CQS Natural Resources Growth and Income

Investment Companies | Annual overview | 8 May 2024

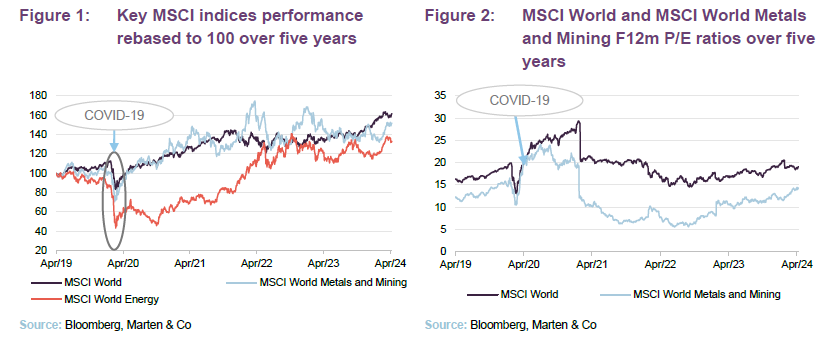

Poised for the starting gun

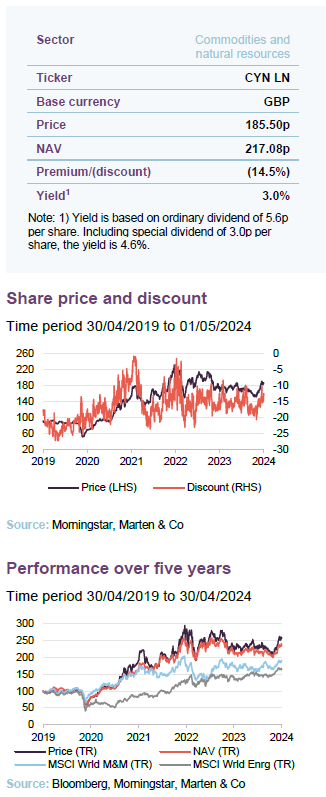

Following a very strong period of outperformance for commodities and natural resources, the last 18 months have been more challenging. However, barring the odd wobble, inflation and interest rates look to be past their peaks. This puts the sector in a strong position to outperform, particularly once the attractive valuations on offer are factored in (metals and mining are trading at a 25% discount to broader global equities, while energy is on a 41% discount – see pages 3 and 4). CQS Natural Resources Growth and Income (CYN), which has provided strong outperformance of its peer group and relevant indices over three and five years, is well placed to capture this, as the small-and-mid-cap producers in which it tends to invest should benefit disproportionately. In the meantime, with a yield of 3.0% and strong revenue generation, this year’s dividend looks likely to be covered and investors are paid to wait. CYN’s mid-teens discount offers comfort too.

Capital growth and income from mining & resources

CYN aims to provide investors with capital growth and income by investing in a portfolio that predominantly comprises mining and resource equities, as well as mining, resource and industrial fixed-interest securities. The fixed income securities include, but are not limited to, preference shares, loan stocks, corporate bonds (convertible and/or redeemable) and government bonds.

Fund profile

Diversified natural resources exposure

CYN’s aim is to provide investors with capital growth and income by investing in a portfolio that predominantly comprises mining and resource equities, as well as mining, resource and industrial fixed interest securities.

Further information can be found at: ncim.co.uk/city-natural-resources-high-yield-trust.

Investments are typically made in securities that the manager has identified as undervalued by the market (both equities and fixed income) and that it believes will generate above-average income returns relative to their risk, thereby also generating the scope for capital appreciation.

CYN’s portfolio is biased towards mid-cap stocks.

CYN’s portfolio is biased towards mid-cap stocks; meaning that it offers a more idiosyncratic exposure when compared against its large-cap-focused peers. It also offers a markedly different exposure to ETFs and the major natural resource-focused indices.

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been CYN’s investment manager since June 2003, when the trust underwent a major reorganisation that saw a complete change of focus to natural resources (previously it had been focused on Latin American investments). On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies and on 3 April 2024 CQS was acquired by Manulife Investment Management. The combined group has an AUM of $14bn. There are no planned changes to the investment management team.

The CQS team has managed CYN since its reorganisation into a natural resources focused investment trust in June 2003.

Ian Francis, Keith Watson and Rob Crayfourd are responsible for the day-to-day management of CYN’s portfolio. Keith and Rob focus on CYN’s equity holdings, while Ian primarily focuses on its fixed income holdings (see page 23 for more details of the management team).

Change in comparator indices

CYN’s portfolio is not constructed with reference to a benchmark.

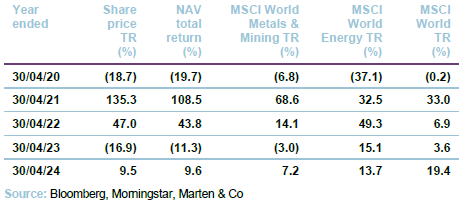

The EMIX Global Mining Index, which previously formed part of CYN’s composite benchmark index, ceased publication in July 2023. The Board considered replacing the EMIX component of CYN’s former benchmark index but, after investigation, a suitable comparable index was not found, and the decision was taken that CYN would not utilise a formal benchmark but would instead publish its performance alongside two comparative indices: the MSCI World Metals & Mining Index and the MSCI World Energy Sector Index (both sterling adjusted). We are using the indices, as well as the broader MSCI World Index, throughout this report.

Manager’s view Inflation and valuations

Commodities and natural resources have had a difficult couple of years and continue to trade at a marked discount to global equities on a forward P/E basis (see Figure 2). F12m P/E ratios have edged up over the last 18 months but are still way below longer-term averages, leaving the sector very cheap relative to history. The managers acknowledge that, in part, this reflects an environment of higher inflation and the impact on the global economy of the higher inflation rates needed to bring this under control.

Significant risk of stagflation

CYN’s managers comment that this has created an opportunity. Whilst disruptive in the short term, inflation tends to be beneficial for commodities over the longer term and they think that current EBITDA multiples can be justified easily. With risks such as the prospect of higher energy prices (think of problems in the Red Sea – see the section on shipping below) and tight jobs markets which can make inflation sticky, it is too early to say that inflation has been tamed. They also feel that, with the economy balancing precariously on the edge of recession, there is still a significant risk that we could enter a period of stagflation as central banks could be forced to tighten monetary policy even though economic growth has turned negative. They note that, historically, this an environment where commodities, particularly gold, can perform well although, reflecting this uncertainty, the managers have been taking a more cautious approach designed to mitigate risks (for example by focusing on commodities that are less tied to Chinese property and white goods).

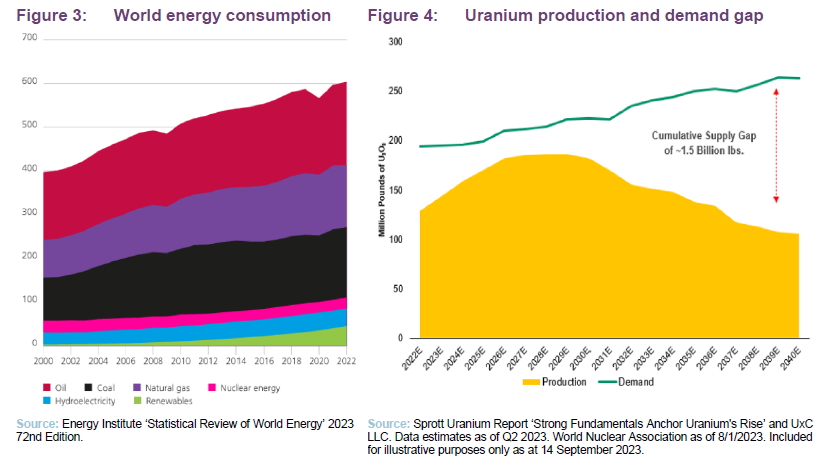

Energy supply remains a key risk

CYN’s managers see a long-term opportunity in energy and energy-related securities that is driven by the focus on decarbonising global energy. In practice, this means removing traditional thermal generation and replacing this with renewables. However, the managers point out that renewables are growing from a low base and that, as emerging markets continue on their path of development, global energy requirements are expected to expand significantly. Figure 3 below illustrates that global energy consumption has increased by more than 50% in a little over 20 years and a similar trajectory is expected over the next couple of decades.

