AVI Global Trust

Investment companies | Annual overview | 21 November 2023

An historic opportunity

AVI Global Trust (AGT) has been performing well recently. Where it can, the manager seeks to engage with investee companies behind the scenes, working with them to unlock value for the benefit of all shareholders. Lately, AGT has also been involved in some more high-profile situations, which we discuss in this note.

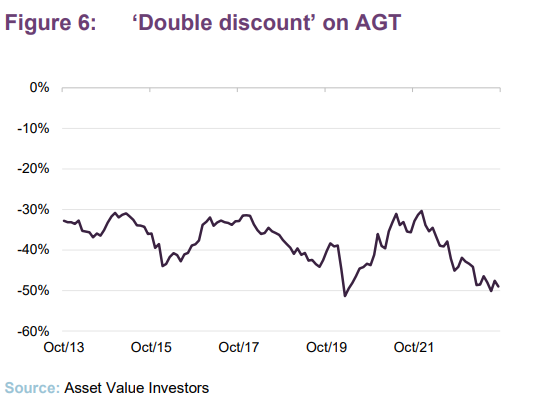

While the NAV seems to be moving in the right direction, the double discount – AGT’s own discount plus the gap between the share prices of investee companies and their underlying intrinsic value – is almost at its widest level since the manager started to calculate it in 2006. As it starts to look as though rates may have peaked, and as momentum grows to address one of the problems that has been weighing on the London-listed investment companies sector (see page 18), we may be at an inflexion point and the current double discount could offer exceptional value.

Extracting value from discounted opportunities

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include holding companies, closed-end funds, and asset-backed special situations.

Fund profile

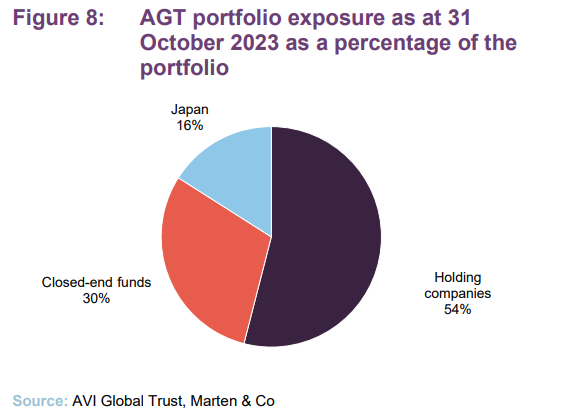

Holding companies, closed-end funds, and asset-backed special situations

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include family-controlled holding companies, closed-end funds, and asset-backed special situations such as asset-rich Japanese operating companies.

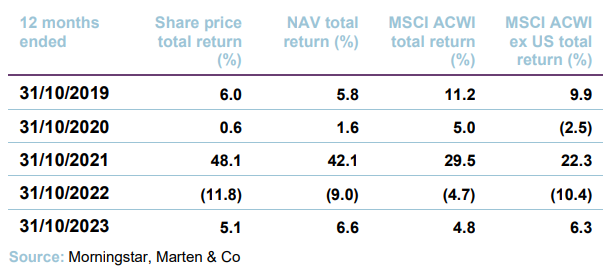

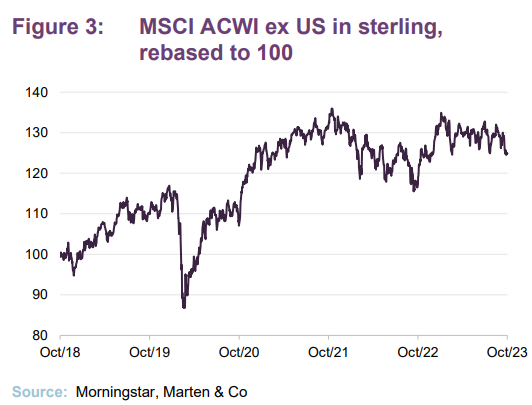

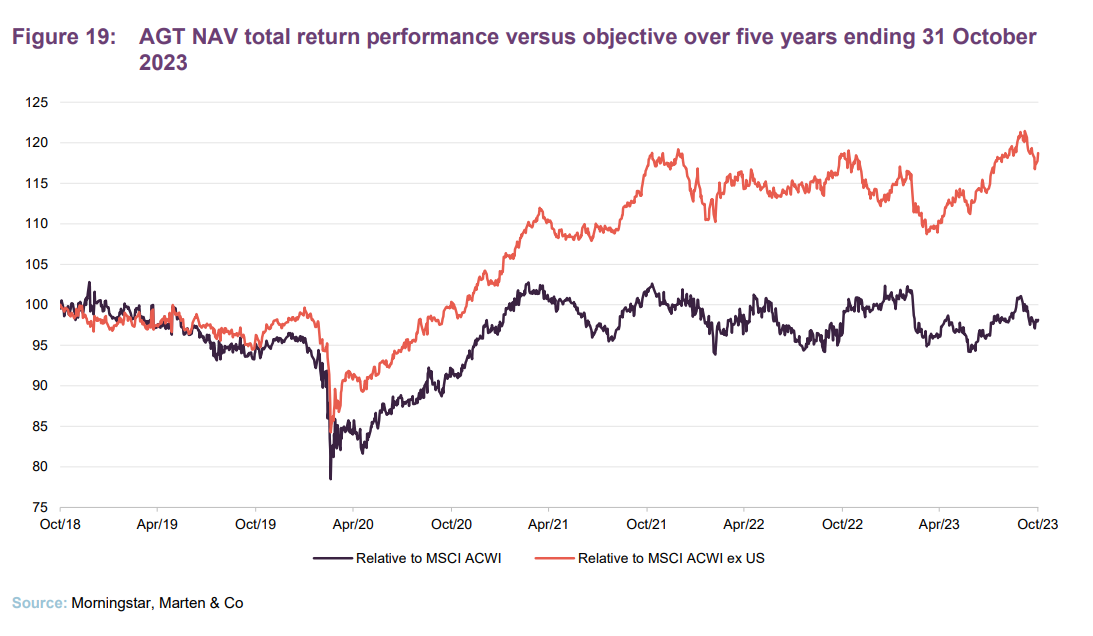

New benchmark

With effect from the publication of AGT’s report and accounts for the 12 months ended 30 September 2023, the company compares itself to the MSCI All Country World Total Return Index, expressed in sterling terms, for performance measurement purposes. In previous years, it had used a World ex US benchmark on the grounds that the trust had a structural underweight exposure to the US, primarily because there are fewer opportunities to invest in family-controlled holding companies there. For this note, we have included comparisons to both indices. In subsequent notes we will just use the new benchmark.

It is worth noting that the performance benchmark has no influence over portfolio construction and AGT’s active share is always likely to be close to 100%.

More information is available at the trust’s website: aviglobal.co.uk

AGT’s AIFM is Asset Value Investors (AVI). AVI was established in 1985, when the trust’s current approach to investment was adopted. At that time, AGT had assets of just £6m and was known as the British Empire Securities and General Trust, later shortened to British Empire Trust. The trust adopted its current name on 24 May 2019.

The manager

Experienced investment team

Since October 2015, the lead manager on the trust has been Joe Bauernfreund, CEO and CIO of AVI. Joe has over 25 years’ experience in the finance industry. After six years working for a real estate investment organisation in London, he joined AVI in July 2002 as an investment analyst. AVI’s head of research is Tom Treanor, who joined the company in February 2011. His previous role was in closed-end fund analysis for Fundamental Data/Morningstar. We talked to Tom when putting together this note.

