Oakley Capital Investments

Investment companies | Update | 2 April 2024

Getting down to business

In spite of an uncertain macroeconomic environment, Oakley Capital Investments’ (OCI) underlying portfolio continued to generate robust earnings growth in 2023 (average 14% EBITDA growth), which in turn drove 4% net asset value (NAV) growth. More importantly, OCI achieved an 18% total shareholder return during the period, extending the long run of strong share price performance delivered by the company (an average compound annual growth rate of 24% per year).

The same macroeconomic uncertainty is also creating opportunity as OCI’s investment manager Oakley has been busy deploying cash into new investments at what it feels are attractive valuations.

There appears to have been a particular focus on building the portfolio’s exposure to the business services sector. This note provides a deeper dive into OCI’s investments in this area.

Consistent long-term returns from private equity

OCI aims to provide shareholders with consistent long-term returns in excess of the FTSE All-Share Index by providing exposure to private equity returns, where value can be created through market growth, consolidation and performance improvement.

At a glance

About OCI

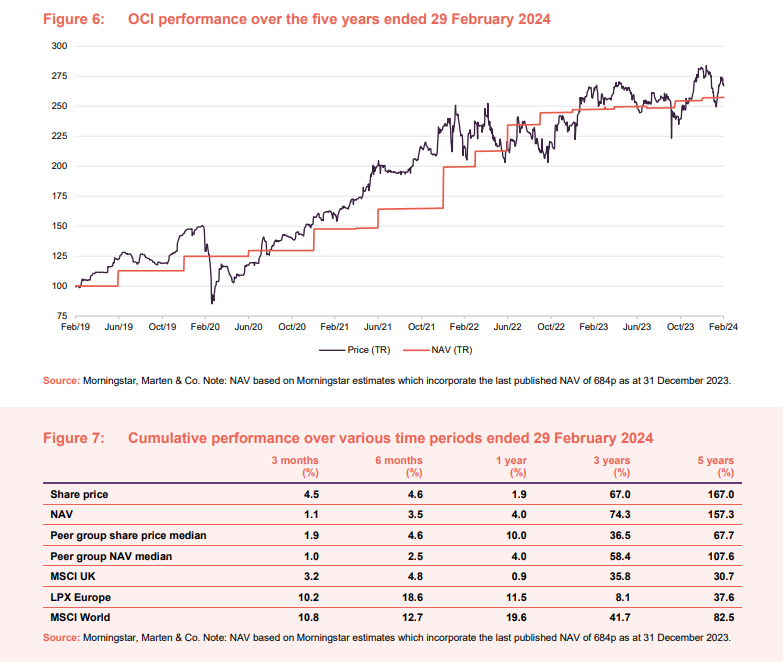

OCI gives its shareholders access to private equity investments made by Oakley Capital (Oakley). Oakley is a private equity investor with a focus on European mid-market investments (companies with a €1bn–€2bn enterprise value). It invests in high growth private companies and has built up an impressive track record, with NAV returns of 157% over the five years ended 29 February 2024 and a share price return of 167% over the same period. Much of this can be attributed to the earnings growth that Oakley helps to drive within the portfolio, an average of 14% growth in EBITDA over 2023 and over 175% over the past five years.

Four key sectors – technology, consumer, education, and business services

Oakley takes controlling stakes in companies that are operating in one of four key sectors – technology, consumer, education, and business services. These companies should be benefitting from ‘mega-trends’ that will help drive revenue growth such as growing, global demand for quality education; business shift to the cloud; consumer shift to digital search and online spending; increased regulation and outsourcing.

Partnering with business founders

Where it can, Oakley seeks to partner with business founders, backing proven leaders, running businesses with a high potential for value creation, through structures that ensure alignment with Oakley’s goals (about three-quarters of all Oakley’s deals have been founder-led). Often, founders will introduce Oakley to new opportunities, and they are also often prepared to entrust their own money to Oakley funds, having contributed about €300m of Oakley’s assets under management.

First through the door

Building a rapport with these business founders is key. Oakley is usually the first outside institution to provide capital to these businesses. It is bringing expertise to help them professionalise, and providing the capital that they need to grow.

Uncontested deals

Around three-quarters of the deals that Oakley does are uncontested. The price that Oakley is paying is not distorted by a competitive process, but rather reflects the trust that the founder is placing in Oakley.