Renewable capacity is growing and, while the UK is ahead of a lot of other markets, globally it is expanding from a low base. Renewables also require significant changes to grid infrastructure, including the provision of storage to address the issue of intermittency, which is yet to be overcome in any meaningful way. CYN’s managers say that the energy crisis could yet return with a vengeance. By increasingly restricting thermal generation, policy makers are taking supply out of the system faster than it is being replaced. Europe and Asia are particularly exposed due to their high level of energy imports, and the situation in Russia/Ukraine has just exacerbated this problem.

CYN’s managers believe that the world is going to need hydrocarbons for longer

Ultimately, CYN’s managers believe that the energy transition is going to take longer than expected and that the world is going to need hydrocarbons for longer. However, against a backdrop of significant policy support for renewables, investment in areas such as oil and gas, coal, uranium and shipping has been overlooked, which creates a strong supply-demand dynamic that faces producers. Reflecting this, over 50% of CYN’s portfolio is invested in these areas.

CYN’s managers note that renewables will displace coal rather than oil in the first instance. They point out that oil price has been around the $80 per barrel mark for some time now, but that the market is still in deficit and global inventory levels are falling, which is reflected in backwardation in the forward price. With limited new supply coming onstream, the outlook is improving, yet valuations still look cheap based on spot prices. Oil rigs, ships and refining capacity are not being built and OPEC still has capacity to inflict cuts to defend the oil price, yet institutional investors are avoiding the space due to ESG considerations.

CYN’s managers comment that hydrocarbon demand tends to be fairly insensitive to slow downs as people still need to drive to work and heat homes, while goods still need to be delivered to supermarkets. They also comment that after OPEC cuts off 3 million barrels of oil per day, there is still spare production capacity that can fill projected global demand growth for 2024.

Uranium

Nuclear power continues to benefit from positive sentiment.

The uranium price has undergone a dramatic recovery during the last four years, particularly during 2023. Initially, this occurred during the second quarter of 2020 as markets tightened (demand recovered against a backdrop of a market that continues to be in supply deficit), but this has continued as energy prices have risen more generally during the last couple of years, highlighting the ongoing need for nuclear to supply baseload capacity. CYN’s managers say that nuclear power continues to benefit from positive sentiment and that both NGOs and investors are increasingly aware of its importance. This is both as a non-carbon emitting energy source and as a diversifier in a world whose energy security has been shaken by the Russian invasion of Ukraine.

The energy crisis has raised the prospect of a reappraisal of energy policies, particularly in Europe, which are needed to adapt to ensure future energy security. Whilst renewables are an ever-increasing component of energy supply, production is intermittent in nature, which makes nuclear an essential part of the energy mix. Reflecting this, nuclear is benefitting from government support to both help meet emission targets and to bolster energy security.

As we have previously highlighted, years of low prices curtailed investment in mining capacity for uranium and the situation in Russia/Ukraine has also increased supply chain uncertainty. The uranium market is already in supply deficit, with reactor life extension in the west and a significant build out in Asia (China has developed a cookie cutter approach to reactor building), and this is set to expand significantly in the coming years. CYN’s managers think this sector offers some good defensive characteristics.

Base metals

Structural growth from the move to green energy and replacing ageing infrastructure.

With the exception of iron ore, which has dominated the majors, CYN’s portfolio has traditionally had a significant exposure to base metals. This served CYN well during in the aftermath of COVID, as base metals performed very strongly, and the managers reduced the exposure as they felt that a number of these stocks, particularly those exposed to copper, looked fully valued.

The managers remain constructive on base metals over the longer term, noting the strong structural demand drivers that they benefit from – for example, the replacement of ageing infrastructure; the move to green energy; years of low expansion capex constraining supply; and ESG considerations restricting capex to support new supply. They think that a backdrop of low supply growth should lead to increasingly tight markets for a number of base metals. However, they have kept exposure to base metals low, reflecting both valuations and near-term demand concerns due to a global slowdown, but particularly the slowdown in the property sector in China, a big consumer of commodities and base metals in particular, where completions are now lagging news starts by around two-and-a-half years. However, the managers say that they will look to add to base metals on any material pull backs.

Precious metals

CYN’s managers say that the reasons to have exposure to gold have increased significantly in recent years. Government debt levels have seen a substantial increase globally in response to COVID, but high levels of issuance continue as governments seek to address issues with ageing infrastructure and fund other social programmes (ageing populations in the Western world reduce productive capacity and add additional costs onto society). At the same time, China, previously a substantial holder of US treasuries, has been de-emphasising these and has been looking to alternatives.

Central bank holdings of gold tend to be sticky, and central bank buying, which has been higher during the last decade, was at record levels during 2022/23. The net effect is that the gold price is close to an all-time high in most currencies, despite selling by ETFs, but CYN’s think this strong central bank demand could continue for a number of years, particularly when you factor in its benefits as an inflation hedge, especially if stagflation does take hold. They also think that ETF selling could switch to buying this year. In their view, the bigger question is how to play this with the gold price already elevated?

Despite the strong run in the gold price, valuations of the gold mining companies are at or close to all-time lows – this is the case for large-, medium- and small-cap producers as well as the developer. However, the managers say that they prefer to avoid the large-cap gold miners and focus on the smaller producers (those with one or two assets) as small moves in inflation and the gold price can shift the share prices of these companies up considerably.

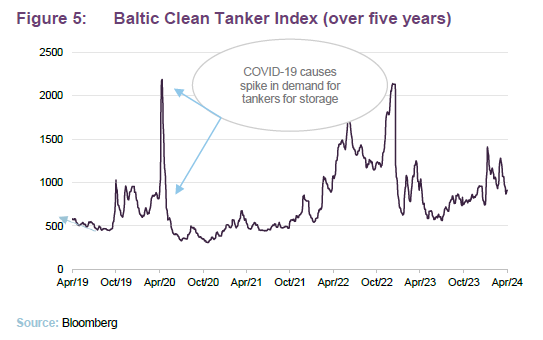

Shipping remains an interesting space

Order books for new vessels are at record lows

CYN’s managers comment that shipping continues to be a very interesting space. On the supply side, the order books for new vessels are at record lows, partly reflecting an uncertain economic outlook as well as a lack of clarity around environmental requirements that are also constraining new orders. This comes at a time when attacks in the Red Sea have restricted passage through the Suez Canal, resulting in more passages around the Cape of Good Hope.

As we have previously discussed, higher demand should lead to improved confidence and a revival in orders, but new ships take time to build and, where there is a strengthening demand backdrop against a tight supply, shipping rates can increase dramatically, leading to very high profitability for shipping companies. Reflecting this, shipping companies are generating high levels of free cash flow, which can support higher dividend payouts.

CYN’s managers point out that both the IMO’s ruling that requires the use of lower-sulphur fuel or scrubbers and the ballast water treatment policy will accelerate scrapping further. They also note that the IMO’s target to cut emissions by 40% by 2030 will likely lead to lower steaming, effectively reducing supply as journeys take longer and will also lead to scrapping. These should be supportive of day rates over the next few years.

