Bluefield Solar Income Fund

Investment companies | Update | 2 October 2023

Record year supports growth strategy

While shares across the whole of the renewable energy infrastructure sector have been under pressure over the past 12–18 months, the execution by Bluefield Solar Income Fund (BSIF) has remained impressive, helping it to maintain its record of sector-leading distributions. The company’s record performance has been driven by its locking in of higher power prices through power purchase agreements. Thanks to the execution of these contracts, the board has good visibility over the bulk of company earnings for the next few years.

BSIF is now 10 years old and as at 30 June 2023 had delivered annualised returns of 6.6% to shareholders. The company has an attractive pipeline of new investment opportunities totalling over 1.4GW. We share the chairman’s frustration that the discount constrains BSIF’s ability to fund these with fresh equity.

Focus on value accretive renewable investments

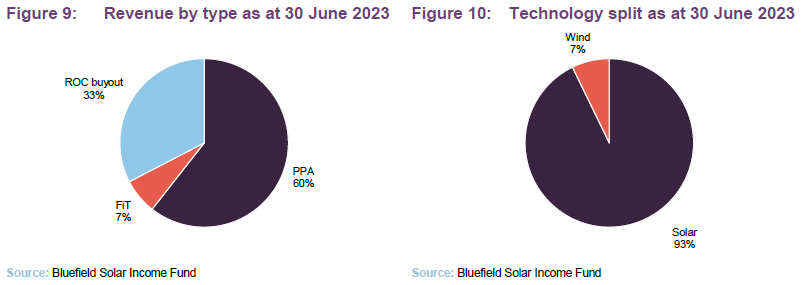

BSIF aims to pay shareholders an attractive return, principally in the form of regular sector-leading income distributions, by being invested primarily in solar energy assets located in the UK. The company also invests a minority of its capital into other renewables assets including wind and energy storage.

Why BSIF?

Readers may wish to refer to our annual overview note, which describes the investment approach in some detail.

