Unjustified selloff creates opportunities

JPMorgan Japanese Investment Trust (JFJ) has given back much of its recent outperformance. The managers select companies that they believe are high-quality and offer good growth prospects for JFJ’s portfolio. They say that these types of companies have experienced a sharp and unjustified selloff.

They note that the selloff mimics those of other countries such as the US and UK, but Japan does not appear to be afflicted by the high inflation or the threat of rising rates that triggered the stock market falls in other countries.

JFJ’s managers are seeing opportunities to buy stocks that they favour on attractive valuations. They say that they are also encouraged by the increasingly shareholder-friendly environment in the country; share buy backs and dividends are at record levels.

Capital growth from Japanese equities

JFJ aims to produce capital growth from a portfolio of Japanese equities and can use borrowing to gear the portfolio within the range of 5% net cash to 20% geared in normal market conditions.

Little logic to sharp selloff

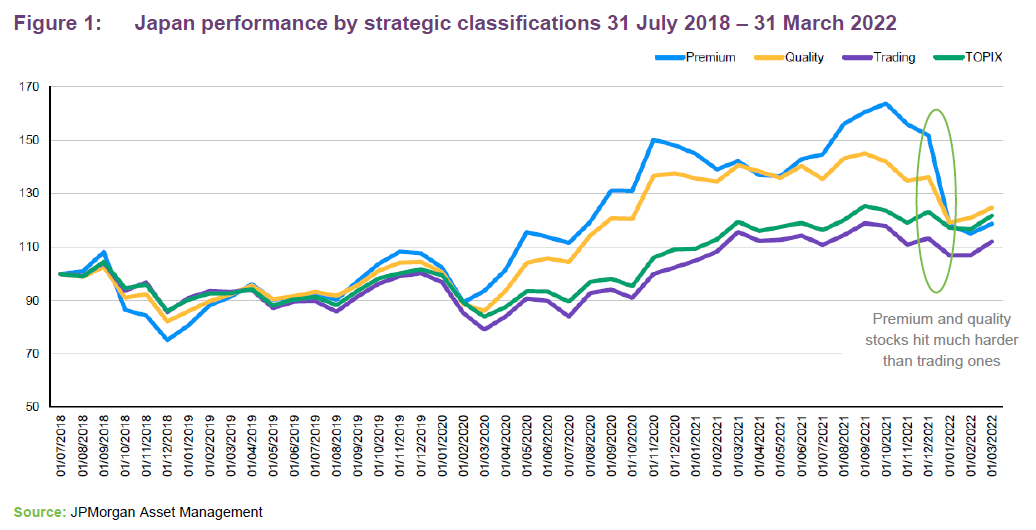

Since we last published, JFJ and other Japanese funds with portfolios focused on growing companies appear to have suffered a sharp reversal in fortune. Globally, there are concerns about rising inflation and interest rates, and this has hit the valuations of ‘growth’ stocks of the type favoured by JFJ’s managers. The inflation/interest rate issue is real for many parts of the world, notably the US, but the managers believe that this is not true of Japan. Nevertheless, growth stocks have sold off here as well. It is commonly said that the hardest-hit stocks have been early-stage and loss-making technology companies. However, the managers say that JFJ’s experience suggests that profitable, high-quality companies appear to have suffered disproportionately.

JPMorgan Asset Management (JPMAM) assigns stocks in JFJ’s universe to premium, quality and trading categorisations based on a range of metrics (see pages 9 to 11 of our annual overview note for more detail on JFJ’s investment process). Figure 1 shows how much sharper the sell-off in the premium-rated best-quality businesses has been.