Other members of the team include Scott Beveridge (an investment analyst focused on real estate-backed opportunities and Asian holding companies), Daniel Lee (the lead investment analyst for Japan, Wilfrid Craigie (an investment analyst researching global holding companies and asset-backed special situations), and a Tokyo-based team member, Jason Bellamy, who ensures a constant local presence to AVI’s ongoing engagement efforts in Japan. The team is also being augmented by the addition of Nick Greenwood and Charlotte Cuthbertson as AVI takes on management of MIGO Global Opportunities Trust from 15 December 2023. This will expand the team to 14.

As at 30 September 2022, AVI’s investment team owned 1,964,479 shares in AGT.

Goodhart Partners, a London-based independent “multi boutique” asset manager, has been a minority investor in AVI since 2016, having offered an exit for legacy shareholders in the company. Goodhart helps support AVI with its business development and sales and marketing strategy.

Good quality assets at a discount

Profit from discount narrowing

AGT seeks to buy assets for less than their fundamental value and then profit as the discount between market value and intrinsic value narrows. AVI will engage with boards and underlying managers to unlock value. Usually, AGT will be a significant investor in the closed-end funds that it holds. It is the availability of value opportunities shapes the portfolio, rather than macroeconomic considerations or the composition of any index.

Underlying assets must represent an attractive investment opportunity in their own right

AVI believes that the underlying assets must also represent an attractive investment opportunity in their own right. When it is considering whether to add a potential investment to the portfolio, AVI is looking for a catalyst that will unlock the discount. However, this can take time to come to fruition. AGT should be able to benefit from uplifts in the underlying asset value as well as discount narrowing.

This is especially true of family-controlled holding companies, where AGT tends to have less sway. This is why it is important to align the trust with high-quality, long-term management and businesses/assets.

Market backdrop

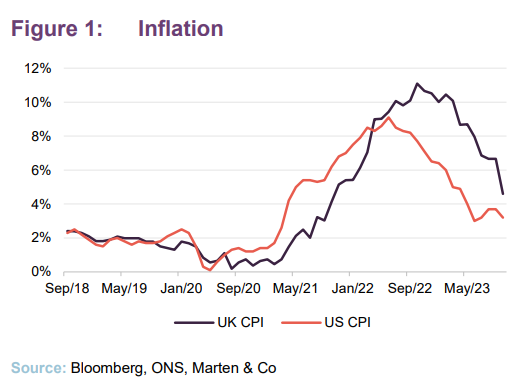

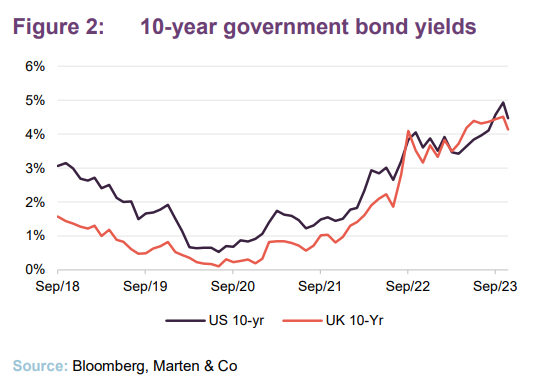

The dominant influence on markets has been rising interest rates as central banks try to stifle inflation. This has made prospective yields on cash and bonds look more attractive and encouraged a shift into these asset classes. At the same time, property investments and alternative assets that had been bought for the uncorrelated yield that they offered now find themselves unloved and trading on wide discounts. Higher interest rates have also hurt those funds and companies that were over reliant on floating rate debt.

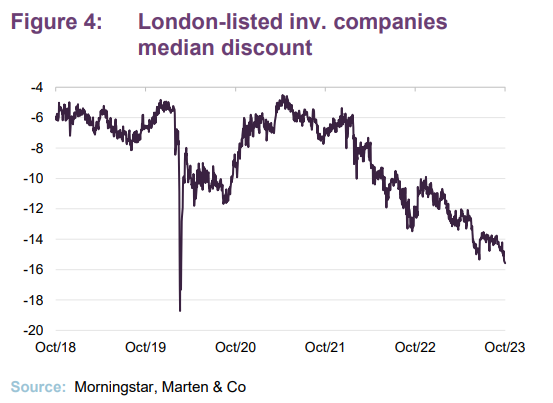

Within the UK investment companies market there is also an apparent buyer’s’ strike as cost disclosure rules work against the sector (see page 18 for further discussion). This has contributed to a marked widening of discounts.

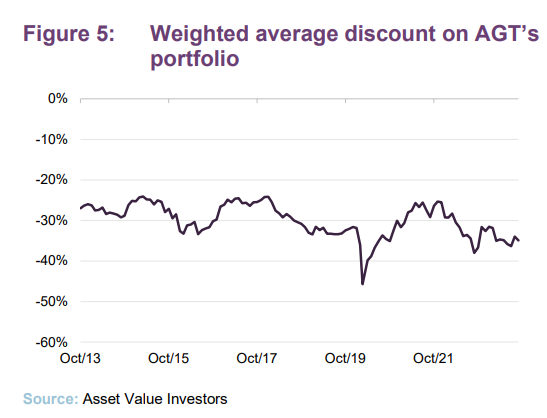

This combination of factors has contributed to a widening of the weighted average discount on AGT’s portfolio, but this represents a combination of both market moves and AGT’s manager’s recycling of both successful and relatively dull investments into more attractive discount opportunities (see page 8 for more detail).

As we discuss on page 17, despite AGT’s share buyback activity and decent NAV performance, there has been a modest widening of AGT’s discount so that, as Figure 6 shows, the ‘double discount’ – the combination of the discount on the underlying portfolio and AGT’s own discount – is not far off its low of about 51%; this represents an attractive entry point for new investors.

Investment process

A universe of over 1,000 stocks to choose from

The universe of AGT’s potential investments amounts to well over 1,000 stocks: over 100 each of European and Asian family holding companies, over 650 closed-end funds, more than 100 heavily over-capitalised Japanese operating companies with significant cash and/or securities holdings, and over 100 other asset-backed situations.

AVI keeps about 400 of these potential holdings under close scrutiny. Listed assets are valued on a mark-to-market basis. Most listed closed-end funds tend to publish regular NAVs, but the team may maintain its own models for funds that publish less frequently. The team also maintains its own models for valuing unlisted assets.

Portfolio constructed on a bottom-up basis, without any reference to benchmark weights

The portfolio is constructed on a bottom-up basis and without any reference to benchmark weights. Potential investments will be subjected to an intensive due diligence process, which includes meetings with management and an analysis of relevant industries, with help from independent experts where appropriate.

AGT has operated with a fairly concentrated portfolio since 2015, with about 25–35 core positions. In practice, this means about a 3% target position in core holdings.

The team has strong relationships with some brokers and AVI is sometimes offered large lines of stock. With the Japanese part of the portfolio, the manager keeps an eye on trading by insiders (as family members face IHT bills, for example), which can give an indication that there is stock available.