Leveraging new technology

Digital disruption and internationalisation are key themes. Disruptive business models that take market share rather than rely on market growth make them less reliant on economic cycles. By shifting business models to a digital world – migrating it to the cloud, for example – Oakley can help the companies expand margins and grow their sales. Digitalisation of business processes also helps with international expansion. Businesses tend to end up with a higher proportion of recurring/subscription revenue, which also helps improve their valuation.

Typically, Oakley will take a controlling stake, which gives it greater ability to deliver positive outcomes. Oakley is using new in-house expertise in financing deals to help optimise capital structures. It often introduces new talent to businesses. Crucially, it also helps support bolt-on acquisitions, which are a key source of growth for some of its investments.

Cross-fertilisation of ideas in areas such as AI

Oakley also leverages the expertise that it has gained from other deals; it is doing a lot of work on how to benefit from artificial intelligence (AI), for example. The recently-launched Touring Fund backed by OCI is focused on building the next generation of software powered by AI, providing early-stage growth capital to revenue-generating businesses, typically in their second or third round of financing (Series B and C). Insights gained through these investments are shared across the portfolio.

Business services

In this note, we thought we would take a closer look at OCI’s business services investments. OCI has been exposed to companies in the business services sector for a while, but the investment adviser recently carved it out as a separate sector.

Companies in this sector often share highly attractive traits: their markets tend to be fragmented, offering consolidation opportunities; their markets are growing, often driven by increased regulation and outsourcing; they tend to sell non-discretionary services such as testing, inspection, certification, and compliance (TICC), and they often have recurring revenue or subscription models. In addition to sharing these traits, Oakley’s business services portfolio companies are also all founder-led.

The first three businesses in this list below are buy-and-build opportunities and together have completed about 30 bolt-on acquisitions since Oakley’s investment in each. Apart from the most recent investment, Horizons Optical, the remaining two are business-to-business (B2B) information platforms benefitting from a shift to a recurring revenue business model which can often attract a higher valuation multiple at exit.

Phenna – leader in the TICC market

Phenna Group (phennagroup.com) is an investment that Oakley made through its Fund V in 2022. It is a TICC company, focused on a $250bn (and growing) potential market, which was established in 2018 by Paul Barry and David Harrison. TICC services are often required by law, and part of the attraction of this business is that revenues are not that sensitive to economic cycles.

Phenna is consolidating a highly-fragmented market

Phenna operates through five divisions, servicing the built environment, infrastructure, niche industrial, compliance & certifications, and food & life sciences sectors. Phenna is consolidating a highly-fragmented market; Oakley says that the 10 largest players only control about 12% of the market. There is scope to broaden Phenna’s activity-set too, into areas such as pharmaceuticals, for example.

In 2022, Oakley supported Phenna as it acquired a major competitor, CTS. Phenna has since grown rapidly through further acquisitions (including 16 deals in 2023, with a particular recent focus on building the group’s presence in Australia) and now is a global business with turnover in excess of £450m, servicing over 18,500 clients from more than 100 offices and laboratories worldwide.

entrepreneurs are encouraged to stay on and help support long-term growth

The individual businesses that make up Phenna retain considerable autonomy, which helps motivate staff. The entrepreneurs that set up these individual business units are encouraged to stay on and help support the long-term growth of the business. This has clear parallels with Oakley’s investment approach.

Steer Automotive – the UK’s leading B2B auto services platform

The acquisition of Steer Automotive (steer.co.uk), a leading B2B automotive repair company in the UK, which was founded by Richard Steer and Gavin Ruddick in 2018, was made through Fund V in January 2024.

Steer services around 5% of the estimated £5bn UK market from 119 locations. It covers commercial as well as passenger vehicles, has a strong presence in the luxury market, and partners with leading insurers (who value its national footprint).

Bolt-on acquisitions can be made at attractive prices, but then folding these additional garages into the group can help bring in considerable additional business for them from insurance companies that have accredited Steer, and profit margins can expand as the new garage benefits from Steer’s pricing power.

Opportunity to consolidate a fragmented market

As well as the opportunity to consolidate a fragmented market (which seems to be a theme within this sector) and expand geographically (it just made its first acquisition in South Wales), there is also a considerable opportunity as the national fleet shifts from fossil fuel to EV and mechanics need to learn new skills. Not all garages will be able to afford the associated cost, but Steer benefits from economies of scale.

Liberty Dental – building a global leader in the global dental lab market

Liberty Dental Group (libertydentalgroup.eu) was a new investment for Oakley through Fund V in 2023. Three companies – Excent Tandtechniek (co-founded by Hidde Hoeve, who is now CEO of the combined group), Flemming Dental and ArtiNorway – were combined to form a business with around 70 dental laboratories servicing around 5,000 dental clinics across Benelux, Germany and Norway.

