Top performer as Asia regains momentum

Pacific Horizon (PHI) has rallied over the past year, outpacing both its benchmark and its peers as sentiment towards Asia has appeared to improve. The trust’s growth-focused approach, which struggled during the period of rising global interest rates, appears to be delivering results again.

Asian markets appear to have benefitted from resilient domestic demand, easing trade tensions, and renewed confidence in technology-led growth. Valuations across much of the region seem undemanding, and PHI’s managers maintain exposure to companies the managers expect to benefit from structural trends such as within semiconductors and artificial intelligence.

Focused on Asia ex-Japan growth stocks

PHI invests in the Asia-Pacific region (excluding Japan) and in the Indian subcontinent in order to achieve capital growth. The company is prepared to move freely between the markets of the region as opportunities for growth vary. The portfolio will normally consist mostly of quoted securities, although it may hold up to 15% of total assets in unlisted investment opportunities, measured at the time of initial investment.

| Year ended | Share price total return (%) | NAV total return (%) | MSCI AC Asia ex-Japan total return (%) | MSCI AC World total return (%) |

|---|---|---|---|---|

| 31/10/2021 | 43.2 | 44.8 | 7.1 | 29.9 |

| 31/10/2022 | (41.4) | (29.5) | (21.0) | (4.6) |

| 31/10/2023 | (1.5) | 0.8 | 7.5 | 4.3 |

| 31/10/2024 | 12.4 | 16.4 | 21.4 | 25.4 |

| 31/10/2025 | 36.9 | 30.2 | 26.4 | 20.1 |

Fund profile

Additional information is available at the manager’s website: www.bailliegifford.com

Pacific Horizon (PHI) is an investment trust that specialises in investing in growth companies in Asia ex-Japan. Baillie Gifford & Co (Baillie Gifford) has been appointed to manage PHI’s portfolio on behalf of Baillie Gifford & Co Limited, the trust’s alternative investment fund manager. Baillie Gifford has managed PHI since 1992. Baillie Gifford is a long-term growth investor, and states that it believes there is a significant opportunity to outperform markets over the long term using this approach. Pacific Horizon was promoted to the FTSE 250 index in January 2023.

About the manager

Well-resourced investment team.

Baillie Gifford has 145 investors/analysts based in its Edinburgh office, with a further three in the US and five in China (these exclude ESG analysts). It is structured as a partnership and says that it encourages a collegiate approach to managing money, while allowing its portfolio managers the final decision regarding their portfolios. It managed or advised on about £213.1bn at the end of September 2025. PHI and the Baillie Gifford Pacific Fund (its open-ended equivalent) had combined total assets of roughly £3.4bn as at 30 September 2025.

PHI is managed by Roderick Snell (lead manager) and Ben Durrant (deputy manager).

Roderick Snell is the senior fund manager for Baillie Gifford’s Asia ex-Japan strategies and is the lead manager of PHI’s portfolio. He is supported by Ben Durrant, who was appointed as deputy manager in January 2023 (please see page 19 for more information on the managers). Roderick states that the team keeps abreast of the political and macro influences in Asia and that thematic considerations are considered. However, he believes that a bottom-up stock picking approach provides greater insight into the overall picture.

PHI is a stock-picking fund that bears little resemblance to the MSCI All Country Asia ex Japan Index comparative index.

The fund primarily follows a stock-picking approach, and the portfolio may differ materially from its comparative index, the MSCI All Country Asia ex-Japan Index (the active share of PHI’s portfolio at the end of December 2024 was 74%).

The pair spend most of their time meeting companies and undertaking stock-specific research. The process and philosophy used to manage PHI has remained the same for the last 30 years.

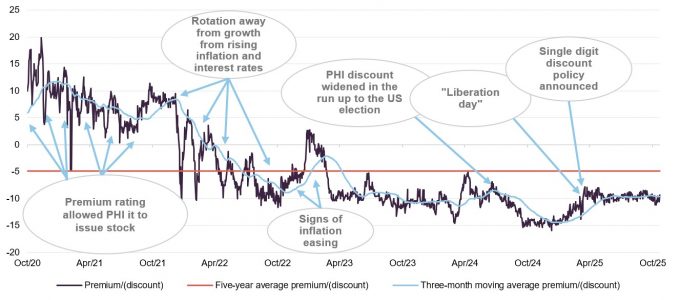

Market roundup – Asian valuations remain undemanding

Since QuotedData last published on PHI in March 2025, there has been significant volatility in global equity markets. This period was characterised by weakness in the run-up to and immediate aftermath of “Liberation Day,” but markets have recovered since seemingly in response to some of the more restrictive measures being rolled back. In this context, Asia – and China in particular – has shown positive performance, seemingly supported by resilient domestic activity and possibly an improved risk appetite.

The region’s equity markets have continued to attract capital into areas exposed to structural growth themes, including artificial intelligence and its broader enabling technologies, where Pacific Horizon maintains meaningful exposure.

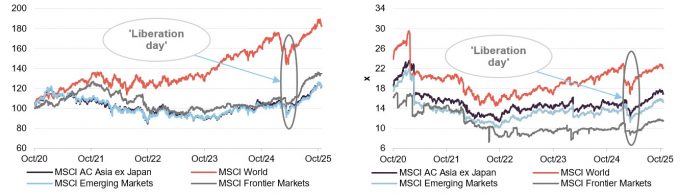

As illustrated in Figure 1, Asia and emerging markets appear to have narrowed the performance gap with the US in recent months, and valuations have increased across the board and are slightly above their five-year averages, although they remain noticeably below their five-year highs.

