Downing Renewables and Infrastructure Trust

Investment companies | Annual Overview | 14 November 2023

Powering ahead

Downing Renewables and Infrastructure (DORE) set out to build an attractive portfolio of renewable energy assets diversified by geography and asset type, and has succeeded in that. In doing so, it alighted upon an opportunity to build a portfolio of hydropower assets in Sweden. As we describe in this note, the management team has identified a number of ways in which it can significantly enhance the returns of these assets. These initiatives have the potential to add meaningfully to both DORE’s NAV and revenues, and in a reasonably short timeframe.

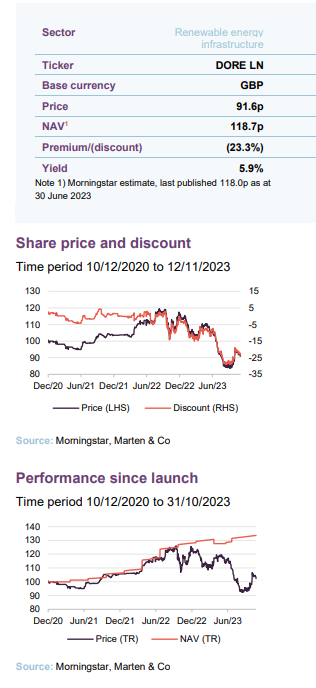

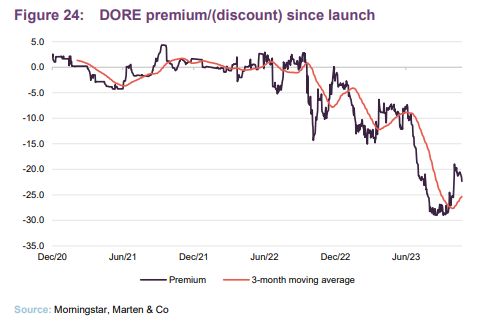

In common with peers, DORE’s discount has widened. This appears to be linked in part to rising interest rates and their potential impact on valuations. DORE’s board has been proactive, authorising share buybacks which have the additional benefit of enhancing the NAV for ongoing shareholders. This, and the opportunity highlighted above, mean that DORE’s share price is now bucking the trend.

Diversified renewable energy and infrastructure

Downing Renewables and Infrastructure Trust aims to provide investors with an attractive and sustainable level of income returns, with an element of capital growth, by investing in a diversified portfolio of renewable energy and infrastructure assets located in the UK, Ireland and Northern Europe.

Fund Profile

DORE aims to provide investors with an attractive and sustainable level of income returns, with an element of capital growth, by investing in a diversified portfolio of renewable energy and infrastructure assets located in the UK, Ireland and Northern Europe.

More information is available on the fund’s website at www.doretrust.com

The company aims to accelerate the transition to net zero through its investments. DORE believes that its actions should directly contribute toward climate change mitigation.

DORE’s strategy focuses on diversification by geography, technology, revenue and project stage

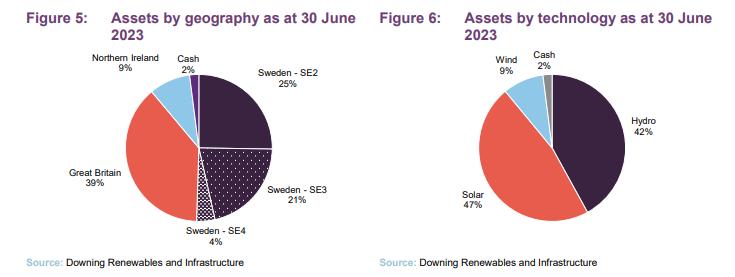

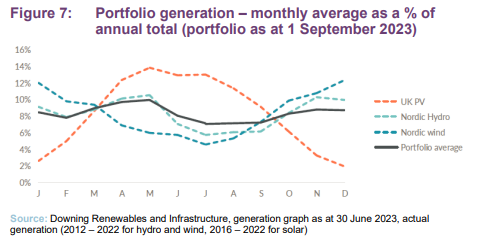

The strategy focuses on diversification by geography, technology, revenue and project stage. The investment manager believes that by investing in a range of renewable energy sources, DORE can reduce the seasonal volatility of revenues and reduce dependency on any single technology to provide more consistent income. There may also be some investments in other infrastructure, whose principal revenues are not derived from energy generation, thus reducing DORE’s exposure to merchant power prices. In addition, diversifying the portfolio geographically should help reduce the portfolio’s regulatory and political risk.

The portfolio will also blend operational projects with construction-ready projects and those under construction. The manager says that investment in construction-phase projects offers the potential for higher returns. The amount invested in construction-ready assets or assets under construction will be limited to 35% of gross asset value, as construction projects tend to have more risk associated with them. The company will not acquire assets that are not construction-ready.

DORE is targeting a NAV total return of 6.5% to 7.5% per annum over the medium to long term. From launch to end June 2023, DORE generated annualised returns of 5.1% in share price terms and 14.9% in NAV terms.

From launch to end June 2023, DORE generated annualised returns of 5.1% in share price terms and 14.9% in NAV terms

DORE’s AIFM is Gallium Fund Solutions Limited. It has delegated portfolio management services to the investment manager Downing LLP (Downing or the manager). Downing has AUM of about £1.9bn, and a team of investment and asset management specialists focused exclusively on energy and infrastructure transactions. We note that Downing has undergone an expansion and now has 60 individuals who solely focus on energy and infrastructure. This is a reflection of both the expansion of the company and the wide range of assets within its energy and renewable portfolio, something which is increasingly reflected in DORE.

DORE raised £122.5m at IPO, topped that up in October 2021 with a £14.9m issue of shares at 102.5p. and another successful capital raise, raising £52.9m gross, in June 2022.

A detailed look at DORE’s investment process was provided in our previous note (see pages 23 to 28 of that note).

Market update – green with optimism

The tailwind behind the renewable energy generators provided by the ongoing need to tackle climate change has been strengthened by a need to address energy security in the wake of the war in Ukraine.

DORE’s management team says that it has a surfeit of investment opportunities. It has also identified a range of potentially revenue and NAV-enhancing projects that could be applied to the existing portfolio, the undertaking of which has already begun in several instances.

As a number of factors – chiefly inflation and higher power prices – have combined to drive higher revenue across DORE’s portfolio, the team sees scope for increasing cash dividend cover over the next few years.

Whilst it is still early in DORE’s life, almost three years after launch the managers are pleased with the progress across the portfolio and the clear benefits that diversifying the portfolio by geography (power market) and asset type has brought to the trust.

