JPMorgan Japanese Investment Trust

Investment companies | Update | 17 January 2024

Are we there yet?

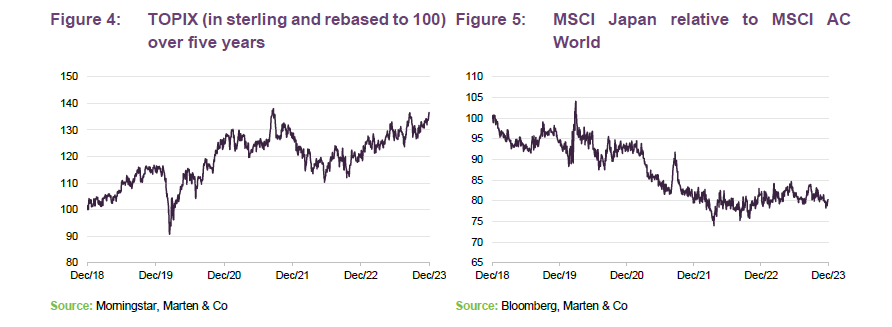

Optimism driven by rapidly developing corporate governance reforms, a divergent economy cycle, and still-negative interest rates likely contributed to a dramatic rally in benchmark Japanese indices over 2023, with the TOPIX index climbing to its highest level in more than 30 years.

The managers note that with the rally driven by more value-focused sectors of the market, returns for the JPMorgan Japanese Investment Trust (JFJ) failed to keep pace for much of the year due to a portfolio more targeted towards high-quality growth stocks. While many of these companies have been out of favour, they believe that this should not be seen as significant negative for investors given the alignment of the portfolio towards a range of secular themes. Perhaps promisingly in December, we began to see an inflection, with the JFJ portfolio up strongly.

The manager adds that many of these companies continue to trade on increasingly attractive valuations, which it believes lays the foundation for significant upside down the track.

Capital growth from Japanese equities

JFJ aims to produce capital growth from a portfolio of Japanese equities and can use borrowing to gear the portfolio within the range of 5% net cash to 20% geared in normal market conditions.

Fund profile

JPMorgan Japanese Investment Trust (JFJ or the trust) aims to achieve capital growth from investments in Japanese companies. For performance monitoring purposes, the trust is benchmarked against the returns of the Tokyo Stock Exchange Index (commonly known as TOPIX) in sterling.

The trust may make use of both long- and short-term borrowings with the aim of increasing returns.

Day-to-day investment management activity is the responsibility of JPMorgan Asset Management (Japan) Limited in Tokyo. The co-investment managers are Nicholas Weindling, who has had responsibility for JFJ’s portfolio for more than a decade, and Miyako Urabe, who was appointed co-manager in May 2019.

Further information about the trust is available at www.jpmjapanese.co.uk

The trust may make use of both long- and short-term borrowings with the aim of increasing returns.

Day-to-day investment management activity is the responsibility of JPMorgan Asset Management (Japan) Limited in Tokyo. The co-investment managers are Nicholas Weindling, who has had responsibility for JFJ’s portfolio for more than a decade, and Miyako Urabe, who was appointed co-manager in May 2019.

High-quality companies that are capable of compounding their earnings sustainably over the long term

The investment emphasis is on identifying high-quality companies that are capable of compounding their earnings sustainably over the long term. That means investing in companies in growing industries that have strong balance sheets and are resilient in the face of macro-economic issues.

Annual results

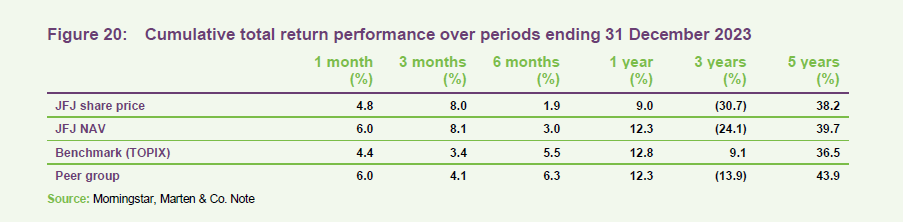

Over the financial year ended 30 September 2023, NAV total return for the benchmark TOPIX index was 29.3%, although the weakening yen meant returns in sterling were only 14.7%. In comparison, JFJ’s NAV total return (in sterling terms) was 8.0%, underperforming the benchmark by 6.7 percentage points, the bulk of which came in September. The manager says that this was driven by a period of outperformance from lower-quality sectors of the market which are not held in the JFJ portfolio. The share price total return, with dividends reinvested, was 6.4%, modestly widening the company’s discount.

Certainly, the managers note that the underperformance was disappointing, although they believe it is not a clear reflection of the quality of the portfolio, or its growth potential going forward.

Positively, over the three months to December 31, the company’s NAV has increased by 8.1% compared to a benchmark increase of 4.1%, while the share price increased by 8%.

Japan’s economy – changing of the guard?