Family-controlled holding companies

The holding companies that AGT invests in should have high-quality portfolios of listed and/or unlisted businesses with the potential for sustained, above-average, long-term NAV growth. The controlling family or shareholder should have a strong track record of capital allocation and have demonstrated that it is capable of generating returns in excess of broader equity markets.

Part of the attraction of investing in these companies is that they operate with a long-term strategic vision; investing for the benefit of future generations, rather than to beat analysts’ short-term estimates.

Preference for holding companies where there is a catalyst in place to narrow the discount

The manager’s preference is for investment in holding companies where there is a catalyst in place to narrow the discount. By the manager’s own estimate, historically about three-quarters of AGT’s returns from holding company investments have come from NAV growth and one-quarter from discount tightening.

Closed-end funds

AGT invests in closed-end funds globally, but the majority of its investments in this area are listed in London. There are many reasons for this; for example, the manager says that while discounts on closed-end funds in the US have widened, they are relatively tight compared to the London market. In the manager’s experience, corporate governance in the US is also relatively poor; directors are often conflicted, for example, which can be a barrier to unlocking discounts for the benefit of shareholders.

AGT’s stakes in closed-end funds are usually larger, to give it greater influence

Again, the focus is on the quality and growth potential of the underlying assets. When investing in closed-end funds, the manager places a greater emphasis on an ability to close the discount. Consequently, AGT’s stakes in closed-end funds are usually larger, to give it greater influence. The manager will engage with management, boards and other shareholders. Historically, half of AGT’s returns on closed-end fund investments have come from discount narrowing.

Asset-backed special situations

AGT’s asset-backed special situations largely comprise a number of Japanese investments. These benefit from a tailwind of a revolution in Japanese corporate governance. The manager has been investing in Japan for over 20 years. In 2012, then-Prime Minister Shinzo Abe proposed a stewardship code, which was adopted in 2013. This was aimed at getting institutional investors to fulfil their fiduciary responsibilities and encouraging engagement with company management.

Japan’s corporate governance has been on an improving trend for some years

A corporate governance code was introduced in 2015 and strengthened in 2018. This included measures aimed at minimising cross-shareholdings, stressing the importance of companies earning more than their cost of capital, bringing in more independent directors, establishing independent nomination committees for new directors, improving disclosure and encouraging greater dialogue with shareholders, and maintaining a level playing field in the treatment of shareholders. AVI describes this as a scorecard with which it could hold Japanese businesses to account.

The number of activist investors in Japanese securities has increased and the manager sees evidence of rising payout ratios, buybacks, and more independent directors. The managers engage with the boards and management of AGT’s holdings, promoting policies for the benefit of all stakeholders.

Engagement usually happens in private

With all of its engagement activities, AVI much prefers that these take place in private, although it is willing to put proposals to shareholders if necessary. The vast majority of engagement activity will never come to light, therefore.

A typical stock in this part of the portfolio will be cash-generative, trade on low valuation multiples, and the underlying business will be of sufficient quality such that the manager can afford to take a long-term view.

Hedging

The manager has the ability to hedge positions (by shorting stocks or indices, for example) should it choose, although this is used infrequently, and the manager would not take a net short exposure. The company may use a variety of derivative contracts, including total return swaps, to enable it to gain long and short exposure to individual securities.

As we discuss on page 19, AGT has a multicurrency debt facility, which allows the manager to limit exposure to certain currencies.

Asset allocation

AGT’s asset allocation is driven by the manager’s stock selection decisions.

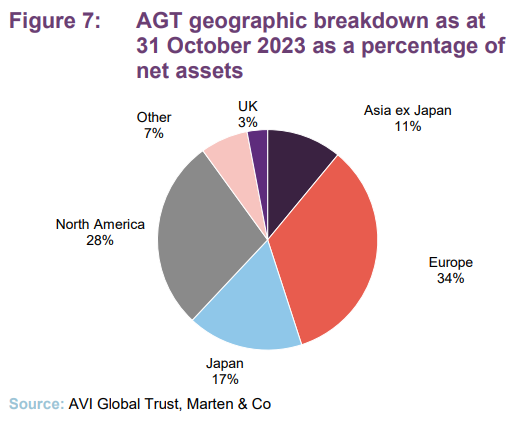

Relative to the position at the end of January 2023 (the data used when we last published), AGT has a lower exposure to the Europe and higher exposure to North America. The split between holding companies, closed-end funds and Japan has barely changed.

Gearing was ramped up in early 2023 (but not to particularly high levels), reflective of the opportunities for discount narrowing that the team was observing rather than a call on the direction of markets. As of 31 October, AGT’s gearing was 4.2%.

Recent trades

The team materially reduced the positions in Pershing Square and EXOR, and sold out of Eurazeo. Profits were taken on Christian Dior. Investments in Fujitec and Spectrum Brands were a success and the positions were sold. The decision was taken to switch more of the portfolio into positions with more certain catalysts for a re-rating. The desire was to create a portfolio with more exposure to idiosyncratic returns, to avoid a reliance on rising markets.

Private equity exposure now more focused

The proceeds were used to top up Schibsted and FEMSA. The basket of private equity stocks was rationalised – selling HarbourVest, abrdn Private Equity Opportunities and NB Private Equity and adding materially to stakes in Pantheon International and Princess Private Equity, where the team saw greater scope for successful engagement. These two stocks are discussed on page 11. In addition, a new position was built in Hipgnosis Songs Fund (see page 12).

New basket of Japanese regional banks

A position was built in a basket of Japanese regional banks in anticipation of an easing of yield curve controls. Regional banks had lagged larger banks in this regard. The AVI team feels that it helps that it is often investing alongside large activist investors in these stocks. The weak yen is still undermining the returns from AGT’s Japanese investments. However, AVI says that the TSE’s call for cost of capital disclosures and for action to ensure that companies trade at a premium to book value are driving further corporate governance improvements.

News Corp

News Corp has some high-quality assets, including a stake in REA Group (Australia’s leading online real estate portal), Harper Collins (a large, high-margin publishing business that is a beneficiary of digitalisation) and Dow Jones, which – in addition to the Wall Street Journal – holds a pricing database covering niche areas such as oil contracts and shipping rates. The group has high margins and ROC, and trades on a big discount to AVI’s assessment of its NAV. This may reflect a ‘Murdoch governance’ and conglomerate discount. AVI believes that the attempt to merge with Fox was a mistake, but shareholders managed to block the idea. A planned sale of a non-core real estate portal in the US (which is ranked third or fourth in its market) fell through.