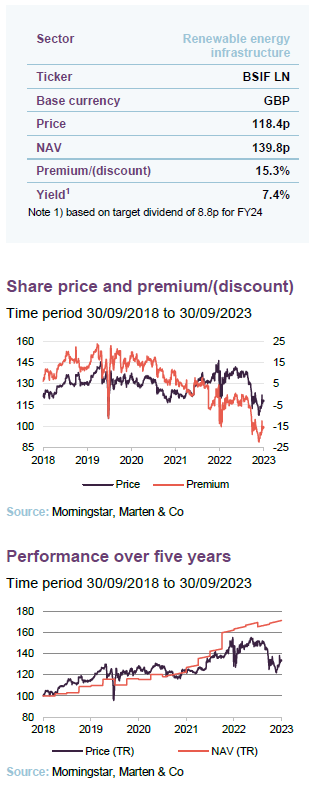

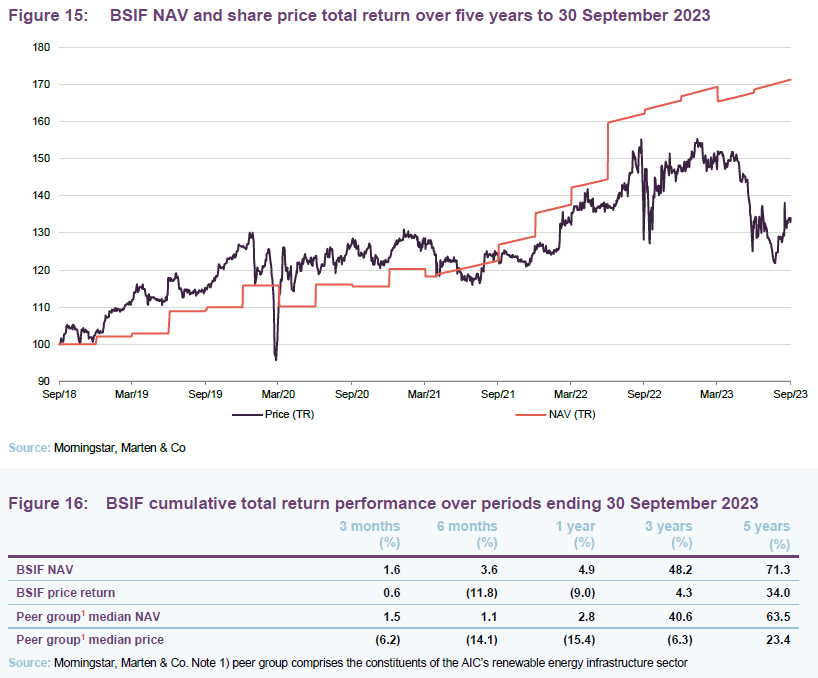

The dramatic shift in the macroeconomic environment over the past couple of years has had a significant effect on alternative income funds such as BSIF. With short-term Government debt yielding close to 5%, investors in search of income have a wider range of options and this has driven the recent capital flight out of the renewable energy infrastructure sector. Across the sector, the median share price total return for the last 12 months at the time of writing was a fall of 15.4% despite positive NAV returns of 2.8%.

BSIF shareholders will be encouraged that it has fared much better than most, in fact it is the third best performing fund in the sector in share price terms. As we explore in this note, there are good reasons why it deserves that status.

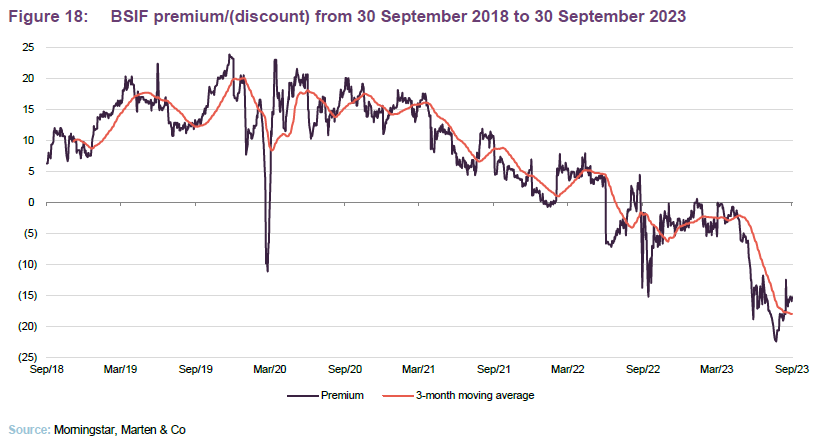

Nevertheless, as we show on page 14, BSIF’s discount is not far off its all-time widest level. This is immensely frustrating given the impediment that this creates for further equity fundraising at a time when there is a compelling need to fund renewable energy investments and when BSIF’s advisers have identified an attractive pipeline of potential opportunities.

Given the company’s ongoing execution, sector leading distributions and secular tailwinds driving performance, we feel that the current discount is hard to justify and likely provides investors with an attractive entry point.

Market Backdrop

In summary, since we published our last note in January 2023;

- UK power prices have continued to ease, helped by lower natural gas prices. This was to be expected, but fortunately for BSIF, as we describe later, it has been able to lock in higher prices for longer through its PPA activity.

- The rate of inflation has fallen but not as far as hoped and remains well above target. However, this is a net positive for BSIF.

- Interest rates have been hiked in an effort to choke off this inflation and, as we explain, this is impacting on discount rates used in NAV calculations.

- UK government policy in the fight against climate change has been watered down. Nevertheless, BSIF has been able to secure Contracts for Differences (CfDs) for new solar projects in the last two auction rounds. It seems likely that a change in government at the next election would be helpful for the sector.

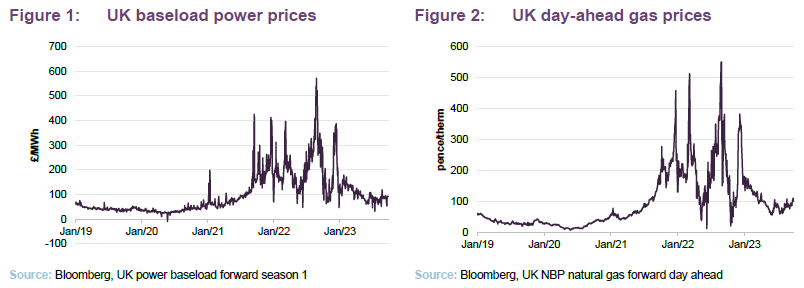

Power prices and fixing

As we have touched on in previous notes, the last few years have proved to be a remarkably volatile period for energy prices which have been impacted by a raft of factors including the pandemic and the invasion of Ukraine. Natural gas price volatility has been extreme which has had an outsized impact on power prices in the UK as shortfalls in power supply are met by gas-fuelled peaking plants, which effectively set the marginal price.

