The future is bright

Whilst Herald Investment Trust’s (HRI’s) results for the year ended 31 December 2021 will not be published for some time, it looks as though it had another impressive year, with particularly strong performances from its semiconductor and UK media holdings (see pages 15 to 23 for a detailed look at HRI’s performance during 2021).

Rising inflation and the potential for interest rises has taken some of the steam out of growth stocks recently, but HRI’s longstanding manager, Katie Potts, believes there’s more to go for. She feels that the sector’s growth will provide a considerable defence against the effects of higher inflation, and remains enthused about the prospects for the stocks in HRI’s portfolio and their ability to have pricing power in an inflationary environment. HRI’s share price discount to net asset value (NAV) has widened recently, but we think this could narrow, potentially making this a good entry point.

Small-cap technology, telecommunications and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia and technology. Investments may be made across the world, although the portfolio has a strong position in UK stocks. The business activities of investee companies will include information technology, broadcasting, printing and publishing and the supply of equipment and services to these companies.

Fund profile

Established in 1994, HRI invests globally in small technology, communications and multimedia companies with the aim of achieving capital growth. It is the only listed fund of its type. The trust invests globally, but has a strong bias towards the UK, which sets it apart from other global technology funds, which tend to be biased towards the US.

New investments in the fund will typically have a market capitalisation of $3bn or less, but are generally much smaller when the first investment is made. If successful, these can grow to be a multiple of their original valuation. This type of investing is longer-term in nature and so the trust’s portfolio tends to have low turnover. Reflecting the risks inherent in this type of investing, and the liquidity constraints of having a small cap investment remit, the trust maintains a highly diverse portfolio of investments (typically in excess of 250) to help mitigate this risk.

Katie Potts has been HRI’s lead fund manager since launch. She was a highly-regarded technology analyst at SG Warburg (later UBS) prior to launching the fund. Katie owns a substantial stake in the company and a significant minority stake in the management company, and therefore is clearly motivated to ensure the success of the fund.

HRI’s size, focus on smaller companies and the depth of expertise within the management team mean that it plays an important role as a provider of much-needed capital to listed technology companies looking for expansion capital.

HRI offers a liquid means for investors to gain access to this part of the market. An investment in HRI might also complement an investment in one of the large-cap technology funds.

Management arrangements

HRI owns a 15.4% stake in its management company, Herald Investment Management Limited (HIML), which was valued at £4.8m as at 31 December 2020. HIML also manages an open-ended investment company (OEIC), The Herald Worldwide Technology Fund – which has more exposure to large-cap companies than the trust – and two venture capital funds, which have ceased to make new investments.

Katie leads a team of eight analysts, three of whom have regional responsibility for overseas investments. The team is based in London, except one member who is based in New York to help support corporate access. US companies do not come to the UK as much as they used to, and HRI feels it necessary to have a US presence to enable frequent contact with companies. The HIML team can also draw on the knowledge of three consultants. We have included some biographical details on the team at the end of this note. Research responsibilities are organised along sector lines, but Katie has also delegated responsibility for managing the Asian portfolio to Fraser Elms (the deputy manager) and Hao Luo, the continental European portfolio to Taymour Ezzat, and more recently, the North American portfolio to Peter Jenkin.

Market valuations

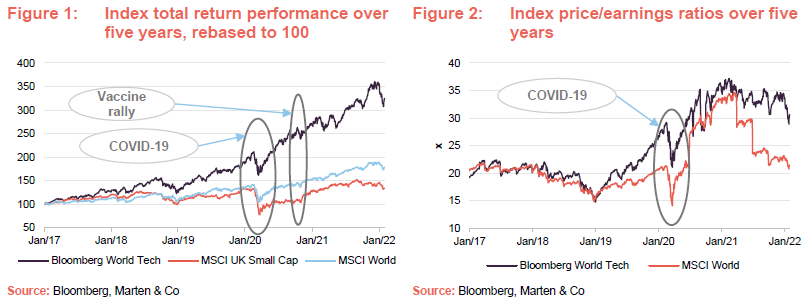

Figure 1 provides a useful illustration as to why investors may wish to consider having an allocation to the technology sector. The global technology sector – as represented by the Bloomberg World Technology Index, which is dominated by companies with large market capitalisations – has provided marked outperformance of global equities – as measured by the MSCI World Index – (all in sterling terms) during the last five years. However, looking at Figure 1, it is clear that this trend was present prior to the onset of the pandemic and that there was a marked acceleration of this trend following the market collapse in March 2020. Figure 1 also illustrates that technology stocks initially suffered as positive news on vaccine development came through in November 2020, and experienced more violent swings as sentiment seesawed during 2021, but overall growth has outstripped that of both UK small-cap stocks and global equities more generally.

As we have discussed in previous notes, one effect of the pandemic is that it appears to have turned the tide on the global economic cycle, moving us from late-cycle to early-cycle in around six months. However, governments and monetary authorities pumped considerable stimulus and liquidity into markets and economies to shore up the system, and there are signs that this may be leading to inflation. As we discuss in the manager’s view section below, rising inflation will likely lead to interest rate rises to try and keep this in check, which would generally be negative for equities and particularly growth stocks.

Many technology stocks were beneficiaries of pandemic-related lockdowns, and whilst many behavioural changes are now entrenched, there will inevitably be some unwinding of these benefits as restrictions ease and economies continue to re-open.

It is worth noting that technology companies have tended to be less reliant on debt finance (often low or negative earnings when such companies are in a growth phase makes it hard to secure debt) and so will be better positioned than many more indebted sectors in the event that interests rates do move up. Technology should also benefit as many governments’ recovery plans include initiatives to build back greener, smarter and better-connected economies.

Figure 2 illustrates that while there has been considerable valuation multiple expansion in both global stocks and technology stocks, these are now some way off their highs. Nonetheless, HRI’s manager thinks that, for many technology stocks, the demand and growth outlooks are strong and that many companies will be able to grow into their current valuations and that their growth will provide a considerable defence against the effects of inflation.

Manager’s view

As we have discussed in our previous notes, the manager’s investment themes tend to be long-term in nature. In the team’s view, the technology, media and telecommunications (TMT) space has attractive demand drivers that represent a source of secular growth in a world where the outlook for economic growth remains uncertain. For many of the subsectors in which HRI invests, this theme has been illustrated by the market’s reaction in the face of COVID-19. Where investors have become concerned about the negative effects of the virus on economies, they have quickly sought the safety of growth stocks and technology stocks in particular.

Technology offers sustainable super-normal margins

HRI’s manager believes that the sector has an unusual ability to earn super-normal margins that can be sustained (for example, software and semiconductors); business models that are scalable with high levels of recurring or predictable earnings; businesses that offer the opportunity for profit margin improvement, particularly in developing companies; a strong tendency towards entrepreneurial management; and strong cash flow generation. The manager sees a broad opportunity across the technology space and continues to highlight the following themes:

- Internet of things; architecture and platforms;

- Wireless charging technology;

- Digital media;

- Graphene (an allotrope of carbon that is the thinnest material known to mankind and incredibly strong – around 200x stronger than steel);

- ADAS (advance driver assistance systems) – driver monitoring;

- 3D memory and 3D logic;

- Network function virtualisation (NFV) and software defined network (SDN);

- Data replication and analysis;

- Machine learning and artificial intelligence (AI);

- Robotics;

- Adaptive security architecture;

- Mesh app and service architecture;

- User programmable software;

- Spin-torque memory (STT MRAM);

- Cloud computing advancement;

- Advanced cyber defence;

- Solid state drives (SSD);

- Falling cost of storage;

- Big data;

- Telehealth;

- Energy storage; and

- Hydrogen fuel cells.

Note: some of these themes are explored in greater detail in our previous notes (see page 32 of this note).

Long-term growth above the wider economy; sector more defensive than market appreciates

Despite the disruption from COVID over the last couple of years, the manager continues to be confident that the technology sector can provide growth over and above that available in the wider economy, and it is perhaps more defensive than the market appreciates. In particular, the recurring revenues associated with IT infrastructure and applications – used by corporations, consumers and governments alike – are effectively non-discretionary spending.

