On the offensive

Bluefield Solar Income Fund (BSIF) is growing actively, supported by a wider mandate after shareholders voted overwhelmingly in July 2020 in favour of proposals to expand the fund’s remit beyond solar. BSIF will apply what many believe has been a very successful model since its launch in 2013 to the complementary technologies of wind and hydro. The expanded mandate also includes battery storage.

A focus on optimising its portfolio over recent years, excellent conditions for solar generation and prolonging the benefit of 2018’s higher power prices through power purchase agreements (PPAs) have allowed BSIF deliver a consistently covered dividend and sector-leading total NAV returns over its lifespan. The fund sees the expanded remit as an appropriate next step in response to shareholders’ appetite for growth. BSIF is arguably well-positioned as momentum behind decarbonisation has gathered pace. Solar remains central, with 134MWp of capacity added since August 2020.

Evolving beyond large-scale UK solar assets

BSIF aims to pay shareholders an attractive return, principally in the form of regular sector-leading income distributions. Historically, this has been achieved by investing in a portfolio of large-scale UK-based solar-energy infrastructure assets. BSIF can now augment its solar portfolio with minority investments in other renewable technologies and energy storage assets.

Expanded mandate neatly aligned with green recovery

BSIF has had a busy few months returning its focus to growth, after a period of consolidation where the focus was on deploying its asset management team to try and optimise the performance of its solar assets.

Armed with an expanded mandate, after an overwhelming majority of shareholders voted in favour of proposals put forward in the summer of 2020 to amend the investment objective and policy, BSIF has set itself up for what many believe will be expected to be a sustained return to asset growth for the industry.

Resolutions to amend the dividend policy, as well as its investment advisory agreement, were also passed.

The following three areas will be the pillar of BSIF’s growth strategy over the foreseeable future:

- Solar development: the pipeline stands at over 450MWp.

- Wind: specific areas within wind potentially offer value. Wind’s generation profile, with its peaks over the winter months, should be a natural complement to solar.

- Battery storage: the development in storage technology and the regulatory environment is making this sub-set of renewables generation increasingly attractive. We note that the soft launch of the National Grid’s dynamic containment service in October 2020 has opened up a lucrative new revenue stream. Since its launch, it has paid an average of £17.0MW/hr, considerably above the recent average fast frequency response prices, of £6.5MW/hr over the same period.

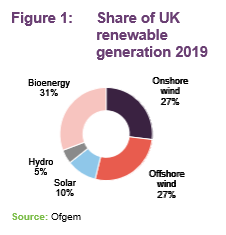

BSIF’s expanded mandate allows it to complement its core portfolio of solar energy assets with minority investments in other renewable technologies, as well as assets outside the UK. Non-solar investments, which are expected to be focused initially on wind, will be capped at a maximum of 25% of BSIF’s gross asset value (GAV), calculated at the time of investment. Wind accounts for the majority of the UK’s renewable generation. In addition to wind, BSIF’s mandate now allows it to invest in hydro and energy storage. It may also invest up to 5% of the GAV in UK solar development opportunities.

Within the 25% non-solar allocation, BSIF may invest up to 10% of GAV in assets beyond the UK. However, there is not thought to be any urgency in investing outside the UK, given the renewed domestic momentum behind supporting renewable energy asset growth. The sector is seen as a cornerstone in the economic recovery that will take place over the next several years. Prime Minister Boris Johnson’s ‘green recovery’ plan is expected to make available around £12bn of state investment to incentivise asset growth within renewables.

Background to the changes – balancing the dividend with asset growth as the industry prepares for the return of subsidies

BSIF has expanded cautiously since 2016, a decision that was reinforced from 2017 onwards, as fewer newly-commissioned solar projects were available once they were no longer eligible for government subsidies.

For a wider discussion of the subsidies that were provided to renewable energy producers up to 2017 and ultimately powered the industry’s growth, please refer to page 8 of our initiation note.

BSIF saw little benefit in actively participating in a secondary market where, before the pandemic struck, an influx of competition for solar assets from private investors further fuelled inflation in prices.

Although BSIF’s yield has consistently been amongst the highest within the AIC’s renewable energy infrastructure sector (see the peer group section), the board has been cognisant of a greater desire among its major shareholders for asset growth. By market capitalisation, BSIF is the smallest of the early-launch funds that listed between 2013 and 2014 (see page 24).

James Armstrong, managing partner of Bluefield Partners LLP, BSIF’s investment adviser, says that the energy market has evolved considerably since the fund’s IPO in 2013. In discussing the decision and timing behind BSIF’s expanded mandate, he drew attention to two driving themes:

- continued decarbonisation; and

- renewables’ share of the overall power mix continuing to increase.

The UK has made a legally binding commitment to achieving net zero carbon emissions by 2050.

Efforts to incentivise asset growth within renewables may result in BSIF identifying more greenfield (building a new facility from the ground up) opportunities alongside the existing pool of brownfield (acquiring or leasing an existing facility) assets. Before COVID-19, it was accepted within government that additional subsidy support was required to supply the industry with sufficient economic incentive to undertake costly asset expansion.

Notwithstanding the technological strides that have considerably reduced the cost basis of wind and solar generation, the prospect of relying exclusively on power price agreements (PPAs) for newly-commissioned projects is arguably not appealing when balanced against a blend of market price risk and regulated income.

Over the second half of 2020, the Department for Business, Energy and Industrial Strategy (BEIS) announced that solar PV will be allowed to participate in the next contract for differences (CfD) allocation round (AR4) for the first time since 2015. As well as solar, wind projects will be able to bid in AR4, the CfD auction planned for 2021. The CfD scheme represents the Government’s main instrument for providing support to low-carbon electricity production and operates through an auction process.

BSIF’s investment adviser notes that based on estimates from Solar Power Media, the indication is that there was a 13GWp pipeline of large-scale solar projects in the development phase, as at 31 December 2020. This represented a 44% increase on the 9GWp reported at 30 June 2020.

Support of 12GW of projects expected through AR4

BSIF notes that the UK Government is aiming to support up to 12GW of renewable energy projects in AR4, with the opening pencilled in for late 2021. The tender will split technologies across three ‘pots’. Pot 1 includes established technologies such as onshore wind and solar PV; pot 2 includes less-established renewable technologies such as advanced conversion technologies and tidal stream; while a new pot 3 has been set up for offshore wind. Further details on the design parameters for AR4 are expected to be published during the period. Subsequent rounds are then expected to be held approximately every two years.

