Herald Investment Trust

Investment companies | Annual overview | 11 January 2023

Efficiency savings

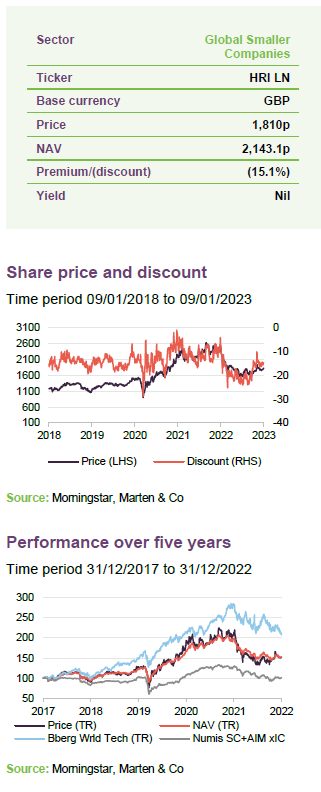

While Herald Investment Trust (HRI), like many other technology and growth-focused strategies, appears to have been caught up in the grips of 2022’s market selloff, its manager says that the fundamentals of many of the companies in its portfolio have remained largely unscathed. In fact, the management team believes that today’s market represents an opportunity, as falling prices and earnings strength push valuations to attractive levels. HRI’s team also highlights that the trust’s closed-ended structure should enable it to be able to capitalise on forced sellers as they emerge. With a view to exploiting these opportunities, HRI has a large (about 11%) position in liquid assets. Though HRI’s discount did widen substantially at the start of the year, it has narrowed since the recent US inflation figures, which raised hopes that an end to fiscal tightening might be in sight.

Small-cap technology, telecommunications and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia and technology. Investments may be made across the world, although the portfolio has a strong position in UK stocks. The business activities of investee companies will include information technology, broadcasting, printing and publishing and the supply of equipment and services to these companies.

Fund profile

More information can be found at the trust’s website: www.heralduk.com.

Established in 1994, HRI invests globally in small technology, communications and multimedia companies with the aim of achieving capital growth. It is the only listed fund of its type. The trust invests globally, but has a strong bias towards the UK, which further distinguishes it from other global technology funds, which tend to be biased towards the US.

New investments in the fund will typically have a market capitalisation of $3bn or less but are generally much smaller when the first investment is made. If successful, these can grow to be a multiple of their original valuation. This type of investing is longer-term in nature and so the trust tends to have low turnover. Reflecting the risks inherent in this type of investing, and the liquidity constraints of having a small cap investment remit, the trust maintains a highly diverse portfolio of investments (typically in excess of 250) to help mitigate this risk.

Experience is important in markets such as these.

Katie Potts has been managed HRI’s lead fund manager since launch. She was a highly-regarded technology analyst at SG Warburg (later UBS) prior to launching the fund. Katie owns a substantial stake in the company and a significant minority stake in the management company, and therefore is clearly motivated to ensure the success of the fund.

HRI’s closed-ended structure offers can be advantageous during market selloffs.

Under Katie’s stewardship, HRI has navigated several downturns and has benefitted from the team’s ability to select companies capable of weathering difficult conditions. HRI’s closed-ended structure has also been used enhance the trust’s returns. Whilst open-ended funds can be forced sellers, HRI can capitalise on its ability to gear to pick up lines of stocks at what the managers believe are attractive prices (we discuss this further on page 9).

HRI’s size, focus on smaller companies and the depth of expertise within the management team mean that it plays an important role as a provider of much-needed capital to listed technology companies looking for expansion capital. This can be particularly valuable in a downturn and may offer HRI additional opportunities to generate alpha when others are not able to.

HRI offers a liquid subcontract for any investor looking to gain access to this part of the market. Given their different focuses, an investment in HRI could be complementary to an investment in one of the large-cap technology funds.

Management arrangements

HRI owns a 15.4% stake in its management company, Herald Investment Management Limited (HIML), which was valued at £5.1m as at 31 December 2021. HIML also manages an OEIC, The Herald Worldwide Technology Fund (which has more exposure to large-cap companies than the trust) and two venture capital funds, which have ceased to make new investments.

Katie leads a team of eight analysts, three of whom have regional responsibility for overseas investments. The team is based in London, except one member who is based in New York to help support corporate access. US companies do not come to the UK as much as they used to, and HRI feels it necessary to have a US presence to enable frequent contact with companies. The HIML team can also draw on the knowledge of three consultants. We have included some biographical details on the team at the end of this note. Research responsibilities are organised along sector lines, but Katie has also delegated responsibility for managing the Asian portfolio to Fraser Elms (the deputy manager) and Hao Luo, the continental European portfolio to Taymour Ezzat and more recently the North American portfolio to Peter Jenkin.

Manager’s view

HRI’s secular trends remain largely intact despite the market downturn.

The global economy is slowing, and many markets may already be in recession. Cost of living pressures, rising interest rates and quantitative tightening present real headwinds. In the UK, this is being amplified by higher taxes, which are putting further pressure on consumers.

However, as we have discussed in our previous notes (see page 24), the manager’s investment themes tend to be long-term in nature. In the team’s view, the TMT space has attractive demand drivers that represent a source of secular growth in a world where the outlook for economic growth remains uncertain. Such opportunities include:

- Internet of things; architecture and platforms;

- Wireless charging technology;

- IT security

- 5G infrastructure

- Digital media;

- Graphene;

- ADAS – driver monitoring;

- 3D memory and 3D logic;

- NFV and SDN;

- Data replication and analysis;

- Machine learning and AI;

- Robotics;

- Adaptive security architecture;

- Mesh app and service architecture;

- User programmable software;

- Spin-torque memory (STT MRAM);

- Cloud computing advancement;

- Advanced cyber defence;

- SSD;

- Falling cost of storage;

- Big data;

- Telehealth;

- Energy storage; and

- Hydrogen fuel cells.

Note: some of these themes are explored in greater detail in our previous notes (see page 24 of this note).

Within HRI’s portfolio, some companies have experienced earnings downgrades, often supply-chain-related. However, the managers note that companies with strong IP tend to have pricing power, and they are still seeing earnings upgrades within the portfolio too. Given the higher interest rate environment, the managers believe it is helpful that few of HRI’s investee companies are utilising debt. The managers also think that this is also often true of their customer base – something which they think should, hopefully, limit the impact of rising interest rates on the viability of their business models.

