February 2023

Monthly roundup | Investment companies

Winners and losers in January 2023

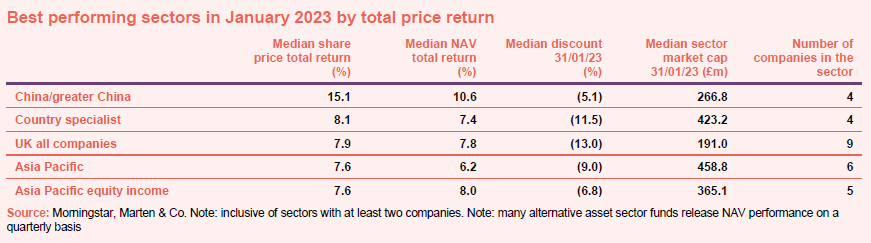

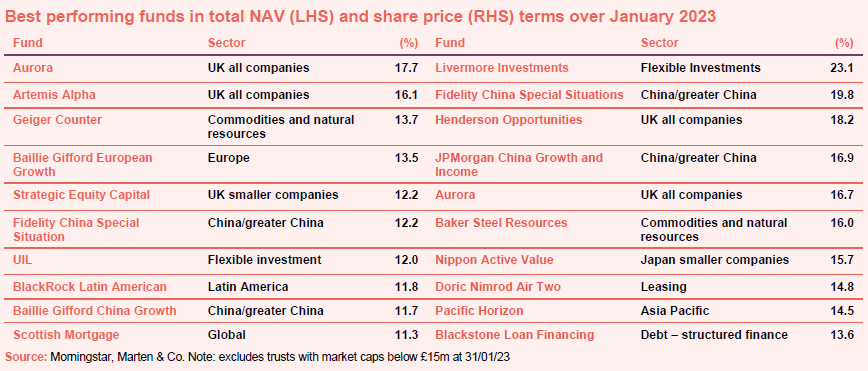

In a month where winners far outweighed losers, once again Chinese funds feature amongst the best-performing investment companies over the month, taking many of the top slots. China has barrelled ahead with the reopening of its economy following the lifting of COVID-related restrictions. The best-performing trust in that sector – JPMorgan China Growth and Income – was up over 45% in NAV terms over the three months ended 31 January 2023. Vietnamese funds rebounded too, lifting the performance of the country specialist sector, although Weiss Korea Opportunity had a good month as well. Unsurprisingly, this spelled good news for Asia Pacific focused funds. In the UK, signs of easing inflation underpinned markets, but stock-specific moves were behind the good performance of the UK all companies sector.

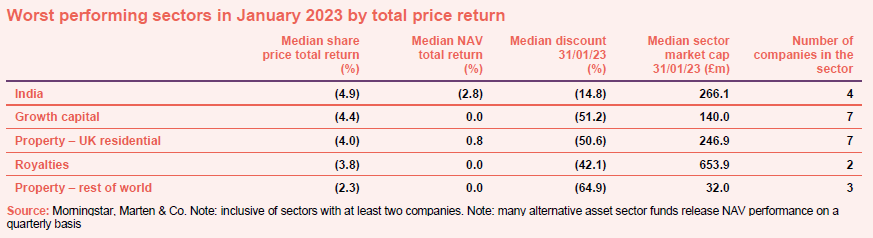

The Indian market lost ground over the month as a short seller attacked one of its largest conglomerates. While Chrysalis continued to recover some of the ground that it lost last year, other constituents of the growth capital sector experienced further discount widening. In the property – UK residential sector, problems with rent collection from a couple of tenants of the specialist supported housing sector weighed on share prices.

Aurora’s impressive NAV uplift was driven by big jumps in the share prices of its holdings in easyJet, Ryanair and Hotel Chocolat, as well as a modest rebound in the share price of its largest position Frasers Group. Artemis Alpha holds easyJet and Ryanair as well, and has Frasers as its largest holding too, but also benefitted as Aurora’s sister trust – Castlenau – bid for Dignity. An uplift in the Uranium price helped Geiger Counter. Baillie Gifford European holds Ryanair, it also benefitted from an uplift in the share price of Norwegian media business Schibsted (which is also a fairly recent addition to AVI Global’s portfolio). Positive trading updates for a couple of Strategic Equity Capital’s holdings, Medica and Hostelworld, drove its NAV higher. The resurgent Chinese stock market is evident in the presence of Fidelity China Special Situations and Baillie Gifford China Growth in these tables.

