Compelling opportunity?

Despite what appears to be a resilient business model, high dividend payout, and large development pipeline, its discount might suggest that investors continue to overlook the Bluefield Solar Income Fund (BSIF). It is possible that this is related to the negative sentiment surrounding the renewable energy sector.

Positively, despite the troubles of the broader sector, the manager believes there is a clear path for the company’s discount to return to its historic premium. It says the new partnership with GLIL provides an avenue for the ongoing development of its pipeline, while the recent sale of a 112MW portfolio of operating solar assets at NAV further highlights the wide discount. The improving economic outlook and falling interest rates could provide another catalyst, as might the new government’s recently announced plans to decarbonise the electricity system as part of the Clean Power 2030 mission. Manager James Armstrong commented that, in his 18 years of experience in renewables, he has never seen such a positive regulatory outlook.

Focus on value accretive renewable investments

BSIF aims to pay shareholders an attractive return, principally in the form of regular sector-leading income distributions, by being invested primarily in solar energy assets located in the UK.

| Year ended | Share price TR (%) | NAV total return (%) | Earnings per share (pence) | Dividend per share declared (pence) | Target dividend per share (pence) |

|---|---|---|---|---|---|

| 30/06/2020 | 5.1 | 12.8 | 12.0 | 7.90 | 7.90 |

| 30/06/2021 | (4.1) | 3.6 | 11.3 | 8.00 | 8.00 |

| 30/06/2022 | 15.1 | 32.7 | 12.0 | 8.20 | 8.16 |

| 30/06/2023 | (2.5) | 5.6 | 17.7 | 8.60 | 8.40 |

| 30/06/2024 | (4.5) | (0.9) | 15.5 | 8.80 | 8.90 |

Source: Morningstar, Marten & Co

Market Background

Inflation has now dropped below the Bank of England’s (BoE) 2% target, while growth has accelerated much faster than expected

When we last wrote on BSIF, the UK economy was experiencing high inflation and falling growth which appeared to weigh heavily on the performance of its equity markets. Fast forward to today and inflation has now dropped below the Bank of England’s (BoE) 2% target while growth has accelerated much faster than expected, doubling since the start of year.

For BSIF, the manager believes the revived economic outlook is increasingly positive, particularly with regard to inflation which it says should provide the BoE with more flexibility on its monetary policy outlook. Headline CPI is falling much faster than the BoE expected, dropping to 1.7% in September, the first time it has printed below 2% since April 2021. Following the latest update, the market now expects around five cuts over the next 12 months, for an implied policy rate of around 3.8%, down from a peak of 5.25%.

Figure 1: Implied UK overnight rate & number of cuts

Source: Bloomberg

As was discussed in detail in our previous note, higher risk-free rates, which have sat above 5% for more than a year, appeared to dampen the appeal of renewable energy assets that had traditionally boasted significant yield premiums. The manager notes the falling spreads were compounded further by the rise in financing costs.

The discount remains one of the narrowest in the entire renewable energy infrastructure sector

Positively for BSIF, the manager notes that the company was able to continue to deliver strong operational performance over this period. While it says this was not reflected in the share price, underlying earnings from the portfolio were as good as they have ever been in the 10-plus years that the fund has been operating. Total funds available for distribution reached an all-time high, driving the dividend towards 9%, which was covered by more than 2x by the company’s earnings during FY2023. As discussed on page 9, results for this year have fallen slightly from these peaks, however, are still well above historic averages.

The manager notes that against the backdrop of fundamental growth and what it says is a steadily improving macroeconomic environment, there does not appear to be a clear reason for why the company’s shares remain so depressed. Having delivered a share price total return of just 2.4% this year, the discount is significant at 16.5%. It notes that this remains one of the narrowest in the entire renewable energy infrastructure sector, perhaps highlighting both the ongoing execution of the trust and extent with which these companies have suffered over the last few years – especially when you consider that the bulk of the sector traded at a premium prior to the pandemic. The manager continues to believe that these discounts go well past the fundamental impacts of tighter monetary policy and expects to see a significant re-rating of the sector when negative sentiment begins to turn.