Wind complementary to solar

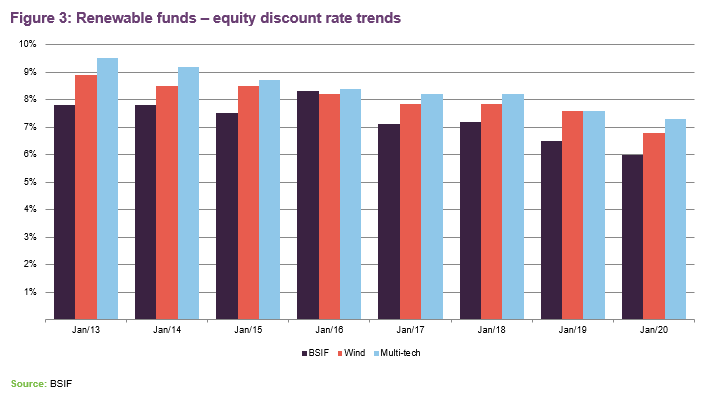

The expansion of BSIF’s investment policy is focused intentionally on the renewable technologies that are closest to solar in terms of risk and return. Solar is the most predictable source of renewable energy, in that it generates output with the least variance. It is followed by wind. In James’s view, the converging trend in discount rates since BSIF’s launch in 2013, illustrated by Figure 3, understates the risks associated with many technologies other than solar and wind. Wind appears to share a complementary generation profile to solar (illustrated by Figure 4), and the regulated revenues attached to such assets lower the exposure to power prices.

BSIF considers the ability to acquire solar and wind portfolios jointly as a competitive advantage based on its recent experience in reviewing purchase opportunities.

The secondary market for wind is thought to be deep, and certain segments are less competitive than others. BSIF has bids in place on operational subsidised onshore wind assets and the investment adviser is expected to remain focused on reviewing opportunities provided by the secondary market.

In July 2020, Bluefield Partners recruited Baiju Devani (please refer to the fund profile section on page 32 for more on Baiju’s background), an experienced wind professional, to take the lead as the investment director overseeing wind acquisitions.

Concerning wind, BSIF believes it can extract higher returns by making use of the investment adviser’s existing asset management infrastructure. The power sales strategy has been successful over the fund’s lifetime and the sophisticated technical asset management infrastructure (discussed in detail in our initiation note) can be applied to wind initially, as well as to other technologies going forward.

Hydro is also seen as complementary to solar and wind, though the UK market for hydro is much smaller (installed capacity of around 5,500MW). James says that BSIF will look towards operating rather than developing hydro assets, and over the long term he does not expect hydro’s share of the fund’s GAV to surpass 5%.

First subsidy-free solar development and wind

The increasingly lower costs associated with solar and wind may indicate that subsidy-free investments will continue to be a viable – and attractive – option over the long term.

In the second half of 2020, a 50MWp PV development controlled by BSIF received planning permission. Developed by Lightrock Power it is the first of a significant pipeline of potential development opportunities.

BSIF notes that the co-location of unsubsidised solar assets with battery storage plants offers the potential to bring efficiencies to construction expenditure and opportunities to enhance the use of the grid connection.

De-linking of the dividend as part of the renewed growth initiative

BSIF’s dividend is no longer linked to the retail price index (RPI). While it intends to remain among the highest dividend-paying fund in the sector, on a pence-per-share basis, de-linking should provide BSIF with a greater capacity to pursue growth.

BSIF is shifting to a progressive dividend policy from a very high base, given that not only has its yield consistently been amongst the highest in the listed renewables sector, but it has also surpassed yields provided by many real assets, outside of renewables.

In addition to extending the life of BSIF’s portfolio through acquisitions, growth in the asset base could also lead to greater liquidity in its shares, as well as cost efficiencies to shareholders, with the fund’s fixed costs potentially spread over a larger base.

Valuable access to regulated income

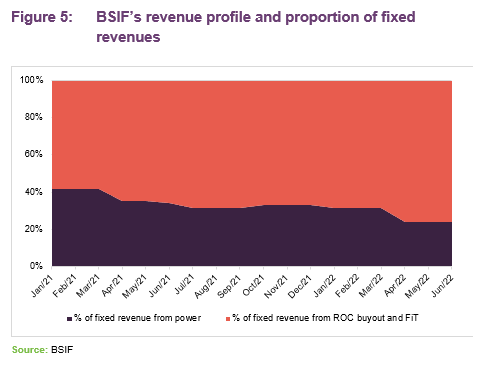

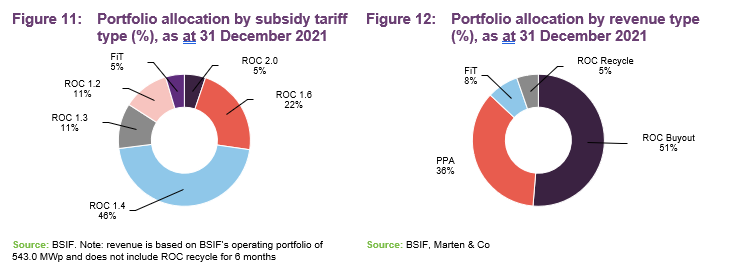

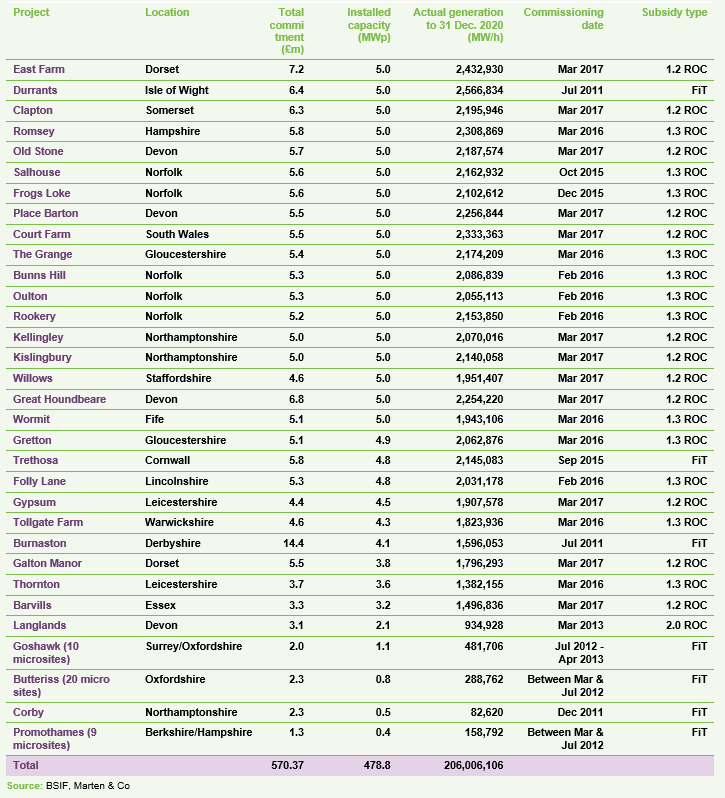

Around 66% of BSIF’s revenues are regulated and non-correlated to spot baseload power prices. Over the most recent reporting period, covering the six months to 31 December 2020, the portfolio’s revenue streams were distributed as follows:

- Regulated revenues from the sale of FiTs and ROCs accounted for 65.9% of total revenue; and

- The sale of electricity to the grid was responsible for the remaining 34.2%.

