| IMPORTANT INFORMATION

NB: Marten & Co has been paid to prepare this note on behalf of Liontrust ESG Trust Plc. This is a marketing communication and not a prospectus. The note is based upon publicly available information and information provided to us by Liontrust ESG Trust Plc and should be read in conjunction with the Liontrust ESG Trust Prospectus published on 26 May 2021 and which can be found at www.liontrust.co.uk/esgt-launch. Readers should not place any reliance on the information contained within this note. The note does not form part of any offer and is not intended to encourage the reader to subscribe for ordinary shares in Liontrust ESG Trust or deal in any other security or securities mentioned within the note. Marten & Co does not seek to and is not permitted to provide investment advice to individual investors. |

The note is not intended to be read and should not be redistributed in whole or in part in the United States of America, its territories and possessions; Canada; Australia; the Republic of South Africa; or Japan.

The details of the share issue, including the risk factors that investors should take into consideration, are more fully described in the prospectus published by Liontrust ESG Trust Plc on 26 May 2021 and we urge readers to read this before making any investment decision. The approval of the prospectus by the Financial Conduct Authority should not be understood as an endorsement by the Financial Conduct Authority of the securities offered. If you have any doubts about the suitability of an investment you should seek professional advice.

For a sustainable future

Liontrust ESG Trust (ESGT) has a target to raise £150m through the issue of 150m ordinary shares at 100p per share. The money raised will be deployed in a high conviction, best ideas portfolio of global companies that the manager believes are capable of growing sustainably over the long term.

ESGT will be managed by an experienced team (see page 27) with a strong track record (see page 23) that goes back over 20 years. Central to the team’s approach is a belief that companies with sustainable business models can deliver superior investment returns. The team will seek to differentiate ESGT from its existing products by using the benefits of ESGT’s closed-end structure. In practice, this includes having fewer positions, investing in some smaller companies and using modest levels of gearing (borrowing).

Global sustainable companies

ESGT aims to deliver a total return over the long term (five years or more) by investing globally in a diverse portfolio of sustainable companies. Sustainable companies are those that the manager believes will capitalise on and help drive the key structural growth trends that will shape the sustainable global economy of the future; will provide or produce sustainable products and services; and have a progressive approach to the management of environmental, social and governance issues.

Links to intermediaries:

Investment summary

The issue

ESGT is targeting a fundraise of £150m (gross) through the issue of new ordinary shares at 100p per share but may issue up to 250m shares in its initial issue. The initial issue is open until 29 June 2021 for investors applying for shares through the offer for subscription or intermediaries offer and 30 June 2021 for applications for the initial placing. The results of the issues will be announced on 1 July and the intention is that admission and dealing in the shares will begin on 5 July 2021.

Subsequently, ESGT may issue a further 250m ordinary shares and/or C shares under a placing programme that closes on 25 May 2022.

Application will be made for the shares to trade on the premium segment of the main market of the London Stock Exchange.

Investment objective and policy

ESGT aims to deliver to its shareholders a total return over the long term (five years or more) by investing globally in listed sustainable companies. Sustainable companies are those that the manager believes will capitalise on and help drive the key structural growth trends that will shape the sustainable global economy of the future; will provide or produce sustainable products and services; and have a progressive approach to the management of environmental, social and governance issues

The board and manager will use the MSCI World Index (total return in sterling) as ESGT’s performance benchmark. The index will not influence the constituents of or weightings within the portfolio.

The manager

ESGT’s AIFM is Liontrust Fund Partners LLP and the portfolio manager is Liontrust Investment Partners LLP. Both entities are part of the Liontrust Group whose holding company is Liontrust Asset Management Plc, a specialist fund management company established in 1995 and listed on the London Stock Exchange. Liontrust Asset Management Plc has offices in London, Edinburgh and Luxemburg. The Liontrust Group currently employs 198 staff and had £30.9bn in assets under management and advice as at 31 March 2021, of which more than £9bn was managed by its Sustainable Investment Team (the team).

The 13-strong team is headed by Peter Michaelis (more information on the composition of the team is provided on page 27) and has a track record that extends over 20 years. Its ambition is to invest in companies that help create a cleaner, healthier and safer world while delivering returns to investors that outperform mainstream funds and indices. More details of the performance achieved by the team are on page 23 of this note.

Liontrust’s Sustainable Future fund range was launched in 2001. The team was a founding member of the PRI and has a track record of engaging on issues that are now central to mainstream investing. Liontrust employees are involved in industry-wide initiatives and working groups.

The manager’s approach combines the avoidance of industries whose products and services have negative effects on sustainability, backing businesses that will have a positive impact on the world and which will benefit financially from doing so, and engaging with companies with the intention of influencing management into changing positively strategy or operational management.

ESGT would be the team’s first new product launch since 2014. The team believes that it will be differentiated from its existing products by virtue of the advantages offered by ESGT’s closed-end structure. In particular, these include a greater ability to invest in less liquid investments including smaller companies, an intention to operate with a more concentrated, high-conviction portfolio of around 30–35 stocks and the ability to use gearing.

The team highlights that there is no separation of people making investment decisions from those doing the sustainability analysis. The manager believes that it derives an information advantage that would be lost if these roles were separate.

While ESGT’s portfolio will predominantly comprise equity investments, the team manages both fixed interest and equities. In the manager’s opinion this gives it a more comprehensive perspective of capital markets and the integration of sustainability therein.

UN Sustainable Development Goals

The UN Sustainable Development Goals (SDGs) are a collection of 17 global goals established by the United Nations General Assembly. These were set out in its 2030 Development Agenda, entitled “Transforming our world: the 2030 Agenda for Sustainable Development”, published on 25 September 2015.

They cover social and economic development issues including poverty, hunger, health, education, global warming, gender equality, water, sanitation, energy, urbanisation, environment and social justice.

Goal 1: No Poverty

Goal 2: Zero Hunger

Goal 3: Good Health and Well-Being for People

Goal 4: Quality Education

Goal 5: Gender Equality

Goal 6: Clean Water and Sanitation

Goal 7: Affordable and Clean Energy

Goal 8: Decent Work and Economic Growth

Goal 9: Industry, Innovation, and Infrastructure

Goal 10: Reducing Inequalities

Goal 11: Sustainable Cities and Communities

Goal 12: Responsible Consumption and Production

Goal 13: Climate Action

Goal 14: Life Below Water

Goal 15: Life on Land

Goal 16: Peace, Justice and Strong Institutions

Goal 17: Partnerships for the Goals (the promotion of international cooperation and the use of public-private partnerships to achieve the goals).

The goals set out to tackle climate change, rising inequalities and unsustainable production and consumption. The UN estimated that globally, between $5trn and $7trn needed to be invested, each year, to achieve its goals.