ESG considerations continue to increase permitting times

Supply demand imbalances, with the opportunity to earn supernormal profits, can last for longer.

CYN’s managers say that, as societies look to improve their environmental footprint, it is becoming increasingly hard to get the necessary planning permission and permits to develop new mines. This means that this process takes longer and by extension it also means that supply demand imbalances, with the opportunity to earn supernormal profits, can last for longer before they are competed away. CYN’s managers say that, in most instances, the challenges are not insurmountable. For example, Foran Mining is working to establish the world’s first carbon-neutral copper mine and it believes that, over the longer term, it can actually make the project carbon-negative.

The managers note that issues of national security may trump some ESG considerations at the margin. Governments around the world have extended or are considering extending the life of some existing thermal generation, including coal, to ensure energy security. However, over the longer term, the managers still expect ESG considerations to prevail.

Investment process – bottom-up coupled with a top-down macro-overlay

Bottom-up coupled with a top-down macro-overlay

CYN’s portfolio is managed using a mixture of top-down and bottom-up investment strategies. The portfolio is able to access the full spectrum of natural resource and commodity investments, and for CYN’s equity holdings the investment process begins with an assessment of the factors driving global demand and supply for specific commodities.

This considers supply-side factors such as exploration success, capacity developments, potential for supply disruptions and technological developments. It also considers demand-side factors such as new applications, the potential for substitution, and technological developments. The managers look at demand from developed markets, but particular emphasis is placed on developments in the large industrialising emerging markets, as these tend to utilise a lot of commodities as they develop. The analysis also takes into consideration inventory levels and how these might develop. This analysis identifies sectors and geographical areas for the managers to focus their attention on when conducting their bottom-up analysis of potential investments.

Sector and geographic asset allocation driven by stock selection.

It should be noted that the portfolio is not managed with reference to the trust’s comparator indices, and while the macro-overlay acts as a guide by directing the managers’ research efforts, it does not provide specific targets for the geographic and sectoral allocations. Instead, these are a result of the managers’ stock selection decisions, which reflect the managers’ assessment of the relative strength of individual investment ideas.

Focused on high-quality assets that are cash flow-generative, with strong balance sheets and management teams.

When constructing the portfolio, the managers seek to build a core that is focused on high-quality assets that are cash flow-generative, with strong balance sheets and management teams that have proven track records. In selecting companies, the managers focus on those:

- with commodities where they see little new supply additions;

- with commodities where they see a strengthening demand outlook;

- that have improving cost structures in terms of production;

- that have low-cost operations and can self-sustain through the cycle; and

- that are multi-project (one-project operations are inherently risky).

The bulk of the managers’ efforts are focused on fundamental analysis of potential and existing investments. The CQS New City team meets an average of 20 resources companies a week and employs a range of valuation metrics to try and identify undervalued assets. These vary depending on the type of investment.

When selecting candidates for the portfolio, the managers seek to identify securities that they consider to be undervalued by the market. They expect these to generate superior income returns relative to their risk, with the scope for capital appreciation as the market rerates them. Whilst income generation and the sustainability of income are key, capital preservation is also a major focus, and the managers are not prepared to sacrifice capital in the pursuit of income. When selecting fixed income holdings, often the managers will seek to exploit opportunities presented by the fluctuating yield base of the market and from redemptions, conversions, reconstructions and take-overs to generate capital growth. The managers’ analysis, which is conducted in-house, includes:

- an assessment of the free cash flow available to the various security holders within a corporate’s capital structure (for example, equity holders, debt holders, preferred stock holders and convertible security holders);

- the prospect of changes to cash flows (for example, from changes in interest rates or the competitive landscape); and

- an assessment of the company’s track record in managing its obligations and the quality of the company’s management.

In assessing and selecting fixed income securities, the managers are able to draw on the expertise of a 16-strong team of credit analysts at CQS.

The managers are able to draw on the expertise of a 16-strong team of credit analysts at CQS.

Once investments are included in the portfolio, the team continues to assess stocks to ascertain whether the level remains appropriate.

ESG Considerations

ESG considerations are key to the manager’s investment thesis – not least, for resource companies to operate successfully and create value for their shareholders, they need a social licence to operate in the jurisdictions where the facilities are present. Failure to achieve this can lead to negative outcomes such as the removal of licences, higher taxation, and stricter regulations, as well less demand for the finished product as buyers also need to consider ESG within their supply chains. CYN’s managers say that this is one of the most significant challenges that mining companies now face, which is why it is high up on their agenda.

Investment restrictions

There are no restrictions for CYN’s holdings in terms of country, sector or size. When investing in higher-yielding securities, CYN may invest beyond its traditional mining and resource companies.

CYN is permitted to acquire securities that are unquoted but which are about to be, or are immediately convertible at CYN’s option into securities that are listed or traded on a stock exchange. It may also continue to hold securities that cease to be quoted or listed if the manager considers this to be appropriate. In addition to this, CYN may invest up to 10% of its gross assets in unquoted securities. It may invest up to 10% of its total assets in other investment companies. CYN may borrow up to 25% of its net assets and will normally be fully invested.

Asset allocation

Diversified portfolio that is biased to mid-caps and producers

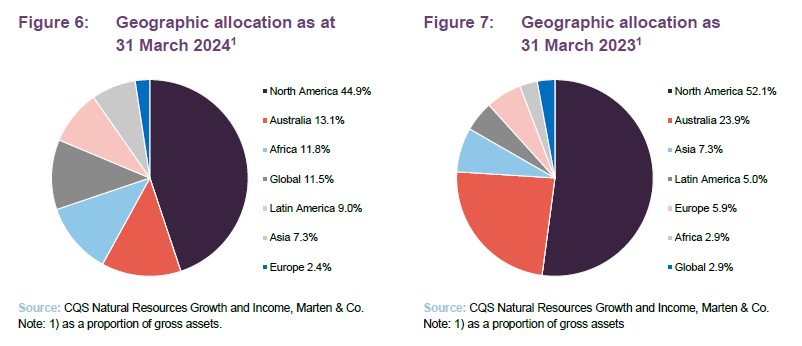

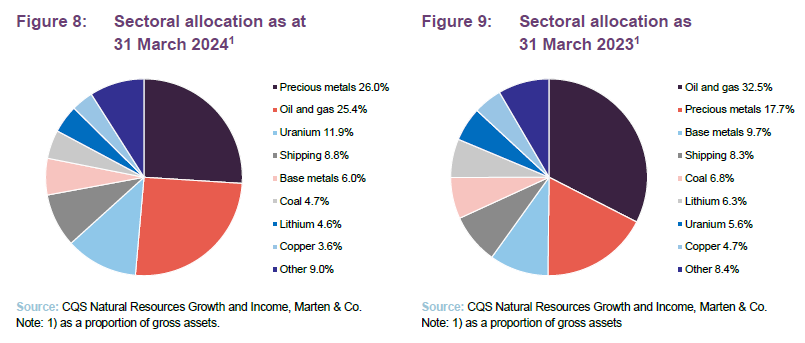

As illustrated in Figures 6 through 10, CYN offers investors a broad natural resources exposure. As at 31 March 2024, CYN’s portfolio had exposure to 152 issues; an increase of 18 from the 134 of a year prior. Historically, the portfolio has tended to hold about 120 issues.

The names of the stocks that make up CYN’s top 10 holdings (see Figure 10) will likely be familiar to regular followers of the trust, which is arguably a reflection of the managers’ long-term low turnover approach. The managers typically expect portfolio turnover to be around 50% per annum, but much of this will be trimming stocks whose prices have got ahead of themselves and adding to holdings where the managers see more value.