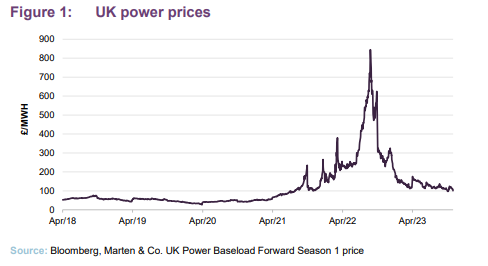

Energy price trends

The elevated energy prices of 2022 were a well-documented phenomenon – the initial stages of this were covered in out last note. Briefly, the combination of the Ukrainian war and the post-COVID increase in energy consumption drove up the price of energy, especially within Europe. The trend since our last note has been one of gradual normalisation, with energy prices falling from their 2022 peaks and approaching a more sustainable long-term level. However, this level still seems likely to be higher than the pre-pandemic levels, thanks to the effective removal of Russian energy from the supply side, set against rising global demand. DORE was (in hindsight) launched at an opportune time, coinciding with the start of a long-term tailwind for energy generators.

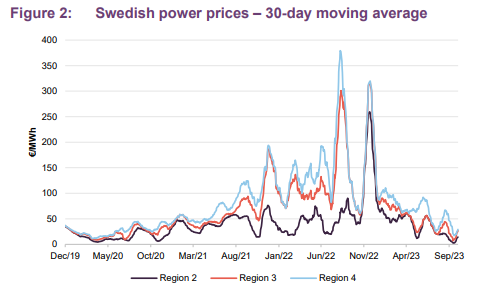

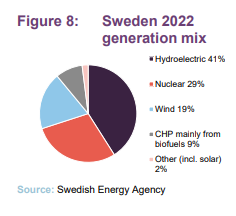

Other than higher prices, another aspect shared by both the UK and Nordic power markets – the primary exposures of DORE’s portfolio – has been their heightened volatility. 2021 to 2023 marked the most volatile period for energy prices in recent memory. Beyond the impact of the war in Ukraine, there have been other factors at work. For example, Sweden was reckoned to be the largest exporter of power within the EU over 2022, as problems with the French nuclear fleet curtailed that country’s output. The effect of this is more pronounced on the Swedish pricing regions with the closest links to Germany (region 4 and then region 3 – which includes Stockholm).

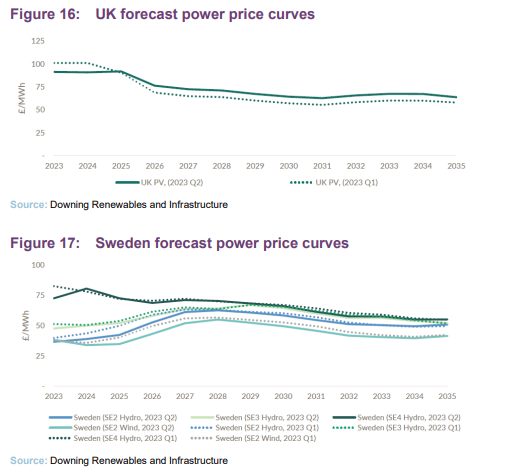

Within the valuation model, DORE’s board is assuming that power prices normalise faster than had been expected when we last published. Figures 16 and 17 on page 16 show how independent forecasts have changed this year.

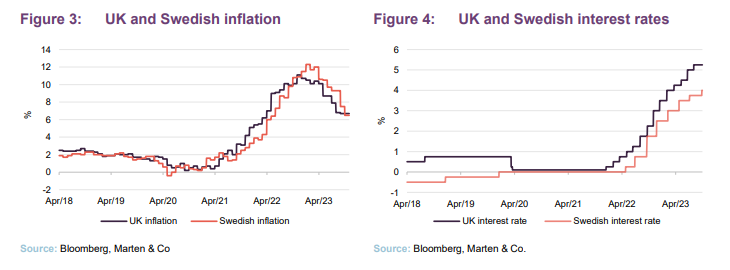

Inflation remains well above targets

UK inflation is proving to be more stubborn than expected, which has pressured the Bank of England to raise rates to their highest level in well over a decade. There are finally signs that UK inflation growth is easing. However, the market is still factoring in the possibility of another 25bp interest rate rise from the BoE (peaking in about five or six months at about 5.5%). Even then, one would expect the BoE to keep rates at their new, more elevated level given that inflation still remains well above the 2% target.

There is a similar situation in Europe, the rate of inflation also appears to be moderating as power prices ease. Like the UK, however, Sweden may also need to further raise interest rates to bring its figures back to its 2.0% target, with the Swedish central bank highlighting that more rate rises may be needed to fully bring inflation under control. The general tone by western central banks has been that if they take their foot off the monetary-tightening pedal too early, then they risk high inflation becoming entrenched, which may be more damaging in the long term than a period of heightened interest rates.

Inflation is a double-edged sword for DORE, as thanks to the inflation-linkage of approximately one third of its contracts, it is seeing its earnings increase. However, the associated rise in interest rates, as central banks try to rein in demand, could also put upward pressure on discount rates, which reduces the present value of DORE’s projected revenues. Nevertheless, as we point out later in this note, the positive effects of inflation on DORE’s valuation have easily surpassed the costs of rising discount rates.

Asset Allocation

Thanks to a successful capital raising, as well as strong NAV growth, DORE had a portfolio (including cash) worth £319m at end June 2023, including wind, solar and hydropower assets with annual generation of about 414GWh (the average UK household uses 2.9 MWh per year). In addition, it is buying two grid assets: Swedish electricity distribution system operator Blåsjön Nät AB (see page 13), and a shunt reactor in Merseyside, which we discuss in more detail on page 12.

A core tenet of DORE’s approach is to ensure that its exposures are diversified by geography and asset type. Figures 5 and 6 illustrate the degree to which this has been achieved. However, Figure 7 perhaps provides a more useful illustration.

The team’s aim is to ensure that the solid line (the average generation of the trust) is as flat and high as possible. In addition, DORE has permission to invest up to 25% of its assets into in non-power-generating investments. The team has recently taken major steps in this regard, having added grid and shunt reactor assets to the portfolio, whose revenue streams are not correlated with those of the power-generating assets.