Volatility has begun to recede over the last few months, as shown in Figures 1 and 2; however, with the issues facing global energy production, and ongoing concerns about supply disruptions, near-term prices remain well above pre-pandemic forecasts.

However, as Figure 3 shows, short-term price expectations have eased dramatically. The main driver of this has been the recent warm winter and the increased availability of LNG, with new facilities coming on stream and Asian demand weaker than expected.

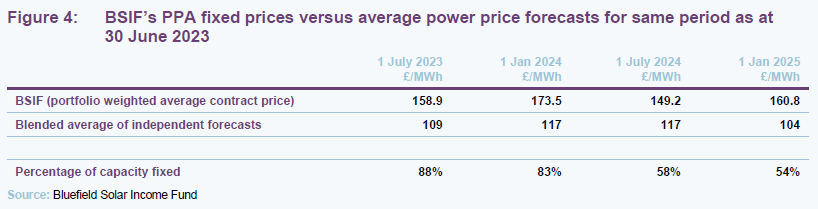

As we have discussed in previous notes, BSIF has been positively impacted by higher electricity prices thanks to its strategy of fixing the price of power sale contracts for individual assets not covered by long term contracts for periods between 12 and 36 months. The purpose of this strategy is to mitigate the company’s exposure to seasonal fluctuations and short-term events which have the potential to increase volatility, whilst allowing flexibility to capitalise on periods of higher power prices, and simultaneously enabling the company to avoid fixing prices during periods of significant weakness. BSIF’s average seasonal weighted power price increased from £57/MWh to £141/MWh over FY23.

The success of BSIF’s PPA-fixing strategy is evidenced in Figure 4, where the prices it is achieving are consistently well-ahead of independent forecasts.

https://quoteddata.com/wp-content/uploads/2023/10/4-bsifs-ppa-fixed-prices-versus-average-power-price-forecasts-for-same-period-as-at-30-june-2023.png

As at 30 June 2023, the average term of the fixed-price PPAs across the portfolio is 26.2 months (FY 2021/22: 25.8 months). When subsidies are taken into account, BSIF has considerable visibility over its near-term revenues (92% to December 2023 and 86% to June 2024). This, in turn, gives the board a high degree of confidence when setting BSIF’s dividend policy (see page 12).

Inflation and subsidy revenue

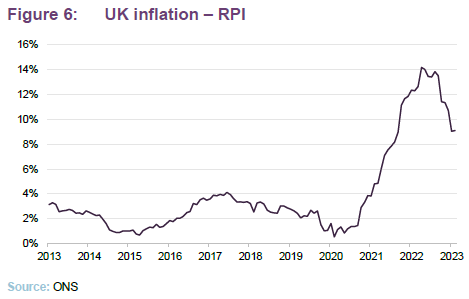

The trajectory of UK inflation has also been well documented and, while Figure 6 shows a clear softening of the data, there remains a long way to go for the UK to return to some form of price stability.

Higher oil prices had been expected to drive inflation higher in August but, while RPI (which is the predominant index driving the level of BSF’s subsidy income) did edge up, CPI fell.

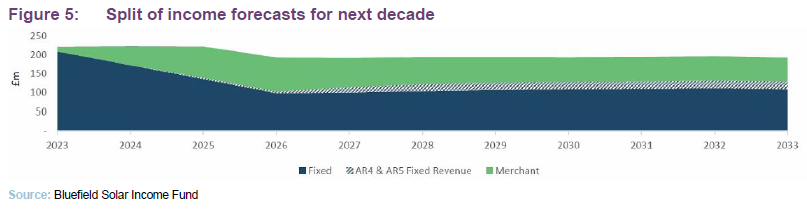

Despite creating further headwinds for the broader economy, higher inflation is a net positive for BSIF. Fixed, inflation-linked revenues make up around two-thirds of BSIF’s total revenue out to 2037, on a discounted basis. These revenues are predominantly made up of Renewable Obligations subsidies, which are linked to inflation as measured by the UK RPI. BSIF’s fixed revenues have the potential to be further enhanced by its pipeline of AR4 and AR5 CfD approved projects (strike prices linked to CPI) with the Low Carbon Contracts Company, which if constructed, would increase regulated revenues by c. 8% out to the mid-2030s.