Liberty Dental allows the creation of bespoke dental implants using digital imaging and 3D printing technology. Turnaround times are much faster than conventional technology.

Oakley believes that this is a highly-fragmented €10bn market. The growth of the business will be augmented through bolt-on acquisitions. There is also scope to expand beyond the group’s home territories.

vLex – B2B legal information platform with recently relaunched AI virtual assistant

vLex (vlex.com) is a cloud-based legal information subscription platform that was founded in 2018 by entrepreneurs Lluis and Angel Faus, and backed by Oakley’s Origin Fund in 2022. The company has its roots in Spain, but now has a presence in London and Miami as well as in Barcelona.

Around 2m global users access its database. Its online library of over 1bn documents contains global legal and regulatory information, including case law, legislation, journals, and dockets from over 100 countries.

Vincent AI is vLex’s new AI-powered legal research assistant, helping users including lawyers to work more productively. It incorporates large language model (LLM) technology but only sources information direct from the Lex database, to ensure that answers to queries only contain references to real cases and materials, thereby avoiding so-called ‘hallucinations’ (where the AI comes up with plausible falsehoods).

Oakley says that vLex has consistently generated double-digit revenue growth in recent years.

Horizons Optical – medical software used to make premium lenses

On 18 March 2024, OCI announced that Oakley was backing Horizons Optical (horizonsoptical.com) through its Origin Fund I. Horizons Optical is a medical software business focused on software used for the manufacture of premium spectacle lenses.

Oakley is partnering with Santiago Soler, CEO of the company, to take the business forward. Oakley is buying out the interests of the original private equity backer, Sherpa Capital. Horizons Optical was founded in Barcelona in 2017, but operates globally. Oakley sees an opportunity to accelerate the company’s international expansion.

Horizons’ software is used to design lenses and coatings used by independent ophthalmic laboratories and optical chains. Lenses can be customised to the needs of individual users; Horizon’s Mimesys virtual reality headset helps produce accurate measurements that are used to produce bespoke lenses.

Strong, long-term growth prospects, opportunity to accelerate the company’s international expansion

Oakley observes that this is a market with strong, long-term growth prospects underpinned by an ageing population and increased use of screens and mobile devices.

Research and development (R&D) is key to keeping Horizons Optical at the forefront of its market. Oakley will provide support for both investment in R&D and in sales and marketing.

TechInsights – B2B information platform for the global chip industry

TechInsights (techinsights.com) is a world-leading content information platform for the semiconductor and microelectronics markets. It reverse engineers technology to provide analysis of its inner workings, and provides technology sector market analysis and deep insight into intellectual property that help support patent investigation, for example.

TechInsights says that every year it analyses over 750 advanced technology products, catalogues over 6,500 components, and analyses over 2,000 chips. It maintains the world’s largest database of semiconductor and technology analysis.

The company was founded in Canada in 1989 by Gavin Carter. Oakley first made its investment through Fund III in 2017 and then in March 2022, Fund III sold its stake as part of a deal that saw CVC Growth Funds invest in the business and Fund IV take some exposure. Since Oakley first backed it, TechInsights has grown both organically (helped by considerable investment in R&D, as well the considerable secular growth within the semiconductor market) and by acquisition.

Shift to subscription model improves profitability

TechInsights has also pivoted its business from providing bespoke insights to individual customers more towards the broad distribution of insights to a wide range of customers through a subscription model. This has improved its profitability and revenue visibility.

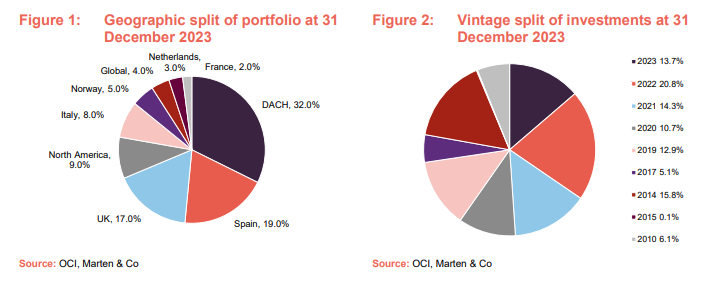

Asset allocation

At 31 December 2023, OCI had net assets of £1,207m. The value of the individual fund investments plus the direct investments totalled £1,224.4m. The funds had net liabilities of £217.3m and OCI had net liquid assets of £199.9m (cash of £207.2m, less net liabilities of £7.3m).