Hydropower – Downing Hydro AB (DHAB)

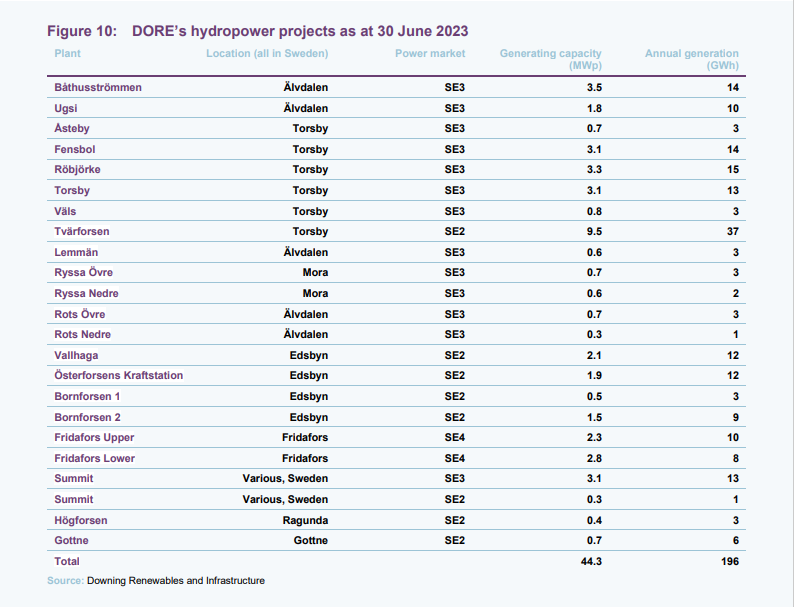

DORE’s hydropower plants have an extensive operating history. The manager feels that one of the strengths of hydropower assets is their longevity, which extends well beyond the design-lives of wind and solar assets; these are not wasting assets.

The Swedish power prices that we presented on page 8 are the daily average price and do not reflect the range of prices available in a day. Sweden has a baseload supply provided by hydropower and nuclear power. However, intermittent wind and solar generation is an increasingly important part of the mix. Sweden usually has a surplus of power that it exports via interconnectors to neighbouring countries, principally Germany and Denmark.

Hydro has advantages over nuclear as generation can be controlled via the regulation of volume of water flowing through the plant. This means that hydro plants are able to capture intraday as well as seasonal variations in power prices, while curtailing production at times of oversupply.

Efficiency and scale benefits from an expanding portfolio

Since our last note, DORE has added eight new hydro plants, all of which are located in Sweden and are fully operational.

- In November 2022, DHAB paid £6m to buy six plants in the SE3 region capable of producing 13GWh per annum and one in the SE2 region capable of producing 1GWh. The plants come with a combination of reservoir storage and run of the river generation plants.

- In March 2023, DHAB acquired two hydropower plants located in Sweden’s SE2 pricing region, for £5.1m, one being a c.2.5GWh plant in Högforsen and the other a c.6GWh hydropower plant in the municipality of Gottne. The acquisitions are being funded through available cash reserves.

The team notes that within Sweden there are few buyers of smaller hydro plants, allowing DORE to capitalise on an inefficient market. Consequently, hydropower has become an even more exciting component of DORE’s portfolio – not simply because of DORE’s recent spate of acquisitions in this space, but rather because of the compelling opportunity that has arisen from DHAB’s economies of scale. By combining multiple powerplants in a single region, DHAB is able to dramatically improve the operational efficiency of these plants.

The team says that it was presented an opportunity last year that was simply ‘too good to pass up’. This opportunity was four hydro plants located in the Bergfors region of Sweden, all of which are connected by a single waterway, and tap into the same system of lakes. These lakes are reservoirs that act like a battery, allowing the plants to capture periods of higher power prices (such as times when wind resource is not available), but crucially, they can discharge power for a much longer period than a conventional lithium-ion battery could.

This creates opportunities to improve efficiency, as DHAB now has full control of all reservoirs in this river system, allowing it to maximise the output of this system of hydro plants and to better match output to fulfil demand from the grid.

DHAB is increasing the centralisation of its plants’ operations, with many requirements now being fulfilled from a single physical location, which is in charge of dispatch control (the regulation of electricity production). DHAB is implementing more advanced technology, such as enhanced weather forecasting, to further increase the efficiency of its new acquisitions.

Exploiting the hydro portfolio’s for energy storage

The DORE team highlights the improving prospects for the hydro investments, thanks to the emergence of new opportunities which were not originally components of its model at time of purchase. For example, DHAB will soon be able to access the growing Frequency Regulation Market in Sweden.

One form that this will take will be DHAB’s participation in the Frequency Containment Reserve (FCR) market. FCRs are active power reserves that are automatically controlled based on the frequency deviation, ensuring that the power supply remains within the standard frequency of 49.9 Hz to 50.1 Hz. Through the combinations of an increasingly centralised and digitalised operation system, and the installation of a software package (at negligible cost – around €10k per plant), DHAB will be able to regulate its power production to such an extent that it can bid for all but the fastest-response FCR-D contracts. The team is targeting participation in late 2023.

Battery

The second opportunity comes from participation in the FCR-D and Fast Frequency Reserve (FFR) market. FFRs are activated to counter low-inertia situations that can lead to rapid frequency drops, with the usage of FFRs being essential for energy supply security. Tapping into the FFR market will require more capital expenditure than FCR, however, as DHAB will need to install battery storage assets to meet the fast-response elements of FFR participation. Thankfully, DHAB has an abundance of land alongside its hydropower plants that would make prime locations for battery installations. DHAB is not only positioned for a low cost of entry into the FFR, but batteries also offer another route to exploit “load shifting”, supplying power when it is most needed and more lucrative to do so.

The opportunity presented via the use of batteries and the FFR market is not simply related to the diversification benefits of DORE tapping into a new market, but also thanks to the ease in which they can achieve this. The addition of batteries to DORE’s portfolio was not something which was on the team’s cards when the trust was set up, but instead an opportunity they discovered once they had purchased their Swedish hydro assets and the subsequent attractive evolution of the ancillary services markets. The hydro sites have two clear advantages, the first being that they included full rights to the land surrounding the hydro plants, and the second that the sites have existing connections to the Swedish grid.

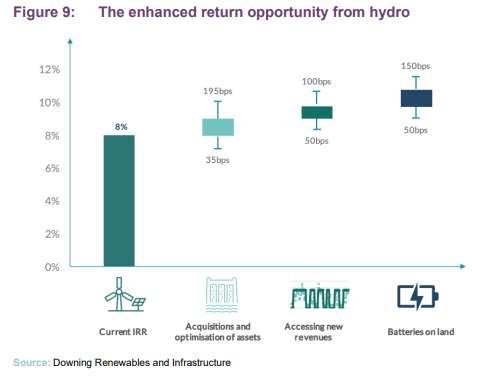

Figure 9 illustrates the return opportunity available to DORE from its hydropower assets. The existing portfolio is valued based on an expected 8% IRR.