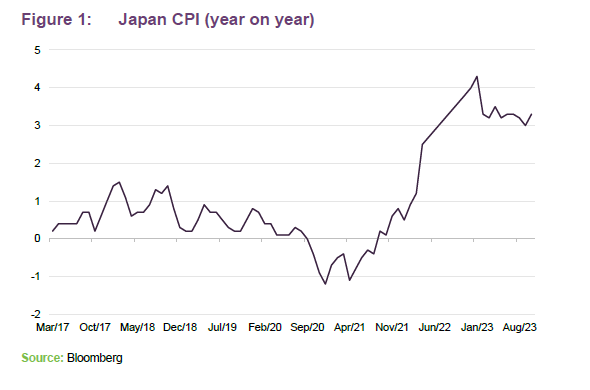

The managers believe there is a lot to like about the state of the Japanese economy today. While the rest of the developed world laments the first bout of real inflation for almost half a century, they say that Japan views rising prices as perhaps a sign of its economy finally escaping the long tail of its bubble and bust cycle of the 1980s and 90s.

Of course, they note, history is littered with investors inclined to believe that Japan’s struggles were set to reverse, only for markets to continue their long march sideways. However, as global growth appears to stutter in the facing of rising interest rates, Japan has remained resurgent, and the managers believe there are indications that we may finally be seeing a durable recovery in the world’s third-largest economy.

As the managers make clear, much of this is thanks to economic reforms driven by the late Shinzo Abe, which they say were aimed to address the stifling financial conservatism that has long plagued the Japanese market and kept global investors away. Among other things, the managers continue, these policies have led to broad sweeping corporate governance reforms, including changes to board structures and a dramatic rethink of capital allocations.

Almost 40% of the TOPIX index trades below book value

The managers add that these developments have gained considerable momentum over the last 12 months, with some of the country’s largest companies beginning to stir from decades of inaction, enacting buybacks and raising dividends to move the dial on shareholder returns which have long been stuck in neutral. In fact, almost 40% of the TOPIX index trades below book value, prompting the Tokyo Stock Exchange’s to announce that they will begin to delist companies unable to “comply or explain”’ valuations that remain below par in the coming years.

This governance evolution and change of focus to deliver positive shareholder returns has occurred in conjunction with a rise in domestic inflation not seen since the 90s. The managers note that while the rest of the world has struggled with uncontrolled price growth and rapidly rising interest rates, Japan has been swimming against the tide, maintaining loose monetary policy to help stimulate an economy which has been stuck in a deflationary quagmire for over two decades, slowly suffocating the broader economy. Whilst the bulk of this inflation has so far been driven by cost-push factors, the managers say they are seeing signs of demand-driven wage increases and a more sustainable rise in prices. Importantly, the BOJ noted recently that Japan’s output gap – the gap between potential growth and actual growth – has closed for the first time in over 20 years. In conjunction, the managers believe that these factors can help set the foundation for a positive cycle of domestic consumption-driven growth that has long eluded the economy.

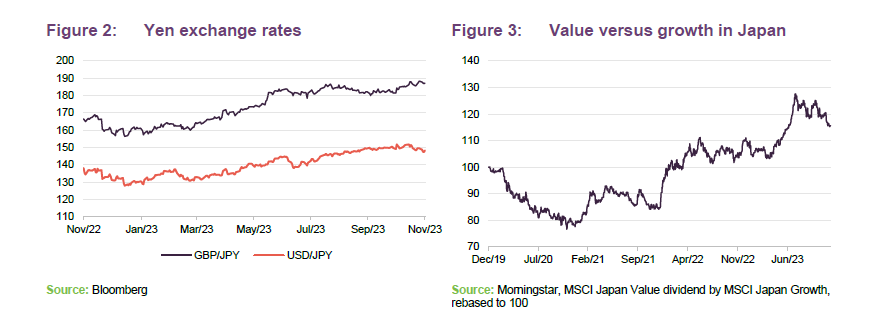

While the managers suggest that BOJ policy settings have helped deliver long-sought price growth, they note that ongoing interventions and foreign exchange exuberance have caused the Japanese yen to plummet sharply, holding back the sterling returns of JFJ and the broader Japanese market. It appears that the shift in the yen has now reached extreme levels (The Economist’s Big Mac Index suggests it is 43% undervalued) although some commentators believe we are now approaching the peak of the global hiking cycle, which could help support the currency.

Domestic factors also look set to boost the yen and with inflation now tracking above target for more than a year

It is possible that domestic factors could also boost the yen and with inflation now tracking above target for more than a year, and the BOJ beginning to tweak its yield curve control policy, the managers believe it is possible that we are set to wave goodbye to the last bastion of the global experiment of significantly negative interest rates.

More than just capital market reforms

The managers believe that in addition to accelerating structural changes to its investment landscape, and broadly positive news on inflation, the Japanese economy also stands to benefit from the ongoing cyclical recovery following the lifting of its pandemic restrictions. Unlike many of the world’s other developed markets, these continued as late as May 2023, which as the managers note, ground domestic demand and tourism – which is becoming an increasingly important component of the economy, worth an estimated 2.2% of GDP – to a standstill.

The Japanese economy also stands to benefit from the ongoing cyclical recovery following the lifting of its pandemic restrictions.

So, the managers continue, while US growth is slowing and the UK and Europe remain mired in stagflation (albeit with some recent, positive developments on the inflation front), they believe Japan looks in broadly good shape, boosted by strong and accelerating capex (thanks to the aforementioned economic reforms), burgeoning wage growth, and the ongoing domestic recovery following the end of the pandemic. They continue that this means Japan’s economic cycle is nicely desynced from other countries and could provide a further point of difference for investors looking for a global diversifier, adding that this is a role traditionally played by China, which due to a raft of geopolitical issues and internal disruption is deemed now to be un-investable by many market participants.