As illustrated by Figure 5, BSIF has 92% of its revenues fixed until June 2021, and 88% of its revenue fixed until December 2021. Non-regulated income is derived from the sale of electricity power purchase agreements (PPAs), which effectively lock-in prices.

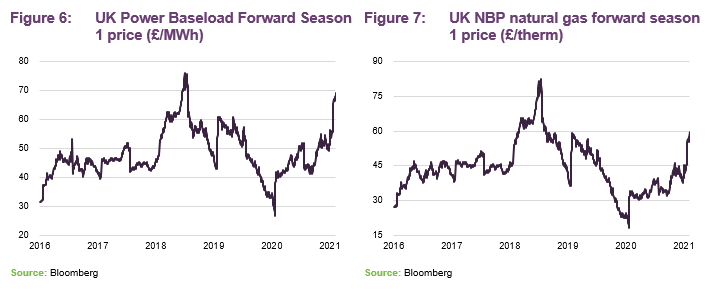

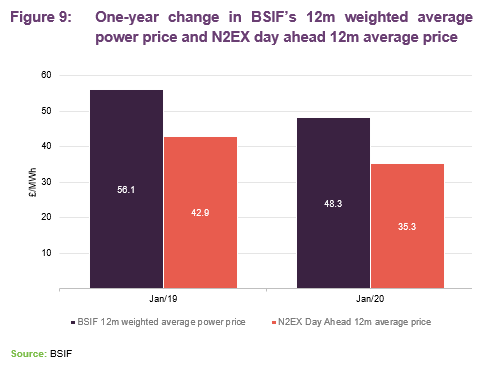

BSIF’s strategy of fixing prices over periods of 12–36 months arguably provides a very useful shelter. Having benefitted from several agreements that were actioned in 2018 – a year which saw power prices rise sharply – BSIF appears to have succeeded in managing the timing of its PPA fixes to avoid the lows in April 2020 (illustrated by Figures 6 and 7), before fixing selected certain parts of the portfolio to take advantage of rising power prices during the second half of 2020 and early 2021.

Some of the PPAs are valid over much longer periods, with around 20% of the portfolio (around 95MWp) having PPAs in place with floor prices until 2029.

BSIF’s investment adviser notes power prices rose steadily during the second half of 2020, increasing from £24.18MWh in April 2020 to £54.98MWh in December 2020. The net result of regulated income streams and the timing of the PPA fixes was the portfolio achieving an average contracted price for the portfolio of £48.37MWh, over the calendar year to 31 December 2020. By comparison, the average day-ahead baseload price was £36.85/MWh for the same period.

A key attraction of solar is thought to come from its high predictability. BSIF’s manager says that, based on historic data, there is a 90% probability that solar irradiation (the power source of solar assets) will vary within a range of +/- 7%.

Investment process

BSIF’s investment adviser, Bluefield Partners, has developed a formalised and repeatable investment process, based on its extensive experience, that it rigorously applies to all potential investments. As a significant investor in the space, the manager benefits from natural deal flow from its network of advisers and partners. Despite its recent focus on improving operational efficiency, BSIF continues to benefit from an ongoing pipeline of potential opportunities.

Before any costs are incurred in preparing for a transaction, a ‘concept review’ of the project is undertaken by the adviser’s managing partners. If, following this review, the partners consider that the project should be progressed, a letter of interest or memorandum of understanding is then issued to the vendor and the adviser will secure exclusivity on the asset. By securing exclusivity, the adviser avoids incurring transactions costs on projects in which it could be subsequently outbid.

Once Bluefield’s managing partners have approved a concept review, the investment adviser issues a concept paper to BSIF’s board. This concept review fixes a project evaluation budget as well as confirming the project proposal is in line with the BSIF’s investment policy and strategy. Once approved, the project moves on to the due diligence stage.

As part of its due diligence, the adviser engages legal, technical and, where required, insurance and accounting advisers to undertake independent due diligence in respect of the project. This includes site visits and a detailed survey of the site to highlight any potential issues. Where specialist expertise is required due to project specifications, the adviser has experience in identifying relevant experts and, in addition to this, it applies its own direct commercial experience in executing solar PV project acquisitions and managing operational solar plants. Assuming that a project passes through the due diligence stage, a detailed investment paper is prepared and submitted to the investment committee for approval.

The investment committee reviews the paper and makes an investment recommendation for the board. The investment committee operates based on unanimous consent and the adviser says that it has a record of making detailed evaluations of project risks. The investment paper discloses all interests which the adviser and any of its affiliates may have in the proposed transaction.

Following approval by the investment committee, recommendations are issued by the adviser for review by the boards of the company and BSIF’s wholly-owned and UK-domiciled portfolio holding company, Bluefield SIF Investments Limited (BSIFIL). Both the company and the BSIFIL board undertake detailed review meetings with the adviser to assess the project before determining any approval. Both board approvals are required for a transaction to be approved.

If the boards of the company and BSIFIL approve a transaction, the adviser is authorised to execute the transaction in accordance with the recommendation and any condition stipulated in the boards’ approval. The board is kept aware of the adviser’s pipeline of potential new investments.

Before executing the transaction, the adviser completes a closing memorandum confirming that the final transaction is in accordance with the terms presented in the investment paper to the investment committee; detailing any material variations and outlining how any conditions to the approval of the investment committee and/or board approval have been addressed. This closing memorandum is countersigned by an appointed member of the investment committee prior to completing the transaction.

Key features of the investment process

Having worked with a range of legal, technical, insurance and accounting advisers to execute transactions in the UK market, the adviser has developed an understanding of key areas of competence for the specialist advisers in the space. It uses this to identify specific individuals who are expert in advising on specific detailed technical aspects of a project both during and following a transaction.

Contract terms are specifically negotiated and tailored for each project, but based on its transaction and project operational experience, the adviser has also developed standardised terms. These have specific protections from the construction contracts regarding recovery of revenue losses for underperformance and obligations for the correction of defects. Underlining their value, these contractual protections have, at times, been exercised by the adviser to the ultimate benefit of BSIF’s shareholders.

Investment restrictions

- No less than 75% of the gross assets will be invested in UK solar assets. BSIF can also invest up to 25% of its gross assets into onshore wind, hydro and storage technologies.

- BSIF is permitted to use non-recourse debt at the SPV level to finance specific solar energy infrastructure assets, or portfolios of assets provided that at the time of investment, total non-recourse financing within the portfolio does not exceed 50% of BSIF’s gross asset value.