CYN’s portfolio has a bias towards mid-cap stocks.

CYN’s portfolio has a bias towards mid-cap stocks, as the managers believe that this is generally where the best opportunities are to be found (this is a key differentiator versus some of its larger peers). The mid-cap bias is also a differentiator versus the passive resource-focused ETFs, which are generally focused on the large-cap stocks, and in a post-MiFID II world, less research coverage generally means that CYN’s managers are more likely to find an undervalued security further down the market cap scale.

Comparing Figures 6 and 7, the most significant changes are the decreases in the allocation to Australia and North America with exposure to Africa offsetting much of this.

Comparing Figures 8 and 9, the most significant changes are the increase in the exposure to precious metals reflecting the manager’s concerns surrounding inflation and the risk that we could enter a period of stagflation (from 17.7% to 26.0%). A more challenging macro outlook is also reflected in the marked reduction in the allocation to base metals (from 9.7% to 6.0%). The increased allocation to uranium reflects the strong uplift in the prices of uranium equities on the back of a much higher uranium price.

CYN’s portfolio has very little exposure to explorers.

The portfolio has very little exposure to exploration and is biased towards producers, which make up its core holdings. The managers prefer companies that are cash-flow-generative and can sustain themselves through the cycle. This can exclude some smaller-cap operations.

Top 10 holdings

Figure 10 shows CYN’s top 10 holdings as at 31 March 2024 and how these have changed since over the prior year.

Diversified Energy and Precision Drilling remain significant positions.

New entrants to the top 10 are Emerald Resources, Frontline, EOG Resources and Karora Resources. Precision Drilling, Diversified Energy, REA Holdings and Euronav have all moved out of the top 10. Diversified Energy and Precision Drilling remain significant positions, occupying 11th and 12th places respectively. The position in Euronav has been sold in its entirety as the manager has switched into Frontline (see below). The managers still like Sigma Lithium, but this has been reduced reflecting the managers’ view that the energy transition will take longer than expected.

We discuss some of the more interesting developments in the next few pages, and have also provided some commentary on Emerald Resources, Precision Drilling, Transocean and Diamondback Energy, which we have not written about previously. Readers interested in other names in the top 10 should see our previous notes, where many of these have been previously discussed (see page 26 of this note).

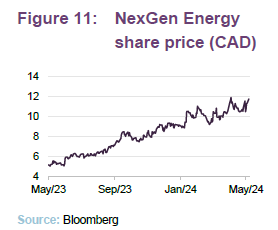

NexGen Energy (8.3%) – ready to secure financing for mine construction

NexGen Energy (www.nexgenenergy.ca) is a uranium exploration and development company with a portfolio of projects that are centred on the Athabasca Basin in Canada, where it holds over 259k hectares of land. NexGen’s southwestern Athabasca Rook 1 property hosts the Arrow Deposit, the South Arrow discovery, the Harpoon discovery, the Bow discovery and the Cannon area. NexGen has long been a constituent of CYN’s portfolio and that of its sister fund, Geiger Counter, where it has traditionally held a more prominent position (it is typically a top five GCL holding).

CYN’s managers say that, despite its very strong share price performance over the last 12 months, they still see a significant amount of upside potential. The company has made significant progress with its Rook I project in the Athabasca Basin. With the indigenous agreements finalised, the Saskatchewan Ministry of Environment has approved the commencement of the 2023 Site Infrastructure and Confirmation Program. CYN’s managers point out that, unlike most other producers, NexGen’s output has not been hedged, which will allow it to benefit from the much stronger uranium pricing environment that we have seen during the last 18 months.

CYN’s managers believe that in the current environment, where it is difficult to get financing for development projects, NexGen’s should be able to benefit from this high pricing environment for some time without the superior profitability being competed away.

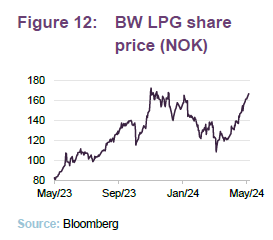

BW LPG (4.3%) – benefitting as a shortage of tonnage has caused LPG carrier spot rates to surge upwards

BW LPG (www.bwlpg.com) has been a CYN holding for some time. The company, which describes itself as the world’s leading owner and operator of LPG vessels, has over 40 years of experience in the liquefied petroleum gas (LPG) market and a fleet of around 50 ships, composed of very large gas carriers (VLGCs) and large gas carriers (LGCs).

BW LPG has worked with leading engine manufacturers to develop the technology to power LPG carriers with LPG and has retrofitted 15 of its LGCs with LPG dual-fuel propulsion technology. It has a further two vessels that are also gas powered. BW LPG highlights the significant benefits of retrofitting a vessel with LPG rather than opting for a new build: 97% carbon emissions during construction; takes two months to complete versus two years; does not add unneeded shipping capacity to the market; cost US$8-9m for a retrofit versus c US$80m for a new build. BW LPG believe that more than half of the current VLGC fleet and c.7,500 merchant vessels can be retrofitted with LPG propulsion.

BW LPG’s share price tends to be economically sensitive and has fallen during the last six months as gas prices have dropped. However, with the potential for gas prices to surge upwards again as economic activity increases and the ongoing uncertainty regarding security of supply, CYN’s managers see the potential for a strong uplift from here.

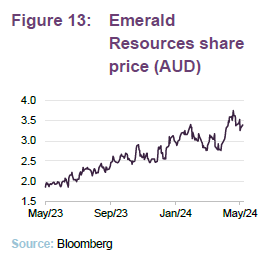

Emerald Resources (4.3%) – Considerable exploration upside and strong track record of bringing mines into production

Emerald Resources (www.emeraldresources.com.au) is an Australian listed gold producer. Its main asset is its Okvau gold mine in Cambodia, that was brought into commercial operation in June 2021, on time and on budget. The company also has a development asset, the Freeman’s Find Prospect in Western Australia, where its maiden reconnaissance drill programme has made a high-grade gold discovery (it said on 18 March 2024 that results, so far, indicate the mineralisation is open both along strike and at depth).

CYN’s managers consider that Emerald Resources has a strong management team with a strong track record of successfully bringing mines into production (eight so far). They think it has a very good asset in Cambodia and that it benefits from being self-funded, as the Cambodian asset can provide the cash needed to bring the Australian asset into operation. They expect to see valuation uplifts come through as the Australian project gets de-risked. However, Emerald Resources also has a very large land package with a history of good discoveries, and so CYN’s managers see the potential for considerable exploration upside too.

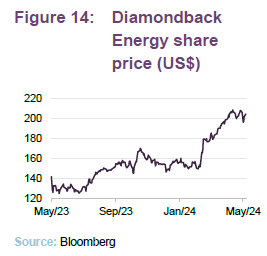

Diamondback Energy (4.2%) – low cost and cash generative US oil and natural gas company

Diamondback Energy (ir.diamondbackenergy.com) is an independent oil and natural gas company that is focused on exploration and development of onshore assets in the Permian Basin in West Texas. Its operations are centred on the Wolfcamp, Spraberry, Clearfork, Bone Spring and Cline formations, where it takes a less-conventional approach, using horizontal drilling, and since 1 January 2021, the company has purchased carbon offset credits to offset its scope 1 emissions (these are the emissions that a company makes directly). CYN’s manager says that Diamondback Energy is a well-managed, cash-generative and low-cost producer with strong capital discipline. The company is focused on growing its base dividend aggressively, while providing a meaningful return of capital to shareholders through opportunistic share repurchases. Like EOG Resources below, it has benefitted from the trend of mega M&A deals in the US oil and gas space that have consolidated the supply side and improved the competitive position of producers (more details below).

