May 2023

Monthly roundup | Investment companies

Kindly sponsored by abrdn

Winners and losers in April 2023

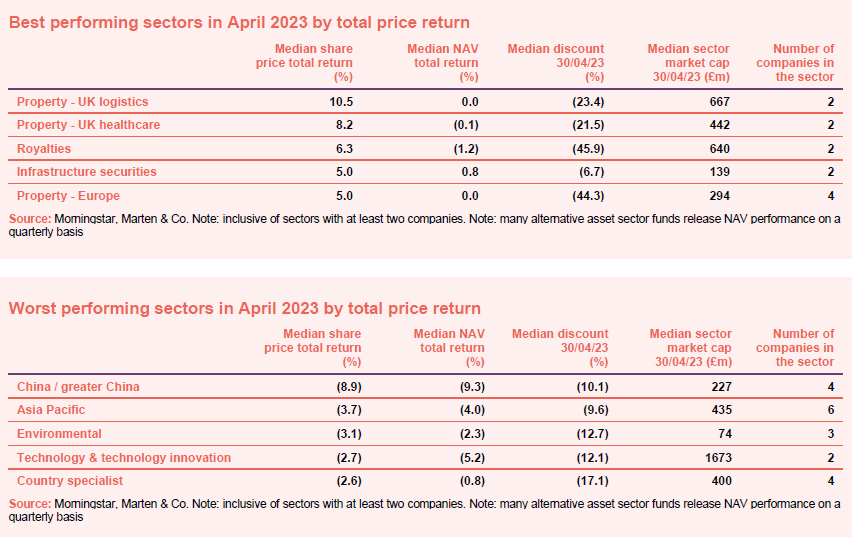

Property stocks returned to positive territory in April after months of losses. The sector was boosted by slowly improving consumer confidence which rose to its highest level in a year and signs of increasing stability in debt markets with average rates ticking down across the curve. Whether this momentum is in any way sustainable is another story, as inflation readings in both the UK and Europe surprised to the upside toward the end of the month, dragging rate expectations higher once again.

For the best performers, the UK logistics sector led the way following a take-private bid for Industrials REIT at a whopping 42% premium to its share price. The deal appeared to act as a catalyst for a re-rating of other industrial and logistics-focused companies including Urban Logistics REIT. UK healthcare also rebounded following a somewhat surprising showing in the worst performers list last month, with its holdings focused on care homes which tend to be relatively resilient to wider growth concerns. Infrastructure funds also appear to have benefited from rate dynamics earlier in the month and have also responded to improving GDP, manufacturing, and jobs data. The royalties sector rallied off the back of a strong annual report from Round Hill Music.

The last few months on the worst performers list have been played out like a game of musical chairs between growth stocks, property, and China, with the world’s second largest economy drawing the short straw this time around. Despite growth coming in ahead of expectations for Q1, markets suffered from increasing tensions with the US over Taiwan and the threat of further EU sanctions, along with wider concerns around both domestic and global demand. Since the end of the zero COVID restrictions, the economy has struggled to reach the lofty heights some expected and faces an uncertain future with domestic demand still tepid and geopolitical tensions rising once more. Economies whose fortunes are strongly linked to the fate of the Chinese economy have also suffered, with Asia Pacific and country specialist funds performing poorly. Environmental funds and technology and technology innovation round out the worst performing sectors for the month. Both are dominated by funds that have considerable overweight exposures to North American markets while also having significant exposure to growth stocks, with both factors weighing on performance.

