AVI Japan Opportunity

Investment companies | Annual overview | 20 February 2024

The sun has risen

2023 has been a particularly noteworthy year for Japan, defined by impressive share price returns (at least in yen terms) and substantial progress in its path to improving corporate governance. The Tokyo Stock Exchange has implemented a series of new efforts to name and shame the worst governance offenders (such as pressuring companies to keep their P/B ratio over one). These efforts have already borne fruit, with Japanese equities outperforming even the US in local currency terms.

AVI Japan Opportunities Trust (AJOT) has been reaping the rewards of its own activism, with an outperformance versus its index over the year.

Unlocking value in Japanese smaller companies

AJOT aims to achieve capital growth in excess of the MSCI Japan Small Cap Index by investing in a focused portfolio of over-capitalised small-cap Japanese equities. Asset Value Investors leverages its three decades of experience investing in asset-backed companies to engage with company management and help to unlock value in this under-researched area of the market.

Why AVI Japan Opportunity?

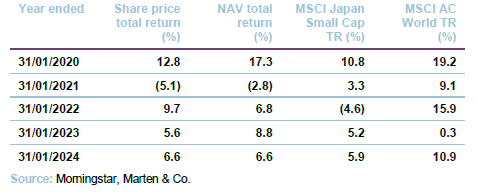

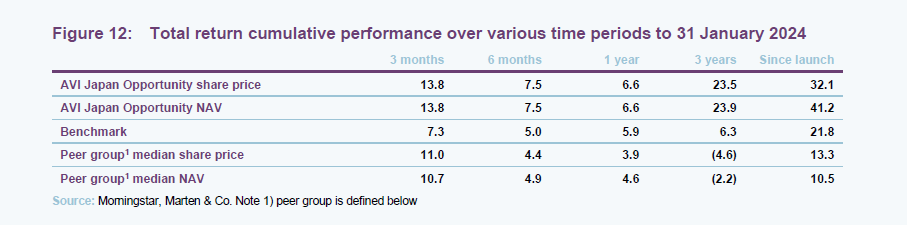

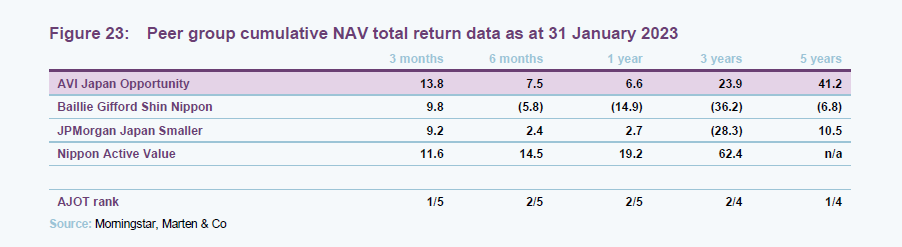

AJOT has now passed its five-year anniversary, having launched in October 2018, and has built a track record of outperformance of both its performance benchmark (MSCI Japan Small Cap Index) and its peer group, delivering an NAV return of 21.5% from launch to the end of January 2024. AJOT was launched to capitalise on the opportunities that can be unlocked through corporate activism in the Japanese small cap market, by resolving key issues which have substantially hampered shareholder returns.

- The Japanese market is undervalued.

- Smaller capitalisation stocks, AJOT’s hunting ground, have lagged larger-cap stocks by a significant margin.

- AJOT is able to identify a deep pool of cash/asset-rich, good-quality companies whose valuations do not reflect these attributes.

- AJOT is a beneficiary of a trend towards improved corporate governance and higher levels of corporate activity within Japan.

- Demonstrably, its engagement activities are unlocking the latent value within the companies in its portfolio.

As an indication of the scale of the opportunity, at the end of December 2023, the portfolio was trading on 8.7x EV/EBIT versus a median for the MSCI Japan Small Cap Index of 15.0x. In addition, as an indication of just how much excess cash was sitting on the balance sheets of portfolio companies at the end of December, on a weighted average basis 49% of the market cap of the portfolio was comprised of cash, investment securities (less capital gains tax) and the value of treasury shares less debt and net pension liabilities.

Fund profile

AJOT is an investor in Japanese companies. Its focus is on good-quality small- and mid-cap listed companies that have a large portion of their market capitalisation in cash, listed securities or other realisable assets. AJOT’s manager seeks to engage proactively with these companies to unlock their value potential.

More information is available at the fund’s website www.ajot.co.uk

AJOT’s AIFM and investment manager is Asset Value Investors Limited (AVI). The lead manager working on AJOT’s portfolio is Joe Bauernfreund, one of a seven-strong team focused on Japan, one of whom is based permanently in Japan, and the majority of whom are Japanese-speakers.

AVI was established in 1985 to manage what is now AVI Global Trust (AGT) and has AUM of about £1.3bn. AVI began investing in Japan over three decades ago and AJOT was launched in October 2018 to focus on the opportunities presented by that market. At the end of January 2024, AVI owned 1,500,000 shares in AJOT.

AVI and its employees are aligned with shareholders

AJOT compares its performance to the MSCI Japan Small Cap Total Return Index, expressed in sterling terms. The index does not inform AJOT’s portfolio construction. AJOT will have a high active share relative to the performance benchmark.

Market backdrop

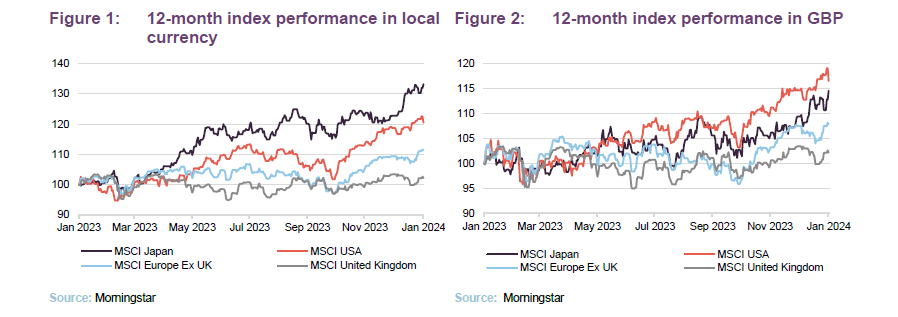

Globally, 2023 was a year in which markets were dominated by headlines about artificial intelligence and inflation. Returns in Europe and the UK were lacklustre. In the US, a ‘Magnificent Seven’ mega caps dominated returns, while most other stocks went sideways. However, Japan’s stock market bucked the trend.

Japanese equities have generated impressive performance over 2023

The success of the stock market is not so much a reflection of the region’s wider economic fortunes, but rather its increasingly shareholder-friendly reforms, many of which have been documented in our past notes and which have been supportive of AJOT’s investment style.