Valuations and inflation

The manager observes that valuations are now at more comfortable levels than they have been previously and this is perhaps not so surprising. Katie had previously felt that the prevailing high valuations reflected a shortage of growth opportunities in a world shackled by COVID and commented that we would likely see a normalisation of valuations as economies started to re-open.

Nonetheless, uncertainties remain, and key amongst these are the inflationary effects of the exceptional stimulus pumped into the global economies by governments trying to stave off the worst effects of the pandemic, and the rise in interest rates that seems likely to follow. The effect of rising interest rates can be greater on growth companies and this is the main reason that growth equities have underperformed during the last couple of months.

For most equities, rising interest rates are considered to be negative (the obvious exceptions being banks and insurance companies who can benefit from greater cash flows) and the negative impact tends to be greater for indebted stocks and growth stocks that tend to be longer in duration. To clarify, many companies are valued on a discounted cashflow basis and a higher discount rate means a lower estimated value for all. However, for companies whose cash flows are front-end-weighted, there is less impact than on those whose cashflows are weighted to the distant future, which tends to be the case for growth companies.

HRI’s manager has been cognisant of this risk for some time. Because of the constraints of smaller companies’ liquidity, and valuation levels that are still potentially vulnerable to rising interest rates, the manager continues to maintain higher-than-normal cash levels to ensure that it can exploit buying opportunities when they occur. However, as we have previously discussed, such opportunities do not necessarily arise during times of market distress. Nevertheless, HRI’s cash reserves can also be used to support investee companies where necessary.

Semiconductor shortages

Global semiconductor sales fell in both 2018 and 2019 but this decline turned around sharply in 2020 and this continued into 2021 with the market facing a severe shortage that has been well publicised. The onset of the pandemic, and the associated boom in home working, led to an uplift in demand to provide the necessary kit with which to achieve this. Accompanying this, there was a marked uplift in demand for consumer electronics as people looked at ways in which to improve their home environments and fill their time. At the same time, COVID-related restrictions negatively affected supply and the market tightened significantly. However, consumer electronics and IT infrastructure have not been the only problem areas. Auto industry demand for chips has increased as it adopts driver assistance and automation technologies, and supply has struggled to respond.

High barriers to entry to semiconductor manufacturing has led to the industry being heavily dependent on TSMC (Taiwan Semiconductor Manufacturing Company Limited) and Samsung, both located in east Asia, which account for around 70% of global supply between them. Output has been increased, but the big players have not been able to fill the gap, resulting in a severe shortage of semiconductors. Inevitably, there have been winners and losers within the tech space. HRI’s manager comments that while some of their holdings have been negatively impacted by the shortage, other companies have benefitted from greater pricing power than they would ordinarily have, and in some instances, have order books that are the biggest they have ever been.

HRI’s manager says that the lead times for those at the leading edge of the technology are now very long – for example a lead time of 25 to 52 weeks is now a common occurrence. Katie says that these lead times have been very tricky for some, but for those that have built up inventory or didn’t curtail investment they are in a strong position.

Investment process

Extensive fundamental research

HIML’s investment process is driven by bottom-up stock selection, based on extensive fundamental research of the universe of smaller companies that make up the telecommunications, multimedia, and technology sectors. The listed universe within this space includes more than 5,000 quoted companies, but in their respective markets, these companies also compete against many more unquoted companies and the HIML team believes it important to get to know as many of these as possible. This is not just because unquoted companies may eventually list, but because the information gleaned by the HIML team from competitors, customers and suppliers can be a useful source of ideas, valuable in evaluating how sustainable a company’s competitive position is and assessing the risks within a business, as well as providing a useful means of cross-referencing the information provided by another company’s management.

Idea-generation

In terms of idea-generation, HIML benefits from being a major player in the UK and companies will routinely make the effort to present to the team. The US is a very important market, however, and as small-cap US technology companies are visiting London less frequently, HIML established a satellite office in New York. In addition, the HIML team also travels extensively to meet companies in their offices or at conferences around the world, albeit during the pandemic the team undertook over 1,200 video calls for one-on-one meetings with investee and potential investee management teams.

Searching for companies with sustainable advantages

The members of HIML’s team remain sensitive to valuation. Rather than just looking to identify companies with the capacity to grow, they are looking for companies that are capable of making decent returns on capital, or those with earnings growth which will propel them to a single-digit price-earnings ratio (P/E ratio) within a reasonable period of time. This requires an analysis of a company’s products, markets and competitive position. In this regard, the HIML team is looking for companies where it can see clear markets for its products and where it has advantages over the competition that mean it is more likely to succeed. These come in a range of forms, but could include superior technology, network effects or barriers to entry such as specific intellectual property, patents and the like.

When assessing potential investments, establishing the quality of the management team is a key part of the process, which is why the HIML team make a lot of efforts to meet and interact with management teams. HRI’s manager is keen to establish whether the underlying managers will be good stewards of shareholder capital, if they have the ability to deliver growth, and if they can take advantage of the growth opportunities that appear in their market. The HIML team say that, in normal conditions, having the right management in place is crucial. However, the value of having a good management team in place becomes self-evident during a crisis, and this is where a lot of value could be lost, or opportunities missed.

Reflecting the benefits that can be accrued from making early-stage investments in technology companies, loss-making companies are considered for the portfolio. However, the team needs to be able to see both a significant market opportunity and a clear path to profitability. The team tends to be wary of companies that are trading on large multiples of sales, and prefers not to own stocks trading on what it describes as ‘concept valuations’.

HIML says that it does not attempt to model companies’ cash flows in any great detail and that, for the types of companies in which it is investing, there is usually far too much uncertainty to make this a useful exercise. However, it does spend considerable time analysing companies’ accounts to gain an understanding of how a business works and the robustness or otherwise of its earnings.

The importance of diversification

The nature of smaller technology, multimedia and telecommunications (TMT) companies is that they are often dependent on a single product or service and, whilst success can propel share prices many times higher, failure can mean bankruptcy. New technologies can create value very quickly but they can also severely disrupt existing business models and product life-cycles can be quite short. The high degree of stock-specific risk that this entails is countered by having a high degree of diversification within the portfolio.

Liquidity considerations and profitability play a part. These small-cap positions tend to be less liquid and, from a risk management perspective, this inherently places a limit on the size of each position, as larger positions are harder to buy and sell and are more likely to move the market. Furthermore, stocks that are held in large size by other investors can make HIML nervous, in case these shareholders ever become forced sellers.

In general, HRI holds less than 5% of the share capital of the companies in its portfolio, if they are loss-making businesses. This gives the manager room to support a company if it needs to undertake a fundraising. The manager also aims not to own more than 10% of the issued capital of its holdings, even if they are profitable businesses.

Reflecting this, the handful of companies where HRI holds a larger percentage of ownership are often those that needed to raise cash, but found insufficient large investors willing or able to invest other than HRI (Katie has said previously that you can damage your own property by failing to support a fundraise) or are positions that were close to HIML’s 10% limit, that repurchased stock, thereby pushing the holding over this threshold.

At the end of December 2021, HRI had over 350 holdings. The HIML team is conscious that, in some investors’ eyes, this is a large number of companies to follow, but it counters that the small companies in which it is investing have far simpler business models than most large-cap companies, and that this makes them much easier to follow in detail. Cross-referencing between suppliers, customers and competitors is an important part of the investment process.

An alternative strategy could be to move up the market-cap scale to find greater liquidity, which would allow the team to increase the average position size and, in the manager’s view, necessitate a migration to a much heavier US weighting. However, the team believes that it is crucial that HRI maintains exposure to micro caps. Katie says that this is where HRI’s best returns have originated, with many stocks rising by more than 10 times. Katie also believes that smaller-cap stocks are generally better value as these companies are not well covered by analysts.

MiFID II regulations restricting who can access research have contributed to a reduction in the amount and quality of research available.

Portfolio construction

HIML’s investment process is driven entirely by stock selection and without reference to any benchmark index. The portfolio has long had a bias to the UK. This reflects Katie’s belief that the UK technology sector is more vibrant than Europe’s; UK stocks are, generally, more reasonably valued than US ones; and Asian stocks have historically had inferior business models, often only competing on price, but it is evident that they are moving up the value chain and gaining pricing power, and therefore can generate profits for outside shareholders.