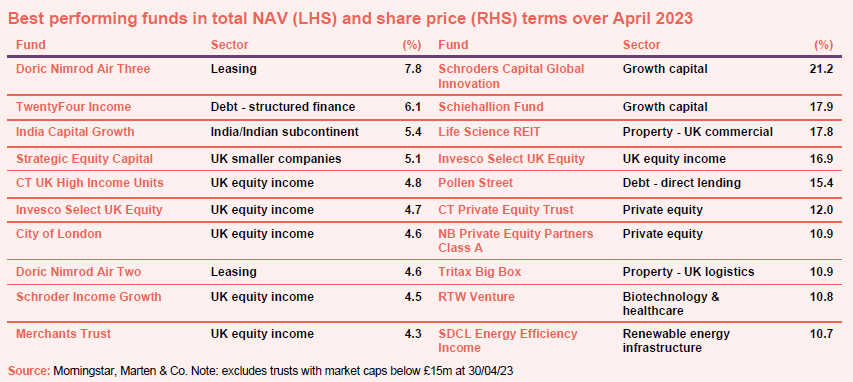

With UK markets up strongly in April it is not a surprise to see funds from the region dominate, although how long this trend lasts is another question altogether. There is a clear tilt towards equity income funds which have benefited from generally positive economic data in the UK. The majority also have overweight exposures to the financial sector which bounced off its lows following last month’s US regional banking disruptions. Among these funds, CT UK High Income was proactive in its approach to the banking fallout, increasing leverage to add to a number of positions which had sold off despite minimal exposure to any stressed assets. Strategic Equity Capital was boosted by a bid for Medica, one of its largest holdings. TwentyFour Income announced its highest ever dividend payment, with management highlighting its long-term floating rate strategy which has provided a significant jump in income. India Capital Growth’s NAV rallied as companies reported good results and The Reserve Bank of India called time on its interest rate hikes. The Doric Nimrod funds have been volatile, however, it would pay not to read much into month-on-month fluctuations with the Air Three fund currently trading on an 88% discount. The UK funds have also benefited from sterling strength which reached a new high-water mark for the year against the dollar.

Schroders Capital Global Innovation (formerly Schroder UK Public Private) has had a horrid run of things over the last few years and continues to trade on a considerable discount of 47% even after the 21.2% jump experienced in April. A 14% overnight move was the catalyst, coinciding with the publication of results and the announcement of a continuation vote planned for 2025. Investors would be wise not to read much into the recent performance which is likely a function of very thin volume. Schiehallion is a similar fund trading on a large discount and relatively thin volume. Its discount had spiked out in March but narrowed again over April. Life Science REIT has rallied with the rest of the property sector with its share price also recovering from an all-time low in March.