As Japan’s largest trading partner, the managers note that China still has a key role to play, and its economy continues to struggle. However, they argue that the world’s second-largest economy could surprise to the upside in 2024 the same way it surprised to the downside in 2023.

They add that additional momentum could come from longer term structural drivers including demographics and onshoring amid the global restructuring of supply chains (which we discuss in more detail on page 8). Each of these factors could have a section to itself; however, the net effect, they add, is a broad swathe of encouraging developments which should have a considerable, positive impact on the Japanese economy, and in particular, those companies able to leverage this growth, going forward.

The managers point out that this positive sentiment and the recognition of the structural drivers of Japan’s resurgence have led to a record rally in Japanese shares with the TOPIX index climbing to a 30-year high, up 28% in yen terms over 2023.

However, this does need to be put in the context of both the weaking currency, as noted above, and its historical underperformance (the index remains 20% below its all-time high from 1989).

The managers also note that despite the economic disparity between Japan, and the rest of the world, the recent rally in the TOPIX has broadly followed global trends, with large caps, and more liquid sectors of the market in favour over small caps and growth. They add that the weakening yen has also helped boost the profits of some low-quality export cyclicals, while the potential for monetary policy normalisation has improved the outlook for financial companies, another cyclical sector characterised by intense competition and commoditised product offerings.

The recent rally in the TOPIX has broadly followed global trends, with large caps, and more liquid sectors of the market outperforming

Continuing, they say that this has meant that many of what they define as ‘old Japan’ companies, which operate in stagnant or declining industries, have outperformed. Adding that these are not just outdated industries such as steel and department stores, but also companies like automakers, who face big challenges in adapting to the shift to electric vehicles and self-driving cars, and even some once-dominant consumer electronics companies, who are being displaced by other Asian competitors.

The managers note that, somewhat counterintuitively, this has meant that sectors of the market you might expect to benefit most from the multitude of structural tailwinds driving the Japanese economy, such as quality and growth that combine long-term structural growth with significant potential from improved governance, have underperformed, even though the managers believe these are the best-positioned to benefit in the long run. Unfortunately for JFJ, its these companies which tend to feature heavily in its portfolio.

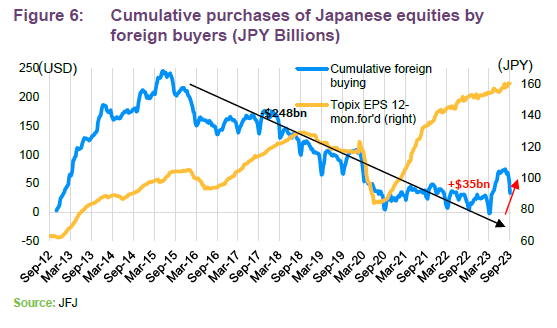

Still, despite this, the managers note that there remain positives, with benchmark returns helping to bring the economy back into the minds of global investors. Foreign purchases of Japanese equities had been trending down for almost 10 years, possibly due to years of underperformance and allocations are dramatically underweight relative to the economy’s share of global equity value. Recently, however, the managers note that there are signs of a positive inflection, as shown in Figure 6, which they suggest is a sign that investors may be starting to buy into the idea that the era of Japanese underperformance is coming to an end.

The managers note that these flows have so far been concentrated in more liquid sectors of the market. However, they believe that as the world continues to struggle with inflation and slowing growth, that the stability and counter cyclical exposure provided by Japan should become increasingly attractive, leading to a sustained and broad-based impulse from foreign investors.

They add that valuations and earnings remain supportive of these flows, despite the market now at a 30-year high, with the TOPIX index trading on a 15x earnings multiple (on a forward PE basis). They believe that this is thanks predominantly to the ongoing earnings growth of its listed companies which, as the managers point out, have not been constrained by the stagnation of the Japanese economy. For JFJ, the managers say that the growth expectations for its portfolio are even stronger, further supporting valuations.