Figure 1: Index total return performance over five years, rebased to 100

Figure 2: Index F12m P/E ratios over five years

Source: Bloomberg, Marten & Co

Source: Bloomberg, Marten & Co

Managers’ view – Asia remains well-placed to perform

When we published in March, we noted that, against the backdrop of a new and vocal administration in the US, higher market volatility and elevated uncertainty more generally, PHI’s managers felt that the potential advantages Asia offers both in the short and long term may be overlooked. They cited low inflation across the board, economies run in a manner described by some as orthodox, low debt levels, and, after a decade of outflows, little hot money left in the region. This raised the broader question as to why, given the region’s higher growth prospects, Asia equities appear to trade at a marked discount to global equities—a feature that remains evident.

PHI’s managers identified two primary factors: China’s economic challenges and ongoing US dollar strength (the greenback was close to decade high levels versus the Chinese yuan). The managers argued that there was evidence to suggest the tide may be starting to turn in Asia’s favour and that the region could be close to an inflection point.

Fast-forward to today, and several things have shifted. The US dollar has weakened, which has been stated as an objective of the current US administration, and China appears to be recovering, supported by renewed domestic policy measures (the government has spent billions on measures such as subsidies, higher wages, and discounts intended to stimulate the domestic economy) and increased exports (some of which may be due to spending brought forward to build inventories in anticipation of tariffs), which appears to have helped offset weak domestic spending. However, while geopolitical uncertainties continue, PHI’s managers comment that most Asian markets have appeared resilient in the face of the tariff situation.

On Trump and tariffs

Cost differentials mean large-scale reshoring is not viable.

The announcement of Trump’s “Liberation day” tariffs initially appeared to trigger a period of volatility across Asian equity markets, with a sharp sell-off. However, PHI’s managers state that the longer-term impact now appears limited. According to the managers, whilst the measures temporarily disrupted sentiment, underlying cost differentials remain a significant factor: average manufacturing wages in the US are roughly 10 times those in Southeast Asia, which, they suggest, implies that tariffs of 100–150% or more would be required to render large-scale reshoring economically viable.

Despite tariffs, manufacturing unlikely to relocate outside Asia in any meaningful way.

They believe that labour intensive manufacturing is unlikely to return to the US or relocate outside Asia in a significant way. Instead, they say that the effect has been one of intra-Asian diversification, with supply chains adjusting at the margin. For example, countries such as Malaysia and Vietnam have seen incremental investment as companies seek to reduce reliance on China while maintaining access to competitive labour and established logistics networks. The managers add that India initially appeared well-positioned to benefit from this reordering, but the imposition of 50% reciprocal tariffs following a dispute about the import of Russian oil has reduced expectations of that outcome. PHI’s managers say that they are comfortable with the macro backdrop in India, noting that both India and China have large domestic economies and neither is dependent on their exports to the US. However, they have been avoiding Indian IT outsourcers due to economic headwinds in the US, as well as uncertainty around their long-term prospects in the face of AI.

The greater burden of the tariff regime appears to have fallen on the US consumer, through higher import costs and a potential squeeze on real purchasing power. PHI’s managers acknowledge that this may have left domestic demand in the US more vulnerable to broader economic slowing, which could weigh on Asian exports at the margin, particularly while inventories revert to more normal levels. The managers say that one area of structural change has been at the higher end of the manufacturing spectrum, where production is more portable. Companies such as TSMC and Samsung Electronics have committed to building new semiconductor fabrication plants in the US, partly in response to policy incentives and strategic considerations. PHI’s managers believe that these projects represent targeted exceptions rather than a broader shift, and that Asia’s role at the centre of global manufacturing remains fundamentally intact.

At the time of the last publication, markets appeared to be focusing on the reflationary aspects of Trump’s policies, with expectations of higher nominal US GDP growth and higher interest rates. However, while tariffs have pushed prices up in the US and elsewhere, the growth outlook appears to have deteriorated, increasing the potential for interest rate cuts in the US, which could benefit Asia and growth stocks.

PHI’s managers state that despite the recent uptick in performance, valuations in Asia remain compelling. However, they believe that the real opportunity lies in PHI’s underlying portfolio companies. They comment that PHI owns companies that, in their view, are shaping industries such as batteries, semiconductors, fintech, gaming, ecommerce, and social networks. The managers state that the world is becoming increasingly multi-polar, and they believe that Asia may be a long-term beneficiary of this.

Investment philosophy and process

The underlying approach

Baillie Gifford believes that markets are inefficient at pricing long-term growth, especially over a time horizon of at least five years, and that this may create an opportunity to generate alpha. For this reason, the firm says that it aims to encourage a culture of long-term thinking within the organisation. Baillie Gifford states that it believes there is persistence of good company management, business models and stock prices. According to the firm, this translates into a culture of “sticking with the winners”.

The company uses proprietary research. The team undertakes much of this, but may also commission research from local research teams, academics, and industry experts. Baillie Gifford sometimes subjects companies to forensic analysis, using the services of investigative journalists and forensic accountants. When speaking with companies, conversations with their management teams focus on the long-term prospects of the business.