Sustainability

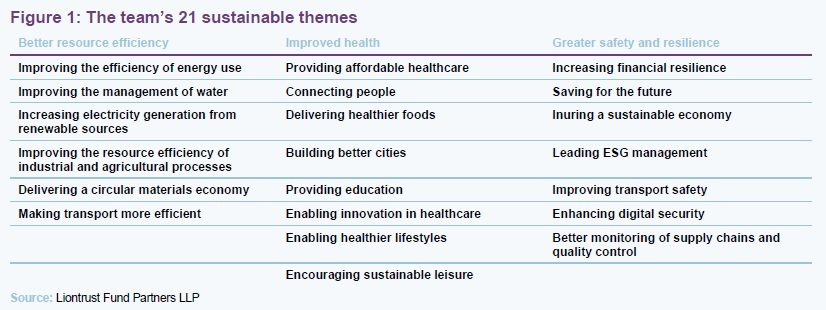

The team has identified 21 sustainable themes that form key structural growth trends that it feels will shape the global economy over multiple decades. Companies that align with these themes will be considered for inclusion within the portfolio. The manager believes that most investors underestimate the speed, scale and persistency of such trends within the economy.

The team groups these themes into three “mega” trends:

- Better resource efficiency (Cleaner): using resources more efficiently (better management of water usage, increasing recycling of waste, lower carbon energy sources and energy efficiency).

- Improved Health (Healthier): improving quality of life through better education, healthier lifestyles and diet or better healthcare.

Greater safety and resilience (Safer): making the systems we rely on safer or more resilient.

From the launch of the Sustainable Future fund range in 2001, these portfolios do not invest in companies exposed to aviation, coal, oil or (internal combustion engine) autos. From 2016, the team has also excluded companies exploring for or producing natural gas. The team has been monitoring the carbon footprint of its funds since 2009.

The team’s latest initiative, launched early in 2020, is the One and a Half Degree Transition Challenge. All companies held within the Sustainable Future funds are now asked to explain how they plan to decarbonise their businesses to limit global warming to 1.5 degrees. Over 200 companies were asked to provide a plan for how they are going to reach zero carbon emissions and over what time period this will be achieved. The team will use all measures at their disposal, including voting and ultimately divesting over time, to persuade companies to reduce their greenhouse gas emissions.

The team will publish a report on the findings of this climate crisis engagement in time for the UN Climate Change Conference of Parties (COP 26) in early November 2021.

The team has engaged in a wide variety of other initiatives including ways to tackle plastic pollution; improving the gender balance in leadership roles within companies; improving workers’ rights and paying living wages; and engaging with financial services companies to encourage responsible investment policies and lending practices. The team has also sought to encourage companies to use their influence to drive forward best practice further down their supply chains.

The investment opportunity

Central to the team’s approach is a belief that companies with sustainable business models can deliver superior investment returns. The manager asserts that interest in sustainable investing and ESG issues has never been greater. Many governments are promising to tackle climate change, with measures such as net zero greenhouse gas emissions targets. Concern is growing too about pollution, overfishing, collapsing biodiversity and social inequality.

The manager believes that companies can work with society and governments to develop solutions to these issues. ESGT will invest in the companies developing the new technologies and innovative products that will help to meet these challenges and benefit people, society and the planet – and therefore lead to a more sustainable world.

In the manager’s opinion, the best outcomes have occurred in situations where societies, via their governments, set the correct framework, and then profit-driven, competing companies deliver the solution. It says that people working together with companies, putting capital to work towards a common purpose, has delivered immense good in many areas. Much of the progress towards the higher quality of life and reduction in poverty has been at least partially driven by this, leading to vaccines and cancer treatments, solar and wind generators, electric vehicles, LED lighting, the internet and modern communications and countless other products and services that make lives better and more sustainable.

The manager believes that its past investments in businesses focused on innovative healthcare, energy efficiency, waste recycling, renewables and mobile networks have been successful precisely because these companies have provided something positive that society needs.

Within this, the best investments have been in companies doing this better than their competitors and then reinvesting in the business to deliver future growth.

The board and the manager, therefore, believe there is a clear alignment in the company’s aim of delivering strong returns by investing in sustainable companies. Far from being an approach that compromises returns, the manager firmly believes it is one that complements the investment selection process, focusing only on those companies well-positioned for the enormous changes it expects to see in the years ahead.

In the opinion of the board and the manager, the company represents a timely contribution to the solution to the world’s problems. The company will invest in what the manager deems to be the optimum portfolio of sustainable companies in the world; while the manager will use of part of its management fees to fund high impact sustainability projects, initially focused on SDGs that are otherwise outside the scope of traditional investments.

Reaching the places that other funds can’t

There are some SDGs that are hard to access through equity markets. The manager will commit to using up to 10% of the management fee that it earns from ESGT to fund research and develop investment instruments targeting hard to invest in SDGs.

- SDG 1: End Poverty – for example, provision of access to loans at fair rates for those in poverty.

- SDG 2: End Hunger – for example, investment in food production and distribution in developing regions.

- SDG 14: Life Below Water – for example, development of bonds in blue carbon (marine sequestration of carbon dioxide) or to back marine protected areas.

- SDG 15: Life on Land – for example, bonds to back biodiversity or carbon and biodiversity enhancement through reforestation.

It is the manager’s intention to identify organisations to partner with that will carry out the research required in these areas. Each project is envisaged to have a three-year time frame, and it is expected that at any one time two projects will be run in parallel. The programmes will be managed by the manager. Progress will be reported every six months.

The market backdrop

The manager highlights the acceleration of certain trends as a consequence of COVID-19. The team believes the longer-term implications of the pandemic for the next decade and beyond will result in some lasting changes in how society thinks and should ultimately support and accelerate their themes towards an economy that is cleaner, healthier and safer, as well as more equitable.

The manager believes there will be significant shifts in the prior consensus:

- People will become more risk averse and save more, if they can, and be more discerning in what they buy. Buying more insurance to manage unforeseen shocks could be another result and the manager would expect to see proactive insurance companies benefit.

- Banks may regain some of the credibility lost in the global financial crisis through their support of businesses.

- The desire to eat healthier food and exercise will persist.

- People will continue to demand improvements in local air quality for the health of their families.

- Efficiency in the use of materials and the desire to make industrial and agricultural improvements will persist. This will also be true for how society manages water and waste.

- Being forced to work remotely and productively means people will do this more, saving time and resources.

- Healthcare systems will be more supported and activity around managing diseases should be bolstered.

Overall, the manager believes many potential changes are directly aligned with its twenty-one themes, and this means they will accelerate positive trends that are already happening.

Six key investment themes

Within the prospectus, the manager highlights six of its key investment themes:

Cities

The trend of increasing urbanisation will continue, with over half of the global population likely to be city dwellers by the early 2040s. Nearly all this growth will occur in Asia and Africa.

Current cities emit 50% to 60% of global greenhouse gases and will have to invest in retrofitting and adapting existing infrastructure to mitigate environmental impacts and adapt to the changing climate.