Key themes within the portfolio

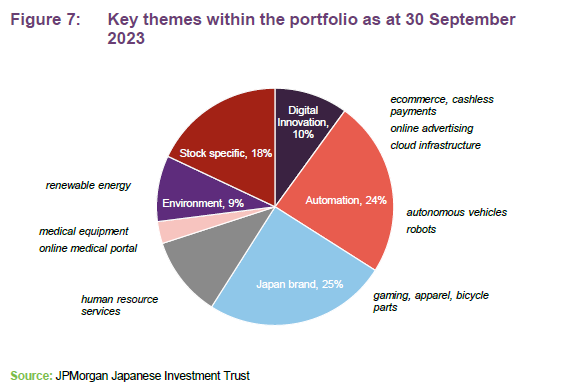

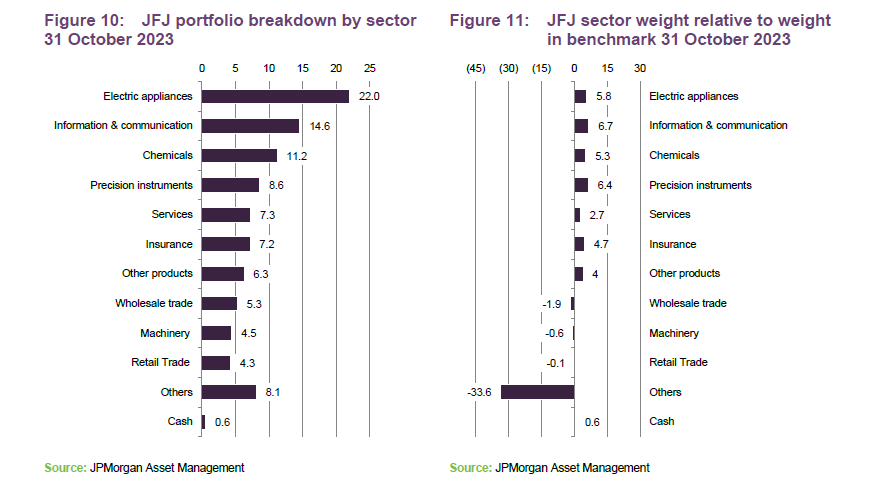

The managers note that while JFJ may not have reaped all the benefits of the 2023 Japanese market rally, they do not see that as a significant negative for investors with a longer-term horizon given the alignment of the portfolio towards a range of secular growth themes that they say do not reflect the composition of the broader market. Promisingly, they saw a positive inflection in many of these sectors at the end of the year. The managers break these into several categories which have been identified as being able to provide long term structural growth – digital innovation, automation, Japan brand, demographic change, medtech, environment and stock specific.

Large swathes of the market represent ‘old Japan’ and these face structural challenges to growth

In our previous note the managers highlighted the need for Japan to modernise its economy, focusing on the lack of penetration of technologies considered part of everyday life in many western countries, such as ecommerce (only 22.4% of Japanese medium sized companies are selling online), and cashless payments (worth just 35% of total sales). The managers note that this focus on digital innovation remains a key component of the JFJ portfolio; however, despite being a laggard in some areas, there are other sectors where Japan is a world leader in terms of technological capability. One such example which they provide is factory automation and hardware technology, currently the second largest of the company’s thematic exposures.

Given the wealth of tailwinds which the managers say include deglobalisation, onshoring, and the rising cost of labour, it is perhaps no surprise that JFJ has such an overweight to the sector. As the managers note, the pandemic, and subsequent events such as widespread supply chain shortages, the conflict in Ukraine and mounting US/China geo-political tensions, have increased companies’ desire for greater control over supply chains, whether it be increasing vertical integration or shifting production. They add that with wage inflation now an issue in the US and other markets, businesses establishing new production plants and warehouses have a stronger incentive to incorporate factory automation into these facilities wherever feasible. The managers also point out that the scale of this re-tooling of global supply chains is immense and Japan is fortunate to be home to some of the world’s leading automation companies, including Keyence and SMC which are both active positions for JFJ.

Semiconductors are another sector where the managers believe structural tailwinds, including the rapidly growing demand for data processing and storage, 5G, and electric vehicles will drive long-term returns. As with automation, they expect that the re-evaluation of global supply chains is a further catalyst for semiconductors with the strategic importance of these assets for both defence and technological development leading to significant global capital investment to shore up supply security and ‘technological sovereignty’. The managers note that Japan has benefitted from these developments, strengthening its technological alliances with countries including South Korea, Taiwan, and the US.

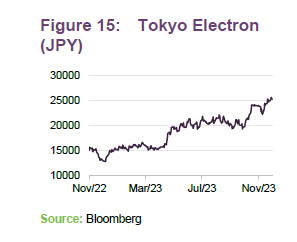

JFJ holds significant exposure investments in Tokyo Electron, Japan Material, and Shin-Etsu Chemical and we discuss some of these themes in more detail in our asset allocation segment on page 14.

Investment process

Unconstrained approach

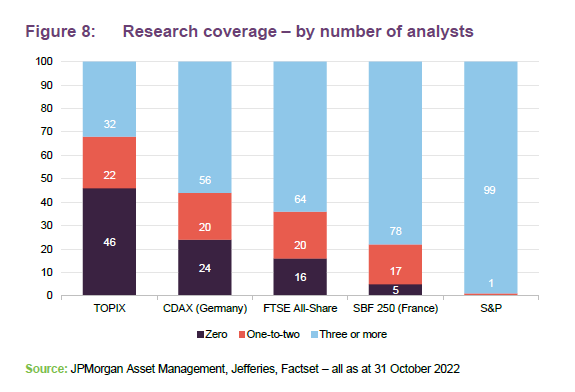

The managers note that one of the most appealing aspects of investment in Japan is the opportunity to unearth previously undiscovered gems in its broad, liquid markets. In order to facilitate this, they say that the company implements a ‘boots on the ground’ approach to its investments, a process which they say is becoming increasingly rare. Leveraging its local, well-resourced team, they aim to meet with as many companies as possible, attending thousands of meetings in a typical year, which they say is crucial given the breadth of the market – the benchmark TOPIX index consists of 2,000 companies and a total of 4,000 companies are listed on the Tokyo Stock Exchange.

Deep pool of under-researched stocks creates opportunities

The managers add that not only does this provide them with unique insights into the rapidly changing corporate environment, but it allows them to tap into a market that they say remains incredibly inefficient and therefore highly conducive to active investment and price discovery, highlighted by the company’s active share which as of 30 September 2023 was 92%.