The managers are able to draw on the resources of the whole investment team when analysing companies, and can sit in on meetings with companies outside their geographic remit. This may assist them when they are trying to identify how their companies compare with competitors domiciled in other markets.

Each member of the team is assigned a geographical focus for research, and these responsibilities are rotated every few years. Investment ideas are presented to the group, but the lead portfolio manager makes the final decision. Roderick and Ben typically spend four to five weeks visiting Asia each year.

The open-ended investment company (OEIC) and PHI are run in parallel, with some exceptions; a key factor is the need to keep the OEIC’s portfolio relatively liquid to allow for inflows and the funding of redemptions. There is an internal limit of holding no more than 10% of the portfolio in illiquid holdings, but within this constraint, PHI has greater freedom to hold more illiquid investments than the OEIC. The OEIC has a larger proportion of large-cap holdings, while PHI has more exposure to small-cap names. There is significant commonality in the stocks held, although the individual weightings may differ. PHI, unlike the OEIC, also has the option of using gearing and invests in unlisted companies.

Building the portfolio

Baillie Gifford is an active investor and does not hold stocks solely based on their size within any benchmark. There are few limits on country, sector or stock weightings imposed on managers. The initial size of a position is determined by the managers’ assessment of the potential risks and rewards of the investment. According to Baillie Gifford, one of the guiding principles of investing at the firm is to “run the winners,” which reflects their belief in the persistency of certain business models. The managers review the overall portfolio to seek to ensure that it does not have a concentration of companies exposed to similar thematic dynamics.

The mandate allows PHI’s managers to use derivatives to control risk and to alter the portfolio’s exposure to markets. In practice, the managers are not undertaking such activity. The managers say that they have no plans to use hedging to alter the portfolio’s currency exposure.

Sell discipline

A loss of confidence in a company’s management may prompt a sale. Roderick and Ben also say that they will sell if they believe that the business model is not working, or if the market appears to have met their expectations.

Portfolio allocation

As at 30 September 2025, PHI held 64 companies in the portfolio, up from 62 as at 31 December 2024. PHI believes that it can achieve an appropriate level of diversification for its strategy by holding 40–120 companies.

In normal market conditions, the managers state that if a position is below half a percent, they need to have a strong view for it to remain in the portfolio. As at 30 September 2025, there were 10 positions that fell below this threshold. During the last financial year, positions in 15 new names were initiated, while complete sales numbered 15.

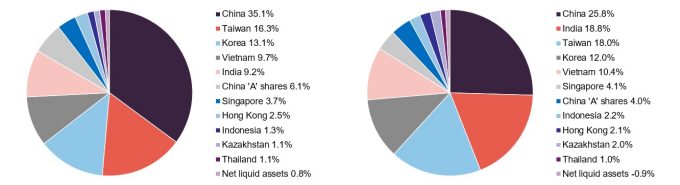

Portfolio activity

There has been no significant change in the themes represented in PHI’s portfolio since the last publication, although exposure to India has continued to decrease while exposure to China has increased. These appear to be the two major shifts in geographical allocations – see Figures 3 and 4. However, while PHI’s managers had been increasing exposure to China, they say that they have been trimming some Chinese companies recently, using market movements to broaden the portfolio’s stock selection in China.

The managers have added to Vietnam, increasing exposure to Vietnamese banks in particular, following new pro-growth reforms. The managers comment that Vietnam has experienced weakness over the last four years as the government pursued a corruption clampdown, which led to a well-publicised real estate crisis that impacted the banks, which then led to a gridlock in approvals with officials reportedly reluctant to sign off on new projects. The managers state that Tô Lâm, the new general secretary of the communist party of Vietnam, appears to be more pro-economic growth and development than his predecessor. According to the managers, he has set ambitious targets for GDP growth and is making reforms to achieve these.

Figure 3: Geographic allocation as at 30 September 20251

Figure 4: Geographic allocation as at 31 January 20251

Source: Pacific Horizon Investment Trust. Note: 1) As a proportion of gross assets.

Source: Pacific Horizon Investment Trust. Note: 1) As a proportion of gross assets.

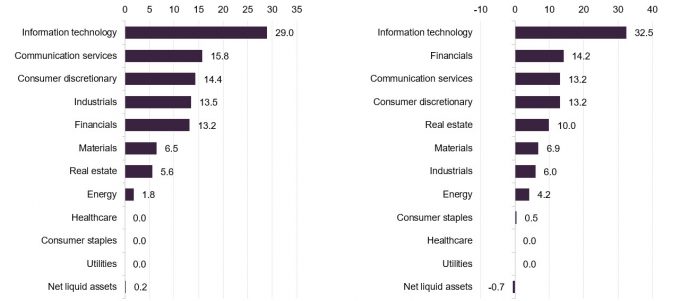

Figure 5: Industry sector allocation at 31 July 20251

Figure 6: Industry sector allocation at 31 July 20241

Source: Pacific Horizon Investment Trust. Note: 1) As a proportion of gross assets.

Source: Pacific Horizon Investment Trust. Note: 1) As a proportion of gross assets.

The managers comment that Korean semiconductor names have also performed well as AI has continued to show momentum. The manager comments that Korean IHT laws have kept valuations low, but states that work is now being done to address this issue.