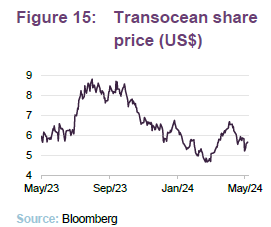

Transocean (4.4%) – well placed to benefit from an improvement in offshore rig day rates

Transocean (www.deepwater.com) is leading provider of offshore contract drilling services for oil and gas wells. It focuses on segments of the market that are technically demanding and has a focus on deep-water and harsh environment drilling services. Transocean’s rig consists of different types of floating rigs, including ultra-deep-water, harsh environment, deep-water and mid-water, as well as high-specification jackup rigs.

Like precision drilling discussed below, CYN’s managers believe that Transocean is well placed to benefit from an improvement in offshore rig day rates. As noted in the managers’ view section on pages 6 and 7, the oil market is in deficit, global inventory levels are falling and there is limited new supply coming onstream. Against this backdrop, the offshore rig market looks attractive. Rig availability remains constrained given the large capital requirement and long lead times for new builds. OPEC still has capacity to impose output cuts to defend the oil price and operators such as Transocean will benefit.

Performance

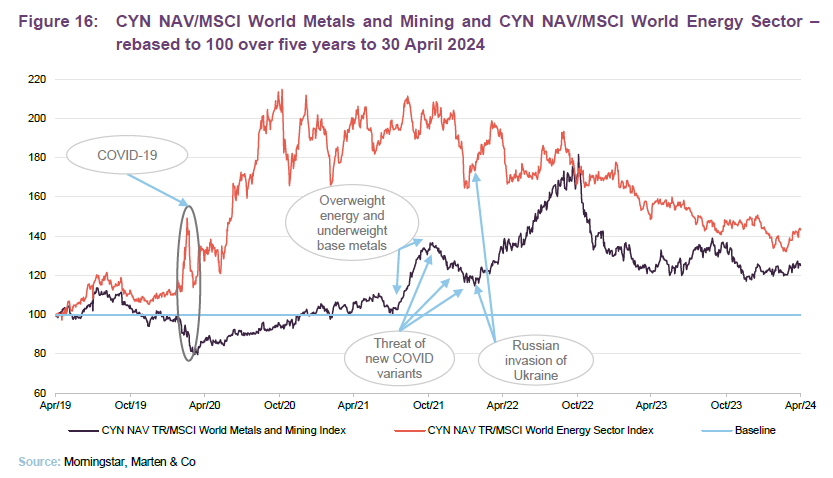

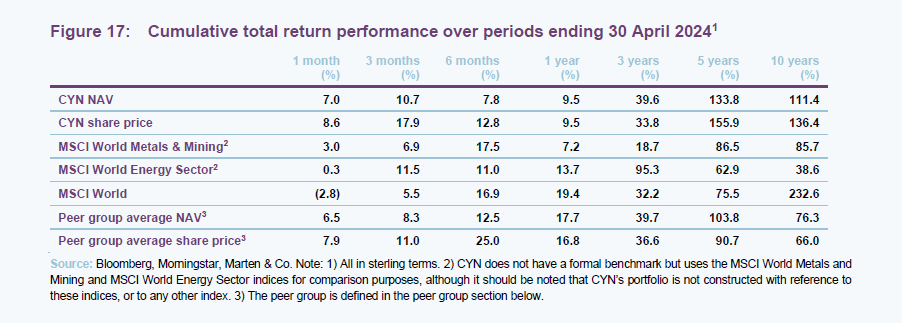

Figures 16 and 17 illustrate that, the prospect of interest rate rises started to rear its head towards 2022, CYN had provided strong outperformance of the MSCI Metals and Mining Index as its smaller-cap holdings benefitted disproportionately from the strong performance of the sector. As we have discussed previously, its relatively-high exposure to base metals and lower exposure to energy drove outperformance following the onset of COVID, but it has benefitted more recently, particularly in the aftermath of Russia’s invasion of Ukraine from the managers’ decision to reverse these allocations – overweighting energy and underweighting base metals.

It is also worth noting that CYN tends to operate with a geared strategy, which will have amplified its performance gains during these periods. CYN’s exposure to the small- and mid-cap segments will also have likely been beneficial as these stocks tend to benefit disproportionately as commodity markets rise.

More recently, these biases have been working against them, but as interest rates fall and the threat of recession recedes, there is potential for strong performance once again.

Peer group

CYN is a member of the AIC’s sector specialist: commodities and natural resources sector, which comprises nine members. Seven of these are illustrated in Figures 18 and 19. However, for the purposes of this peer group analysis, we have excluded Global Resources Investment Trust (GRIT) and Tiger Resource Finance (TIR) on size grounds (both sub-£10m market cap). Members of the sector will usually have:

- over 80% invested in commodities and natural resources securities or assets;

- less than 80% in debt; and

- an investment objective/policy to invest in commodities and natural resources securities or assets.

Despite all being members of the commodities and natural resources sector, the funds included in this peer group comparison are quite diverse and are imperfect comparators for CYN.

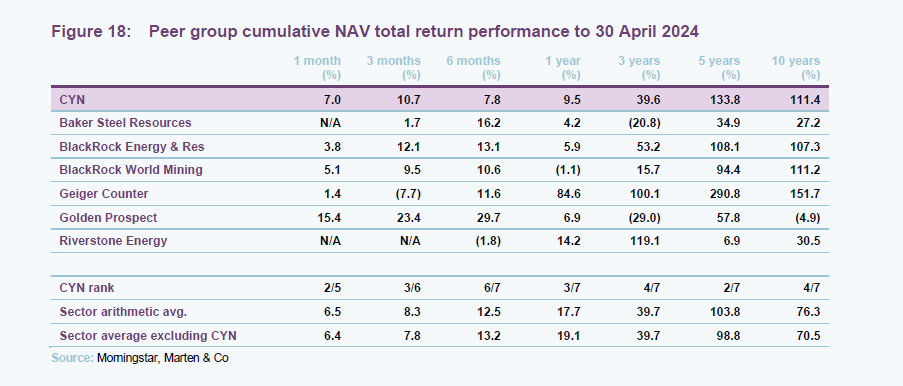

As illustrated in Figure 18, CYN with the exception of the shorter six-month period, CYN has strongly outperformed BSRT (arguably its closest peer) in NAV terms over all of the periods provided, and the differences in the performance are particularly stark. BSRT, which had a much higher exposure to Russia than CYN, suffered more heavily in the aftermath of the invasion of Ukraine, and, in the aftermath, BSRT had minimal exposures to the areas that performed well while CYN benefitted from being geared into a rising commodity market (BSRT has maintained a net cash position).

Comparing CYN’s NAV performance against the rest of the peers, it is notable that RSE and, to a lesser extent, BERI have benefitted over the three-year period from having a higher exposure to energy stocks which surged following the Russian invasion of Ukraine. CYN has also benefitted from its exposure to oil and gas, but to a lesser extent as its weighting is lower. CYN has beaten BERI over five years but is pipped over 10 years. However, it has beaten BRWM convincingly over the three-, five- and 10-year periods.