- When DORE acquires standalone or small portfolios of plants, it can often do so at lower valuations, providing increased returns.

- It can then extract economies of scale as it incorporates these new acquisitions into its portfolio, which now numbers 28 plants.

- Installing digital controls and accessing the FCR market provide opportunities for revenue optimisation and enhancement.

- Installing batteries alongside the plants gives access to additional revenue opportunities.

- The result is that DORE’s hydropower plants have the potential to be significantly more profitable than the team envisaged originally. This should flow through into the NAV and to revenue fairly quickly.

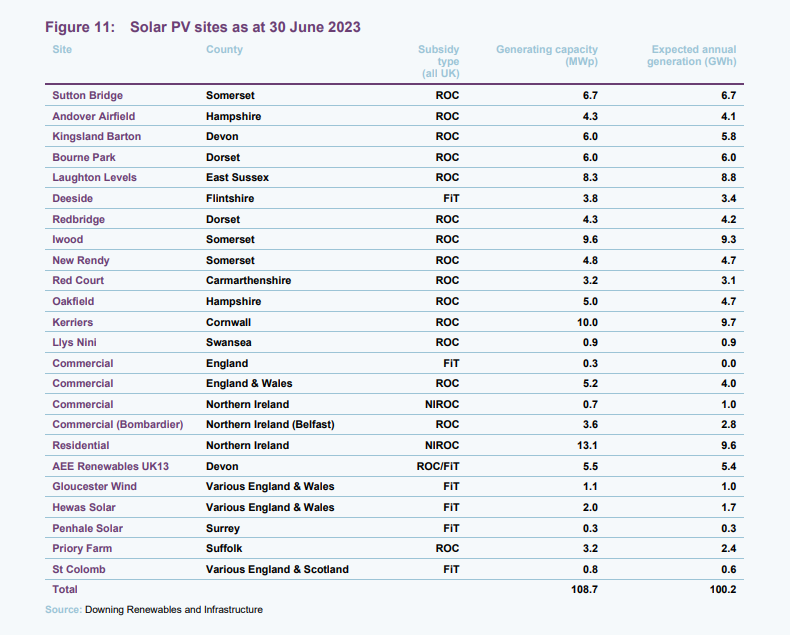

Solar

DORE’s initial solar portfolio was acquired in March 2021 and as described below, the portfolio was expanded in April 2023. All of these solar assets are located in the UK and benefit from a combination of FiT, ROC and NIROC subsidies.

DORE now has about 4,800 solar assets with a total annual average production of about 101GWh.

Latest solar acquisition

The most recent addition to DORE’s solar asset portfolio was a £12.6m portfolio of operational solar PV assets located in the UK. The portfolio has a total output of 13.0MWp, generated across two ground-mounted sites and 1,600 commercial and residential installations (which come with high levels of fixed, inflation-linked revenues). The purchases were funded using the remainder of DORE’s cash reserve.

The DORE team has made significant progress in improving the efficiency of its solar operations, via a spare part optimisation process, with ground-mounted solar assets grouped where they can share key components. We expect to see further efficiency-saving initiatives within DORE’s solar assets in the future.

The power produced by the ground-mounted solar portfolio is sold through a long-term offtake agreement with Statkraft (a power company owned by the Norwegian state), with the effect that 86% of the solar portfolio (by capacity) benefits from a PPA floor.

Wind

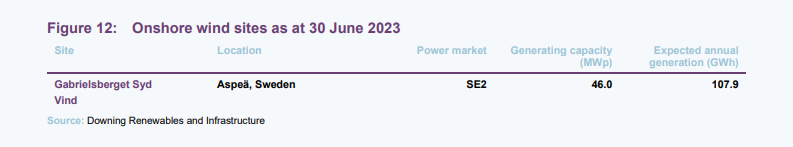

The 46MWp onshore Gabrielsberget Syd Vind project located in northeast Sweden was acquired in February 2022 for approximately €23.8m. The deal was funded on an ungeared basis using the group’s cash resources.

The wind farm is powered by 20 Enercon E-82 2.30 MW turbines and is located on a plateau in north-eastern Sweden at approximately 220 metres above sea level in the SE2 pricing region. The project has been operational since 2011. Operation and maintenance services are provided by Enercon GmbH. The asset is expected to generate about 108 GWh of electricity per annum and the power generated is sold through a short-term offtake agreement with Centrica.

Grid services

Merseyside Reactive Power

On 19 June 2023, DORE announced that it had acquired Mersey Reactive Power – a UK-based, fully operational 200 MVAr shunt reactor – for a cash consideration of about £11.0m (funded from its revolving credit facility).

Shunt reactors are high voltage transmission systems designed to control voltage during load variations, allowing for the effective transfer of energy along the grid. In more technical terms, a shunt reactor provides reactive power recovery which brings energy ‘back in phase’ and prevents loss of power across the grid.

The project has an expected life of 40 years, and has an initial fixed-price, inflation-linked, availability-based contract with National Grid ESO until 2031. Once the initial contract is up, DORE might either renew the fixed term, or opt to engage in merchant pricing, which, while more volatile, tends to offer substantially higher returns.

Traditionally, reactive power facilities have been co-located within large generation plants. However, as the mix of power on the grid changes, many of these sites have been closed and the areas where reactive power is needed have shifted. This creates opportunities for further investments of this type for DORE.

Blåsjön Nät AB

In its most recent transaction, announced on 12 July 2023, DORE acquired 100% of a Swedish Electricity Distribution System Operator, Blåsjön Nät AB, for about £7m. Blåsjön delivers 16-18GWh per annum of electricity through 436km of medium and low voltage overhead lines to its roughly 1,500 domestic and business customers in northern Sweden. The asset also comes with three primary and 161 secondary substations.

Blåsjön is effectively a licensed monopoly, and hence operates in a highly regulated environment, generating consistent and predictable cashflows that are correlated to Swedish inflation and interest rates, but not to merchant power prices.

The team had been searching for a grid asset for over a year. The asset provides an agreed rate of return on a regulated asset base. DORE can benefit if it can deliver pre-approved investments under budget. The customer base is primarily residential, and the number of new residential connections is not expected to have much of an impact on returns. However, the team says that there has been a fair bit of historical under-investment in the assets.

The team says that there is an opportunity to increase the exposure to this sector, exploiting economies of scale. There are many municipality-owned small power grids. Once again, DORE financed the Blåsjön acquisition from its revolving credit facility, drawing down about £8.5m.