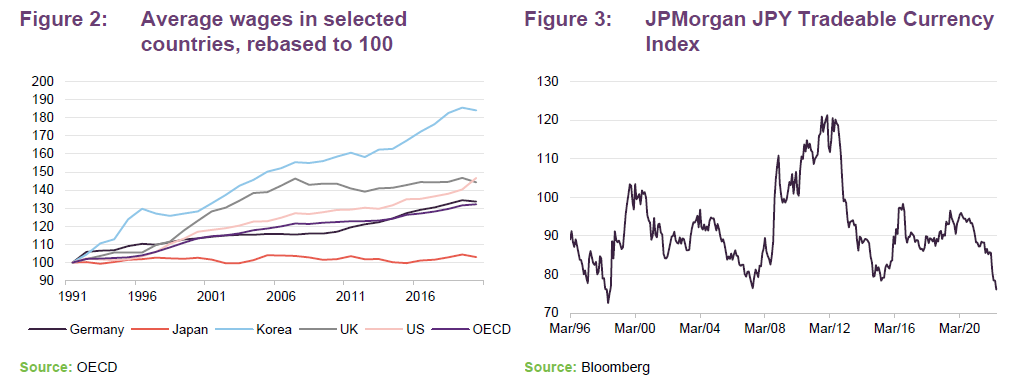

We talked to joint manager Nicholas Weindling before writing this note, he says that there are no signs of material inflation in Japan – Japanese CPI was running at 1.9% in May 2022. He says that what inflation there is, is cost-push inflation and it is not sticky. There has been no real increase in wages (+1.7% year-on-year in April); in fact, Japanese wages have only risen by about 3% per annum in nominal terms over the last 30 years.

He feels that it is hard to foresee a rise in interest rates either. Japan is sticking by its ultra-easy monetary policies. Given the policy contrast between Japan and the US, it is perhaps unsurprising that the yen has been weak, approaching multi-decade lows on the chart in Figure 3. However, that has had a significant negative effect on returns.

Exporters should be beneficiaries of the weak yen, but Nicholas says that for the most part, the best of these have already moved production closer to the end customer and so will not benefit as much. Some companies that JPMAM perceives as low quality – such as Mazda and Canon – will have a temporary boost because they still manufacture goods for export in Japan.

There are companies in the portfolio that will benefit, however, because they earn a lot of money overseas, examples that Nicholas gave us were Nintendo and Recruit Holdings.

Nicholas notes that the Japanese economy is still in the process of recovering from the effects of COVID-19. For example, the country has only recently decided to readmit tourists (from 10 June). However, restrictions still apply; visitors will only be allowed on package holidays, must be chaperoned, and will be required to wear masks (as most of the population still does), he adds.

No change is envisaged on the political front. Nicholas says that the new Prime Minister is popular, and whilst there is an election in a few weeks’ time, he does not foresee any shift in the balance of power.

Shareholder return revolution

Nicholas says that the real change, one that has accelerated recently, has been in the pace of shareholder friendly actions by companies. He thinks that this amounts to a shareholder return revolution. Share buybacks were up 65% year-on-year, on top of record levels. Companies in every sector are buying back stock – between 2% and 5% is common – as they begin to optimise their cash-heavy balance sheets.

Operationally, Nicholas says that there has been very little change to the fundamentals of over 90% of the stocks in the portfolio. The stocks have just de-rated. In some cases, he says, this is clearly counterintuitive, he sees additional drivers for growth in areas such as robotics and automation as inflation drives up wages in countries such as the US, for example.

The managers have a five-year view when assessing the merits of existing and potential investments. Nicholas says that, on that time frame, the best, premium-rated stocks now look the best value. Their share prices have been hit as hard, or sometimes even harder as they were in the indiscriminate sell-off of March 2020. That is apparent in the performance attribution figures on page 10. Of a dozen premium-rated companies in the portfolio, quite a few have been amongst the worst performers over 2022.

By contrast, in the managers’ eyes many of the lowest quality stocks look as though they may offer negative returns from here. On that basis, Nicholas thinks that this may be a good opportunity to back JFJ’s approach. Nicholas is not making any call on the timing of a turnaround, but he thinks the situation is unusual and exciting.

Asset allocation

Last year was one of very low turnover on the portfolio. This has picked up a little in 2022 year-to-date, as the managers take advantage of the opportunities that they believe are presenting themselves. Given their confidence in the longer-term outlook for the portfolio, gearing has been maintained in the low teens.

There were 63 holdings in the portfolio at 31 October 2021; that figure had fallen to 60 by end March 2022 as the portfolio continued to become a little more concentrated.