GLIL Infrastructure strategic partnership

The manager believes that BSIF has executed extremely well given the broader macro backdrop over the last few years. Despite this, it says the stubborn discount has limited the company’s ability to raise the fresh capital needed to finance future growth and capitalise on its pipeline of investments. As a solution, following considerable consultation, the company announced in December 2023 that it had entered into a strategic partnership with GLIL Infrastructure (GLIL). The manager says the agreement is unique amongst the actions being taken by other listed peers, allowing BSIF to maintain its investment momentum and make progress on its capital allocation objectives. It says the deal also increases the diversification of the company’s revenue base, provides external validation of its assets, and creates additional liquidity for the fund.

In August, BSIF completed the sale of a 50% stake in a 112MW operational portfolio.

The first phase of the project, completed in January 2024, enabled Bluefield Solar to co-invest £20m in a 247MW portfolio of UK solar assets alongside £200m from GLIL. The acquisition raises the level of regulated revenues in the portfolio and increases the proportion of FiT income. The deal also freed up around £10m of liquidity which was used to pay down the company’s outstanding revolving credit facility (RCF).

In August, BSIF then completed the sale of a 50% stake in a 112MW operational portfolio. This resulted in a payment to BSIF of circa £70m. Crucially, this was also executed at NAV, which the manager says provides further validation that the discount BSIF trades at is irrational. The deal provided a further £50m to pay down the RCF, the balance of which now sits at £133.5m. The additional capital from the sale has been made available to fund the construction of approximately 17MW of development assets, marking the start of the third phase of the tie-up.

Phase three of the partnership, which is currently in progress, is a commitment for GLIL and Bluefield Solar to co-invest into a selected portfolio of circa 10% of the company’s development pipeline and enable construction over the next two to three years. The manager says the ability to protect and progress the value of BSIFs development pipeline at a time when public infrastructure funds are struggling has been crucial in preventing the discount widening to a point where it becomes difficult to see a path forward, which it says we have witnessed with several other trusts in the sector. It believes this momentum, and any additional realisations at or above NAV, are crucial for the health of both BSIF and the broader renewables sector and are an excellent way of highlighting the underlying value which exists.

Energy policy & power prices: supporting the journey to Net Zero

The new Labour Government has targeted the expansion of renewable energy as one of its five key missions.

The manager notes that the GLIL partnership allows BSIF to capitalise on the long-term structural changes to the UK power market which it says are fuelling the company’s growth.

Notably, it believes these have become even more compelling in recent times with the new Labour Government targeting the expansion of renewable energy as one of its five key missions, with plans to fully decarbonise the electricity system by 2030. This includes a promise to treble the UK’s solar power capacity. Highlighting the optimism, BSIF manager James Armstrong commented that in his 18 years of experience in renewables, he has never seen such a positive outlook.

In addition to the increasing reliance on renewables, the manager says BSIF will also benefit from what it says will be a structural rise in power prices over the next decade. While prices have begun to normalise following the anomalous period post pandemic, some forecasts suggests that average prices for the next few years will be significantly higher than those seen over most of the fund’s life, as shown in Figure 2. As an example, the blended power forecast out to December 2027 is 62% higher than the average price prior to 2021.

The manager says that multiple factors have contributed to this inflation, including the decommissioning of ageing infrastructure, and increasing energy demand. It believes that the last point remains under appreciated, noting what it says is the unprecedented demand stemming from data centres and AI, contributing to its house view that prices will be even higher than forecast in future.

Figure 2: Rising power price outlook

Source: Bluefield Solar Income Fund

Already responsible for around 5% of all solar power in the UK, and with a growing pipeline of assets, the manager notes that BSIF remains at the forefront of these policy reforms and structural changes. As it has made clear, the largest constraint in realising these opportunities remains the access to capital which is why the company has been so positive on the agreement with GLIL. It believes that in combination with the energy market reforms, the fundamental upside for BSIF is significant, especially given current discounts, which it says should narrow as the company continues to realise the value in its pipeline and operational assets.