Japan’s macro picture showed some of the same characteristics seen across the developed world, such as positive – but ultimately low – GDP figures. Japan’s economy shrank 0.7% in the third quarter of 2023, following two quarters of positive growth (1.2% in Q1 and 0.9% on Q2). We note that Japan unexpectedly reported a negative (0.4%) growth for the fourth quarter of 2023, tipping the country into a technical recession. Japan’s economic outlook is expected to improve over 2024 however, supported by a weak currency and stronger external demand.

Comparing Figure 1 and Figure 2, it is clear that overseas investors were stung by the Japanese yen, which depreciated versus all major currencies over the year and cost sterling investors some 18.6% in performance.

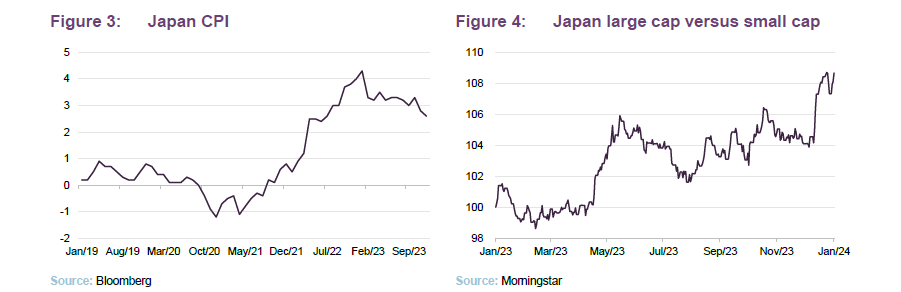

The yen’s weakness reflects the easy-money policy stance of the Bank of Japan, which has stuck by its yield curve control policy that has been keeping interest rates artificially low. This despite the emergence of meaningful inflation in the country, which peaked at around 4.4%, and even led to some wage inflation.

The AJOT team sees a reasonable chance of a rebound of the yen over the near-to-medium-term, which would be a powerful tool for enhancing overseas investor returns. Interest rates seem likely to fall again in the US, Europe, and the UK; the Bank of Japan may be easing its foot off the pedal slowly, but it does seem to favour some gradual return to positive rates; and a rising stock market could encourage inflows from overseas investors.

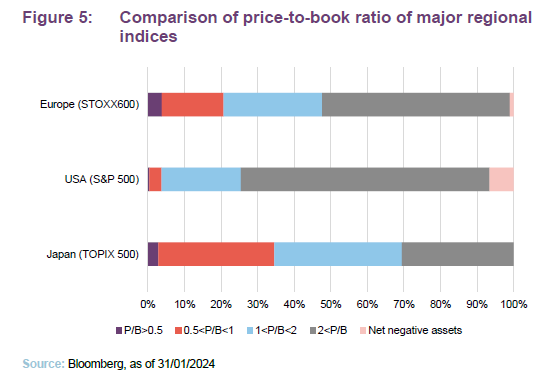

A weak yen has favoured large caps over small

The weak yen is often supportive of Japan’s largest companies, typically the global export giants, such as Toyota, Mitsubishi, and Sony. Japanese small caps, however, are more domestically focused, and have not benefited quite as much. This goes a long way to explaining the outperformance of Japanese large caps over small ones, with the MSCI Japan outperforming the MSCI Japan small cap by 8.7% over the last 12 months, as can be seen by Figure 4.

Corporate governance – a year to remember

2023 was a year that saw substantial reforms implemented in Japan’s equity market

In a transformative shift, the Tokyo Stock Exchange (TSE) has been implementing several reforms designed to force the hand of management teams and address key issues which have been a barrier to governance reforms, reduced shareholder value, and ultimately increased the cost of capital for Japanese equities. Some of the headline changes include:

- Listed companies asked to disclose policies and initiatives to improve share price considering cost of capital, especially if trading on a price-to-book-ratio (P/B) of one or less.

- Prime market firms (c.1,600 companies) are required to simultaneously disclose key information in both English and Japanese.

- The TSE has announced that it will end the grace period for meeting the new listing criteria for prime listing in March 2025.

- The TSE has published a framework of actions it expects boards and management to pursue in an effort to improve valuations.

- The TSE will implement a “name and shame” regime, flagging the companies which are failing to implement actions to improve their governance and shareholder returns, releasing a list every month.

- The TSE will also regularly consult with investors and publish their opinions on the measures taken by Japanese companies.

- Further scrutiny of parent-subsidiary listings and cross-company ownership.

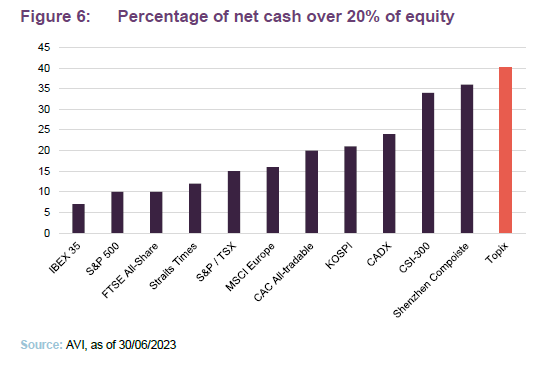

This list is by no means exhaustive and does not convey the finer nuances of the TSE policies; however, it does show a very serious intention to address the key issues that have been dogging Japanese equity valuations. Figure 5 shows the scale of the problem, with Japan having the largest portion of companies on a P/B ratio below one.

Work still remains to be done to bring Japan’s valuations in line with the rest of the developed world

2023 saw another year of increased cash utilisation, with a record number of buybacks and dividends made (a total of ¥28tn in dividends and buybacks). However, despite this progress, Japan still remains home to the most overly capitalised companies of any equity market, as seen by Figure 6. This means that despite 2023 being the best-ever year for shareholder activism in Japan, with 71 proposals made by activist funds so far, and Japan taking the crown as the second-largest market for activist investors, a substantial amount of work still remains to be done before Japanese governance practices catch up with their developed market peers.

There have nonetheless been upsides from the reforms, and more than simply increasing the share prices of Japanese equities. Japan’s shareholder yield (the combination of dividend yield and share buyback yield) exceeds that of the S&P 500, with the MSCI Japan reporting a 3.5% yield versus the 2.7% yield of the S&P 500. This reflects the weight of cash being released from Japan’s over-capitalised balance sheets.

Investment process – how the portfolio is selected

Start with a simple quantitative screen

AVI begins by screening the market for companies with excess cash/listed securities. A simple metric for this is to identify companies with greater than 30% of cash relative to their market cap. The data is not always accessible – it takes a lot of work for the analysts to find the true figures – for example, sometimes the cash has been lent to the parent company. Screening out the most illiquid companies leaves a pool of about 900 companies.

Not all of these are great businesses – many are effectively zombie companies existing just to provide employment or to service pension payments. It can take time for activism to bear fruit. A poor-quality investee company could destroy value faster than AVI can unlock it.

