Lar España Real Estate

Real Estate | Update | 19 October 2023

Defying the retail gloom

Lar España Real Estate’s manager says that the company’s strong financial and operational numbers show that it continues to defy the doom and gloom surrounding the retail sector. The value of its Spanish shopping centre and retail park portfolio has been stable despite higher interest rates – thanks in large part to rental growth within its portfolio (gross rental income was up 16.4% over the first half of 2023).

Retail sales within its portfolio totalled more than half a billion euros in the first six months of the year (well ahead of last year and pre-pandemic levels), which the manager says provides confirmation of the quality and dominant nature of its assets. The manager believes that Spain has been less-impacted by structural changes that have plagued the retail sector in the UK and US, adding that there are no supply issues and online retailing is far less prevalent.

The company is looking to put the proceeds from recent sales (achieved at prices above book value) into high-yielding shopping centres where it plans to unlock hidden value. Having re-established its dividend at pre-COVID levels, a re-rating may follow.

Exposure to Spanish retail

Lar España Real Estate aims to grow its EPRA net tangible assets (NTA) through active asset management of Spanish commercial real estate, and deliver high returns primarily through the payment of considerable annual dividends.

Market overview

GDP forecast to grow 2.2% in 2023, exceeding previous projections.

The Spanish economy has proved more resilient than analysts had expected in 2023, with GDP growth expected to reach 2.2%, an upward revision of 0.3 percentage points on the Spring forecast and noticeably above the 1.3% projected by the OECD at the start of the year. In 2024, GDP growth is forecast to moderate to 1.9%, as economic activity is expected to soften towards the end of this year and into the first half of 2024.

Household consumption is expected to be supported by lower inflation and a resilient labour market. Annual HICP inflation (the harmonised index of consumer prices – which tracks CPI in each EU country) is forecast to moderate to 3.6% in 2023, on the back of the continued fall of energy prices. A further slowdown to 2.9% is projected for next year.

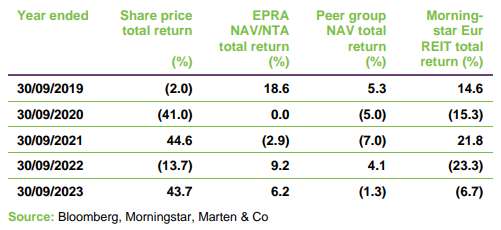

Retail sales in Spain grew 7.3% in July 2023.

Retail sales grew nationally 7.3% year-on-year in July 2023, compared with a 6.5% increase in the previous month. On a monthly basis, retail sales grew by 0.2% in July, continuing a run of 12 consecutive months of increases, as shown in Figure 1.

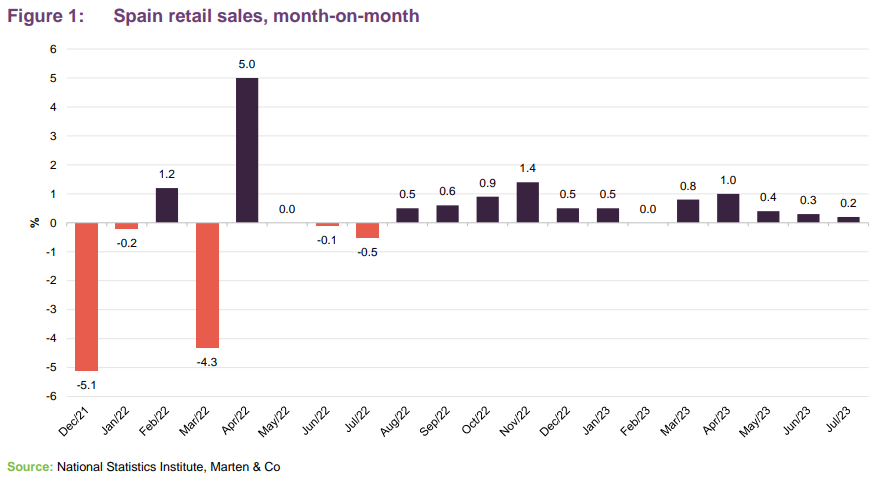

The sales figures among Lar España’s assets are trending better than the national average, with sales in its shopping centres and retail parks reaching €505.1m in the first six months of 2023, up 7.5% compared to the same period in 2022, and up 16.1% on the same period in 2019, as shown in Figure 2. Figure 3 shows that footfall is close to pre-pandemic levels, and has been steadily increasing year-on-year, with its assets visited 39.5m times during the first six months of the year.