Livermore is on a wide discount and trading in the stock is thin. There was no news that we could spot that would have triggered its discount narrowing over the month. The better sentiment towards the UK, coupled with share buybacks, helped Henderson Opportunities to narrow its discount. Caledonia Mining’s acquisition of Zimbabwean gold miner Bilboes Gold was the main bit of good news in Baker Steel Resources’ portfolio. Its discount was perhaps overwide at the start of the month. Nippon Active Value launched a tender offer for shares in T&K Toka.

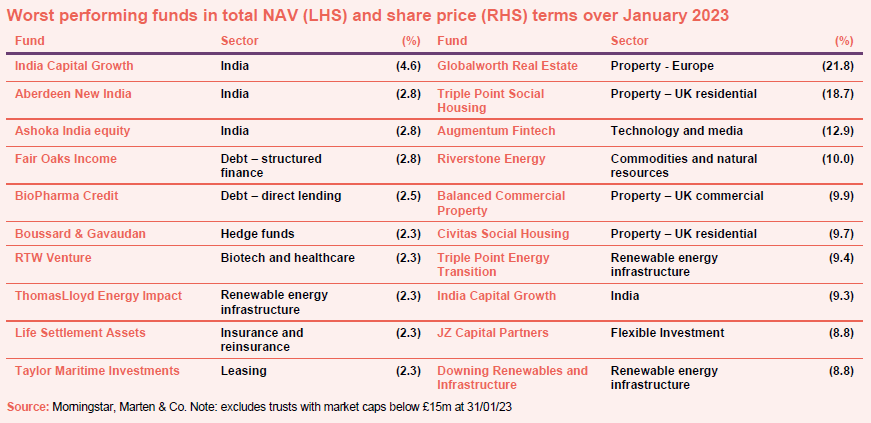

Worst-performing

The deteriorating sentiment in the Indian market is obvious in the table, where all three of the worst-performing funds fall into that sector.

In an environment where most markets were moving higher, a weaker US dollar accounts for all of the NAV declines over the bottom part of the table.

The share price moves follow a different pattern. Eastern European property fund Globalworth Real Estate experienced a significant widening of its discount over the month. There was no stock-specific news associated with the move – although ECB interest rate hikes are the most likely culprit, but the free float is limited and so any selling pressure is amplified.

Triple Point Social Housing and Civitas Social Housing have been experiencing problems with some tenants. One – My Space Housing – is the subject of enforcement action by the Regulator of Social Housing and has not been paying rent. It seems likely that both funds will look to move properties from My Space to alternative tenants. Triple Point Social Housing also has a problem with Parasol Homes, which is also in rent arrears.

Augmentum Fintech’s discount, which had held up reasonably well relative to funds in the growth capital sector (which it has a lot of similarities to) widened at the start of January. Share buy backs since appear to have helped the share price rebound in February.

Weaker commodity and power prices may have contributed to the discount widening that occurred for Riverstone Energy (oil price) and Downing Renewables and Infrastructure (Swedish power prices). In both cases, the reaction may be overdone. There was no new news on Triple Point Energy Transition, but the fund is subscale in a crowded sector and its dividends since launch have not been covered by earnings.

JZ Capital Partners reported at the start of the month that two separate claims, alleging criminal complaints in connection with fraud claims made last March, have been filed in the Spanish courts. The allegations relate to two individuals who were members of the management team that manages JZCP’s investments in European micro-cap companies.