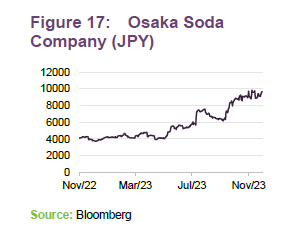

Almost 46% of companies within the TOPIX index have zero analyst coverage compared to just 2% of the S&P 1500, and almost 70% of companies with a market cap in excess of $10m are covered by three or fewer analysts, which the managers say highlights the wealth of opportunity that exists. An example of this is the Osaka Soda Company, which we discuss in more detail on page 10. The company is a producer of raw materials for new, fast-growing obesity drugs, and yet garners virtually no coverage from analysts despite shares rallying over 100% in the last six months alone.

The managers say that while It may sound somewhat sensationalistic, given the wealth of opportunity that exists in the rapidly developing Japanese market, and the secular factors driving returns for its more dynamic themes, they argue there has never been a better time to be an active investor in Japan. They believe that this opportunity is made more compelling by increasingly attractive valuations driven by the ongoing earnings growth of companies like Osako Soda.

Asset allocation

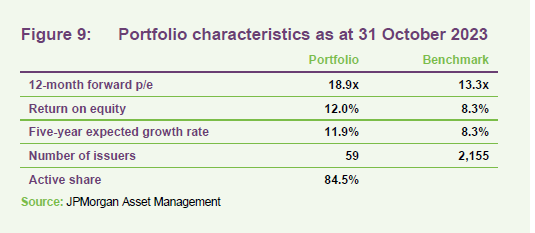

The managers note that on average, the stocks in JFJ’s portfolio are more expensive than those in the benchmark, reflecting their much higher returns on equity and their superior growth prospects. They say that these sectors of the market have been hit hard by negative sentiment over the past 12-24 months and have generally missed out on the more recent market recovery.

The movement of JFJ’s valuation multiples highlight the extent of this de-rating with the current p/e of 18.9x having almost halved from where it began in 2022, although, the managers note that allocation decisions within the portfolio have also played a role. For comparison, the average stock in the benchmark has moved only slightly, from 13.8x in 2022 to 13.3x today, which, they say reflects the uneven nature of the recent recovery.

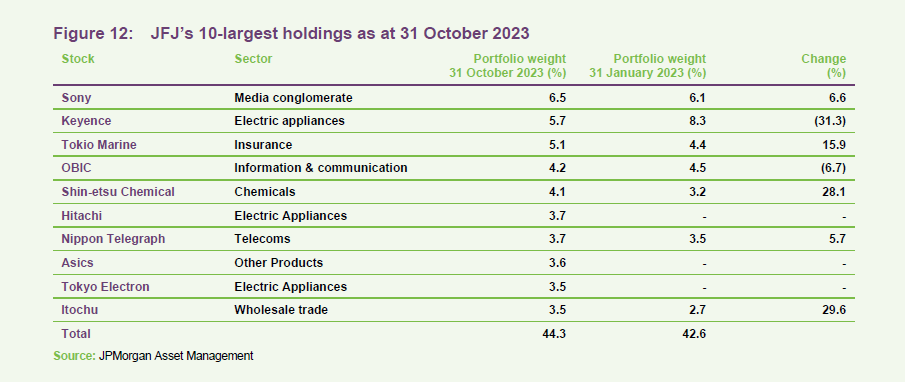

Top 10 holdings

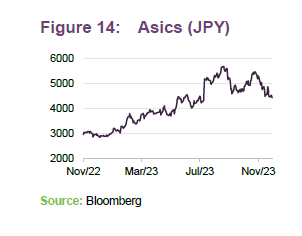

Since 31 January 2023, three stocks have dropped out of the list of JFJ’s 10-largest holdings – Nintendo, Hoya, and Nomura Research Institute (although all three are still large positions within the portfolio) – and they have been replaced by Hitachi, Asics. and Tokyo Electron.

The concentration of the portfolio has also increased slightly, with the 10-largest holdings accounting for 44.3% of the portfolio compared to 42.6%.

Looking at the new positions in the top 10 in detail:

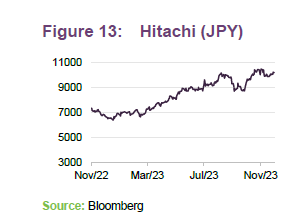

Hitachi

Hitachi (hitachi.com/) is a relatively recent addition to the portfolio, with JFJ opening a position in 2021 following the company’s acquisition of ABB power grids. The managers note that this was a prime opportunity to increase JFJ’s exposure to the renewables sector. They say that the company is now positioned as a global leader in power transmission, an industry which they believe has a long growth trajectory given the increasing infrastructure requirements of renewables which need three-to-four times more transmission lines than thermal power sources. The acquisition also increased the company’s performance on its carbon scoreboard.

The managers note that Hitachi is much more than just a renewable energy play, with the global conglomerate boasting a diverse product range from nuclear power to kitchen appliances, although with a focus more towards industrial electronics and machinery.

They add that the company has embraced Japan’s sweeping corporate governance reforms having already made huge strides by reducing the number of its listed subsidiaries from nine to zero and with a resolute focus on free cash flow, the managers expect much more emphasis on shareholder returns going forward.

Notably, they continue, its core IT business is profitable and growing and the company has been accelerating growth through its digital, green and innovation sectors.