Retail sales in Lar España’s portfolio exceed pre-COVID levels.

The manager says that the strong performance data reflects the quality of Lar España’s portfolio of properties, which are mostly categorised as ‘dominant’ – large centres, in large catchment areas with little competition. The effort rate – a key retail performance metric that measures the ratio between the total cost to the retailer (including rent and charges) and the turnover generated at the property (also known as the occupancy cost ratio) – was 9.5%. This increases the appeal of the assets to retailers, the manager states.

Quality portfolio proving resilient

The manager believes that the quality of Lar España’s portfolio has been shown up not just in the performance of the retailers that lease space in the centres, but in rental income and valuations over a long period of time.

In its half-year results to the end of June 2023, the value of the group’s portfolio fell by 0.5% to €1.465bn. The stable valuation is impressive, the manager believes, given the significant interest rate rises and their impact on valuations in the real estate sector. The company’s EPRA net tangible assets (NTA) was €10.76 per share at 30 June 2023, versus €10.93 at the end of 2022.

Gross rental income grew 16.4% in first half of 2023.

Gross rental income was up 16.4% to €48.9m, thanks to strong operational performance. The company carried out 100 lease agreements in the first half of the year (eight new lettings, 22 re-lettings and 70 renewals). This achieved an average rental uplift of 7.7% on previous rents (excluding the inflation-linked uplifts baked into the leases). Occupancy across the portfolio was stable at 95.9% (from 96.6% at 31 December 2022).

The manager comments that, off the back of the strong performance, the company was able to pay a dividend for 2022 of €0.60 per share – a 66.7% increase on the level paid in 2021 – back in line with its pre-COVID levels. This represents a dividend yield of 10.6% on the current share price.

In July 2023, the company sold two retail park assets – Vistahermosa and Rivas Futura – for €129.1m, at a slight premium to their book value at 31 December 2022 (more details on the rationale of the disposal is on page 9). The company plans to use the proceeds to acquire new shopping centres that fit its investment criteria (large, dominant centres in their catchment area that have significant capital and rental growth potential through intensive asset management opportunities), where it says yields are higher and hidden value exists.

Retail done differently

No over-supply of retail space in Spain.

The oversupply issues that have plagued the UK and US retail markets are non-existent in Spain, the manager says. The country’s density of shopping centre space per inhabitant is 0.34 sqm, according to the Caixabank 2021 Retail sector report, which is well below the figure in the US of 2.35 sqm per inhabitant. The total floorspace classified as shopping centre in Spain amounts to 11.5m sqm across 410 assets (centres over 5,000 sqm), according to Cushman & Wakefield. In comparison, there is around 17.5m sqm in the UK across 726 shopping centres. Reflecting the oversupply, there was a vacancy rate of 18.2% across shopping centres in the UK at the end of 2022 (according to the British Retail Consortium). In Spain, the shopping centre vacancy rate is much lower and just 4.1% at Lar España’s shopping centres.

Spanish malls have less exposure to department stores, which has been one of the root causes of spiralling vacancy rates in the UK and US and which is still being worked out. For instance, 46% of US mall space was let to department stores or hypermarkets, according to the Caixabank 2021 Retail sector report, compared to 24% in Spain.

Online retail penetration rates in Spain expected to reach 8% in 2024, far below other European countries.

The boom in online retailing that has been prevalent in the US and UK over the past decade has yet to be seen in Spain. The company believes that for many reasons online retailing as a percentage of total retail sales will not hit the levels of 20% to 30% seen in the UK and US.