- BSIF may also use short-term borrowings at the holding company level to facilitate the purchase of investments, but such short-term debt (when taken together with the debt taken at the SPV level) is not permitted to exceed 50% of its gross asset value.

- At the time of acquisition, no single investment in a solar energy infrastructure asset (excluding any third-party funding or debt financing in such asset) will represent more than 25% of BSIF’s net asset value.

- BSIF is not permitted to invest more than 10% of its gross asset value, at the time of investment, in other closed-ended investment funds which are listed on the FCA’s Official List.

Sustainability

COVID-19 has been a reminder of how abruptly the world can change. While the hope is that normal life can be resumed in 2021, climate change and sustainability continue to pose urgent long-term threats.

The UK, alongside many other countries, will place considerable emphasis on green initiatives in the stimulatory policies used to reboot economic activity. For the UK to deliver on its net zero carbon emissions legally binding commitment, substantial additional investment into renewable energy generation and storage will be required.

Renewable energy investors such as BSIF may play a pivotal role in redressing some of the impact of climate change. BSIF’s portfolio of solar assets delivers carbon savings of 125,500 tonnes CO2e (a standard unit for measuring a carbon footprint) per year (54,000 tonnes CO2e over the six months to 31 December 2020), which it says is equivalent to powering 170,000 homes with clean energy. In 2019 BSIF became the first Guernsey-domiciled, London-listed investment company to be awarded Green Fund status by Guernsey. It was also awarded the LSE Green Economy Mark.

Among its planned future initiatives, BSIF expects to commit to the UN Principles of Responsible Investing.

Valuation drivers

BSIF publishes NAVs on a quarterly basis, based on portfolio valuations prepared by the investment adviser. NAV calculations depend on several key assumptions regarding the discount rate, inflation rate, taxation, power prices, the energy yield from the portfolio, and project terminal values.

Portfolio valuations are produced on a six-monthly basis (31 December and 30 June each year). BSIF’s portfolio was valued at £608.4m, as at 31 December 2020 (0.99m/MW based on a total capacity of 613MWp). BSIF’s NAV per share was 117.1p, compared to 117.0p, at the 2020 FY-end to 30 June.

Movements in the value of the portfolio over the six months to 31 December 2020 are displayed in Figure 8. The £27.9m figure for ‘balance of portfolio return’ is mainly the result of the unwinding of the discount rate over the period, though in this instance it also includes the effects of the slight alteration in BSIF’s capital structure following the £45m equity raise in November 2020 (see the capital structure section).

There is no publicly quoted price for the projects in which BSIF invests, so the projects are valued by discounting the net unlevered (removing the effect of any debt) forecast cash flows over the life of each project (after deducting any taxation). This is irrespective of whether a project has been financed using debt (the approach discounts all of the net cash flows from a project and not just those that are due to BSIF, through BSIFIL). Since June 2016, the discount rate used is a portfolio-weighted average cost of capital (WACC). Prior to this, it was calculated using a risk-free rate plus a market risk premium calculated by the investment adviser (based upon its judgement of market pricing within the UK solar photovoltaics (PV) sector).

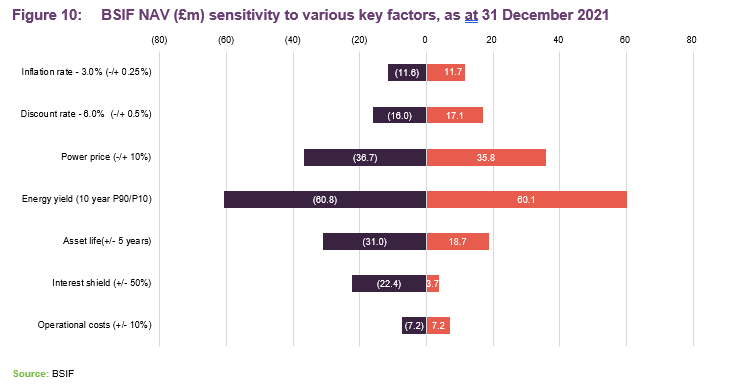

In the sections below, we look at some of the key inputs behind BSIF’s valuation. The sensitivity of the NAV to these inputs is visually illustrated by Figure 10 on

page 16.

Power prices – up over the second half of 2020 but medium- and long-term forecasts lowered further

The power prices used to forecast project cash flows are based on estimates by three independent forecasts, which are blended equally. Power prices staged a recovery over the second half of 2020,

The forecasts used in BSIF’s most recent interim results, to 31 December 2020, implies a compound annual growth rate, in real terms from 2021, over the 30-year forecast of (0.02%). Forecasters continue to predict that prices will be held back by falling commodity prices and increased renewable generation post-2030.

Figure 6 on page 10 showed the price trend in UK baseload power over the years since BSIF’s launch. The surge in prices over 2018 reflected higher commodity prices (coal and natural gas) and a reform of the EU’s emission trading system, which was expected to lead to scarcity of carbon credits.

UK power prices appear to be heavily influenced by gas prices, reflecting the importance of gas-fired plants within its generation mix. A tightening in gas supplies towards the end of 2020 provided upward momentum to baseload power prices.

Discount rate

The discount rate applied to cash flows can have a pronounced impact on valuation. The discount rate is applied to a project’s cash flows to arrive at a net present value. BSIF believes that its use of a relatively lower discount rate compared to some of its listed peers is justified based on the predictability of solar PV.

In BSIF’s view, the convergence of discount rates (see Figure 3) used for different renewable technologies in the years since its launch is not representative of their different complexities and variances. The investment adviser makes a comparison with anaerobic digestion, a more complicated technology than wind and solar, which is being valued using a comparable discount rate.

Factoring in the power price forecasts used in the valuation accompanying the 30 June 2020 annual results, resulted in BSIF lowering the discount rate to 6.00% (from 7.18% in June 2019 and 6.50% in December 2019).

Energy yield

The energy yield of a solar photovoltaic asset is the amount of energy that it produces. This is dependent on three key factors:

- the irradiation captured by the power plant;

- the ratio at which the power plant converts the solar irradiation to energy (the performance ratio); and

- the availability of the power plant (days per year available as a percentage of the total possible).

Irradiation forecasts are supplied by the technical adviser and are formed from several long-term irradiation databases that use both ground- and satellite-based measurements. A weighted average is formed based on the quality of the dataset, with outliers excluded. The base case yield is also referred to as the P50 value; that is, there is a 50% probability that the actual yields will exceed this (and, conversely, a 50% probability that the yield will fall short of the estimate).

Asset life extensions

Extending the useful life of an asset increases the value of the portfolio increases the number of years a portfolio generates income.

In computing the discounted cash flows to arrive at the estimated value for each project, it is assumed that each asset has a terminal value of zero after an operational life of approximately 25 years from commissioning.