Exclude loss-making and highly cyclical businesses

The next step, therefore, is to exclude loss-making and highly cyclical businesses. AVI wants to invest in companies of reasonably good quality, with resilient business models and the prospect of healthy profit growth. The targets are solid and sometimes high-margin businesses. This leaves about 200 companies.

AVI quantifies the fundamental value of these companies using measures such as EV/EBIT – sometimes these are negative and almost all are at least low single digits.

Identify route to unlocking value

The next question is how might AVI go about unlocking value; for example, are there like-minded shareholders? This step includes dialogue with other key stakeholders. Following this part of the process, the target list will have been whittled down to fewer than 100 companies.

Portfolio construction

From the target list, the manager maintains a single digit number of ‘ready to go’ opportunities on which it has performed detailed due diligence.

Each stock in the portfolio should have the potential to outperform the market on its quality and growth merits. Additional alpha comes from the events that unlock the underlying value.

20–30 positions

AJOT is managed with about 20–30 positions and AVI is happy for AJOT to be at the low end of this. The manager applies a risk overlay to ensure that the portfolio is not over-exposed to any one sector or group of companies. The constituents of the portfolio would be roughly equally weighted, but position sizes vary with respect to the strength of the manager’s conviction and the stock’s liquidity. In addition, positions in stocks where AJOT is engaged in an active campaign to unlock value may be higher.

Ahead of a purchase, the analysts will prepare an internal note on the suitability of a stock and an allocation decision will be made based on liquidity.

Generally, AVI is prepared to be patient – it can take time to get alignment amongst stakeholders. The manager would exit a position if it became clear that the desired result was not achievable or if it felt that the quality of the stock had deteriorated markedly.

AVI’s approach to engagement

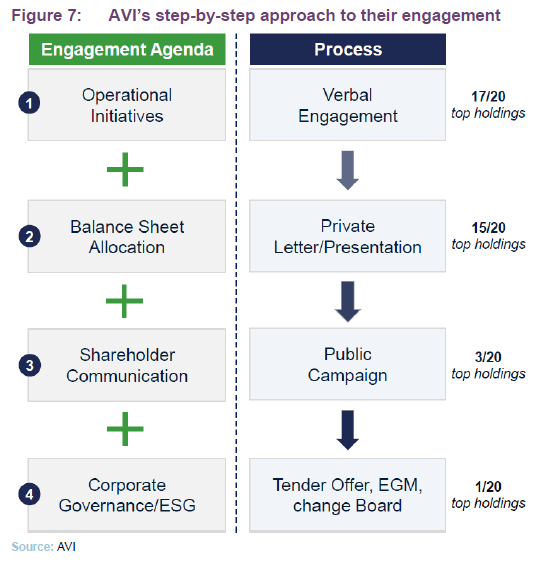

No companies are truly alike, and thus AVI’s approach to engagement must be tailored to the idiosyncrasies of each company’s business model, and the governance issues that AVI is trying to remedy. However, AVI does not generally aim to take a hostile or overly aggressive approach to activism; rather, it aims to work with their management teams to find co-operative solutions to these companies’ problems – a process which allows multiple successful campaigns within a single company, and also sees holdings spend multiple years in AJOT’s portfolio.

The team will seek to escalate the intensity of its campaigns if it is not seeing sufficient progress. Figure 7 shows the hierarchy of these activities. Note that for the majority of AJOT’s holdings, their campaigns will not be made public until after the outcomes have been announced. In rare cases AVI may go public, to apply additional pressure on management teams; or have to pursue policies that actively force management and boards to change their behaviour, through shareholders voting against them.

AVI will go public with its concerns if they cannot resolve them in private

Investment restrictions

There are no limits on sector weightings within the portfolio. It is not expected that, at the time of investment, any single holding (including any derivative instrument) will represent more than 10% of AJOT’s gross assets. However, AJOT has discretion to invest up to 15% of its gross assets in a single stock if a suitable opportunity arises.

There are no restrictions on AJOT’s exposure to stocks with any given market capitalisation, but the portfolio will normally be weighted towards small- and medium-sized companies.

Derivatives can be used for efficient portfolio management purposes and to provide gearing.

AJOT’s current campaigns

In past notes, we have covered a number of AJOT’s previous governance campaigns, including those for Fujitec and NC Holdings.

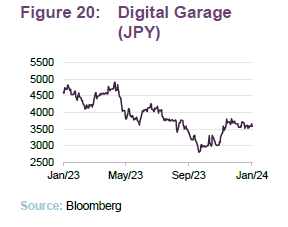

Digital Garage

Digital Garage is the most recent public campaign announcement at the time of writing, with AVI having publicly announced its concerns in November 2023. We note that the issues surrounding Digital Garage’s poor governance has led it to be one of AJOT’s few major detractors over the last 12 months, as we outline on page 17.

AVI’s concerns were based on Digital Garage’s corporate governance practices and directors’ credibility, with the company being unaligned with the direction of Japan’s governance reforms. Prior to going public, AVI sent two presentations and five letters to the company’s board to encourage corporate governance reforms and a clearer strategy, with all engagement so far carried out in private. Unfortunately, no new measures were announced in 2023, forcing AVI to go public, and announce that it intends to vote against the election of all directors at is 2024 AGM, and will aim to get other similarly-minded minority shareholders to vote in accordance.

The specific actions AVI intends to implement include: 1) measures to overcome poor performance and share price weakness, 2) reducing the capital invested in Kakaku.com which has consistently failed to generate synergies (it holds 20% of the company’s outstanding shares), and 3) resolving concerns over the composition of the board of directors that have been ignored. Relative to their closest peer, GMO Payment Gateway, Digital Garage has volume and profit growth approximately two-thirds that of GMO and has also significantly underperformed in share price terms.

AVI believes that Digital Garage’s poor performance, unconvincing growth strategy and inefficient holding structure have resulted in the company trading around 40% below its intrinsic value. More detail about AVI’s concerns surrounding digital garage can be found here.

SK Kaken

Here, we look at their ongoing public engagement with SK Kaken, whose primary business is the production of architectural finishing coating materials and fireproof insulation. AVI notes that its paint business is one of its most attractive business segments, given that it dominates Japan’s domestic industrial paint market.

In spite of its apparent quality, SK Kaken trades on a P/B multiple of 0.7 and its share price has languished, down 11.5% over the past 12 months.

The AVI team notes several key issues plaguing the company and which have been depressing shareholder returns. SK Kaken has only 410 shareholders, meaning it only narrowly meets the requirements for listing on the TSE Standard market. 40% of SK Kaken’s shares are owned by, and key senior executive positions held by, members of the founding Fujii family. These entrenched family positions, combined with the board’s average tenure of 15 years, have stifled innovation and progress within the company.