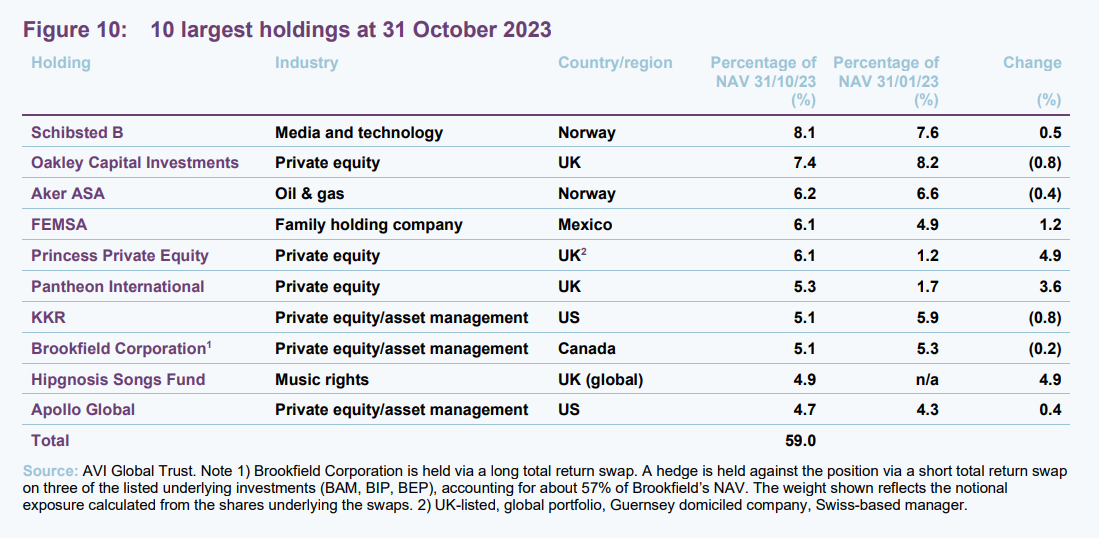

Top 10 holdings

AGT’s portfolio remains relatively concentrated, with the top 10 accounting for 59.0% of the portfolio.

Since we last published using data as at the end of January 2023, EXOR, Pershing Square and Christian Dior have dropped out of the list to be replaced by Princess Private Equity, Pantheon International and Hipgnosis Songs Fund.

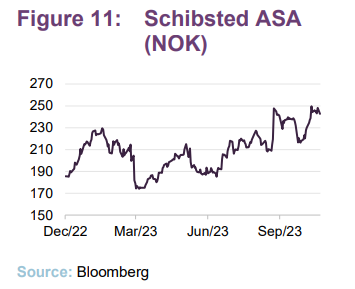

Schibsted ASA

As we discussed in our last note, AVI was attracted to Schibsted because it thought it was trading at a big discount to the sum of its parts and that there might be an opportunity to monetise its stake in online classified ad business Adevinta.

Schibsted had a poorly-received capital markets day in March 2023. However, the price has recovered since. The jump in September reflects news that Blackstone and Permira had issued a non-binding takeover proposal for Adevinta. Adevinta said that as part of the deal, eBay and Schibsted would retain part of its current shareholding.

There is no guarantee of success for the bid, but the team feels that if it failed, there would be greater pressure on the Schibsted board for a spin-off.

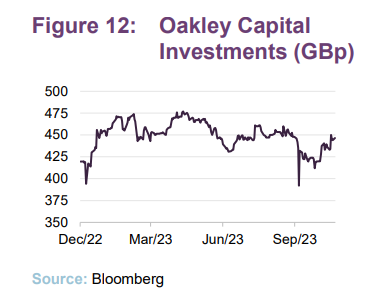

Oakley Capital Investments (OCI)

The AVI team comments that Oakley Capital Investments’s NAV has been relatively flat this year after a very strong run, but the team feels that this is not a bad result in the current environment.

AGT would like to see some action on share buybacks, but recognises that Oakley needs to balance this against its commitments. We would also observe that OCI’s discount has narrowed over the past 12 months.

The AVI team liked OCI’s announcement of a new €190m commitment to Oakley Origin II. That fund will be focused on lower mid-market buyouts, which AVI feels is a key area of strength for Oakley. Oakley is deploying capital into what is more of a buyers’ market. Recent investments include Thomas’s London Day Schools, a dental labs business, an AI-powered marketing platform, and a software business targeting the transport and logistics market.

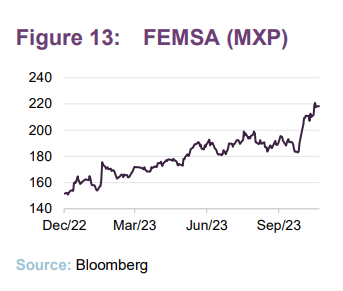

FEMSA

FEMSA has been performing well. It sold a stake in Heineken for €3.2bn earlier this year and also issued a €0.5bn bond exchangeable into Heineken shares. It took the opportunity to pay down debt. FEMSA is merging its US distribution business with a rival, releasing $1.7bn of cash and leaving it with a 37% stake in the enlarged business. FEMSA does still own its stake in the Coca Cola bottling company.

The AVI team says that as FEMSA becomes a purer play on the strength of the Mexican consumer, it is attracting greater interest from investors. Nevertheless, it thinks that it still looks attractively valued, particularly relative to a comparator such as Walmex.

Q3 results showed a 20.8% increase in revenues for Proximity Americas, the convenience store division. FEMSA is also seeing fast growth in users of its mobile payments app – Spin by OXXO. It looks as though it is on track to meet its target of 10m users by the year end, up from 5.3m at the start of 2023. A new loyalty card operation, Spin Premia, is also growing quickly, reaching 36.6m users by end September 2023.

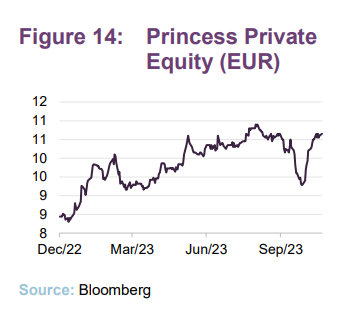

Princess Private Equity

Princess Private Equity is a London-listed global private equity fund with a Swiss-domiciled but global manager, Partners Group AG, which has over $142bn of AUM.

Some years ago, Princess opted to shift its portfolio from investments made through limited partnership funds to direct investments. Now, the portfolio is almost all direct (98.8% at 30 September 2023). About 57% of the portfolio is in small/mid-cap buyouts and just under 35% in large/mega-cap buyouts. Over five years, Princess has beaten the MSCI World Index in NAV terms but it has lagged recently. The fund pays out 5% of NAV each year in dividends.

AVI notes that Princess has a new chairman (Peter McKellar – ex head of private markets at Standard Life Aberdeen and deputy chairman of Asset Co). The team feels that the direction of travel with this trust is good. A new capital allocation policy should be forthcoming, which could see Princess contemplating buybacks.

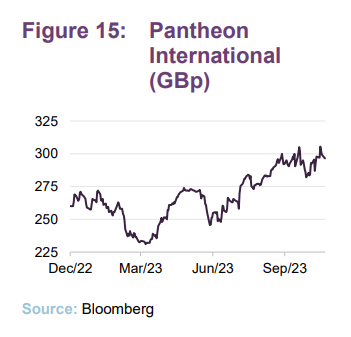

Pantheon International

Pantheon International is another London-listed private equity company. It has assets of about £2.3bn but its portfolio is more exposed to growth capital (20% of the portfolio at 31 August 2023) and to limited partnership funds (67%) than Princess. While fund of funds on average trade at wider discounts than direct-investing peers, Pantheon International has re-orientated its portfolio over the years towards co-investments and secondary direct deals that provide it with more balance sheet flexibility. However, Pantheon International still trades on a wide discount to NAV despite long-term performance that is well ahead of the MSCI World Index (average 13.9% per annum NAV returns over 10 years ended 30 September 2023 as compared to 12.0% for the index).

The AVI team engaged with chairman John Singer, exploring possible ways to tackle the fund’s wide discount. The team feels that, on a 45%-ish discount to NAV, it is hard to justify prioritising new investments over share buybacks. The Pantheon International board implemented a £150m tender offer and intends to buyback a further £50m of shares by the end of May 2024. It will keep further returns of capital under review.

