JPMorgan Japanese Investment Trust

Investment companies | Annual overview | 22 March 2023

Backing the new Japan

JPMorgan Japanese Investment Trust (JFJ) has a large exposure to good quality companies that are at the forefront of the modernisation of the Japanese economy. The portfolio embraces businesses in robotics, ecommerce, digitalisation, healthcare, and renewables. It also backs some great Japanese brands and businesses that are helping the economy adapt to an ageing population.

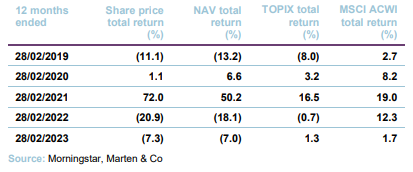

These are ‘growth’ stocks and, as we discussed in our last note, even though Japan has not, as yet, experienced the interest rate rises that triggered the selloff in growth stocks in other markets, their share prices have plunged, and this has impacted on JFJ’s performance.

The trust’s managers, Nicholas Weindling and Miyako Urabe, highlight the valuation opportunity that this has created; Japan was out of favour before this fall, the stocks in the portfolio are cheaper yet still boast superior earnings growth prospects than the average Japanese company, and the yen is undervalued. This could be a good chance to back a former sector-leading trust, while underlying valuations look cheap.

Capital growth from Japanese equities

JFJ aims to produce capital growth from a portfolio of Japanese equities and can use borrowing to gear the portfolio within the range of 5% net cash to 20% geared in normal market conditions.

Fund profile

Further information about the trust is available at www.jpmjapanese.co.uk.

JPMorgan Japanese Investment Trust (JFJ or the trust) aims to achieve capital growth from investments in Japanese companies. For performance monitoring purposes, the trust is benchmarked against the returns of the Tokyo Stock Exchange Index (commonly known as TOPIX) in sterling.

The trust may make use of both long- and short-term borrowings with the aim of increasing returns.

Day-to-day investment management activity is the responsibility of JPMorgan Asset Management (Japan) Limited in Tokyo. The co-investment managers are Nicholas Weindling, who has had responsibility for JFJ’s portfolio for more than a decade, and Miyako Urabe, who was appointed co-manager in May 2019. They are supported by a well-resourced team.

High-quality companies that are capable of compounding their earnings sustainably over the long term.

The investment emphasis is on identifying high-quality companies that are capable of compounding their earnings sustainably over the long term. That means investing in companies in growing industries that have strong balance sheets and are resilient in the face of macro-economic issues.

Benefitting from local knowledge

Well-resourced local presence.

The investment team is based in Tokyo, where JPMorgan has had an office since 1969. Nicholas says that it is now relatively unusual for non-domestic asset managers to have a physical presence in Japan. Visiting companies is an integral part of the team’s investment process, but until very recently, the pandemic made it hard for competing firms based outside the country to do likewise.

The team is 25-strong and is a mix of fund managers and analysts – roughly half and half. In addition, one of the strengths of the business is that the managers can also draw on the expertise of JPMorgan’s analytical teams around the world. This helps with competitive analysis, for example – it can also help identify trends on which Japan is behind the curve, of which there seem to be a few, as we discuss later in this note.

Japan’s economy – all change or no change?

Markets were said to be surprised about the choice of Kazuo Ueda as the new governor of the Bank of Japan. The announcement on 10 February led to some strengthening of the yen and an increase in government bond yields. There is speculation that this will accelerate an end to Japan’s yield curve control policy and perhaps an increase in interest rates.

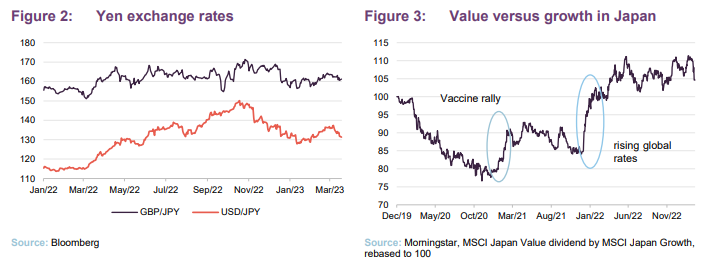

As we discussed in our last note, as in other markets, rising global borrowing costs appeared to trigger a shift from growth to value investing early in 2022, despite the Bank of Japan pursuing a policy of keeping borrowing costs low as a way of stimulating economic demand.

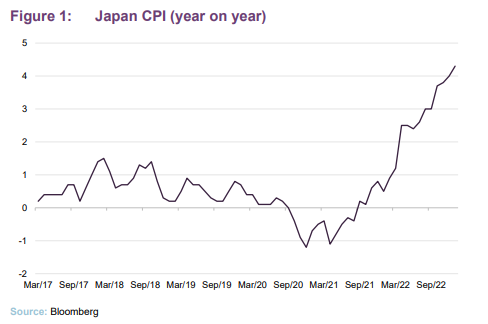

That policy weighed on the currency and also appears to have allowed inflation to gain traction in the country, driven largely by rising prices of imported commodities, exacerbated by the weak yen. Inflation has breached 4%, a 41-year high, and wages have been rising too, as companies struggle to re-hire the part-time employees that were laid off during the COVID lockdowns. However, this is a slow process, and they remain below developed market comparators.

The weak yen and the savage switch from growth to value have held back JFJ’s sterling returns since the beginning of 2022. However, since end October 2022 when US inflation started to fall, the yen has strengthened relative to the US dollar, but there is a long way to go. Anecdotally, the manager says that there are glaring inconsistencies between the price of goods and services in Japan relative to other developed countries.