Following a lack of progress by other means, AVI has gone public with its attempts to reform SK Kaken’s business practices. Whilst SK Kaken could benefit from radical reforms, AVI has put forward reforms which it believes are easily addressable:

- The cancellation of 90% of the 438,400 shares held in treasury. SK Kaken currently holds 14% of outstanding shares in treasury.

- Increasing the dividend from ¥400 per share to ¥800, representing a 30% payout ratio. SK Kaken has retained earnings on its balance sheet, with cash and equivalents accounting for 71% of balance sheet assets.

More details of AVI’s campaign, and company presentation, can be read here.

Asset allocation

At the end of December 2023, AJOT’s gearing was 1.6%. The trust’s borrowing facilities mean that manager has firepower available to take advantage of any market weakness.

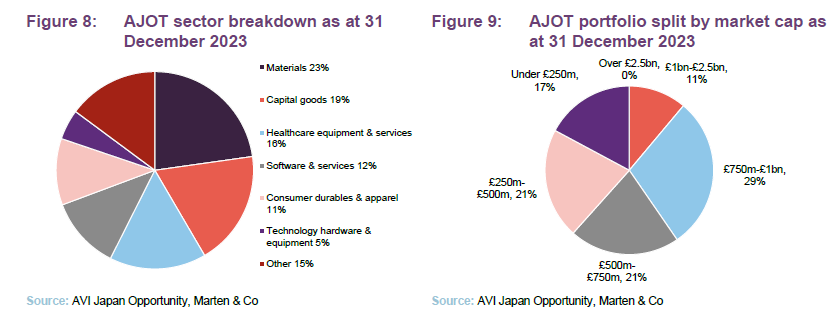

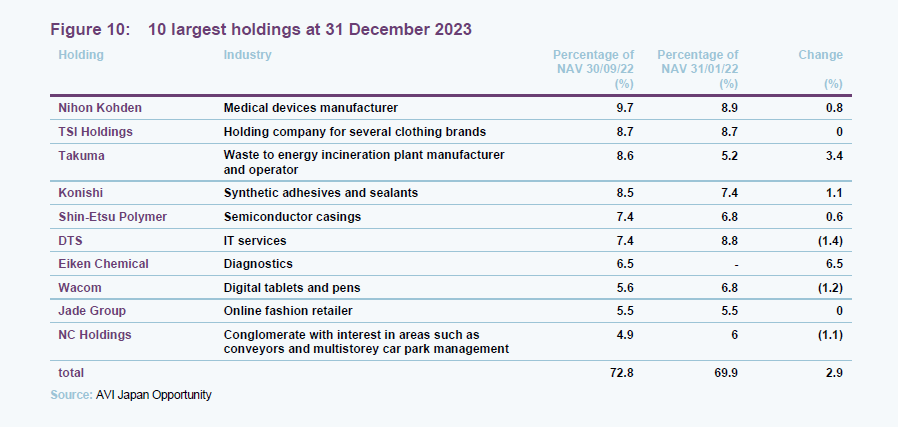

On 31 December 2023, AJOT had 22 holdings. After a period of higher turnover last year, with the team thinning down AJOT to focus on higher-quality companies, its allocation has remained steady. AJOT’s top 10 weighting has increased slightly since our last note, due to the comparatively large addition of Eiken Chemical, reflecting the team’s confidence in the opportunity.

The sector breakdown is a function of the manager’s stock selection decisions and changes since our last note (mainly the increased exposure to healthcare) reflect that.

Likewise, the shift from companies in the £500m-£750m range to those in the £750m-£1bn is also a consequence of stock selection and market movements.

10 largest holdings

AJOT’s top 10 holdings with one new entrant: Eiken Chemical.

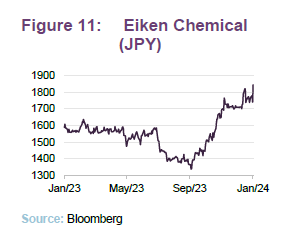

Eiken Chemical

The major purchase made by AJOT since our last note is Eiken Chemical (eiken.co.jp), which manufactures clinical diagnostics and equipment, and is a new holding for the team. Its chemicals and tools are typically used in the diagnosis of cancer, disease, and infections; with the products specialised enough to fill niche markets, which inherently puts up high barriers to entry, given the lack of competition and the complexity of developing solutions. One of its crown jewels is its colon cancer screening tests, which account for 40% of its sales, and are utilised regularly by the NHS. It also developed the LAMP method for the amplification of DNA, a lower-cost alternative for disease detection which has been described as “one of the most valuable tools in virtually all life science fields”.

Beyond the attractiveness of the company’s patented procedures, its business model is one that is indicative of a higher-quality company. It operates what the AJOT team believes is a ‘razor blade’-style model, generating the majority of its profits though the repeated sales of high margin tubes and solutions which are required to operate the analysing equipment. Another testament to its quality is the medical industry’s recognition of the accuracy and consistency of its products.

The AJOT team sees a strong valuation opportunity in Eiken (hence its entrance into the top 10 holdings, despite being a new purchase). The company trades on a low 8x EV/EBIT multiple compared to the 26x of its global peers. It is the belief of the AJOT team that this valuation gulf has emerged as a result of the complexity of its products, which can make understanding the company’s model difficult, the fall in price of medical reagents after COVID-19, and its cash-heavy balance sheet, with 32% of its assets being held as cash.

As with any of AJOT’s campaigns, they take time, however the team does note that Eiken’s management seem receptive to initial suggestions. The AJOT team envisages a c.100% upside if the 2030 plan is implemented, and a further 200% upside if it successfully launches and commercialises a DNA-based stool test.

Other trading activity

The team exited Fuji Soft and Pasona. Fuji Soft is a software firm, which the team first purchased to capitalise on the activism of another Singapore-based fund, which successfully appointed two new directors. After a privatisation rumour circulated around the company, its share price rose 17%, which brought it to a valuation that the team felt was sufficient, selling their position for a 18% annualised return (equivalent to a 73% IRR).

The team sold out of Pasona, an employment and staffing firm, after it, too, saw a sudden surge in its share price. In Persona’s case, it was due to selling its 51% stake in Benefit One to M3 at a 40% premium. The resulting 37% increase in its share price allowed the team to sell out for a 40% return over the life of the holding (equivalent to a 10% IRR). Whilst Pasona has been a net positive contributor since the position’s inception, it was nonetheless a detractor over 2023.

The team also made two small tactical purchases. These are not designed to be targets of an AVI campaign, but rather special situations which offer a near-term upside based on other activists’ efforts.