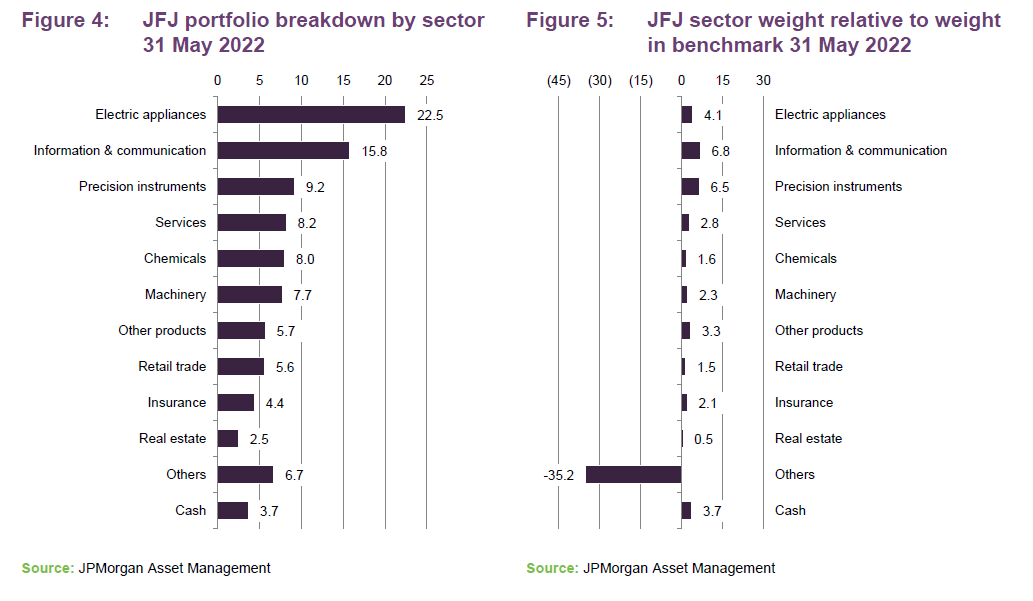

Sector weightings are driven by stock selection decisions. The allocation to services has fallen relative to the position at the end of October 2021, while the exposures to insurance, and chemicals are higher.

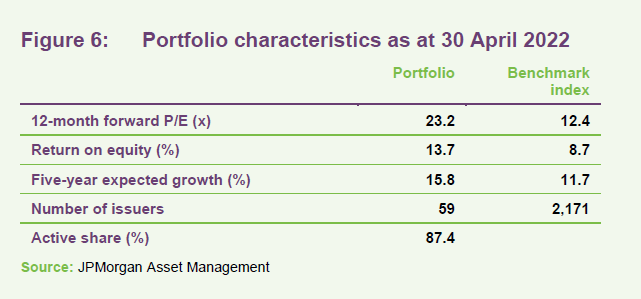

Figure 6 shows that the average stock in JFJ’s portfolio continues to be markedly more expensive than the average stock in the benchmark index, but the managers say that this is a price worth paying to access these faster-growing and better-quality businesses.

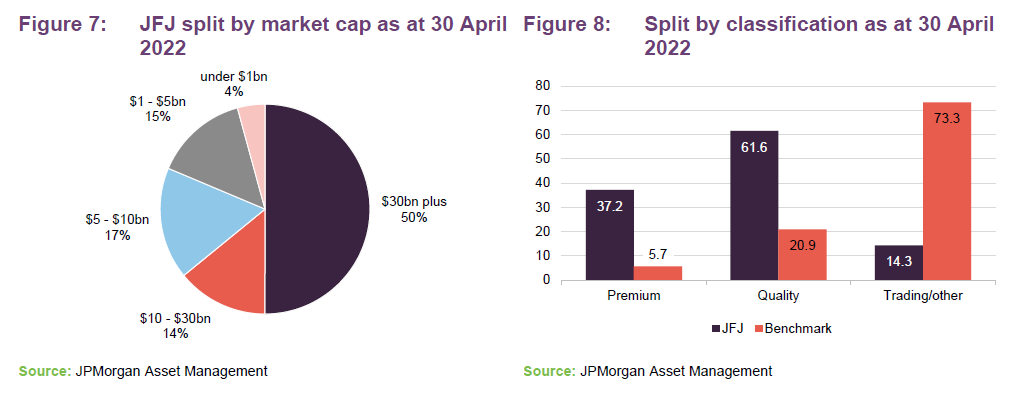

JFJ’s portfolio has a bias to the largest ($30bn plus) stocks relative to the benchmark, but an underweight exposure to the next tier ($10bn–$30bn).

Given the investment approach, JFJ has a strong bias to premium- and quality-rated companies. As discussed, the managers have taken advantage of adverse market conditions to add to the quality-rated segment.

Top 10 holdings

Since we last published (using data as at 30 November 2021), Recruit Holdings and MonotaRO have fallen out of the list of the 10-largest holdings. New holding Tokio Marine (see below) has been added to the portfolio and Nintendo, which was just outside the top 10 last November, has moved back up again.