It should be noted that BSIF’s investment adviser has an active programme of working to extend asset lives (both through planning and lease amendments), which may justify the use of longer asset lives in the future.

Over the 12 months to 31 December 2020, successful asset extension activity by the investment adviser resulted in 306MWp of capacity being valued based on an additional five to 15 years of operational life. As at 31 December 2020, the weighted average life of the portfolio was 27.1 years.

Sensitivity analysis

Figure 10 shows the impact on BSIF’s NAV per share based on up/down scenarios. The greatest impact would come from changes to energy yields, followed by power prices and the discount rate.

Asset allocation

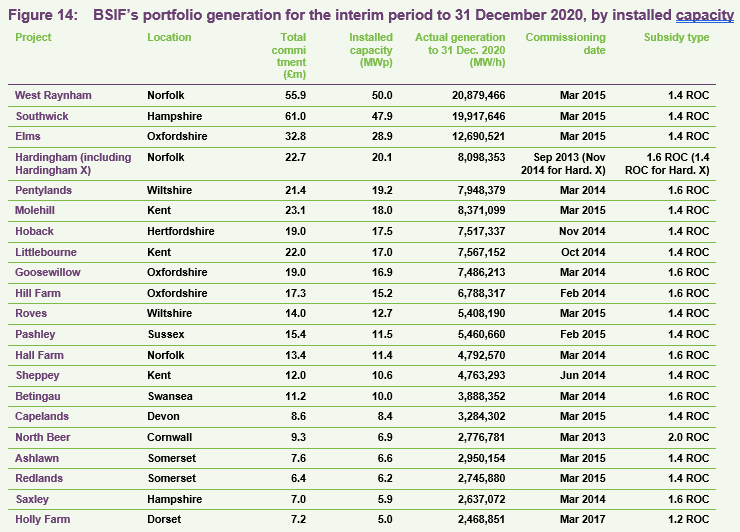

As at 11 January 2021, the date BSIF announced the acquisition of Bradenstoke Solar Park (a 70MWp plant), the portfolio comprised over 100 solar PV projects amounting to a cumulative installed capacity of 612MWp. This represented a 38.8% increase on the 30 June 2018 figure quoted in the initiation note.

BSIF’s solar farms are spread across England and Wales, with a bias towards southern England, reflecting the higher irradiation levels available. The largest exposure to a single county remains with Norfolk, at 18%.

As illustrated by Figures 11 and 12, as at 31 December 2020, 64% of revenues were regulated (split between the sale of ROCs and FiTs), while 73% of the regulated revenue was accredited at 1.4 ROCs or above.

The portfolio has grown significantly since the summer of 2020

Over the most recent interim results period to 31 December 2020, BSIF reviewed subsidised and subsidy-free opportunities totalling more than 700MW, across onshore wind, solar and storage.

With a strengthened mandate in hand, BSIF has actively stepped up the pace of growth since the end of its last financial year, by adding two portfolios with a combined capacity of 134MWp:

- A 64MWp portfolio of 15 ground-mounted solar PV plants was acquired in August 2020 for an initial £106.6m. With eight sites clustered in the south-west of England, two in west Wales and a further five across central and eastern England. Thirteen of the projects are ROC-accredited with tariffs ranging from 1.4–2.0, while two of the projects are FiT-accredited. BSIF notes that in the period of 2021–2033 (2033 representing the year in which subsidies on the earliest plants begin to expire), the percentage of regulated revenues from this portfolio is projected to be approximately 66%.

- Most recently, BSIF acquired Bradenstoke Solar Park in January 2021 for £89m. The site sits on 213 acres, with a capacity of 70MWp. Bradenstoke has been operational since March 2015 and is accredited with a tariff of 1.4 ROCs.

BSIF’s portfolio

Performance

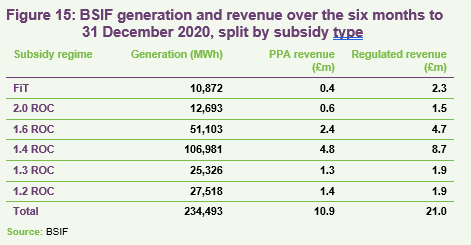

Below-average irradiation over the second half of 2020

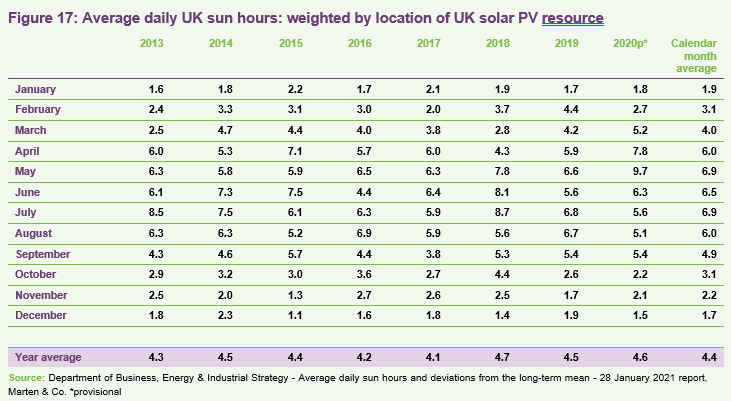

Whilst underlying earnings declined by 9.6% year-on-year to £18.7m, over BSIF’s interim results period to 31 December 2020, portfolio income increased by 0.6% to £33.1m. Overall, 2020 brought a third successive year of above-average solar irradiation in the UK, following an especially warm spring. This is captured by Figure 17. However, July, August, October and December were below-average months, with all of these falling over the interim reporting period. Interest charges and a tax expense also contributed to the decline in underlying earnings.

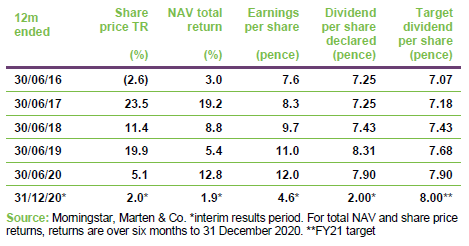

A snapshot of BSIF’s financial performance over its most recent financial years, as well as the most recent interim results, is provided in Figure 16, while the revenue generation split by subsidy type is illustrated below in Figure 15.

For every year since BSIF’s launch in 2013, BSIF’s dividend has been fully covered by earnings. The 7.90p total dividend declared and paid for FY20/21 was once again comfortably covered by underlying portfolio earnings of 12.03p. This has allowed BSIF to build up a buffer of retained earnings, amounting to £63.5m, as at 31 December 2020. On a per-share basis (15.59p), this was equivalent to 1.95x the target dividend of 8.00p for the year ended 30 June 2021.