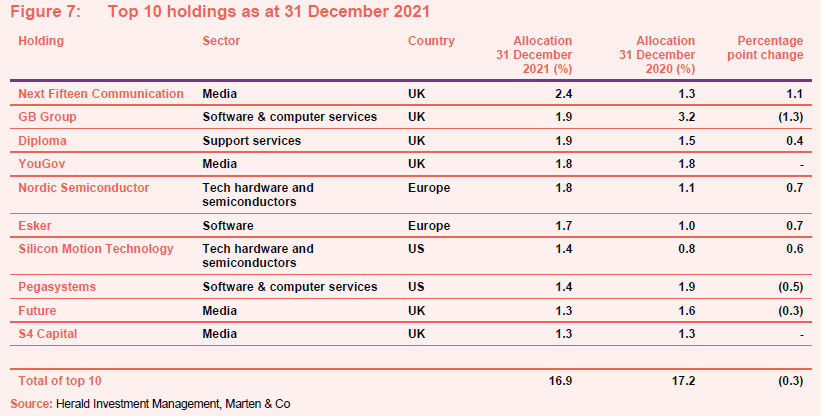

Long-term winners tend to form the core of the portfolio (the top 10 holdings were 16.9% of the fund at the end of December 2021). HRI’s larger positions usually started as much smaller positions and then grew as they outperformed their brethren.

HRI has some minor exposure to unquoted companies, including its stake in HIML. This is not an area that the trust is focused on, and no more unquoted investments are currently planned. The HIML team believes that it is useful that HRI retains the flexibility to hold unquoted investments, however, as this gives it the opportunity to retain attractive companies that choose to delist.

Sell discipline

Stocks are sold when valuations no longer reflect the growth prospects of the company, their margins start to normalise relative to the wider market (an indication that the company’s intellectual property is no longer capable of supporting superior returns) or when there is a clear deterioration in the business model. Companies that have grown larger are typically top-sliced to fund new investments and provide further capital to the earlier-stage smaller companies.

Asset Allocation

As we have discussed previously, HRI tends to hold positions for the long term, with the manager topping and tailing positions along the way where it feels these have run ahead of themselves or represent good value. Portfolio turnover is typically in the region of 15% per annum, suggesting an average holding period of around six to seven years, but much of the sales activity occurs through mergers and acquisitions (M&A), while positions are frequently added to when companies are fundraising. The average holding period for the top 20 holdings is 13.6 years. Open market buying and selling also takes place, but liquidity is lower in small caps and so opportunities to do this may at times be limited.

HRI’s portfolio does have a long tail of smaller positions. However, successful companies tend to become larger positions as they grow. This is both due to valuation increases and because HIML will add to a position as the company delivers and the team gains confidence in the company and gets to know its management team. Over the course of 2021, the number of holdings increased from 324 to 356.

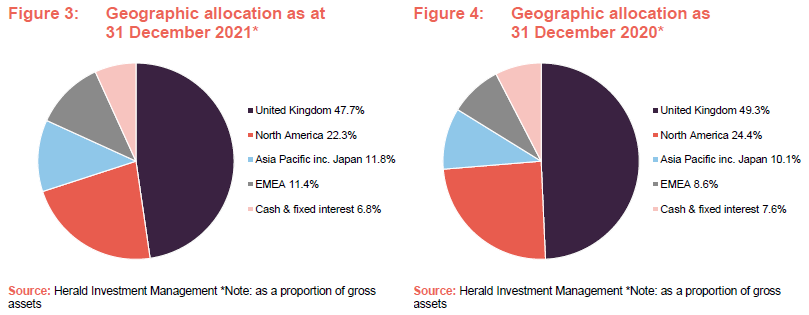

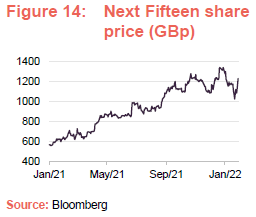

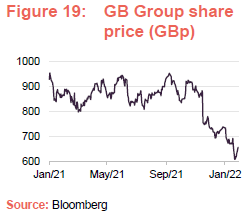

As illustrated by comparing figures 3 and 4, the changes to HRI’s asset allocation over the course of 2021 have been relatively modest. The trend of taking money out of the UK has continued (the allocation to the UK has falling by 1.6 percentage points over the course of 2021), although the manager had hoped to be able to reduce this a little further. The strong performance of HRI’s larger media holdings in the UK (Next Fifteen Communications, a UK media holding and a long-time top 10 HRI holding, was the strongest performer last year – see page 19), coupled with the need to support some of their existing holdings (for example the GB Group fundraise – see page 21) have partially offset the manager’s efforts in this regard.

In addition to taking money out of the UK, the manager had also been working to reduce HRI’s allocation to the US on valuation grounds (it felt that this market looked particularly expensive) and the allocation has reduced by 2.1 percentage points over the course of 2021. The manager sold out of a number of holdings including Manhattan Associates and Materialise, and saw stocks such as Cloudera and SharpSpring exit to takeovers. Profits were also taken on HRI’s positions in Five9, Digital Turbine and Ballard Power Systems. However, the manager decided to stick with a number of US holdings where it knows the management team well and believes in the long-term outlook for the business.

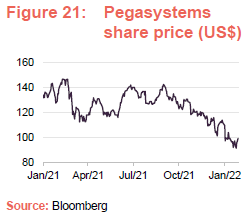

With the benefit of hindsight, the manager would like to have reduced the US allocation further as a number of HRI’s larger US holdings (for example, LivePerson, Five9, Pegasystems and Bandwidth), which had previously performed very strongly, gave back some of this outperformance in 2021 (many of these companies supported the shift to the new normal in the face of the pandemic and have subsequently underperformed as the threat of the most severe economically strangling effects of the virus have receded).

The manager has continued to reallocate into EMEA (Europe, Middle East and Africa) and Asia and the allocations to these areas have increased by 2.8 percentage points and 1.7 percentage points respectively. The allocation to cash has also decreased marginally (a fall of 0.8 percentage points).

Top 10 holdings

Figure 7 shows HRI’s top 10 holdings as at 31 December 2021 and how these have changed over the previous 12 months. Reflecting the manager’s long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular readers of our notes on HRI. Changes in the composition of the top 10 tend to reflect the relative performance of HRI’s large holdings.

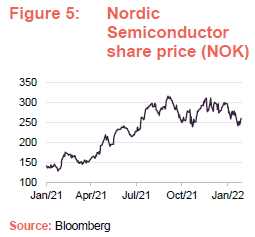

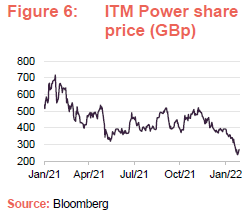

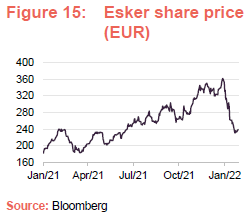

Between the end of December 2020 and the end of December 2021, ITM power, Five9, Liveperson have dropped out of HRI’s top 10 holdings, with Nordic Semiconductor, Esker and Silicon Motion Technology moving up in their stead.

Nordic Semiconductor and Esker are the top two performing European stocks over the period of 2021 to 23 December 2021. Their performances are discussed in greater detail in the performance section on page 19 but, to summarise, Nordic Semiconductor has benefitted from a severe shortage of supply in its end market, while Esker (AI-driven process automation software that improves its clients’ cashflow cycles) has recovered strongly during 2021. This is partly because orders were delayed during 2020, but also because the company has been providing a robust operational performance.

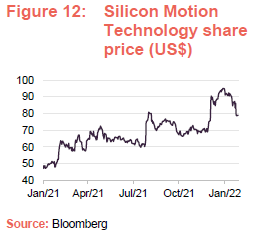

Silicon Motion Technology was the strongest performing stock from HRI’s portfolio over the period of 2021 to 23 December 2021. It is discussed in greater detail in the performance section on page 20 but, to summarise, like Nordic Semiconductor, it has benefitted from a severe shortage of supply.

ITM Power, which manufactures integrated hydrogen energy equipment, was a major contributor to performance in 2020 as interest in the space grew. The manager took significant profits in both 2020 and 2021. However, the share price has retrenched as the initial enthusiasm has subsided. Over the course of 2021, the company was as a significant detractor, which is discussed in the performance section on page 22.

