May 2024

Monthly | Investment companies

Kindly sponsored by abrdn

Winners and losers in April 2024

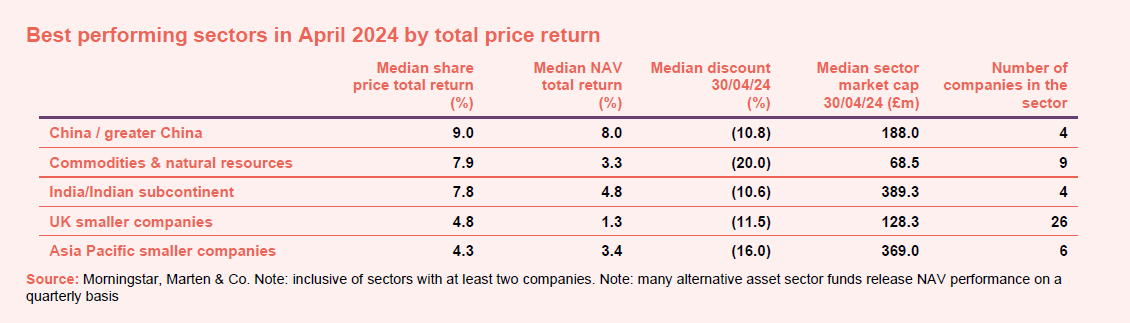

Chinese shares lead the list of best performers in April, although they remain deeply depressed with the world’s second largest economy still struggling with a range of long-standing structural issues. So far, the People’s Bank of China has been reluctant to introduce wholesale measures to counteract its falling share market, although more recently, sentiment has begun to improve as investors look towards increasingly attractive valuations in the region. Notably, Hong Kong’s Hang Seng index entered a technical bull market in April, although it remains down almost 10% over the past 12 months.

The commodities sector continued to perform strongly, led by Golden Prospect Precious Metals for the second month running. The company represents a leveraged play on the price of gold, which is up strongly over 2024 despite real rates rising steadily. Fears around the Federal Reserve’s control of inflation seem to be the most likely explanation for the rally.

After a barnstorming run through 2023, Indian markets have experienced a volatile start to the year, although were up strongly in April as Narendra Modi looks to secure a third electoral victory. The market is backing the incumbent to delivering ongoing economic growth; the economy is forecast to expand by 6.5% through 2024.

It was somewhat surprising to see the rate sensitive UK Smaller Companies sector rally on the back of April’s inflation data, which came in slightly hotter than expected, although dovish commentary from the Bank of England (BoE) helped boost sentiment. Importantly, inflation continues to trend downward toward the 2% target, unlike in the US where we have seen a reacceleration in recent months.

The Asia Pacific region was also up strongly, led by Pacific Horizon, which benefited from the strong growth of both the Indian and Chinese markets which make up well over 50% of the fund.