Some areas exposed to a slowing economy

Semiconductors and advertising are obvious casualties of economic slowdown.

The two sectors which are amongst the most likely to be hit by an economic slowdown are, in HIML’s opinion, the semiconductor sector and the advertising sector.

Semiconductor shortages have eased and the sector has, in the managers’ view, become oversupplied. The team believe that this excess supply is in a large part due to over-eager management teams at semiconductor manufacturers but also due to a fall in demand. Consumer computer demand for semiconductors is expected to fall by about 15%, with the consumer PC market being a major source of demand for components such as graphics cards (a type of semi-conductor which is the bread-and-butter of Nvidia for example, which was previously one of the US most valuable companies prior to the market downturn). The managers also note that semiconductor demand is also being impacted by the global supply chain issues, particularly around automobile manufacturing, as the lower volume of car production has had a knock-on effect on their need for semiconductors. Thankfully, any issues in the semiconductor sector may have less of an impact on HRI than on some other technology strategies, as HIML has been underexposed to the sector.

However, HRI holds niche fabless players which are less cyclically exposed.

In part, this is a structural underexposure, given that what the managers believe are the more attractive players in the sector typically trading on market caps outside of HRI’s remit. HRI’s semiconductor exposure tends to be constrained to niche fabless players. HIML feels that innovation within the sector will more than offset slowing demand for existing business.

The managers believe that the other near-term headwind for the sector is the impact of the economic cycle of certain services, particularly on advertising revenue. They comment that, whilst much of the products and services technology provides are structural in their growth, advertising remains a cyclical business, as advertising budgets tend to be amongst the first to be cut when earnings are expected to fall. The managers also observe that there is still a structural shift towards digital advertising, given its greater reach and flexibility, and think that print advertising will likely be the first to be hit in a downturn, although digital advertising will not be immune. This is something we have already seen in the earnings announcements of Alphabet, which has reported a slowdown in the growth of Google’s advertising arm, with its reported 4.2% growth missing its forecasted 8% (though it is still growing, reflecting the structural shift towards digital advertising).

Resilient demand in structural growth subsector

Cyber security and digital transformation remain bright spots.

The team does see several bright spots, with certain subsectors still likely to see strong growth in the demand for their services, in their view. They highlight subsectors such as IT security, where demand tends to increase as systems become more complex – with greater volumes of data, programs and physical infrastructure requiring protection – and as cyber-attacks become increasingly sophisticated. Cybersecurity also saw a surge in attention with the outbreak of the war in the Ukraine, as Russian attacks on Ukrainian digital infrastructure raised the profile of state-sponsored hacking.

Whilst the pace may slow, the team also think that digital transformation will continue despite a more challenging economic environment, as digitising certain systems will almost always offer efficiency savings. With companies increasingly scrutinising their spending, the products that can provide the greatest degree of cost savings will be increasingly more attractive. One example of this is banks moving their IT systems to the cloud, which can lead to leaps in productivity as at times ailing systems are suddenly upgraded to faster, yet more cost-efficient cloud computers.

Valuations

Thanks to the combination of a market sell off, against a backdrop of sustained profit growth, the HIML team believe that they are being presented with a clear valuation opportunity.

Share prices have fallen despite robust earnings.

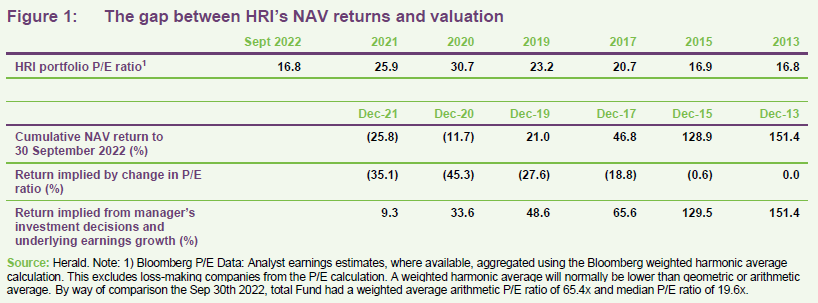

The top part of Figure 1 shows the total P/E ratio of HRI’s portfolio as at

30 September 2022 and at various (31 December) financial year ends historically. The bottom of Figure 1 shows the cumulative performance of HRI’s portfolio from those various calendar year ends to 30 September 2022; the return implied by the change in the aggregate price to earnings ratio of HRI’s portfolio over the same periods; and the implied return from the manager’s investment decision and underlying earnings growth (effectively the balancing figure).

A comparison of the rows in the bottom part of Figure 1 suggests that, in aggregate, there has been a noticeable disconnect between the share price movements of HRI’s portfolio holdings and their earnings multiples. For each of the time periods provided, the change in valuations has implied a negative or zero return, yet, until recently, the trend has been one of significantly positive NAV growth. Figure 1 shows that one would need to go back to 2013 to find a period on which HRI’s portfolio traded at a similar P/E ratio. However, it also illustrates that the last time HRI’s portfolio was valued on this P/E, the subsequent eight years and nine-month period provided NAV growth of over 150%.

The managers highlight that the P/E derating since December 2021 has been substantial and comment that, while they are relieved to have better valuations, they are also pleased to have a significant cash pile to deploy should markets get cheaper.

The managers say that an example of this disconnect is Next Fifteen Communications, the UK based technology and data consultancy firm, and HRI’s third-largest holding. They believe that Next Fifteen is a beneficiary of the move towards corporate digitisation, commenting that its advisory services include divisions like Consumer Engagement, which is direct reflection of the demand for digital services as it aids in the building of critical digital assets such as e-commerce platforms. Next Fifteen saw its earnings-per-share more than double between the December 2020 and July 2022 (its financial half year). HRI’s managers comment that despite demonstrating the ability to realise the structural growth potential, the market has seemingly downgraded Next Fifteen, ignoring the success that it has shown.

Dry powder

HRI’s has a substantial amount of ‘dry powder’ to capitalise on near-term opportunities.

While low valuations can offer attractive entry points, they are of little use without the capital to take advantage of them. Thankfully HRI is positioned for the current market, sitting on a small cash pile that HIML is looking to deploy at the most opportunistic of times (such as providing liquidity to existing holdings when needed or buying stakes from forced sellers, as noted above).