In addition, this part of BSIF’s revenue is exempt from the Electricity Generator levy, discussed in detail in our last note.

In its accounts, BSIF says that its RPI inflation forecast for 2023 has been increased to 7% (from 5.5% in December 2022 and 3.4% in June 2022), reflecting expectations that UK inflation will remain higher for longer. As evidence builds that inflation will fall during H2 2023, a rate of 3.5% has been applied for 2024 (2024 inflation forecast previously used: 4.0% in December 2022 and 3% in June 2022). The forecast for 2025–2029 is 3.0% and for 2030 onwards 2.25%.

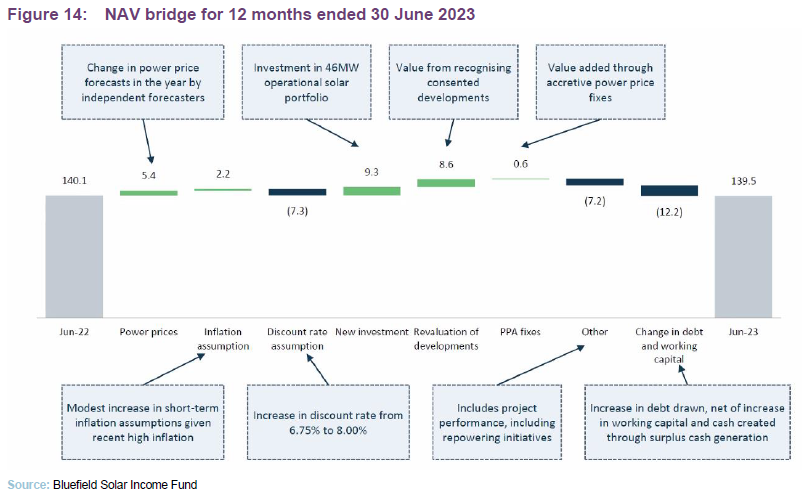

Discount rates

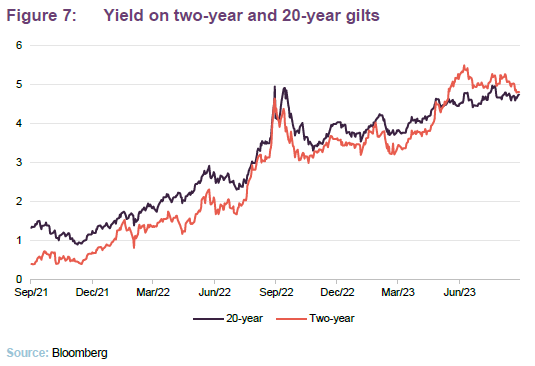

The other major headwind affecting BSIF, and the renewable energy sector as a whole, is the impact of higher discount rates, evidenced in Figure 7. As of 30 June 2023, BSIF’s weighted average discount rate had risen to 8%, an increase of 75bps from December 2022 and 125bps from 30 June 2022.

That change was predominantly due to a rise in gilt yields, which have risen significantly over the last few months due to several technical factors, in addition to the UK’s ongoing struggles with inflation.

Market pricing also plays a role in setting discount rates, however the adviser notes that the secondary market for solar portfolios has remained relatively stable, within a range of £1.2m–£1.4m/MWp, over the past 12 months.

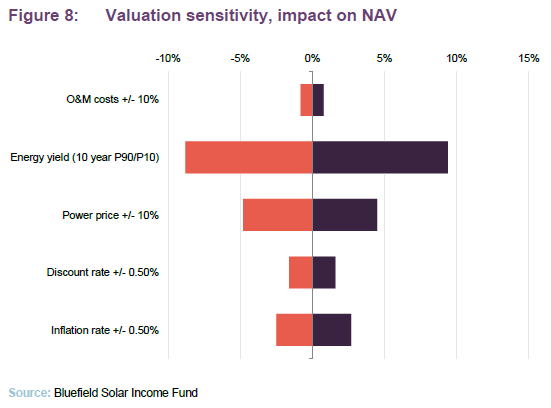

Valuation sensitivities

With a number of moving parts, BSIF has provided a sensitivity analysis towards the key underlying assumptions within the discounted cash flow model which drives valuation decisions, highlighting how changes in certain variables would impact the company.