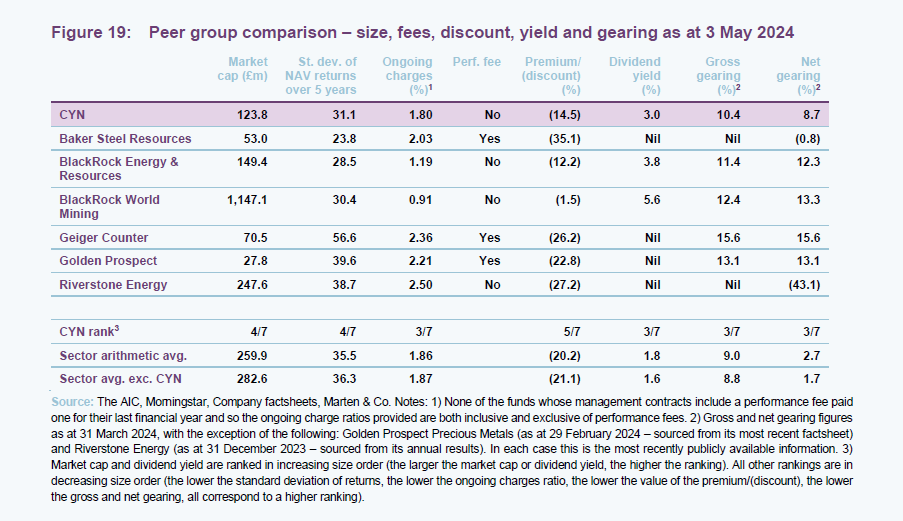

CYN is the fourth-largest fund in the sector. It briefly overtook BERI as commodities rallied, but has relinquished this again when energy stocks surged. CYN’s market cap remains markedly below the peer group average due to the significant scale of BlackRock World Mining.

CYN’s objectives include a focus on income, and CYN is one of three trusts that offer a yield within the peer group. As discussed on pages 18 and 19, CYN has held its dividend constant at 5.6p per share for the last eight years and has seen some yield compression during the last couple of years as its share price has increased significantly.

The volatility of CYN’s NAV returns is the fourth-lowest in the sector and markedly lower than the peer group average, perhaps reflecting the fact that it has a more diversified portfolio than some of the funds in the peer group that have a very specific focus. It is notable that both of the BlackRock Funds, despite their large-cap focus, have volatilities that are close to CYN’s.

CYN’s ongoing charges ratio is also markedly below that of BSRT.

CYN ranks third in terms of its ongoing charges ratio, which is below the peer group average and also below that of BSRT. CYN does not pay a performance fee. BSRT has not paid a performance fee recently, but its management arrangements include the provision of one that could potentially become payable in future years. A number of the funds within the sector are quite small and have higher ongoing charges ratios as a result, which serves to elevate the sector average.

CYN’s discount is below the peer group average.

Perhaps reflecting its strong performance, yield and below-average ongoing charges ratio, CYN’s discount is 5.7 percentage points narrower than the peer group average. It is also noteworthy that BSRT’s discount is significantly wider than CYN’s (BSRT’s is now the widest in the sector at 35.1%). We think that BSRT’s long-term performance record is one key factor weighing on its discount. However, its high management fee (1.75% of its average market cap), as well as the large stake that management hold in the company (24% held directly with a further 4.6% held by a fund that is controlled by the manager), is also a contributory factor as it is a clear barrier to an external investor attempting to take action on BSRT’s discount. Usually management stakes are considered to be a positive, but this reduces once the level starts to impede independent shareholders.

Gearing is another consideration, and may be more of a concern for investors when markets are at more elevated levels and the end of the cycle is approaching. CYN’s gearing levels are modestly above the sector averages, although in reality, the sector comprises a number of moderately geared funds and a number of funds that are ungeared. Riverstone Energy’s high cash balance (it is transitioning from being an energy fund focused on oil to one that is focused on renewables) is also distorting the figures.

Quarterly dividend payments

CYN intends to pay an attractive level of dividend income.

Subject to market conditions, the company’s performance, its financial position and its financial outlook, the board intends to pay an attractive level of dividend income to shareholders on a quarterly basis. The company intends to pay all dividends as interim dividends can be paid out of capital when required.

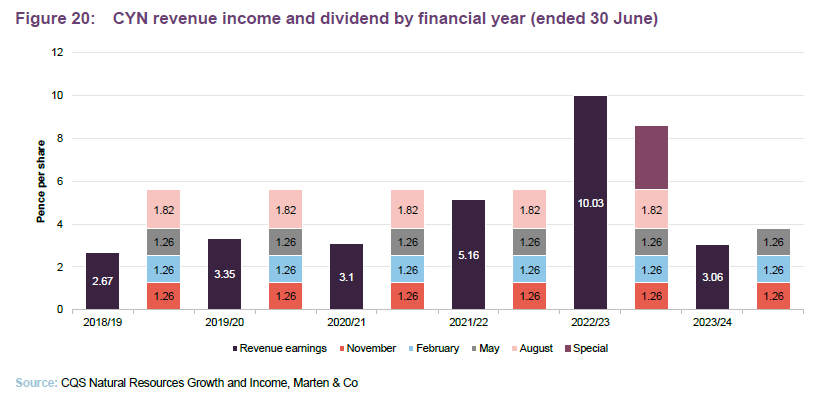

For a given financial year, the first interim dividend is paid in November with the second, third and fourth interims paid in February, May and August. As illustrated in Figure 25 below, the total ordinary dividend paid for a number of financial years has been 5.6p per share. This is a yield of 3.0% on CYN’s share price of 185.50p as at 3 May 2024. However, reflecting strong revenue income during the last financial year (CYN’s revenue income increased by 94.4% due to a small number of holdings paying much higher income from their operations), CYN also paid a special dividend of 3.00p, making a total dividend of 8.6p. The high level of income during the last financial year not only allowed CYN to pay a covered dividend for the first time in a number of years, but also allowed it to add 1.43p per share to its revenue reserve.

Following the substantial increase in revenue income during the last financial year, CYN cautioned in its interim results that, while the revenue outlook remains healthy, supported by income from shipping and energy, it is reasonable to say that a repeat of last year’s supernormal payout is unlikely given a reduced level of special dividend receipts from energy investments year to date. As such, the Board intends to follow the pattern of previous years (three identical interim dividends, with the last dividend adjusted to reflect the full year revenue position). The board has if CYN does benefit from any material one-off dividends from its holdings, it may consider an additional special dividend.

Revenue and capital reserves

As at 31 December 2023, CYN had a revenue reserves of £1.20m, or 1.80p per share, which compares to a revenue reserve of £2.96m, or 1.43p per share as at 30 June 2023. This is a marked uptick as CYN had previously depleted its revenue having paid a dividend out of capital for a number of years. However, CYN has plenty of capacity to maintain the dividend at 5.6p per share, provided the board is still comfortable with paying this out of capital.

Premium/(discount)

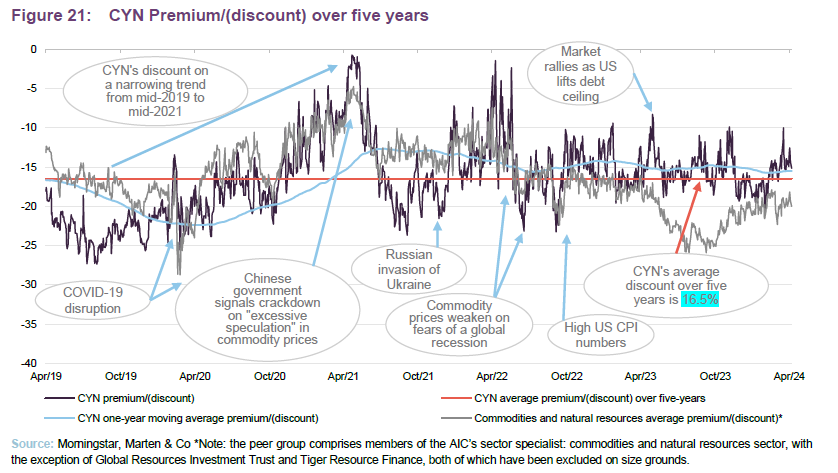

Figure 21, which illustrates CYN’s discount over the last five years, shows that the overall trend between the end of October 2021 and May 2022 was one of discount tightening, but there has been considerable volatility as the market digested both Russia’s invasion of Ukraine and a raft of interest rate rises. Initially, following the invasion, CYN’s discount and the average of its peer group narrowed significantly, reflecting tightening commodity markets, particularly for energy. However, as interest rate rises started to bite and fears of recession took hold, CYN’s discount and the peer group average widened out again.