This ‘dry powder’ is both a reflection of the team’s increased defensiveness and the continuing spate of M&A activity within the portfolio, with a number of HRI’s holdings having been bought out recently, despite the market downturn. Over the first three quarters of 2022, HRI saw acquisitions totalling £118m, receiving £96m in cash – almost twice the amount that it received from M&A activity in 2021. This possibly suggests that market participants remain just as bullish on the valuation opportunities as HIML.

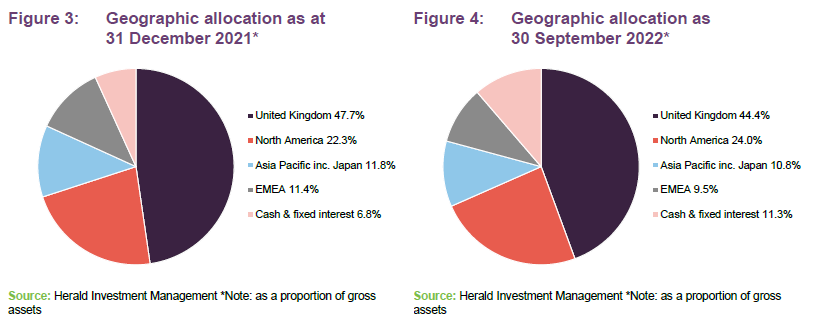

Currently HRI has liquid assets and fixed interest holdings of 11.3% of its gross assets. This is the highest level in recent memory, and a sizable amount of liquid capital that can quickly be deployed when the opportunities arise. HRI remains ungeared, though it does retain a revolving credit facility through which it can increase its gearing quickly if needed. Whilst HIML has historically been successful in its use of gearing (such as during the 2008 financial crisis) HRI has been ungeared for several years now.

A market dip isn’t just for Christmas

Throughout this note we have alluded to the possible opportunity to utilise HRI as an opportunity to capitalise on the current market downturn, ‘buying the dip’ as the term goes. This is an opportunity that has arisen thanks to the sweeping market selloff over 2022 which, thanks to a widespread fear of the impact of rising interest rates, has captured most of the tech sector. This has, in the team’s view, led to a disconnect between current share prices and their fair-value based on their long-term growth potential. Through many of our past notes (see page 24) we have outlined the long-term sectoral opportunities presented by technology companies, and whilst there have been cracks in certain sectors, specifically advertising and semiconductor manufacturing, the team believe that the vast majority of technology companies continue to benefit from the same tailwinds that supported their growth prior to 2022. The managers comment that these growth opportunities are one of the reasons for the earnings component of HRI’s P/E ratios having remained so stable over 2022.

The small-cap advantage

Extensive fundamental research

Bottom-up stock selection based on fundamental analysis. HRI’s universe is vast with over 5,000 listed companies.

HIML’s investment process is driven by bottom-up stock selection, based on extensive fundamental research of the universe of smaller companies that make up the telecommunications, multimedia, and technology sectors. HRI is arguably unique amongst all other closed-ended strategies, as it is the only one to exclusively focus on small to mid-size companies in the aforementioned sectors. This suggests that HRI might offer several advantages, such as diversification benefits and unique sources of alpha.

While HIML’s investment process is designed to capture what the team believes are most exciting opportunities within telecommunications, multimedia, and technology, it is more nuanced than simply picking the most attractive growth stories. Other important factors besides a company’s growth prospects are the team’s sensitive approach to valuations and their commitment to diversification. In the case of valuations, they are looking for companies that are capable of making decent returns on capital, or those with earnings growth which can propel them to a single-digit P/E within a reasonable period. When it comes to diversification, the team holds a range of companies, not simply based on size or style, but also on less apparent factors like end-consumer type. Diversification is also achieved through HRI’s large number of holdings (c.350), which helps to reduce the at-times-substantial idiosyncratic risk of their investments.

HRI can capitalise on the liquidity issues faced by the equivalent open-ended strategies.

We have covered the HIML team’s approach in far greater detail in our previous notes, but think that it is worth highlighting a few facets of its approach to investing, given the current market climate. One is the potential to leverage the benefits of HRI’s closed ended structure. Whilst this has in the past taken the form of the effective use of gearing (though HRI is currently ungeared), an advantage in current markets is HRI’s vastly lower liquidity requirements, relative to its open-ended peers.

By not being bound to meet the requirements of daily liquidity, HRI is free to hold the most thinly traded companies (these are often at the smaller end of the market cap spectrum). This means that in times of market downturns (such as the one we are witnessing today), HIML has the capacity to be an opportunistic buyer, swooping to pick up company shares when their values are depressed by sudden, large sales. This might help HRI to capture the benefits of ‘buying the dip’ in a far more effective way than a large cap fund could.

Another pertinent point is the team’s approach to unprofitable companies, given the increasing scrutiny company valuations are facing. The team comment that their focus on quality, skilled management, and value creation has meant that it has historically approached unprofitable companies with caution. This is not to say the manager avoids such companies, however, but the team requires clarity around an unprofitable company’s path to value-creation. The manager comments that the team’s experience makes it aware of how certain types of companies react to challenging business environments, and as such they have an insight into which of the cohort of unprofitable companies are likely to deliver on their promised growth. HRI currently has its lowest allocation to unprofitable companies for many years, a reflection of the challenging market environment that many companies are facing.

While many tech funds have well-resourced teams, the combination of HRI’s large number of holdings and their small-cap focus places a significant degree of pressure on the team at HIML, given the lack of traditional analyst coverage in the space. However, HIML does not appear to be showing signs of being under-resourced. The team comment that, despite its global remit, they have on occasion been the first professional investment team to meet its companies in person post-COVID-19, even in overseas regions. This possibly points to the team’s ability to find undiscovered gems that the wider market has yet to pick up on.

Asset Allocation

Diversification is all the more important during a market downturn.

Whilst the typical ‘growth’ manager often takes a highly concentrated approach to equity investing, Herald is set apart by its highly diversified portfolio of 352 companies. The need for diversification in small cap investing is well documented, as each company carries elevated levels of idiosyncratic risks, be it through its greater sensitivity to local economic activity or as a result of its highly specialised business practices, relative to their large-cap equivalents.