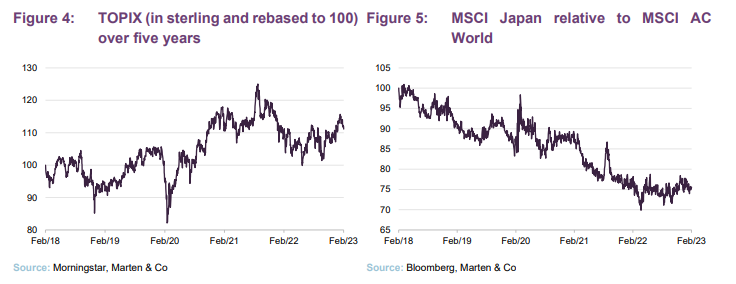

Figure 5 seems to suggest that Japan is now holding up better relative to other global markets. It has a long way to go, however, before it makes up the underperformance of recent years.

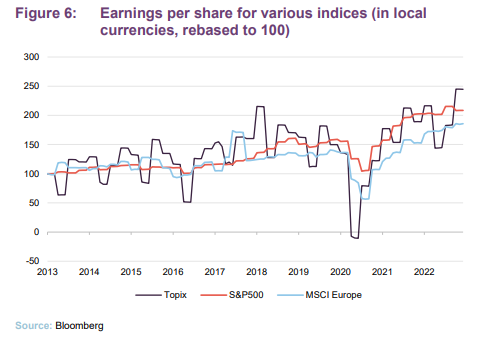

Nicholas notes that the stagnation of the Japanese economy has not constrained the average earnings per share growth of listed companies. For example, over the decade to the end of 2021, Japan’s economy grew by just 3.7% (according to World Bank data) but, as the chart shows, the earnings per share growth on the TOPIX index more than kept pace with the S&P500 and MSCI Europe. Nicholas thinks that a large part of that can be attributed to Japan’s corporate governance revolution which we have discussed in previous notes (see page 24).

Key themes within the portfolio

Large swathes of the market represent ‘old Japan’ and these face structural challenges to growth.

In the managers’ view, the benchmark index is dominated by ‘old Japan’ companies operating in stagnant or declining industries. These are not just obviously outdated industries such as steel and department stores, but also companies like the automakers who are facing big challenges in adapting to the shift to electric vehicles and self-driving cars. The managers note that many formerly-successful consumer electronics companies are being displaced by other Asian competitors.

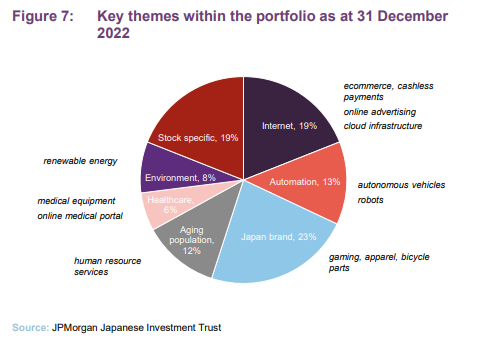

The managers break the portfolio down across a number of key themes – internet, automation, Japan brand, aging population, healthcare, environment and stock specific. Each of these areas represents a structural growth opportunity that the fund can benefit from.

An all-encompassing theme is the need for Japan to modernise its economy. It lags other developed areas in many areas, from the ability to pay for goods and services with cards, to embracing the need for renewable energy, for example. Attitudes are changing, however.

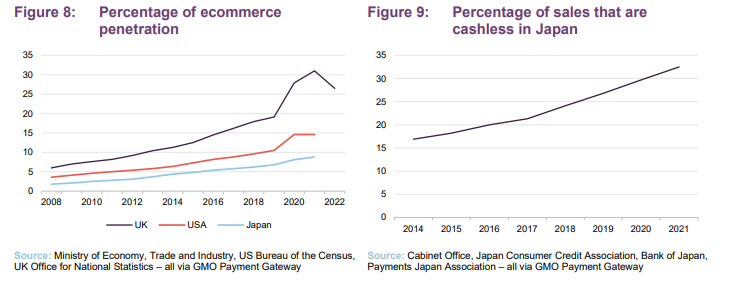

GMO Payment Gateway, a payment business in JFJ’s portfolio, was the source of the data in Figures 8 and 9. Clearly, Japan lags in terms of ecommerce penetration by some margin. OECD data suggests that in 2018 (the last available data) only 22.4% of Japanese medium-sized businesses (those with 50 to 249 employees) were selling online (that compared with a figure of 35.9% in the UK).

The use of cashless payments was even further behind. Although the Japanese data shows increased use of various forms of cashless payments, including credit and debit cards, the Bank of England says that in 2021 the equivalent figure in the UK was 85%.

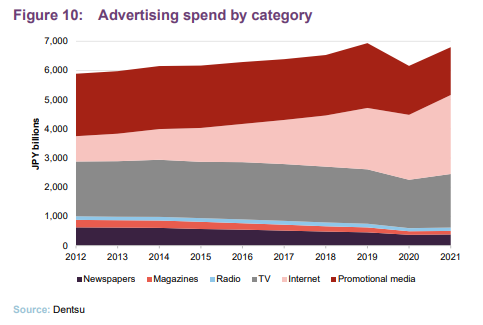

Figure 10 shows increased use of internet advertising in Japan, buoyed by COVID-19.

