim’s venture capital arm, which screens companies that may carry material execution risks and are often in the earliest stages of their commercial life, such as start-ups. In practical terms, SSIT’s investments are made at the later stages of the funding cycle, with around 70% invested in series C or D funding, which are the latter stages of funding prior to IPO.

Top holdings

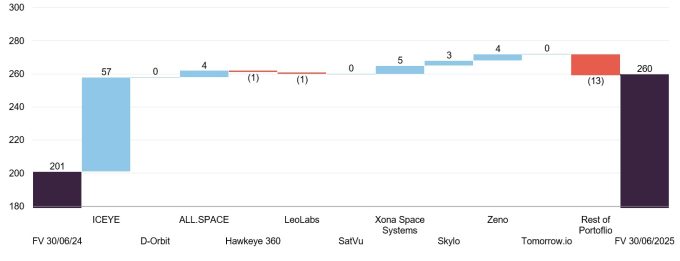

Figure 5 shows SSIT’s top 10 holdings as at 30 September 2025 and how these have changed since 31 December 2024, which was the most recently available data when the previous publication was released.

Holdings that have moved into the top 10 are Skylo, Zeno, and Tomorrow.io. Names that have moved out of the top 10 are AST SpaceMobile, PlanetWatchers and Seraphim Space Ventures II. Further discussion of SSIT’s holdings can be found in previous notes – see page 17 of this note.

Figure 5: SSIT 10-largest holdings as at 30 September 2025

| Stock | Subsector | Country | As at 30/09/25 (%) | As at 30/06/25 (£m) | As at 31/12/24 (£m) | Change(£m) |

|---|---|---|---|---|---|---|

| ICEYE | Platform/Earth observation | Finland | 34.7 | 98.5 | 52.4 | 46.1 |

| D-Orbit | Launch/in-orbit services | Italy | 12.1 | 34.2 | 32.4 | 1.8 |

| ALL.SPACE | Downlink/ground terminals | UK | 10.5 | 29.8 | 28.5 | 1.3 |

| HawkEye 360 | Platform/Earth observation | US | 10.4 | 29.6 | 22.0 | 7.6 |

| LeoLabs | Product/data platforms | US | 4.4 | 12.4 | 13.1 | (0.7) |

| SatVu | Platform/Earth observation | UK | 3.9 | 11.2 | 11.2 | – |

| Xona Space Systems | Platform/navigation | US | 3.7 | 10.5 | 6.2 | 4.3 |

| Skylo | Satcoms | US | 1.6 | 4.5 | N/A | N/A |

| Zeno | Space infrastructure | US | 1.3 | 3.7 | N/A | N/A |

| Tomorrow.io | Data platforms | US | 1.3 | 3.7 | N/A | N/A |

| Total of top 10 | 83.9 | 238.1 | 169.2 | 68.9 |

Source: Seraphim Space

ICEYE – accelerating growth as defence demand scales

ICEYE has continued to expand its operations as a commercial synthetic aperture radar (SAR) provider, with a series of defence contracts and product launches during 2025. Recent developments include a $168m agreement with the Finnish Defence Forces for sovereign SAR capability and the introduction of a deployable intelligence, surveillance, and reconnaissance (ISR) Cell, which enables near-instant intelligence generation at the frontline. ICEYE has expanded its constellation with a further six satellites launched on SpaceX Falcon 9’s Transporter-14 and is investing more than €250m to grow manufacturing capacity and advance next-generation SAR technologies, supported by a €41.1m Business Finland R&D package.

The company continues to secure contracts across NATO-aligned nations – including the Netherlands, Portugal, Japan and others – which SSIT’s manager says reflects a growing demand for all-weather, high-resolution intelligence. This includes a contract with Japan’s IHI Corporation for four satellites and an associated image acquisition system, with the option to procure a further 20 satellites at a later stage.

ICEYE’s growing pipeline, broadening international footprint and continued innovation (including its new ‘Tactical Access’ premium tasking service launched in October) position the company for further growth in the manager’s view.

D-Orbit – continued progress as in-space logistics expands

D-Orbit continues to expand its activities in in-space logistics, particularly flexible last-mile space transportation, with further operational developments during the period. The company launched its 18th and 19th Orbital Transfer Vehicles (OTVs) on SpaceX’s Transporter-14 mission in June 2025. These vehicles are used for deployment, repositioning, and hosted-payload missions for a base of satellite customers. As satellite constellations increase and operators appear to be prioritising cost-effective orbital logistics, SSIT’s manager expects D-Orbit to benefit from long-term structural growth in in-space servicing and mobility.