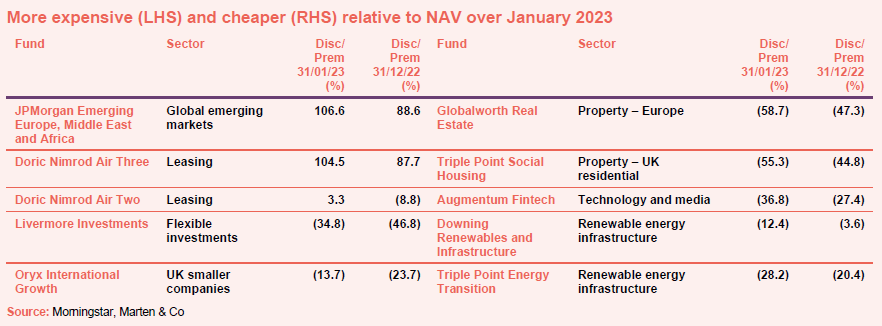

Moves in discounts and premiums

The discount widening stories have all been covered above. On the discount tightening/higher premium side of the equation, JPMorgan Emerging Europe, Middle East and Africa saw its premium climb. Unfortunately, there seems to be no sign of an end to hostilities in Ukraine, so we are not sure what is driving this move.

For the plane leasing funds, the story continues to be about the prospects for these funds being able to sell or re-lease their aircraft fleets at the end of the initial lease periods. Moves in the sterling/dollar rate have an impact too.

Livermore was mentioned above. Market participants views about the outlook for the CLO market (which accounts for a substantial proportion of the portfolio) are mixed. Some commentators are concerned about the prospect of debt defaults, which would impact both the income from the CLOs and their capital value. By contrast, if central banks can engineer a soft landing for the economy, the outlook for these investments would be brighter.

Oryx International Growth’s discount has been on a narrowing trend since November 2022 (when it was in the 30s). North Atlantic Smaller Companies raised its stake in the trust once again in January. It holds over 52% of Oryx’s share capital.

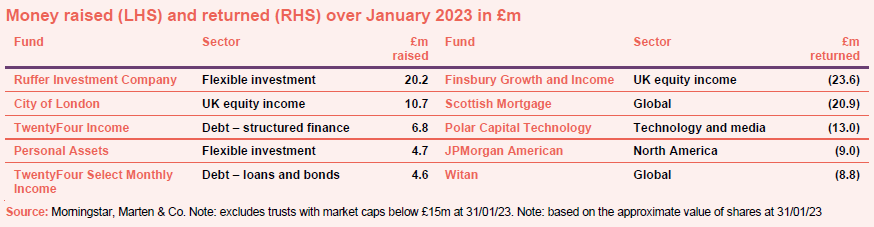

Money raised and returned

There was a net outflow of funds from the investment companies sector over the course of January 2023. Conviction Life Sciences abandoned its fundraise in January, but AT85 Global Mid Market Infrastructure published a prospectus. Harmony Energy Income merged its C shares into its ordinary shares during the month.

For the most part, the funds raising and returning cash – via tap issues and share buy backs – are the usual suspects. Debt funds are becoming more popular as bond yields are higher, helping attract funds to the two TwentyFour funds and CQS New City High Yield, which ranked number six on the list. However, on the returning capital side, Pershing Square and Fidelity China are both absent. Pershing Square’s buyback activity is on pause. Fidelity China is one of the best-performing funds of the past three months. The surprise(?) entry at number one is Finsbury Growth and Income. We have long argued that the trust does not offer a sufficiently attractive yield to be considered an income fund, were it to relocate to the UK all companies sector, its performance would not look too bad relative to its new peer group.

Major news stories and QuotedData views over January 2023

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 4 November | ROOF, CYN, PEY | Jason Baggaley | abrdn Property Income |

| 11 November | MAJE, TLEI, CRS | James de Uphaugh | Edinburgh Investment Trust |

| 18 November | Long Term Assets, Renewables | Jeff O’Dwyer | Schroder European Real Estate |

| 25 November | Renewables, DGI9, NBMI, HOME | Bruce Stout | Murray International |