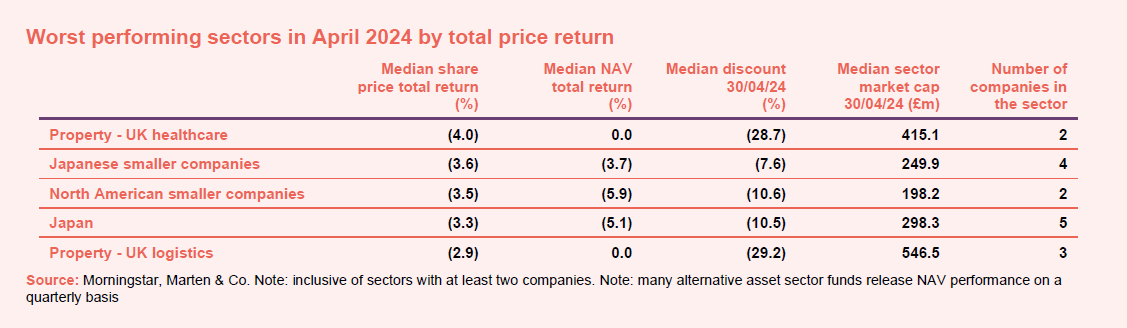

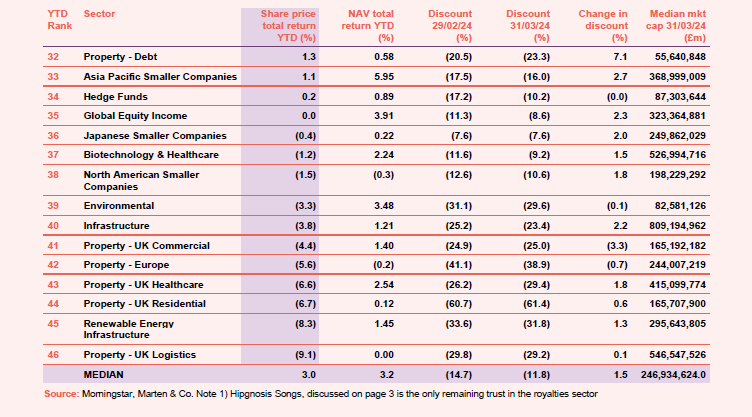

In terms of the worst performers, the property UK healthcare sector leads the way. The sector is made up of just two trusts, Target Healthcare REIT which was down 7.6% and Impact Healthcare REIT which was down just 0.4%. It is not immediately clear what drove the fall, although given the domestic focus of these industries it is likely that the hotter than expected inflation print played a role. It was a similar story for the Property UK logistics sector.

Japanese markets took a breather in April after a strong period of growth which saw the benchmark Nikkei 225 index finally breach its previous all-time high set prior to the 1980s crash. Currency chatter dominated the headlines as the yen fell to a 34-year low against the dollar, pushing up prices of imported goods and increasing inflation risks. The flow on effect has led to concerns around domestic growth and interest rates, weighing on more economically sensitive sectors of the market including small caps.

Hotter than expected inflation in the US weighed on the North American smaller companies sector which is traditionally more sensitive to interest rate volatility.