Portfolio

BSIF’s operational portfolio as of 30 June 2024 encompassed 129 solar PV projects (87 large-scale sites, 39 micro-sites and three rooftop sites), six wind farms and 109 single-stick wind turbines, spread across England, Wales, Scotland and Northern Ireland. In addition to this, the company took a 9% stake in a 246.6MW portfolio of UK solar assets, acquired during the year in partnership with GLIL Infrastructure. This took the total portfolio capacity to 834MW, comprising 776MW of solar and 58MW of onshore wind.

Figure 3: Revenue by type as at 30 June 2024

Figure 4: Technology split as at 30 June 2024

Source: Bluefield Solar Income Fund

Source: Bluefield Solar Income Fund

Figure 5: Locations of BSIF’s solar plants at 30 June 2024

Source: Bluefield Solar Income Fund, Marten & Co

Total portfolio capacity is 834MW, comprising 776MW of solar and 58MW of onshore wind.

During the year, the combined solar and wind portfolio generated an aggregated total of 810.6GWh (2023: 836.2GWh), representing a generation yield of 997.6 MWh/MW (30 June 2023: 1,029 MWh/MW).

Post period end, two of the company’s largest solar investments – Mauxhall Farm (44.4MW) and Yelvertoft (48.4MW) – were energised. Net of the sale of its 50% stake in a 112.2MW portfolio of operating solar assets discussed on page 4, the generating capacity of the portfolio increased to 883MW, comprising 824.7MW of solar and 58.3MW of wind.

Construction and development pipeline

As discussed, BSIF also has what the manager describes as a sizeable pipeline of assets which has continued to expand despite the macroeconomic challenges over the last few years. During the year, the company was able to secure planning on 223MW of solar projects and 90MW of battery projects. These additions saw the pipeline grow to 1,557MW, made up of 954MW of solar and 603MW of battery storage as of 30 June 2024. As Figure 6 shows, this is broken down into various stages of development, noting that BSIF has a 5% investment limit in pre-construction development stage activities, of which less than 3% is currently committed.

Figure 7 highlights the current value of the construction projects and consented projects in the BSIF valuation. Currently, no value is attributed to projects without planning consent and the manager believes there remains a significant opportunity for these to be monetised as they shift through consenting process. As discussed on page 4, it says this is a key element of the third phase of the GLIL partnership. Longer term, the option exists to review disposals of up to a third of the company’s development pipeline as well as consideration of further sales of its operational assets. The manager says the optionality involved in both the initial phases of the partnership, and longer-term developments can add significant value for BSIF shareholders, particularly as any sales will provide further evidence that the discount at which the company’s shares trade is excessive.

Figure 6: Development pipeline (MW)

Figure 7: Development Pipeline value (£m)

Source: Bluefield Solar Income Fund

Source: Bluefield Solar Income Fund

Performance

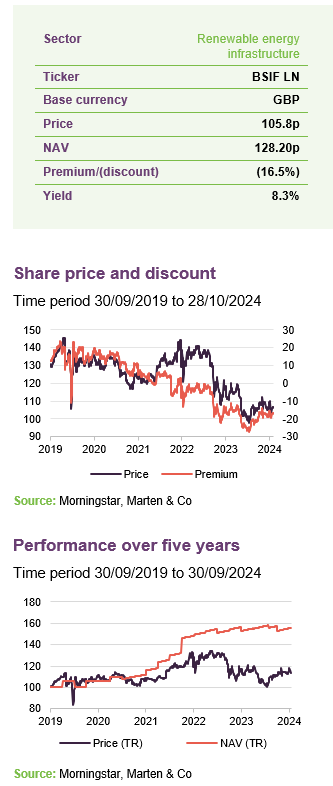

Figure 8: BSIF NAV and share price total return over five years to 30 September 2024