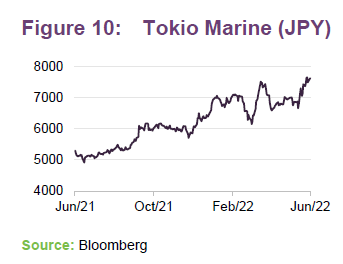

Tokio Marine

Tokio Marine (tokiomarinehd.com) is a stock that JFJ has held in the past. Nicholas says that JFJ bought back into the stock over the first quarter of 2022. Tokio Marine is the leading domestic non-life insurer and Nicholas says that it also has a good operation in the US covering niche lines of business. The non-life insurance market is effectively a three-player oligopoly in Japan, which helps margins.

FY2021 was a year of strong earnings growth (+47% in earnings per share, 15% on a normalised basis) for the company and growth is targeted to continue in FY2022 (+9%, 5% excluding the impact of fx). Dividends seem to be growing faster than normalised earnings (+28% in FY2021 and +18% in FY2022) and a JPY100bn share buyback is planned for FY2022.

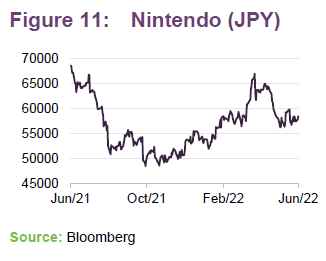

Nintendo

In May, Nintendo (nintendo.co.jp/ir/en) reported results for the financial year ended March 2022. They showed falling sales but marginally higher earnings per share (down 3.6% and up 0.3% respectively). The dividend payout ratio was increased from 50.2% to 55.1%. Nevertheless, the company still finished the period with over JPY1trn (almost £6bn) of cash on its balance sheet. Nicholas likes the stock because customer behaviour is shifting from buying physical games in cartridge form to downloading software. Nicholas says that allows for higher margins, However, part of Nintendo’s fortunes is still linked to sales of hardware, and shortages of semiconductors held back sales over the period. This is continuing into the current financial year. Rising semiconductor prices are having an impact. However, the weak yen is beneficial as Nintendo made $6.3bn of sales in dollars and €3.1bn of sales in euros over the last financial year.

Other investment activity

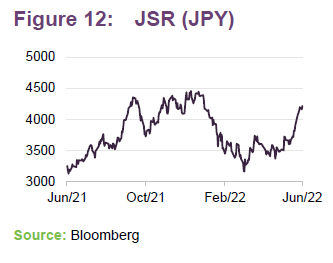

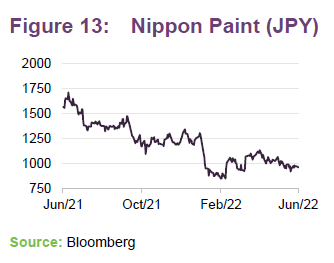

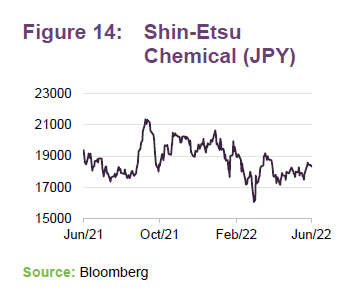

Over the course of the first quarter of 2022, new investments have been made in JSR Corp, Kissei Pharmaceutical, Nippon Paint and Tokio Marine. Additions were made to positions in Nippon Sanson and Shin-Etsu Chemical. Reductions were made to positions in Lasertec, Cyberagent, Sysmex and MonotaRO. JFJ sold out of Mercari, Giftee, HENNGE and Base. Some of these transactions are discussed below.

JSR

JSR – which is an acronym of Japan Synthetic Rubber (jsr.co.jp) has radically transformed its business; selling off its cyclical, low quality synthetic rubber operations (to ENEOS), returning some of the proceeds to shareholders and focusing on its much higher quality chemicals/semiconductors (digital solutions) and pharmaceutical manufacturing (life sciences) business. Nicholas thinks that the rump business – with high and stable margins, and good free cash flow – should attract a higher rating. The company’s management believe that the market is not appreciating the potential value of its life sciences business. The company has a strong balance sheet and is actively considering M&A opportunities.