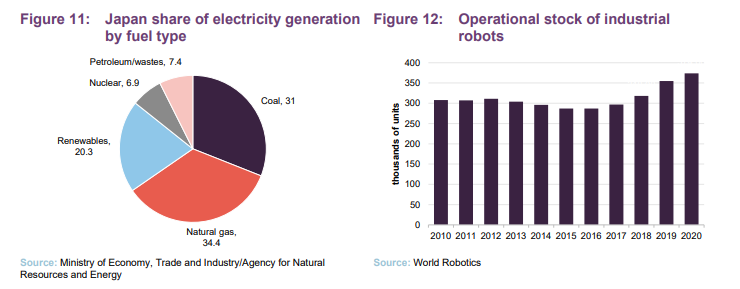

In the area of renewables, Japan’s reliance on imported fossil fuels was a headwind to the economy over 2022. In its 2021 Strategic Energy Plan, Japan said it aimed to have renewables account for 36–38% of its energy mix by 2030.

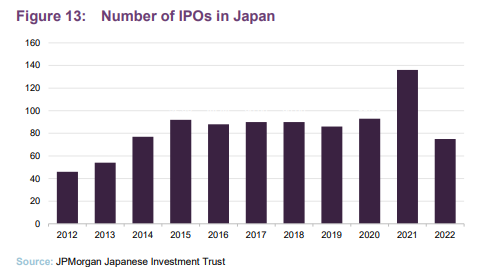

Japan’s robotics industry is a success story; it is the global leader with about 45% of the global supply according to the International Federation of Robotics. Nicholas feels that this has been driven in part by its need to adapt to a shrinking workforce. The domestic market is said to be the second-largest after China.

The reopening of China’s economy marks the beginning of the end of the impact of COVID on Japan’s economy. As inbound tourism recovers, some of JFJ’s Japan brand businesses should benefit. Demand for Japanese exports should also improve – China is Japan’s largest trading partner. One potential beneficiary of this in JFJ’s portfolio is Nippon Paint, which we discussed in our last note.

Investment process

Unconstrained approach.

The emphasis is on long-term sustainability of returns, and there is a clear bias in favour of quality businesses and growth. The approach is unconstrained – they look at the whole market, including a number of smaller companies. The closed-end structure helps in that regard.

High active share.

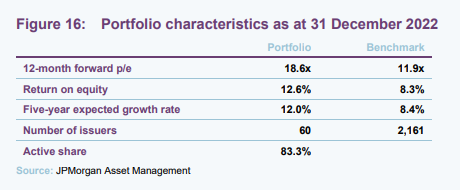

Stock selection drives sector exposure and those sectors that do not fit well within their quality and growth style are not included in the portfolio. Typically, the portfolio’s active share will be in excess of 80% and may approach 100%. At

31 December 2022, it was 83.3% on a geared basis.

Deep pool of under-researched stocks creates opportunities.

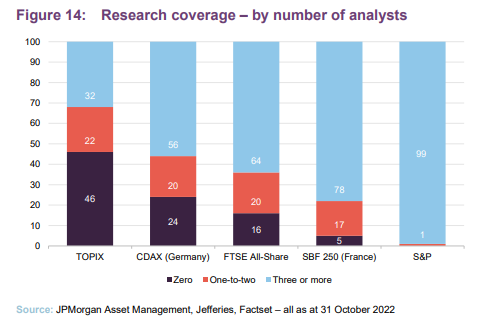

The Japanese market is highly inefficient and therefore conducive to a stock picking approach. The universe comprises around 4,000 stocks, and – as the managers highlighted in JFJ’s last annual report – that figure is being augmented by a healthy number of IPOs, although many of these are too small to be suitable for JFJ’s portfolio.

Based on data from October 2022, over 68% of companies with a market cap in excess of $10m are covered by three or fewer analysts and almost half the market has no coverage at all, which is in stark contrast with other developed markets.

The team meets as many companies as possible, with around 4,000 meetings in a typical year, including quite a few pre-IPO companies (although the managers will not invest in unlisted companies).

Practical approach

For each stock, the managers want to assess:

- does the business create value for shareholders? (Economics);

- can this value creation be sustained? (Duration); and

- how will governance impact shareholder value (Governance).

When assessing stocks for inclusion in the portfolio, the first questions are: is this a business that they want to own? Does it have competitive strengths that will allow it to thrive? And is it operating in an attractive industry demonstrating secular growth? Valuation considerations are secondary to this.

Indications of quality include returns on equity, free cash flow generation and balance sheet strength. The company should have competitive strengths that give it pricing power. Management should be of good quality, accessible and aligned with the interests of shareholders.

Governance and other aspects of ESG

ESG considerations are fully integrated into the stock selection process. One long-running theme within Japan has been improvements to corporate governance. Assessing governance aspects is therefore a key part of the investment process. Social and environmental factors are evaluated as well.

JPMAM is a signatory to both the UN PRI and the Net Zero Asset Managers Initiative. JPMAM is a signatory to the Japanese Stewardship Code and endeavours to vote at all meetings called by companies within JFJ’s portfolio.

98-question ESG analysis helps identify companies to avoid.

Companies being considered for inclusion within the portfolio are judged on the basis of a 98-question risk analysis that covers a wide range of ESG aspects (about two-thirds of questions) as well as broader risks, with simple yes/no answers. This analysis should pick up anomalies such as a substantial divergence between accounting profits and cash generation.

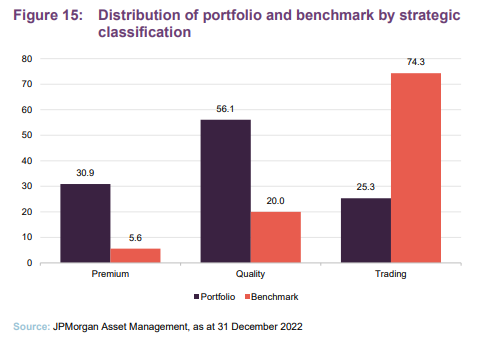

Universe divided between ‘premium’, ‘quality’ and ‘trading’.