Portfolio

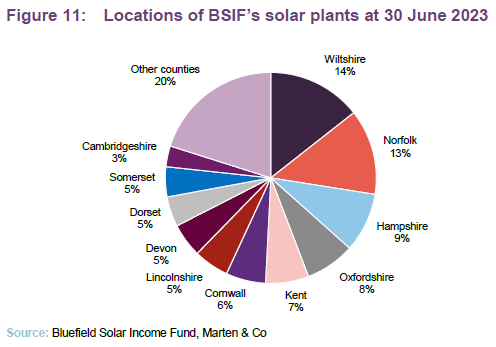

At 30 June 2023, BSIF had an operational portfolio of 129 solar PV plants (87 large scale sites, 39 micro sites and 3 roof top sites), 6 wind farms and 109 small scale UK onshore wind turbines with a total capacity of 812.6MW

Since we last published on BSIF in January 2023, it has completed the purchase of three recently consented ready-to-build solar PV projects, totalling 97MWp from its development partners Lightrock Power and Bluefield Renewable Developments, for a total of £3.9m. The projects, which are located in Devon, East Sussex and Shropshire, have grid connection dates between 2024 and 2026.

In the UK government’s latest auction of contracts for difference (AR5), BSIF secured allocations of CfDs on all four of the projects (totalling about 200MW) that it submitted to the latest auction round. The strike price for these solar projects was £47/MWh (in 2012 prices), slightly higher than the £45.99/MWh secured for three projects in AR4.

As we have discussed in previous notes, part of the attraction of the wind portfolio was the opportunity to repower the wind turbines in Northern Ireland. The decision was taken to repower 17 of the 29 small-scale turbines with EWT 250kW turbines. This increases both their efficiency and output, whilst maintaining their respective NIRO accreditation status.

As at 30 June 2023, seven turbines had repowered and returned to operation, a further nine have planning approval for repowering (with a new 25-year term), and two have received a turbine delivery, with repowering planned for FY24. Planning applications for the remaining projects have been submitted.

BSIF’s portfolio is overseen by a team of 115 (and growing) within Bluefield Partners and Services covering primary investment, secondary investment, ESG, development, engineering, construction management, monitoring and reporting, debt compliance, technical asset management, operation and maintenance and commercial.

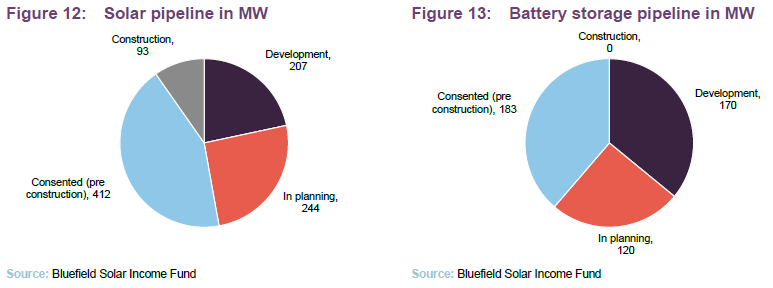

Construction and development pipeline

At 30 June 2023, BSIF’s portfolio had 93MW under construction, 595MW approved, 364MW in planning, and further potential capacity identified of 377MW. That is 1.43GW of additional capacity, split as to 956MW of solar and 473MW of battery storage. The consented/pre-construction projects have connection dates between 2023 and 2028.

The construction/consented pipeline was valued at £67.7m at 30 June 2023 (£42.4m and £25.3m, respectively).

Projects under construction are Yelvertoft (49MWp in Northamptonshire) and Mauxhall Farm (c.44MWp in North East Lincolnshire). Yelvertoft signed a fixed price EPC contract with Bouygues in September 2022 and is targeting operation in Q4 2023, while Mauxhall Farm signed a fixed price EPC contract with EQUANS in March 2023 and is expected to be operational in Q2 2024.

Mauxhall Farm is planned to be a co-located project and construction of a 25MW battery energy storage scheme is expected to commence shortly after the solar plant has been commissioned.

ESG

Over the year ended 30 June 2023, BSIF’s portfolio delivered savings of the equivalent of 173,000 tonnes of carbon dioxide.