A comparison of the sector allocations shows an increased exposure to industrials (up 7.5 percentage points), an increase in communication services (2.6 percentage points), and a smaller rise in consumer.

Top 10 holdings

Figure 7: Top 10 holdings as at 30 September 2025

| Holding | Sector | Business focus | Country | Allocation 30 September 2025 (%) | Allocation 31 January 2025 (%) | Percentage point change |

|---|---|---|---|---|---|---|

| TSMC | Technology | Internet services | China | 11.3 | 10.8 | 0.5 |

| Tencent | Technology | Online gaming/social networking | China | 8.2 | 4.9 | 3.3 |

| Samsung Electronics | Technology | Electrical equipment manufacturer | Korea | 5.7 | 5.6 | 0.1 |

| SK Square | Technology | Electronic components | Korea | 4.2 | – | 4.2 |

| Zijin Mining | Materials | Gold and copper miner | China | 3.5 | 2.7 | 0.8 |

| ByteDance | Communications | Owner of TikTok | China | 3.3 | 3.1 | 0.2 |

| Sea Limited | Communication services | Online gaming/ecommerce | Singapore | 3.3 | 3.4 | (0.1) |

| Alibaba | Technology | E-commerce | China | 3.3 | – | 3.3 |

| MMG | Materials | Chinese copper miner | HK/China | 3.0 | 2.2 | 0.8 |

| EO Technics | Technology | Semiconductor laser markers | Korea | 2.2 | 2.0 | 0.2 |

| Total of top 5 | 32.9 | 28.1 | 4.8 | |||

| Total of top 10 | 48.0 | 42.3 | 5.7 |

Figure 7 shows PHI’s top 10 holdings as at 30 September 2025 and how these have changed since 31 January 2025 – this being the most recently available data when last published. Holdings that have moved into the top 10 are SK Square, Alibaba, MMG and EO Technics.

Names that have moved out of the top 10 are Equinox India Developments, Daily Hunt, Accton Technology and PDD Holdings. The manager has also continued to increase portfolio concentration since the last publication, as Figure 7 illustrates.

We discuss some of the developments below. Many of PHI’s other holdings have been discussed in detail in our previous notes – see page 21 of this note.

As explored further in the performance section on page 11, PHI’s exposure to AI and technology holdings appears to have contributed to performance in recent months. The managers says that, in the semiconductor sector, PHI has benefitted from its significant holdings in the likes of TSMC, Samsung, SK Hynix (which PHI also has exposure to through SK Square, a holding company for SK Hynix; the managers have shifted PHI’s exposure more into SK Square, citing the discount to NAV at which it trades) and EO Technics.

They add that, in the tech sector, holdings such as Tencent, ByteDance (TikTok) and Alibaba have shown momentum. Alibaba was added back into the portfolio as the managers believed that the Chinese government’s previously negative approach to tech companies had reversed and they consider that Alibaba’s cloud and AI businesses may have potential.

Both MMG and Zijin Mining have moved up the ranks, which appears to reflect higher copper prices.

Equinox India Developments was reduced as the manager narrowed the exposure to India to fund the increased allocation to China. Daily Hunt (part of VerSe Innovation) is a private holding whose valuation was written down as its “Josh” short-form video app – similar to TikTok – has not scaled as the managers had expected. The company has undergone restructuring, including layoffs to improve efficiency, with the stated aim of achieving profitability.

Other holdings

PHI’s managers comment that Meituan, the Chinese food delivery company, has struggled recently as the market has become concerned about the prospect of stronger competition, with Alibaba and JD.com expanding into the food delivery space. The managers note that Meituan remains the dominant food delivery business in China, with around 70% market share and high utilisation. The managers state that the next 18 months could be challenging, but believe Meituan is well-funded and cash-rich, and they think it is well positioned to respond to increased competition.

PHI’s managers have added to CATL, via its IPO on the Hong Kong Stock Exchange, which they describe as a global leader in battery production. They say that battery production appears to be becoming increasingly commoditised but believe CATL has scale (it has around a 40-50% market share) and can fund R&D to sustain what they describe as a technological advantage (its new Shenxing Pro battery can charge to a 478km range in 10 minutes). According to the manager, CATL is profitable while many peers are still loss-making. The manager recently sold CATL H-shares, which were at a premium, and switched into the A-shares.

Baidu (China’s equivalent of Google) has been sold. PHI’s managers say that the business has been stagnant for some time, and they are concerned that its core search advertising business may be under threat from AI. They report that the company has been investing heavily in areas such as AI models and infrastructure, AI cloud services, and autonomous driving, but believe it is not leading in any of these. They think that companies such as Tencent and Alibaba are in better positions. The managers replaced the position with a holding in Pony AI, an autonomous driving specialist which they believe is better placed.

PHI’s managers comment that the tech conglomerate and longstanding PHI holding Sea Limited has reported strong performance, which the company attributes to growth in its three core businesses: e-commerce (Shopee), digital entertainment (Garena), and digital finance (SeaMoney/Monee). The company cites improved advertising revenue from Shopee (the e-commerce business is now profitable and significantly derisked); growth in the fintech business and a notable performance of the mobile game Free Fire. The company is also expanding into Brazil. The managers questioned whether it could compete effectively against Mercadolibre, but observe that it is generating US$250m of EBITDA per quarter. The managers state that the market is not ascribing any value to this business, which they believe could ultimately be the most valuable part of the entire enterprise. The managers view it as the strongest consumer-focused stock in Southeast Asia.

