January 2024

Monthly | Investment companies

Kindly sponsored by abrdn

Winners and losers in December 2023

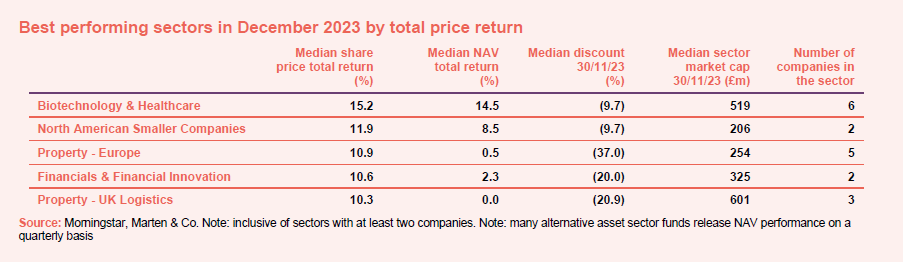

December saw a continuation of November’s market rally, with the MSCI All Countries World Index up 4.1%. However, the excitement did show signs of faltering towards the end of the month, as investors had to weigh the actual likelihood of near-term interest rate cuts. The investment trust sector saw another month of net positive share price returns, with only two sectors reporting negative share price returns over the month. December data also supported the notion that the US was heading for a ‘soft landing’, having added more jobs than expected, while US inflation figures came in line with expectations, which further improved the market’s mood.

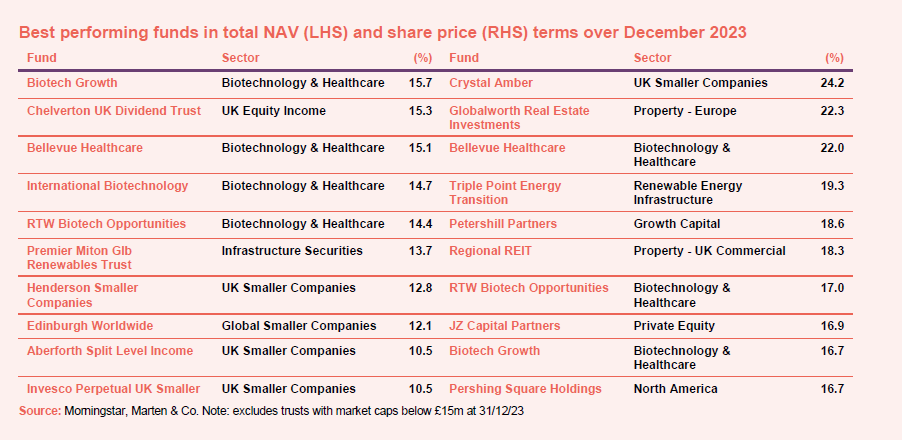

Biotechnology & healthcare made a rare appearance as the top performing sector over the period, with four of its six constituents reporting double digit NAV and share price returns. The NASDAQ Biotechnology Index was up 12.1% on the month. The strong performance of risk assets helped, as did over $30bn worth of takeovers made in the month, with four global pharmaceutical giants snapping up promising biotech firms; and finally, there were also several positive drug-trial results reported over the period, supporting their respective companies’ share prices.

The rally in North American Smaller companies was aided by lower interest rate expectations and would be a beneficiary of stronger US economic data, given the sensitivity of smaller companies to their domestic economy.

European and UK property was supported by lower rate expectations.

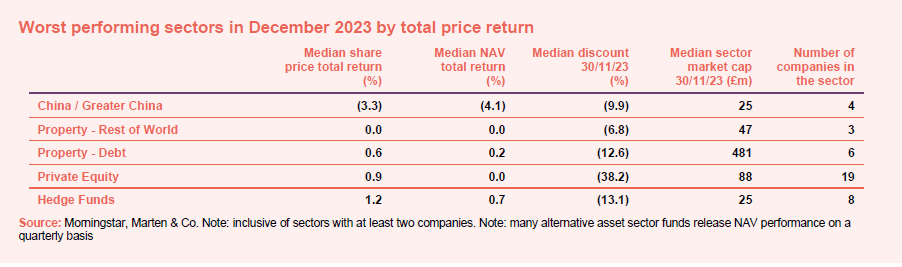

China was the only negatively performing sector over the period, with the country continuing to display a lacklustre economic outlook, compounded by the ongoing property debt crisis within the country, as well as a crackdown by the Chinese government on their domestic video game industry. The MSCI China was down 4.1% over the month. China’s slowdown also effected the Property – Rest of World sector, as it includes Asian property trusts.

Rather than there being any specific factors weighing upon them, the other sectors in the list simply failed to capitalise on the tailwinds supporting the rest of the investment trust universe. Though we note that there were some stock specific issues within the property – debt, and hedge fund sectors, with ICG-Longbow Senior Sec. UK Prop Debt and Gabelli Merger Plus+ Trust respectively.

The majority of the top NAV performers were within the biotech sector. Biotech Growth was a beneficiary of Astra Zeneca’s bid for cell-therapy business Gracell Biotechnologies.