HRI’s diversified portfolio is also a result of its long tail of smaller positions. HIML will add to a position once a company begins to realise the potential that it has forecasted for them. Small cap tech companies also have the ability to generate exponential levels of share price growth, given their lack of market coverage. Once they appear on the radar of the broader investment community, investors can flock to the company in ever larger numbers. Diversification has also become another advantage of HRI in the context of the current downturn, as it reduces the impact of stock specific risks, with certain companies having been particularly hard hit by the current climate. The performance of Facebook versus the wider FAANGs is an example that may be familiar to many readers.

HRIs asset allocation has remained largely consistent since our last note, with the largest change being the increased weighting towards liquid assets, for reasons we described earlier in the note. Changes in HRI’s portfolio are predominantly the result of broader market movements, as well as the impact of M&A activity taking out a number of positions.

In our prior note, we commented that HIML had intended to reduce their allocation to the US on valuation grounds. However, given the relative strength of the region over 2022 YTD, its allocation has begun to creep up again. Dollar strength has boosted the US allocation, relative to the rest of the world. This may be unwinding now.

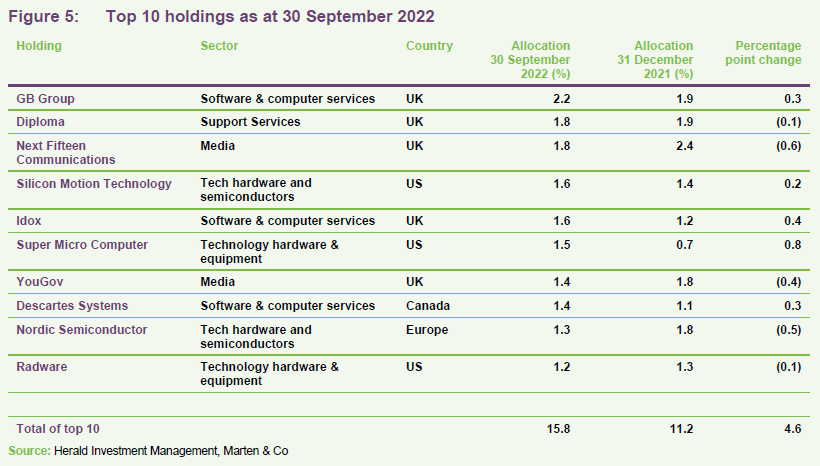

Top 10 holdings

Figure 7 shows HRI’s top 10 holdings as at 30 September 2022 and how these have changed over the previous 12 months. While the team typically takes a long-term approach to investing, with the companies that have the largest weightings often having been in the portfolio for over a decade, there has been a degree of movement in the trust’s top 10 holdings since our last note. There have been four new entries into HRI’s top 10 since our last note, a considerable increase on the one new holding we reported in our last note. We remind readers that new entrants into the top 10 are seldom new purchases by the team, as new positions typically take the form of small allocations which the team builds up over time as the company successfully realises their investment case. In the case of the current top 10, the new entrants are largely the result of their relative share price strength, with the company having its position topped up by the HIML team in light of its improving outlook.

Between the end of December 2021 and the end of September 2022, Esker,

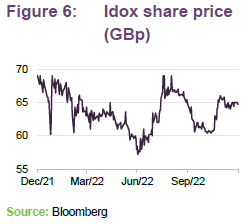

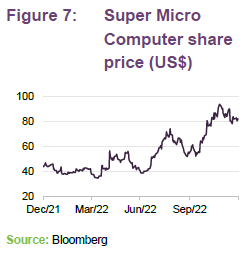

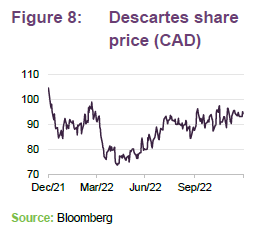

S4 Capital, Future, and Pegasystems have dropped out of HRI’s top 10 holdings, with Idox, Super Micro Computer, Descartes Systems Group, and Radware replacing then.

Idox is a UK-based software company, focusing on developing information management and solutions for the public and asset-intensive sector, with a presence across most developed countries. Its diverse range of product offerings include computer aided facilities management, transportation management, and electoral services. Idox is not a new holding for HRI (it first entered the portfolio in the early 2000), but its resilience during the recent downturn has seen it move up HRI’s rankings, having fallen only 11% year to date (less than half that of HRI over the same period). Idox’s resilience is due in part to the reliable nature of government contracts, which are often long-term, stable sources of revenue. In fact, Idox’s EPS has remained relatively stable since 2021, despite the current downturn.

Super Micro Computer is a Silicon Valley-based firm providing optimised server and storage systems for various markets, from cloud computing to 5G providers. The solutions include a raft of various types of software, such as AI and high-performance computing, data management, and hyperscale infrastructure. Super Micro Computer also provides physical products like workspace solutions and gaming products.

Having initiated a position in 2017, the team has been adding to it almost consistently since. This increased position size has been compounded by the fact that Super Micro Computer has seen a substantial rise in its share price since 2020, even over 2022. Super Micro Computer is by far the best-performing stock in HRI’s top 10, retuning 78% year to date. This re-rating has been in part a result of strong earnings the company posted, effectively doubling over 2022.

Descartes is a Canadian company providing cloud-based software-as-a-service solutions for improving the productivity, performance and security of logistics-intensive businesses. Descartes solutions is an all-encompassing ‘one-stop-shop’ for logistic services, with products ranging from consumer and security filing to invoice payments and route and schedule mapping.

Descartes first entered HRI’s portfolio in 2006 and has been steadily rising in share price since 2009, accelerating post COVID-19 given the surging demand for logistics. Descartes is effectively flat year to date, although it did report improved earnings at the start of the year. The HIML team have been taking profits in the company since 2016; however, the continuing strength of the firm has meant that it has crept up in value within the portfolio regardless.

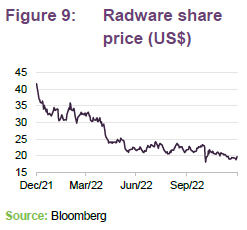

sRadware is a US-based cyber security firm. It offers its clients a range of different options for various forms of cyber-attacks, offering both network security products and application delivery. As we mentioned earlier, cyber-security has grown in importance and HRI’s manager comments that Radware being a clear beneficiary of the sectoral tailwind. The team have modestly increased their exposure to Radware based on market weakness over 2022.