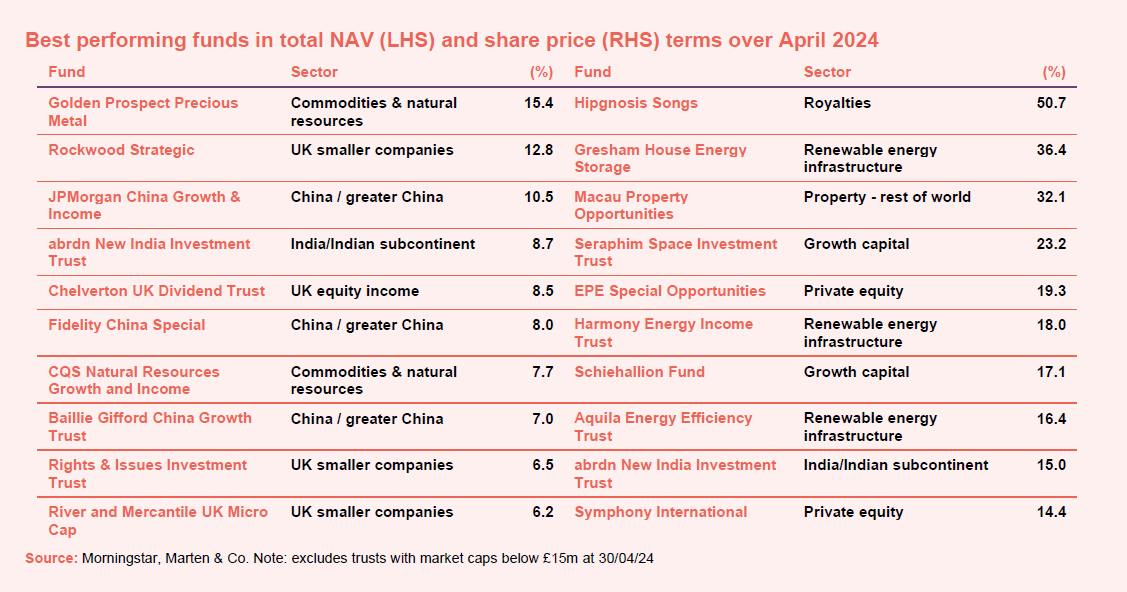

Looking now at the best performing companies in terms of NAV growth, Golden Prospect Precious Metals led the way, as noted on page one. The rally in gold also benefited CQS Natural Resources, as did the performance of the broader commodities indices. This reflects slowly improving economic sentiment, particularly in China which is the world’s largest consumer of commodities. As discussed, improving sentiment in China has had a positive effect across the region with several funds up strongly. India’s economic performance has also benefited the abrdn New India Investment Trust which is heavily exposed to the domestic economy, particularly financials and industrials. Its share price was further boosted after comment that it had been approached by India Capital Growth.

Rockwood Strategic was the second-best performer in terms of NAV growth thanks to the outperformance of several of its largest positions, most notably RM Plc which accounts for almost 10% of the trust and was up 32%. The Chelverton UK Dividend Trust also benefited from solid stock selection over April, with a number of its companies reporting strong Q1 earnings. Two more UK-focused trusts – Temple Bar and River and Mercantile UK Microcap – benefited from doveish messaging from the BoE, with governor Andrew Bailey saying that he expected a sharp fall towards the 2% inflation target in May.

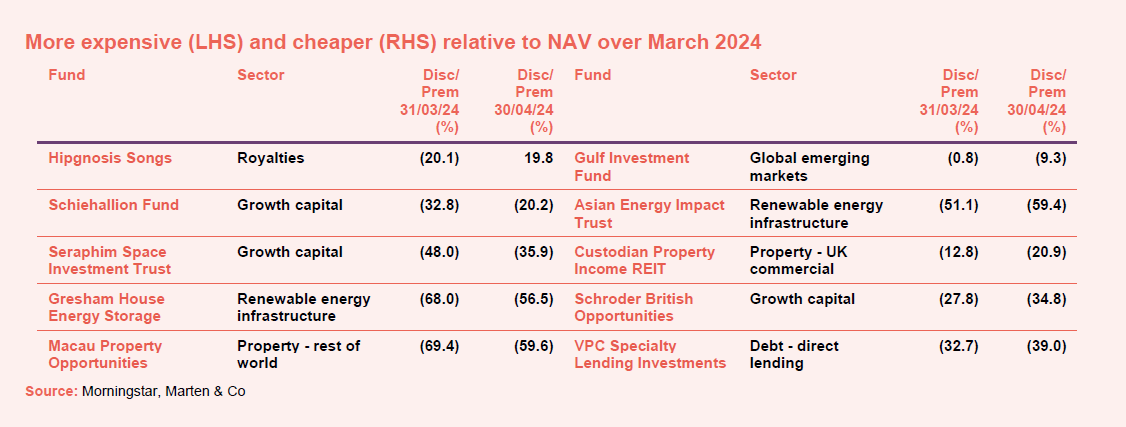

In terms of share price performance, the Hipgnosis Songs trust was at the centre of a bidding war, with the latest offer representing a 48.1% premium to the 71p per share price of SONG on 17 April 2024 (the last business day before the commencement of the offer period on which the initial bid for SONG was made).

Despite announcing a temporary suspension of its dividend and additional share buybacks, shares in Gresham House Energy Storage and Harmony Energy Income were up strongly following an announcement from the company which highlighted a number of positive updates to the UK’s national gird balancing mechanism. This is expected to significantly improve the potential revenue generated from its battery storage assets.