As discussed in both our April 2020 and November 2020 notes (see pages 10 and 14 of those notes respectively), Five9 provides cloud-based software for contact/call centres. It has a purpose-built virtual contact centre (VCC) cloud platform that is both secure and highly scalable, allowing its stock to perform very strongly during 2020 as investors recognised the attractions of the business model during the pandemic. However, while it continues to trade significantly above its pre-pandemic levels, Five9’s share price has retrenched during the second half of 2021 as vaccine rollouts took effect and threat of the worst effects of lockdowns has receded.

Liveperson, which develops conversational commerce and AI software and is discussed as a significant detractor in the performance section on page 22, performed strongly during 2020 as it benefitted from increased demand due to COVID, but this has corrected as the threat has receded.

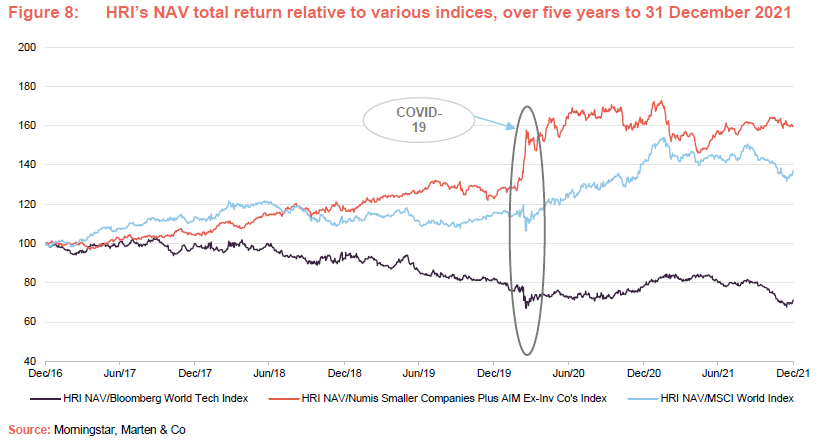

Performance

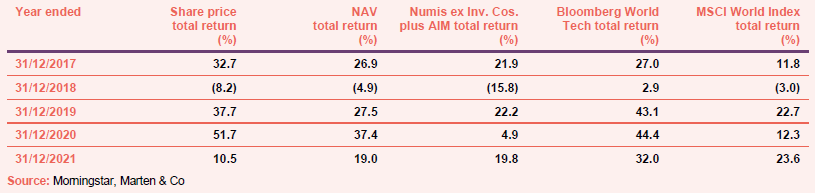

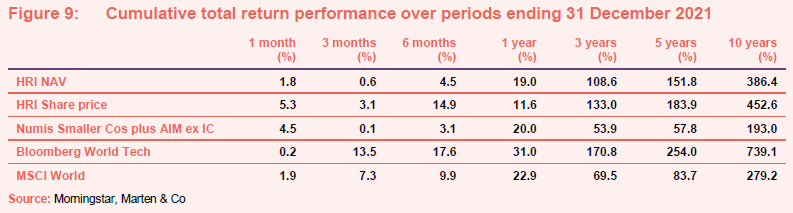

As illustrated in Figure 8 below, HRI has outperformed the Numis Smaller Companies Plus AIM Index and global equities more generally (as represented by the MSCI World) over the last five years, although it has underperformed the large cap dominated Bloomberg World Tech Index during the period. As illustrated in Figure 9, these relative performances also reflect the HRI’s longer-term relative performance over the 10-year period.

As we have previously discussed, HRI recovered strongly following the COVID-related market rout of March 2020, as investors turned their attention firmly towards stocks that offered the prospect of growth in an otherwise low growth world. As illustrated In Figure 8, HRI also outperformed the Bloomberg Tech Index for around a year following the market collapse, although this has started to recede from the end of March 2021 as vaccine roll-outs have taken effect and investors’ focus has looked more towards value opportunities.

The performance of the technology sector has been driven by a small number of mega-cap tech companies in recent years, including Microsoft, Alphabet (Google), and Apple. These are outside HRI’s remit, but nonetheless severely distort the main technology indices. HRI’s manager says that, excluding these few companies, the returns from the sector have been less robust and that returns at the small cap end, and software in particular, have lagged.

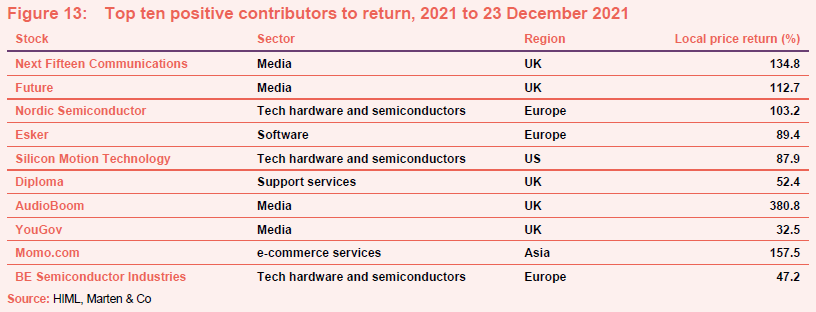

Performance during 2021 to 23 December 2021

While HRI’s results for the accounting year ended 31 December 2021 will not be published for a while yet, its unaudited NAV for the year end has been released and HIML has kindly supplied us with some performance data for HRI’s investments by geography, sector and key contributors for the period from 31 December 2020 to

23 December 2021. Combined, these should give us a reasonable indication of what the full-year results will look like. To summarise, HRI’s NAV performed strongly in the first half of the year, while its performance in the second half was reasonably flat.

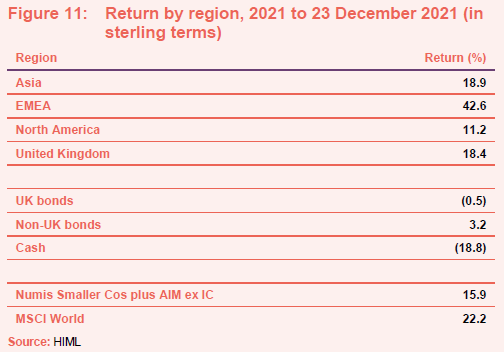

HIML has supplied us with some performance data for HRI’s investments by geography, which has been reproduced in Figure 11. From this, it is clear that Europe has been the most strongly-performing region, by some margin. As is explored further in our discussion of the key performance contributors below, this is primarily due to the strong performance of three key holdings: Nordic Semiconductor, Esker and BE Semiconductor Industries (between them, Nordic Semiconductor and Esker accounted for over half of the return earned in Europe), and so the outperformance of the European portfolio has been largely driven by stock selection. In terms of holdings that detracted from the performance of the European portfolio during the period, overall losses were limited to just £5.88m spread over eight positions, versus total gains of £72.47m. This is despite the currency being a marked headwind – in local currency terms the European portfolio returned around 55.2%, with the currency detracting around 13.1%.

As illustrated in Figure 11, the UK portfolio has outperformed the Numis Index despite the broad rotation away from growth to value seen particularly during the last quarter of 2021. Interestingly, its performance is only around three percentage points behind global equities more generally (as represented by the MSCI World Index), despite the recent headwinds to growth and UK equities still being out of favour with international investors more generally. HRI’s manager comments that the UK portfolio benefitted particularly from the strong performance of its media holdings (as discussed further in the section on key contributors to performance), which underperformed during 2020, but saw a strong recovery during 2021. Next Fifteen Communications was the strongest positive overall contributor during the period, followed by Future Plc which provided the second largest positive contribution. Anecdotally, the majority of the UK portfolio is invested in AIM technology stocks and HRI’s manager believes that the UK portfolio has outperformed these stocks as a group during the period.

Looking at HRI’s North American portfolio, it has returned around 11.2% in sterling terms (which was a local currency return of around 8% and a currency gain of around 3.2%), which is markedly behind the local market tech indices that HRI traditionally compares this portfolio’s performance to. HRI’s manager says that, following three strong years of performance from the North American portfolio (from January 2018 to December 2020, the portfolio returned around 130%, while the index returned around 90%), they were reducing exposure to the region on valuation grounds but, with the benefit of hindsight, they should have reduced the exposure more aggressively. Examples of holdings that the manager took profits on are Five9, Digital Turbine, Cloudera, Manhattan Associates and Ballard Power Systems. The largest positive contribution came from Silicon Motion Technology, by some margin. The largest detractors were Liveperson, Bandwidth and Pegasystems – companies that had all previously performed strongly as their business models were bolstered by the effects of COVID but gave back some of their outperformance in 2021 as vaccines have taken effect and the threat of the strongest restrictions has eased.