Cities at their best enable a high quality of life with low impacts. This requires infrastructure investment, community planning, water management and efficient mass transport, with thermally efficient buildings essential. Widespread digital connectivity, combined with strong local communities, also reduces the need for travel.

Buildings and infrastructure will be designed for low life-cycle impact using Building Information Modelling software that minimises the impact of construction, use and demolition/recycling.

Cities will also be increasingly designed with biodiversity in mind, such as Milan’s ‘treescrapers’ for example – two residential tower blocks built in 2014 that are covered in 800 trees, 4,500 shrubs and 15,000 plants.

Healthcare

Significant advances across areas such as gene editing and DNA sequencing.

The traditional model has a large element of trial and error, with people seeking help when they feel ill and hoping whatever drug or procedure prescribed is effective, but this intervention often proves too late. Instead, the manager sees a move towards a more personalised system, where an understanding of how someone’s genetic make-up makes them vulnerable to diseases.

In the coming years, this paves the way for early diagnostics and pre-emptive treatment, testing babies before birth and adults early and on an ongoing basis. The manager expects to see the price of sequencing the genome continue to fall, equipment for these tests become more prevalent (diagnostics platforms are now more commonly deployed) and testing more convenient. Liquid biopsy, for example, allows cancer detection from blood rather than having to take a tissue sample, removing pain and inconvenience from the process.

The manager also expects to see fewer chronic treatments (taking a pill every day) and more one-off treatments via gene editing or therapies. Diagnostic progress allows greater understanding of diseases and more personalised treatment: ‘one and done’ correction of genes that cause problems (at source), ongoing testing to identify and treat diseases earlier and more exciting and targeted vaccines. Messenger ribonucleic acids technologies can help treat cancer for example, moving beyond the more traditional vaccinated areas.

Transport

The manager expects that electric vehicles will be the dominant form of passenger transport and the combustion engine an antique as quiet, clean cities become the norm. Cars will be charged from solar panels connected to houses and battery technology will develop such that refuelling is a thing of the past.

Development of electric passenger planes is also beginning to be adopted. Their cost advantage (fuel is around 15% of the cost of flying, which is removed) will lead to smaller aircraft flying regional routes more regularly, and technology will replace long queues to check in at airports. This will make flying a more pleasurable and customer-friendly experience.

High-speed trains will also provide competition for regional travel, with their relative comfort and convenience combined with the fact that technological advances ensure you can get from London to Paris in under an hour.

Autonomous vehicles will be the norm for deliveries of food and parcels, as well as taxis and other forms of transportation. Driving your own car will never be fully autonomous, with the safety system taking control of braking and moving lanes/turning.

Overall, the manager predicts road accidents will be very rare, air quality substantially improved and transportation a much more pleasurable experience by 2041.

Energy

The electricity society consumes will primarily come from renewable sources and be delivered through a hugely upgraded and more intelligent grid that includes demand side management.

Many things that currently consume fossil fuels will have switched to be powered by electricity, such as electric vehicles and heat pumps to heat and cool buildings.

As stated, the proportion of cars that run on the internal combustion engine will be much smaller than now and falling away to antique status.

There will be a broader understanding of reducing wasted energy through energy efficiency and significant efficiency gains in new buildings as well as many industrial processes. Waste recovery systems will be much smarter to facilitate much higher recycling rates.

Communication

The digital economy is increasingly central to a properly functioning global economy and this will continue to increase over the coming decades. Digital technologies can enhance the productivity and reliability of a wide range of sectors and improve quality of life through positive impacts in areas including health and education.

The manager expects to see ongoing shifts in the future of networking, systems, applications and services and, as part of that, any negative impacts and concerns around privacy, surveillance and disinformation, as well as use (or overuse) of technology will need to be addressed.

The internet will continue to play a vital role in how we communicate but artificial intelligence could potentially personalise our experiences within platforms and quantum technologies and computing make networks faster and more available. Fibre optic cables’ data carrying capacity has increased in recent decades and the scale and speed of electronic digital signal processing is likely to continue, up to the theoretical limits of computing.

Satellites and aerial technology will enable faster access for everyone, including those in remote locations. Developments are likely to result in increased coverage and better and faster services, such as data transfer. The coming years could see a shift towards cell free networks, where users are surrounded by antennae rather than the other way around.

The world will move towards the internet of things where devices are connected to enhance our experience and provide access to services such as remote medical care. There may be a move from the 2D experience on flat-panel devices to 3D where we extend the experience beyond sight and sound through improved sensors or body sensory systems.

The manager also expects to see advances in augmented reality – viewing the world through a technological overlay is likely to become more advanced and available and language barriers may continue to reduce as we rely more on translation software integration.

Finance

Commoditisation of mainstream banks will continue with technology-first businesses continuing to eat into their profits and more companies that nominally have nothing to do with financial services making significant profits from this area.

Physical cash will be a thing of the past, helping to reduce both the tax gap and the shadow economy.

Some governments might have their own cryptocurrencies and these will be far more assimilated into everyday transactions.

Everyone, regardless of their socioeconomic status or geography, will have access to affordable financial services, with a cashless payment and savings system fostering greater financial inclusion in currently underbanked countries.

Transparency and reporting

The manager believes investors will want greater transparency on the nature of the companies in their portfolios – attribution by investment return is not enough – and to see alignment with decarbonisation, health outcomes and diversity targets met. Alongside the question of the return an investment has delivered, there will be the question of what impact an investment has had on people and the planet, and managers will have to be in a position to answer positively to both. The manager continues to measure the impact of its portfolios, including by:

- clearly articulating exposure to the manager’s 21 sustainable investment themes;

- clearly showing how these themes directly contribute to the SDGs at the specific performance indicator level of the goal;

- engaging with companies in which the manager is invested to measure and communicate the primary impacts of the products or services the business provides as well as how it is managing the main impacts from its operations;

- showing the carbon impact/footprint of the manager’s portfolios; and

- being transparent and disclosing this information to investors and shareholders.

Investment process

ESGT will be free to invest in sustainable companies in any particular market, sector or country and will not be subject to market capitalisation limits.

The investment process is a high-conviction, bottom-up approach whereby sustainability is explicitly integrated throughout. The process is designed to capture long term investment opportunities from transformative changes in the global economy, tied to the idea that over time economies become more sustainable.

Thematic analysis

There are four stages to the investment process. The first of these is to identify companies that exhibit strong and dependable growth prospects and are aligned with the 21 themes that we identified in Figure 1 on page 7. More than 50% of a company’s revenues should be linked to at least one theme.

Sustainability analysis

The second stage is a sustainability analysis which looks both at the products or services offered by the company and its management of ESG exposures relevant to that industry sub-sector. This approach uses sustainability to identify companies with better growth prospects and higher quality management.