Performance – now benefitting from rotation away from India into China

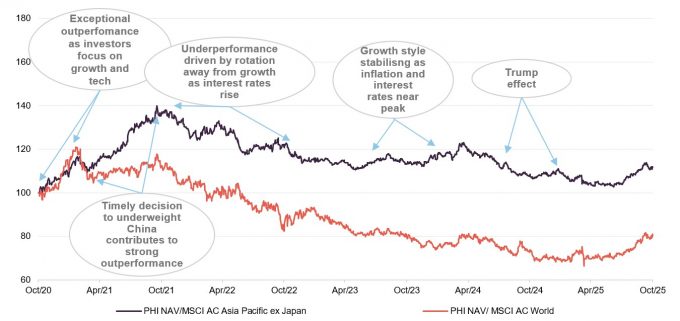

Previous notes have indicated that PHI has a long-term record of outperformance relative to both its MSCI AC Asia Pacific ex Japan benchmark and the MSCI AC World Index, as shown in Figure 9. Recent performance data suggests that PHI has outperformed over more recent time frames, and its performance relative to peers has improved, with PHI ranking as the top performing fund in its peer group for all of the periods shown in Figure 9 (see Figure 10 on page 13). PHI is also the top-performing fund in share price total return terms over most periods.

Figure 8: PHI’s total return NAV performance relative to its comparative benchmark (MSCI AC Asia ex Japan) and the MSCI AC World, over five years to 31 October 2025

Source: Bloomberg, Marten & Co

PHI’s managers say that performance benefitted from decisions to decrease exposure to China in 2021 in favour of India, and to reallocate away from India into China in 2024, as we discussed in our last note. The latter move was based on the view that the Indian market was increasingly priced for perfection, while valuations in the Chinese market appeared negative, even considering the challenges that the Chinese market was facing. This, along with an early decision to increase exposure to semiconductors, appears to have contributed to PHI’s performance during the last year.

Trump’s tariff announcements in early 2025 appear to have negatively impacted growth-orientated positions, but were followed by a rebound from May onwards. China appears to have performed strongly and Korean semiconductor names have also shown positive performance.

PHI’s managers state that they expect further volatility, but believe that, over the long term, the performance of PHI’s holdings should outpace the returns of companies with lower or no growth prospects. The portfolio has been rationalised and concentrated, and the managers state that the fundamental approach remains unchanged.

Figure 9: Cumulative total return performance over periods ending 31 October 2025

| 1 month (%) | 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | 10 years (%) | Manager tenure1 (%) | |

|---|---|---|---|---|---|---|---|---|

| PHI NAV | 7.4 | 22.3 | 42.0 | 30.2 | 52.8 | 55.9 | 374.7 | 402.8 |

| PHI share price | 5.7 | 21.1 | 40.1 | 36.9 | 51.7 | 27.2 | 360.6 | 406.2 |

| MSCI AC Asia Pacific ex Japan | 7.1 | 13.9 | 31.9 | 26.4 | 65.1 | 39.6 | 166.8 | 179.8 |

| MSCI AC World | 4.8 | 9.3 | 23.6 | 20.1 | 57.2 | 94.9 | 243.5 | 296.2 |

| Peer group NAV2 | 6.7 | 13.9 | 29.3 | 17.9 | 47.8 | 47.8 | 243.4 | 282.2 |

| Peer group share price2 | 5.7 | 13.5 | 30.4 | 23.3 | 48.3 | 37.4 | 237.7 | 279.1 |

Peer group comparison – Asia Pacific sector

PHI is a member of the AIC’s Asia Pacific sector, which comprises four members, all of which are illustrated in Figures 10 and 11. All four were members of the peer group when we last published. Members of the Asia Pacific sector will typically have:

- over 80% invested in quoted Asia Pacific shares;

- less than 80% in any single geographic area;

- an investment objective/policy to invest in Asia Pacific shares;

- a majority of investments in medium to giant cap companies; and

- an Asia Pacific benchmark.

Please click here for an up-to-date peer group comparison of PHI versus its Asia Pacific peers.

It appears that, while the peer group is primarily capital-growth-focused, the Baillie Gifford approach has traditionally placed a strong emphasis on growth.

Peer group performance

In previous notes (see page 21), we have discussed how PHI’s strong bias towards growth appears to have served it well over the long term, though it struggled after interest rates began to rise in 2022 in response to inflationary pressures. This year, however, sentiment towards growth companies appears to have improved.

Trump’s “Liberation Day” tariff announcement initially seemed to spur a short-term increase in activity, possibly from businesses looking to stockpile ahead of expected cost increases. However, markets now appear to anticipate that the resulting drag on global growth may prompt central banks to cut rates, which could provide renewed support for growth-focused stocks. PHI has rallied and ranks first out of four in terms of its NAV total return performance for all of the time periods provided in Figure 10, with the exception of the three-year period, which includes a significant part of the previous growth sell-off.

Longer-term periods may be better suited to assessing a long-term strategy such as PHI’s. PHI’s managers state that they aim to be invested in the top 20% of growth companies in the Asia Pacific region and that they explicitly look for companies they believe can double their earnings over a five-year time horizon.