Nippon Paint

Nippon Paint (nipponpaint-holdings.com/en/ir) has operations in 30 countries and geographical locations around the world, and is the leading manufacturer of paint sold in both Japan and China. Nippon Paint’s share price is over 60% below its November 2020 peak. Nicholas says that this is mainly a reaction to the slowdown in the Chinese property sector (not helped by the renewed lockdowns in the country) which could translate into lower demand for paint, and rising raw material costs (chiefly crude oil and naphtha). He sees this as a great opportunity to pick up a high-quality stock on a low rating.

The managers have put about 50bp into the stock for now and may top it up if the opportunity presents itself.

Shin-Etsu Chemical

Shin-Etsu Chemical (shinetsu.co.jp/en/ir) is the leading global producer of PVC resins, silicones used in a range of applications including electronics, silicon wafers used to make semiconductors, and other electronic materials. Nicholas notes that the company has been buying back stock and has increased its dividend. He sees potential in its silicon wafers business. Primarily, however, he is attracted by the potential for the company to thrive by making its balance sheet more efficient rather than via any operational improvements. Such opportunities offer reward for lower risk.

Nicholas notes that the company is doing well, with sales and net profits growing by 39% and 70% respectively for the year ended 31 March 2022. The global semiconductor shortage is reflective of increasing demand and should help underscore future growth.

Outright sales

Base is a Shopify-style business. HENGEE is a cloud security business that offers single sign-on login management. Giftee is an eGifts business serving the C2C and B2C markets. Mercari is a C2C online marketplace, a bit like Etsy. Nicholas says that all four were businesses where competitive threats emerged faster than he had expected.

Performance

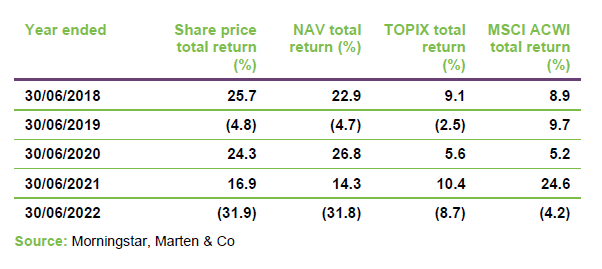

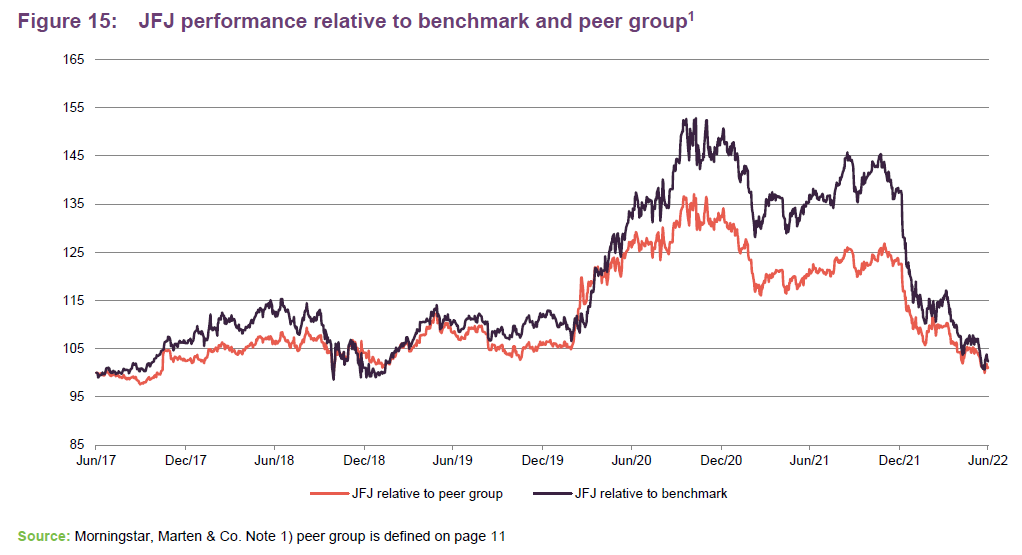

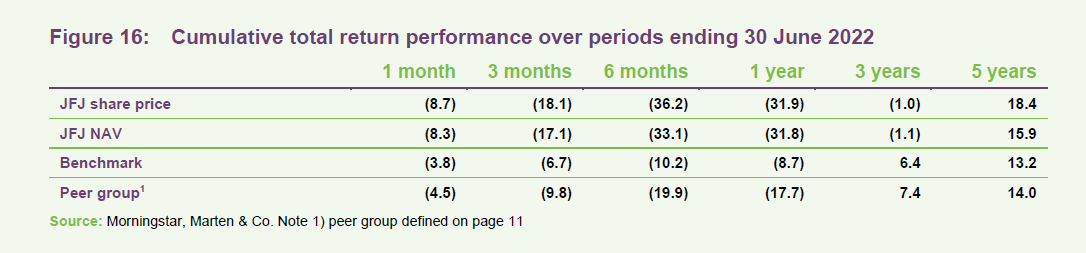

Nicholas describes the recent sell-off as brutal. He notes that JFJ has underperformed before – he feels that the nature of the portfolio, with its relatively-high active share, is such that it won’t track the benchmark index – but this has been extreme.