Every company is given a Sustainability Matrix rating, which analyses the following aspects:

- Product sustainability (rated from A to E): this assesses the extent to which a company’s core business helps or harms society and/or the environment. An A rating indicates a company whose products or services contribute to sustainable development (via one of the investment themes); an E rating indicates a company whose core business is in conflict with sustainable development (such as tobacco or polluting activities such as coal fired electricity generation).

Management quality (rated from 1 to 5): this assesses whether a company has appropriate structures, policies and practices in place for managing its ESG risks and impacts. Management quality in relation to the risks and opportunities represented by potentially material ESG issues are graded from 1 (excellent) to 5 (very poor).

Only companies which are rated A1-4 and B1-4 will be considered suitable for the ESGT’s portfolio, providing an additional focus on companies delivering products and services which are broadly positive in impact on society and the environment.

This differentiates ESGT from other funds managed by the team with sustainable investment strategies which can also invest in companies rated C.

The manager notes that those companies that were assigned a product rating of A or B exhibited five-year average outperformance against their relevant comparator benchmarks of 20% and 26% respectively. The model portfolio (see pages 17 to 22) has an average product rating of B2.

Where companies have been assigned management ratings of 3 and 4, the manager feels that it can engage with management of these businesses to improve the performance of investee companies with respect to SDG and other ESG indicators.

Business fundamentals

Stage three is an analysis of the fundamentals of the business. The manager targets companies that exhibit growth above both the industry average and the economy as a whole. It also explicitly targets companies which can illustrate recurring revenue streams, sustainable margins and can consistently convert earnings to free cash flow. Typically, these companies have a maintainable competitive advantage through high barriers to entry provided by scale, technology or their business models.

Valuation

Finally, the manager models five years of future revenue, margin and expected earnings and free cash flow to identify companies with significant potential valuation upside. The manager has to believe that all of the companies in which it invests are undervalued.

The manager says that its forecasts deviate from its peers predominantly in the integration of different thematic growth rates, in its forecasting over longer periods and in its ability to understand the power of sustainable themes. The manager uses these financial forecasts to derive a future share price target that it believes the company can achieve. The analyst has to explicitly identify the appropriate type and magnitude of valuation multiple to use to determine the magnitude of undervaluation.

Only companies that have gone through the four steps set out above and have therefore passed all four of the “quality” filters will be eligible for investment by the company. At the end of this filtering stage, the team will typically have a focused investment list from which to construct the portfolio. To be eligible for investment by the company, the upside on a new investment must be at least 10% per annum on a five-year view. Companies that do not meet this final 10% hurdle, will remain on the watch list.

Portfolio construction

Having identified companies suitable for inclusion within the portfolio, the portfolio construction process is designed to diversify systemic risk while also skewing the portfolio to enhance its overall sustainability. This should result in exposure across a wide variety of industry sectors (via a spread of the manager’s sustainable themes) and should benefit from potentially distinct and uncorrelated growth drivers.

The manager will aim to construct a concentrated portfolio of ‘best ideas’, of between 25 and 35 companies. Position sizes will reflect an assessment of risk, reward and the strength of conviction in the candidate.

The portfolio’s usual active share is expected to be over 90%. Turnover is expected to be low, representing the long-term nature of the sustainable investments and the manager’s long-term time horizon. The aim is to hold positions for five years or more.

Sell discipline

The manager expects that it will typically sell a holding in ESGT’s portfolio when it reaches a valuation where it cannot see further upside and the case for selling and recycling it into an investment with greater return prospects is compelling.

Holdings may alternatively be sold when the future does not turn out quite as envisaged and events reveal a side to an investee company or sector that the manager did not anticipate. Where this negates the original investment thesis including the manager’s ESG analysis, the manager would expect to sell the stock.

The manager will not formulate new reasons to hold on to an underperforming investment.

Although selling is sometimes necessary, the manager will look through short-term fluctuations in markets or share prices and focus on the long-term investment horizon.

Ongoing engagement

On an ongoing basis, the team will seek to drive change in carefully selected areas. All members of the team conduct sustainability research alongside traditional financial and business analysis and are therefore best placed to conduct both engagement and voting.

The manager says that engagement is resource-intensive, but its approach enables it to target engagement on material issues, maximising the information advantage and increasing its leverage with companies. The approach is:

- Proactive – stated initiatives set each year.

- Reactive – initiated at the manager’s request, arising from questions or concerns from the initial analysis of ESG issues, ongoing monitoring of holdings, emerging issues or controversies. Engagement also arises at the request of a company (e.g. offering feedback or guidance on ESG initiatives).

- Collaborative – with other investors.

For proactive engagement, the manager prioritises initiatives in collaboration with its advisory committee each year, assessing how portfolio holdings are positioned and defining targets.

The advisory committee will oversee engagement efforts and plans and will ensure the manager remains focused on engagement that benefits the company.

For reactive engagement, the manager will identify issues through an annual sustainability analysis and external controversies data on each investee company. Where the manager can be more effective as part of a group, it will collaborate with other investors.

Generally, the manager is a very active owner on behalf of its investors, typically voting against management of investee companies on at least one vote at around 60% of votable meetings. The manager’s voting policies are structured by geographic area and it will publicly disclose all of its decisions and the rationale for each vote. The manager will communicate its voting intentions to companies and will engage with them on issues of contention to effect change with a view to being able to vote in favour in subsequent years.

Investment restrictions

ESGT will comply with the following investment restrictions:

- no more than 10% of net assets will be exposed to any one company;

- no more than 20% of net assets will be exposed to companies listed on exchanges in emerging market countries;

- no more than 10% of net assets will be invested in aggregate in unlisted securities, convertible securities and/or preference shares; and

- the company will not hold securities which represent more than 20% of the voting rights of any company.

Each of the above restrictions will be calculated at the time of investment.

Hedging and derivatives

The company may use derivative instruments to create leverage via synthetic long positions (i.e. positions which are in economic terms equivalent to long positions), for example, by using futures, options and contracts for difference (CFDs). This strategy may be used to gain exposure to equities and equity-related securities and to seek both to protect and to enhance the returns achieved. Each synthetic long position will be treated as if a direct equity investment had been made and will be subject to the same diversification and risk spreading limits as set out in the investment restrictions above. The use of derivatives to create leverage will also be subject to the leverage and borrowing limits set out below.

The company may also use derivatives for efficient portfolio management purposes including hedging.

In particular, investments will be made in assets denominated in a number of currencies. The manager may, at its discretion, choose to hedge all or a proportion of the non-sterling denominated assets of the company into sterling.

Asset allocation

As discussed in the investment process section, the manager will apply a rules-based approach to the construction of ESGT’s portfolio. Using this approach, it will aim to build a concentrated portfolio of ‘best ideas’ for ESGT, comprising between 25 and 35 companies from the manager’s Sustainable Future investable universe. These companies will have the highest sustainability scores – only companies rated A or B in the manager’s sustainability matrix ratings will be eligible for inclusion in ESGT’s portfolio.