Performance

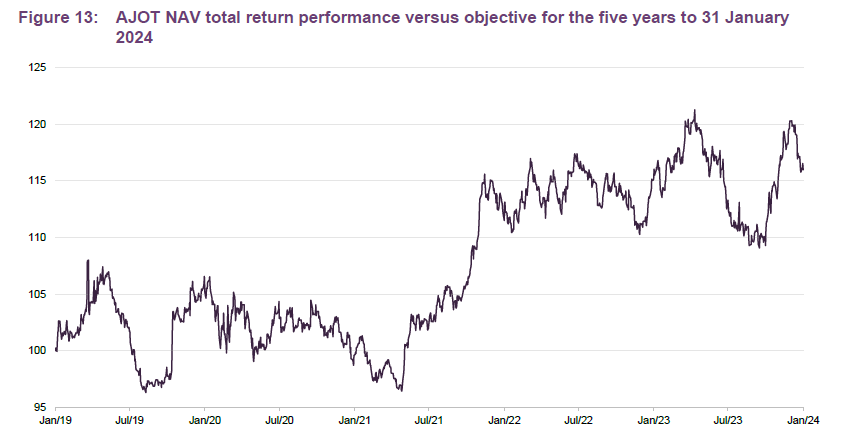

In what has been a good year for Japanese equities, as we outlined on page 4, AJOT has been able to sustain its outperformance relative to its benchmark, the MSCI Japan Small Cap Index. As can be seen by Figure 13, AJOT achieved much of this outperformance in the latter half of the year, rallying 10% relative to its benchmark before giving up ground.

AJOT continues to outperform its benchmark

Despite the nominally strong returns of Japanese equities, AJOT has been impacted by the weakness of the Japanese yen, returning 6.6% over the last 12 months, less than that of the MSCI ACWI. The yen does remain undervalued vs the pound in historic terms, and Daniel Lee, co-head of Japan research, believes that a potential mean reversion in the yen could be a powerful catalyst for UK investors in Japan, and by extension AJOT.

Performance attribution

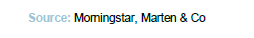

AVI provided us with data on the leading contributors and detractors from AJOT’s returns over the 2023 calendar year.

Contributors

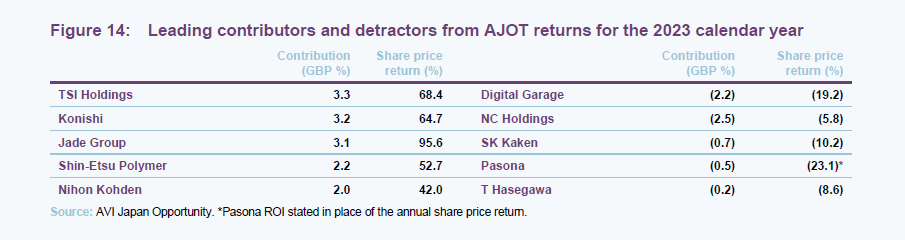

TSI Holdings

TSI holdings (https://www.tsi-holdings.com/en/) is an apparel company which owns several brands, ranging from street fashion to sports equipment. At the start of 2023 c.180% of its market cap was covered by net cash, investment securities and real estate. A value over 100% effectively meant the market assigned a negative value to its apparel business, the core of its business model. Daniel notes that many of the brands within their portfolio are exceptionally valuable, including, for example, the New Balance line of golf products.

TSI’s shares rallied on the back of an announcement of a 5.8% share buyback and the resignation of the founding-family chairman. TSI also announced positive progress in achieving its target operating margin of 4.3% by 2025, and the market appreciated further TSI’s announcement it would aim to achieve its highest operating profit in history in 2024. On a more fundamental level, TSI was also the beneficiary of the post-COVID surge in Chinese consumption, with Japan being a major shopping destination for Chinese tourists.

TSI’s shares jumped as a result, reaching a six-year share price high of ¥863, a 94% increase from the start of the year. TSI has pulled back in the fourth quarter of 2024, with the post-COVID boom petering out, and the company having issues with high material costs and excessive inventories.

The team continues to drive reforms within TSI, with AVI being TSI’s largest shareholder at just over 6% of the voting shares. TSI continues to trade on a sub-1x P/B ratio (which places it in the firing line of the TSE), with the team believing that management still has a way to go in realising the full potential of TSI, though thankfully TSI’s management and directors have met AVI’s comments positively, and AVI is hopeful of further announcements in 2024.

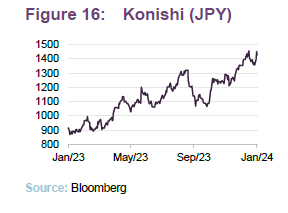

Konishi

Konishi (bond.co.jp) is a leading chemicals and adhesives company, with its best-known products being bonding solutions such as adhesives, sealing materials, and wax products. For the end consumer, these products range from children’s glues to industrial sealants. Konishi also has non-adhesive businesses, which includes a substantial chemical product arm, whose products are utilised in a range of services, from producing paints to services electronics manufacturing. It also operates a civil engineering business.

There have been notable successes by AVI in achieving reforms. Following intense private conversations with Konishi’s management, they implemented a mid-term plan committing Konishi to invest or return all of its cash over the next three years. They also outlined a three-year EBITDA growth target of 35+. This was the first time Konishi disclosed a capital allocation plan and its first commitment to buying back shares.

Konishi saw strong share price performance over the first three quarters of 2023, a direct result of the company’s more shareholder-friendly policies. 2023 was also a strong year for the company in general, reporting 20% gross profit growth and 10% revenue growth, indicative of the quality of its business. It also reported a 56% growth in earnings per share. Despite its growth, there remains clear valuation opportunity. The company’s P/B Ratio of 1.2 is barely above the TSE’s threshold, with c.30% of its market cap held as cash at the end of 2023.

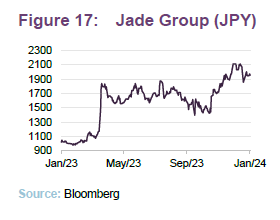

Jade Group

Jade Group (jade-group.jp), the online fashion retailer, was a top contributor in our last note as well, in which we covered Jade Group’s positive earning announcements and buyback policy. Jade Group has gone from strength to strength, adding an additional 32% to its share price over the fourth quarter. Daniel comments that this is due to the management’s exceptional performance, having “flawlessly” completed its acquisition of Rebook, improving shareholder communications, and announcing three further acquisitions. Jade Group’s shares rallied in November on the back of its semi-annual results, which outlined its 31% growth in year-on-year (YOY) merchandise sales, and 96% growth in YOY operating income. The AJOT team remains positive on the company’s outlook, though it has trimmed down its position for the purpose of good portfolio management.