Pipeline

The DORE team has outlined several possible avenues through which DORE can further improve its diversification. The most recent acquisitions have absorbed some of its remaining firepower but there is still room to increase leverage, plus the dividend is sufficiently well covered that it is generating excess cash flow that can be reinvested in the pipeline (see page 9).

As we have outlined, there is a considerable opportunity in co-located battery storage within the Swedish hydropower portfolio, as well as bolt-on acquisitions of additional hydropower plants. Then there are also further opportunities in grid services in both Sweden and the UK.

The team would like to further diversify DORE’s exposures by geography. Were DORE able to close its discount and raise fresh equity, we would envisage it being able to deploy capital raised relatively quickly and at attractive returns.

ESG

DORE has very strong ESG credentials. DORE is an Article 9 fund under EU taxonomy and the EU Sustainable Finance Disclosure Regulations, which are explained below. As an Article 9 fund, DORE has a core sustainable objective of accelerating the transition to net zero through its investments.

We note that the team’s commitment to ESG is not solely fulfilled by the provision of renewable energy, as it is also conscious of the direct impact that renewable energy extraction can have on society and environment, such as the impact of biodiversity.

The DORE team has provided a hugely detailed report on the ESG and sustainability activities in the trust’s annual report, which can be read here. For the purposes of our note, we have extracted several key outcomes that we believe are worth highlighting as clear advantages of DORE’s approach to ESG.

- Given DORE’s substantial allocation to hydropower, the team has implemented a policy around responsible water usage and fish protection. In practice, the Downing group is a part owner of Ljusnan and Dalvälven Water Regulation Enterprises, which allows the group to positively impact Swedish fish communities and the surrounding environment. With respect to the team’s recent acquisitions (see pages 8-12), it has installed a “fish pass” to ensure the stability of the local fish populations. The team also outlines its future plans for these sites in the annual report.

- Downing remains committed to ensuring that it nurtures the biodiversity within its sites, and during 2022 it authorised 12 ground surveys on their UK solar sites. These reports ensure that the team can optimise the habitats surrounding portfolio assets and ensure that they meet the baseline level of biodiversity. The team is pleased that the portfolio is already displaying good biodiversity, based on the enhancements proposed by ecological specialists. However, there remain several species of interest to which the team is giving extra attention to ensure their ecological needs are met, and these are outlined in the annual report.

- Although the latter two initiatives would fall under the ‘E’ in ESG, Downing has also made sizable headway in improving the social outcomes for the communities surrounding their projects, as well as improving the overall awareness of the need for sustainable energy generation. Not only does DORE prioritise local providers of external services, such as maintenance, but each project pays on average £20,000 per year to fund local community projects. DORE has also provided free power to local residents, or discounted power in the case of commercial landlords. This initiative has powered 3,730 homes in the UK over 2022, which provided many households with much-needed respite during the ‘cost of living’ crisis.

- Downing has appointed a third-party education firm, Earth Energy Education, to aid in improving the awareness of the need for sustainable energy. In 2022, over 190 primary school children visited DORE solar sites to give them a practical education in renewable energy. The DORE team intends to expand the reach of this programme over 2023.

DORE aligns with several UN Sustainable Development Goals (UN SDG): affordable and clean energy; industry, innovation and infrastructure; climate action; and life on land. Many of the previously-mentioned ESG initiatives are direct examples of how DORE has met these goals.

DORE has also produced a highly detailed climate disclosure, in line with the recommendations of the Task Force for Climate Related Financial Disclosures. Within the annual report, it has produced an enormously detailed nine-page report in this regard, covering the four content pillars: governance, strategy, risk management, metrics & targets. The level of detail is far too great to cover in a justifiable manner within this note, as it encompasses a huge range of analysis, from portfolio sensitivity analysis to the assessment of the impact of changing demographics.

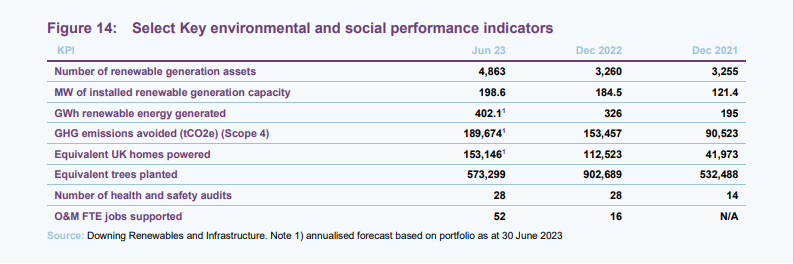

Sustainability indicators

DORE has provided a detailed breakdown of key performance indicators across financial years, a snapshot of which we show below.

NAV assumptions

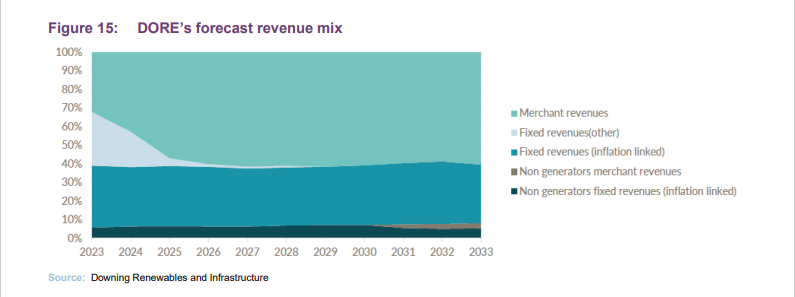

A high proportion of DORE’s near-term revenue is fixed as can be seen in the chart in Figure 15, which incorporates the grid services acquisitions that DORE has made recently.

A high proportion of DORE’s near-term revenue is fixed as can be seen in the chart in Figure 15, which incorporates the grid services acquisitions that DORE has made recently.

Forecast power prices are based on fixed prices under contractual arrangements where these are in place, short-term power price hedges, and a blend of forecasts from two leading independent consultants.

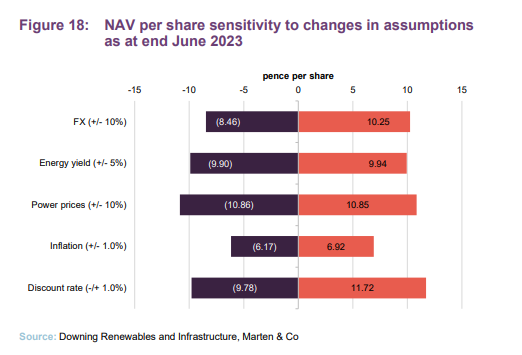

DORE’s NAV benefitted from higher-than-expected inflation assumptions, with the UK and Sweden both seeing their 2023 inflation expectations rise above prior forecasts. Within DORE’s valuation model, the weighted average long-term inflation assumption across the portfolio is 2.4%.

