Pantheon Infrastructure

Investment companies | Update | 11 September 2023

Travelling in the right direction

Pantheon Infrastructure (PINT) is still adding to its portfolio. The most recent commitment is to Zenobe, a battery storage and electric vehicle fleet specialist. This was in conjunction with Infracapital. This follows an investment in GlobalConnect (a pan-Nordic data centre and fibre business), which offers the potential to participate in the growth of demand for data across Northern Europe. It also comes with a well-regarded sponsor in EQT.

PINT’s NAV is moving in the right direction and is underpinned by some fairly conservative assumptions, including a 13.7% weighted average discount rate (applied to PINT’s forecast cash flows to calculate the NAV). Dividends are on track. In fact, you could say that everything is going in the right direction. The one exception is PINT’s share price, which, instead of reflecting the NAV growth, has moved to trade on a double-digit discount to NAV. This seems unjustified to us, but we recognise that double-digit discounts are now commonplace for these types of funds. This could represent a good buying opportunity for a long-term investor.

Global high-quality infrastructure with strong ESG credentials

PINT aims to provide access to a globally diversified portfolio of high-quality infrastructure assets, primarily in developed OECD markets, which are expected to generate sustainable attractive returns over the long term. It targets co-investment assets that have strong ESG credentials and underpin the transition to a low-carbon economy.

Progress report

Readers may wish to consult our initiation note, which was published on 17 March 2023.

Over the months since we last published on PINT, the trust has made two new investments, started buying back shares, announced an updated NAV as at

31 March 2023, and secured an increase to its borrowing facilities. We take a look at each of these in this note, and we also have a more in-depth examination of the company’s investment in logistics company Primafrio.

Asset allocation

The following charts are based on PINT’s Q1 2023 NAV update using data as at 31 March 2023. They exclude the recent investments in Zenobe and GlobalConnect.

The changes since we last published reflect the discontinuation of a planned £25m investment in a US renewables asset referred to in our last note which did not proceed due to PINT being unable to agree satisfactory reporting requirements with the sponsor.

Portfolio

PINT has now invested/committed £455m to 13 assets.

New investment – Zenobe

£35m commitment to Zenobe in conjunction with Infracapital.

On 7 September 2023, PINT announced that it had committed about £35m to Zenobe (zenobe.com).

Zenobe is a UK domiciled but global (UK, Australia, New Zealand and Benelux) business that provides electrification solutions to owners of vehicle fleets (for bus companies, for example) and owns batteries that are used to help balance the UK’s national power grid. Since the company was founded in 2017, it has delivered 435MW of grid-connected battery capacity, and has provided bus operators with c.1,000 electric vehicles under a leasing structure.

Once its batteries reach the end of their life cycle, Zenobe repurposes them for further use. Its refurbished batteries provide portable power or on-site static power to maximise clean energy usage.

PINT’s investment in Zenobe was made through a co-investment vehicle managed by Infracapital (infracapital.co.uk), which PINT describes as a leading European infrastructure investor that has raised and managed over £7bn in assets.

New investment – GlabalConnect

Investing €23.1m alongside EQT in GlobalConnect, a pan-Nordic data centre and fibre business.

On 22 June 2023, PINT announced that it had committed to investing approximately €23.1m (£19.9m) in a pan-Nordic data centre and fibre business GlobalConnect. As described in our initiation note, PINT invests alongside selected expert investors; in this case, the investment is being made through a co-investment vehicle managed by affiliates of EQT AB Group, a leading global investment manager with highly experienced in digital infrastructure and leading track-record, headquartered in Sweden and managing approximately €126bn in fee-generating assets.

EQT Infrastructure has been invested in GlobalConnect since 2017 and as a result the Pantheon team knows the asset well, as other Pantheon-managed funds had been investors previously alongside EQT.

GlobalConnect is a digital infrastructure company with an extensive fibre network across the Nordics. The company serves B2C and B2B customers across three complementary business segments:

- Fibre-To-The-Home (FTTH);

- Fibre-To-The-Business (FTTB); and

- Hyperscalers – cloud providers, operators (including mobile network operators) and data centres.