It should be noted that, reflecting the more economically sensitive nature of resource companies, CYN’s discount and those of its peers tend to exhibit a degree of cyclicality. Although CYN’s discount and that of the wider sector have been quite volatile, these discounts have tended to narrow in response to signs that inflation is slowing down, offering the prospect of lower interest rates. This is somewhat counterintuitive, given that commodities tend to act as a hedge against inflation, but it is noteworthy that the discount has widened recently at a time when inflation figures have come in a little ahead of expectations, which may be creating an opportunity. (Figure 21 illustrates other events that have impacted on CYN’s discount. Readers can find out more about these in our previous notes – see page 26 of this note).

There has been an increasing appreciation in the last few years of the fact that the natural resources sector is exposed to a number of long-term structural growth drivers (think both of the changes needed to decarbonise energy provision globally and the need to replace aged infrastructure around the world, the frailties of which were laid bare by the pandemic).

Comfort from CYN’s yield

Sector topping yield may provide investors with some comfort, in current turbulent conditions.

When assessing CYN’s discount, it should be noted that the trust’s mid-cap bias may amplify market movements. However, its relatively-high yield (the highest in the sector – see pages 17 and 18) offers investors a degree of comfort in that they are paid to wait.

During the last 12 months, CYN has traded at discounts between 8.3% and 20.7%, with an average of 15.6%. As at 3 May 2024, the discount was 14.5%, which around 3.0 percentage points below its longer-term five-year average and is in line with the mid-point of its one-year trading range. CYN’s discount is 5.7 percentage points narrower than the sector average of 20.2%. In comparison, the sector’s five-year average discount is 16.2% (with a range of 4.7% to 28.7%). CYN’s five-year average discount is 16.5% (with a range of 0.7% to 27.4%).

Focused on raising awareness of the trust

CYN’s board has recently authorised some share repurchases.

CYN has the authority to repurchase up to 14.99% and allot up to 9.99% of its issued share capital although, reflecting the fact that the board considers that share repurchases could have a limited ability to provide any sustained change in the discount, there is no formal discount control mechanism or discount target. CYN recently began repurchasing shares (the first repurchase was on 24 April 2024).

We have previously said that, given CYN’s current size, we believe share repurchases may have a limited impact on the discount as they would also serve to reduce liquidity and put upward pressure on CYN’s ongoing charges ratio (its fixed costs being spread over a smaller asset base). We therefore think that a measured approach is required but note that these repurchases not only provide liquidity to some shareholders who wish to exit but will also be NAV accretive to remaining shareholders.

The board and manager are focused on increasing awareness of the trust, with the aim of eliminating the discount and ultimately growing the trust, which is reflected in the addition of Frostrow Capital to broaden the reach of CYN’s marketing efforts even further.

Fees and costs

Tiered base management fee; no performance fee

CYN has a tiered management fee structure.

Under the terms of the investment management agreement, CQS is entitled to receive a basic management fee of 1.2% per annum of total net assets up to £150m, 1.1% of total net assets above £150m and up to £200m, 1.0% of total net assets above £200m and up to £250m and 0.9% of total net assets above £250m. The management fee is calculated and paid monthly in arrears and there is no performance fee element. The management agreement can be terminated on

12 months’ notice by either side.

Secretarial and administrative services

With effect from 22 November 2023, Frostrow Capital LLP has been appointed as CYN’s administrator and company secretary (these services were provided by BNP Paribas Securities Services S.C.A. previously). The total fees for these services were £154,000 for the year ended 30 June 2023 (2022: £141,000). Frostrow has also been appointed to provide investor relations and marketing services to CYN. BNP Paribas Securities Services continues to act as CYN’s custodian, banker and depositary. Custody and depositary fees were £34,000 and £50,000 respectively for the year ended 30 June 2022 (2022: £32,000 and £50,000).

Allocation of fees and costs

The investment management fees are allocated 25% to capital and 75% to revenue. All other expenses are charged wholly to revenue, with the exception of costs relating to the disposal of investments, which are charged wholly to capital. The ongoing charges ratio for the year ended 30 June 2023 was 1.8% (2022: 1.7%).

Capital structure and life

Simple capital structure.

CYN has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 3 May 2024, there were 66,888,509 of which 162,250 are held in treasury with 66,726,259 in general circulation.

Short-term unsecured loan facility

£15m loan facility with optional £20m extension.

CYN is permitted to borrow and has a £25m unsecured loan facility with Scotia Bank (Europe) Plc for this purpose. The loan facility, which has an expiry date of 17 September 2024, is rolled every three months and can be cancelled at any time. Under the terms of the facility, CYN is not permitted to allow the adjusted asset coverage ratio to be less than 3.5 to 1, and CYN’s total net assets are not permitted to be less than £45m. CYN’s board has set a borrowing limit of 25% of net assets for ordinary market conditions. As at 31 March 2024, CYN had gross gearing of 10.4% and net gearing of 8.7%.

Unlimited life with an annual continuation vote

CYN does not have a fixed winding-up date, but at each annual general meeting (AGM), shareholders are given the opportunity to vote on the continuation of the company as an investment trust.

Financial calendar

The trust’s year-end is 30 June. The annual results are usually released in September/October (interims in March) and its AGMs are usually held in November/December of each year. As discussed on page 25, CYN pays quarterly dividends in November, February, May and August.

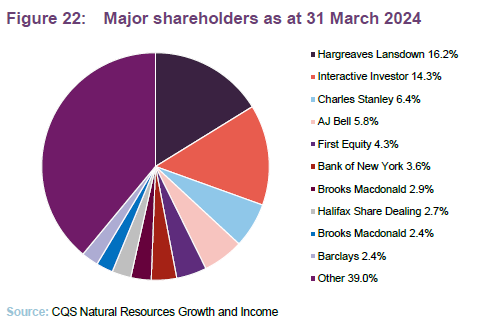

Major shareholders

Collectively, the major retail investing platforms occupy a significant portion of CYN’s register, suggesting that there is a large retail presence within its investor base. We are also aware that Saba Capital, the activist investor, has been building a position – it announced on 26 April that its holding was 13.19%. However, it does not appear in Figure 22 below as it uses a range of custodians to hold its share through, making it hard to identify.

Management team

CYN is co-managed by Ian Francis, Keith Watson and Rob Crayfourd. Keith and Rob focus on the equity side of the portfolio, while Ian primarily focuses on the fixed income securities. Keith and Rob also manage Geiger Counter Limited (also a client of Marten & Co) and Golden Prospect Precious Metals Limited.

Ian “Franco” Francis

Ian Francis has over 35 years of investment experience.

Ian is a partner at CQS and Head of New City. He also manages the CQS New City High Yield Fund, which, like CYN, is a client of Marten & Co. Ian joined NCIM in 2007 and has over 35 years’ investment experience, primarily in the fixed interest and convertible spheres, having worked for Collins Stewart, WestLB Panmure, James Capel and Hoare Govett. He is able to draw on the expertise of a 16-strong credit analysis team at CQS.