Anecdotally, the manager says that, for the first time in a number of years, the number of companies available to them for investment in US public markets has grown. However, the primary market in the US has been very frothy during the first three quarters of 2021 and, consequently, very little primary capital was committed. However, in the final quarter of 2021, valuations in this segment came down to more sensible levels, which HRI’s manager says that this is creating fresh opportunities.

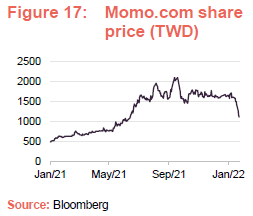

Looking at HRI’s Asian portfolio, this benefitted from a number of takeovers – for example Praemium in Australis, SK Materials in Korea and China’s 51Jobs (HRI had exposure to 51Jobs through a US-listed ADR). The portfolio returned 18.4% in sterling terms (3.4% in local currency with a 15.0% currency gain), with an overall net gain of around £55.5m. Strong contributions came from Momo.com, Mainstream Group and E Ink.

Key performance contributors 2021 to 23 December 2021

The strongest positive contributions have come from:

- Next Fifteen Communications – this marketing agency group, which consists of approximately 20 subsidiary agencies, has been a significant HRI holding for a number of years. The stock suffered heavily during the market collapse of March 2020 as investors turned away from companies dependent on advertising revenue. However, as vaccine roll-outs have taken effect, Next Fifteen has been one of a number of media holdings that has performed strongly.

- Future – this company publishes a range of special-interest consumer magazines and websites and has been a strong long-term-performing holding for HRI. The company has bounced in 2021 as vaccine roll-outs have taken effect, leading to an expectation of a recovery in its advertising revenues.

- Nordic Semiconductor – this is a Norwegian semiconductor company that specializes in microchip level design solutions in the areas of wireless communication and multimedia. It has benefitted from a semiconductor market that has suffered from a severe shortage of supply, which has been reflected in its share price performance.

- Esker – describes itself as a recognised leader in AI-driven process automation software globally (see page 10 of our October 2019 for more details). Esker’s clients use its cloud-based solutions to drive greater efficiency, accuracy, visibility and cost savings throughout their purchase-to-pay (P2P) and order-to-cash (O2C) processes. The company initially saw a delay in orders due to the pandemic in FY2020, but benefitted from a strong rebound during the fourth quarter of 2020 (Q4 2020), which continued into FY2021, which was reflected in its share price performance last year. Esker has reported a 16% year-on-year increase in its revenue for the fourth quarter of 2021 (Q4 2021), despite a slowing in transaction volumes in December as COVID cases surged. It has also recently announced plans to acquire Market Dojo, an e-procurement software business.

- Silicon Motion Technology – this is a fabless semiconductor company (one that does not have a manufacturing plant) that designs, develops and markets, high-performance, low-power semiconductor solutions for the multimedia consumer electronics market. Like Nordic Semiconductor, it has benefitted from a semiconductor market that has suffered from a severe shortage of supply, which has been reflected in its share price performance.

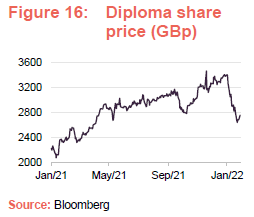

- Diploma – Diploma is a group of specialised distribution businesses that services industries with long term growth potential. It has been a significant HRI holding for some time and has a good track record of growing its sales, around three-quarters of which are outside the UK (it has performed particularly well during periods of sterling weakness post-Brexit). Diploma performed strongly across its three main business segments throughout 2021 (controls: +16%, seals +7% and life sciences +14%), with underlying revenue growth up 12% year-on-year and 7% ahead of that for the 2019 financial year.

- AudioBoom – this company describes itself as the leading global podcast company. It has 32m unique users and its shows are downloaded 116m times a month. Its platform provides commercial services for a network of 250 top tier podcasts. The company provided strong share price growth over the course of 2021 (from around 250p per share at the beginning of the year to over 1,000p before it announced its fourth quarter trading update on 14 December 2021). In its trading update, it announced that it expected full year 2021 trading to be significantly ahead of current market expectations. It said that significantly improved EBITDA (earnings before interest, tax depreciation and amortisation) and marginally improved revenue have been driven by further development of its technology platform, and the continued focus on its content expansion plan. Key drivers of its success during the fourth quarter of 2021 have been: high advertiser demand for premium content; strong audience growth globally; and, following the November launch of Showcase, increased revenue from ad tech. (Showcase is AudioBoom’s global podcast advertising market place. It offers advertisers access to more than 8,000 podcast channels for dynamic advertising, and gives podcasters the opportunity to reach more than 2,000 ad buyers.)

- Momo.com – is a Taiwanese e-commerce services company that offers both TV and internet shopping services (including beauty products, clothing, leather goods and food) primarily to its domestic market. It also offers catalogue mail order, personal insurance, property insurance and travel related services. Momo.com was a net beneficiary of COVID as consumers switched more of their purchasing online, which saw it post decent growth during the 2020 financial year. However, it was able to carry this forward into the first half of 2021, with its second quarter 2021 operating margin hitting a five-year peak of around 5% due to improving economies of scale. Its second quarter 2021 earnings per share (EPS) of NT$4.86 was up 13% quarter on quarter and 88% year-on-year. Active users were also up 27% year-on-year, which was attributed to a better shopping experience and last mile delivery capability.

- YouGov – is an international data and analytics group that is another long-time HRI holding (which we last discussed it in our April 2020 note). It recovered strongly in the aftermath of the COVID-related market collapse of 2020, with its results to the end of July 2021 showing strong performance across all divisions and geographies, which it said had been driven by continuous client demand. It also reported an encouraging sales pipeline which gave it confidence in its growth prospects for the 2022 financial year.

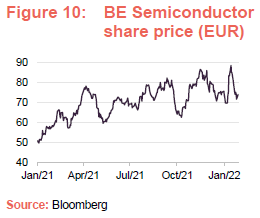

- BE Semiconductor Industries – another long-term HRI holding, this business produces assembly equipment for the semiconductor industry. HIML considered this to be a very attractive end market before the current supply shortage due to the strength of the long-term structural growth opportunity and the typically very high margins available in the space (these businesses also tend to be highly scalable).

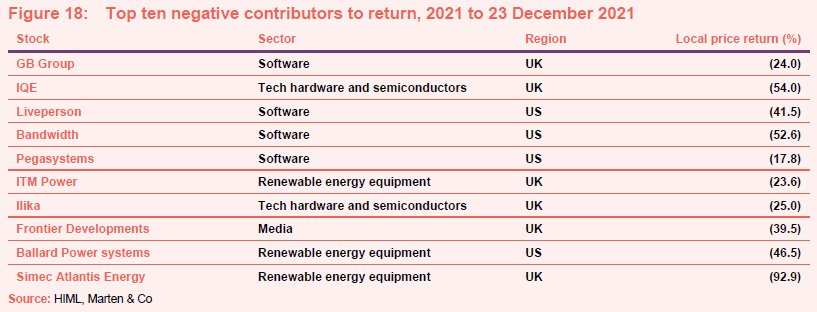

Key performance detractors 2021 to 23 December 2021

Notable negative contributions have come from:

- GB Group – this company, which specialises in identity data intelligence, has been a strong long-term-performing holding for HRI. However, following a couple of years of difficult performance, the company undertook a US$750m fundraise to buy Acuant, a US identity verification firm and know your customer (KYC)/ Anti-Money Laundering (AML) compliance provider. HRI’s manager says that the fundraise was undertaken in a market where demand for GB Group stock was already limited and the company paid a higher multiple for Acuant than GB Group was trading on itself, which also made the fundraise difficult for the market to digest. Given the lack of other external investors, HRI’s manager decided to support the capital raise (Katie has often said that you can damage your own property by not supporting a fundraise) but did not fully stand its corner.