The geographic split of the portfolio is presented slightly differently to that in our last note, with positions in Germany and Switzerland combined as ‘DACH’, and North American investments aggregated together.

Funds

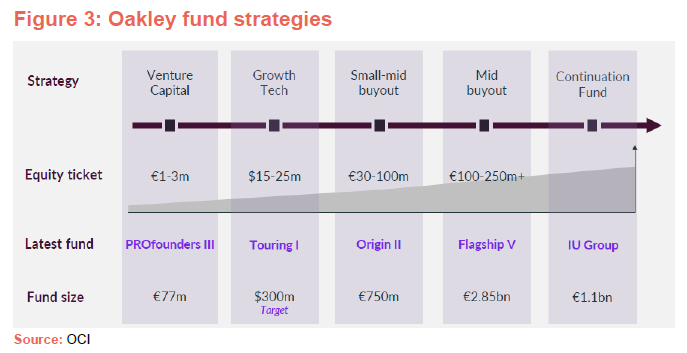

There were no changes to OCI’s fund investments since our last note. Figure 3 gives a good indication of the spread of ‘ticket sizes’ and stage for OCI’s existing commitments.

Figure 4 gives more information on OCI’s commitments by fund – both the original commitment and the amount outstanding at end December 2023, and the realised returns generated.

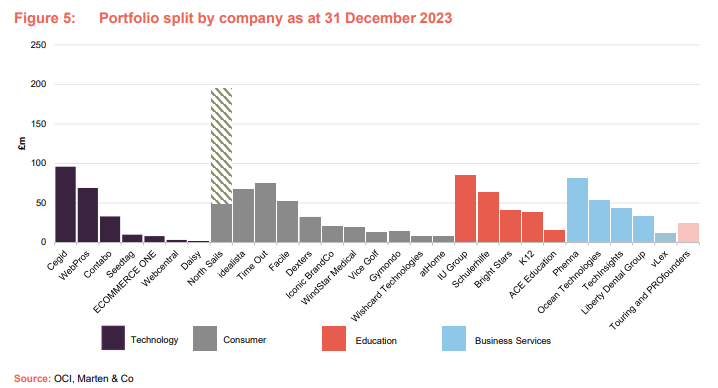

The shaded portion in Figure 5 relates to OCI’s £144.4m worth of preferred equity in North Sails (which we discussed in our last note – see page 12 of that note).

K12 is composed of Affinitas and Thomas’s London Day Schools, which are still being run as separate businesses.

Recent investments

The fund invested £175m during the year and realised £266m from the portfolio. Fund III’s exit from IU Group accounted for £240m of those realisations. OCI realised a 13.7x gross money multiple on the amount that it had invested in that company. The manager’s enthusiasm for that business remains and Fund V reinvested in the company alongside third-party investors.

Including the reinvestment into IU Group, £140m was invested in new positions and £35m was allocated to support existing positions.

Oakley is taking advantage of relatively weak markets to build positions in new investments at attractive prices. Setting aside the smaller positions in the PROfounders III and Touring funds, there are now 28 positions in the portfolio (most of which we have covered in earlier notes), and Steer Automotive (page 6) and Horizons Optical (page 7) will soon be added to that.

PROfounders III added two new investments in 2023 and at the end of the year had £2.5m invested in four positions:

- health (nilohealth.com) – this provides workplace-based mental health solutions;

- Scaleup Finance (finance) – a subscription-based financial management platform for early-stage businesses, akin to an outsourced finance director;

- Dash Games (dashgames.co) – founded by a group of developers who have worked for some of the biggest names in the industry, Dash Games is working on launching new free-to-play mobile-based games; and

- Isla (health) – an online clinical records system that encompasses images and video as well as text-based documents.

The AI-focused Touring Fund has got off to a good start, with £24.7m invested at the year end. The four companies that the fund backed in the second half of 2023 were:

- Pixis (ai) – supplies AI-powered SaaS for marketing businesses. Customers can use its tools to create digital assets, and measure, analyse, and automate every aspect of their digital marketing campaigns;

- Netradyne (com) – creates vehicle fleet management software that measures driving performance and alerts drivers when they are not driving safely;

- Numa (com) – provides software that helps manage customer relationships at automotive dealerships; and

- Exaforce (com) – provides cybersecurity software to cloud-based businesses.

Liquidation of Fund I

The position in Time Out that was held through Fund I is now held directly by OCI and all the assets in Fund I have now been distributed.