The AVI team emphasises that the argument here is not that Pantheon or any other trust should be trying to drive down its discount, but rather that boards should be focused on accessing the best returns on investment.

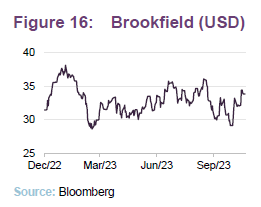

Brookfield

Brookfield comprises listed stakes in its asset management business and in closed-end funds it manages, a real estate portfolio and some unlisted positions. AGT’s exposure to the underlying listed positions has been shorted. The remainder trades on an implied negative value. The extent of this is that the property portfolio equity value could be written down by 75% and the shares would still be trading on a 26% discount to NAV. The AVI team thinks that such a decline is unlikely given the portfolio’s exposure to many high quality trophy assets. Negative headlines may continue but there is scope for capital returns through tender offers and share buybacks. It could also spin off more assets – just 25% of the asset management business has been spun out to date.

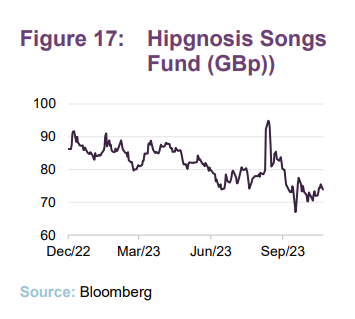

Hipgnosis Songs Fund

Hipgnosis Songs Fund moved to trade at a discount to NAV at the start of 2022 and that discount widened significantly over August/September 2022. A significant negative was a decision to take on significant leverage to fund portfolio acquisitions, and a failure to fix the cost of the fund’s debt until after rates had spiked higher. With a continuation vote looming, pressure grew for a partial realisation of its portfolio to fund share buybacks. In the event, the proposal put forward was to sell a fifth of the portfolio to a fund with links to the manager at a headline price of a 17.5% discount to NAV that would have worked out as an even worse deal for SONG shareholders once taxes and deal costs were taken into account.

AVI was vocal in its opposition to the deal and, given the loss of faith in the board and the manager that accompanied this proposal, recommended that investors vote against SONG’s continuation. The team increased the position in SONG to around 5% of the portfolio ahead of the votes.

Concurrently, SONG revealed a significant over-accrual of revenue in respect of CRB III. Its board said that, as a result, SONG would not pay a dividend that had already been declared.

Both the disposal and continuation were voted down convincingly. Shareholders also opposed the re-election of the chairman. Two other directors stood down before the vote.

Now AVI feels that it is critical that SONG has the right board in place to decide on the next steps for the fund. SONG has said that it will not pay dividends for the remainder of its financial year as it needs to conserve cash to meet bonus payments on previous catalogue acquisitions.

The new board will need to have a dialogue with the lenders about covenants. It may also be necessary to revisit catalogue disposals, but in circumstances that are more favourable to third-party bidders – AVI felt that third parties were given insufficient time for due diligence in the previous exercise. In addition, the manager’s right to match any bid may have been offputting, and the NDA terms were thought to be too onerous.

Other portfolio developments

Longstanding position Symphony has announced that it will adopt a managed wind-down policy.

Digital Garage

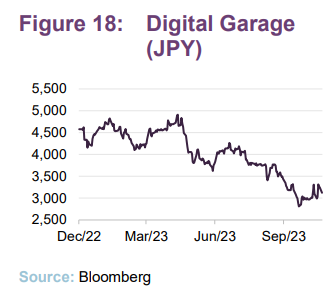

The AVI team has announced that it has strong concerns about the actions of the Digital Garage board and plans to vote against the election of that company’s directors at its next AGM in June 2024.

Across its funds, including AGT, AVI controls a 3% stake in Digital Garage, a company that it has been invested in since 2018. AVI highlights the market’s disappointing reaction to an underwhelming medium-term management plan and the company’s inefficient balance sheet, which includes a sizeable stake in Kakau.com. AVI also feels that the Digital Garage board needs shaking up.

Performance

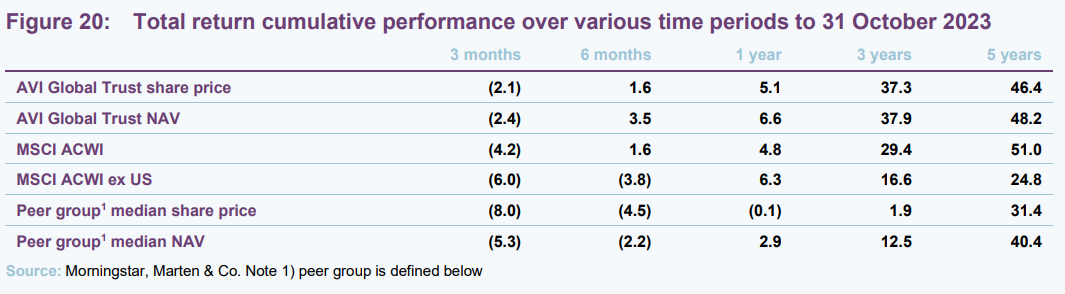

The team is happy with AGT’s returns for the financial year ended 30 September 2023, which were well ahead of both its old and new benchmarks. As Figure 19 shows, in recent years the new benchmark has been harder to beat.

Contributions to returns

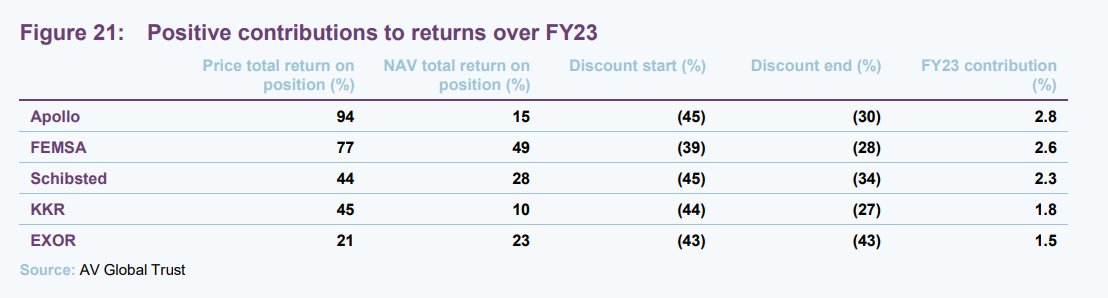

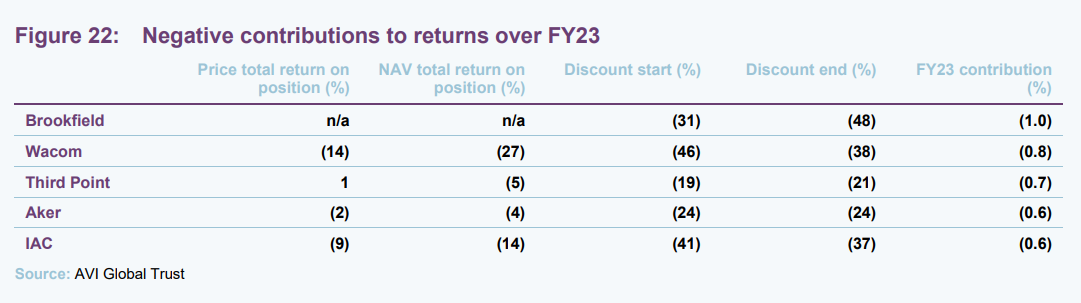

AVI has supplied us with some performance attribution data for the financial year ended 30 September 2023.