ALL.SPACE – strengthening its position in resilient multi-orbit connectivity

ALL.SPACE has continued to report progress in 2025 as demand appears to be growing for secure, multi-orbit communications across defence and government markets. During the year, the company secured €3.4m of ESA funding to accelerate the integration of 5G Non-Terrestrial Networks into its next-generation hybrid terminals, supporting switching between satellite and cellular connectivity and aligning with European goals for sovereign communications capability. Additional developments included an MoU with Telesat Government Solutions, enabling ALL.SPACE’s Hydra terminals to be certified for the forthcoming Lightspeed LEO network, which is already in use with the US Navy and Army and is designed to provide connectivity across GEO, MEO and LEO fleets.

More recently, the company expanded its software offering through partnerships with the European Space Agency and with Aalyria, combining ALL.SPACE’s multi-orbit hardware with network-orchestration software to provide autonomous, secure and low-latency connectivity in contested environments. Management states that with its combination of advanced hardware and software capabilities, ALL.SPACE is positioned to address rising defence-driven demand for resilient satellite-enabled communications.

HawkEye 360 – expanding capacity as RF intelligence demand accelerates

HawkEye 360 has continued to expand its space-based radio-frequency (RF) intelligence network, increasing its capacity as a provider of signals intelligence to government and defence customers. The company launched its twelfth satellite cluster in June 2025, which has enabled dawn-dusk orbital coverage along with a Ka-band downlink to support higher potential data capacity. Cluster 12 became fully operational during September, and the company states that this has enhanced global monitoring performance across interference detection, maritime domain awareness and strategic intelligence applications. Development of Cluster 13 is underway and HawkEye 360 has additional clusters under contract. SSIT’s manager states that the business remains well aligned with rising global defence budgets – particularly among NATO members – where demand for commercial RF geolocation services appears to be growing.

LeoLabs – strengthening role in space safety and orbital traffic management

LeoLabs continues to expand its activities in space situational awareness (SSA) at a time when governments appear to be placing greater emphasis on space safety and the protection of orbital assets. In August 2025, the company signed a Space Act Agreement with NASA to evaluate how LeoLabs’ high-resolution tracking data and safety analytics may support NASA’s efforts to prevent satellite collisions and enhance overall orbital traffic management. NASA will assess LeoLabs’ radar metrics, safety products and its commercial catalogue of almost 25,000 tracked low Earth orbit objects. This development suggests there is the potential for an increasing role for commercial SSA providers within national frameworks.

SSIT’s manager comments that, with space becoming more congested and contested, LeoLabs’ ability to deliver sub-10-metre tracking accuracy and scalable real-time monitoring may position it to benefit from rising regulatory and operational demand.

SatVu – advancing thermal intelligence as government traction grows

SatVu has reported progress through 2025 as demand appears to be increasing for high-resolution thermal imaging across defence, climate, and infrastructure monitoring. Despite the early loss of its first satellite, SSIT’s manager comments that the company has continued to demonstrate commercial momentum. According to SatVu, HotSat-1’s initial data indicated the potential value of its mid-wave infrared capability, which the company reports helped to secure $6m in pre-orders for its follow-on spacecraft, HotSat-2. It also received a $10m insurance payout and manufacturing support from Surrey Satellite Technology Ltd to address earlier issues.

More recently, SatVu was awarded a contract worth up to €3m by the European Space Agency to supply high-resolution thermal data to the Copernicus programme over a three-year period. SSIT’s manager states that SatVu has deepened its engagement with defence users, delivering thermal familiarisation training to NATO personnel as part of the APSS initiative, where its ability to detect activity such as vehicle movements and energy use may provide an additional “activity layer” for ISR missions.

Xona Space Systems – developing next-generation GPS

Xona Space Systems has continued to develop Pulsar, its next-generation LEO PNT constellation. The company raised $92m in a Series B round led by Craft Ventures, bringing total funding to more than $150m, including a $20m STRATFI award from the US Space Force. Xona also launched Pulsar-0, its first production-class satellite, which the company states is a step towards a full constellation capable of delivering encrypted, spoof-resistant, centimetre-level positioning as a commercial alternative to legacy global navigation satellite systems (GNSS). SSIT’s manager says that, with rising geopolitical concern over GNSS vulnerabilities, Xona is well positioned as one of the leading commercial providers of resilient navigation services.

Skylo – expanding its footprint in direct-to-device connectivity

Skylo has continued to expand its position as a standards-based Non-Terrestrial Network (NTN) provider, with 2025 bringing a series of partnerships that broaden its global reach. During the year, Skylo enabled satellite messaging on Samsung’s Galaxy Z Fold7 and Z Flip7 devices through Verizon, which represents a step in bringing direct-to-device capability into the consumer handset market. The company also expanded its presence in wearables, extending its partnership with Garmin to provide satellite messaging and SOS features on the new fēnix® 8 Pro multisport watches in regions including the US, Canada, and Europe.