Source: Morningstar, Marten & Co

Figure 9: BSIF cumulative total return performance over periods ending 30 September 2024

| 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | 5 years(%) | |

|---|---|---|---|---|---|

| BSIF NAV | 1.7 | (1.3) | 1.7 | 34.0 | 55.4 |

| BSIF price return | 6.3 | 14.5 | 0.9 | 10.2 | 17.8 |

| Peer group1 median NAV | 1.4 | (0.9) | 0.5 | 22.9 | 45.5 |

| Peer group1 median price | 1.5 | 10.2 | (0.2) | (8.5) | 7.7 |

Source: Morningstar, Marten & Co. Note 1) peer group comprises the constituents of the AIC’s renewable energy infrastructure sector

As Figure 9 highlights, BSIF has generated strong NAV returns in recent years. The manager says that this has been made possible by the company’s stable, defensive business model which is underpinned by regulated and inflation linked earnings, and a successful power price hedging strategy – both of which are discussed in detail in our previous note which you can see here. In its view, the ongoing growth has allowed the company to sustain its progressive dividend strategy, consolidating BSIF’s position as one of the most reliable income options for investors in the UK.

Despite this, the manager believes that sentiment towards BSIF is still deeply depressed, weighed down by the negative perception of many other renewable energy infrastructure trusts which have struggled with rising debt liabilities and cash flow concerns. It had hoped that the beginning of the BoE’s monetary easing cycle would act as a catalyst for a re-rating of the sector, however, so far, it says the response has been relatively modest.

Positively the manager notes that despite the troubles of the broader sector, it sees a clear path for its discount to head towards par and return to its historic premium as the partnership with GLIL develops. The manager adds that the improving economic backdrop should provide further momentum, as will the structural growth in UK renewable energy development.

Annual results

BSIF announced its full year results for the year ended 30 June 2024 on 30 September. The company’s NAV total return fell slightly, down 0.83%, influenced by irradiation levels which were significantly below long-term averages; falling electricity prices; and a number of one-off factors including planned upgrades.

Figure 10: NAV Bridge for 12 months ended 30 June 2024

Source: Bluefield Solar Income Fund

Income generated remains well above historical averages, with funds available for distribution of £64.5m, 64% ahead of 2021 levels

Despite this, the manager says that the company was able to deliver solid operational returns with portfolio revenue only marginally down year on year, while total income still rose 3.1%. It says that this highlights the value of BSIF’s ongoing power price hedging strategy, with roughly 40% of the portfolio fixed at almost 2x the current spot market price, and its high proportion of regulated and inflation-linked revenues. The income generated remains well above historical averages, with funds available for distribution of £64.5m, 64% ahead of 2021 levels, allowing BSIF to maintain its progressive dividend policy. For FY2024, the total declared dividends increased to 8.80pps, up 2.3% from 8.60pps in 2023, for a yield of 8.3% at current prices which was covered 1.36 times by current earnings.

FY2025 dividend target of not less than 8.90pps.

For 2025, the board has set a target dividend for the year ended 30 June 2025 of not less than 8.90pps. The manager notes that the 1.1% year on year increase is down on BSIF’s traditional rate of dividend growth, however, it says that with one of the highest yields in the sector, the company has opted to focus some of its excess capital on additional share buybacks and the reduction of its RCF.

Peer group comparison

The renewable energy infrastructure sector offers a diverse range of companies, from growth orientated battery and green hydrogen providers to more stable utilities.

BSIF is one of the largest and most liquid funds in the peer group, offering what it describes as an attractive yield and one of the sector’s most competitive ongoing charges ratios.