Many of these have been discussed earlier in the note. Apollo and KKR were affected by the sell-off in March 2023, related to the collapse of SVB. AVI says that at the time, there was concern over the outflows from Apollo’s insurance business but they disagreed with this premise. 80% of annuity policies had protections in the form of early termination policies. The team added to the position at the lows and it recovered strongly.

The AVI team describes Third Point’s NAV performance as disappointing. Aker was hit by a fall in the oil price. The position in Brookfield was hedged but the underlying discount widened.

Peer group

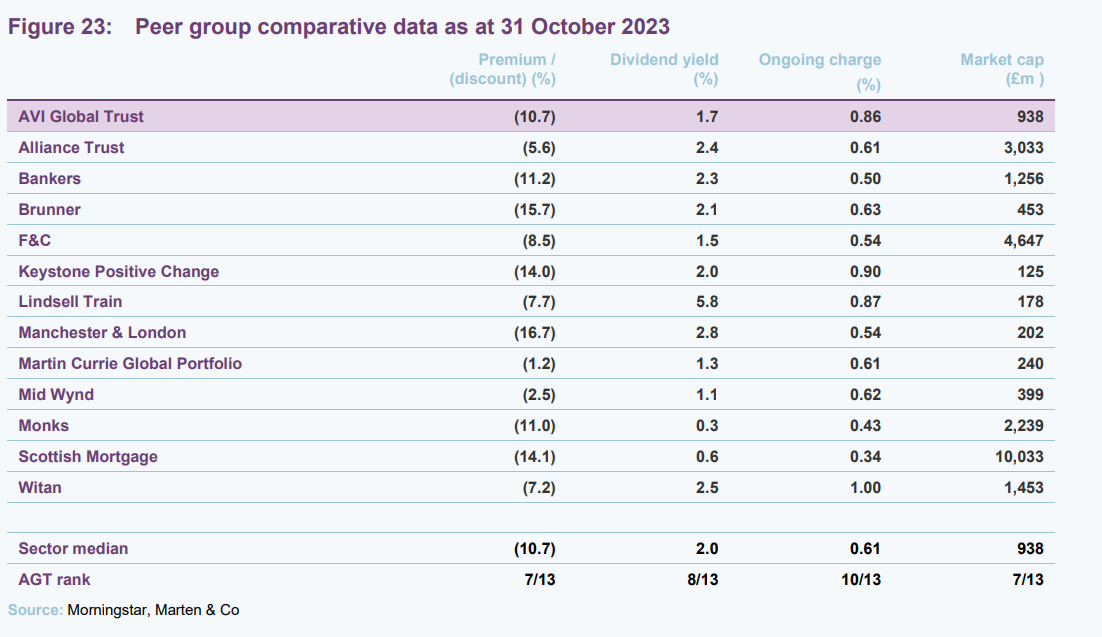

AGT is a constituent of the AIC’s Global sector. For the purposes of this note, we have compared AGT with the other members of this sector. The members of this peer group invest predominantly in listed equities.

AGT’s discount has narrowed relative to this peer group since we last published. Its yield is about middle of the pack, although none of these trusts invests with the primary intention of generating a high yield. AGT’s ongoing charges ratio is at the higher end of this peer group, but we would argue that none of these figures is particularly high.

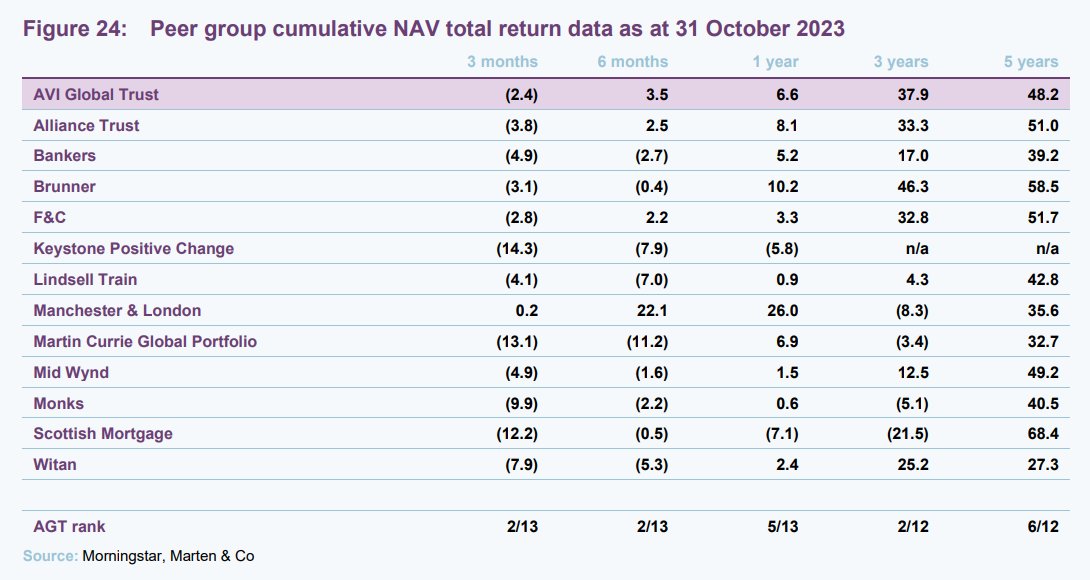

Although widening discounts have weighed on AGT’s NAV, it is one of the best-performing global investment companies over the past few years.

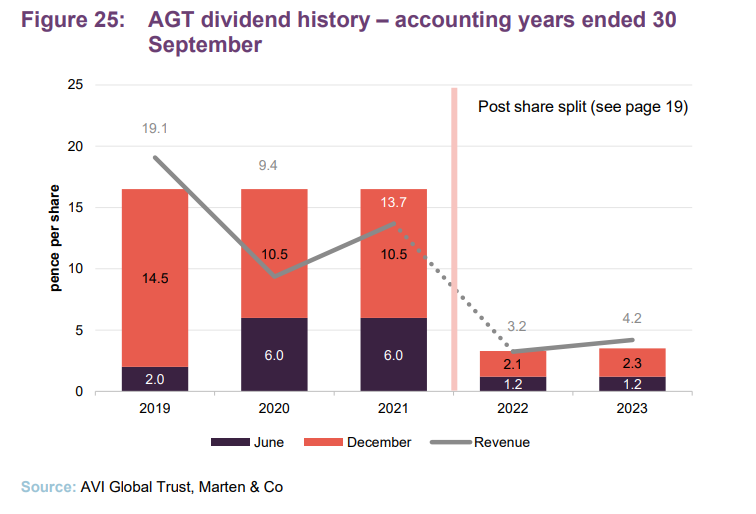

Dividend

AGT normally declares two dividends per year, an interim in June and a final in December.

After a run of years when factors such as COVID meant that AGT’s revenue did not cover its dividend, the 12 months ended 30 September 2023 delivered net revenue per share of 4.19p, more than sufficient to cover dividends totalling 3.5p and allowing the trust to rebuild its revenue reserves which now stand at £32.3m, equivalent to 7.0p per share.