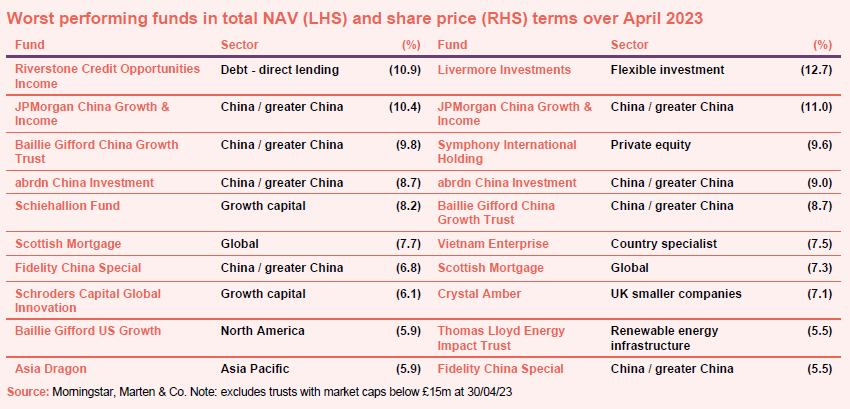

Worst-performing

Funds with exposure to China dominated the worst performers list both by NAV and share price return. As discussed above, the economy is battling a number of geopolitical and economic issues which have weighed on risk assets over the past year. That being said, performance for the region has not been a complete write-off (Chinese market indices are roughly in line with the UK year to date) however they have fallen well short of expectations which were sky high as investors anticipated pent up demand to slingshot risk assets higher. Aside from the rising geopolitical concerns, the economy has struggled to reinvigorate domestic consumption, which remains around 8% below pre-pandemic trend, while manufacturing has also fallen into contraction thanks to weak global demand and a deteriorating growth outlook. Traditionally, policy makers would look to juice investment and consumption through broader fiscal packages, however this remains at odds with the country’s bloated property sector, a hangover from its pre-pandemic excesses. Spare capacity as a result of previous high capex has also held back investment adding to woes. It’s little surprise then that funds exposed to the sector have performed poorly over the past month as post zero-COVID optimism rolls into uncertainty. Unfortunately, it is hard to be overly bullish going forward given the potential for geopolitical flareups which are almost impossible to discount, regardless of valuations that may appear attractive on the surface.

For those funds on the list not exposed to China, Riverstone Credit Opportunities NAV fell in April following a revaluation of warrants related to a loan that was previously repaid. Scottish Mortgage’s largest holding, Moderna which accounts for 8.6% of total assets fell 14% in April, while Tesla, its third largest holding, worth 5.1%, was down 22%. Baillie Gifford US Growth also saw a number of its portfolio assets trade down for the month. Having headlined the best performers list last month, with shares growing 24.6%, Livermore gave back a chunk of those gains in April as it attempts to recover from a steep sell off in 2022. Crystal Amber continues to trade down following its continuation vote failure last year. Thomas Lloyd Energy Impact’s shares had already fallen before it was forced to suspend trading in its ordinary shares following some uncertainty in the fair value of one of its investments. It seems likely that the shares will drop further once trading recommences.

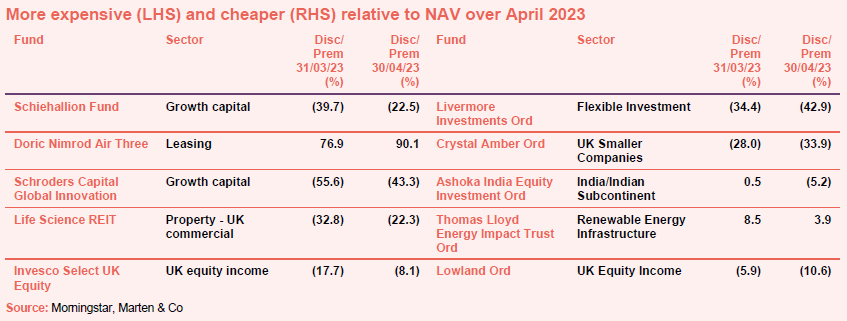

Moves in discounts and premiums

As discussed above, the movements of Schiehallion, Doric Nimrod, and Schroder are more a reflection of current volatility in these funds rather than any particular, fundamental improvement. Similarly, while the tightening of Life Science REIT’s discount is certainly a positive, the bounce off its lows could be taken with a pinch of salt given the current uncertainty in the sector. The Invesco Select UK Equity fund was boosted by the broader stability of UK markets over the course of the month, while also benefiting from solid stock specific outperformance with several portfolio holdings, including SEE, RELX, National Grid, and Next – which were all up strongly. As for the companies with widening discounts, DGI9 and HydrogenOne once again headlined the worst performers. On one hand, this again reflects the relatively volatility of smaller funds exposed to growthier sectors of the market, however we have written on several occasions how the relative discounts are not a fair reflection of the underlying fundamentals of both companies. Phoenix Spree has continued to feel the effects of its suspended dividend while the other funds have been discussed above.

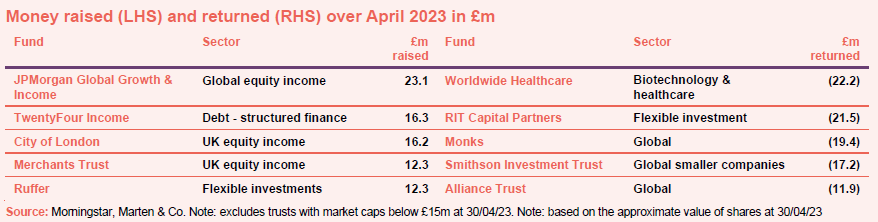

Money raised and returned

Money raised for April was a case of the usual suspects – income funds JPMorgan Global Growth & Income, TwentyFour Income, Merchants, and City of London plus capital preservation specialist Ruffer all featured on the list of biggest raisers for the first quarter.