They also add that the company has also been a prime beneficiary of the recent rally of large caps and more liquid sectors of the Japanese market, with the stock up 58% in 2023. Despite the rally, earnings multiples remain well below peer group averages, although the company does trade at a slight premium to its historic levels.

ASICS

ASICS (corp.asics.com/) is manufacturers and distributors of sporting goods and equipment. The managers note that the company has gone through a challenging period over the last few years, going back to 2015 when they targeted an ambitions customer base and product expansion in an attempt to compete with larger competitors such as Nike and Adidas. Unfortunately, they continue, the company struggled to manage the cost of this effort while several long-term investments failed to deliver the desired results, weighing heavily on growth.

Following a change in management a few years ago, the managers highlight that ASICS re-focused on its core product, running shoes, while also targeting investments in China and it its digital platform. It appears that driven by these changes, earnings and revenue have increased considerably, culminating in annualised revenue growth over the last three years of around 20%. This has also coincided with the broader rally in Japanese equities with shares up 75% over the past year. Thanks to improving profitability, earnings multiples remain roughly in line with both recent averages and its broader peer group.

Tokyo Electron

Tokyo Electron is one of the world’s largest manufacturers of semiconductor production equipment with a global market split between China, Taiwan, South Korea, the US, and Japan. The managers note that the company has benefitted handsomely from the rise in demand for data processing and storage, and the announcement of massive capital expenditure programs from semiconductor fabrication plants and equipment manufacturers such as TSMC, Intel, ASML, and Samsung. Over the last three years shares in the company are up 94% and while there has been some suggestion of overcapacity in the cyclical semiconductor market, they believe that the long-term drivers for the sector are immense. Dubbed the ‘semi-conductor super cycle’, they say that the demand for the technology is increasing exponentially as the silicon content increases across a broad range of end devices from the CPUs, GPUs, and AI accelerators required for data centres, to 5G smartphones and EVs.

The managers do point out that given the traditionally cyclical nature of the semiconductor sector, valuation multiples can be slightly misleading, so while current earnings and cashflow multiples appear well ahead of historic averages, this may not be a true representation of the underlying value of the Tokyo Electron, particularly given the secular drivers behind the sector.

Other portfolio activity

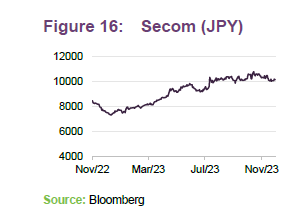

JFJ has also initiated several new holdings since our last note, most notably Secom, with other additions including Seven & I Holdings, T & D Holdings, Japan Material, and Unicharm. Several other holdings have also seen considerable moves in their respective share prices, including Itochu and Osaka Soda Company.

JFJ has also initiated several new holdings since our last note, mostly notably Secom

These purchases were funded by the outright sale of a number of holdings whose investment cases had deteriorated, including Nihon M&A Center, Nippon Prologis REIT, and JSR. The company also sold stakes in Digital Garage, Misumi, CyberAgent, M3, and Oriental Land.

In addition to the general derating of higher growth sectors of the market, the net effect of these purchases and sales is that the JFJ portfolio now trades on a significantly lower multiple than over the last three years, at under 20x earnings versus over 30x at the peak. Meanwhile, its quality and growth characteristics are unchanged, with the portfolio generating an ROE almost 38% higher than the market.

Secom

Secom (secom.plc.uk/) controls what the managers describe as a virtual duopoly with over a 50% market share of the Japanese security market for households and corporates. Positive free cash flow has allowed the company’s net cash to grow from around JPY 20bn to JPY 620bn over the last 20 years, which is over 25% of the market cap. The managers believe this provides a good example of the need for capital allocation reforms. With these gathering steam, the company has announced two major buybacks, for the first time in 15 years, worth 4% of its outstanding shares, while also rising prices for the first time in 20 years.

The manager believes the company is an excellent way to gain exposure to Japan’s rapidly evolving corporate environment compromising the growth prospects of the trust.

Osaka Soda Company

Osaka Soda Company is the world’s number one producer of silica gel used in producing GLP-1 obesity drugs. As noted on page 9, the company is one of thousands of Japanese companies with very limited coverage by sell-side analysts, despite what the managers highlight as very unique market positioning.

Its shares have taken off thanks to what the managers believe is the development and demand of these new obesity drugs, up over 300% over the last three years. Despite this, the managers say that the company maintains reasonable fundamentals even after manufacturing troubles caused a considerable drop in profitability earlier in the year.

Earnings multiples are currently above long-term averages at around 28x, however the managers say these are predicted to fall to 19x in 2025 given the company’s growth prospects. The company also has double-digit operating margins and ROE which is backed by what the managers describe as a range of niche but globally sought-after products.

The managers note that the company also maintains an impressive balance sheet, as is common in Japan, with a net cash position and equity ratio above 70%. As highlighted with Secom, recent reforms have also led to an enhanced shareholder return policy with the company targeting a dividend to total payout ratio of 40%.

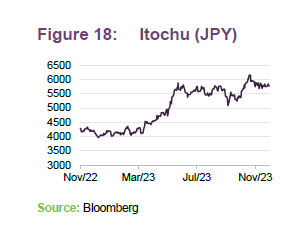

Itochu

Itochu (itochu.co.jp) is one of Japan’s largest conglomerates, with a market cap of over JPY9trn. Around 35% of company sales are related to the food sector, both products, and distribution, with a further 25% in energy and chemicals. The portfolio also includes ownership of, investments in, or distribution arrangements with, many well-known global brands, such as Isuzu, Mazda, and Converse, and convenience store business FamilyMart. Famously, it has been a recent target of Warren Buffet’s Berkshire Hathaway, which disclosed a 5% stake in the company.