Online retail sales are expected to rise to 8% of total sales in 2024 (from 5% in 2019). Outside of the big two Spanish cities of Madrid and Barcelona, online retailing penetration rates will remain at very low rates, the company believes, due to a number of factors including poor infrastructure and the geographical landscape obstructing the effective operation of online retail.

Whilst the UK retail market has grappled with the impact of online retailing over the past decade, the manager says that Lar España has been able to take learnings and respond to technological and digital advances ahead of time. The company says that it has taken steps to make its assets omnichannel – meaning they serve both traditional retail and online retailing. We explored these in detail in our initiation note published in March 2023 (links to which can be found on page 2 and 14). To summarise, these include:

- Click & Shop – a website where retailers in the shopping centre can promote their products and discounts, enabling customers to buy products online and collect in store.

- Lar Conecta – an initiative that gives stores access to each shopping centre’s digital communication channels and their online traffic (Lar España’s shopping centre website has 1,750,000 visits and a more than 500,000 social media following), helping them to promote their brands and increase sales.

- WhatsApp Shopping – giving customers the chance to access personal shopping and style advice through WhatsApp, as well as real-time information on product specifications and availability and the option to collect purchases in-store or have them delivered to their homes.

Other ‘smart’ technology initiatives produce customer analytics that can be used to help drive business development and gain a deeper understanding of user behaviour, spending and profiles.

Investment and leasing market

Investment levels remain subdued, but leasing market buoyant.

Stifled investment activity across the commercial real estate sector (including the retail sector) has continued, due to the impact of higher interest rates and uncertainty over their future level. Just €210m was transacted in the Spanish retail sector in the second quarter of 2023, according to Knight Frank, which is around 60% less than the corresponding period in 2022. This brings the total for the first half of the year to just €385m. The manager states that with inflation coming under control, and interest rates perhaps peaking, investor sentiment towards the sector may improve later this year and into 2024.

Whilst the investment market has yet to rebound, the leasing market appears to be buoyant, both nationally and within Lar España’s portfolio. As mentioned earlier, the company carried out 100 lease agreements during the first half of 2023, having conducted 176 during 2022. These were at a 7.7% uplift to previous rents (excluding the CPI inflation-linked uplift).

All of the leases signed with Lar España are subject to annual rental uplifts in line with CPI. The company says that it has continued to pass the full amount on to tenants with little pushback, which contributed to a 16.4% increase in gross rental income in the first half of 2023.