- IQE – this compound semiconductor wafer company had been a drag on HRI’s performance for a couple of years prior to the onset of COVID. The company supplies the wafers that enable the iPhone’s facial recognition technology, and struggled when iPhone sales began to disappoint, which was exacerbated by some speculative short selling. However, like many tech stocks, while it performed strongly during 2020 as markets rebounded following the COVID-related collapse, its shares have disappointed in 2021 and it is now trading markedly below its pre-COIVD levels. The shares saw a sharp move down towards the end of November 2021 when the company announced that it expected to post a decline in revenue for its full-year 2021 results of around 8% year-on-year, due to softening demand in the fourth quarter of 2021. It commented that 5G infrastructure deployments had been weak during 2021, but that it expected this to provide a multi-year growth cycle for the company.

- Liveperson – this technology company develops conversational commerce and AI software for its clients to use in their interactions with their customers, at scale, with the aim of creating a convenient and seemingly personal relationship. Like Bandwidth and Pegasystems below, LivePerson saw increased demand for its services as the world rushed to adjust to the new normal in the face of the pandemic. Reflecting this, its shares performed very strongly during 2020, but have given back a sizeable chunk of this previous outperformance in 2021 as vaccine roll outs have taken effect. Much of this retrenchment occurred during the fourth quarter of 2021 as investors started to fret about the prospect of rising interest rates and inflation to the detriment of many growth stocks.

- Bandwidth – this company provides telecommunication services in the US. Specifically, it provides voice over internet protocol (VOIP), integrated phone systems, smart phones and business-grade internet connectivity solutions using cloud-based communication systems. It benefitted very strongly during 2020 as businesses sought to adjust the telecoms and IT systems in the face of COVID, but has given up much of its previous strong performance in 2021 as restrictions have eased.

- Pegasystems – this company provides cloud software for customer engagement and operational excellence (encompassing digital process automation, robotics, and AI) and, having performed strongly during 2019, benefitted from strong demand during 2020 as customers sought to adjust their offering for a post-COVID-19 world (see page 16 of our November 2020 note). However, more recently, some of its larger projects have been slow to get off of the ground, which has impacted its performance.

- ITM Power – this company manufactures integrated hydrogen energy equipment to enhance the utilisation of renewable energy that would otherwise be wasted, specialising in electrolysers, and hydrogen for fuel cell products. As we discussed in our November 2020 note, it performed very strongly in the first half of 2020 as investors became increasingly convinced by hydrogen as a source of clean energy. The start of the climate change conference – COP 26 – in Glasgow kicked off another significant leg up in its share price, which lasted around three months, but, more recently, there has been insufficient news to keep the momentum in its share price going and it has given back a significant chunk of its previous strong performance. Nonetheless, it is still trading at over 2.5x its level two years ago.

- Ilika – established as a spin out from the University of Southampton’s chemistry department, this company is a leading supplier of solid-state battery technology for use in applications in areas such as industrial internet of things, medtech, electric vehicles (EV) and consumer electronics. Its share price saw a huge uplift in December 2020 (which continued in January 2021), which made it the fifth largest contributor to performance in that financial year. The uplift appears to have been driven by heightened interest in the potential for its batteries to be used in EVs. However, while its share price has rallied during the last quarter of 2020, its share price began a marked pull back from the end of January 2021 that, by the end of September 2021, had seen Ilika give back most of the strong performance that it provided during December 2020 and January 2021.

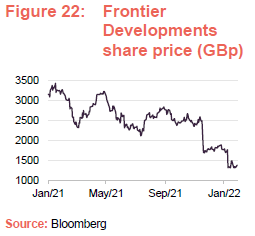

- Frontier Developments – this British gaming company, which has produced several games in the Elite series, was one of a number of companies that benefitted from lockdown restrictions in 2020. 2021 saw Frontier Developments give back a significant proportion of its previous gains as vaccine roll-outs have taken effect and restrictions have eased.

- Ballard Power Systems – this company develops and produces hydrogen fuel cells for a range of applications including materials handling, residential cogeneration, backup power and transportation. Like other fuel cell stocks, it performed strongly during 2020 (particularly in the second and fourth quarters) as investors became increasingly focused on the provision of clean energy, aided by expectations that President Joe Biden would put a lot of emphasis on this in his infrastructure and climate bills. However, poorer than expected results has led to significant downward pressure on Ballard’s share price in 2021 so that it is now trading below its level immediately prior to the onset of COVID.

- Simec Atlatis Energy – this is a renewable energy company, with more than 1,000MW of capacity in various stages of development. This includes the world’s largest free-stream tidal power project, MeyGen. In addition to project development, the Atlantis Turbine and Engineering Services division designs, supplies and maintains tidal turbines and subsea connection equipment. Like ITM Power above, it performed very strongly in the first half of 2020 as investors became increasingly focused on the provision of clean energy. However, it struggled in 2021 with its share price falling after it announced first half losses of £10.7m in September and then again in December 2021 when it announced that it was taking actions to reduce its headcount and monthly operating costs.

Dividend

HRI is focused primarily on generating capital growth, and dividend income makes up only a small part of returns. The consequence of this is that HRI only declares a dividend where this is necessary to retain investment trust status, and in practice, no dividend has been declared since 2012.

HRI had revenue reserves of -£2.74m (4.18p) per share as at 31 December 2020 (2019: +£1.25, or 1.86p per share). During 2020, HRI made a revenue return of -6.00p (2019: +0.05p). While audited figures for the year ended 31 December 2021 are yet to be published, a comparison of HRI’s cum-fair and ex-fair NAVs per share as at 31 December 2021 (2,719.33p and 2,727.69p respectively), suggests that, crudely, HRI has incurred revenue losses of 8.36p per share over the course of 2021 (which are vastly offset by capital gains of around 375p per share). As such, we do not expect there will be any requirement for HRI to pay a dividend for the year ended 31 December 2021.

Discount

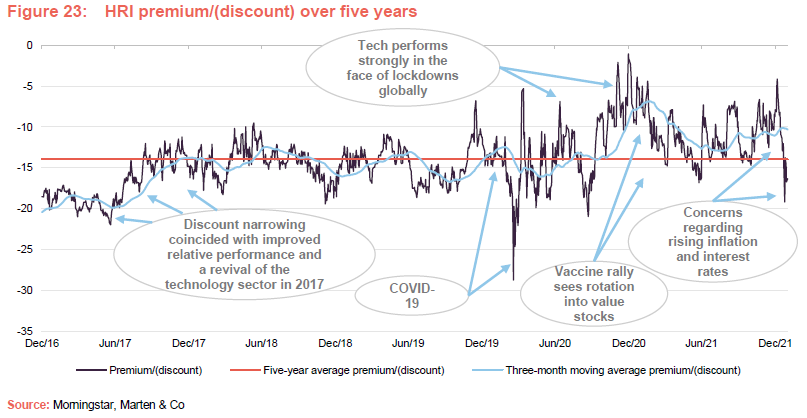

As we have discussed in previous notes, prior to the COVID-related market collapse, HRI had tended to trade within a discount range of 10% to 20% for the previous three to four years. As is illustrated in Figure 23, HRI’s discount has tended to narrow during periods where performance is strong or when the technology sector has been in favour. For example:

- between mid-2016 and early 2018, which coincided both with an improvement in HRI’s relative performance and a marked revival in the performance of the global technology sector, particularly during 2017;

- during the first half of 2019 and again during the final quarter of 2019; and

- during the aftermath of market collapse of March 2020 as governments across the globe implemented lockdowns to contain the spread of the virus.

When we last published on HRI at the beginning of November 2020, we commented that, having widened dramatically as markets collapsed in the face of an accelerating COVID-19 infection rate (reaching a five-year low of 28.8%) the discount had since narrowed again, and the shares appeared to be moving back towards their previous trading range. This trend continued, albeit with some volatility, with the discount reaching its lowest level, in at least 10 years, of 1.0% on 30 December 2020, likely driven by negative sentiment around the lifting of restrictions as the UK struggled to contain the spread of the virus and was thrust back into lockdown.