Forward foreign exchange rates are based on a 10-year forward curve provided by DORE’s foreign exchange advisers. DORE does hedge some of its foreign exchange risk. At the end of December 2022, 39% of forecast EUR dividend receipts from SPVs out to December 2027 were hedged, with 51% of the groups EUR denominated NAV also being hedged (as of end December 2022). DORE’s hedging policy was described in the investment process section of our previous note.

Discount rates are assigned to individual assets and the weighted average of DORE’s discount rates has been affected by the change in the mix of assets within the portfolio. Discount rates increased over 2022 and 2023, in response to an increase in the risk-free rate. At end June 2023, these ranged between 6.3% and 8.0%, with a weighted average of 7.8%, up from 7.7% as of end December 2022 and 7.3% as of end December 2021.

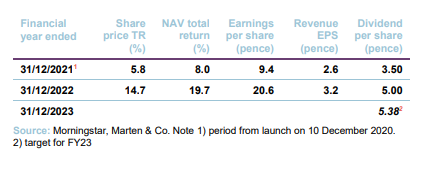

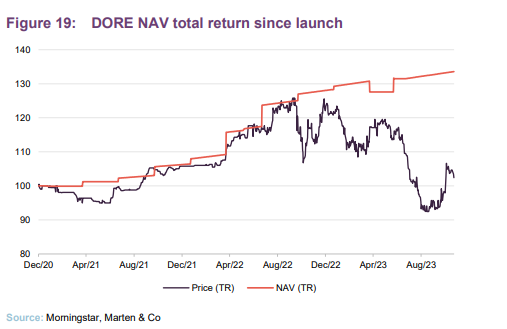

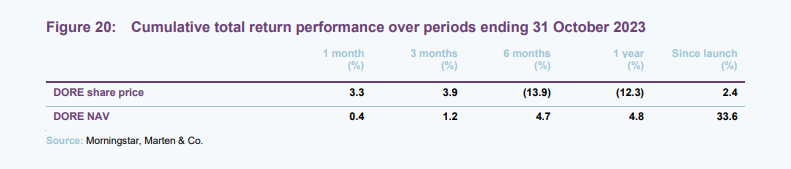

Performance

DORE has made good progress since launch, returning 33.6% by 31 October 2023 in NAV terms. However, the emergence of a discount means that in share price terms, the return is 2.4%.

Interim results to June 2023

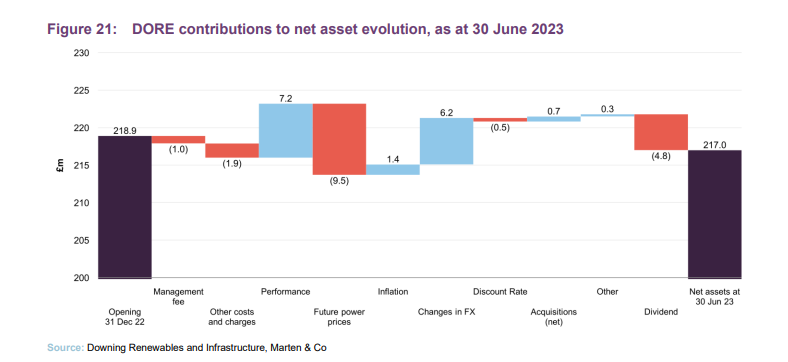

In its update for its first half, ending 30 June 2023, DORE reported a £1.9m decrease in NAV, from £218.9m to £217.0m. The team reported £7.2m gain from the portfolio’s performance, but this was outweighed by a loss of £9.5m due to downward power price revisions. Inflation outcomes were marginally higher than budgeted.

The two other factors influencing the NAV were dividend payments made over the two quarters, totalling £5m, and major tailwinds from foreign exchange movements.

The accretive acquisitions made over the reported period (note that the power grid and shunt reactors assets described on page 12 were completed after the half-year reporting period) added £0.3m to DORE’s NAV. The weighted average discount rate edged up slightly from 7.7% to 7.8%.

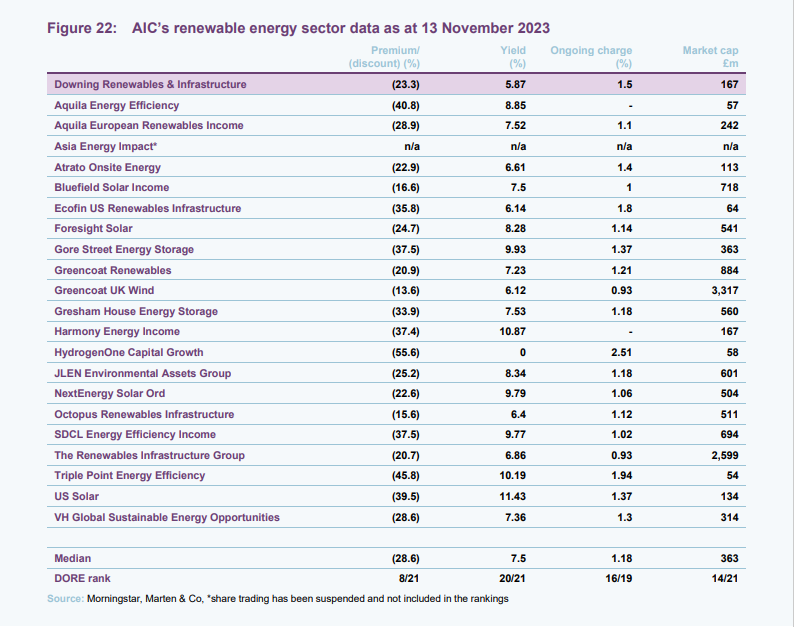

Peer group

Up to date information on DORE and its peer group is available on the QuotedData website

DORE is a constituent of the AIC’s renewable energy sector. There are now 22 members of this peer group. Three funds focus exclusively on battery storage assets. Two funds invest exclusively in US projects, which tend to have long-term PPAs. One invests in hydrogen-related assets and has more of a capital growth focus. Of the remainder, none has DORE’s current strong focus on the Nordic region or hydropower. We note that Asia Energy Impact has suspended its share trading, pending the resolution of auditing issues.