The pullback in performance relative to the benchmark has been more pronounced than the underperformance against the peer group. Other competing trusts also had a growth bias.

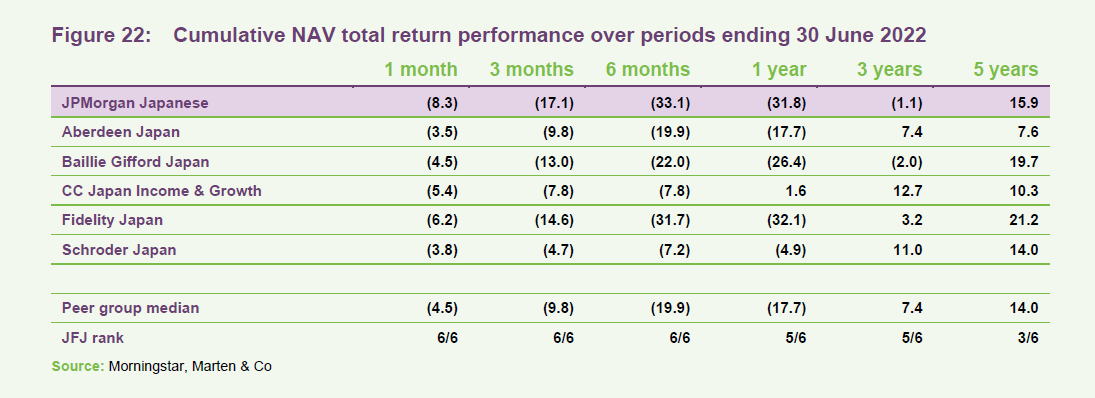

The net effect is that JFJ has given back its strong outperformance over 2020. The longer-term picture is better. Over five years, JFJ remains ahead of its benchmark and above-average within its peer group. Over 10 years to end June 2022, JFJ has returned 170%, which compares to 122% for the MSCI Japan Index.

Performance drivers

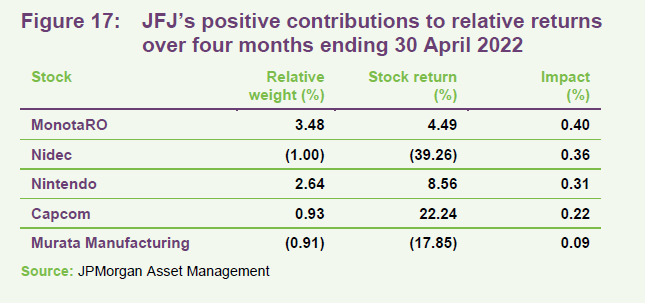

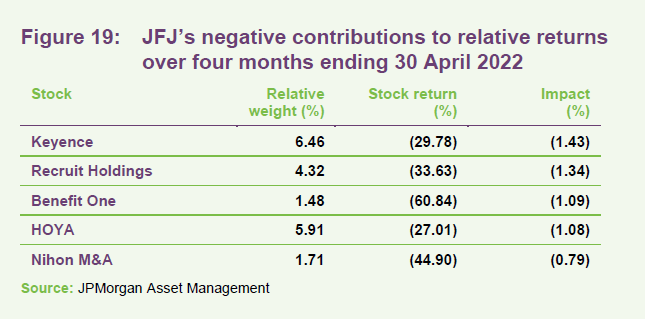

The managers have kindly supplied us with some performance attribution data which covers the four-month period to end April 2022. As sentiment turned, few stocks made a positive contribution to returns.

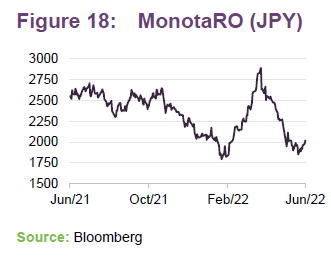

MonotaRO

MonotaRO (monotaro.com/en/ir) is an ecommerce business operating in the material distribution industry. Nicholas notes that it was one of few quality-rated businesses to outperform, and the managers elected to trim the position. MonotaRO is investing in its business to boost capacity, and they had feared that the market would take a short-term view by punishing lower profitability.