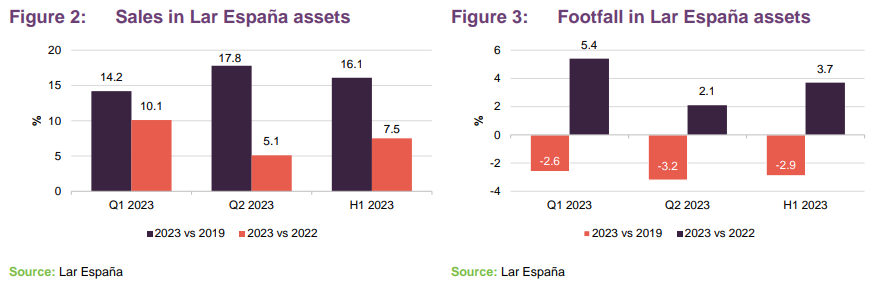

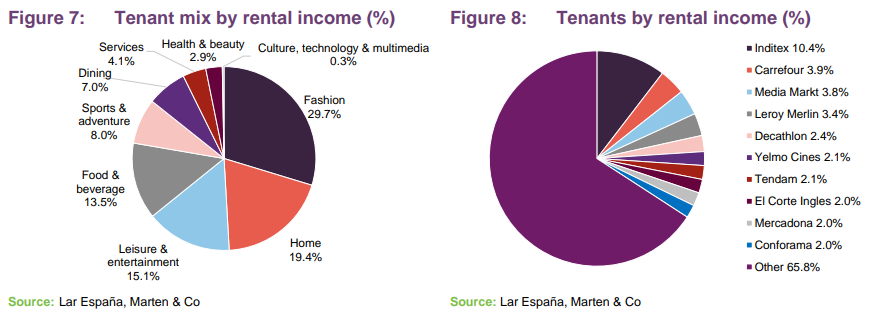

Portfolio

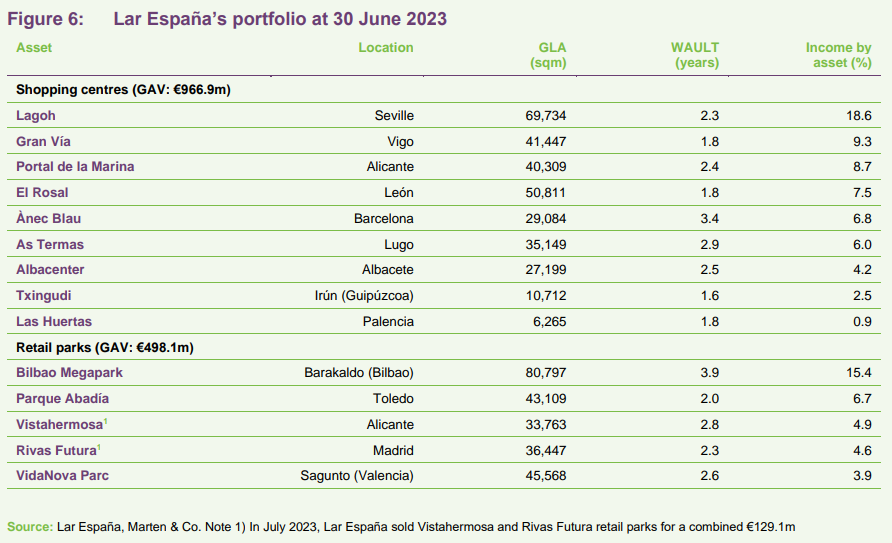

Lar España’s portfolio was valued at €1.465bn on 30 June 2023 (a small decrease from €1.473bn at 31 December 2022). It comprised nine shopping centres and five retail parks – although, as mentioned earlier, post-period end, the company sold two retail parks assets for €129.1m. It has a diverse range of tenants, as shown in Figures 7 and 8, with more than 1,000 leases and an occupancy rate of 95.9%. Its top 10 tenants account for 34.2% of the company’s rental income, while 65% of leases have expiries beyond 2025. The portfolio has a WAULT of 2.6 years.

Lagoh shopping centre

The largest asset in Lar España’s portfolio, the company bought the site of the Lagoh shopping centre in March 2016 for €38.5m and completed the development of the 69,734 sqm mall in 2019. It opened its doors in September 2019 and is home to a range of retailer and leisure brands. The centre comprises 148 stores.

It is located in the centre of Seville, the fourth-largest city in Spain, which has a population of 676,000 and 1.5m in the Greater Seville metropolitan area. Despite the demographics, the Lagoh shopping centre is the first dominant shopping centre in the Greater Seville area. In December 2022, the centre recorded 1m visits – the highest monthly footfall figure since it opened.

The brand-new shopping centre was designed with technology and sustainability at its core. Technology initiatives at the mall include a sensor system that monitors visitors’ flow around the centre and use of space, which can inform prime footfall areas and marketing decisions. Sustainability features include solar panels providing low-carbon electricity and geothermal technology. Energy provided to the whole complex is 100% renewable and the scheme has been awarded the BREEAM Sustainability Building Certification. The scheme was awarded the Best Shopping Centre in Spain award by the Spanish Association of Shopping Centres.

Bilbao Megapark retail park

Megapark is the largest retail complex in the Basque Country and the fourth largest in Spain, covering a total area of 128,000 sqm, of which Lar España owns 81,577 sqm. It is the only retail park within a radius of 400 kilometres and is the leading scheme in the Bilbao area, with a catchment area of more than 2.2m people.

Developed in 2007, Lar España bought its holdings in two separate deals in 2015 and 2017 for a combined €178.7m.