Having one of the shorter track records of its peer group, we are pleased to see the progress that DORE is making. Its discount is, we think, starting to reflect the potential for NAV growth driven by the factors that we have discussed in this note. However, there is more to go for. Its ongoing charges ratio has fallen, as a direct result of its increased size. DORE’s dividend yield, while on the low end, is also improving, thanks to the board’s commitment to a progressive pay-out.

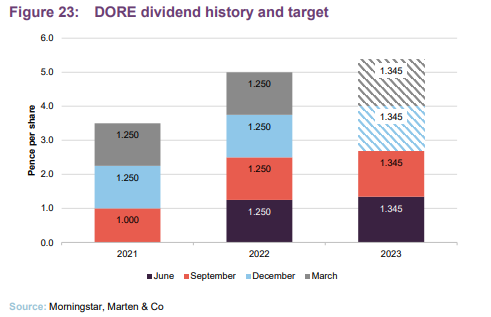

Dividend

DORE pays dividends on a quarterly basis, with dividends typically declared in respect of the quarterly periods ending March, June, September, and December and paid in June, September, December, and March respectively. DORE declared and paid dividends totalling 5.0p in respect of the accounting year ended 31 December 2022. These dividends were covered by cash generated from the portfolio 1.26x, increasing its coverage from 1.21x for 2021.

The target dividend for 2023 is 5.38p, which is a 7.6% increase on its 2022 pay-out, reflecting the progressive dividend policy that the board has adopted. The team forecasts dividend coverage in excess of 1.4x for the next three financial years. Whilst DORE’s 5.9% yield is not the highest amongst the peer group, it is attractive, and may be sufficient for income-focused investors.

DORE has a special distributable reserve, which was converted from its share premium account. It currently stands at £111m, £3m less than its 2022 financial year end value, due to its being used to finance part of DORE’s dividend.

Premium/(discount)

Over the 12 months ended 31 October 2023, DORE’s shares have traded in a range of a 29.0% discount to a 0.1% premium. The average discount over this period was 13.9%. At 12 November 2023, DORE was trading on a discount of 23.3%.

Whilst DORE’s previous bouts of trading at a discount were likely a function of its size and relative immaturity, its current discount is a reflection of an issue plaguing the wider unlisted peer groups, with few, if any, private-asset strategies trading on a premium.

At first glance, DORE’s discount seems perplexing, in our opinion, as recent markets have been so favourable to energy producers. However, thanks to the recent series of aggressive interest rises by global central banks, investors are becoming uncertain around future valuations of unlisted assets, with rising interest rates being a downward force on valuations. This has weighed on the discounts of almost every investment company. There is also a substitution effect in place, as rising interest rates have made bonds a more attractive vehicle for yield-seeking investors, reducing the relative attractiveness of high-yielding strategies, such as DORE. Thankfully, it seems that DORE’s discount has bottomed out, at least for now, which may be partly due to the release of the semi-annual report which highlighted the improving outlook for the trust vis-a-vis the considerable opportunity to enhance returns by investing in assets such as battery storage.

Prior to the widening of DORE’s discount, it was able to make a highly successful capital raise in June 2022. DORE was able to issue 47.6m new shares at a price of 111p per share, raising a gross £52.9m in the process, equal to 25.2% of its net assets at the time. The fundraise pushed DORE’s market cap through £200m, making it a sufficient size and liquidity to appear on the roster of larger investors.

The board has said that it intends to seek to limit, as far as practicable, the extent to which the market price of the ordinary shares diverges from the NAV. The board has made its first batch of repurchases in March 2023, and since then has repurchased c.2.6m shares, as of 12 November 2023.

Fees and costs

0.95% on first £500m, 0.85% above that, no performance fee

The investment manager is entitled to a management fee of 0.95% per annum of NAV up to £500m and 0.85% per annum on amounts in excess of £500m. The fee is payable quarterly in arrears. There is no performance fee.

The investment management agreement is for an initial term of five years from the date of admission and thereafter is subject to termination on not less than 12 months’ written notice by any party.

For 2022, the other major items of expenditure included £152,000 for the AIFM, £167,000 for the auditor BDO LLP, £58,000 to Link Company Matters Limited as company secretary, and £69,000 in legal fees.

DORE’s ongoing charges ratio for 2022 was 1.50%, down from 1.6% for the initial accounting period. As noted in the peer group section, this should fall as the trust grows.

Capital structure and life

DORE has 184,622,487 ordinary shares in issue, 2.6m of which are held in treasury, and therefore the total number of shares in circulation and with voting rights is 182,009,454. There are no other classes of share capital.

Continuation votes in 2025, 2031 and every five years thereafter

DORE has an unlimited life. However, the company’s articles require the directors to propose a continuation resolution (as an ordinary resolution) at a general meeting to be held in December 2025 and then again at the annual general meeting to be held in 2031 and at each fifth annual general meeting thereafter.

If a majority of shareholders vote against continuation, the directors will put forward proposals for the reconstruction or reorganisation of the company.

The company’s financial year end is 31 December, and its AGMs are likely to be held in June.

Gearing and hedging

The company seeks to adopt a prudent approach to leverage such that each asset is financed appropriately for its underlying cash flows. Total long-term structural debt will not exceed 50% of gross asset value (at the time of drawing down or acquiring the debt). Short-term debt may also be used to facilitate the acquisition of investments. Short-term debt will not exceed 10% of gross asset value (again, at the time of drawing down or acquiring the debt). We note that as of 30 June 2023, DORE had effectively drawn down its cash reserves; thus, future acquisitions will be financed from its debt facility and surplus cash generated by the portfolio.

DORE, through its subsidiary DORE Hold Co Limited, has access to a four-year £40m multicurrency (sterling and euros) revolving credit facility provided by Santander UK at a rate of 225bp over SONIA.

Thanks to the two recent acquisitions (Blåsjön and Merseyside), DORE’s drawing and commitments under its credit facility are now about £18m.

DORE also has a €43.5m seven-year facility with Skandinaviska Enskilda Banken (SEB) secured against its Swedish hydropower assets (held through DHAB – see page 8). €27.4m of this is drawn. Long-dated interest rate swaps mean that the cost of this is 2.3% until the end of 2032. Given the enhanced returns offered from the hydropower portfolio, it would clearly make sense to maximise the use of this facility.

For the solar portfolio, DORE has amortising debt with a maturity in September 2034, £68.5m from Aviva and £10.1m lent by institutional investors managed by Vantage Infrastructure.

Approximately 12% of the Aviva debt is fixed at an interest rate of 3.37%. The interest rate is fixed in real terms on the remaining balance at 0.5%. The debt service of this larger debt tranche is inflation adjusted, with indexation tracking UK RPI.