Informed by this analysis, the managers divide JFJ’s universe between ‘premium’, ‘quality’ and ‘trading’ companies. The worst companies – often those in the utilities, energy and real estate sectors – have scores (i.e. red flags) in the high 20s. Within JFJ’s portfolio, on average premium companies score 7, quality companies score 9 and trading companies score 14. Very few companies qualify for inclusion within the premium category, but these are the companies in which the manager has the highest conviction. Almost three-quarters of stocks in the index fall into the trading category.

JFJ is not an activist fund. However, the investment approach emphasises contact with companies, and the managers will engage in dialogue with management where they feel that ESG improvements are needed. They will also ensure that JFJ exercises its voting rights at company meetings. The investment stewardship team and investment management team in Japan conducted 45 engagements with 27 portfolio companies in the year to 30th September 2022, specifically to discuss ESG issues. The companies engaged with represented 72% (by value) of the portfolio.

JPMAM is part of the Japan Working Group of the Asian Corporate Governance Association, which sent a letter to the Japanese FSA and JPX/TSE to urge them to set targets for achieving faster and higher levels of board gender diversity on Japanese-listed companies. The letter suggests that all TSE Prime companies be required to achieve 30% female representation on boards by 2030 through amendments to the TSE listing rules, and the Corporate Governance Code should encourage all listed companies to reach this level sooner if they can.

JFJ’s portfolio’s carbon emissions are just 11% of those of the index, on a per $m invested basis.

An analysis of the carbon emissions associated with JFJ’s portfolio, carried out as at 30 September 2022, showed that the portfolio had significantly less exposure to carbon emissions than its benchmark; 25.2 tons of CO2e per $m invested versus 227.3 for the index.

Assessing value

Valuations based on a five-year outlook and on sustainable earnings.

Valuations are assessed on the basis of five-year forecasts of sustainable earnings growth, dividends and the multiple that the managers think a stock should be trading on in five years’ time. Cash on the balance sheet is reflected later in the process.

Position sizes will reflect the conviction that the manager has in a stock and whether it has been assigned to the premium, quality or trading buckets. Premium stocks may have a 3–5% weighting in the portfolio, quality stocks a 2–4% weighting and trading stocks a 0.5–2% weighting.

On average, the portfolio will contain between 40 and 80 positions. The portfolio is regularly assessed to ensure that overall risk factors are within acceptable levels.

Investment restrictions

The board seeks to manage risk by imposing various investment limits and restrictions:

- JFJ must maintain 97.5% of investments in Japanese securities or securities providing an indirect investment in Japan.

- No investment to be more than 5.0% in excess of benchmark weighting at time of purchase and 7.5% at any time.

- The company does not invest in unquoted investments and to do so requires prior board approval.

- The company does not normally enter into derivative transactions, and to do so requires prior board approval.

- The company will not invest more than 15% of its gross assets in other UK-listed investment companies and will not invest more than 10% of its gross assets in companies that themselves may invest more than 15% of gross assets in UK-listed investment companies. In practice, the managers say that they never have and do not ever envisage investing in other investment companies.

- The managers do not hedge the portfolio against foreign currency risk.

These limits and restrictions may be varied by the board at any time at its discretion.

Sell discipline

Low turnover, reflecting long-term approach.

Generally, JFJ’s is a low-turnover portfolio, reflecting the managers’ long-term investment horizon. However, stocks may be sold if the investment case deteriorates or if an adverse corporate governance change occurs. Stocks may be replaced if the managers identify a similar investment opportunity with a better risk/reward profile.

The managers like to run their winners, but will take profits if valuations exceed their long-run targets.

Asset allocation

On average, the stocks in JFJ’s portfolio are more expensive than those in the benchmark, reflecting their much higher returns on equity and their superior growth prospects. As a reflection of the savage de-rating that JFJ’s stocks have experienced, the 18.6x p/e that the portfolio was trading on at the end of 2022 was significantly lower than figure at the start of the year of 33.6x. By contrast, the average stock in the benchmark has de-rated from 13.8x to 11.9x.

Nicholas points out that the sell-off seemed to hit companies assigned to the premium category hardest.

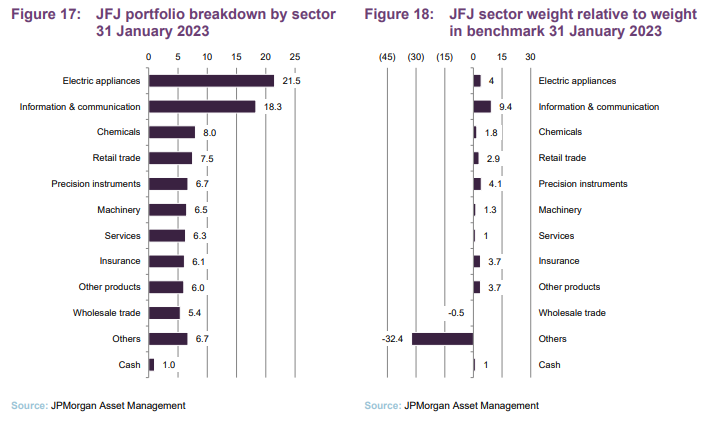

There are few changes of substance to the distribution of JFJ’s portfolio by sector since we last published (using data as at 31 May 2022). Sector weights are driven by the managers’ stock selection decisions, and the core positions within the portfolio have been fairly stable.