The managers note that the majority of its portfolio is in stable, cashflow-generating businesses that have benefitted from the steady normalisation of global demand and supply chains over the past few years, with revenue now almost 20% greater than before the pandemic. They believe that the company stands to be a key beneficiary of the ongoing corporate governance reforms, with the JFJ team believing its focus on steady profit growth, ROE and desire to improve shareholder returns as particularly noteworthy.

They say that the stock has benefitted from its scale and status as a figurehead of the Japanese market, with shares up almost 40% over the past year (in yen terms), and while this rally has pushed up cash flow and earnings multiples above long-run averages, they say its P/E multiple of 11.5x remains cheap, and well below broader market averages of around 14x.

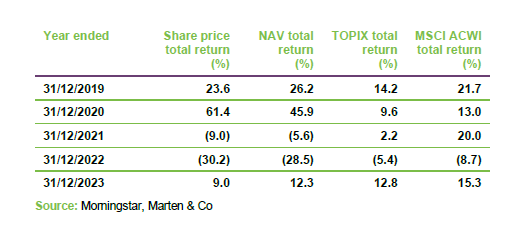

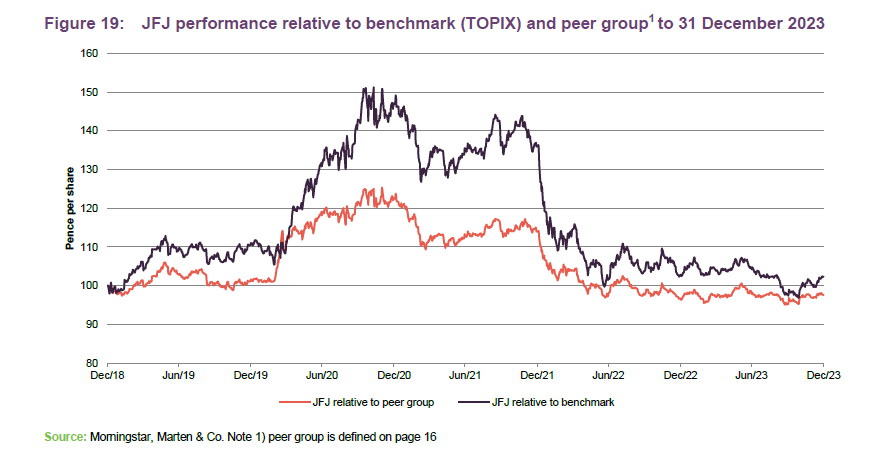

Performance

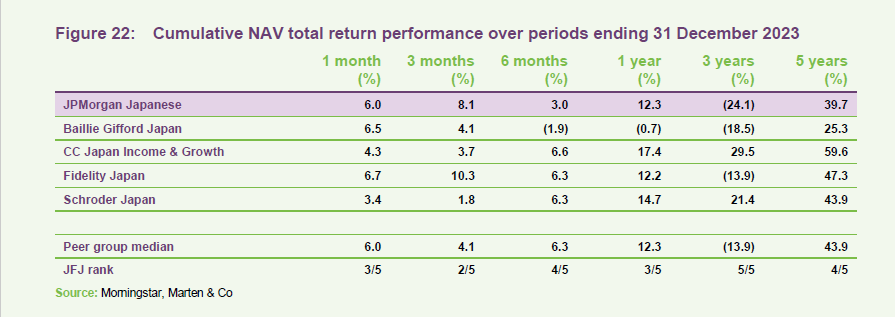

The managers say that the ongoing rotation away from growth orientated stocks and a shift towards more defensive positioning over the last couple of years has weighed on the performance of the JFJ portfolio. This has left the company marginally behind its immediate peer group over the five-year period to 31 December 2023, although it remains ahead of the wider TOPIX index, thanks predominantly to strong returns towards the end of the year. While the managers note that the modest underperformance of the peer group remains frustrating, they do feel the current portfolio is well positioned to generate positive returns going forward, given its exposure to a number of strong and developing tailwinds, as discussed in the portfolio section above. The believe that this view is supported by recent returns over the last few months, which highlight JFJ’s potential upside.

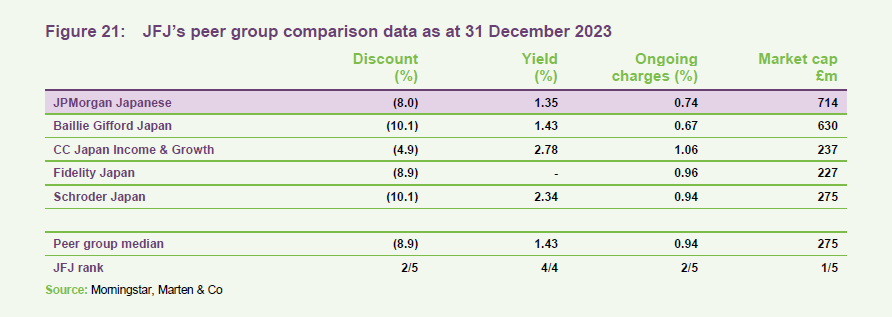

Peer group

For the purposes of this note we have used the constituents of the AIC Japan sector as a peer group. The trusts listed here have roughly similar objectives except for CC Japan Income & Growth, which – as its name implies – tends to place more emphasis on income generation, and consequently has the highest yield. By contrast, JFJ’s growth focus puts its yield at the bottom end of the peer group, although the fund is not managed to produce a yield. It is also worth pointing out that since our last note, the Aberdeen Japan Trust has merged with Nippon Active Value and Atlantis Japan Trust and is therefore no longer included in the peer group.