In Sweden, Tele2 launched the country’s first 3GPP-compliant satellite IoT service using Skylo’s NTN technology, which allows devices to switch between terrestrial and satellite networks for uninterrupted connectivity in remote areas. SSIT’s manager comments that, with its expanding ecosystem of device, operator and semiconductor partners, Skylo is well positioned to benefit from rising global demand for ubiquitous connectivity.

Zeno Power – compact nuclear power for extreme environments

SSIT’s manager comments that Zeno Power has continued to expand its activities in next-generation radioisotope power systems, securing partnerships and increasing its access to materials required for long-duration energy supply. Earlier in the year, SSIT participated in Zeno’s $50m Series B round, supporting the development of compact nuclear batteries designed to provide power in space, deep ocean, and polar environments where conventional energy sources may not be practical.

More recently, Zeno signed a multi-million-dollar agreement with French nuclear fuel specialist Orano to acquire Americium-241, an isotope derived from nuclear waste with a half-life of more than 400 years. This material may enable higher-power, longer-lived radioisotope systems and is expected to be used to support multiple missions annually, including deep-space exploration and human operations near nuclear sources.

SSIT’s manager states that, with growing interest from government and commercial users seeking resilient, maintenance-free power systems, Zeno may be well positioned to become a strategic supplier of nuclear energy solutions for extreme-environment missions.

Tomorrow.io – next-generation weather intelligence

Tomorrow.io continues to expand its operations as a provider of high-resolution, real-time weather intelligence, supporting customers across aviation, defence, logistics and national resilience. The company is progressing the build-out of its global weather-satellite constellation, which is designed to deliver increased revisit rates and data accuracy for forecasting applications.

While there have been no major public announcements since the last publication, SSIT’s manager states that the company remains a strategically important participant in the move towards space-enabled climate and operational intelligence, providing hyper-local insights that may assist government and commercial users in planning, mitigating, and responding to increasingly volatile weather conditions, which the manager describes as a national priority for many countries.

Performance

H2 FY2025

As of 30 June 2025, SSIT reported a total NAV of £281.1m (118.52p per share), representing a 17.2% increase from the £239.7m (101.04p per share) NAV that SSIT reported at 31 December 2024. It is also an increase of 27.1% over the course of the last financial year (total NAV as at 30 June 2024 was £228.1m or 96.18p per share).

As was the case when the previous report was published, the largest contributor to this growth appears to have been unrealised fair value gains within its portfolio, which the manager attributes primarily to defence and geopolitical trends. SSIT’s manager believes the trust may continue to benefit from growing government and commercial spending on space security and modernisation, which the manager states supports long-term NAV growth potential.

ICEYE, which doubled in value during the course of the year, was the largest contributor to performance (see Figure 6). SSIT’s manager states that the private holdings continue to deliver on key milestones, with a number reporting revenue growth during the last year, and their management teams expect them to become EBITDA profitable before the end of 2025. The manager suggests that this could indicate potential for further NAV growth as SSIT’s holdings continue to be de-risked. The manager believes that the performance reflects both stock selection and growing demand across the SpaceTech sector.

SSIT’s manager states that the strength of the unrealised gains reflects the extent of the progress made in the underlying holdings. SSIT’s manager reports being engaged with the process of adding value to its holdings and supporting them in realising these gains over time via IPOs, M&A deals, or secondary market sales.

The breakdown of the changes in the fair value of SSIT’s individual holdings over the period is shown in Figure 6. The total value of SSIT’s portfolio companies increased by 28.9% over the last financial year, from £201.5m to £259.8m. In terms of new funding rounds closed by existing portfolio companies, only one investment, D-Orbit, reported a decline in its valuation, as its most recent fundraising was a down-round, while three reported up-rounds and six unchanged rounds. D-Orbit’s valuation was 288% higher at the end of June 2025 than SSIT’s in-price. As of the end of June 2025, the fair value of all but two of SSIT’s top 10 holdings was above its reported cost, with a median fair value versus cost ratio of 108%, ranging between a maximum of 288% and a minimum of 86%.

SSIT’s portfolio companies do not generally follow fixed valuation schedules (such as quarterly reappraisals). Instead, fair values are updated in response to specific events, such as funding rounds, commercial milestones, or material operational developments. This approach may limit NAV volatility, but it can also lead to periods where a holding’s valuation does not see any fair value progression.