The UK market rallied in December, and small caps did particularly well. However, the catalyst for this is not a positive as the performance may suggest, as the UK market rallied on increasing expectations of a rate cut by the Bank of England in the new year to counteract weak growth, with the UK reporting a fall in output over the third quarter of 2023. Chelverton UK Dividend’s returns are geared by its zero dividend preference shares, as are Premier Miton Global Renewable Trust’s. The utilities and infrastructure sectors are beneficiaries of the improving interest rate outlook.

Edinburgh Worldwide’s performance reflected the general rally in risk assets over the month.

Crystal Amber announced a share buyback program in December, buying back up to £5m of its shares. Standard & Poor’s affirmed Globalworth’s BB+ credit rating. Out of favour Regional REIT could be a big beneficiary of a recovering UK property market. Pershing Square and Petershill Partners continued to buy back stock.

Triple Point Energy Transition announced that in light of its persistent discount and chancing market environment that it will implement a realisation of its assets, selling down its portfolio and returning capital to its shareholders, with its share price rallying in response.

JZ Capital Partners share price improved after the announcement that will receive $62.5m form the sale of one of its assets, which will lead to an NAV uplift of c.19 cents per share. The trust also repaid $45m in debt in the month, which also shored up investor confidence.

Worst performing

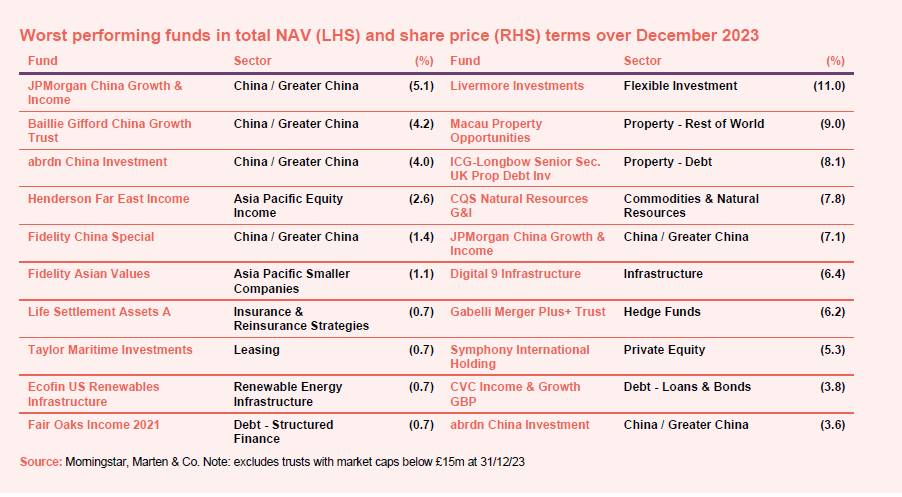

In NAV terms, the most common factor weighing on these investment companies was exposure to the Chinese economy, with the factors behind its market slowdown detailed earlier.

Ecofin US Renewables Infrastructure said that its Texan windfarm would be reconnected to the grid but slightly later than planned, but the NAV moves for it and most other non-Chinese-related funds reflect a weaker US dollar.

In share price terms, China is a big factor again. This also includes CQS Natural Resources, given China’s role as a major consumer of natural resources.

ICG-Longbow has continued to suffer at the hands of a difficult market environment, with the manager even outlining the specific difficulties in their December update, however, there were no specific factors driving its discount other than broader market sentiment. We remind readers that ICG-Longbow is in the process of being wound up, however the managers commented that they have yet to receive firm bids for some of their remaining loans, which likely weighed on investor demand.

Digital 9 Infrastructure remains out of favour following last month’s disappointing news. The initial excitement around news of Symphony International’s wind down appears to have worn off.

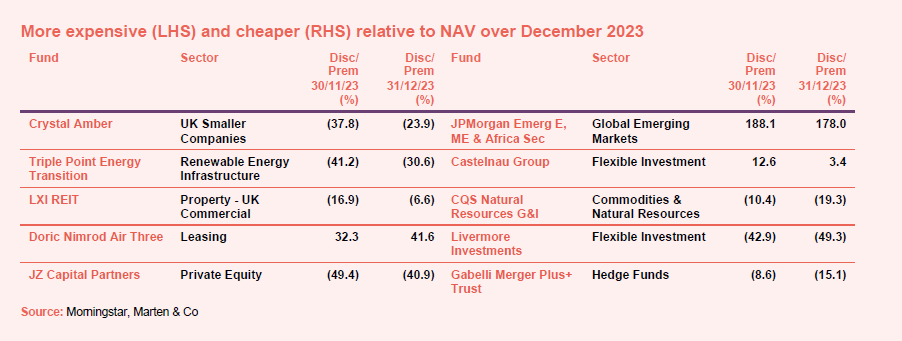

Moves in discounts and premiums

Many of these funds have been discussed already. The violent shifts in JPMorgan Emerging Europe, Middle East and Africa’s share price continued again this month, reflecting its past life as a Russian equity strategy. LXI REIT’s discount narrowed on the back of an announcement of a possible all-share merger with LondonMetric Property. Castelnau’s premium fell by 10% on the 27th of December following an announcement that two of its underlying holdings had appointed an administrator, which would lead to a reduction in the value of its investment in Phoenix SG, the parent company.