Comprised of 81 retail units and 8,200 car parking spaces, Megapark is home to leading international retailers, such as Ikea, Mediamarkt and Leroy Merlin, and hosts the cinema with the highest box-office turnover in the Basque Country.

Gran Via shopping centre

Located in Vigo, the largest city in the Pontevedra province, the Gran Vía shopping centre has 41,453 sqm of lettable space and is the main shopping centre serving 482,100 people in the catchment area. The mall opened in 2006 and was acquired by Lar España in September 2016 for €141m.

It comprises 121 retail units that are let to a mix of international brands and Spanish companies, including Zara, H&M, Massimo Dutti and Carrefour.

ESG

Portfolio obtained a score of 86/100 for ESG credentials, 15% ahead of the index average.

Lar España has made substantial progress in reducing energy consumption and carbon emissions from its portfolio over the first half of 2023, the manager says. Electricity consumption was down 9.8% compared to the same period in 2022. Meanwhile, fuel consumption was down 15.5%. Overall, energy consumption fell 13.3% on a per visitor basis and 10.3% per sqm.

As for carbon emissions, scope 1 emissions (direct carbon emissions from the portfolio) in the first half of 2023 were 19.8% lower than the same period in 2022, mainly due to a reduction in fuel consumption needed for heating its centres, the manager says. Scope 2 emissions (indirect emissions arising from where the energy is produced) fell 32.3% using the location-based method (which is based on the emissions intensity of the local grid area) and were zero on market-based reporting metrics, due to 100% of its electricity being from renewable energy. Lar España is in the process of calculating its scope 3 emissions (indirect emissions occurring across its value chain). Combined, scope 1, 2 and 3 emissions fell by 38.3% per sqm, while emissions per visitor dropped 40.5% – due to higher footfall.

The manager says that carbon emission and energy consumption reduction were achieved principally through the implementation of the company’s energy efficiency plan, which audited each shopping centre and retail park and set individual action plans.

‘Green leases’, whereby the tenant is incentivised to meet sustainability and energy usage targets, are applied on more than 20% of the portfolio (up from 10% at the end of 2022). This figure is expected to continue to grow, the manager believes, as leases are renewed and new lettings signed.

The company’s portfolio obtained a rating in the Global Real Estate Sustainability Benchmark (GRESB) assessment of 86 out of 100 in 2023, which is a 90% increase on its 2018 score. GRESB is the global ESG benchmark and reporting framework for the property sector, both listed and non-listed, and is one of the world’s leading sustainability indices. The company’s score is 15% higher than the average score in the index, which is made up of more than 1,000 participating companies. 100% of the portfolio is BREEAM-certified, with an ‘excellent’ or ‘very good’ rating.

Asset recycling programme

Sold two retail parks ahead of book value.

The company says that it made a significant step in its asset rotation plan, which it announced in 2022, with the €129.1m sale of two retail park assets – Vistahermosa and Rivas Futura in July 2023. These were mature and established assets, with high occupancy and where asset management initiatives had taken place and value-add opportunities exhausted, the manager says. The sales were made at a slight premium to their book value at 31 December 2022.

With the sales proceeds and existing cash reserves (it now has around €230m in the bank), it will look to acquire new assets that fit its investment criteria (large, dominant centres in their catchment area that have significant capital and rental growth potential through intensive asset management opportunities). It is analysing dozens of assets across Spain in the shopping centre sub-sector, where it says yields are higher than in the retail park sub-sector and which are often under-managed, and hidden value exists. There are around 70 shopping centre assets in the country that fit its investment criteria – 40,000 sqm in size, in a catchment area of at least 400,000 people and with at least 4m visits a year – it says.