| 2 December | CHRY, SYNC | Rhys Davies | Invesco Bond Income Plus |

| 9 December | VSL, RTW, SYNC | Stuart Widdowson | Odyssean |

| 16 December | HOME, API, FSF | Richard Aston | CC Japan Income and Growth |

| 6 January | 2022 review | Andrew McHattie | Review of 2022 |

| 13 January | DGI9, AT85 | Thao Ngo | Vietnam Enterprise |

| 20 January | RICA, ORIT | Stephanie Sirota | RTW Venture Fund |

| 27 January | JLEN, HGEN, USF, HNE | Eileen Fargis | Ecofin US Renewables |

| 3 February | SOHO, AERI | Will Fulton | UK Commercial Property REIT |

| Coming up | |||

| 10 February | Colm Walsh | ICG Enterprise | |

| 17 February | |||

| 24 February | Jean-Hugues de Lamaze | Ecofin Global Utilities & Infrastructure | |

| 3 March | David Bird | Octopus Renewables | |

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly

Research

While Herald Investment Trust (HRI), like many other technology and growth-focused strategies, has been caught up in the grips of 2022’s market selloff, the fundamentals of many of the companies in its portfolio have remained largely unscathed. In fact, HRI’s management team believes that today’s market represents an opportunity, as falling prices and earnings strength push valuations to attractive levels

As we describe in this note, there are a lot of moving parts that go into making Bluefield Solar Income Fund (BSIF) run smoothly. However, the net result should be a fund that offers investors attractive, relatively predictable and largely inflation-linked levels of income, plus the prospect of capital growth.

In recent months, the actions of successive UK governments and sharp increases in bond yields have unnerved investors in the sector. This has created some discount volatility for BSIF and its peers.

However, we think that this is a short-term problem.

High interest rates have hit the share prices of real estate companies, with those in sectors with low investment yields, such as logistics, particularly impacted. abrdn European Logistics Income (ASLI) is no different and the market turmoil has seen its share price discount to net asset value (NAV) widen to 34.0% – in line with its UK peers. This is despite the fact that the spread between property yields and the cost of debt is far wider in Europe (property yields were higher in Europe than the UK and cost of debt lower meaning rising interest rates would put less pressure on property yields in Europe in comparison to the UK and suggesting values will be less impacted).

Ecofin US Renewables Infrastructure Trust’s (RNEW’s) share price moved from a premium to net asset value (NAV) to a discount in July 2022 as the original fund management team resigned. The portfolio assembled is solid, performing well and delivering on expectations. A new fund management team, led by Eileen Fargis, is now in place and the opportunity available to RNEW is considerable.

GCP Infrastructure (GCP) has seen a dramatic improvement in the tailwinds supporting its investment approach. The rise in UK inflation and power prices has driven a substantial, positive uplift in its net asset value (NAV). This uplift has more than made up for the negative impact of the UK government’s new levy (windfall tax) on energy producers. GCP has also made major strides in the quality of its ESG disclosures.

However, the company’s shares have moved to trade on a historically wide discount to NAV, currently 14.7%. As we explain in this note, this may be a reflection of the wider pressure on bond yields that has been felt globally, although as a result, GCP now offers an attractive dividend yield of 7.2%, one of the highest yields of its peer group.

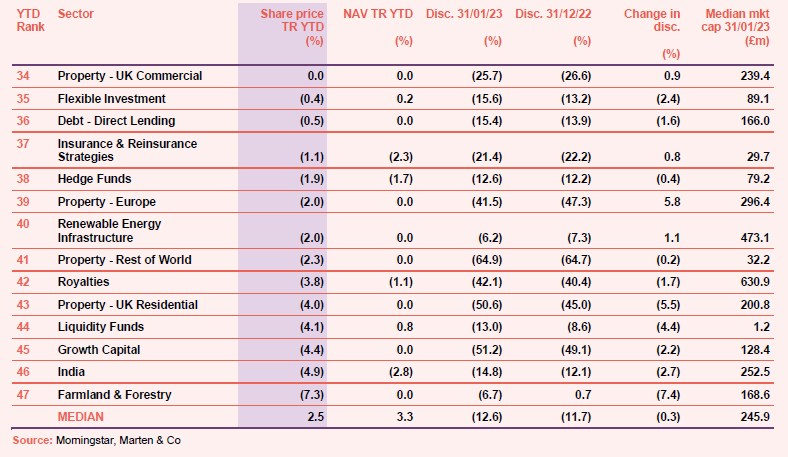

Appendix 1 – median performance by sector, ranked by 2022 year to date price total return

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.