Keith Watson

Keith joined the NCIM team in 2013, initially as a dedicated natural resources analyst focused on supporting CYN’s managers.

Prior to NCIM, he worked for Mirabaud Securities, where he was a senior natural resource analyst; Evolution Securities, where he was director of mining research; Dresdner Kleinwort Wasserstein, where he was a top-ranked business services analyst; Commerzbank; and Credit Suisse/BZW. Keith began his career in 1992 as a portfolio manager and research analyst at Scottish Amicable Investment Managers. He has a BSc (Hons) in Applied Physics from Durham University.

Robert (Rob) Crayfourd

Rob joined the NCIM team in 2011. He has over 13 years’ financial experience, having previously worked for the Universities Superannuation Scheme and HSBC Global Asset Management, where he focused on the resources sector. Rob holds a BSc in Geological Sciences from the University of Leeds and is a CFA charterholder.

Board

All directors are non-executive and independent.

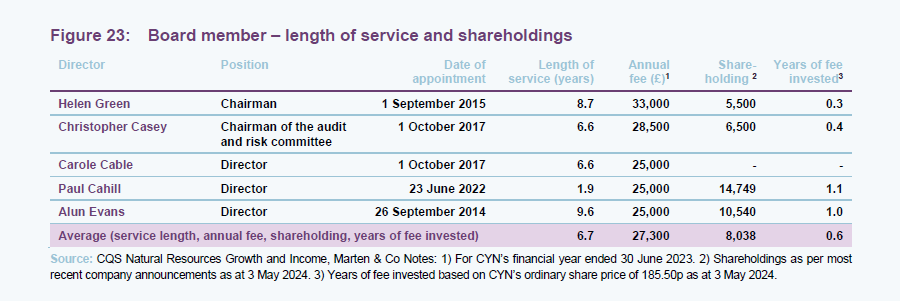

CYN’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. The company’s articles of association limit the aggregate fees payable to the directors to a total of £175,000 per annum, which has a comfortable amount of headroom at the current fee levels.

Board members offer themselves for re-election annually.

CYN’s articles of association require that board members offer themselves for re-election at least once every three years. Board members that have served for nine or more years must offer themselves for re-election annually. However, board policy is that all members offer themselves for re-election annually. All five board members were re-elected at the trust’s last AGM on 15 December 2023.

Succession planning

As is illustrated in Figure 23, Alun Evans has served on CYN’s board for over nine years now. In its 2023 annual report, CYN’s directors said that they felt that Alun continues to provide invaluable experience and that it was in the best interests of the company that he should continue in his role at that time. However, with its chairman Helen Green – the next long-serving director – having been on CYN’s board for 8.7 years now, we think that the board will want to consider recruitment in the next couple of years to allow for an orderly transition between directors.

Board diversity

Two of the three most-senior board positions are held by women.

At the time of writing, the board has a 60/40 split in terms of gender identity (men/women), one of the two most-senior positions (board chair) is held by a woman, and one (chair of the audit committee) is held by a man (the board has not considered it necessary to appoint a senior independent director).

At present, the board is entirely composed of individuals who are classified as White British or other White (including minority-White groups). The board acknowledges that diversity in the boardroom is an increasingly important area of focus and that, while the board is diverse in terms of experience and background, it is not ethnically diverse. The Board says that it is investigating setting up a board apprenticeship scheme to provide personal development opportunities for ethnically diverse candidates, probably having full-time roles in the natural resources sector.

Alignment

As is illustrated in Figure 23 four of NCYF’s directors have personal investments in the fund, which we consider to be favourable as it helps align directors’ interests with those of shareholders. With an average level of fees invested of 0.6 years, there is some way to go to reach an average of two years’ fees invested, which has been shown to provide superior performance on average, but Paul Cahill’s inaugural purchase noted below has covered a year’s worth of fees, and additional purchases by board members could move the average up quite quickly.

Two directors have purchased shares during the last 12 months: Paul Cahill purchased 14,749 shares at 169.5p per share on 20 November 2023; and Alun Evans purchased 2,900 shares 169.7p on 2 April 2024. None of the directors have disposed of any shares during the last year.

Helen Green (chairman)

Helen is a chartered accountant with considerable experience of investment funds and, in particular, of fund administration and governance. She is a director of Saffery Champness (one of the UK’s Top 20 accountancy practices), in Guernsey. Helen joined Saffery Champness in London in 1984, relocating to Guernsey in 2000. She is a director of Acorn Income Fund Limited and Landore Resources Limited. She was formerly a director of Advance Frontier Markets Fund Ltd, Henderson Diversified Income Fund Ltd and John Laing Infrastructure Fund Ltd. Helen became CYN’s chairman with effect from 31 March 2022 following the retirement of the previous chairman, Richard Pricket. Helen had previously been chair of CYN’s audit committee.

Christopher Casey (chairman of the audit and risk committee)

Christopher is a chartered accountant and was formerly a partner at KPMG until 2010. Since leaving KPMG, he has carried out a number of non-executive board roles, including chairman of China Polymetallic Mining Ltd. Christopher is currently a director of Eddie Stobart Logistics Plc, TR European Growth Trust Plc, Black Rock North American Income Trust Plc and Mobius Investment Trust Plc. He became chairman of the audit committee on 31 March 2022 when Helen Green became the trust’s chairman.

Carole Cable (director)

Carole has had a 25-year career connected to the mining and commodities sector, initially on the sell side at JP Morgan and Credit Suisse, and latterly as a non-executive director both of Nyrstar NV (a global mining and multi metals business) and Women in Mining UK. She is currently a partner and co-head of the Energy and Resources division at Brunswick Group LLP, where she advises clients in the mining sector.

Paul Cahill (director)

In his early career, Paul worked as an investment banker at Morgan Grenfell and then as a managing director at Minorco (Anglo American) where he was responsible for Asia Pacific & Australia. At the time, he was based in Singapore and worked on several copper and gold joint ventures in Australia, Indonesia, PNG, and the Philippines.

In 2001, he left Anglo American to co-lead the establishment, strategic direction and management of Gazelle Corporate Finance, a boutique investment banking business providing corporate finance, M&A and debt restructuring advice to the Boards of FTSE 100 and Fortune 500 companies. However, he returned to Anglo American in 2008, where he became group head of business development and head of strategic relationships management. Paul was a key member of Anglo American’s senior leadership team, accountable for the group’s growth agenda and the development and management of the group’s business and relationships in China, India, Japan, Mozambique, Mongolia, Russia, and the DRC. In 2017, he became a co-founder and managing director of Bacchus Capital Advisers, an independent investment and merchant banking platform focused on metals and mining and with particular expertise in public market takeover and defence, complex cross-border M&A, equity and debt financing and corporate restructuring. He remains chairman of the Bacchus Capital Advisory Board.

Alun Evans (director)

Alun has over 40 years’ experience working in the investment management industry. He began his career at Capel-Cure Myers, moving to Carr Sheppards Crosthwaite in 1990, where he became an executive director in 1998. Alun joined Cheviot in 2009 as Business Development Director, from which he retired in August 2017.

Previous publications

Readers interested in further information about CYN may wish to read our previous notes (details are provided in Figure 25 below). You can read the notes by clicking on them in Figure 25 or by visiting our website.

Figure 24: QuotedData’s previously published notes on CYN

| Title | Note type | |

| Strong recovery potential? | Initiation | 11 June 2019 |

| Recovery on-hold, hold on | Update | 23 June 2020 |

| Burnished copper | Annual overview | 14 April 2021 |

Source: Marten & Co

IMPORTANT INFORMATION

This marketing communication has been prepared for CQS Natural Resources Growth and Income Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.