Economic and Political Monthly Roundup

Kindly sponsored by Allianz

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Roundup

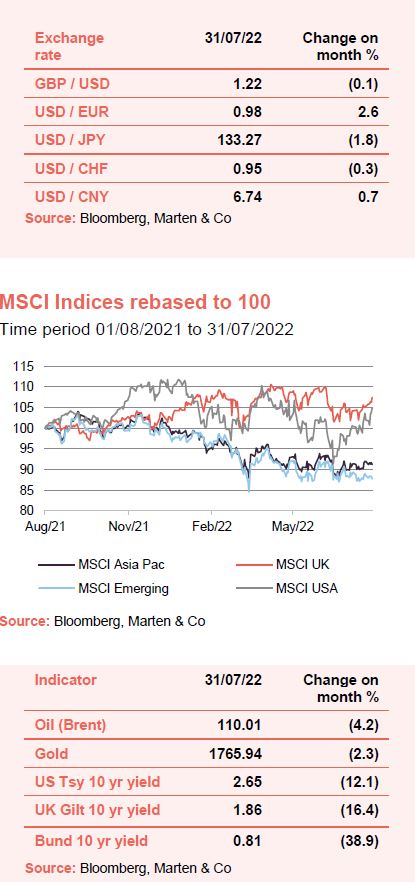

The threat of recession seems more and more likely as rising inflation, supply chain woes, oil price volatility (as a result of the ongoing war in Ukraine) and of course the pandemic, remain key macroeconomic challenges. Two 0.75% US interest rate rises in quick succession, and a higher-than-expected increase in European interest rates, appear to have convinced investors that inflation will eventually be tamed; bond yields plummeted. UK equity markets enjoyed an upturn, although a contributing factor may well have been the announcement of Prime Minister Boris Johnson’s resignation. Meanwhile, the month saw other major global events including the assassination of former Japan prime minister Shinzo Abe, wildfires across Europe as a result of record-breaking heatwaves while the World Health Organisation declared monkeypox a global health emergency.

July’s highlights

Global

Brunner’s chair discusses the ‘silver lining’ for bottom-up investors.

Paul Niven, manager of F&C, shares fears of a recession to hit developed economies later this year and into 2023.

Despite a ‘bleak’ backdrop, the chair of Herald is reassured by signs of bubbles deflating – especially in the US.

The managers of Scottish American say the world economy still faces a great deal of uncertainty.

UK

The managers of Aberforth Split Level income list four macroeconomic challenges that they believe are increasing the risk of recession later this year.

John Dodd and Kartik Kumar of Artemis Alpha say that over time, cash-generative franchises with duration will find ways to adapt to inflation.

Miton UK Microcap’s chair highlights the benefits of investing in microcap companies in the face of current macro concerns.

The managers of Oryx International Growth think that the global economic picture has arguably rarely looked more uncertain.

SVM UK Emerging’s manager says there are signs that the UK economy is adapting to the disruption in supplies, creating opportunity for new onshore suppliers to replace risky ones overseas.

Richard Davidson, chair of Aberforth Smaller Companies says he is perplexed that government bond markets are not more concerned about inflation.

BlackRock Throgmorton’s Dan Whitestone believes a valid market concern is that sell-side forecasts look too high.

The managers of Law Debenture think that in a year’s time, as the large jump in energy costs work their way out, inflation will likely retreat.

Flexible investment

The JPMorgan Global Core Real Assets team share their outlooks for real estate, infrastructure and transport.

Nick Greenwood and Charlotte Cuthbertson, managers of MIGO Opportunities say they expect that there could be more volatility to come as the global economic headwinds put pressure on markets.

Technology & media

Tim Levene of Augmentum Fintech says the volume of venture capital raised over the last two years leaves significant “dry powder” commitments across Europe.

Polar Capital Technology’s manager thinks we are facing a more uncertain macroeconomic backdrop than at any stage since the pandemic.

Other

We have also included comments on Asia Pacific from abrdn New Dawn; Japan from Atlantis Japan Growth; India from Aberdeen New India; China from abrdn China; Russia from JPMorgan Russian; private equity from Seed Innovations; debt from Henderson Diversified Income and TwentyFour Income; financials from Polar Capital Global Financials; growth capital from Schroder British Opportunities; infrastructure from Sequoia Economic Infrastructure Income; renewable energy infrastructure from Gore Street Energy Storage, Greencoat UK Wind and Harmony Energy Income; biotechnology & healthcare from Bellevue Healthcare; royalties from Hipgnosis Songs; environmental from Jupiter Green; leasing from Doric Nimrod Air Three and Doric Nimrod Air Two and property from SEGRO, Hammerson, Primary Health Properties and Unite Group.

Full version

Click on the link at the bottom of the page to access the full report.

Kindly sponsored by Allianz

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.