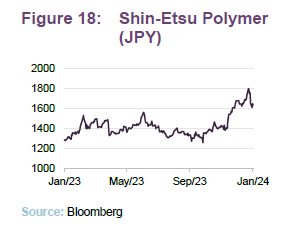

Shin-Etsu Polymer

Shin-Etsu Polymer (Shinpoly.co.jp) is a manufacturer of silicon and vinyl resin materials, and its products are utilised by a range of industries, from semiconductor manufacturing to wrappings. The majority of Shin-Etsu’s gains made over 2023 came in the last quarter of the year. The catalyst for this was the increased scrutiny of TSE on the practice of listed parent/subsidiary structures, which can be a major impediment in aligning management interest with independent shareholders. Shin-Etsu Polymer is a subsidiary of Shin-Est Chemical. Despite the scrutiny, Shin-Etsu Chemical still owns over 50% of Shin-Etsu Polymer, with Shin-Estu Chemical also being a customer and supplier of Shin-Estu Polymer. Despite the regulatory impetus, the structure continues to weigh on Shin-Etsu Polymer’s valuations, trading on 7.3x EV/EBIT, and P/B of 1.2.

AVI will continue to keep the pressure on Shin-Etsu’s management, having put forward proposals to both Shin-Etsu Polymer and Shin-Etsu Chemical in private, including asking for independent directors to account for a majority of Shin-Etsu Polymer’s board and dissolving the listed structure entirely.

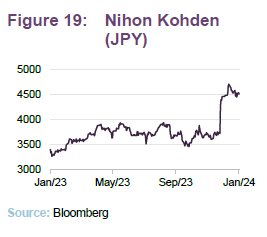

Nihon Kohden

Nihon Kohden (nihonkohden.com) is a leading manufacturer of medical electronics, and is AJOT’s largest position. Following the announcement on 25 December that Valueact Capital Management, a well-known US activist investor, had taken a 5% stack in the company, its share price jumped 15% on the day, and continued rallying in the following days.

Daniel comments that Nihon Kohden’s discount has narrowed since their initial investments, now trading on an EV/EBIT multiple of 15x versus its peers’ 20x, though Daniel remains confident that there still remains huge potential. The transformation towards higher margins and a modernised business model continues.

Negative contributors

Generally speaking, 2023 has been an overwhelmingly positive year. There were only two noteworthy detractors, i.e. those which detracted more than 1% to AJOT performance: Digital Garage and NC Holdings.

Digital Garage

The largest detractor to AJOT was Digital Garage (garage.co.jp), a payments platform. The market gave a poor reception to Digital Garage’s mid-term plan, released in May 2023, as it failed to reorganise its conglomerate structure, specifically to address its 20% stake in Kakau,com, a non-core asset. The company also made a poorly-received share issuance. AJOT still retains its position in Digital Garage and AVI has opted to escalate its engagement activities, going public in announcing concerns and its intention to vote against all directors at the upcoming AGM. We discuss the details of their campaign in more detail on page 9.

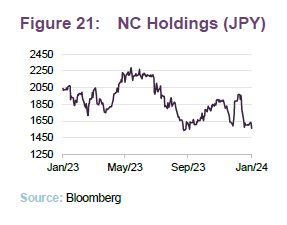

NC Holdings

NC Holdings’s (nc-hd.jp) performance has been a casualty of its poor management decisions and generally lacklustre earnings. NC Holdings’s subsidiary, Nippon Conveyor, announced that (along with seven of its peers) it is being investigated on suspicion of violating the Anti-Monopoly Act, which led to a decline of some 33% over the third quarter of 2023. Its share price has failed to recover since.

AVI takes no view on the legal case, but simply uses it as an example of the need to reform NC Holdings’s management practices. AVI has been active in that regard, voting to remove all outside incumbent directors at the last AGM and seeking to install two highly experienced directors with capital markets experience. The board fought AVI’s eight shareholder proposals, with six achieving majority support from shareholders. Daniel believes that this demonstrates its disregard for shareholders; however, AVI is continuing to meet with management, and comments that NC Holdings’s president appeared receptive to AVI’s recommendation, likely in light of the clear shareholder concerns.

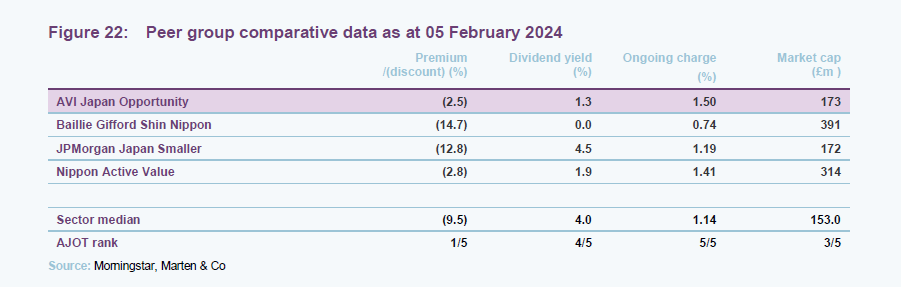

Peer group

Up-to-date information on AJOT and its peers is available on our website

AJOT is a constituent of the AIC’s Japanese smaller company sector. Within this peer group of four trusts, the closest comparator is Nippon Active Value, which has a similar investment approach to AJOT. The other two are more focused on growth stocks, and this accounts for much of the disparity in the performances of these funds.

Relative to Nippon Active Value, AJOT is smaller, and takes a more co-operative approach to its management engagement than Nippon Active Value. AVI notes that following Nippon Active Value merging with two other Japanese trusts, it has taken positions in larger companies, which may reflect the increased asset base and lack of liquidity in smaller companies, and may complicate further engagement efforts.

Over the last five years AJOT has outpaced its peers by some margin, reflecting not only the idiosyncratic return potential activist events can offer, but the benefits of its lack of intentional stylistic bias. The strong growth-stock biases of Ballie Gifford Shin Nippon and JPMorgan Japan Smaller for example have fallen foul of the rise in global interest rates. AJOT has lagged Nippon Active Value over the last three years, though, reflecting the lumpy nature returns from activism.

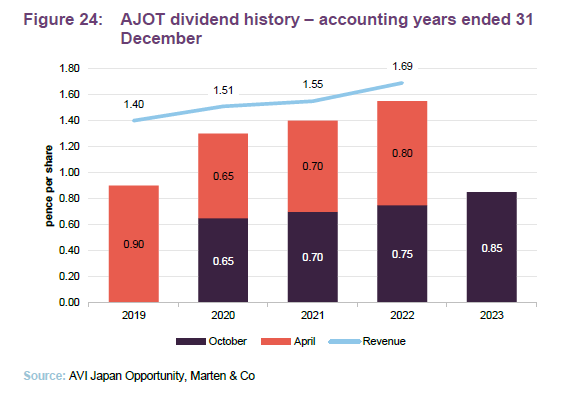

Dividend

AJOT is not managed to produce any target level of income. The board distributes substantially all of AJOT’s net revenue, taking the form of semi-annual dividends declared in April and October.

At 30 June 2023, AJOT had accumulated revenue reserves of £2,571,000 (1.83p per share), which have been building since launch, as revenue has been consistently ahead of the level of distribution.