For those companies returning cash, Worldwide Healthcare continues to be a regular feature on the list with its active discount management policy aiming to limit the discount to no more than 6% (it is currently around 10%). RIT Capital Partners has also been aggressively buying back shares, as its discount widened close to pandemic lows.

Major news stories and QuotedData views over April 2023

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

| · Dunedin Income Growth AGM – 16 May

· abrdn Asia Focus Group Update – 16 May · QuotedData’s Property Investment Conference 2023 – 18 May · Riverstone Credit Opportunities Income AGM – 18 May · Riverstone Energy Limited AGM – 23 May · Lar Espana Q1 conference call – 19 May · BioPharma Credit AGM – 30 May |

· International Public Partnerships Limited AGM – 31 May

· Middlefield Canadian Income AGM – 1 June · NB Global Monthly Income Fund AGM – 6 June · Fair Oaks Income AGM – 8 June · Nippon Active Value AGM – 8 June · Round Hill Music AGM – 12 June · Aquila Energy Efficiency AGM – 14 June |

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

|

Research

Last year was a turbulent one for markets and, unusually, there were few places for investors to hide, with nearly all asset classes recording large declines. RIT’s net asset value (NAV) also fell in 2022, and this appears to have unnerved some investors who, after 10 years of consecutive NAV uplifts, may have come to believe that RIT‘s portfolio would never decline in value. This has led to RIT Capital Partners (RIT) coming in for some criticism recently, with some investors claiming that RIT has ‘changed its stripes’. As a result, the shares have come under short-term pressure and have been selling at a record discount to NAV against recent history of around 23%. We believe this is unjustified and presents a rare opportunity to buy a unique trust with an impressive long-term track record.

The team behind the Gulf Investment Fund (GIF) has more than proven its worth as an active manager, having negotiated the turbulent markets of 2022 to deliver truly impressive outperformance of both GIF’s peers and its benchmark. In particular, in recent trading activity, it has eschewed some of the more highly-valued regions, and the globally exposed petrochemical sector (as at 31 December 2022, GIF had no direct exposure and limited indirect exposure), in favour of more-attractively-valued opportunities focused on the domestic economies of the Gulf.

HydrogenOne Capital Growth (HGEN) is the only pure play green (renewables-powered, no carbon dioxide produced) hydrogen fund available on the London listed market. It offers diverse exposure to nine exciting private hydrogen investments and a hydrogen production facility that is being developed in Germany. Spurred on by the need to tackle climate change and improve energy security, globally, governments are devoting considerable resources to jump-starting the green hydrogen industry. HGEN is well-positioned to benefit as investee businesses scale rapidly over the coming years. The investment adviser has around £500m worth of additional opportunities available.

In a world of volatile equity markets and uncertain futures, MATE offers investors a refreshingly straightforward target of achieving an average of 6% compound annual returns over a rolling five-year period and paying an inflation-linked dividend. MATE has now passed its five-year anniversary, and its life has been marked by two of the worst bear markets in recent memory. Given that we are in the grip of a painful downturn, it is unsurprising that MATE has fallen short of its target return. Commendably, the team has not taken on more risk in an attempt to catch up.