Figure 10: Peer group cumulative NAV total return performance to 31 October 2025

| 1 month (%) | 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | 10 years (%) | |

|---|---|---|---|---|---|---|---|

| PHI | 7.4 | 22.3 | 42.0 | 30.2 | 52.8 | 55.9 | 374.7 |

| Pacific Assets | 5.9 | 6.2 | 12.0 | (1.1) | 15.0 | 41.5 | 145.6 |

| Schroder Asia Total Return | 6.6 | 12.8 | 30.7 | 18.1 | 61.7 | 50.7 | 250.9 |

| Schroder AsiaPacific | 7.1 | 14.2 | 32.6 | 24.5 | 61.6 | 43.1 | 202.5 |

| PHI rank | 1/4 | 1/4 | 1/4 | 1/4 | 3/4 | 1/4 | 1/4 |

| Sector arithmetic avg. | 6.7 | 13.9 | 29.3 | 17.9 | 47.8 | 47.8 | 243.4 |

The average market cap for the peer group is £620.3m, which is approximately 17% higher than at the time of the previous publication (£530.2m). PHI is the second-largest fund in terms of market capitalisation.

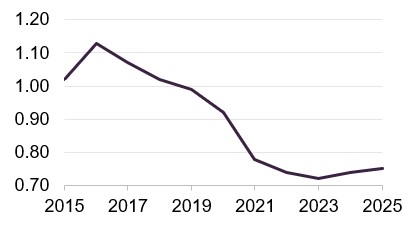

As discussed on page 17, PHI’s ongoing charges ratio has increased slightly for the last two financial years, following a period of decline over a number of years, and is currently the lowest in the sector at 0.75% (the next-lowest being Schroder Asia Total Return at 0.88%). The average ongoing charges ratio for the peer group as a whole has also increased slightly, from 0.90% to 0.91%.

All members of the peer group continue to trade at a discount, although the sector average discount has narrowed marginally from 9.7% to 9.6% (as at 20 November 2025). PHI has tended to trade at a small premium to the sector average historically, which may be related to its performance over the longer term and the board’s efforts at repurchasing PHI stock. PHI’s discount is currently 1.1 percentage points above the sector average.

As previously noted, PHI’s dividend yield remains the lowest in the sector. However, PHI focuses on providing capital growth and only pays dividends to the extent required to maintain its investment trust status. Whilst a dividend is being proposed for the year ended 31 July 2025, there have been years where it has not paid a dividend.

Figure 11: Peer group comparison – size, fees, discount, yield and gearing as at 20 November 2025

| Market cap (£m) | St. dev. of NAV over 5 years | Ongoing charges (%) | Perf. fee | Premium/ (discount) (%) | Dividend yield (%) | Gross gearing (%)2 | Net gearing (%)2 | |

|---|---|---|---|---|---|---|---|---|

| PHI | 626.2 | 17.80 | 0.75 | No | (9.6) | 0.20 | 7.4 | 7.4 |

| Pacific Assets | 425.1 | 12.99 | 1.10 | No | (10.0) | 1.08 | Nil | (4.4) |

| Schroder Asia Total Return | 527.5 | 15.16 | 0.90/1.501 | Yes | (0.7) | 2.04 | 6.5 | 5.3 |

| Schroder AsiaPacific | 868.3 | 14.17 | 0.88 | No | (11.0) | 1.89 | 4.0 | 4.2 |

| PHI rank3 | 2/4 | 4/4 | 1/4 | 3/4 | 4/4 | 4/4 | 4/4 | |

| Sector arithmetic avg. | 611.8 | 15.03 | 0.91/1.061 | (7.8) | 1.30 | 4.5 | 3.1 |

PHI previously had one of the lowest net gearing levels in the sector, but it has increased and is now the highest. According to the managers, this reflects their conviction in the scale of the opportunity. At 6.8%, PHI’s gearing level is still appears relatively modest. PHI’s NAV returns continue to show the greatest volatility within the peer group. However, the volatility does not appear to be excessive and may be considered to be the price of the trust’s long-term performance.

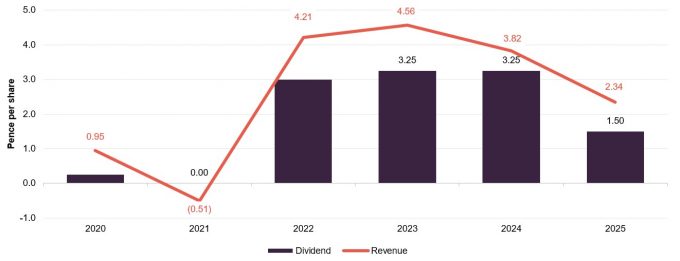

Dividend

Capital-growth-focused; any dividend is the minimum required to maintain PHI’s investment trust status.

PHI’s primary objective is to generate capital growth. Any dividend paid is by way of one final payment per year, following approval at the AGM. PHI’s board has stated that investors should not consider investing in the company if they require income from their investment. In four of the last 10 years – 2017, 2018, 2019 and 2021 – PHI did not pay a dividend. In years of a revenue deficit, PHI is not required to pay a dividend and the board has also stated that it does not intend to draw on PHI’s revenue reserve to pay or maintain dividends.