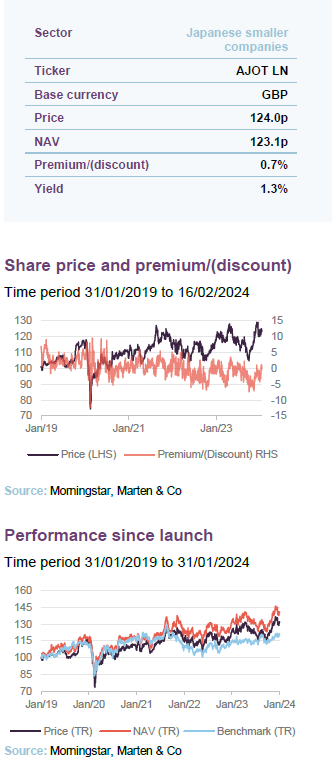

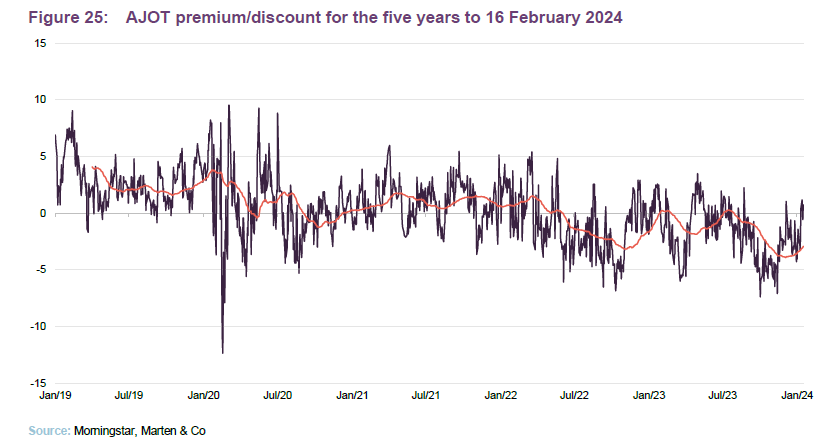

Premium/(discount)

Over the 12 months ended 31 January 2024, AJOT’s shares traded between a 3.5% premium and a 6.9% discount. The average discount over the period was just over 1.2%. At 16 February 2023, AJOT was trading at a 0.7% premium.

We note that AJOT’s discount has generally been range bound between a five per cent discount and a slight premium since mid-2022. This implies that AJOT hasn’t seen the same aggressive selloff that other trusts have during the period of rising interest rates. This is likely due in part to the board’s discount management efforts, as we outline below, and the confidence investors have in AJOT.

The board recognises that it is in the interests of shareholders to maintain a mid-market price for the ordinary shares that is as close as possible to NAV. The board monitors the discount over rolling four-month periods and will buy back stock if the average discount exceeds 5%. The discount should also be limited by the regular exit opportunity (see page 22).

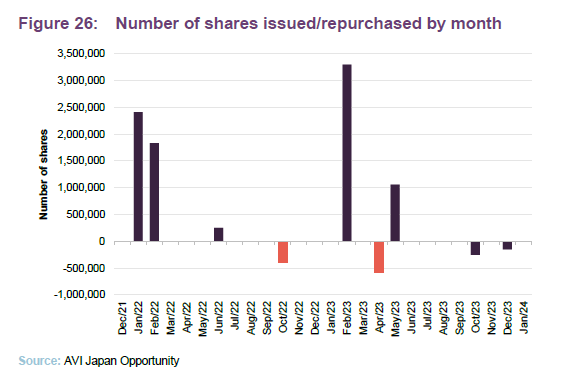

At the AGM held in May 2022, shareholders gave the directors authority to issue up to 20% of AJOT’s then share capital over the following 15 months (or up to the next AGM, whichever is the earlier). Shares will only be issued (or reissued from treasury) at a price equal to NAV plus a premium at least sufficient to cover the costs associated with issuing the shares.

The board was also granted permission to repurchase up to 14.99% of the ordinary shares. Shares repurchased may be held in treasury. If the four-month moving average discount is greater than 5%, the board will endeavour to reduce the discount by buying back shares. Figure 26 shows the issuance and repurchase of shares by month over the last two years.

Fees and costs

Asset Value Investors Limited is AJOT’s AIFM and investment manager. The manager is entitled to a fee of 1.0% of the lower of AJOT’s market cap or its NAV at each quarter end. A quarter of the management fee is reinvested in AJOT shares (through open-market purchases), which are held for a minimum of two years. The manager’s contract can be terminated by one year’s notice by either party.

Fee based on lower of market cap and NAV

The fee structure is one we like, as it gives the manager an incentive to work with the board to keep the discount narrow.

AJOT’s depositary is JPMorgan Europe Limited, and JPMorgan Chase Bank, London Branch is the company’s custodian. Link Company Matters Limited is the company secretary and Link Alternative Fund Administrators Limited is AJOT’s administrator.

For the year ended 31 December 2022, the management fee amounted to £1.5m, directors’ fees (detailed on page 22) totalled £130,000 and other expenses totalled £806,000. AJOT’s ongoing charges ratio for this period was 1.50%, up from 1.45% for 2021.

Capital structure

At 16 February 2024, AJOT had 140,836,702 ordinary shares in issue, 400,000 of which were held in treasury. Therefore, the number of shares admitted to trading and with voting rights was 140,436,702. There are no other classes of share capital. No ordinary shares were held in treasury at that date.

The company’s accounting year end is 31 December, and its AGMs are usually held in April/May.

AJOT has an unlimited life; however, shareholders have an opportunity to exit the company at a price close to NAV in October 2024 and every two years thereafter. The exact mechanism for this will be determined around six months in advance, following consultations with shareholders.

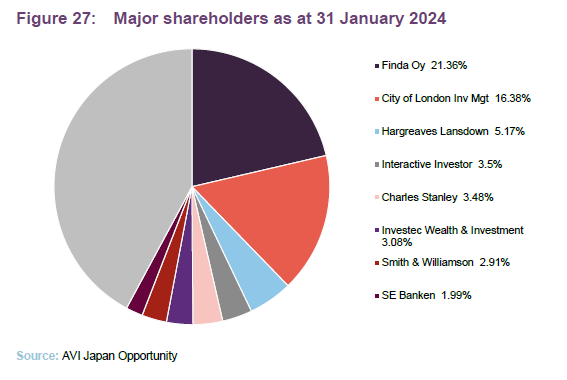

Major shareholders

Gearing and hedging

AJOT’s gearing is capped at 25% of NAV, at the time of drawing down any borrowings. The interest rate on amounts drawn is TONAR +1.15%. When less than 50% of the facility is being utilised, commitment fees of 0.375% are charged on undrawn balances. If over 50% is drawn down, 0.325% is payable on the undrawn amount.

AJOT does not currently intend to hedge its underlying currency exposure, but the board and manager keep this under review.

Management team

AVI is fielding quite a large team (seven in total, five of whom are Japanese nationals) on AJOT.