The Macau Property Opportunities fund rallied following a market announcement on 16 April which provided detail on the government’s real estate anti-speculation policies, which have been in place for over a decade. These measures, which follow a similar move by Hong Kong in February, include the axing of prevailing special stamp duty requirements and improving loan-to-value ratio ceilings for mortgage loans.

The Schiehallion Fund continued its solid start to 2024, with shares up strongly following the release of its annual results which highlighted its ongoing focus on buybacks. The Seraphim Space Investment Trust has also had an impressive start to the year after a number of positive portfolio announcements showed significant improvements in profitability. The shares are now up 102% year to date, although they remain well down on the recent highs achieved back in 2022. Shares of Aquila Energy Efficiency were up strongly following the announcement of a tender offer.

Worst performing

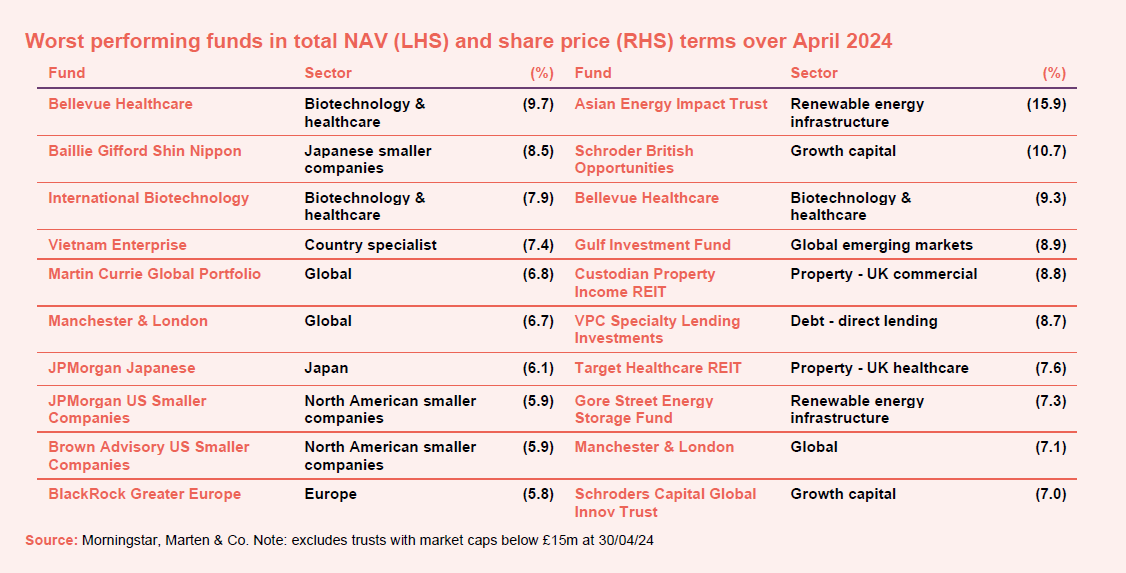

Following a period of strong growth towards the end of 2023 fuelled by the expectation of falling interest rates and a number of high-profile takeover bids, the NAVs of Bellevue Healthcare and International Biotechnology lagged peers over April and are now down over the past 12 months.

The two global companies, Martin Currie Global and Manchester & London are both heavily concentrated in US technology, particularly Manchester & London which has almost 60% of its fund spread across NVIDIA and Microsoft. Both companies fell steadily in April after several months of uninterrupted gains, as investors took profits amid uncertainty about the timing of interest rate cuts.

These factors have also influenced the performance of the North American smaller companies sector with many of these companies particularly sensitive to interest rates and broader economic health, with the US experiencing its first real signs of a slowdown in April.

As noted, the Japanese sector has struggled with concerns around its currency, growth, and inflation, with similar headwinds impacting on country specialist, Vietnam Enterprise. The trust followed the broader Vietnam market down as GDP data for Q1 showed a slowdown in growth due to tepid consumption activity and weak exports. The economy is also suffering from a falling currency, forcing its central bank to intervene as the dong fell to a new record low against the USD.