Performance

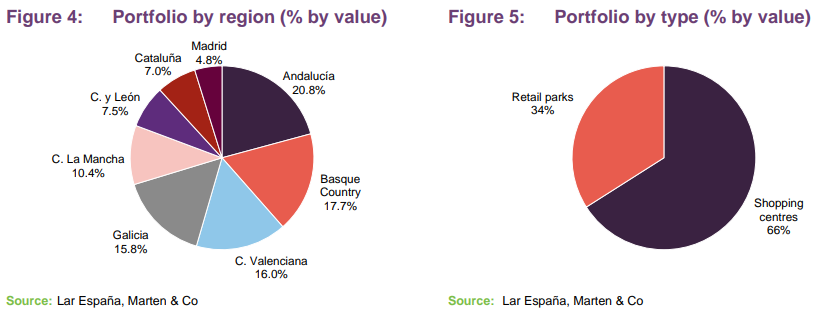

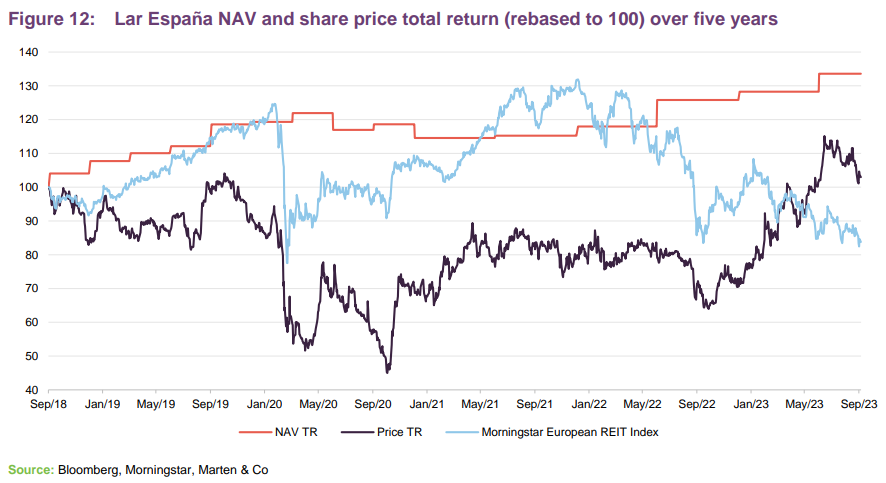

Lar España has posted a NAV total return of 33.6% over a five-year period.

Lar España’s EPRA NAV/NTA total return has recovered strongly following a dip during COVID. The value of its portfolio held up relatively well during the pandemic and during the period of high interest rates over the past year, perhaps due to the dominant nature of the assets, rental growth and consistently high occupancy rates. Although the EPRA NTA fell slightly in the six months to 30 June 2023, a €0.60 dividend paid during the period (back to pre-pandemic levels) saw its NAV total return grow. Over five years the group has returned 33.6% in NAV terms. The company’s share price total return had been trailing the Morningstar European REIT Index, but a recent rally has seen it outperform the index over five years, returning 3.7% versus -15.3%.

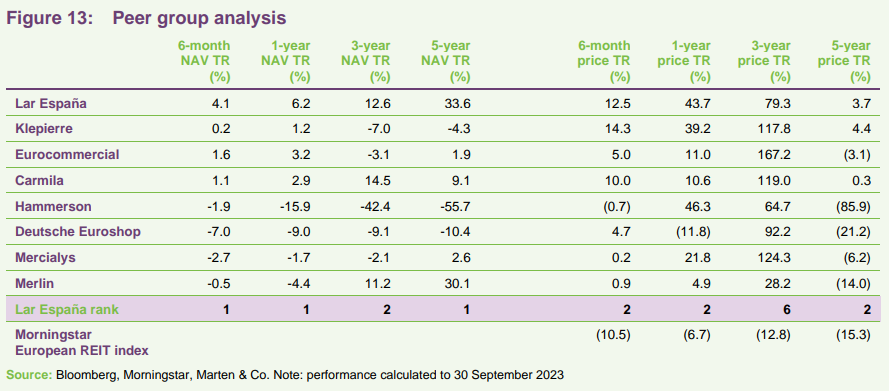

Peer group analysis

We have put together a comparison of Lar España’s listed peers in Europe, including pan-European and country-specific retail landlords and a Spanish peer. The peer group we have assembled consists of: Klepierre, Eurocommercial and Carmila (which are pan-European); Hammerson (UK), Deutsche Euroshop (Germany) and Mercialys (France), which are country-specific; and Merlin (which owns Spanish real estate predominantly in the office sector). We have also used the Morningstar European REIT Index as a comparator on share price returns.