GlobalConnect has a large and diverse network across the Nordics and Germany consisting of approximately 149,000km of fibre cables, approximately 1m homes passed, approximately 34,500 sqm data centre estate and over 30,000 FTTB customers. The business mix is split approximately two-thirds fibre and one-third hyperscalers/data centres.

The energy used to power data centres tends to come from renewable sources.

Pantheon noted in its diligence numerous investment highlights supporting the investment proposition. For instance, the platform’s location in the Nordics, a region with favourable regulatory regimes to digital infrastructure and in close geographical proximity to Europe, allows the data centre segment to benefit from large supplies of renewable power. This, combined with the cooler climate which reduces the need for artificial means of cooling, enables GlobalConnect to meet demand for customers in both the Nordics and Europe that are seeking reliable, low latency services that also support their ESG objectives.

GlobalConnect has grown as a result of organic growth and M&A. The strong organic growth has leveraged the strong underlying demand for fibre, connectivity and data centres across both the B2B and B2C segments. Whilst FTTB (i.e. B2B) growth slowed during COVID, the diversification of the platform and shift to working from home enabled FTTH to grow significantly.

Expansive, hard-to-replicate network with limited competition of similar scale.

Pantheon considers the platform to have numerous organic and inorganic growth opportunities which is supported by management’s track-record of delivering such initiatives and GlobalConnect’s strong competitive positioning. PINT’s managers feel that Global Connect’s existing fiber network with its extensive and unique footprint provides significant barriers to entry and downside protection whilst at the same time giving it the opportunity for significant growth through network expansion in FTTH as well as the datacenter segment.

In particular, PINT’s managers think that there is the potential to cross-sell products to existing FTTB customers. GlobalConnect is helped in this by its ability to provide end-to-end connectivity on its own network.

Significant organic and inorganic growth opportunities.

Sweden and Norway are relatively mature markets but there are still opportunities to infill areas with low coverage. The business is achieving uplifts in revenue per user helped by a desire from end users for higher-quality data connections for things such as gaming for FTTH users and video conferencing for business users. Nevertheless, pricing is said to be competitive versus peers.

The incumbents tend to be large, heavily indebted players who are constrained from committing more capital. There are also municipalities that set out to deliver services but struggled to deliver them. Some smaller players, unable to scale, are dropping out of the market. This supports GlobalConnect’s ability to take market share from incumbent operators.

The hyperscalers operate under long-term (10+ years) contracts with GlobalConnect. PINT’s managers feel that this business is sticky, given that many of these companies are running hard just to keep pace with the growth of demand for their services.

High degree of long-term/recuring revenue with low churn and inflation-linkage.

The FTTB contracts have a high degree of recurring revenues too. That customer base is diversified, and PINT’s managers believe that they value GlobalConnect’s ability to provide a ‘one-stop-shop’ service. Whilst contracts are typically shorter in length than with hyperscalers, there is strong customer retention, and a level of inflation linkage within contracts.

The manager has a high conviction in the attractiveness of GlobalConnect as a business and believes that PINT’s entry valuation is conservative.

Primafrio – a closer look

In this note we thought it might be useful to include a deeper dive into Primafrio, which was PINT’s first investment.

Primafrio is a chilled logistics business with a 60-year history, based in Spain but operating across Europe (27 countries). The fleet comprises more than 2,700 refrigerated lorries fitted with on-board navigation systems, GPS and real-time fleet management devices to make the most efficient use of the trucks. Intermodal (trucks + trains) services are used where this is more efficient.

Five logistics bases on the Iberian peninsula.

Primafrio operates six logistics bases on the Iberian peninsula – one in the Basque region between Bilbao and Pamplona; Girona, north of Barcelona near the French border; Murcia in the southeast of Spain; Huelva in the southwest of Spain; Madrid, and Lisbon in Portugal.

The core of the business is in the export of fruits and vegetables from Iberia to other parts of Europe, in addition to the import of other food products and pharmaceuticals. Brexit provided an opportunity as it has an advantage over smaller players that cannot not cope with the extra paperwork.