Performance since IPO in July 2013

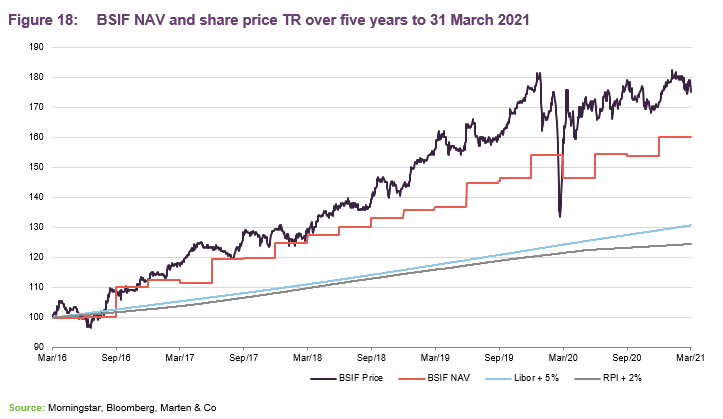

Over its life span, since coming to the market in July 2013, BSIF has delivered a NAV total return of 85.1% and a share-price total return of 97.4% (using Morningstar data and based on a launch date of 15 July 2013), as at 31 March 2021.

As illustrated in Figure 18, both its NAV total return and share-price total return have been significantly ahead of inflation (as measured by RPI). For the purpose of comparison, and to be consistent with earlier notes, we have used:

- RPI + 2%; and

- Libor + 5%.

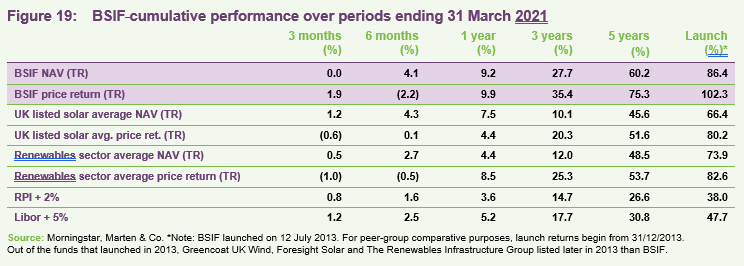

The NAV has seen a relatively stable evolution. We also note that since its launch, BSIF has beaten the averages of its solar and wider renewables peer-group NAV and share-price total returns (see Figure 19).

Peer group comparison

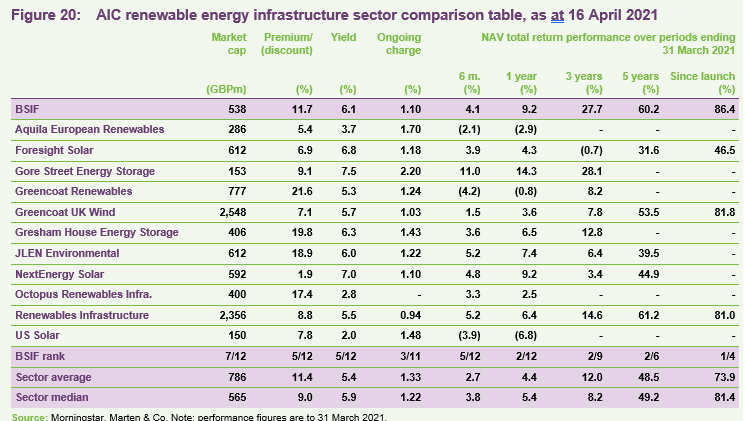

The 12 companies displayed in Figure 20 make up BSIF’s peer group. The list comprises the AIC’s renewable energy sector, excluding funds focused on energy efficiency and recent IPOs (Downing Renewables & Infrastructure, Ecofin US Renewables and VH Global Sustainable Energy Opportunities). BSIF sits alongside NextEnergy Solar (NESF), Foresight Solar (FSFL), and US Solar, as one of four established funds following a predominantly solar PV-focused approach. NESF and FSFL are the most comparable given their size and UK focus.

The remaining eight funds listed in Figure 20 below form the wider sector’s most comparable subset, in our view; The Renewables Infrastructure Group (TRIG) holds both wind and solar farms; JLEN Environmental Assets has a diverse portfolio including solar, wind, anaerobic digestion and water and waste projects; Greencoat Renewables and Greencoat UK Wind (UKW) are focused on wind generation; Octopus Renewables Infrastructure has a particular focus on onshore wind and solar; Aquila European Renewables Income also has a diverse portfolio that includes solar; and battery storage funds Gore Street Energy Storage and Gresham House Energy Storage are included as well, to reflect the expansion in BSIF’s mandate.

BSIF’s cumulative total NAV returns over the three- and five-year periods to 31 March 2021 rank second, from a total of nine and six funds, respectively. Returns were well ahead of the pure solar funds, NextEnergy Solar and Foresight Solar. The strong performance of Greencoat UK Wind and TRIG over the past five years has emphasised the attraction of wind. Cumulatively, we note that onshore, and offshore wind accounted for 86% of TRIG’s net capacity, on 30 September 2020.

A focus on optimising the performance of its PV projects has arguably borne fruit, with BSIF’s 12-month trailing dividend yield remaining amongst the peer group’s highest. Solar’s perceived strong income generation capacity appears to be borne out by the fact that all three of the established funds yield above the sector median and average. While NESF and FSFL trade at higher yields, their premiums are significantly lower than BSIF’s. Amongst the fund’s trading at premiums above 10%, BSIF’s dividend yield was the second highest behind Gresham House Energy Storage, as at 16 April 2021.

BSIF’s historically cautious approach to expansion is perhaps reflected by a lower market capitalisation than many of the funds that launched around the same time. Notwithstanding its size, BSIF’s ongoing charges ratio (OCR) is the joint third lowest (alongside NESF).

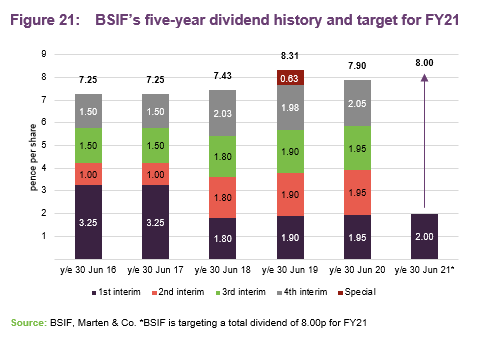

Dividend

BSIF’s five-year dividend history is shown in Figure 21, along with the target for a total distribution of 8.00p for the year to 30 June 2021. As explained on page 9, the dividend will no longer be linked to RPI, with a greater onus being placed on growth. BSIF has consistently been amongst the highest-yielding funds in its peer group.

BSIF pays quarterly dividends. For a given financial year, the first interim dividend is paid in February with the second, third and fourth interims paid in May, August and November respectively (dividends are usually declared the month before payment).