Top 10 holdings

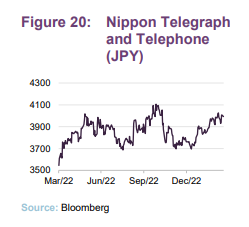

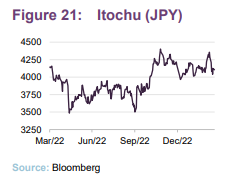

Since the end of May 2022, two stocks have dropped out of the list of JFJ’s 10-largest holdings – Tokyo Electron and SMC (both of which are still large positions within the portfolio) – and they have been replaced by Nippon Telegraph and Itochu.

The portfolio is a little less concentrated than it was last May, when the 10-largest holdings accounted for 47.3% of the portfolio.

Looking at a few of these in more detail:

Nippon Telegraph and Telephone

Nippon Telegraph and Telephone or NTT (group.ntt/en/ir/) is the Japanese equivalent of BT. It was privatised in 1985 and is a substantial global business with over 330,000 employees. It is playing a key role in the digital transformation of the Japanese economy, and its digitalisation efforts are aimed in part at cutting overheads (it reckons it can achieve JPY200bn of cost savings in this area over its 2023 financial year).

In JFJ’s annual report, the managers noted NTT’s attractive valuation and highlight an ROE of 15%. Part of the investment thesis is that retirements are shrinking NTT’s workforce and this is reducing its wage bill (as older workers tend to be on higher salaries). They also welcome the company’s management’s focus on improving shareholder returns.

Results for Q3 2022 saw operating revenues and profit reach record-high levels, albeit that the increase in profit was a modest 0.2%, held back by high electricity prices. Full-year forecasts are for a 3.3% uplift in EPS, but its 2023 target is an 8.8% uplift on the 2022 level.

Itochu

Itochu (itochu.co.jp/en/ir) is a conglomerate, one of the largest in Japan, with a market cap of about JPY6.5trn. Its portfolio of businesses spans textiles, machinery, metals, minerals, energy, chemicals, food, general products, real estate, information and communications technology, and finance. The managers note that many of these businesses are stable cashflow generating companies. The portfolio includes ownership of, investments in, or distribution arrangements with, many well-known global brands, such as Isuzu, Mazda, and Converse, and convenience store business FamilyMart.

The managers initiated a position in Itochu during 2022. Again, the attraction was management’s determination to improve shareholder returns.

Other portfolio activity – new holdings/additions

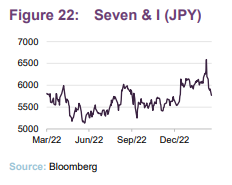

Seven & I

Seven & I (7andi.com/en/) is a global retail business encompassing convenience stores (where it trades as 7-Eleven), superstores, department stores, supermarkets, speciality stores, and food services. It also has associated financial services and IT services operations.

The company has been selling off peripheral businesses as it focuses on its core convenience offering. COVID had a significant impact on sales and profitability, but both have recovered strongly. The managers added the stock to the portfolio in the final quarter of 2022 and at the end of December 2022 it was a 2.4% position.

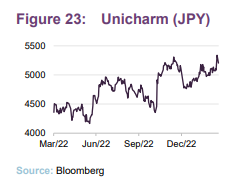

Unicharm

Unicharm (unicharm.co.jp/en) was another new addition to the portfolio in Q4 2022. The core of the business is its non-woven fabrics and absorbent materials operations. It retails these in areas such as health, pet care (where it has expanded into pet food), feminine hygiene, baby and child care, and beauty.

Profitability has been impacted by the rise in input costs and lockdowns in China. Nevertheless, sales hit a record high in 2022. This was a much smaller position (0.8%) at the end of December.

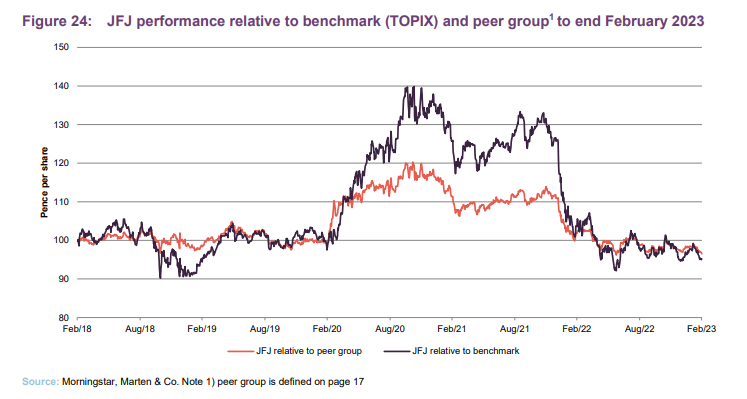

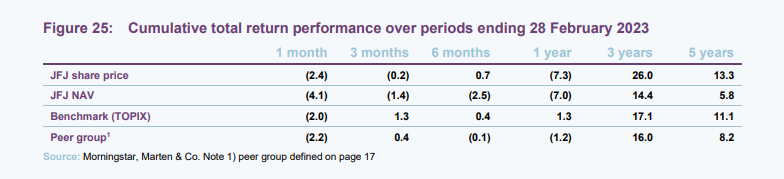

Performance

As the chart in Figure 24 shows, the sell-off in growth-focused stocks that began in November 2021 and accelerated through the early months of 2022 led to JFJ giving back all the relative gains that it had made in 2020. This left it marginally behind both its benchmark and its peer group over the five-year period ending in February 2023. Shareholders may be comforted that the share price held up relatively well over this period.

In our view, there was little that the managers could have done to avoid the worst of the setbacks without compromising on their investment style. As we showed on page 12, the portfolio is much more attractively valued than it was at the start of 2022. In time, the JFJ’ portfolio’s superior growth characteristics should be rewarded.