Position sizes within the portfolio will reflect the manager’s assessment of the risk, reward and the strength of its conviction in the holding. The companies selected will be those best able to diversify risk and reduce the volatility of returns. This approach should result in ESGT’s portfolio being exposed to a wide variety of industry sectors (via a spread of the manager’s sustainable themes) and the portfolio should benefit from potentially distinct and uncorrelated growth drivers.

Model portfolio

ESGT’s prospectus provides details of a model portfolio that is designed to provide an illustration of what ESG’s portfolio could look like. Some of the data has been reproduced below. It should be noted that, while the model portfolio may provide an illustration, there can be no assurance that ESGT would hold any or all of the stocks in the model portfolio.

In the interests of diversifying the portfolio, and to allow it to impact a wide range of environmental and societal issues, investments will be spread across the range of twenty-one ESG thematic categories which have been linked to the seventeen SDGs shown on page 6. The twenty-one themes, which are illustrated in Figure 1 on page 7, are at the heart of the manager’s idea generation. At least 50% of a company’s revenues should be linked to at least one theme.

The model portfolio has biases towards mid cap, growth and quality stocks. It has an active share in excess of 90% versus ESGT’s MSCI World Index benchmark.

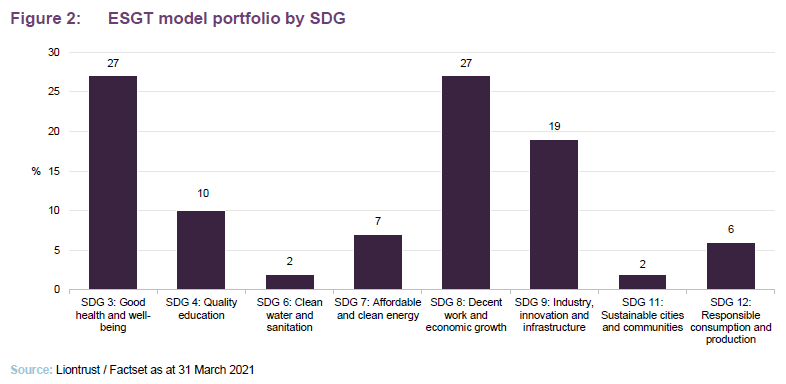

Model portfolio – SDGs

Figure 2 provides a breakdown of the model portfolio by SDG. It illustrates that the model portfolio has exposure to eight SGDs, with significant exposures to SDG 3 (good health and well-being), SDG 8 (decent work and economic growth) and SDG 9 (industry, innovation and infrastructure). The model portfolio also offers good exposures to SDG 4 (quality education), SDG 7 (affordable and clean energy) and SDG 12 (responsible consumption and production); as well as small exposures to SDG 6 (clean water and sanitation) and SDG 11 (sustainable cities and communities).

Reaching the SDGs that are hard to impact through investment

As discussed in the investment opportunity section on page 9, there are some SDGs which are hard to impact through investment. Specifically, for these areas, there are currently very few opportunities to invest successfully while having a positive impact on these SDGs.

A distinguishing feature of ESGT’s investment process is that the manager will donate up to 10 per cent. of the management fees paid by the company to the AIFM (who is responsible for the fees payable to the manager). This money will be used to fund research identifying and developing financial instruments covering the currently uninvestable SDGs. The 10% level is to be reviewed periodically, but the aim is that, in time, investments addressing these difficult to access SDGs will become available for the company and others to invest in.

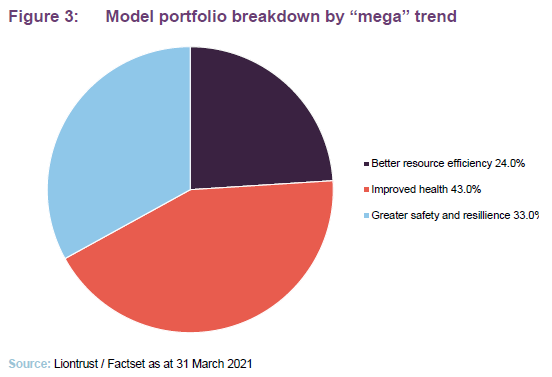

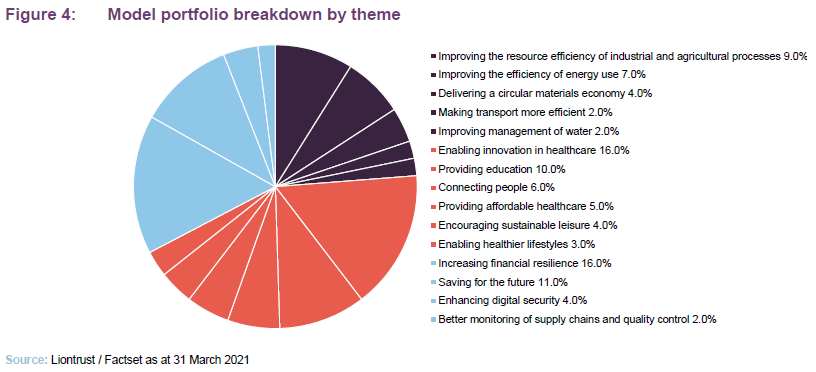

Model portfolio – mega trends and themes

Figure 3 provides a breakdown of the model portfolio according to the “mega” trends that were highlighted on page 7, while Figure 4 provides a more granular breakdown of the portfolio by theme. Figure 4 illustrates that the model portfolio offers a diversified exposure to a wide range of sustainable investment themes.

Model portfolio characteristics

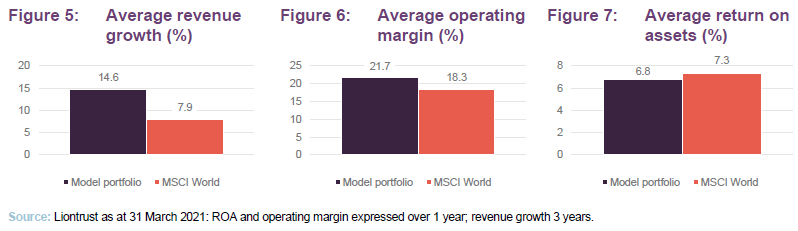

Liontrust has provided a comparison of ESGT’s model portfolio against its performance benchmark index, the MSCI World Index. This is illustrated in Figures 5, 6 and 7. Based on data as at 31 March 2021, the model portfolio has much higher revenue growth over three years (14.6% versus 7.9%), and a higher operating margin (calculated over one year). The average return on assets is modestly lower than that of the MSCI World (6.8% versus 7.3%). This is consistent with the manager’s expectation that ESGT’s portfolio will be biased towards both growth and quality.

As noted above, the model portfolio has an active share in excess of 90%, and the manager expects that ESGT’s portfolio will have low turnover, with holding periods anticipated to be typically greater than five years.