Performance

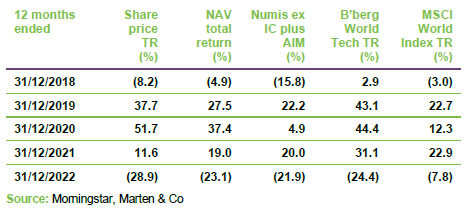

Over a five-year time period, HRI has managed to demonstrate a positive track record, generating a 52.7% NAV return. HRI has been able to generate five-year outperformance relative to both a global small cap index, with the MSCI World Small Cap returning 33.3%, and the UK small cap universe, with the Numis Small Companies plus AIM returning 1.1%. HRI’s NAV returns are also commensurate with that of the wider global equity market over the last five years.

This is interesting because, within the technology space, at least over 2020 and 2021, the best-performing companies have often been the mega-cap technology names, and these have also driven a substantial amount of the MSCI ACWI’s return over the period. This has made it even harder for HRI, with its small-mid-cap focus, to beat the performance of global equity markets over the period. Were we to use a longer, 10-year, period, HRI has in fact beaten the MSCI World by some 17% (see Figure 10).

The dominance of mega cap technology also explained the underperformance of HRI relative to the Bloomberg technology index, which reflects the wider global technology market and is dominated by the likes of Apple, Amazon and Microsoft.

https://quoteddata.com/wp-content/uploads/2023/01/10-2.png

12-month performance to 31 November 2022

HRI’s recent 12-month performance has been a reflection of the selloff in global risk assets, with HIML’s focus on small cap and technology factors, which are often considered amongst the higher risk-categories of equities, a key factor. Whilst HRI has underperformed wider global equities, it has outperformed the UK small cap sector, and marginally outperformed global technology stocks.

As we alluded to earlier in the note, HRI’s NAV performance has not, in the minds of the HIML team, been a result of stock-specific issues, but rather a wider sell-off of risk assets, with the market punishing almost all forms of equities irrespective of their long-term potential. Interest rate rises have increased the rate at which investors discount future earnings back to the present when valuing companies. This has a greater effect on growth companies who have a large proportion of their value discounted back from the future. However, current market valuations may not reflect a rational re-valuation of future growth based on higher discount rates, given that several of HRI’s holdings have only improved their long-term revenue profile yet still saw their share prices fall.

HRI’s US allocation has been its best performing.

The broad-based nature of this sell off can be seen by HRI’s regional performance breakdown, with almost every region having fallen by roughly the same amount. The outlier in this case has been HRI’s US portfolio. This comparative resilience is possibly a reflection of the healthier outlook the US economy had over 2022, with its rise in inflation being coupled with superior economic growth when compared to other economic nations. It may also be due to factors such as a stronger consumer, full employment, and energy independence.

HRI’s US exposure also benefited from the strengthening of the US dollar over the last 12 months. In addition, there have been a number of takeovers within the HRI’s US holdings as M&A activity picks up. It may be that the US is the first to emerge from the downturn. However, it is worth remembering that HRI’s regional weightings do not map onto the earnings of these companies, which are often global in nature.

What does ‘unique’ mean for performance?

HRI’s has a much lower beta to global technology than its closest peers.

We have described HRI as a ‘unique’ investment strategy in many of our notes, a moniker that is the result of it being the only investment trust to exclusively focus on global small cap technology stocks. However, while the opportunity set is different, it is reasonable to ask what the degree of overlap might be with its larger cap peers.

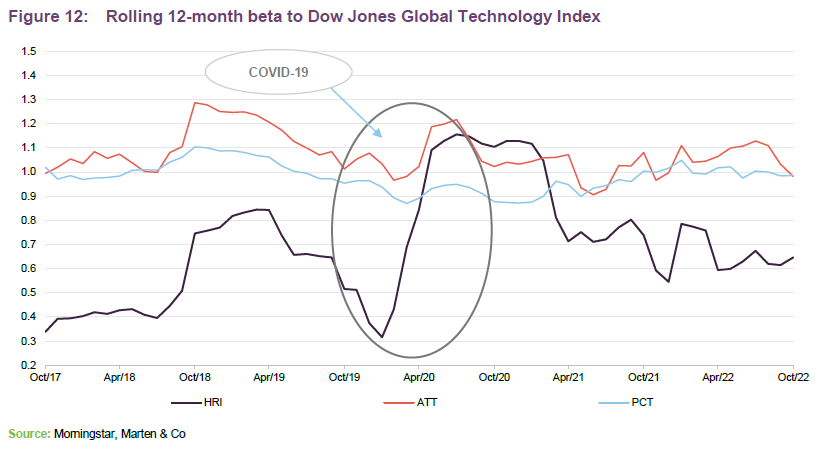

The below chart shows the rolling 12-month beta of HRI to the Dow Jones Global Technology index, an index utilised by Allianz Technology Trust (ATT) and Polar Capital Technology (PCT), the two large cap technology trusts, with said index also being viewed as a proxy for the entire global technology sector, thus having an overwhelming bias to large cap companies.

As can be seen, HRI has exhibited a far lower Beta to the index than those of ATT and PCT, bar a brief period during the COVID-19 crash. This shows that, over nearly all time periods, HRI’s performance trajectory has shown less corelation to technology than some might expect. This is something which is important in not only distinguishing HRI but also in allowing it to fit within a wider equity portfolio, as a low beta implies superior diversification benefits. This is could be useful considering that some investors may have seen their large-cap technology exposure increase over recent years given the strong momentum behind the sector.

As is clear from Figure 12, HRI offers strong diversification when compared to other London-listed technology-focused strategies.