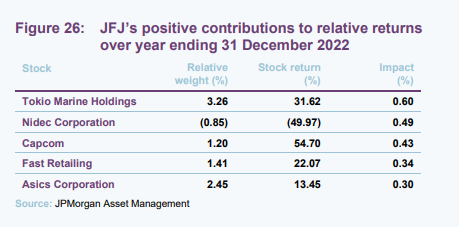

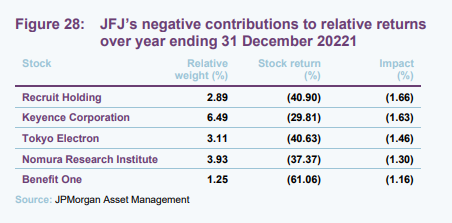

Performance drivers

The managers kindly supplied us with some performance attribution data which covers the 12-month period to end 2022.

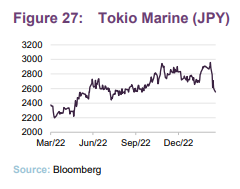

Tokio Marine

Tokio Marine (tokiomarinehd.com/en) is an insurance and life assurance business. We discussed it in our last note where we noted that results for its 2021 financial year were good. COVID-related losses and those related to natural catastrophes such as Hurricane Ian and Winter Storm Elliott in North America have impacted on 2022’s results. However, rate increases and increased market share are driving a projected 9% increase in 2022’s premium income. The company’s forecast is for adjusted net income of JPY400bn for the full year, about 5% down on the prior year.

Recruit Holding

Recruit Holdings (recruit-holdings.com/en/) also featured in the list of largest negative contributions in our last note. The recruitment business owns Indeed and Glassdoor, which have a strong presence in the US.

In its Q3 results, revenue was up 18% year-on-year but a large part of that was down to the strength of the US dollar. Earnings fell, however, leading to a 5.7% drop in EPS. The company is forecasting a 4.7% fall in EPS for its full accounting year, but this is an improvement on its initial guidance. Higher advertising costs are having an impact on profitability. There are concerns about a slowdown in recruitment as businesses are nervous about the health of the economy. The mass lay-offs in the technology sector in the US may weigh on that part of its operations.

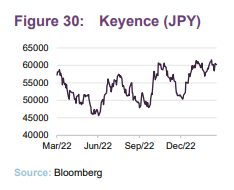

Keyence

Keyence (keyence.co.uk) is, as we have discussed in earlier notes, a longstanding position within JFJ’s portfolio. The need for many economies to adapt to a shrinking workforce, and the shift to ‘reshoring’ support the secular growth of the robotics sector. Keyence de-rated in the growth selloff, but appears to have been on a gradual recovery since the summer of 2022.

Financially, Keyence’s third quarter results, announced at the beginning of February, came in ahead of analyst’s expectations, with net sales up 24% year-on-year. That and the promise of an increased full-year dividend helped buoy the share price.

Peer group

Up-to-date information on JFJ and its peer group is available on our website.

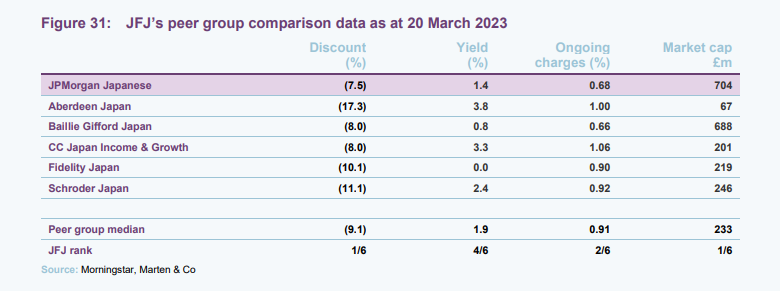

For the purposes of this note we have used the constituents of the AIC Japan sector as a peer group. The trusts listed here have roughly similar objectives except for CC Japan Income & Growth, which – as its name implies – places more emphasis on income generation and consequently has the highest yield. By contrast, JFJ’s growth focus puts its yield towards the bottom end of the peer group.

JFJ remains the largest and most liquid trust in its peer group, and this helps keep its ongoing charges ratio towards the bottom end of the table. The discount is the lowest of this peer group, but the range here is quite tight. JFJ is not managed to produce a yield.

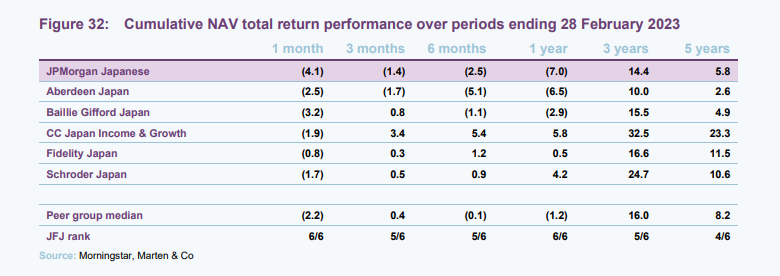

The setback experienced in growth investing is the main influence on relative returns within this peer group, with the most value-oriented – CC Japan Income & Growth – leading the sector’s NAV returns over most time periods, a dramatic reversal from the position when we published our December 2021 note on JFJ, when it led the sector over most time periods and the income-focused trust languished towards the bottom of the table.