Trucks often return laden with refrigerated/temperature-controlled goods – Spain imports meat, cheese, and flowers from other parts of Europe – but they also carry other goods such as electronics, ADR or pharmaceutical products. The pressures from the rising cost of living have had a small impact on volumes of some more expensive products. However, the high values of cargoes relative to the cost of transport mean that margins are not likely to be seriously impacted by higher overheads.

Focus on maximising the use of the fleet.

The focus is on maximising the use of the fleet by reducing/eliminating empty kilometres travelled. There is an active commercial team at HQ tasked with optimising revenues to this effect. However, PINT’s managers say that the high-margin fruit and vegetable exports would means that the business is profitable even without the revenue from the typically lower-margin return legs.

Produce is collected from across Iberia, and loads from different customers are combined in the cross-docked logistics warehouses to maximise the use of the fleet and make it practical to ship goods daily to ensure freshness. This groupage model was pioneered by Primafrio in Spain.

Each truck has two drivers on board so that it can keep moving and reduce transit times without compromising driver safety. Drivers are drawn from across Europe and may include family pairs. Primafrio has local installations. Training is included as part of the employment package, including on an on-site simulator. Drivers are incentivised based on their efficiency.

Net zero target for 2030.

From an ESG angle, the business is exploring ways to reduce its fossil fuel use, with the aim of achieving net zero by 2040. Electric-powered trucks, which have an effective 300km range, are used for first- and last-mile deliveries. The business is also experimenting with hydrogen-powered and more aerodynamic vehicles. In the meantime, bills are minimised by using newer trucks and trailers having solar PV panels on top, and aerodynamic systems.

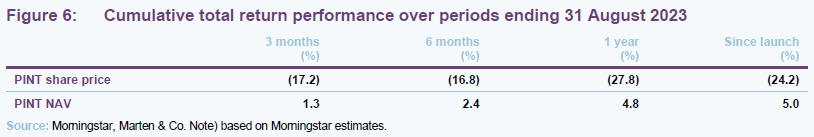

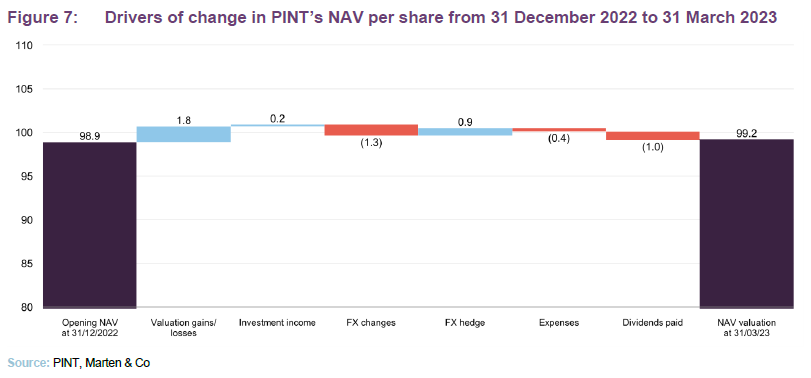

Performance – small NAV uplift over Q1 2023

PINT’s NAV at 31 March 2023 was 99.2p, up 0.3p on the level at end December 2022. The total return for the quarter was 1.3%.

PINT’s underlying portfolio returns were held back by the strength of sterling, but that was largely offset by currency hedges. PINT has now declared and paid dividends totalling 2p, in line with projections.

The 1.8 pence per share valuation uplift was driven by unrealised movements across eight investments, which are performing largely as expected. Three investments continue to be valued at cost, in line with the underlying sponsor’s valuation policy, given the timing of those investments.

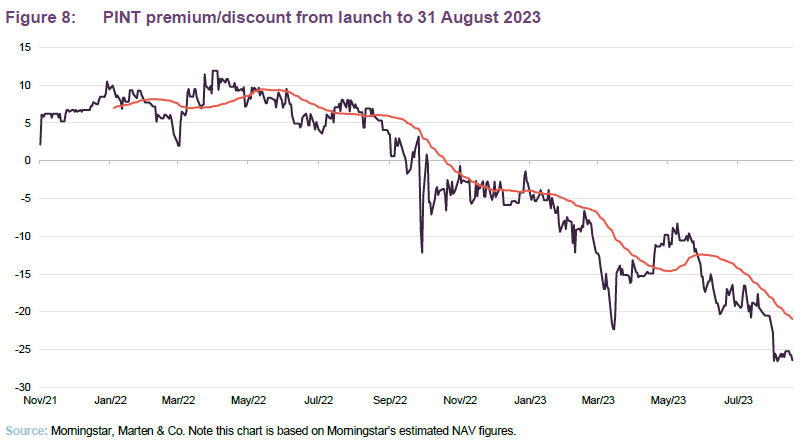

Premium/(discount)