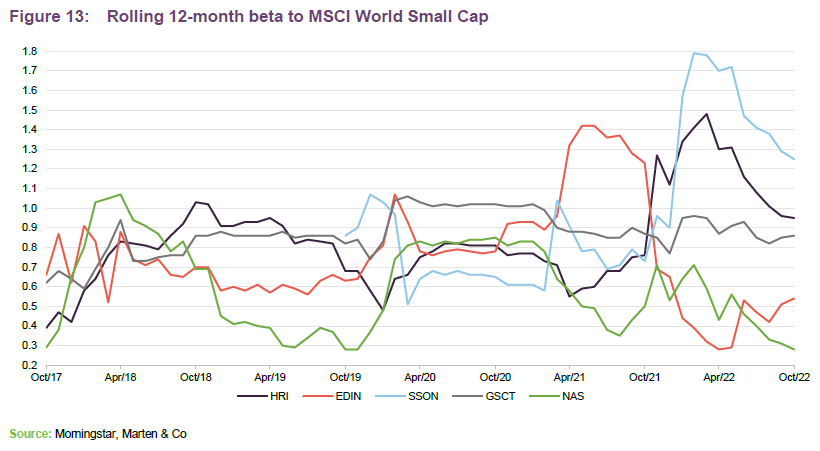

Another reasonable question is what diversification benefits does HRI offer when compared to its UK Smaller companies peer group? Figure 13, which compare the beta of HRI relative to the MSCI Global Small Cap index to those of its peers in the AIC global Smaller Company sector, provides an illustration.

While HRI offers diversification benefits (it has an average rolling 12-month beta of 0.84 over the last five years), this is less than that offered by some of its peers (for example, Edinburgh Investment Trust and North American Investment Trust). The primary cause is that HRI exhibited a greater sensitivity to the wider market during periods of market turmoil than many of its peers, as we have seen during 2022. This is likely may be due to the fact that Herald’s process focuses on companies which can epitomise the perceived advantages of small cap investing – highly disruptive, nimble strategies which can offer potentially outsized growth potential. However, for similar reasons these can be at the forefront of investors’ minds during a market sell off, be it due to their illiquidity, high valuations, or perceived likelihood of being more exposed to risk during periods where the market is risk-off.

Dividend

HRI is focused primarily on generating capital growth, and dividend income makes up only a small part of returns. The consequence of this is that HRI only declares a dividend where this is necessary to retain investment trust status, and in practice, no dividend has been declared since 2012.

HRI had revenue reserves of -£9.09m (12.6p) per share as at 30 June 2022 (December 2021: -£8.16m, or -12.6p per share). It appears unlikely that HRI will generate a positive revenue reserve for the current financial year. As such, it looks likely that there will not be any requirement for HRI to pay a dividend for the year ended 31 December 2022.

Discount

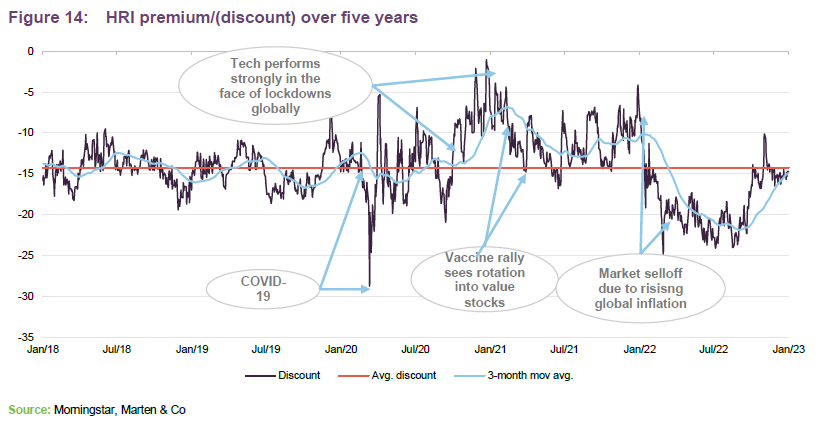

HRI’s discount has narrowed recently, back in line with its long-term average.

While HRI has traded at a discount throughout the entirety of the last five years, the size of its discount can be viewed as being a historic reflection of the strength of its style of investing – the discount has tended to narrow during periods of strong performance. This can be seen during the post-pandemic-crash period, which saw an outperformance of technology stocks, with HRI trading at its narrowest discount of the last five years at the end of 2020.

For the same reason, HRI saw its discount sharply widen during the start of 2022 as investors began to take stock of structurally higher inflation, selling out of high-growth strategies like HRI. HRI’s discount been narrowing recently. This may be due in part to investors regaining confidence in the sector, possibly viewing it as oversold, and due to inflation expectations beginning to soften. HRI currently trades on a 15.2% discount and over the past year, HRI has traded on a discount ranging between 8% and 25%, with an average discount of 18.4%.

HRI’s discount has narrowed over recent weeks, which suggests demand for HRI’s strategy. While HRI has generated positive NAV returns over the last month, we think that the narrowing of HRI’s discount is possibly a reflection of investors’ confidence in the future of HRI, rather than a reflection of short-term performance. As we have outlined throughout this note, there is a possible disconnect between the earnings performance of HRI’s investments, and their share prices. Similarly, if HRI’s own share price has been depressed by the current outlook, it too could re-rate if sentiment towards the sector improves. It seems reasonable that should the macro-economic issues that drove the risk-off environment subside, there may be further potential for HRI’s discount to narrow further, with shifts in such factors potentially key drivers of HRI’s near term discount movements.

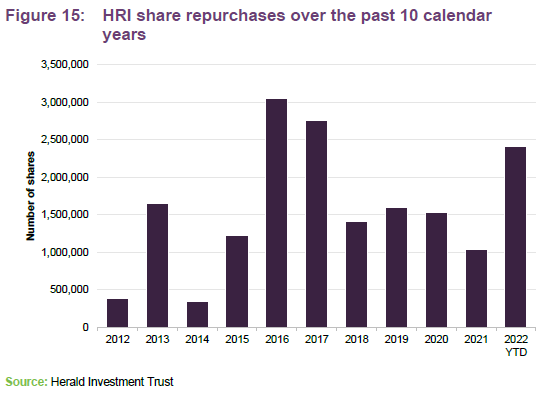

Active in repurchasing its own shares

Whilst HRI’s policy is not to attempt to control the discount, because it is not considered appropriate given the limited liquidity available within the underlying portfolio companies, the trust will repurchase shares opportunistically. Where repurchases are undertaken, the aim is to enhance the NAV per share for remaining shareholders.

Fees and costs

Tiered management fee structure with no performance fee

1% annual management fee up to assets of £1.25bn and 0.8% thereafter.

No performance fee.

HIML is entitled to an annual management fee of 1% of HRI’s net assets up to £1.25bn and 0.8% of HRI’s net assets above this level.