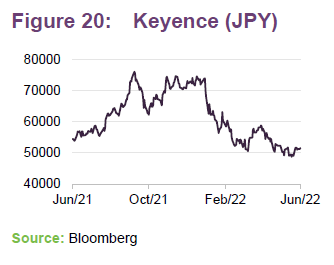

By contrast, many of JFJ’s other large positions, including many rated as premium, were hit quite hard. Chief of these was Keyence, JFJ’s longstanding largest exposure.

Keyence

We wrote about Keyence (keyence.co.uk) in our initiation note. It has been the largest position in the trust for many years and a holding since November 2011. The company makes sensors that support factory automation. Results for the year ended 31 March 2022 were very good, with sales up 40.3% and earnings per share up 53.8%. Keyence’s management seem fairly upbeat, anticipating growing demand for automation. The share price move is clearly at odds with this.

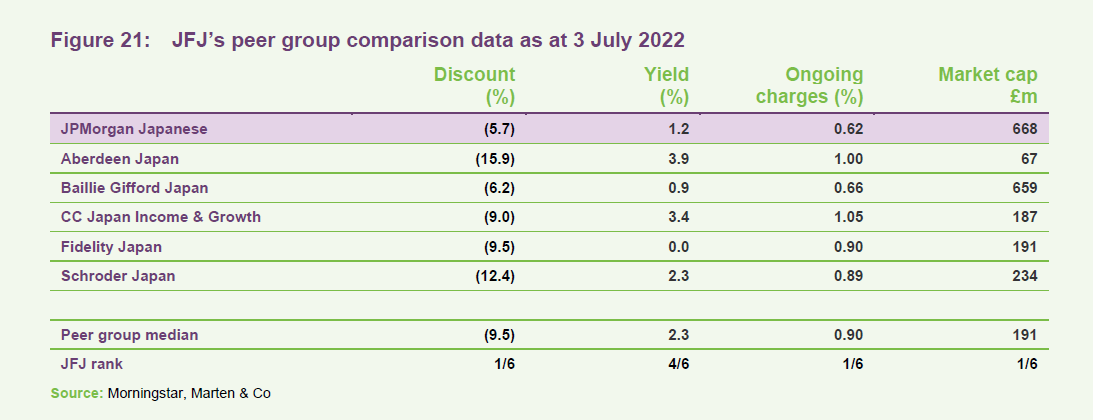

Peer group

For the purposes of this note, we have used the constituents of the AIC Japan sector as a peer group.

JFJ remains the largest and most liquid trust in its peer group. It also trades on one of the tightest discounts, although almost all of these funds are trading at wider discounts than they were when we last published. The exception is CC Japan Income & Growth, which – as its name implies – places more emphasis on income generation and consequently has the highest yield. By contrast, JFJ’s growth focus puts its yield towards the bottom end of the peer group. JFJ can boast the lowest ongoing charges ratio of the funds in this peer group.

The pullback in JFJ’s performance over 2022 has dragged down its returns over the medium-term putting JFJ at the bottom end of this group, but its longer-term numbers are better. Over five years, it is ahead of the peer group median. Over 10 years, it ranks third within this peer group.