For the year ended 31 July 2025, PHI generated a revenue surplus of £2.1m, equivalent to 2.34p per share (2024: a revenue surplus of £3.6m, equivalent to 3.82p per share), which represents a 38.7% decrease over the prior year. The board proposed a final dividend of 1.50p per share (payable on 1 December 2025) for the 2025 financial year. The 1.50p, which is a dividend yield of 0.20% on PHI’s share price of 752.0p as at 20 November 2025, represents a decrease of 53.8% over the prior year.

Figure 12: PHI ordinary dividends over the last five financial years (ended 31 July)

Source: Pacific Horizon Investment Trust, Marten & Co

Structure

Fees and costs

Baillie Gifford & Co Limited acts as PHI’s alternative investment fund manager and has delegated portfolio management services to Baillie Gifford & Co. PHI has a tiered management fee that is 0.75% on the first £50m of net assets, 0.65% on the next £200m of net assets and 0.55% on the remaining net assets.

Management fees are calculated and paid quarterly in arrears, and there is no performance fee. The managers may terminate the management agreement on six months’ notice, and the company may terminate it on three months’ notice. Baillie Gifford & Co Limited also provides company secretarial services to PHI, which are included as part of the management agreement.

Figure 14: Ongoing charges ratio (%)1

Source: Pacific Horizon Investment Trust Note: 1) For financial years ended 31 July.

Reflecting its tiered fee structure, a reduction in the management fee and share issuance up until the end of 2021, PHI’s ongoing charges ratio was on a declining trend, but as illustrated in Figure 14, it has increased by 3bp over the last two years (from 0.72% for FY 2023, to 0.74% for FY2024 and 0.75% for FY2025). PHI’s net assets have increased during the last six months, which may put downward pressure on its ongoing charges ratio. PHI currently has the lowest ongoing charges ratio in its peer group (see Figure 14 in the peer group comparison on page 14), with its ongoing charges ratio being 16bp below the sector average.

Capital structure

PHI has a simple capital structure with one class of ordinary share in issue.

PHI has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 20 November 2025, there were 92,074,961 of these in issue, of which 8,892,711 were held in treasury. The number of shares in issue with voting rights was 83,182,250.

Each year, the company seeks authority to buy back up to 14.99% of its shares at a discount to NAV. It also requests permission to issue up to 10% of its issued share capital at a premium to NAV. As discussed on page 15, these authorities provide the board with a mechanism to manage PHI’s premium/discount.

Gearing

PHI has a £60m multi-currency revolving credit facility.

PHI has a £60m multi-currency revolving credit facility (RCF) with The Royal Bank of Scotland International Limited that expires in March 2026. Gearing parameters are set by the board and the managers operate within these, currently the range is set at -15% (i.e. a net cash position) to +15%.

At the end of October 2025, PHI had gross gearing of 7.4% and net gearing of 7.4%, which is higher than when we last published (5.2% and 3.1% as at the end of February 2025). The main covenants relating to the RCF are that PHI’s borrowings should not exceed 30% of its adjusted net asset value, and its net asset value should be at least £300m. The facility has a non-utilisation fee of 0.4%.

Major shareholders

Figure 15 shows that PHI has a retail presence within its share register, as indicated by the major platforms, which account for over 40%. Wealth managers account for over 20%. Since the last publication, J. Safra Sarasin, a Swiss private bank that focuses on sustainability, has continued to add to its position.

Figure 15: Major shareholders as at 30 October 2025

Figure 16: Percentage point changes in shareholdings since 12 March 20251

Source: Bloomberg, Marten & Co

Source: Bloomberg, Marten & Co. Note: 1) The date of the shareholder data used when we last published on PHI.

Five-yearly continuation votes

The next continuation vote is due at the 2026 AGM.

Shareholders are given the opportunity to vote on the continuation of the company every five years. Shareholders approved PHI’s continuation at the trust’s 2021 AGM. The next continuation vote is due at the 2026 AGM.

Financial calendar

PHI’s financial year-end is 31 July. It usually publishes its annual results in September (interims in March) and holds its AGMs in November. Where applicable, it pays its annual dividend shortly after its AGM.

Management team

Roderick Snell joined Baillie Gifford in 2006 and became a partner in 2023. He has managed the Baillie Gifford Pacific Fund OEIC since 2010 and has been lead manager of PHI’s portfolio since June 2021, having been its deputy manager since September 2013. Prior to joining Baillie Gifford’s emerging markets team, Roderick worked in its UK and European equity teams. He is a co-manager of the emerging markets leading companies strategy. Roderick graduated from the University of Edinburgh in 2006 with a BSc (Hons.) in Medical Biology.

Ben Durrant joined Baillie Gifford in 2017 and, prior to joining the emerging markets team, worked in Baillie Gifford’s UK, global discovery and private markets teams. Prior to joining Baillie Gifford, he worked for RBS in their group strategy and corporate finance team. Ben is a chartered accountant and a CFA charterholder. He graduated from the University of Edinburgh in 2012 with a BSc (Hons.) in Mathematics, and has co-managed the Baillie Gifford Pacific Fund since 2021.

Board

All directors submit themselves for re-election annually.

PHI’s board comprises five directors, all of whom are non-executive and are considered to be independent of the investment manager. The directors do not sit together on other boards. The directors put themselves forward for re-election at the first AGM following their appointment. Thereafter, directors submit themselves annually for re-election. Angela Lane is the longest-serving director, with seven years of service, while the average length of director service is 5.3 years.