Figure 11: AIC renewable energy infrastructure sector comparison table, as at 28 October 2024

| Market cap (£m) | Premium/(discount) (%) | Yield(%) | Ongoing charge (%) | |

|---|---|---|---|---|

| Bluefield Solar Income | 638 | (16.5) | 8.3 | 1.0 |

| Aquila Energy Efficiency Trust | 43 | (38.2) | 8.7 | – |

| Aquila European Renewables | 209 | (25.7) | 8.7 | 1.1 |

| Atrato Onsite Energy | 116 | (14.8) | 7.1 | 1.8 |

| Downing Renewables & Infra. | 144 | (29.1) | 6.9 | 1.6 |

| Ecofin US Renewables | 40 | (41.9) | 1.9 | 1.8 |

| Foresight Environmental Infrastructure Group | 572 | (25.2) | 9.2 | 1.2 |

| Foresight Solar Fund | 496 | (23.2) | 9.0 | 1.2 |

| Gore Street Energy Storage | 309 | (42.9) | 11.7 | 1.4 |

| Greencoat Renewables | 846 | (16.6) | 7.2 | 1.2 |

| Greencoat UK Wind | 3,039 | (15.7) | 7.4 | 0.9 |

| Gresham House Energy Storage | 280 | (56.9) | 11.5 | 1.2 |

| Harmony Energy Income | 119 | (45.7) | 0.2 | – |

| HydrogenOne | 46 | (65.0) | 0.0 | 2.6 |

| NextEnergy Solar | 450 | (24.3) | 10.9 | 1.1 |

| Octopus Renewables Infrastructure | 437 | (26.6) | 7.8 | 1.2 |

| SDCL Energy Efficiency Income | 649 | (33.7) | 10.5 | 1.0 |

| The Renewables Infrastructure Group | 2,427 | (20.7) | 7.6 | 1.0 |

| Triple Point Energy Efficiency | 46 | (24.6) | 12.0 | 2.1 |

| US Solar Fund | 110 | (39.7) | 5.0 | 1.4 |

| VH Global Sustainable Energy Opp.s | 287 | (34.2) | 7.8 | 1.4 |

| Peer group median | 290 | (26.6) | 7.8 | 1.2 |

| BSIF rank | 5/21 | 3/21 | 10/21 | 2/20 |

Source: Morningstar, Marten & Co

While returns have been modest in recent years, BSIF has still delivered annualised NAV growth of over 11% over both three- and five-year periods, which the manager says reflects the underlying strength of the trust’s assets and its ability to manage them.

Figure 12: AIC renewable energy infrastructure sector NAV performance comparison table, periods ending 30 September 2024