Following this, vaccination programmes started to take effect in many parts of the world, extending the rotation away from growth into value that began with the vaccine rally back in November 2020. The resurgence of value, at the expense of growth, weighed on HRI’s discount with the discount moving out round 15 percentage points over the next six months (it reached its one-year discount high of 16.8% on 24 June 2021). This widening occurred despite the fact that HRI’s NAV had continued to perform well during the first half of 2021 and the prospects for technology stocks generally remained sound, so the widening appears unjustified in our view.

As discussed in the performance section, HRI’s NAV provided a positive absolute return during the second half of 2021 (an NAV total of 4.5%) and outperformed the Numis Index (which provided a total return of 3.1%). However, its share price returned 14.9%, reflecting a marked narrowing of HRI’s discount in the second half of 2021. We think that this narrowing in part reflects a catch up from the first half of 2021, where HRI’s performance was not properly reflected in its discount, HRI’s repurchase activity in the secondary market (see below) as well as the strong performance of technology stocks more generally as investors once again sought the benefits of structural growth as markets climbed a wall of worry.

Key concerns in the second half included China, whose economy took a knock as stringent restrictions to control the spread of the virus kicked in from August. Subsequently, curbs on property, restrictions on the education sector and then a clampdown on various internet stocks by the Chinese government added to these worries, and what this would mean for the global economic recovery. Alongside these worries over China, a global energy price crunch, the spectre of rising inflation, with the potential for interest rate rises, followed by the emergence of the omicron variant all weighed on markets, with investors refocusing their attention back on growth areas.

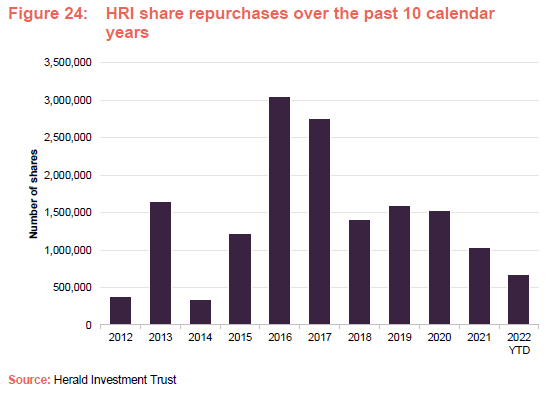

Active in repurchasing its own shares

Whilst HRI’s policy is not to attempt to control the discount, because it is not considered appropriate given the limited liquidity available within the underlying portfolio companies, the trust will repurchase shares opportunistically. Where repurchases are undertaken, the aim is to enhance the NAV per share for remaining shareholders.

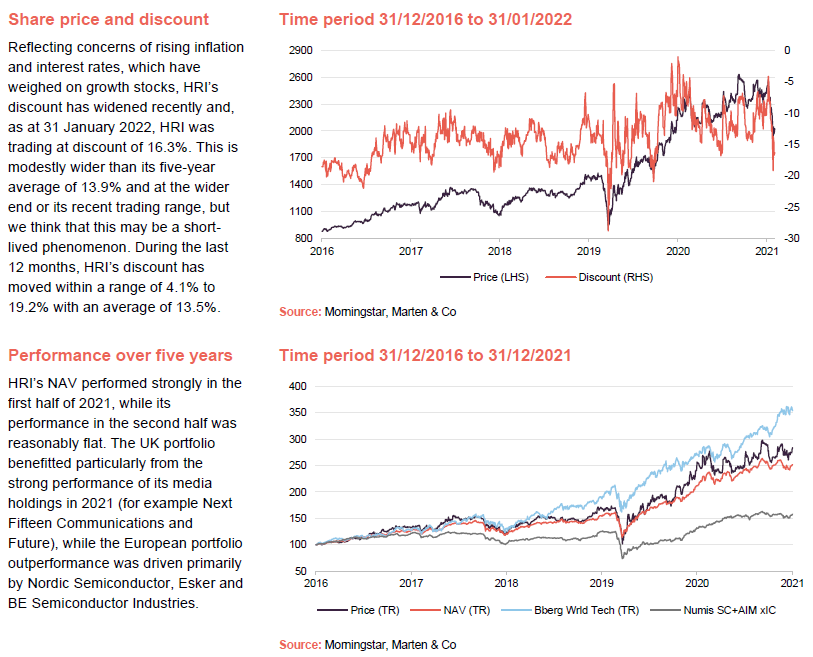

Reflecting concerns of rising inflation and interest rates, which have weighed on growth stocks, HRI’s discount has widened recently and, as at 31 January 2022, HRI was trading at discount of 16.3%. This is modestly wider than its five-year average of 13.9% and at the wider end or its recent trading range, but we think that this may be a short-lived phenomenon. During the last 12 months, HRI’s discount has moved within a range of 4.1% to 19.2% with an average of 13.5%.

Fees and costs

Tiered management fee structure with no performance fee element

HIML is entitled to an annual management fee of 1% of HRI’s net assets up to £1.25bn and 0.8% of HRI’s net assets above this level.

The NAV is calculated monthly using mid-market prices, which is somewhat unusual, as most NAVs are calculated at bid prices. However, given that many of HRI’s underlying holdings trade on wide spreads, the mid-market valuation gives a better indication of the true value of the portfolio. There is no performance fee. The management fee also covers the cost of company secretarial services, which HIML has delegated to Law Debenture Corporate Services.

In the year to the end of December 2020, HRI’s ongoing charges ratio was 1.08%, down modestly from 1.09% the year before. The asset management contract is subject to 12 months’ notice.

Capital structure and life

Simple capital structure

HRI has a simple capital structure with one class of ordinary shares in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 31 January 2022, there were 64,077,416 in issue with no shares held in treasury.

The trust is permitted to borrow up to 50% of net assets and previously had a £25m multi-currency revolving loan facility (like a bank overdraft) with RBS that matured on 31 December 2019. The facility was undrawn prior to its maturity, as HRI has been running with net cash for some time, and so the decision was taken not to renew the facility. The facility has not yet been replaced. As at 31 December 2021, HRI had net liquidity of 6.8% of its total net assets.

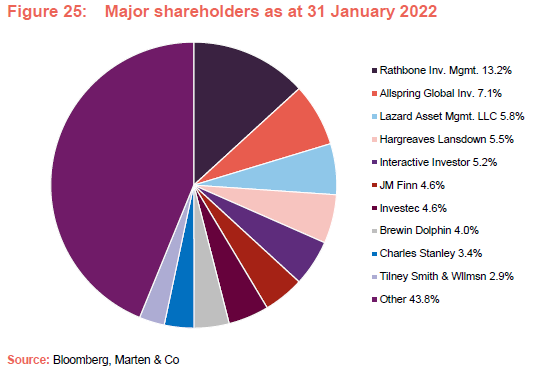

Major shareholders

Unlimited life with three-yearly continuation votes

HRI does not have a fixed life, but shareholders are offered a continuation vote every three years. The next continuation vote is scheduled for the trust’s annual general meeting (AGM) in April 2022. Given its strong long-term performance record, the uniqueness of its investment proposition and its readiness to repurchase shares where its shares are at a marked discount and it can find the necessary liquidity, we expect shareholders will approve HRI’s continuation for another three years.

Financial calendar

The company’s year-end is 31 December. The annual results are usually released in March (interims in July) and its AGMs are usually held in April of each year.

Board

HRI’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. Tom Black was appointed as chairman in April 2021, following the retirement of Ian Russel. Prior to this, Tom was the senior independent director and James Will was appointed to this role. Short biographies of all board members are provided below. Other than HRI’s board, its directors do not have any other shared directorships.

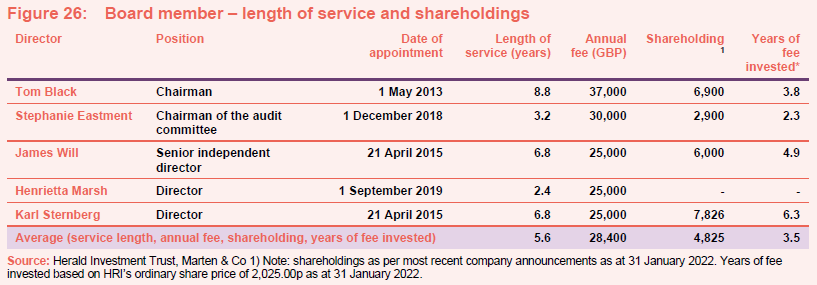

Total fees for the directors are capped at £200,000. Figure 26 shows the current composition of the board and provides some information on members’ length of service and shareholdings in the company. It is board policy that all serving directors retire and offer themselves for re-election annually.