Figure 13 shows Lar España’s short- and long-term performance versus its peers. It ranks first among its peers over every time period in NAV terms (apart from three years, where it is ranked second), while its share price has started to recover.

Premium/(discount)

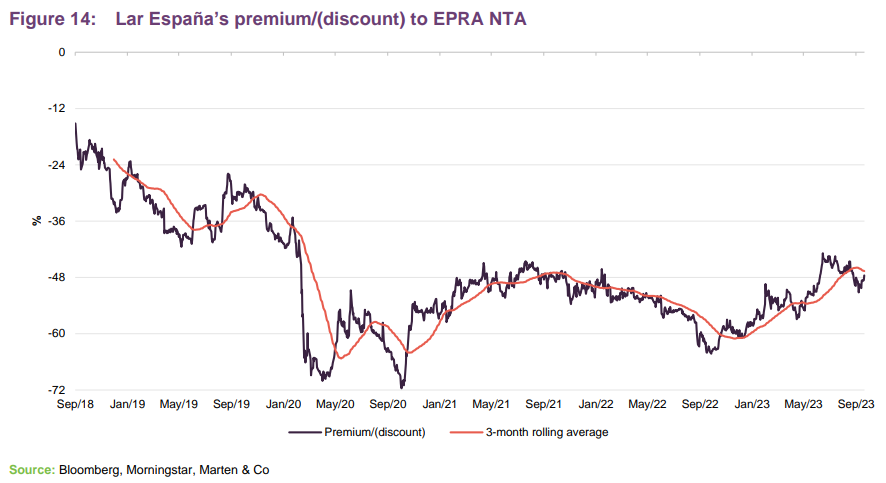

Lar España’s shares have been trading at a substantial discount to EPRA NAV/NTA for the past five years. Its share price plunged at the onset of the COVID pandemic in early 2020, and despite a small recovery, its share price still lingers at an extremely wide discount of 47.6% at 17 October 2023.

Fund profile

The company’s website is larespana.com.

Lar España Real Estate is a SOCIMI (the Spanish equivalent of a listed Real Estate Investment Trust (REIT)) that has been listed on the Madrid Stock Exchange since 5 March 2014.

Lar España was the very first Spanish SOCIMI to be floated. It was also the first listing on the Madrid Stock Exchange for three years, and the first listing of a real estate company in seven years. It was founded at the bottom of the Spanish property cycle when real estate prices were at record lows and the real estate market was entering a new cycle.

The company is focused on investment in real estate assets throughout Spain, in the retail sector. It aims to deliver high returns for its shareholders through the payment of considerable annual dividends, and create value by increasing the company’s EPRA net tangible asset (NTA) through active asset management. The group’s portfolio comprises nine shopping centres and five retail parks and was valued at just over €1.473bn on 31 December 2022.

The manager – Grupo Lar

Grupo Lar has €3.5bn AUM in six countries.

Lar España is exclusively managed by Grupo Lar, a private Spanish real estate company that has more than 53 years’ experience in the sector. It has expertise in development, investment and asset management and boasts a large team of professionals that actively manage its portfolio to maximise operational efficiency.

Grupo Lar is 100% owned by the Pereda family and has 248 employees in six countries. It has €3.5bn of assets under management spread across six countries in Europe and the Americas, diversified across the residential, retail, offices and industrial sub-sectors. It has established joint venture partnerships with several prominent international investors including Green Oak, Grosvenor, Goldman Sachs, Henderson Global Investors and Ivanhoe Cambridge.

Previous publications

QuotedData has previously published an initiation note on Lar España – Dominant assets make a resilient business – in March 2023, as well as two short version notes – Built to last, in December 2020 and Ducks in a row in November 2021. You can read them by clicking the links.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Lar España Real Estate.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.