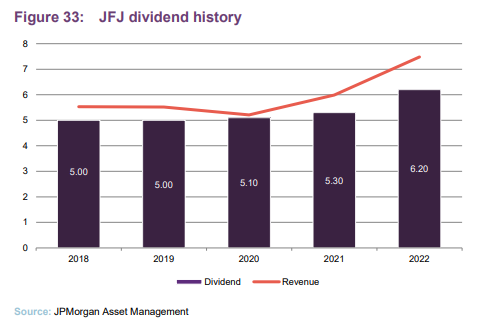

Dividends

The board’s dividend policy is to pay out the majority of the revenue available each year. The investment objective’s emphasis on capital growth means that income generation is not a focus for the managers. A revenue reserve has built up over the years and this stood at £18.5m at the end of September 2022 (equivalent to about 12.0p per share).

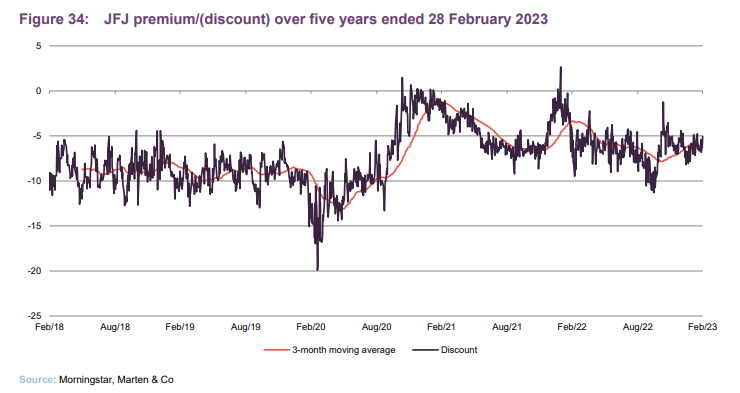

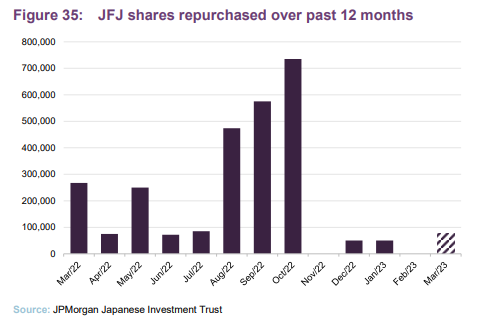

Discount

Over the 12 months to the end of February 2023, JFJ’s discount moved within a range of 11.3% discount to a 1.2% discount and averaged 6.5%. At 20 March 2023, the discount was 7.5%.

JFJ’s discount narrowed over 2020, driven in part by increased interest in the fund following a good spell of performance. Pleasingly, the discount has been relatively stable over the period where the trust’s outperformance has unwound (for the reasons explained on page 15 onwards). The board monitors the discount closely and will authorise share buy backs when it feels that these are appropriate.

Each year at the AGM, the board puts forward resolutions that permit the company to issue new shares, reissue shares from treasury and repurchase shares for cancellation or to be held in treasury. The board has stated that shares held in treasury would only be reissued at a premium to NAV.

Fees and costs

The trust employs JPMorgan Funds Limited as its Alternative Investment Fund Manager (AIFM) and company secretary. Management of the portfolio is delegated to JPMorgan Asset Management (UK) Limited, which in turn delegates day-to-day investment management activity to JPMorgan Asset Management (Japan) Limited in Tokyo. The manager is a wholly-owned subsidiary of JPMorgan Chase Bank which, through other subsidiaries, also provides marketing, banking, dealing and custodian services to the company.

Tiered management fee structure and no performance fee.

JPMorgan Funds Limited is entitled to an annual management fee calculated as 0.65% of the first £465m of net assets, 0.485% on the next £465m and 0.40% on amounts above £930m. There is no performance fee. The contract can be terminated on six months’ notice. For accounting purposes, in the last financial year the management fee was charged 10% against the revenue account and 90% against the capital account.

Other administrative expenses for the year ended 30 September 2022 amounted to £960,000 (FY21 £846,000).

For the year ended 30 September 2022, the trust’s ongoing charges ratio was 0.68%, up from 0.61% for the prior year as the trust shrank in size (magnifying the effect of fixed overheads).

Capital structure

JFJ is a UK-domiciled investment trust with a premium listing on the main market of the London Stock Exchange. The company has 153,792,089 ordinary shares with voting rights. A further 7,455,989 ordinary shares are held in treasury.

The company’s accounting year end is 30 September and AGMs are usually held in the following January. The last was held on 12 January 2023.

Gearing

The company has the ability to use borrowing to gear the portfolio within the range of 5% net cash to 20% geared in normal market conditions.

The company’s gearing is facilitated by a ¥5bn floating rate revolving credit facility provided by Mizuho Bank and a series of senior secured loan notes:

- ¥2bn fixed rate 10-year series A senior secured loan notes at an annual coupon of 0.76% which will expire on 2nd August 2028.

- ¥2.5bn fixed rate 15-year series B senior secured loan notes at an annual coupon of 0.95% which will expire on 2nd August 2033.

- ¥2.5bn fixed rate 20-year series C senior secured loan notes at an annual coupon of 1.11% which will expire on 2nd August 2038.

- ¥2.5bn fixed rate 25-year series D senior secured loan notes at an annual coupon of 1.21% which will expire on 2nd August 2043.

- ¥3.5bn fixed rate 30-year series E senior secured loan notes at an annual coupon of 1.33% which will expire on 2nd August 2048.

JFJ did have a ¥13bn loan provided by Scotiabank, but this matured in December 2022 and the board is exploring options to replace this facility.