Stock specific factors weighed on The BlackRock Greater Europe trust. ASML, its second largest holding, accounting for 7.3% of the fund was down almost 5% after it announced softer than expected sales for Q2. LVMH, its third largest holding, was down 7% as economic pressure weighed on luxury spending.

In terms of the share price performance list, Asian Energy Impact Trust (formerly ThomasLloyd Energy Impact) has continued to sell-off after its listing restoration. This followed the drawn-out debacle surrounding its investment in the Rewa Ultra Mega Solar Park in India. The company has since announced that it will ask shareholders to approve an orderly realisation of its assets. In addition, its shares were once again suspended after it missed a deadline for publishing its annual report.

There does not appear to be a particular catalyst for the fall in the Schroder British Opportunities trust. We did see a large trade well above the company’s average daily volume at the beginning of May as the company’s discount slipped below 35%. It was a similar story for the Gulf Investment Fund. While there are no specific factors to explain the move, geopolitical concerns may have played a role. The company also trades on thin volume due to very large institutional ownership.

Custodian Property Income REIT’s share price came under further pressure in April after the disappointment of its failed bid for abrdn Property Income Trust.

It has been one way traffic for the VPC Specialty Lending Investments fund since it announced it would be proposing a managed wind down at the end of 2022. Shares have lost almost half their value since the announcement, with the illiquid nature of its investments increasing the challenges of returning capital to investors.

It appears that sentiment towards the Gore Street Energy Storage Fund continues to suffer from the issues related to the National Grid’s electricity system balancing mechanism which have weighed heavily on peers Gresham House Energy Storage and Harmony Energy Income Trust. This is despite having much less exposure to the UK thanks to a more diversified asset base. As noted above, the other two have bounced following a positive update related to this.

Moves in discounts and premiums

Each of the companies featured in this list have already been discussed. Notably, the majority of the funds becoming more expensive still trade on significant discounts.

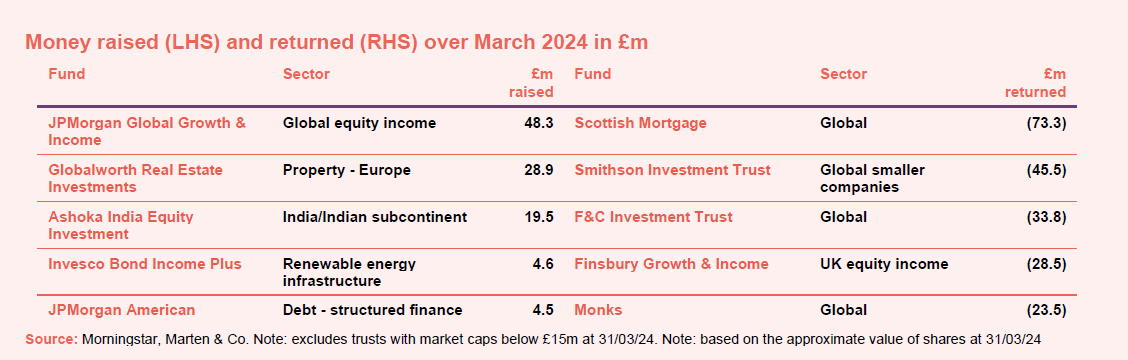

Money raised and returned

JPMorgan Global Growth & Income which regularly features in the list of top issuers led the charge in raising new capital in April followed by other regulars Ashoka India Equity Investment, and Invesco Bond Income. The JPMorgan American trust has recently started issuing shares, with the company now trading at a premium to NAV. The Globalworth Real Estate trust has also continued to issue shares to satisfy its stock-based compensation plan despite trading at a significant discount.

In terms of money being returned to investors, it was the case of the usual suspects, led by Scottish Mortgage which maintained its pace of buybacks following its recently announced capital allocation programme. We have since learned that activist hedge fund Elliott has been selling down its stake.