Small cap bias

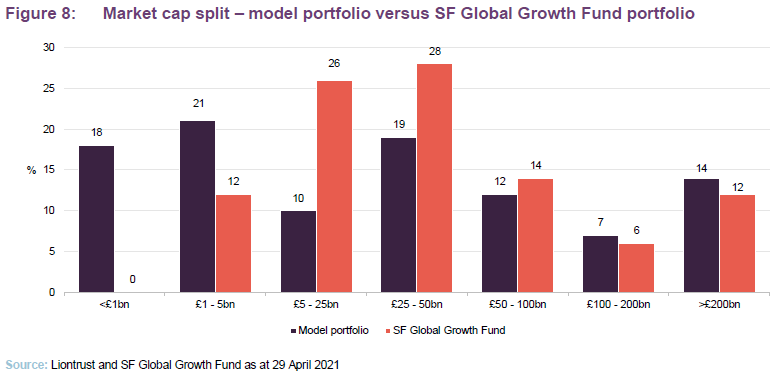

Figure 8 provides an illustration of the market cap split of the model portfolio versus that of the open-ended Liontrust SF Global Growth Fund.

ESGT’s closed-end structure, and the permanency of capital this brings, will allow the managers to be unconstrained by market cap when constructing the portfolio (a key strength of the closed-end structure is that managers do not need to maintain liquidity within the portfolio to finance possible redemptions). Reflecting this, the model portfolio is able to move further down the market cap scale versus the Liontrust SF Global Growth Fund, and 39% of the model portfolio is allocated to companies with a market cap below £5bn. Of the 35 holdings in the model portfolio, 13 are not held in SF Global Growth Fund’s portfolio and, reflecting the greater opportunity to move down the market cap scale, the average market cap of these 13 companies is £2bn.

A distinctly different investment proposition to the global trusts currently on offer

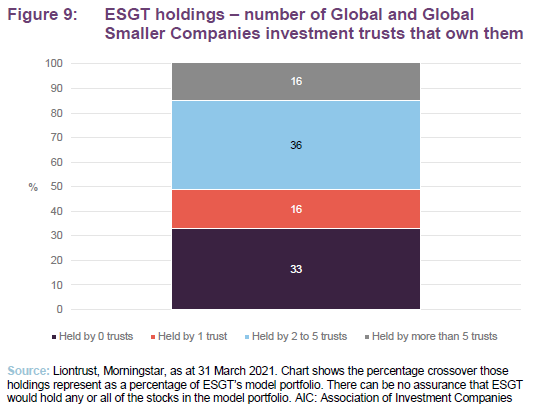

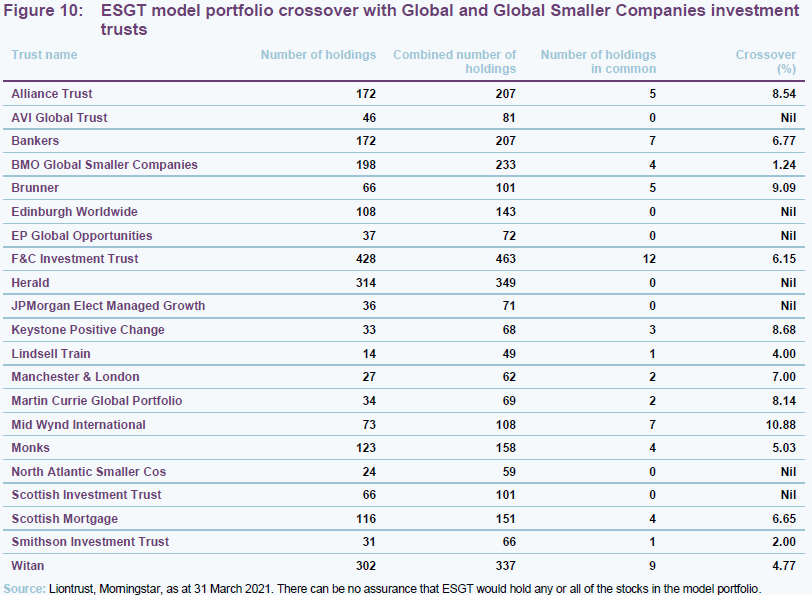

The prospectus provides some analysis, conducted by the manager using data from Morningstar as at 31 March 2021, that compares the model portfolio of ESGT to those of the constituents of both the AIC’s Global sector and the AIC’s Global Smaller Companies Sector. The key takeaways of this analysis are as follows:

- 33% of the model portfolio is invested in stocks that are not owned by another AIC Global or AIC Global Smaller Companies Investment Trust;

- 16% of the model portfolio is invested in stocks that are owned by one other AIC Global or AIC Global Smaller Companies Investment Trust;

- 36% of the model portfolio is invested in stocks that are not owned by between two and five other AIC Global or AIC Global Smaller Companies Investment Trusts; and

- 16% of the model portfolio is invested in stocks that are owned by at least five other AIC Global or AIC Global Smaller Companies Investment Trusts.

The conclusions are represented graphically in Figure 9 below.

Manager’s performance record

Over the year ended 31 March 2021, eight of its ten UK-registered funds were first quartile in their peer groups and the same eight were also top quartile over three years and five years to the end of 2020. Liontrust has also won numerous accolades and awards for the performance of its Sustainable Investment Team including: Investment Week Fund Manager of the Year Awards in 2020 for the Liontrust SF Cautious Managed and Liontrust SF Managed funds; Best ESG Fund (Liontrust SF Global Growth Fund) at the Portfolio Adviser Fund Awards 2020; Best Active Ethical/Sustainable Fund (Liontrust SF Global Growth Fund) at the AJ Bell Fund and Investment Trust Awards 2019; and Mixed Asset Fund of the Year (Liontrust SF Managed Growth Fund) at the FT Adviser 100 Club Awards 2019.

Proven track record

As discussed on page 5, Liontrust’s Sustainable Future fund range was launched in 2001 and so the manager has some 20 years of experience in sustainable investing. However, Liontrust has not offered this strategy to investors in a closed-ended structure before, and so there is not a perfect vehicle which we can look to when seeking to illustrate how the strategy, which will be used to manage ESGT, would have performed historically (for example, ESGT’s portfolio is not constrained by market cap). While accepting this limitation, the prospectus provides details of the performance record of the Liontrust Sustainable Future Global Growth Fund as this is considered to be the most directly comparable to the investment policy of ESGT. Data for the Class 2 Accumulation unit has been provided – this is available to all investors, including retail investors. The performances provided are net of fees.