| 3 months(%) | 6 months(%) | 1 year(%) | 3 years(%) | 5 years(%) | |

|---|---|---|---|---|---|

| Bluefield Solar Income | 1.8 | 0.3 | 1.7 | 34.1 | 55.5 |

| Aquila Energy Efficiency Trust | 0.0 | 0.0 | (0.6) | n/a | n/a |

| Aquila European Renewables | (0.2) | (4.6) | (12.0) | (0.4) | n/a |

| Atrato Onsite Energy | 1.6 | 3.2 | 3.9 | n/a | n/a |

| Downing Renewables & Infra. | 1.3 | 1.5 | 4.2 | n/a | n/a |

| Ecofin US Renewables | (5.5) | (22.8) | (32.5) | n/a | n/a |

| Foresight Environmental Infrastructure Group | 1.7 | 3.0 | 0.9 | n/a | n/a |

| Foresight Solar Fund | 1.8 | 3.7 | 4.0 | 33.2 | 46.2 |

| Gore Street Energy Storage | 1.9 | 1.3 | (0.6) | 21.9 | n/a |

| Greencoat Renewables | (0.3) | 0.5 | 1.0 | 29.6 | 38.5 |

| Greencoat UK Wind | 1.1 | 2.3 | 2.1 | 45.5 | 71.5 |

| Gresham House Energy Storage | 1.3 | (15.3) | (23.3) | 10.9 | n/a |

| Harmony Energy Income | (1.4) | (8.9) | (15.5) | n/a | n/a |

| HydrogenOne | 0.0 | 0.0 | 2.1 | n/a | n/a |

| NextEnergy Solar | 2.2 | 0.8 | 1.3 | 21.5 | 29.3 |

| Octopus Renewables Infrastructure | 1.5 | 4.2 | 4.0 | 24.0 | n/a |

| SDCL Energy Efficiency Income | 1.8 | 3.6 | 7.1 | 3.8 | n/a |

| The Renewables Infrastructure Group | 1.6 | 1.8 | (0.1) | 27.5 | 44.9 |

| Triple Point Energy Efficiency | 1.8 | 3.4 | (4.5) | n/a | n/a |

| US Solar Fund | (5.0) | (5.7) | (15.1) | (4.9) | n/a |

| VH Global Sustainable Energy Opp.s | 1.4 | (2.0) | 10.3 | n/a | n/a |

| Peer group median | 1.4 | 0.8 | 1.0 | 22.9 | 45.6 |

| BSIF rank | 6/21 | 14/21 | 9/21 | 2/12 | 2/6 |

Source: Morningstar, Marten & Co

Dividend

BSIF pays quarterly dividends. For a given financial year, the first interim dividend is paid in February, with the second, third and fourth interims paid in May, August and October/November respectively (dividends are usually declared the month before payment).

In the 2024 financial year, BSIF paid a total of 8.8p, in line with the target. Within its peer group, BSIF has consistently delivered the highest dividend on a pence per share basis (or euro equivalent).

Figure 13: BSIF’s dividend history

Source: Bluefield Solar Income Fund, Marten & Co

As discussed in the annual results section on page 9, the target dividend for FY25 has been set at not less than 8.9p, an increase of 1.1% from the year prior. As noted, the increase in the FY25 target is down on BSIF’s traditional rate of dividend growth, with the company adjusting its capital allocation policy to capitalise on current share price discounts and reduce some of its short-term borrowings. The manager believes there is an obvious long-term benefit to shareholders if BSIF balances underlying and carried earnings between dividend payouts and other uses of capital.

Fund profile

BSIF is a Guernsey-domiciled sterling fund, with a premium main market listing on the London Stock Exchange (LSE). At launch on 12 July 2013, it focused primarily on acquiring and managing a diversified portfolio of large-scale (utility-scale) UK-based solar energy assets, to generate renewable energy for periods of typically 25 years or longer. Bluefield Solar owns and operates a UK portfolio of 834MW, comprising 776MW of solar and 58MW of onshore wind.

In July 2020, shareholders approved proposals to expand the remit and BSIF began making investments in onshore wind and energy storage projects soon after.

BSIF is designed for investors looking for a high level of income with regular distributions.

Further information regarding BSIF can be found at: www.bluefieldsif.com

BSIF’s primary objective is to deliver to its shareholders stable, long-term sterling income via quarterly dividends. The majority of the group’s revenue streams are regulated and non-correlated to the UK energy market.

The underlying investments are held in SPVs which, in turn, are held through BSIF’s wholly-owned and UK-domiciled portfolio holding company, Bluefield Renewables 1 Ltd (BR1).

Bluefield Partners LLP – an experienced investment adviser

Bluefield Partners LLP was established in 2009 as an investment adviser to companies and funds investing in solar-energy infrastructure. It has been BSIF’s investment adviser since launch. Its business comprises the investment adviser, an asset manager (Bluefield Services Ltd), a maintenance manager (Bluefield Operations Ltd), a solar project developer (Bluefield Development) and a construction management services division for new build projects (Bluefield Construction Management Ltd)”

Previous publications

Readers interested in further information about BSIF may wish to read our previous notes (details are provided in Figure 15 below). You can read the notes by clicking on them in Figure 15 or by visiting our website.

| Title | Note type | Date |

|---|---|---|

| Walking on sunshine | Initiation | 7 February 2019 |

| On the offensive | Update | 20 April 2021 |

| Transformational deal | Annual overview | 1 July 2021 |

| Executing on revised objective | Update | 15 December 2021 |

| Politicians cloud otherwise bright future | Annual overview | 12 January 2023 |

| Record year supports growth strategy | Update | 2 October 2023 |

| Fundamentals shine despite discount | Update | 24 April 2024 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Bluefield Solar Income Fund.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.