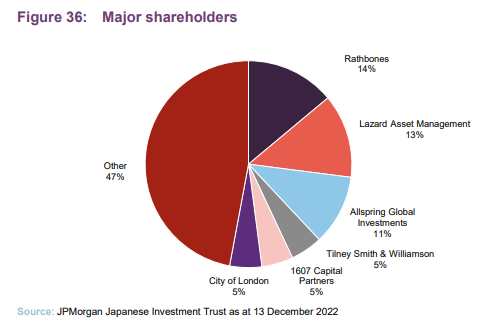

Major shareholders

Core management team

Nicholas Weindling is a country specialist for Japan equities and a member of the Japan team within the Emerging Markets and Asia Pacific (EMAP) Equities team based in Tokyo. Nicholas joined JPMorgan Asset Management in 2006 from Baillie Gifford in Edinburgh, where he worked initially as a UK large-cap analyst and latterly as a Japanese equities investment manager. Nicholas obtained a BA (Hons) in History from Cambridge University. He was made manager of JFJ in August 2010.

Miyako Urabe is a country specialist for Japan equities, and a member of the Japan team within the Emerging Markets and Asia Pacific (EMAP) Equities team based in Tokyo. She joined JPMAM in 2013 from Credit Suisse Securities Equity Sales desk in Tokyo as an Asia ex-Japan specialist. Miyako began her career at Morgan Stanley MUFG Securities covering Japan and Asia ex-Japan. She obtained a Bachelor’s degree in Economics from Keio University, Japan.

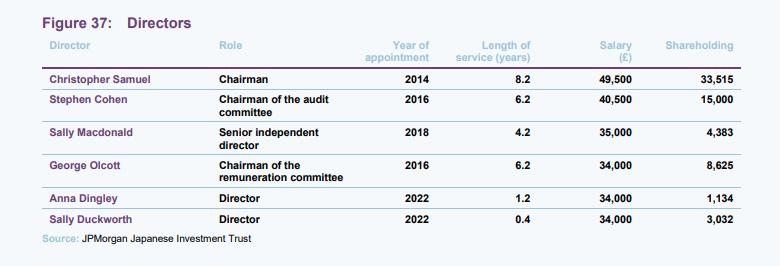

Board

Each of the directors is independent of the manager and they do not sit together on other boards.

Sir Stephen Gomersall retired from the board at the AGM in January 2023 and Sally Macdonald replaced him as senior independent director. The chairman Christopher Samuels has said that he intends to retire at the AGM in 2024 and the board has agreed that Stephen Cohen will take up the position. This will leave a vacancy for the audit chair which will be filled by Sally Duckworth, the most recent recruit to JFJ’s board.

Christopher Samuel (chairman)

Christopher became chairman in December 2018. He is currently chairman of BlackRock Throgmorton Trust Plc, and a non-executive director of Quilter Plc and UIL. Christopher was previously chief executive officer of Ignis Asset Management. He has considerable experience of financial services, including the investment management industry, over some 35 years and was based in Japan earlier in his career. He is a Chartered Accountant.

Stephen Cohen (chairman of the audit committee)

Stephen has had over 34 years in executive roles in asset management, including setting up two businesses in Japan and living there for seven years.

He managed Japanese equity portfolios for 10 years. He also latterly ran a Japanese equity activist business. Currently, he is a non-executive director of Schroder UK Public Private Trust Plc.

Sally Macdonald (senior independent director)

Sally has around 37 years’ experience in asset management, of which seven were in UK markets and the balance in Asian markets. She was head of Asian equities at Marlborough Fund Managers until 2021.

Sally is a non-executive director of Fidelity Asian Values Plc and Evelyn Partners Fund Solutions Ltd. Her previous board experience includes the Royal College of Nursing Foundation.

Dr. George Olcott (chairman of the remuneration committee)

George has 15 years of investment banking and asset management business experience in Japan and Asia with SG Warburg/UBS, and has served on the boards of a number of listed Japanese corporations as an independent director (currently on the board of Kirin Holdings, and on the audit and supervisory board of Toyota Motor Corporation). He is a specially appointed professor and vice president of Shizenkan University, and holds advisory roles at JR Central.

Anna Dingley (director)

Anna has a 25-year career spanning technology, finance and government sectors. She is the founder and managing director of Japan Connect Ltd, a Japanese business development consultancy which connects UK and Japanese entrepreneurs, investors, and executives. She is fluent in Japanese. Anna is a non-executive director of Nihon M&A Center Holdings Inc., a Tokyo Stock Exchange listed company in Japan. She was previously a trustee of The Japan Society in the UK.

Sally Duckworth (director)

Sally is an established entrepreneur, with over 20 years’ experience of working in, investing in or advising companies, predominantly with a technology focus. She qualified as a Chartered Accountant with PricewaterhouseCoopers LLP, working in its financial institutions audit group, before joining JPMorgan. Sally has been an investment manager in early-stage technology venture capital, co-founded an angel network and taken several C-suite roles in growth companies.

Sally is a non-executive director and the chair of audit for Mobeus VCT 2 Plc and the non-executive chair of StorMagic Ltd.

Previous publications

Readers may be interested in our previous publications on JFJ, which are listed in Figure 38 below. These are available to read on our website or by clicking the links in the table.

Figure 38: Previous publications

| Title | Note type | Publication date |

| Number one for a good reason | Initiation | 09 September 2020 |

| Strength to strength | Update | 09 December 2020 |

| Medium-term outlook undimmed | Update | 24 May 2021 |

| Bright long-term future | Annual overview | 17 December 2021 |

| Unjustified selloff creates opportunities | Update | 5 July 2022 |

Source: Marten & Co

Legal

This marketing communication has been prepared for JPMorgan Japanese Investment Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.