Directors’ fees

There is a limit of £200,000 for the aggregate of fees paid to directors, which forms part of the company’s articles of association, and shareholders would have to vote to approve any change to this limit. For the current financial year, the fee rates for the directors have been increased by 3.5% over the prior year. At these fee rates, the total directors’ fees amount to £178,540, which is within the £200,000 limit.

Figure 17: Board member – length of service and shareholdings

| Director | Position | Date of appointment | Length of service (years) | Annual fee (£)1 | Share-holding 2 | Years of fee invested3 |

| Roger Yates | Chairman | 13 March 2024 | 1.7 | 46,580 | 15,000 | 2.4 |

| Angela Lane | Audit committee chairman and senior independent director | 1 October 2018 | 7.1 | 38,810 | 8,923 | 1.7 |

| Sir Robert Chote | Director | 25 November 2020 | 5.0 | 31,050 | 500 | 0.1 |

| Wee-Li Hee | Director | 1 June 2020 | 5.5 | 31,050 | 10,000 | 2.4 |

| Joe Studwell | Director | 9 November 2018 | 7.0 | 31,050 | 5,000 | 1.2 |

| Average (service length, annual fee, shareholding, years of fee invested) | 5.3 | 35,708 | 7,885 | 1.6 | ||

Recent share purchase activity by directors

Since the last publication in March 2025, all directors’ holdings have remained the same. All of the directors have personal investments in the trust and the average level of fees invested is 1.6 years.

Roger Yates (chairman)

Roger was chief executive of Henderson Global Investors from 1999 to 2008, prior to which he held fund management roles at Invesco/LGT and Morgan Grenfell Asset Management. He is currently the senior independent director of Mitie Group Plc, the chair of British Biotech Trust and a non-executive director of Jupiter Fund Management Plc. Roger was previously the senior independent director of both St James’s Place and IG Group Plc. He was also previously the chair for Electra Private Equity Plc and was a non-executive director of JP Morgan Elect Plc.

Angela Lane (audit committee chair and senior independent director)

Angela became both PHI’s audit committee chair and senior independent director on 10 November 2020. She is a qualified accountant and previously spent 18 years working as a private equity investor for 3i Plc. Angela has held several non-executive and advisory roles for small and medium capitalised companies across a range of industries. She is a non-executive director and chair of the audit committee of BlackRock Throgmorton Trust Plc and Seraphim Space Investment Trust Plc. Previously, Angela was non-executive chairman of Huntswood CTC and a non-executive director of Dunedin Enterprise Investment Trust Plc where she was chair of the audit committee.

Sir Robert Chote (director)

Sir Robert is an economist, journalist and academic. He became chairman of the Northern Ireland Fiscal Council in 2021 and will begin his tenure as President of Trinity College, Oxford, in November 2025. He became chairman of the UK Statistics Authority in 2022 and is stepping down in September 2025. He served as chairman of the Office for Budget Responsibility from 2010 to 2020. Sir Robert served as director of the Institute for Fiscal Studies from 2002 to 2010, as an advisor to the International Monetary Fund from 1999 to 2002, and as economics editor of the Financial Times from 1995 to 1999. He is a visiting professor at the Department of Political Economy, Kings College London. Sir Robert also serves on advisory boards at the Warwick Manufacturing Group and the Centre for Economic Performance at the London School of Economics.

Wee-Li Hee (director)

Wee-Li is an experienced Asian analyst, fund manager and CFA Charterholder. Brought up in Singapore, she speaks fluent Mandarin and studied in the UK at the University of Leeds and the London School of Economics and Political Science. After graduation in 2002, she joined First State Investments in Singapore as an analyst, subsequently moving to the firm’s Edinburgh office in 2005. Having co-managed Scottish Oriental Smaller Companies Trust Plc, Wee-Li became lead manager in 2014, stepping back due to family commitments to return to a co-manager role in 2017 and retiring at the end of 2019. She is a director of Melville Paisley Investments.

Joe Studwell (director)

Richard Frank (“Joe”) Studwell has spent over 25 years working in East Asia as a journalist, independent researcher at Dragonomics, and author under the name of Joe Studwell. His published works include Asian Godfathers: Money and Power in Hong Kong and South East Asia and How Asia Works: Success and Failure in the World’s Most Dynamic Region.

Previous publications

Readers interested in further information about PHI may wish to read our previous notes (details are provided in Figure 20 below). You can read the notes by clicking on them in Figure 20 or by visiting our website.

Figure 20: QuotedData’s previously published notes on PHI

| Title | Note type | Publication date |

|---|---|---|

| Invest in Asian growth | Initiation | 21 March 2016 |

| Brave new world | Update | 10 October 2016 |

| Top of the pops! | Annual overview | 30 October 2017 |

| Pause for breath? | Annual overview | 8 November 2018 |

| 2018 re-calibration paying off | Annual overview | 8 November 2019 |

| Powered by technology | Annual overview | 20 January 2021 |

| Blistering performance | Annual overview | 25 November 2021 |

| Convergence opportunity | Annual overview | 8 December 2022 |

| Consistent growth and quality bias | Annual overview | 6 December 2023 |

| Inflection point approaching? | Annual overview | 19 March 2025 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Pacific Horizon Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.