ESG is a key proponent of BSIF’s strategy with three of the adviser’s team members dedicated to this area, and its annual report has an extensive section dedicated to aspects of ESG. Over its 2023 financial year, BSIF generated annual CO2e savings of over 173,000 tonnes (up from 120,000 tonnes for the prior year), with enough renewable energy to power approximately 288,000 homes (FY22 215,000 homes), and over £253,000 to be paid to community benefit schemes (FY22 £154,000).

BSIF also conducted 30 biodiversity assessments across its operational portfolio, with further improvements planned.

BSIF is also stress testing the resilience of the portfolio to climate change, including the effects of higher temperatures and possibly lower wind speeds.

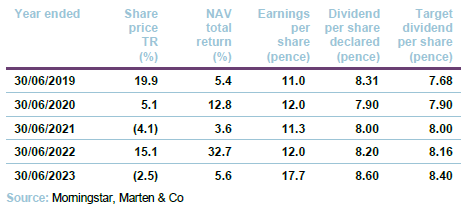

Performance – a bumper year

Since we last published, BSIF has published its annual results covering the 12 months ended 30 June 2023.

The adviser reports that solar portfolios are being priced at £1.2m–£1.45m per MWp, this is roughly the same level as in previous years. Nevertheless, the board has opted to raise the discount rate used to calculate the net present value of BSIF’s future cash flows to 8.0%, up from 6.75% at end June 2022.

Solar portfolio

Solar irradiation was 6.0% above budget for the financial year. However, availability issues – related to supply chain problems and capital improvement works, principally in March and April 2023 – held back generation and the generation yield was very marginally lower than forecast (959.88MWh/MWp versus a target of 959.91). Consequently, total generation from the solar portfolio was 702.4GWh, marginally (0.2%) below budget.

Nevertheless, the abnormally high prices for power experienced in FY2022/23 that we discussed on page 10, meant that this was a bumper year for the profitability of BSIF’s solar portfolio. The average power price achieved was £223.68/MWh, almost 69% more than for FY2021/22 and 19.5% more than budgeted.

The net of this was revenue of £157.1m from the solar portfolio, 121% higher than the revenue achieved in FY22.

For the coming year, optimisation/repowering work on the portfolio has been scheduled for the winter months when irradiation/output is naturally lower. The adviser is budgeting about £4m–£5m of spend in this area per annum.

Onshore wind portfolio

As was the case in FY22, the wind resource was lower than budgeted and this held back the amount of power generated by the wind portfolio. Total generation from this part of the portfolio was 133.8 GWh, 16.2% below budget.

There was also an impact from reduced availability at the Delabole Wind Farm. The decision was taken to replace the operations and maintenance (O&M) provider for this windfarm and significant liquidated damages have been recovered from this O&M provider.

Nevertheless, the average price achieved for the power produced was above forecast and the total revenue from the wind portfolio was £27.9m.

Earnings and NAV impact

The net effect was that BSIF generated underlying earnings of 17.72p per share, which after debt amortisation of 2.98p and 8.6p of dividends (up from 8.16p for FY22) left 6.14p per share to be added to reserves.

BSIF’s NAV fell from 140.39p at 30 June 2022 to 139.7p at 30 June 2023. BSIF’s annual report identified a number of factors that drove this change:

f

f

We have discussed most of these performance drivers elsewhere in this note. We would highlight the positive benefit of BSIF’s new investments, which – we think – supports the board’s decision to prioritise using the supernormal cash flows earned from higher power prices to fund BSIF’s considerable pipeline.

Dividend

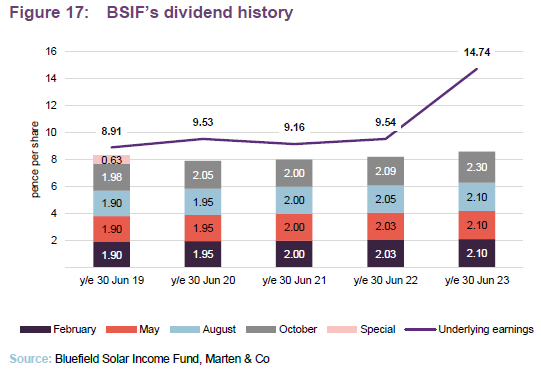

BSIF pays quarterly dividends. For a given financial year, the first interim dividend is paid in February, with the second, third and fourth interims paid in May, August and October/November respectively (dividends are usually declared the month before payment).