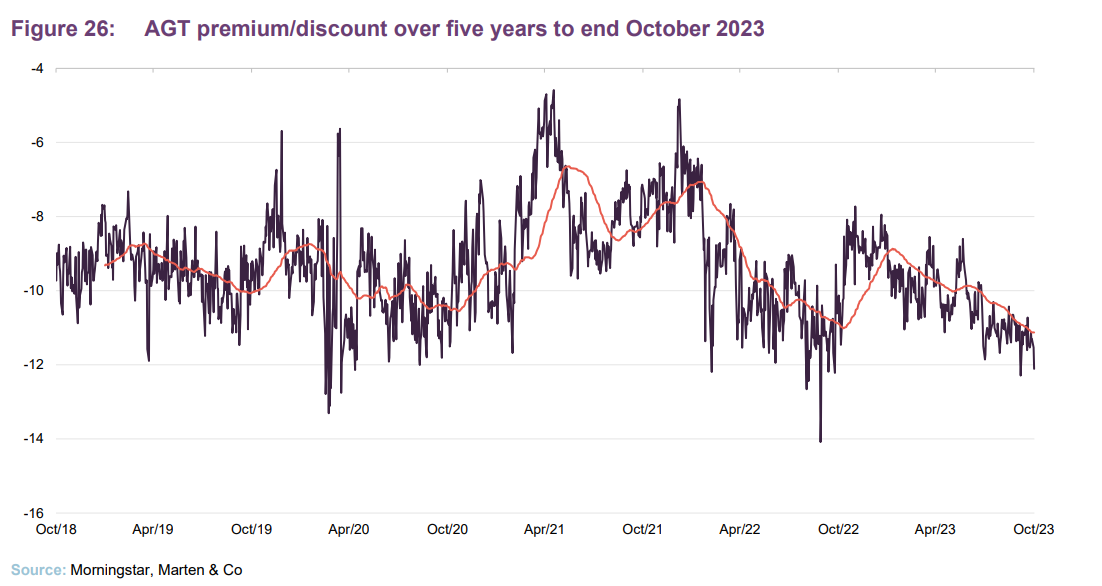

Discount

Over the 12 months ended 31 October 2023, AGT’s discount moved within a range of 12.3% to 7.7% and averaged 10.0%. At 19 November 2023, AGT’s discount was 10.7%.

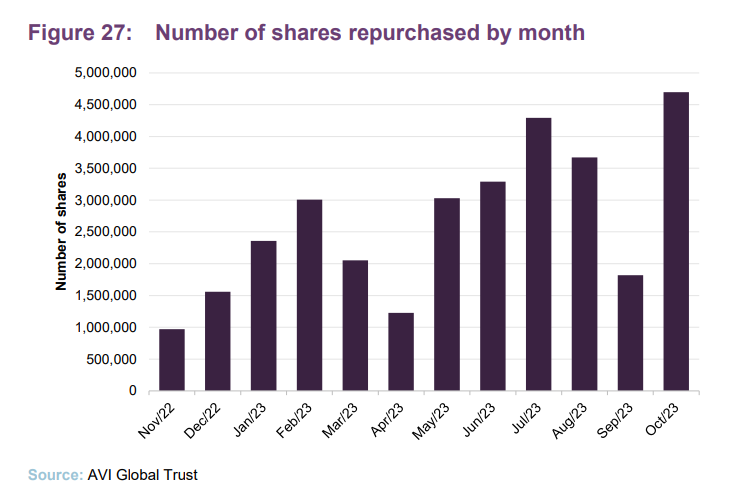

At the AGM in December 2022, shareholders approved resolutions empowering the board to buy back up to 14.99% of its then-issued share capital and issue up to a third of its then-issued share capital. A separate resolution granted permission for 5% of the then-issued share capital to be issued without pre-emption.

AGT’s board uses share buybacks with the intention of limiting volatility in AGT’s discount. Over the 12 months ended 31 October 2023, around 32.0m shares or 6.5% of the shares in issue at the start of the period were repurchased. Buying back shares at a discount enhances the NAV per share. AGT’s estimate of the benefit of buybacks over the 12 months ended 30 September 2023 is about 0.6% of NAV.

The board also employs a marketing budget (administered by the investment manager) with the aim of stimulating demand for the trust’s shares.

Fees and costs

The investment manager is entitled to an annual management fee of 0.70% of the first £1bn of AGT’s net assets and 0.60% of any net assets above £1bn. The fee is calculated quarterly by reference to the net assets at the preceding quarter end and paid monthly.

The investment management agreement can be terminated on six months’ notice.

For accounting purposes, 30% of the management fee is charged against revenue and the balance against capital.

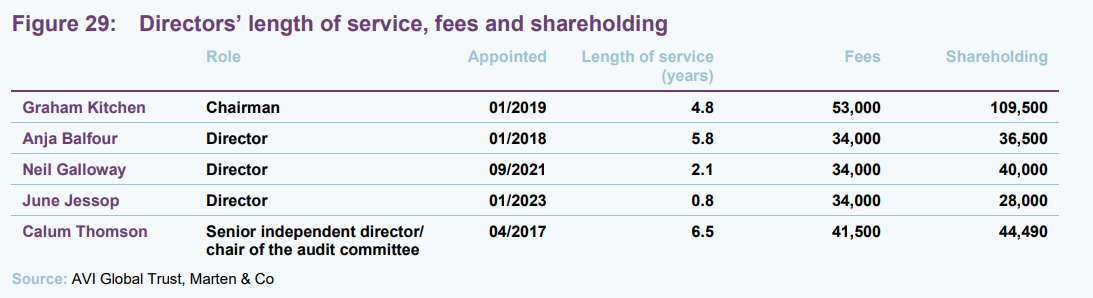

A breakdown of directors’ fees is shown on page 21. For the year ended 30 September 2023, the only other expenses of note were marketing expenses of £573,000 (FY22: £570,000), advisory and professional fees of £360,000 (FY22: £560,000), and depositary fees of £123,000 (FY22: £144,000).

The ongoing charges ratio (based on the trust’s own running costs) for the year ended 30 September 2023 was 0.86%, down from 0.88% for the prior year.

In previous years, AGT has disclosed its share of the underlying costs charged by the managers of the funds that it invests in. For the accounting year ended 30 September 2023, this has not been published.

London-listed investment companies cost disclosures

For some years now, a problem has been brewing with respect to the rules around cost disclosures. In AGT’s report and accounts for the financial year ended 30 September 2023, the trust published an ongoing charges figure of 0.86%, down from 0.88% for the prior year. That figure includes all of the ongoing running costs of the company, including the manager’s fee.

In accordance with AIFMD and MiFID rules, platforms, wealth managers, IFAs and the like – each of which have to disclose charges to their customers – have been aggregating all the costs associated with making an investment. For investment companies, this includes a look-through cost that incorporates any underlying charges incurred where an investment company holds another fund. This has the effect of inflating the cost figure, making some funds look prohibitively expensive.

The AGT board’s stance is that this is a misleading approach as the costs included within the trust’s underlying investments are already factored into the assessment of the fair value of those investments. Putting it another way, AVI’s choice of investments should reflect the risk/return opportunity for AGT rather than which investment will look better from a cost disclosure point of view.