Figure 6: Investment portfolio movements

Source: Seraphim

Q1 FY2026

On 25 November 2025, SSIT released its first quarter results for the current financial year. As of 30 September 2025, SSIT reported a total NAV of £283.6m (119.55p per share), which represented a 0.9% increase over the quarter, reaching a new record NAV, having also reached a record at 30 June. Within the end of September NAV, the fair value of SSIT’s portfolio increased by 1.9%, or £4.9m, to £264.7m. This included a £0.4m decrease in unrealised fair value, which was more than offset by a £3.8m foreign exchange gain, along with follow-on investments of £1.5m.

Within the changes in unrealised fair value, HawkEye 360 saw its fair value increase by £9.0m over the quarter. SSIT’s manager say that this is due to a combination of performance within the underlying business and corporate activity that is currently underway (no details have been disclosed).

ICEYE’s fair value was reduced by £1.6m to £98.5m, from £105.1m as of 30 June 2025, which SSIT’s managers state is to “fully reflect the terms of corporate activity currently underway”. While no details of the corporate activity have been disclosed, ICEYE has reported operational progress (see pages 7 and 8).

Because both ICEYE and HawkEye360 have corporate activity underway and are being priced off of these events, they are not being valued in SSIT’s NAV using the multiples methodology usually employed. However, SSIT’s manager states that it expects both to revert to the comparable multiples methodology within six months and that it anticipates more growth over the year ahead for both businesses.

Portfolio returns

SSIT’s positive NAV growth was driven by unrealised returns

From inception on 14 July 2021 to 30 November 2025, SSIT has delivered a NAV total return of 22.0%. SSIT’s listed equity allocation has been a detractor to SSIT’s performance, but this has been offset by the increase in the value of its unlisted portfolio.

We continue to use the MSCI Aerospace and Defence Index as a comparator for SSIT. The index had only marginally outperformed SSIT’s NAV up until October 2023, after which it experienced a sustained increase in performance, which may have been influenced by the outbreak of the Israel-Gaza conflict in October 2023. Since then, geopolitical tensions appear to have persisted and, following “Liberation day” in April this year, the index has increased at a faster rate.

Figure 7: SSIT performance from launch to 30 November 2025

Source: Bloomberg, Marten & Co

According to the team, SSIT may benefit from the same factors that have been influencing defence stocks. The team states that the current gap may not be sustainable and that SSIT could have potential for catch-up performance. SSIT manager believes that approximately 70% of its portfolio has defence applications, and comments that its investee companies continue to demonstrate growing profitability.

Figure 8: SSIT performance over periods ended 30 November 2025

| 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | Since launch (%) | |

|---|---|---|---|---|---|

| Price | 7.8 | 5.2 | 29.1 | 55.6 | (22.8) |

| NAV1 | 0.9 | 18.3 | 27.2 | 13.9 | 22.0 |

| MSCI World Aerospace and Defence | 0.7 | 8.1 | 35.5 | 93.6 | 115.9 |

Source: Bloomberg, Marten & Co. 1) NAV performance is based on the latest NAV valuation, as of 31 December 2024. SSIT commenced trading on 14 July 2021

Premium/(discount)

Over the last 12 months, SSIT’s shares have traded within a range between a 52.5% discount to NAV to a 15.9% discount, averaging at a 38.7% discount. On 1 December, SSIT was trading at a 35.6% discount.

Figure 9: SSIT premium/(discount) from launch

Source: Bloomberg, Marten & Co

As shown in Figure 9, SSIT briefly traded at a premium following its IPO in July 2021. The broader growth stock sell-off in 2022, which may have been influenced by rising inflation and increasing interest rate expectations, coincided with SSIT shifting to trading at a discount. SSIT’s discount peaked in July 2023 at 72%. The subsequent easing of monetary policy in developed markets during 2024 appears to have coincided with a significant narrowing of the discount.

SSIT’s manager thinks that the current discount offers an attractive entry point, given the increased demand from defence sectors. The conflict in Ukraine continues the dual uses of SpaceTech, which it thinks has likely put additional downward pressure on SSIT’s discount. While SSIT’s discount remains wide, the general trend has been one of gradual narrowing. SSIT’s growth capital peers also trade on wide discounts.

Previous publications

Readers interested in further information about SSIT may wish to read our previous notes (details are provided in Figure 10 below). You can read the notes by clicking on them in Figure 10 or by visiting our website.

Figure 10: QuotedData’s previously published notes on SSIT

| Title | Note type | Publication date |

|---|---|---|

| Science fiction becoming science fact | Initiation | 14 August 2024 |

| Entering orbit | Update | 7 November 2024 |

| SpaceTech – the critical frontier in modern defence | Update | 25 May 2025 |

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Seraphim Space Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.