The Vantage Infrastructure managed facility has an all-in fixed rate of 1.54%.

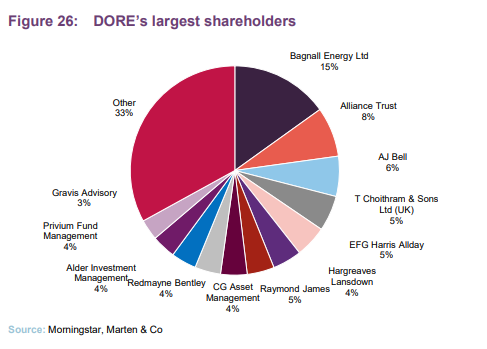

Major Shareholders

Investment adviser

Downing LLP (Downing) was founded in 1986 and has over 30 years of experience of investing in the renewables sector.

Downing has a 21-strong in-house asset management team with expertise across power markets, engineering, data analytics, finance, and commercial management.

Investment team

The investment team is responsible for originating, negotiating and executing renewable energy and infrastructure investments. It is responsible for all aspects of the capital and acquisition structure, including raising debt finance.

The key individuals responsible for executing the DORE’s investment strategy are:

Tom Williams – partner, head of energy and infrastructure

Tom heads up the team, which he joined in July 2018. He has 23 years of experience as principal and adviser across the private equity and private debt infrastructure sectors. Tom has carried out successful transactions totalling in excess of £13bn in the energy, utilities, transportation, accommodation and defence sectors.

Tom started his career working as a project finance lawyer in 1999 before moving into private equity with Macquarie Group in London and the Middle East. He holds a Postgraduate Diploma in Legal Practice from the Royal College of Law and a BA in law from Cambridge University.

Henrik Dahlström – investment director

Henrik joined as investment director in June 2020 to expand the team’s European presence and lead transactions in the Nordic regions. He spent 17 years with Macquarie Infrastructure and Real Assets (MIRA). By the time he left MIRA, Henrik was a director responsible for covering the Nordic region. This role included the origination and execution of transactions in the renewable energy and infrastructure sectors as well as holding asset management and board responsibilities.

Henrik has worked across renewable energy and infrastructure sectors as a principal for investments in the UK and in Europe. He holds a Bachelor’s degree in Business and Finance from Bond University and a Master’s degree in Finance from Gothenburg School of Economics.

Tom Moore – head of private market operations

Tom joined Downing in May 2019 and now heads a team of 21, managing over 470MWp of energy generating assets across five separate technologies. The team has expertise split across financial, technical and commercial sectors. Prior to joining the investment manager, Tom was a director at Foresight Group, where he had oversight of a significant portfolio of renewable energy investments. Tom is a Chartered Accountant and has a BSc in Economics from the University of York.

Danielle Strothers – head of asset management

Danielle joined the team in September 2019. She works alongside Tom, focusing on asset performance, business operations and compliance. Danielle is also responsible for the co-ordination of the valuation process across the energy portfolio.

Prior to joining the investment manager, Danielle was a senior portfolio manager at Foresight Group, where she was responsible for the operations of their renewable energy portfolio. She is a chartered accountant and holds a BSc in Accounting & Finance from the University of Birmingham.

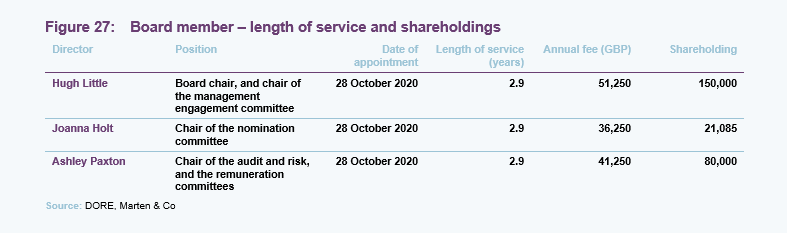

Board

The board comprises three non-executive directors, each of whom is independent of the manager and does not sit together on other boards.

Hugh Little (non-executive chair)

Hugh qualified as a chartered accountant in 1982. In 1987, he joined Aberdeen Asset Management (AAM) and from 1990 to 2006 oversaw the growth of the private equity business before moving into the corporate team as head of acquisitions.

Hugh retired from AAM in 2015. He serves as a director of Dark Matter Distillers Limited and as a governor of Robert Gordon’s College. In recent years, Hugh has also been Chair of Drum Income Plus REIT plc and CLAN Cancer Support, a local charity. Hugh won the ‘Non-Executive Director of the Year’ award at the Institute of Directors, Scotland awards ceremony held in May 2019.

Joanna Holt (non-executive director)

Joanna is a specialist in the technical and commercial elements of energy projects, with 20 years’ experience in renewable energy and flexibility investments, building on her academic engineering background. In 2015, she co-founded international consultancy company Everoze, which provides a broad range of engineering and strategic consulting services, plus incubation and development of other start-ups in this space. Prior to co-founding Everoze, Joanna led the global Project Engineering group within DNV Renewables and was a member of the DNV Renewable Advisory Board.

Joanna’s early career included management consultancy (PWC) and project finance (Fortis Bank).

Ashley Paxton (non-executive director)

Ashley has 25 years’ experience in the funds and financial services industry in London and Guernsey. Throughout that period, he has served on a large number of London listed fund boards on IPOs and other capital market transactions, audit and other corporate governance matters. Ashley was a partner with KPMG in the Channel Islands since 2002 and transitioned from audit to become its C.I. head of advisory in 2008, a position he held through to his retirement from the firm in 2019.

Ashley is a Fellow of the Institute of Chartered Accountants in England and Wales and a resident of Guernsey. Amongst other appointments, he serves on the boards of JZ Capital Partners Limited, and TwentyFour Select Monthly Income Limited and is chairman of the Youth Commission for Guernsey & Alderney, a locally-based charity delivering high-quality targeted services to children and young people to support the development of their social, physical and emotional wellbeing.

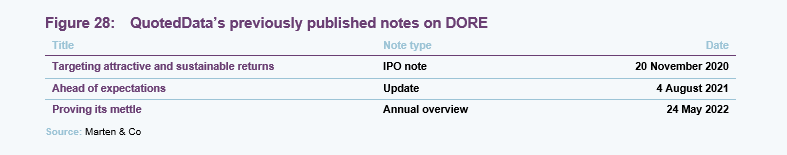

Previous publications

Readers interested in further information about DORE may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 28 or by visiting our website.

IMPORTANT INFORMATION

This marketing communication has been prepared for Downing Renewables and Infrastructure Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.