The NAV is calculated monthly using mid-market prices, which is somewhat unusual, as most NAVs are calculated at bid prices. However, given that many of HRI’s underlying holdings trade on wide spreads, the mid-market valuation gives a better indication of the true value of the portfolio. There is no performance fee. The management fee also covers the cost of company secretarial services, which HIML has delegated to Law Debenture Corporate Services.

In the year to the end of December 2021, HRI’s ongoing charges ratio was 1.02%, down modestly from 1.08% the year before. The asset management contract is subject to 12 months’ notice.

Capital structure and life

Simple capital structure

HRI has one class of ordinary share in issue. It can gear up to 50% of net assets.

HRI has a simple capital structure with one class of ordinary shares in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 31 December 2022, there were 62,173,223 in issue with no shares held in treasury.

The trust is permitted to borrow up to 50% of net assets and previously had a £25m multi-currency revolving loan facility with RBS that matured on 31 December 2019. The facility was undrawn prior to its maturity, as HRI has been running with net cash for some time, and so the decision was taken not to renew the facility. The facility has not yet been replaced. As at 30 November 2022, HRI had net liquidity of 11.5% of its total net assets.

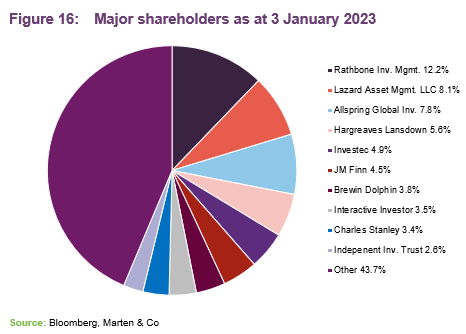

Major shareholders

Unlimited life with three-yearly continuation votes

HRI does not have a fixed life, but shareholders are offered a continuation vote every three years. The next continuation vote is scheduled for the trust’s AGM in April 2025.

Board

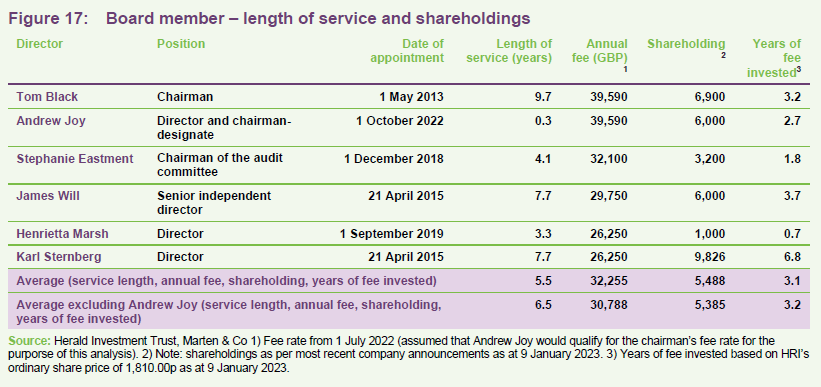

HRI’s board has undergone a modest refresh during the last couple of years and its size has expanded from four to six directors.

HRI’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. The current chairman, Tom Black, was appointed as chairman in April 2021, following the retirement of Ian Russell. Prior to this, Tom had been the senior independent director and James Will was appointed to this role.

Tom has indicated his intention to retire from HRI’s board at the conclusion of its AGM in April 2023 and Andrew Joy has been recruited with the intention that he will take over as chairman when Tom retires. In advance of this, Andrew was appointed as an independent non-executive director and chairman-designate of HRI on

1 October 2022. Tom and Andrew are working closely together to ensure an orderly transition. Short biographies of all board members are provided below. Other than HRI’s board, its directors do not have any other shared directorships.

Shareholders approved an increase in the cap on total fees for the directors from £200,000 to £250,000 at HRI’s AGM in April 2022. Figure 26 shows the current composition of the board and provides some information on members’ length of service and shareholdings in the company. It is board policy that all serving directors retire and offer themselves for re-election annually.

As illustrated in Figure 26, with the exception of Andrew Joy who is a very recent addition to the board, all of the directors have made significant personal investments in HRI’s ordinary shares (an average of 3.2 years’ worth of their fees, including Andrew Joy). This is generally considered to be favourable, as it shows significant commitment to the trust and helps to align directors’ interests with those of other shareholders.

Recent transactions by directors in HRI’s shares

There were no share disposals by HRI directors during the last 12 months. In terms of purchases, Karl Sternberg bought 1,000 ordinary shares, in July 2022, at a cost of £16.80 per share, 1000 in May 2022 at £17.27 per share, and a 1,000 share at £18.41 per share in April 2022, taking his beneficial interest to 9,826 HRI shares.

Henrietta Marsh has completed her first purchase of HRI stock, acquiring 1,000 shares at £16,45p per share in July 2022. Andrew Joy has also completed his first purchase of HRI shares, purchasing 6,000 shares at £18.80 per share.

Stephanie Eastment purchased 300 shares in May 2022, at a price of £17.42 per share. This took her beneficial interest to 3,200 shares of HRI.

Tom Black (chairman)

Tom joined HRI’s board in May 2013 and became the chairman on 20 April following the retirement of Ian Russell at the conclusion of the trust’s AGM that day. Tom was previously chief executive of Detica Group Plc, a leading company in the field of large-scale information collection and analysis for intelligence and counter fraud applications. As such, he understands HRI’s smaller companies remit, having grown an early stage technology company and listed it on the London Stock Exchange. He also has advisory roles with a number of smaller unlisted businesses. Tom is chairman of Thruvision Group Plc (formerly Digital Barriers Plc), and is a non-executive director of CloudCoCo Group Plc. He is also chairman and trustee of the Black Family Charitable Trust, which is focused on supporting disadvantaged young people with their educational needs.

Andrew Joy (non-executive director and chairman-designate)

Andrew is highly regarded for his extensive knowledge of the financial sector and of the high-growth part of the smaller company sector. He was one of the founding partners of Cinven, a leading private equity firm investing in Europe and U.S. and has been chairman or director of numerous growth companies over the past 30 years. He was previously chairman of The Biotech Growth Trust Plc, a position he has held since July 2016 and retired from in July 2022. He is also a senior advisor of Stonehage Fleming, chairman of the investment committee of FPE Capital and is a trustee of several charities.