This argument holds true for all investors. There is a groundswell of opinion that the problem can be rectified if London-listed investment companies are no longer classified as Alternative Investment Funds. A private members bill has been put forward in the House of Lords to that effect.

Capital structure and life

AGT has 502,247,868 ordinary shares in issue, of which 45,600,956 shares are held in treasury. The number of total voting rights is 456,646,912. There are no other classes of share capital. AVI Global subdivided its shares on a five for one basis with effect from 17 January 2022.

AGT does not have a fixed life. Its financial year end is 30 September and its AGMs are usually held in December.

Gearing

AGT has a JPY12bn unsecured multicurrency RCF provided by Scotiabank Europe Plc which runs until 26 August 2024. The interest cost depends on which currency is being drawn as follows:

- Japanese yen 1.025% margin over the Tokyo unsecured overnight rate (TONAR);

- Pounds sterling 1.42% margin over SONIA (sterling overnight index average);

- US dollars 1.25% margin above the secured overnight financing rate (SOFR);

- Euros 1.25% margin above the Euro short-term rate (€ STR).

Undrawn balances below JPY2.0bn are charged at 0.35% and any undrawn portion above this is charged at 0.30%.

Under the terms of the facility, the covenant requires that the net assets shall not be less than £300m and the adjusted net asset coverage to borrowings shall not be less than 4:1.

AGT has also issued five loan notes:

- £30.0m of 4.184% series A unsecured loan notes 15 January 2036;

- £30.0m of 3.249% series B unsecured loan notes 15 January 2036;

- €20.0m of 2.93% Euro senior unsecured loan notes 1 November 2037;

- JPY8bn of 1.38% senior unsecured loan notes 6 July 2032; and

- 5bn of senior unsecured loan notes 25 July 2033.

At 17 November 2023, the effect of valuing the loans at fair value was to increase the NAV by 3.27p per share.

At 31 October 2023, AGT’s net gearing was 4.2%.

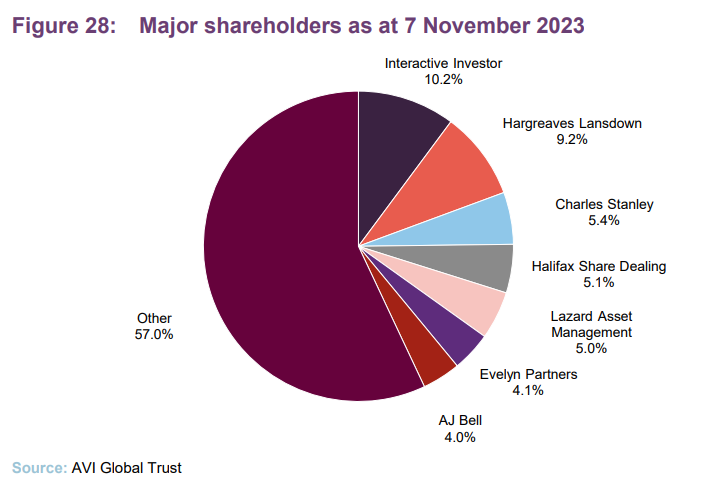

Major shareholders

Board

AGT has five directors, all of whom are non-executive, independent of the manager and do not sit together on other boards.

Susan Noble retired as chairman and as a director on 10 December 2022. Graham Kitchen stepped up as chairman on that date.

Graham Kitchen

Graham has over 25 years’ experience as an investment manager at Invesco, Threadneedle and, until March 2018, Janus Henderson, where he was global head of equities.

He was previously chair of the investment committee for the Cancer Research Pension Fund, member of the investment committee of the charity Independent Age, and chairman of Invesco Perpetual Select Trust Plc.

Graham is interim global head of investment strategy at Perpetual Group, chairman of Perpetual Asset Management UK Limited and Trillium Asset Management UK Limited, and a non-executive director of The Mercantile Investment Trust Plc and Places for People.

Anja Balfour

Anja has over 20 years’ experience in managing Japanese and international equity portfolios for Stewart Ivory, Baillie Gifford and Axa Framlington.

She is chair of The Global Smaller Companies Trust Plc, a member of the Finance and Corporate Services Committee of Carnegie UK Trust, and a non-executive director of Scottish Friendly Assurance Society.

Previously Anja was chairman of Schroder Japan Growth Fund Plc, a trustee of Venture Scotland and a non-executive director of Martin Currie Asia Unconstrained Trust Plc.

Neil Galloway

Neil has 25 years’ experience living and working internationally. Currently based in London, he has spent most of his career working in Asia but also has experience in the Americas, Europe and the Middle East. Following a successful banking career, he has held senior finance and management roles, almost entirely with or for family-controlled companies, overseeing finance, treasury, risk management, legal, IT, projects and business development, with experience in significant business transformation programmes in large and complex businesses. He is chief financial officer of Pepco Group NV.

Neil was previously executive vice president of IWG Plc, an executive director and CFO of DFI Retail Group Holdings Limited based in Hong Kong. His industry experience spans banking, hospitality, retail (mass market, luxury and franchise operations), real estate and services industries.

June Jessop

June was previously senior business manager at Stewart Investors and a member of the EMEA Management Committee of First Sentier Investors (of which Stewart Investors is a sub-brand).

She has spent 30 years in financial services, gaining broad experience in portfolio management, client relationship, business development and, latterly, general management roles. June has been an investment manager for institutions, charities and private clients, including managing assets of an investment trust and investing in investment trusts on behalf of clients.

Calum Thomson

Calum is a qualified accountant with over 25 years’ experience in the financial services industry, including 21 years as audit partner at Deloitte LLP, specialising in the asset management sector. He has wide-ranging experience in auditing companies in the asset management sector and latterly as a non-executive director and audit committee chairman.

Calum is non-executive director and audit committee chairman of The Diverse Income Trust Plc, The Bank of London and The Middle East Plc, Ghana International Bank Plc, abrdn Private Equity Opportunities Plc, and Baring Emerging EMEA Opportunities Plc. He is also a non-executive director of Schroder Unit Trusts Limited and Schroder Pension Management Limited, chairman of The Tarbat Discovery Centre and a trustee of Suffolk Wildlife Trust.

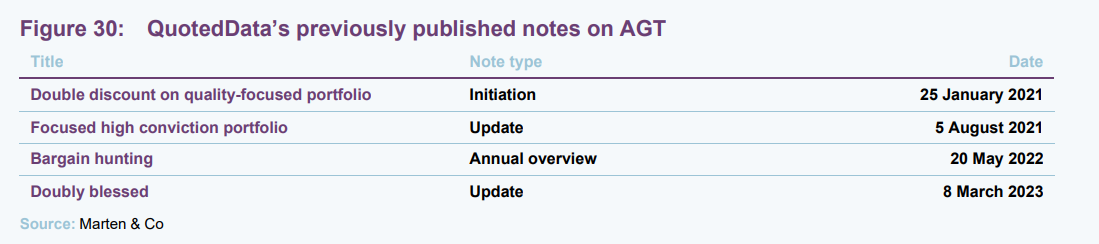

Previous publications

Readers interested in further information about AGT may wish to read our previous notes listed below.

Double discount on quality-focused portfolio

Focused high conviction portfolio

IMPORTANT INFORMATION

This marketing communication has been prepared for AVI Global Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.