Following the retirement of Simon Knott, who managed Rights and Issues (RIII) for 39 years, RIII’s portfolio is now the responsibility of Dan Nickols and Matt Cable, part of the UK small and mid-cap team at Jupiter Asset Management. The Jupiter team aims to ensure that RIII continues to offer access to a focused portfolio of handpicked UK small and mid-cap companies, though the trust will be bolstered by a significant increase in the investment management resource dedicated to the portfolio. RIII gives investors access to the dynamism underpinning the UK small-cap market. Dan has a good track record for his strategy with an open-ended fund that has generated twice the returns of its benchmark since the start of his tenure in 2004. RIII gives the Jupiter team the opportunity to augment this with the opportunities provided by a closed ended structure, notably the ability to hold high-conviction weightings in a more concentrated portfolio than it would use for its open-ended funds.

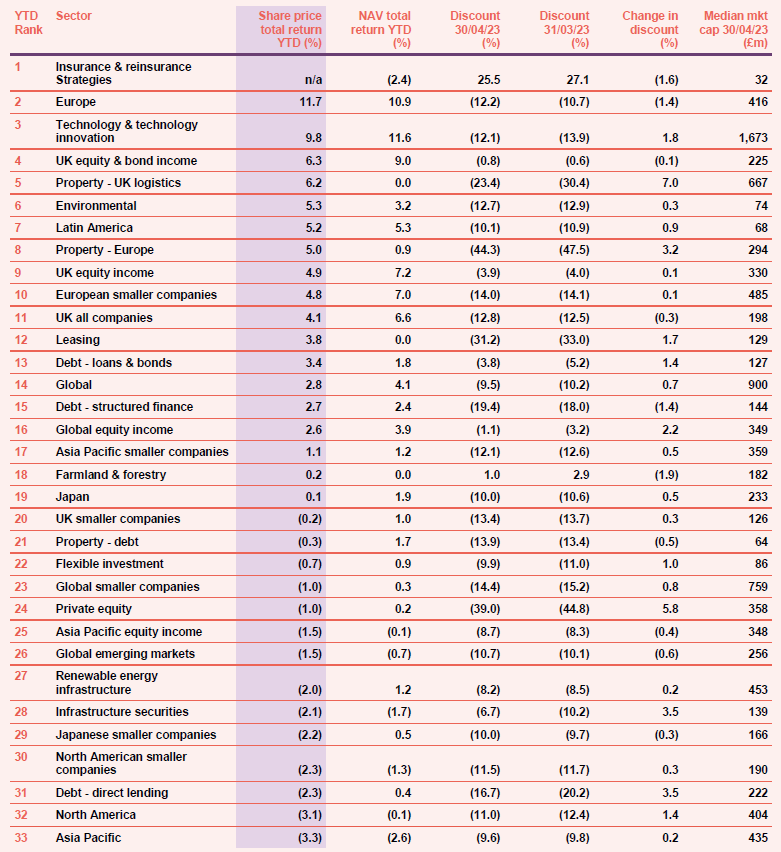

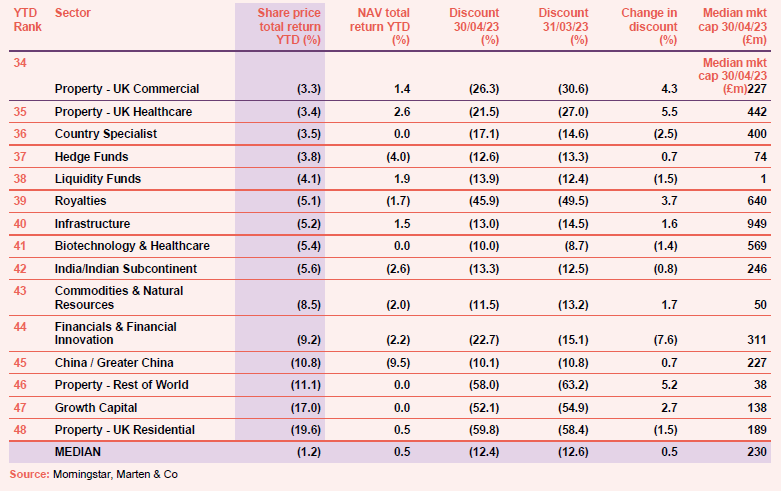

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.