Stephanie Eastment (chairman of the audit committee)

Stephanie Eastment is a chartered accountant and company secretary with over 30 years’ experience in the financial services industry. She has considerable experience in the investment trust sector and is a member of the AIC’s Technical Committee. Stephanie qualified with KPMG and held various accounting and compliance roles at Wardley and UBS before joining Invesco Asset Management in 1996 as Manager, Investment Trust Accounts. When she left Invesco in July 2018, she was Head of Specialist Funds Company Secretariat and Accounts. Stephanie is a non-executive director and audit chair of Murray Income Trust Plc.

James Will (senior independent director)

James joined HRI’s board in April 2015 and became the senior independent director on 20 April 2021 following Tom Black’s appointment as chairman at the conclusion of the trust’s AGM that day. James was, until 2014, chairman and a senior corporate finance partner of law firm Shepherd and Wedderburn LLP, where he also headed the law firm’s financial sector practice. During his career as a lawyer, James was involved in advising smaller quoted technology companies, for over 20 years, on a range of corporate transactions, including flotations, secondary fundraisings and mergers and acquisitions. He is chairman of both The Scottish Investment Trust Plc and Asia Dragon Trust Plc.

Henrietta Marsh (director)

Henrietta has a background in fund management, having worked in UK small cap and private equity investment over several decades. From 2005 until 2011, she was AIM fund manager at Living Bridge Equity Partners and, prior to that, she spent 14 years at 3i in several roles, including as fund manager of 3i Smaller Quoted Companies Trust Plc (1997–2002). Henrietta spent her early career with Morgan Stanley and Shell. She is currently a non-executive director of Gamma Communications Plc (AIM listed), a trustee of 3i Group Plc’s pension fund and a member of London Stock Exchange’s AIM Advisory Group.

Karl Sternberg (director)

Karl spent much of his earlier career at Morgan Grenfell (which became Deutsche Asset Management), where he rose to become chief investment officer, Europe & Asia Pacific. Subsequently, he was a founding partner of Oxford Investment Partners Limited, where he worked from 2006 until 2013, when it was acquired by Towers Watson. Karl is a non-executive director of Clipstone Logistics REIT Plc, Monks Investment Trust Plc, Lowland Investment Company Plc, Alliance Trust Plc, JP Morgan Elect Plc, Island House Investment LLP and Jupiter Fund Management Plc.

Management team

Katie Potts

Katie is the managing director and also the lead fund manager for HIML. She established HIML in December 1993 to manage HRI, which was launched in February 1994. Katie read Engineering Science on a GKN Group scholarship at Lady Margaret Hall, University of Oxford. She worked for five years in investment management at Baring Investment Management Limited, before joining S.G. Warburg Securities’s UK electronics research team in 1988. The team was consistently voted top team in the Extel survey of analysts in the sector, and she was voted top analyst by finance directors of electronics companies canvassed by The Treasurer magazine. In addition, Katie had responsibility within S.G. Warburg’s UK research department for commenting on accounting issues.

Katie is supported in managing the funds by a team of eight other investment professionals and three consultants.

Fraser Elms

lead responsibility for managing HIML’s Asian portfolios. Prior to joining HIML, Fraser was a technology analyst with Dresdner Kleinwort Benson, where he covered the European technology sector. Before this he worked at Prudential for three years as member of a team of three UK unit trust fund managers that managed £5bn in equities, with Fraser having lead responsibility for three funds collectively worth £400m. He graduated from Lancaster University with a degree in Economics and initially joined Prudential as a product manager for their unit trusts, before completing an MSc in Investment Analysis at the University of Stirling and re-joining Prudential in an investment role. Fraser covers the semiconductor sector.

Taymour Ezzat

Taymour joined HIML in November 2004. He is a portfolio manager on the venture funds, sitting on the venture committee and taking lead responsibility for a number of the investments in the venture portfolios. He also has analytical responsibility for the media sector across all HIML’s quoted and unquoted portfolios, as well as responsibility for the European portfolio. Previously he spent a year appraising a number of venture capital opportunities for E.D. Capital Partners. Prior to that, Taymour spent six years at Northcliffe Newspapers, the regional newspapers division of Daily Mail and General Trust (DMGT), latterly as finance director of its electronics publishing arm. Prior to this, he worked for Reuters in London and Eastern Europe for four years. Taymour qualified as an accountant with Price Waterhouse, and studied Economic History at the London School of Economics and Political Science.

Hao Luo

Hao joined HIML in 2004 and works with Fraser Elms on managing the Far East portfolios. He also has analytical responsibility for the manufacturing sector globally. Hao obtained a BA in Economics from Hunan University in China and a Masters degree in Finance from Manchester University, and worked for J&A Securities in Shanghai from 2000-2002. He is a CFA charterholder.

Peter Jenkin

Peter joined HIML as an analyst in 2015. He covers the software sector and contributes to the overall investment selection. Previously, Peter worked jointly on the European portfolio, but now has responsibility for HRI’s North American portfolio. Before joining HIML, he studied Construction Engineering Management at Loughborough University.

Bob Johnston

Bob was recruited in 2016 to establish a US office for HIML. He has more than 20 years’ experience in the technology sector on the sell-side, and he has worked with the HIML team for roughly 15 years. Most recently, Bob was with the technology specialist Pacific Crest. He previously also worked for Hambrecht & Quist and SoundView Technology Group. Bob has taken responsibility for telecommunications, networking and security analysis.

Danny Malach

Danny joined HIML in June 2016 and, since April 2017, has acted as the funds dealer. He obtained a First Class Honours in his undergraduate degree in Accounting at Northumbria University, and subsequently achieved a Merit in his MSc in International Economics and Finance.

Fati Naraghi

Fati joined HIML towards the end of 2019 to focus on the Herald Worldwide Technology Fund and to cover some of the larger technology companies. Prior to joining HIML, she spent 20 years at Newton Investment Management where she was responsible for the global tech sector. Fati has a Ph.D. in Communications Systems and is qualified as an AWS Cloud Practitioner.

Previous publications

Readers interested in further information about HRI may wish to read our previous notes (details are provided in Figure 18 below). You can read the notes by clicking on them in Figure 18 or by visiting our website.

Figure 18: QuotedData’s previously published notes on HRI

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Herald Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.