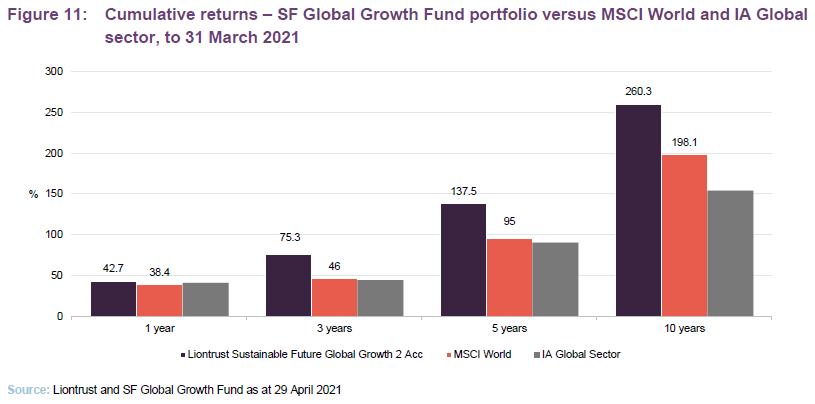

Figure 11 below provides an illustration of the Liontrust Sustainable Future Global Growth 2 Acc against the comparator benchmarks – the MSCI World and IA Global sector. It can be seen in Figure 11 that the Liontrust Sustainable Future Global Growth 2 Acc outperformed both the MSCI World Index and the IA Global Sector for all of the periods provided (returns are calculated to 31 March 2021).

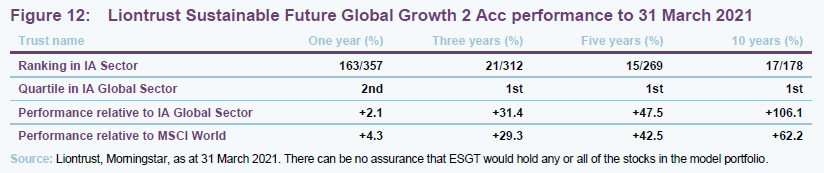

Figure 12 shows how the Liontrust Sustainable Future Global Growth 2 Acc’s performance ranks within the IA sector, as well as its relative performance against the IA Global Sector and the MSCI World. It can be seen that the performance is top quartile for the longer-term periods of three-, five- and ten-years. Over the shorter-term one-year period, its performance is second quartile. Outperformance of both the IA Global Sector and MSCI World is strong over the longer-term periods.

Dividend policy

It is anticipated that the majority of shareholder returns, generated by ESGT, will be through capital appreciation rather than income generation. Reflecting this, ESGT does not have any dividend targets. However, it will pay out its income as required by law and, where required, it intends to pay dividends on an annual basis. For example, like all investment trusts, ESGT will be required to pay out at least 15% of its income (as calculated for UK tax purposes) in respect of an accounting period to maintain its investment trust status.

Premium/discount management

The board of ESGT has the discretion to issue further shares or perform share buybacks to manage the trust’s premium or discount to NAV, as and when it deems appropriate.

Premium management

If the trust is trading at a premium to NAV, the company may choose to issue new shares to meet investor demand. From the outset, the board has shareholder authority to issue up to 250m ordinary shares and/or C shares, on a non-pre-emptive basis through a placing programme.

No shares will be issued at a price below the last published NAV per share at the time of the announcement of any proposed issue unless they are first offered pro-rata to existing shareholders.

Shareholders can choose to renew this permission at ESGT’s first annual general meeting, which is expected to be held in July 2022.

The prospectus notes that this is entirely at the board’s discretion and investors should not expect or rely on this being exercised.

Discount management

A special resolution has been passed by which the company may buy back up to 14.99% of shares, to correct any imbalance between supply and demand. Any share buybacks would be made only out of the available cash resources of the company and may be held in treasury or cancelled.

The maximum price (excluding costs) which may be paid for a share must not be more than the higher of:

- 5% above the average of the mid-market values of the shares for the five working days before the purchase is made, or

- the higher of: (a) the price of the last independent trade; and (b) the highest current independent bid for the shares on the London Stock Exchange at the time the purchase is carried out.

In addition, ESGT will only make such repurchases through the market at prices (after allowing for costs) below the relevant prevailing NAV per share under the guidelines established from time to time by the board. The prospectus states that in normal and stable market conditions the board hopes to limit the discount to NAV per share to no wider than 5%.

Shareholders will be asked whether they want to renew this permission at ESGT’s first annual general meeting. As with ESGT’s premium management policy, no expectation or reliance should be placed by shareholders on the board exercising the share buyback scheme.

Treasury shares

As stated above, any repurchased shares may be held as treasury shares, rather than having to cancel them.

These shares may be subsequently cancelled or sold for cash. This would give the company the ability to reissue ordinary shares quickly and cost effectively, thereby improving liquidity and providing the company with additional flexibility in the management of its capital base.

Unless authorised by shareholders, no shares will be sold from treasury at a price less than NAV unless they are first offered pro rata to existing shareholders.

Fees and costs

The initial costs of bringing ESGT to market are expected to be no more than £3m, which equates to 2% of gross proceeds (assuming ESGT achieves its fundraising target of £150m), resulting in a starting NAV per share of at least 98p.

The company’s ongoing charges are estimated at 1.03% per annum, based on gross proceeds of £150 million. This excludes all costs associated with making and realising investments. Some of the components of this are discussed below.

Management fee

The prospectus states that the AIFM will receive an annual fee of 0.65% of the prevailing net assets of the company. It is calculated and paid quarterly in arrears and there is no performance fee.

Company secretarial and administration fees

JTC (UK) Limited has been appointed as company secretary and administrator of ESGT and is entitled to receive an annual fee of £75,000, in addition to a set-up fee of £30,000. The company secretary is also entitled to additional fees for services such as inter alia, payroll services and additional board or committee meetings which will be payable by the company.

Depositary

The Bank of New York Mellon (International) Limited has been appointed as ESGT’s depositary and is entitled to receive fees in respect of its depositary, custody and certain administration services. This is dependent on the gross assets of the company subject to a minimum fee of £15,000 (inclusive of VAT), plus certain event-driven fees.

Registrar

Equiniti Limited has been appointed as ESGT’s registrar and is entitled to receive an annual share register maintenance fee of £5,000 per year for the second and third year of the registrar agreement (there is no share register maintenance fee in the first year of agreement) plus £1 per shareholder account more than 5,000 shareholder accounts per year. The registrar is also entitled to receive an annual share register analysis reporting service fee of £6,000 per year and certain activity fees.

The board

Each of ESGT’s board of directors is entitled to receive a fee of £25,000 per year plus an additional annual fee of £5,000 for the chairman of the audit and risk committee. The chairman’s fee will be £35,000 per year.

The directors are also entitled to out-of-pocket expenses or additional renumeration should they perform extra or special services on behalf of the company.

Auditor

ESGT’s auditor is BDO LLP.

Capital structure and life

Following admission to trading, ESGT will have just ordinary shares in issue and no other classes of share capital. Applications will be made to the FCA for ESGT’s ordinary shares to be admitted to the premium segment of the Official List and to the London Stock Exchange for such shares to be admitted to trading on the premium segment of its main market.

Gearing

ESGT is permitted to borrow and, from time to time, may use borrowings for investment purposes and for working capital. Borrowings are not normally expected to exceed 10% of net assets but will not, in any event, exceed 20% of net assets, as calculated at the time of drawdown.