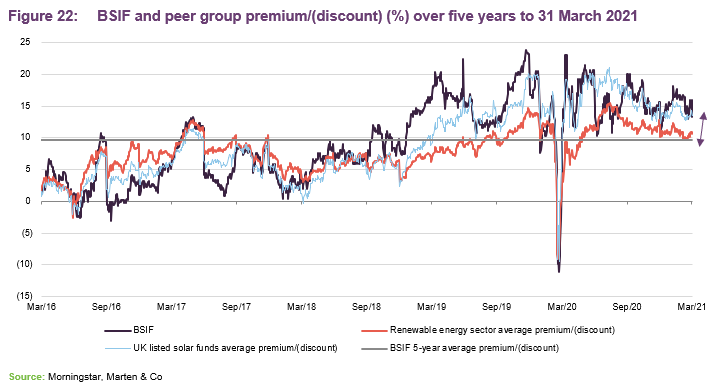

Premium/(discount)

BSIF’s yield, backed by a high percentage of regulated revenues appears to have been useful in an environment where so many historically reliable channels of equity income have fallen foul to the pandemic. Premiums across the sector have risen throughout much of 2020; it may be that the uncorrelated government-backed income sources provide a compelling yield alternative to traditional equity income pathways that have come under strain.

The continued growth of ESG investing, and a view that the government will likely look to renewables to play a key role in a post-COVID economic recovery, appear to have also shaped sentiment.

Over the 12 months to 31 March 2021, BSIF’s shares traded at an average premium of 15.9%, peaking at 23.0% during the sharp early initial recovery in markets in April 2020. The lowest premium was 10.2%, on 7 July 2020.

Since May, BSIF’s shares have re-established their premium to the renewable energy sector. As at 16 April 2021, BSIF was trading at a 11.7% premium to its most recently published NAV of 117.1p per share, as at 31 December 2020

(30 September 2020: 117.0p).

Fees and costs – new fee arrangement sees variable component removed

The investment advisory agreement (IAA) between BSIF and Bluefield Services was updated in July 2020 to reflect the following:

- the removal of the variable fee component;

- an amendment to the rate and bands on which the annual fee is based; and

- changes to the term of the IAA.

The variable fee provided for the investment adviser to return 35% of the annual base fee, if within a given financial period the dividend paid was lower than the RPI-linked target. The adviser was previously able to earn variable fees of up to 1% of NAV when the RPI-linked dividend target was exceeded.

The amendments to the IAA see BSIF’s fee structure move in line with its peer group. Figure 23 illustrates the changes to the rate and bands on which the annual base fee is based.

The resetting of the term of the IAA sees the investment adviser appointed for an initial three-year term, effective from 1 July 2020. Thereafter, the agreement is terminable on 12 months’ notice. This three-year term reflects the investments made by Bluefield Partners to carry out the next phase of growth for BSIF. At launch in 2013, the adviser was appointed on an initial five-year term.

BSIF’s OCR, as at 30 September 2020, was 1.10%. BSIF’s OCR compared to its peer group is shown in Figure 20 on page 24.

Capital structure and fund life

BSIF has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 31 December 2020, there were 406,999,622 shares in issue (370,499,622 as at 31 December 2019) with none held in treasury.

BSIF is permitted borrowings of up to 50% of its gross assets and has both a long-term financing agreement with Aviva Investors and a three-year revolving credit facility (RCF) with RBS. Both the Aviva debt and the RCF are held by BSIFIL

(i.e. at the portfolio holding company level). BSIF says that this structure is a deliberate approach to maximise both transparency and portfolio management flexibility. As at 31 December 2020, the all-in blended debt cost of the facilities was 2.5%.

Gearing – long-term borrowing provided by Aviva Investors; short term revolving credit facility provided by RBS

BSIF raised £45m in November 2020, in an oversubscribed placing. The equity raise followed the August 2020 15 plant 64.2MWp acquisition, which was financed through increased debt facilities and resulted in the total outstanding debt of the company increasing to £328.2m which included £44.1m drawn on BSIF’s RCF. This represented 43.1% of BSIF’S GAV, which while in line with the target long-term leverage of 40–50% of GAV, precipitated the equity raise, in anticipation of further acquisitions being made.

Following the most recent acquisition in January 2021, BSIF’s total outstanding debt has increased to £370.4m. The deal was financed using the BSIF’s RCF, which as well as being extended to September 2022 (with an option to extend to September 2023), has also been increased to £100m. The margin on the facility remains at LIBOR + 2.0%.

As at 31 December 2020, borrowings under the long-term financing agreement with Aviva Investors amounted to £160.0m (£99.9m under the fixed price loan and £60.1m under the index-linked loan). Gearing, as a percentage of GAV, stood at 37%.

Both the RCF and the long-term financing agreement are secured upon a selection of BSIF’s assets, but both offer the ability to substitute the reference assets.

BSIF has a relatively small project finance loan (£10.3m as at 31 December 2020) secured against its Durrants project (a 5 MWp FIT plant located on the Isle of Wight). The facility was provided by Bayern Landesbank and is fully amortising with a final maturity of 2029. BSIF says that this particular facility has not been refinanced as it has onerous break costs associated with early loan prepayment.

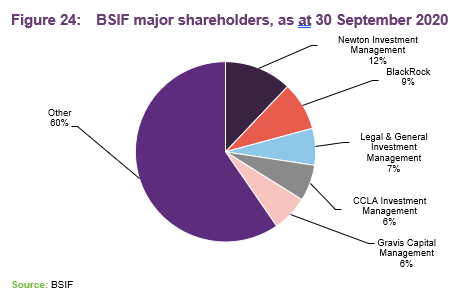

Major shareholders

Unlimited life with a continuation vote at the 2023 AGM

BSIF has been established with an unlimited life, but its articles of association require that it offer its shareholders a vote on whether the company should continue every five years. The first discontinuation vote took place at the company’s AGM on 30 November 2018 and was rejected overwhelmingly (by 99.5% of shares voted). The next vote is scheduled for the company’s AGM in 2023.

Financial calendar

BSIF’s year-end is 30 June. The annual results are usually released towards the end of September (interims in February) and its AGMs are usually held in November of each year. As discussed in the dividend section, BSIF pays quarterly dividends in February, May, August, and November of each year.

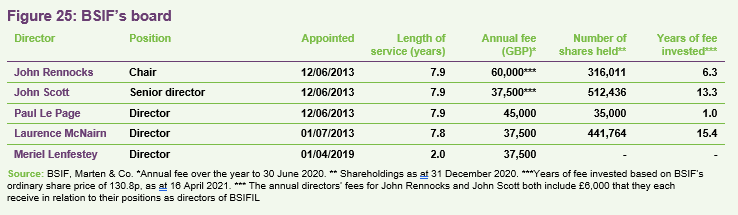

Board

BSIF’s board comprises five directors (details of their individual experience are provided below); all members are non-executive and considered to be independent of the investment manager.