BSIF had been targeting dividends of 8.4p (paid in quarterly instalments of 2.1p) for the accounting year ended 30 June 2023. In the event, after paying three quarterly payments of 2.1p, the jump in BSIF’s underlying earnings per share (after servicing its debt) to 14.74p, encouraged the board to raise the final dividend to 2.3p, bringing the total for the year to 8.6p.

Within its peer group, BSIF has consistently delivered the highest dividend on a pence per share basis (or euro equivalent).

The target dividend for FY24 has been set at not less than 8.8p, an increase of 2.3% on the total dividend for FY23. While this may look like a small uplift in the context of the rate of inflation and BSIF’s strong dividend, there is an obvious benefit to shareholders if BSIF uses the cash that it saves to fund its pipeline of new investment opportunities (with the sector trading at a discount, many of BSIF’s peers are struggling to raise funds and so BSIF should be able to achieve keen pricing on the projects it selects).

Premium/(discount)

The COVID-related panic in markets during March 2020 saw a short-lived discount emerge for BSIF, with the shares quickly regaining their poise. However, the premium eased over the course of 2021 and early in 2022, the shares began to trade at a discount to NAV.

Widening discounts have been an issue for the entire investment companies sector, but renewable energy funds have been amongst the worst affected. We believe that the primary driver of this has been the increase in interest rates that has accompanied the fight against inflation. Higher yields available on cash deposits and bonds have tempted investors away from alternative income funds such as BSIF.

While it may be premature to draw any firm conclusion, the chart in Figure 18 suggests that the tide may have turned in August as investors as slowing, albeit high inflation, gave investors increasing confidence that the peak in rates was in sight.

Balance sheet

At the portfolio level, following a refinancing of its three-year term loan, BSIF now has a £130m term loan provided by NatWest that matures in December 2039. £110m of this is hedged for the full term at an effective fixed cost of about 2.7% per annum.

At the group balance sheet level, BSIF also has access to a £210m revolving credit facility and an uncommitted accordion feature that allows for a further £30m of borrowing. This facility matures in May 2025 and is provided by Lloyds Bank, RBS International, and Santander UK. The cost of this is 190bps over SONIA. £153m of the RCF was drawn down at 30 June 2023.

BSIF’s total outstanding debt amounted to £597.4m, equivalent to an LTV of about 41%. About 20% of BSIF’s debt at 30 June 2023 was inflation-linked and the balance fixed. Crucially, the cost of servicing the inflation-linked debt is much lower than the company’s inflation-linked revenues. The average cost of BSIF’s long term debt at 30 June 2023 was about 3.5%.

Fund profile

BSIF is a Guernsey-domiciled sterling fund, with a premium main market listing on the London Stock Exchange (LSE). At launch on 12 July 2013, it focused primarily on acquiring and managing a diversified portfolio of large-scale (utility-scale) UK-based solar energy assets, to generate renewable energy for periods of typically 25 years or longer. BSIF owns and operates one of the UK’s largest, diversified portfolios of solar assets with a combined installed power capacity of 813MWp.

In July 2020, shareholders approved proposals to expand the remit and BSIF began making investments in onshore wind and energy storage projects soon after.

BSIF is designed for investors looking for a high level of income with regular distributions.

Further information regarding BSIF can be found at: www.bluefieldsif.com.

BSIF’s primary objective is to deliver to its shareholders stable, long-term sterling income via quarterly dividends. The majority of the group’s revenue streams are regulated and non-correlated to the UK energy market.

The underlying investments are held in SPVs which, in turn, are held through BSIF’s wholly-owned and UK-domiciled portfolio holding company, Bluefield Renewables 1 Ltd (BR1).

Bluefield Partners LLP – an experienced investment adviser

Bluefield Partners LLP was established in 2009 as an investment adviser to companies and funds investing in solar-energy infrastructure. It has been BSIF’s investment adviser since launch. Its business comprises the investment adviser, an asset manager (Bluefield Services Ltd), a maintenance manager (Bluefield Operations Ltd), and a solar project developer (Bluefield Development).

Previous publications

Readers interested in further information about BSIF may wish to read our previous notes (details are provided in Figure 19 below). You can read the notes by clicking on them in Figure 19 or by visiting our website.

Figure 19: QuotedData’s previously published notes on BSIF

Source: Marten & Co

Legal

This marketing communication has been prepared for Bluefield Solar Fund Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.