In addition to the seven individuals listed below, AVI has seconded one person from a leading Japanese law firm for six months. He is assisting with the team’s engagement efforts and is based in London.

Joe Bauernfreund (CEO and CIO)

Joe is the portfolio manager of AJOT and the named portfolio manager of AVI Global Trust. He joined Asset Value Investors in July 2002 as an investment analyst, following completion of a Masters in Finance from the London Business School. He worked closely with John Walton in focusing on the European Holding Companies, then covered the entire portfolio and became joint manager with John Pennink. Prior to joining Asset Value Investors, Joe worked for six years for a real estate investment organisation in London.

Tom Treanor (head of research)

Tom joined AVI in February 2011. He works closely with the analyst team, providing support and guidance on prospective and current investments across the portfolio, in addition to taking responsibility for all investments in closed-end funds.

Tom spent nine years working for Fundamental Data/Morningstar in various roles involving closed-end fund analysis. He has a degree in Economics from the University of Leicester.

Daniel Lee (co-head of Japan research)

Daniel joined AVI in February 2015. He focuses on researching Japanese companies.

Before joining AVI, Daniel completed internships at Pamplona Capital Management and Mercer. He has passed all three levels of the CFA exam, and graduated with a First Class Honours degree in Physics from the University of Bristol.

Kaz Sakai (co-head of Japan research)

Kaz started working with AVI in May 2020, researching Japanese companies while completing his MBA at Harvard Business School. He formally joined AVI’s investment team in June 2021. Prior to Harvard, he was engagement manager at McKinsey & Company’s Strategy and Corporate Finance Practice in Tokyo.

Kaz had previously been with McKinsey & Company from 2011–2016 as a general consultant in Tokyo and an RTS Practice Associate in Melbourne, and also gained valuable private equity experience from 2016-2018. He holds a B.Sc in Geochemistry from the University of Tokyo and an MBA from Harvard Business School.

Shuntaro Shimizu (senior investment analyst)

Shuntaro joined AVI in January 2023 from Bain & Company, where he worked within its management consultancy division. Prior to that, he worked within the Bank of Japan. He has a Bachelor of Law from the University of Tokyo and an MBA from Stanford.

Jason Bellamy (investment consultant)

Jason joined AVI in March 2020. He works closely with the analyst team and leads on the engagement efforts in Japan. Jason brings more than 30 years’ experience in the financial services industry, working for and engaging with global companies, government bodies, regulators and international investors including Sumitomo Mitsui Trust Bank, First Trust Advisors and Aberdeen Standard Investments. He is based in Tokyo.

Jason has a BSc in Economics from The London School of Economics & Political Science (University of London).

Esme Morter (ESG analyst)

Esme joined AVI in 2021. She graduated with a First-Class Honours degree in International Relations and French from the University of Sussex and completed the CFA Certificate in ESG Investing in 2023.

Luke Hutcherson (junior investment analyst)

Luke joined AVI in October 2023. Before joining AVI, he completed internships at Tico Capital Management and Ernst & Young.

Yuki Nicholas (Japan team assistant)

Yuki joined AVI in February 2020 as a Japan team assistant to provide translating support, desk research and other secretarial support to the members of the Japan team.

Yuki previously worked for BZW Tokyo as an assistant to the investment strategist and the economist.

Board

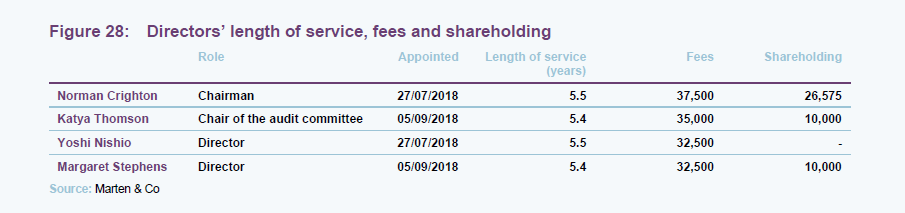

AJOT has four directors, all of whom are non-executive and independent of the manager. No director sits on another board together with another member of AJOT’s board. The directors stand for re-election at each AGM.

Norman Crighton

Norman is an experienced public company director, having served on the boards of eight closed-end funds and one operating company. He has extensive fund experience, having previously been head of closed-end funds at Jefferies International and investment manager at Metage Capital Limited. Norman’s career in investment banking covered research, sales, market making and proprietary trading, servicing major international institutional clients over 15 years. His work in many countries included restructuring closed-end funds as well as several IPOs. As a fund manager, Norman managed portfolios of closed-end funds on a hedged and unhedged basis covering developed and emerging markets.

Following on from his long-term promotion of best corporate governance practice, Norman has more recently been focusing on expanding his work into environmental and social issues. He holds a Master’s degree from the University of Exeter in Finance and Investment.

Norman is currently non-executive chair of RM Secured Direct Lending Plc, Weiss Korea Opportunity Fund Limited and Harmony Energy income Trust Plc.

Ekaterina (Katya) Thomson

Katya started her career at Deloitte LLP, where she qualified as a chartered accountant in 1996. She is a corporate finance, strategy and business development professional with over 25 years of experience with UK and European blue chip companies. Katya is a non-executive director and audit committee chairman of Miton Global Opportunities Plc and Henderson EuroTrust Plc, and a non-executive director of Allianz Technology Trust and The New Carnival Company CIC. She is a member of the Institute of Chartered Accountants in England and Wales.

Yoshi Nishio

Yoshi began his career at Goldman Sachs International, where he had overall responsibility for the trading of Japanese equities and equity derivative products. Since then, he has combined his twin specialisations of finance and media as an investor, advisor and consultant. Much of his work has had a Japanese focus, with clients ranging from family offices to the office of the chairman of Columbia Pictures in Hollywood in the period following the studio’s acquisition by the Sony Corporation, to the Ministry of Finance of the Russian Federation. Yoshi is fluent in Japanese and in English.

Margaret Stephens

Margaret was a partner at KPMG until 2016, having qualified as a Chartered Accountant in 1988. From 2007, she played a key role in building KPMG’s Global Infrastructure Practice, also leading UK and international due diligence and structuring services on major merger and acquisition transactions and public private partnerships. Margaret was also a board trustee of the London School of Architecture until April 2020 and a non-executive board member and chair of the audit and risk committee at the Department for Exiting the European Union until its closure in January 2020.

Currently, Margaret is a non-executive director and chair of the audit and risk committee of VH Global Sustainable Energy Opportunities Plc and a trustee, director and chair of the audit committee of the Nuclear Liabilities Fund.

Previous publications

Readers interested in further information about AJOT may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 29 or by visiting our website.

Figure 29: QuotedData’s previously published notes on AJOT

Source: Marten & Co

IMPORTANT INFORMATION

This marketing communication has been prepared for AVI Japan Opportunity Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.