Over the 12 months ending on 31 August 2023, PINT’s shares traded as wide as a 26.5% discount to NAV and as narrow as an 5.9% premium to NAV. On average, the discount was 9.8% over this period. At 7 September 2023, the discount was 24.1%.

On 31 March 2023, in the face of the widening discount and in the belief that the share price was materially undervaluing PINT’s portfolio and prospects, PINT’s board authorised share buybacks up to a total consideration of £10m. Since then, 4.835m shares have been bought back into treasury.

Every constituent of the AIC’s infrastructure sector is now trading on a discount. However, we note that 3i Infrastructure, which has a similar investment approach to PINT’s, is trading on one of the tightest discounts (currently 9.5%). Given PINT’s investment objective and the portfolio assembled to date, we feel that its discount should narrow.

It is hard to determine the exact cause of the discount widening, but the most obvious trigger has been rising interest rates. There is concern amongst some investors that higher interest rates will put upward pressure on the discount rates used to calculate NAVs.

In its annual report, published in March 2023, PINT said that transactional evidence was showing limited to modest increases in discount rates. The consensus amongst sponsors that the investment manager works with was that discount rates would either remain flat or see some modest increases.

PINT’s weighted average discount rate is 13.7%.

PINT’s weighted average discount rate following its recent investments was 13.7%. That is significantly ahead of discount rates on many competing funds and represents a substantial risk premium to absorb the elevated risk-free rates being seen today.

Balance sheet

PINT now has access to a £115m RCF plus a £185m uncommitted accordion facility.

In June 2023, PINT agreed a £52.5m increase in its revolving credit facility (RCF) bringing the total to £115m. The increase in the loan facility provides the company with additional liquidity to support further investment in high-quality infrastructure assets from PINT’s near-term investment pipeline. Subject to certain conditions and lenders’ consent, PINT also has access to a £185m uncommitted accordion which will enable the company to increase its facility as it grows over time. The loan facility remains undrawn.

PINT would pay an initial margin of 2.85% per annum over the relevant currency benchmark rate or compounded reference rate on drawn amounts under the loan facility, reducing to 2.65% per annum once certain expansion thresholds have been met. The facility expires on 19 December 2025, but can be extended through an uncommitted extension option, subject to lenders’ consent.

Fund profile

More information is available at the fund’s website: pantheoninfrastructure.com.

PINT is targeting NAV total returns of 8–10% per annum from a portfolio of infrastructure assets that offers the prospect of some capital growth as well as an attractive level of income. PINT makes co-investments in infrastructure assets alongside leading investors in these areas, leveraging their additional expertise and experience. It invests globally, with a primary focus on developed markets, with the majority of its investments in Europe and North America.

Digital, renewables and energy efficiency, power and utilities, transport and logistics.

Its initial focus is on digital infrastructure (data centres, fibre networks, mobile telecom towers and the like); renewables and energy efficiency (wind, solar, sustainable waste-powered electricity generation, smart meters); power and utilities (energy utilities – transmission and distribution, water and conventional power generation); and transport and logistics (ports, rail, roads and airports).

In its prospectus, PINT also included the potential for social infrastructure (such as education, healthcare, government and community buildings) but these assets are typically lower-returning.

The board believes that PINT can offer investors stable, predictable cash flows, inflation protection, embedded downside protection, and sub-sector diversification.

Previous publications

Our initiation note – Reliable income streams with inflation protection – was published on 17 March 2023. You can read it by clicking the link or visiting our website, QuotedData.com.

Legal

This marketing communication has been prepared for Pantheon Infrastructure Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.