In addition to this, ESGT’s board has adopted a policy that the trust’s gross asset exposure, whether from borrowing or derivatives (where such derivatives are used for investment purposes), will not exceed its net assets by more than 30%, as calculated at the time of drawdown. For these purposes, gross asset exposure is defined as the value of ESGT’s total portfolio, whether through direct or indirect investment (including through derivatives), after the deduction of cash balances but without considering any hedging and netting arrangements.

Five-yearly continuation votes starting in 2026

ESGT’s board will propose an ordinary resolution that it continues as an investment trust every five years after its first annual general meeting. The first such continuation vote will be proposed at a general meeting of the company to be held in July 2026.

If a continuation resolution is not passed, the directors are required to put forward proposals for the reconstruction, reorganisation or winding-up of the company to shareholders for their approval within six months following the date on which the relevant continuation resolution is not passed.

These proposals and failure to pass the continuation vote may or may not involve winding-up the company or liquidating all or part of its then existing portfolio of investments.

Financial calendar

The company’s financial year end will be the last day in February each year and the first set of full accounts will cover the period from launch to 28 February 2022. The company will also publish unaudited half-yearly reports to 31 August each year. ESGT’s first annual general meeting is expected to be held in July 2022.

The team

The 13-strong team is headed by Peter Michaelis and has been managing sustainable funds for 20 years. Three lead managers will take responsibility for ESGT.

Peter Michaelis

Peter joined Liontrust in April 2017 as part of the acquisition of Alliance Trust Investments, where he was head of investment. He has been managing money in sustainable and responsible investment for over 20 years.

Peter started his career working for the Steel Construction Institute as an environmental engineer before moving to Henderson Global as an analyst and assistant portfolio manager. In 2001, he moved to Aviva, where he was promoted to lead portfolio manager on a number of its sustainable and responsible investment funds, before eventually heading the department. Peter has a PhD in environmental economics.

Simon Clements

Simon also transferred to Liontrust in 2017 having spent five years at Alliance Trust Investments. He is currently the lead manager of the SF Global Growth and Absolute Growth funds, and co-manager on the SF Managed, SF Cautious Managed and SF Defensive Managed funds.

Prior to this, he spent 12 years at Aviva Investors where, most recently, he was head of global equities. He has also worked as a portfolio accountant and risk and performance analyst. Simon holds a BA in economics and a graduate diploma in applied finance and investment.

Chris Foster

Chris also moved to Liontrust in April 2017 with the acquisition of Alliance Trust Investments. He joined the firm through their management training programme, where he completed rotations within Alliance Trust Savings, fund sales, and equity investments. He has a degree in economics and mathematics.

The advisory committee

The investment team is supported by an advisory committee of five experts in sustainable development who guide the team’s longer-term thinking. The committee members are:

Sophia Tickell

Sophia is co-founder and director of Meteos, a non-profit company, which runs senior dialogues, focused on finance, health and the environment. She is the author of ‘Banking on Trust’, ‘Vital Connections: Science, Society and Sustaining Health’, the EnergyFutures report, and the PharmaFutures series. She is also a non-executive director at Liontrust Asset Management.

Tony Greenham

Tony is director of economy, enterprise and manufacturing at the Royal Society of Arts, Manufactures and Commerce, where he leads a programme of policy research into the future of work, social impacts of technology, green industrial strategy and economic democracy. Once a corporate stockbroker, Tony has written extensively on financial sector reform.

Jonathon Porritt

Jonathon is founding director of Forum for the Future, the UK’s leading sustainable development charity. His book, ‘The World We Made’, seeks to inspire people about the prospects of a sustainable world in 2050. He is also chancellor of Keele and was once chair of the UK Sustainable Development Commission.

Tim Jackson

Tim is a professor of sustainable development at the University of Surrey and director of the Centre for the Understanding of Sustainable Prosperity. From 2004 to 2011, he was economics commissioner on the UK Sustainable Development Commission.

Valborg Lie

Valborg Lie is stewardship manager at LGPS Central, responsible for bespoke engagement and voting services to support investment objectives. She has worked on responsible investment issues for more than 15 years and was head of RI within the Norwegian Ministry of Finance between 2005 to 2013. Valborg leverages an exclusive network of institutional investors and sovereign wealth funds globally to help promote and build RI best practices.

Board

ESGT’s board has five board non-executive directors who are responsible for the determination of the trust’s investment objective and policy and have overall responsibility for its activities including the review of investment activity and performance and the control and supervision of its service providers.

The prospectus states that all of the directors are independent of the AIFM, the manager and other service providers, and are from the sustainable investment, investment trust and asset management sectors.

They will meet at least four times a year to, amongst other things, review and assess ESGT’s investment policy and strategy, its risk profile as well as performance. The audit and risk committee will meet at least three times a year. Brief biographies are provided below.

Richard Laing, chair

Richard holds several non-executive positions and currently chairs 3i Infrastructure. He is also on the board of Tritax Big Box REIT and JP Morgan Emerging Markets. He used to be a trustee of Plan International UK, the international children’s charity, and The Overseas Development Institute. Richard was CEO of CDC Group from 2004 to 2011, having joined the organisation in 2000 as finance director.

Prior to this, he spent 15 years at De La Rue, where he held several positions in the UK and internationally, most recently as the group finance director. Richard was also formerly a non-executive director of Perpetual Income and Growth.

Clare Brook, non-executive director

Clare is currently CEO of the Blue Marine Foundation, an ocean conservation NGO. Prior to this, she worked for 24 years in sustainable investment across a number of firms. At Jupiter, she managed the pioneering Ecology fund and the UK’s first ‘green’ investment trust in the early 90s. She then managed the Global Care range of funds at NPI and Henderson from 1994 to 1999.

In 2001, she established the sustainable investment division of Aviva where she and her team launched the Sustainable Future range of funds, now managed by Liontrust. In 2008, Clare co-founded WHEB Asset Management, a positive impact investment firm.

Sarah Ing, chair of the audit and risk committee

Sarah is a chartered accountant with 30 years’ experience in financial services including audit, corporate finance, investment banking and asset management. During her executive career, she was a top-rated equity research analyst covering the UK general financial services sector and also founded and ran an equity hedge fund investment management business.

Kunle Olafare, Non-Executive Director

Kunle is CEO and client director of SK Financial, a London based independent financial planning firm. Prior to joining the firm in 2009, he spent nine years as head of advice, financial planning at Kleinwort Benson and prior to this held various investor and client facing roles as an IFA.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Liontrust ESG trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it and readers should place no reliance on the information contained therein.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information and information and should be read in conjunction with the Downing Renewables and Infrastructure Trust prospectus published on 12 November 2020. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

QuotedData is a trading name of Marten & Co, which is authorised and regulated by the Financial Conduct Authority.