As illustrated in Figure 26, with the exception of Henrietta Marsh, who is the most recent new addition to the board, having joined it in September 2019, all of the directors have made significant personal investments in HRI’s ordinary shares (an average of 3.5 years’ worth of their fees). This is favourable in our view, as it shows significant commitment and helps to align directors’ interests with those of shareholders.

Recent transactions by directors in HRI’s shares

There were no share disposals by HRI directors during the last 12 months. In terms of purchases, Stephanie Eastment bought 400 ordinary shares, in August 2021, at a cost of £24.1152 per share, taking her beneficial interest to 2,900 HRI shares.

Tom Black (chairman)

Tom joined HRI’s board in May 2013 and became the chairman on 20 April following the retirement of Ian Russell at the conclusion of the trust’s AGM that day. Tom was previously chief executive of Detica Group Plc, a leading company in the field of large-scale information collection and analysis for intelligence and counter fraud applications. As such, he understands HRI’s smaller companies remit, having grown an early stage technology company and listed it on the London Stock Exchange. He also has advisory roles with a number of smaller unlisted businesses. Tom is chairman of Thruvision Group Plc (formerly Digital Barriers Plc), and is a non-executive director of CloudCoCo Group Plc. He is also chairman and trustee of the Black Family Charitable Trust, which is focused on supporting disadvantaged young people with their educational needs.

Stephanie Eastment (chairman of the audit committee)

Stephanie Eastment is a chartered accountant and company secretary with over 30 years’ experience in the financial services industry. She has considerable experience in the investment trust sector and is a member of the AIC’s Technical Committee. Stephanie qualified with KPMG and held various accounting and compliance roles at Wardley and UBS before joining Invesco Asset Management in 1996 as Manager, Investment Trust Accounts. When she left Invesco in July 2018, she was Head of Specialist Funds Company Secretariat and Accounts. Stephanie is a non-executive director and audit chair of Murray Income Trust Plc.

James Will (senior independent director)

James joined HRI’s board in April 2015 and became the senior independent director on 20 April 2021 following Tom Black’s appointment as chairman at the conclusion of the trust’s AGM that day. James was, until 2014, chairman and a senior corporate finance partner of law firm Shepherd and Wedderburn LLP, where he also headed the law firm’s financial sector practice. During his career as a lawyer, James was involved in advising smaller quoted technology companies, for over 20 years, on a range of corporate transactions, including flotations, secondary fundraisings and mergers and acquisitions. James is chairman of both The Scottish Investment Trust Plc and Asia Dragon Trust Plc.

Henrietta Marsh (director)

Henrietta has a background in fund management, having worked in UK small cap and private equity investment over several decades. From 2005 until 2011, she was AIM fund manager at Living Bridge Equity Partners and, prior to that, she spent 14 years at 3i in several roles, including as fund manager of 3i Smaller Quoted Companies Trust plc (1997–2002). Henrietta spent her early career with Morgan Stanley and Shell. She is currently a non-executive director of Gamma Communications Plc (AIM listed), a trustee of 3i Group Plc’s pension fund and a member of London Stock Exchange’s AIM Advisory Group.

Karl Sternberg (director)

Karl spent much of his earlier career at Morgan Grenfell (which became Deutsche Asset Management), where he rose to become chief investment officer, Europe & Asia Pacific. Subsequently, he was a founding partner of Oxford Investment Partners Limited, where he worked from 2006 until 2013, when it was acquired by Towers Watson. Karl is a non-executive director of Clipstone Logistics REIT Plc, Monks Investment Trust Plc, Lowland Investment Company Plc, Alliance Trust Plc, JP Morgan Elect Plc, Island House Investment LLP and Jupiter Fund Management Plc.

Management team

Katie Potts

Katie is the managing director and also the lead fund manager for HIML. She established HIML in December 1993 to manage HRI, which was launched in February 1994. Katie read Engineering Science on a GKN Group scholarship at Lady Margaret Hall, University of Oxford. She worked for five years in investment management at Baring Investment Management Limited, before joining S.G. Warburg Securities’s UK electronics research team in 1988. The team was consistently voted top team in the Extel survey of analysts in the sector, and she was voted top analyst by finance directors of electronics companies canvassed by The Treasurer magazine. In addition, Katie had responsibility within S.G. Warburg’s UK research department for commenting on accounting issues.

Katie is supported in managing the funds by a team of eight other investment professionals and three consultants.

Fraser Elms

Fraser Elms joined HIML in May 2000. He is the deputy manager of HRI and has lead responsibility for managing HIML’s Asian portfolios. Prior to joining HIML, Fraser was a technology analyst with Dresdner Kleinwort Benson, where he covered the European technology sector. Before this he worked at Prudential for three years as member of a team of three UK unit trust fund managers that managed £5bn in equities, with Fraser having lead responsibility for three funds collectively worth £400m. He graduated from Lancaster University with a degree in Economics and initially joined Prudential as a product manager for their unit trusts, before completing an MSc in Investment Analysis at the University of Stirling and re-joining Prudential in an investment role. Fraser covers the semiconductor sector.

Taymour Ezzat

Taymour joined HIML in November 2004. He is a portfolio manager on the venture funds, sitting on the venture committee, and taking lead responsibility for a number of the investments in the venture portfolios. He also has analytical responsibility for the media sector across all HIML’s quoted and unquoted portfolios, as well as responsibility for the European portfolio. Previously he spent a year appraising a number of venture capital opportunities for E.D. Capital Partners. Prior to that, Taymour spent six years at Northcliffe Newspapers, the regional newspapers division of Daily Mail and General Trust (DMGT), latterly as finance director of its electronics publishing arm. Prior to this, he worked for Reuters in London and Eastern Europe for four years. Taymour qualified as an accountant with Price Waterhouse, and studied Economic History at the London School of Economics and Political Science.

Hao Luo

Hao joined HIML in 2004 and works with Fraser Elms on managing the Far East portfolios. He also has analytical responsibility for the manufacturing sector globally. Hao obtained a BA in Economics from Hunan University in China and a Masters degree in Finance from Manchester University, and worked for J&A Securities in Shanghai from 2000-2002. Hao is a CFA charterholder.

Peter Jenkin

Peter joined HIML as an analyst in 2015. He covers the software sector and contributes to the overall investment selection. Previously, Peter worked jointly on the European portfolio, but now has responsibility for HRI’s North American portfolio. Before joining HIML, Peter studied Construction Engineering Management at Loughborough University.

Bob Johnston

Bob was recruited in 2016 to establish a US office for HIML. He has more than 20 years’ experience in the technology sector on the sell-side, and he has worked with the HIML team for roughly 15 years. Most recently, Bob was with the technology specialist Pacific Crest. He previously also worked for Hambrecht & Quist and SoundView Technology Group. Bob has taken responsibility for telecommunications, networking and security analysis.

Danny Malach

Danny joined HIML in June 2016 and, since April 2017, has acted as the funds dealer.. He obtained a First Class Honours in his undergraduate degree in Accounting at Northumbria University, and subsequently achieved a Merit in MSc in International Economics and Finance.

Fati Naraghi

Fati joined HIML towards the end of 2019 to focus on the Herald Worldwide Technology Fund and to cover some of the larger technology companies. Prior to joining HIML, she spent 20 years at Newton Investment Management where she was responsible for the global tech sector. Fati has a Ph.D. in Communications Systems and is qualified as an AWS Cloud Practitioner.

Previous publications

Readers interested in further information about HRI may wish to read our previous notes (details are provided below). You can read the notes by clicking on the links below.

Invest in the future, Initiation, published 16 August 2016

Tech bids demonstrate value, Update, published 20 December 2016

Backing growing businesses, Update, published 11 July 2017

Who wants to be a billionaire?, Annual overview, published 07 December 2017

From small acorns…., Update, published 12 June 2018

Shifting sentiment, Annual overview, published 12 February 2019

“Profits are only profits when they are realised”, Update, published 08 October 2019

Changer is a coming, Annual overview, published 1 April 2020

Hot chips, Update, published 5 November 2020

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Herald Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.