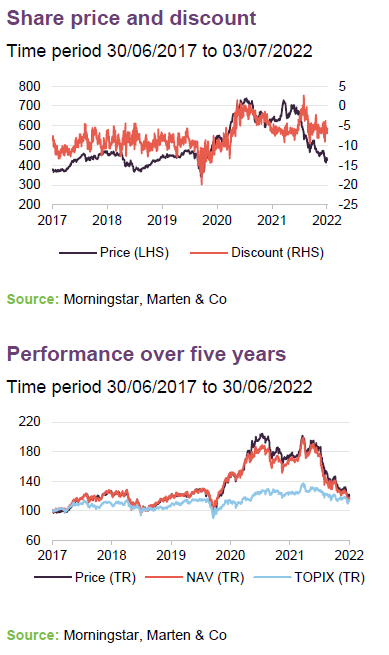

Discount

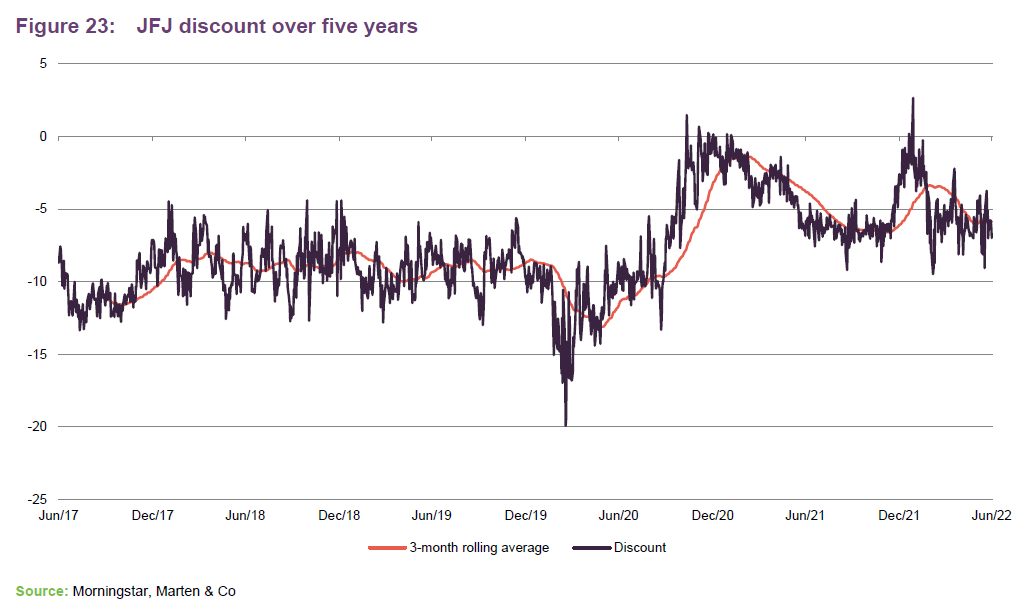

Over the 12 months to the end of June 2022, JFJ’s discount moved within a range of 9.5% discount to a premium of 2.7% and averaged a discount of 5.5%. At 3 July 2022, the discount was 5.7%.

As stated above, wider discounts are commonplace within JFJ’s peer group. The board monitors the discount closely and has both stepped up efforts to market the trust and authorised share buy backs; 250,000 shares were repurchased over May and a further 72,000 over June, for example. If investors come to believe, as the manager does, that the selloff in good-quality, high-growth Japanese companies is overdone, we could also see a narrowing of the discount, once again.

Fund profile

JPMorgan Japanese Investment Trust (JFJ or the trust) aims to achieve capital growth from investments in Japanese companies. For performance monitoring purposes, the trust is benchmarked against the returns of the Tokyo Stock Exchange Index (commonly known as TOPIX) in sterling.

The trust makes use of both long- and short-term borrowings with the aim of increasing returns.

Day-to-day investment management activity is the responsibility of JPMorgan Asset Management (Japan) Limited in Tokyo. The co-investment managers are Nicholas Weindling, who has had responsibility for JFJ’s portfolio for more than a decade, and Miyako Urabe, who was appointed co-manager in May 2019. They are supported by a well-resourced team of 26 investment professionals in Japan.

The investment emphasis is on identifying high-quality companies that are capable of compounding their earnings sustainably over the long term. That means investing in companies in growing industries that have strong balance sheets and are resilient in the face of macro-economic issues.

The managers recognise that JFJ’s performance may lag its benchmark in periods of market exuberance. However, the managers prefer to focus on identifying attractive stocks rather than attempting to time markets. Similarly, the trust’s gearing level is driven by availability of attractively priced stocks, not by macroeconomic considerations.

Benefitting from local knowledge

The investment team is based in Tokyo, where JPMorgan has had an office since 1969. Nicholas says that it is now relatively unusual for non-domestic asset managers to have a physical presence in Japan. Visiting companies is an integral part of the team’s investment process, but the pandemic has made it hard for anyone based outside the country to do likewise.

The team is 26-strong and is a mix of fund managers and analysts – roughly half and half. In addition, one of the strengths of the business is that the managers can also draw on the expertise of JPMorgan’s analytical teams around the world. This helps with competitive analysis, for example – it can also help identify trends on which Japan is behind the curve.

Previous publications

Readers may be interested in our previous publications on JFJ, which are listed in Figure 24 below. These are available to read on our website or by clicking the links in the table.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on JPMorgan Japanese Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.