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Major news stories and QuotedData views over March 2024

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

Research

Having successfully undertaken its latest act of corporate engineering, Grit Real Estate Income Group (Grit) is in a good place to realise substantial capital value and income growth over the medium term. The sale of two assets to meet a capital call by its majority-owned development partner (Gateway Real Estate Africa – GREA) means GREA is well capitalised to deliver a near-term pipeline of developments, including a diplomatic housing scheme pre-let to the US government. Further projects (including more residences for the US embassy as well as hospitals, industrial and data centres) will provide Grit with substantial net asset value (NAV) and earnings growth when they complete and rental income streams are stabilised.

CQS Natural Resources Growth and Income – Poised for the starting gun

Following a very strong period of outperformance for the commodities and natural resources sector, the last 18 months have been more challenging. However, barring the odd wobble, inflation and interest rates look to be past their peaks. This puts the sector in a strong position to outperform once again, particularly once the attractive valuations on offer are factored in (metals and mining are trading at a 25% discount to broader global equities, while energy is on a 41% discount – see pages 4 and 5).

Bluefield Solar Income Fund – Fundamentals shine despite discount

In common with the other funds in the renewable energy sector, the last six months have continued what has been a challenging period for the Bluefield Solar Income Fund (BSIF), with its ongoing fundamental performance (including strong revenue and earnings growth) failing to reverse a steady slide in its shares which began back in May 2023. Despite this, the company has continued to deliver solid NAV growth and market-leading shareholder distributions thanks to a range of contractual arrangements (discussed on page 6) that underpin its assets.

HydrogenOne Capital Growth – Momentum building despite discount

While shares of HydrogenOne Capital Growth (HGEN) have continued to fall, investors should be buoyed by the ongoing growth of the portfolio and the accelerating development of the green hydrogen sector. Despite challenging macro-economic conditions (including stubborn inflation and still elevated interest rates), HGEN’s net asset value (NAV) grew 5.8% over 2023, while the portfolio generated aggregate revenue growth of 125%. This momentum reflects the rapidly accelerating demand for green hydrogen products and services, with many of HGEN’s companies investing heavily to increase productive capacity to cope with growing backlogs.

abrdn Private Equity Opportunities – On the way to greener pastures

Despite navigating through challenging conditions in 2023, abrdn Private Equity Opportunities (APEO) (now Patria Private Equity, or PPET) achieved remarkable success with recently published annual results reporting both positive net asset value (NAV) growth and double-digit share price returns. APEO’s discount to NAV has narrowed by more than 10 percentage points in recent months, so that it is shares are trading on a 28.9% discount currently, narrowing from about 45% last October. This resilience came in spite of a slowdown in activity in European private equity markets in 2023, dampened by a residual fear of rising interest rates and geopolitical tensions.

In spite of an uncertain macroeconomic environment, Oakley Capital Investments’ (OCI) underlying portfolio continued to generate robust earnings growth in 2023 (average 14% EBITDA growth), which in turn drove 4% net asset value (NAV) growth. More importantly, OCI achieved an 18% total shareholder return during the period, extending the long run of strong share price performance delivered by the company (an average compound annual growth rate of 24% per year). The same macroeconomic uncertainty is also creating opportunity as OCI’s investment manager Oakley has been busy deploying cash into new investments at what it feels are attractive valuations.

We are now more than three years into the tenure of Ian Lance and Nick Purves as managers of the Temple Bar Investment Trust. In that time, the Redwheel team has established a well-diversified portfolio of value-orientated holdings, positioned for what they believe is a long-overdue reversion to more normal market conditions, after a decade of exceptional economic policy and quantitative easing. Slowing growth and stubborn inflation in the UK have weighed on returns over the past 12 months. However, the trust remains well ahead of both benchmark and peer group averages since the change in management, and the current negative sentiment surrounding UK markets has allowed Ian and Nick to pick up a number of market-leading companies at historically low multiples.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.