Up-to-date information on JFJ and its peer group is available on our website

JFJ remains the largest and most liquid trust in its peer group, and this helps keep its ongoing charges ratio towards the bottom end of the table. The discount is also one of the lowest, but the range here is quite tight.

The managers note that the setback experienced in growth investing is the main influence on relative returns within this peer group, with the most value-oriented fund, CC Japan Income & Growth, leading the sector’s long term NAV returns. This is a dramatic reversal from when we published our December 2021 note, with JFJ leading the sector over most time periods, and the more income-focused trusts languishing towards the bottom of the table. Promisingly, the managers note that over the last few months we have seen signs of a reversion in this trend.

As the managers discussed above, the medium-term outperformance of broader Japanese Indices is not fully reflected in the JFJ portfolio. Whilst acknowledging that this is unfortunate, the managers do not believe this should be seen in an entirely negative light. As an example, they say that one of the largest detractors in company’s most recent quarter was its significant underweight to Toyota Motor Corporation. The stock is up 53% year to date thanks to what they say is a combination of moderating supply constraints, a weak yen helping inflate export revenues, and excitement over the prospects of its solid-state battery research. Despite the short-term growth, the managers view the company as one of Japan’s old guard of industries in structural decline, struggling to adapt to the modern world. In Toyota’s case, they say that is the shift to electric vehicles and self-driving cars.

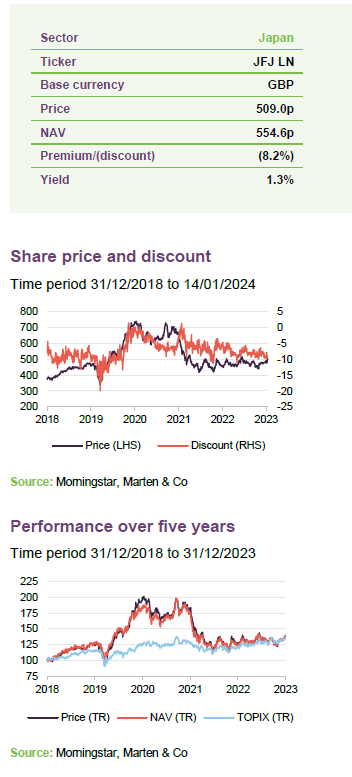

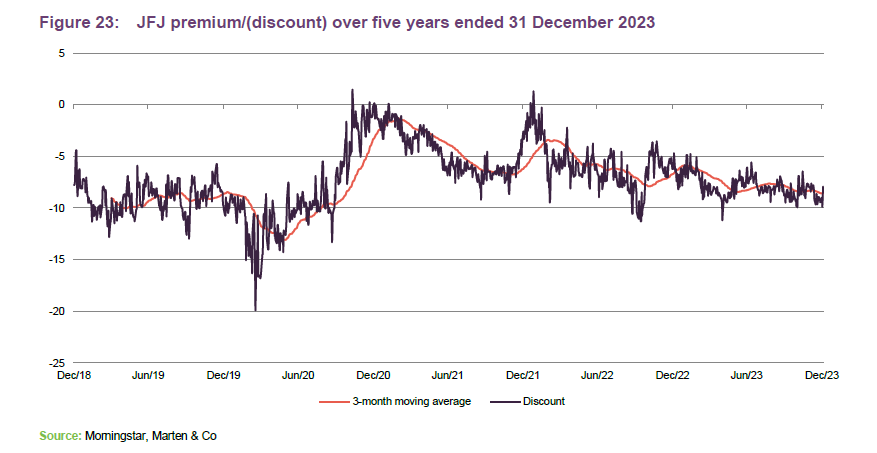

Discount

Over the 12 months to the end of December 2023, JFJ’s discount moved within a range of a 11.2% discount and a 4.7% discount, averaging 7.9%. At 15 January 2024, the discount was 8.2%.

The managers say that this relatively tight band should be seen as a positive given the volatility of previous years, and will hopefully set the stage for an inflection towards par and an eventual premium as the fund’s long-term strategy beds in.

The board monitors the discount closely and will authorise share buybacks when it feels that these are appropriate. To this end, during the past financial year, a total of 3,870,000 shares (2.4% of shares in issue) were repurchased.

Gearing

The company has the ability to use borrowing to gear the portfolio within the range of 5% net cash to 20%. As of 30 November 2023, gearing was equivalent to 13.1%.

During the second half of the financial year, the company took out a ¥10bn revolving credit facility with Industrial and Commercial Bank of China Limited, London Branch, which is in addition to the existing ¥5bn credit facility with Mizuho Bank Limited.

Previous publications

Readers may be interested in our previous publications on JFJ, which are listed in Figure 24 below. These are available to read on our website or by clicking the links in the table.

Figure 24: Previous publications

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on JPMorgan Japanese Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.