Reconstruction Capital II has published its accounts for the year that ended 31 December 2013. The net asset value back then was €0.3287, down from €0.3933 at the end of 2012 but we already know that at the end of April 2014 the asset value had recovered a little to reach €0.3436. The reasons behind […]

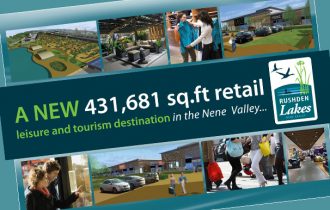

LXB Retail Properties has published its interim results covering the six months ended 31 March 2014. Its EPRA NAV rose by 4.3% to 120.98p over the period and it bought back £40m of its shares. Cash levels fell from £35m to £20m. They got planning permission for the Old Gasworks at Sutton and Brocklebank Retail […]

Target Healthcare REIT is buying two purpose-built care homes – Bromford Lane in Washwood Heath, Birmingham (pictured) and Beechdale Manor in Bilborough, Nottingham, for £14.3m. The homes can cater for 181 residents between them, offering residential, nursing and dementia care as well as specialist high dependency care at Bromford Lane. The price equates to a net […]

Having struggled to make any investments, GCP Sovereign Infrastructure has talked to 92% of its shareholders (by votes) and has agreed that it will seek to wind up the company and cancel its admission to the Specialist Funds market. The manager, GCP, will make a contribution to cover all the expenses of the initial offer […]

Tritax Big Box REIT is buying William Morrison’s distribution centre in Sittingbourne, Kent for £97.8m. The 919,443 sq ft South East Regional Distribution Centre was developed in 2009. The distribution centre is being acquired from Wm Morrison Supermarkets plc subject to a new leaseback agreement for 25 years and with annual rent reviews indexed to […]

Geiger Counter has published its interims – over the six months to the end of March 2014 its net asset value rose from 31.29p to 32.81p and the ordinary share price rose from 24.75p to 30.88p. Gains from holdings in Denison Mines, Fission Uranium and Cameco were offset by a fall in the value of UEC. […]

F&C Global Smaller Companies has published its results covering the year that ended 30 April 2014. On a net asset value basis returns were broadly in line with the benchmark – 12.3% generated by the portfolio, rising to 12.6%, calculating the effect of marking the company’s debt to fair value, and a 12.4% return on […]

Invesco Income Growth has published its results covering the year that ended on 31 March 2014. Over the period the fund generated a total return of 14.2% on net assets – ahead of the 8.8% return generated by the FTSE All-Share Index. The discount narrowed and so the return to shareholders was 16.7%. The dividend […]

Tamar European Industrial Fund announced on 16 June that Lux Starlight, a newly incorporated Luxembourg private limited liability company, and TEIF have agreed on the terms of a recommended cash offer to be made by Lux Starlight for the entire issued and to be issued ordinary share capital of TEIF. The offer is 38.25p in cash, valuing the total […]

Origo Partners has today released its results for the year ended 31 December 2013. The net asset value back then was $0.39 (down 20% from $0.49 at the end of 2012). The main reason for the fall was a 50% write down in the value they put on their holding in Gobi Coal & Energy. […]