The average length of service is 6.7 years. Three of the five directors were appointed at the fund’s launch with John Scott being appointed shortly thereafter. Meriel Lenfestey was appointed in April 2019.

Two of BSIF’s directors, John Rennocks and John Scott are directors of BSIF’s wholly-owned subsidiary BSIFIL (see page 4 of our initiation note as well as Appendix 2 of this note). For the year ended 30 June 2020, they both received remuneration of £6,000 as directors of BSIFIL

BSIF’s articles of association require that all board members offer themselves for re-election at three-yearly intervals. However, in accordance with corporate governance best practice, it is the board’s policy that all directors stand for

re-election annually. BSIF’s articles do not specify a total limit for directors’ fees.

Other than BSIF’s board and its subsidiaries, its directors do not have any other shared directorships and, as illustrated in Figure 25, all of the directors have significant personal investments in the fund. This is favourable in our view, as it shows commitment to the fund and helps to align directors’ interests with those of shareholders.

John Rennocks (chair)

John has broad experience in emerging energy sources, support services and manufacturing. He is a Fellow of the Institute of Chartered Accountants of England and Wales, and is also chairman of Utilico Emerging Markets (an investor in infrastructure and related assets in emerging markets) and AFC Energy Plc (a developer and manufacturer of alkaline fuel cells).

John has previously served as a non-executive director of Greenko Group Plc (a developer and operator of hydro and wind power plants in India), a non-executive deputy chairman of Inmarsat Plc and a non-executive director of Foreign & Colonial Investment Trust Plc, as well as several other public and private companies. He has also served as executive director-finance for Smith & Nephew Plc, Powergen Plc and British Steel Plc/Corus Group Plc.

John Scott (senior director)

John is a former investment banker who spent 20 years with Lazard, and has considerable experience as an investment trust director. He has been chairman of Impax Environmental Markets Plc since May 2014, was appointed chairman of Jupiter Emerging and Frontiers Income Trust in May 2017 and in June 2017 he retired as chairman of Scottish Mortgage Investment Trust Plc after eight years of service.

In addition, John has been chairman of Alpha Insurance Analysts since April 2013 and, until the company’s sale in March 2013, he was deputy chairman of Endace Ltd. of New Zealand. In November 2012, he retired after 12 years as a

non-executive director of Miller Insurance. John has an MA in Economics from Cambridge University and an MBA from INSEAD. He is also a Fellow of the CII and of the CISI.

Paul Le Page (director and chair of the audit committee)

Paul has extensive knowledge of, and experience in, the fund management and the hedge fund industry. He is responsible for managing hedge fund portfolios at Financial Risk Management (FRM), a subsidiary of Man Group Plc, and is a director of several FRM funds. Before joining FRM, Paul was an associate director at Collins Stewart Asset Management from January 1999 to July 2005, where he was responsible for managing the firm’s hedge fund portfolios and reviewing fund managers. He is currently a director of, and audit committee chairman for, Thames River Multi Hedge PCC Limited and was previously a director of, and audit committee chairman for, Cazenove Absolute Equity Limited.

Paul graduated from University College London in Electrical and Electronic Engineering in 1987. He then spent 12 years in industrial research and development, latterly as the research and development director for

Dynex Technologies (Guernsey) Limited, where he qualified as a Chartered Electrical Engineer. He completed his MBA in July 1999.

Laurence McNairn (director)

Laurence is an executive director and indirect shareholder of the fund’s administrator and company secretary, Heritage International Fund Managers Limited. He joined the Heritage Group in 2006 and, prior to this, worked for the Baring Financial Services Group in Guernsey from 1990. He holds board positions with a number of fund groups and has extensive experience with listed vehicles, particularly with regard to audit committees.

Before working in fund administration, Laurence was the finance director of an industrial electronics manufacturing company which was part of a UK plc and also worked in professional practise with KPMG. He is a member of The Institute of Chartered Accountants of Scotland.

Meriel Lenfestey (director)

Meriel is the most recent appointee to BSIF’s board, having joined in April 2019. Her experience includes the founding of Flow Interactive in 1997, a London based customer experience consultancy providing creative strategic and tactical expertise across all sectors embracing digital transformation. Since exiting the business in 2016, Meriel has held a portfolio of non-executive director and advisory roles across energy, telecoms, transport, infrastructure, technology, e-gaming, entrepreneurial support, and local charities. These include being chairman of Gemserv, a provider of consultancy and governance services helping the energy and health markets embrace technology-driven change and deliver large programmes effectively; senior independent director at Jersey Telecom who are leading the world in full-fibre, delivering innovative global IOT (internet of things) services and providing local data and voice services; as well as holding non-executive director roles at International Public Partnerships, and Aurigny Air Services.

Meriel has an MA in computer-related design from the Royal College of Art, a Financial Times non-executive director diploma and is a fellow of the RSA.

Fund profile

Stable regulated sterling income from a portfolio of large-scale UK solar assets soon to be complemented by wind

BSIF is a Guernsey-domiciled sterling fund, with a premium main market listing on the London Stock Exchange (LSE). Since its launch on 12 July 2013, it has focused primarily on acquiring and managing a diversified portfolio of large-scale (utility-scale) UK-based solar energy assets, to generate renewable energy for periods of typically 25 years or longer. BSIF owns and operates one of the UK’s largest, diversified portfolios of solar assets with a combined installed power capacity of over 600MWp.

BSIF’s primary objective is to deliver to its shareholders stable, long-term sterling income via quarterly dividends. The majority of the group’s revenue streams are regulated and non-correlated to the UK energy market.

The underlying investments are held in SPVs which, in turn, are held through Bluefield SIF Investments Limited. Further explanation of BSIF’s operating structure can be found in Appendix 2.

Bluefield Partners LLP – an experienced investment adviser

Bluefield Partners LLP was established in 2009 as an investment adviser to companies and funds investing in solar-energy infrastructure. It has been BSIF’s investment adviser since launch. To date, it has led the acquisitions of, and currently advises on, over 50 UK-based solar assets that are located on sites that are agriculturally, commercially, or industrially situated.

Bluefield Partners says that its team has been involved in over £2.5bn of solar photovoltaic funds and/or transactions in both the UK and Europe since 2008. This includes over £1.1bn in the UK since December 2011.

Growing the team’s wind expertise

In July 2020, BSIF announced that Baiju Devani had joined Bluefield Partners as a senior hire, with the title of UK investment director. Baiju, whose expertise lies in wind, joined from Ingenious, where from 2013 to 2019 he was a fund manager within the infrastructure team. Before this, he spent five years as a member of the commercial team at RES, one of the UK’s largest independent renewable energy developers.

Previous publications

We refer readers interested in further information about BSIF and solar photovoltaic assets to our initiation note, “Walking on sunshine.”

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Bluefield Solar Income Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.