The £147m of loans and accrued interest that OCI had made to North Sails has been converted into preferred equity (this ranks higher than ordinary equity in the capital structure). The underlying business is said to be trading well, hence its positive contribution to the NAV.

The two direct positions in North Sails and Time Out are expected to be realised in the short to medium term.

Performance

Results for 2023

OCI published results for the 12 months ended 31 December 2023 on 14 March 2024. The fund produced an NAV return of 4% for the year. However, a narrowing discount meant that the return to shareholders was 18%. The dividend for the year was 4.5p. The impressive return crystallised by Fund III’s disposal of IU Group (see page 10) in 2023 was largely captured in the NAV for 2022.

Once again, the underlying companies in the portfolio delivered strong earnings growth, with a 14% organic uplift in portfolio EBITDA and additional growth through mergers and acquisitions activity.

IU Group, North Sails and Idealista were the top contributors to NAV growth (+10p, +9p and +7p, respectively). These were offset slightly by falls in the value of Daisy (-4p) and Bright Stars (-3p).

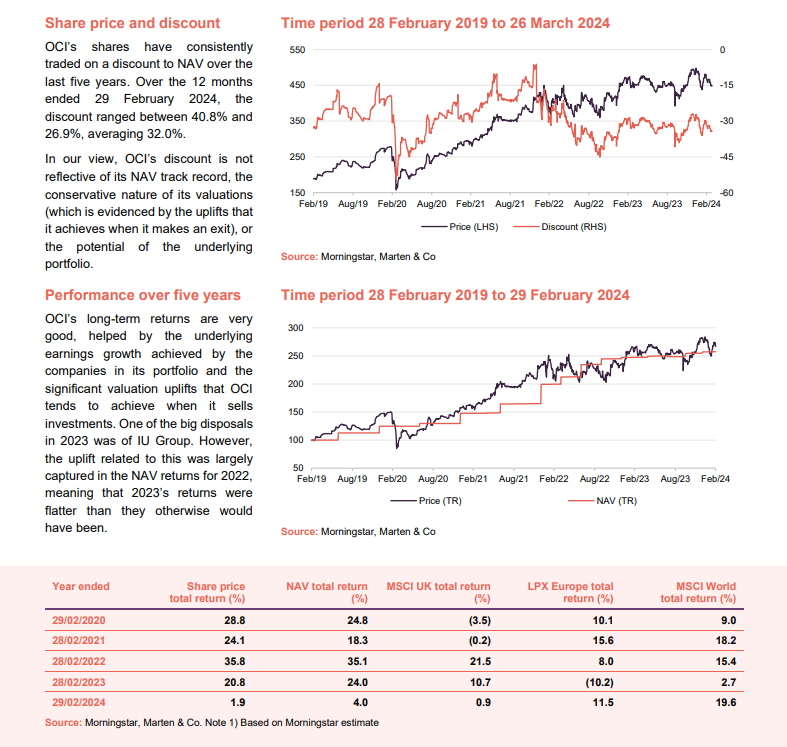

In Figure 7, the LPX Europe Index is an index of the share prices of listed private equity funds. Its relatively strong performance over the 12 months ended 29 February 2024 reflects the discount narrowing efforts that the wider sector has adopted, following on from OCI’s earlier buyback activity (£57m worth bought back since 2020).

Cash and commitments

The cash position rose to £207m during 2023, which, when coupled with the undrawn £175m revolving credit facility, gives liquid resources of £382m. £243m is expected to be called over the next 12 months and a further £532m is expected to be called over the following four years – which is expected to be covered by further portfolio realisations. If it turns out that realisations run ahead of expectations, it may be that the board feels that it is appropriate to fund further share buybacks.

Premium/discount

OCI’s shares have consistently traded on a discount to NAV over the last five years. Over the 12 months ended 29 February 2024, the discount ranged between 40.8% and 26.9%, averaging 32.0%. At the time of publishing, the discount was 34.3%.

In our view, OCI’s discount is not reflective of its NAV track record, the conservative nature of its valuations (which is evidenced by the uplifts that it achieves when it makes an exit), or the potential of the underlying portfolio.

It is encouraging that, as mentioned above, the wider sector is becoming more proactive about addressing discounts. This should in time shift the dial.

It may also help that it looks as though interest rates have peaked. Valuations of listed comparators ought to be positively influenced by this.

Previous publications

Our initiation note – The best-performing UK-listed private equity fund was published on 4 April 2023. We followed this up with a note published on 15 December 2023 – Walking the walk. You can read these notes by clicking the links or visiting our website, quoteddata.com.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Oakley Capital Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.