Money raised and returned

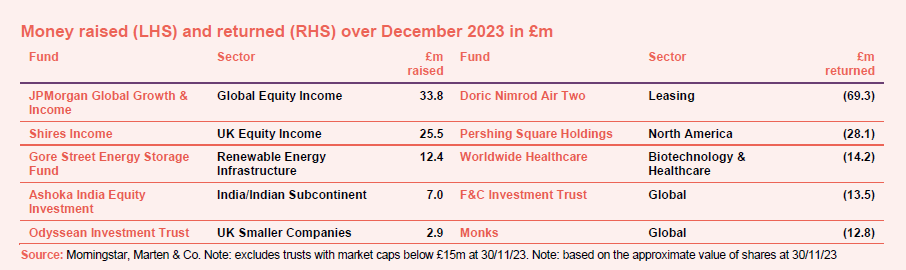

While the level of new issuance remains low by historic standards, it has none the less improved from November. JPMorgan Global Growth & Income continues to dominate. Shires Income issued 11m new shares in connection with its merger with abrdn Smaller Companies Trust (this does not reflect net new money coming into the sector – 7.7m shares opted a cash exit). Gore Street issued 14m new shares in connection with its partnership with Nidec Motor Corporation.

Having sold two planes, Doric Nimrod Air Two redeemed 49m shares in a compulsory redemption, redeeming 2 shares for every 7 existing.

Major news stories and QuotedData views over December 2023

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

|

Research

Despite broader economic challenges, Oakley Capital Investments (OCI) continues to deliver outstanding, market beating shareholder returns. Its focus on cash-generative companies with recurring revenues and asset-light business models means the portfolio remains well insulated as financial conditions have tightened, highlighted by double digit earnings growth over the last financial year. The staggered nature of its investments has provided a consistent stream of realisations (at an average premium of 35%), validating net asset values (NAVs) and providing plenty of financial flexibility

Henderson High Income (HHI) has recently announced that Henderson Diversified Income will be merged into it, subject to shareholder approval, which will add advantages of scale to HHI in the coming months, such as enhanced liquidity and the possibility of lower charges

Vietnam Holding (VNH) continues to provide both a peer group and benchmark beating performance (it is the top-performing Vietnamese fund in NAV terms over one, three and five years – see pages 18 to 20) and, aided by Vietnam’s long-term structural growth drivers, its manager continues to see very strong growth runways for its stocks. Despite this, VNH has, until very recently, been hampered by a low double-digit discount to net asset value (NAV) that has been persistent and unjustified (see page 23)…

We are now more than 12 months into Jupiter Asset Management’s tenure managing the Rights and Issues investment trust (RIII), following the retirement of Simon Knott, who was at the helm for 39 years. New managers Dan Nickols and Matt Cable remain committed to its heritage, retaining the core principles of one of the UK’s oldest and most successful investment trusts, while adding the benefits of Jupiter’s large and well-resourced UK Small and Midcap investment team

Polar Capital Technology’s (PCT’s) manager Ben Rogoff’s conviction levels on the potential of artificial intelligence (AI) have risen, reflecting the all-encompassing possibilities of the technology. His bullishness is displayed in the make-up of PCT’s portfolio, which is weighted almost 80% towards stocks that he believes are AI beneficiaries or enablers. The potential for huge productivity gains – which could boost global GDP by 7%, according to Goldman Sachs – and few barriers to mass adoption puts the technology sector at a profound moment in time, with corporate spend on AI set to rocket

If an inflexion point in the interest rates cycle has been reached, as seems to be the case, Urban Logistics REIT (SHED) is a compelling proposition. Valuations have stabilised – as evidenced by a 0.2% uplift in the value of SHED’s portfolio in the six months to September 2023 – while the company has substantial reversion baked into its portfolio (reversion is the rental growth potential of the portfolio, being the difference between current portfolio rents and the estimated rental value of the portfolio).

Optimism driven by rapidly developing corporate governance reforms, a divergent economy cycle, and still-negative interest rates saw a dramatic rally in benchmark Japanese indices over 2023, with the TOPIX index (the Tokyo Stock Price Index) climbing to its highest level in more than 30 years.

With the rally driven by more value-focused sectors of the market, returns for the JPMorgan Japanese Investment Trust (JFJ) failed to keep pace for much of the year due to a portfolio more targeted towards high-quality growth stocks (generally speaking, for JFJ, this means companies with strong franchises, balance sheets and cash-flow generation, which have the potential to compound earnings over the long term).While many of these companies have been out of favour, we do not see that as a significant negative for investors given the alignment of the portfolio towards a range of long-running themes. Promisingly, in December, we began to see a turning point in many of these sectors, with the JFJ portfolio up strongly.

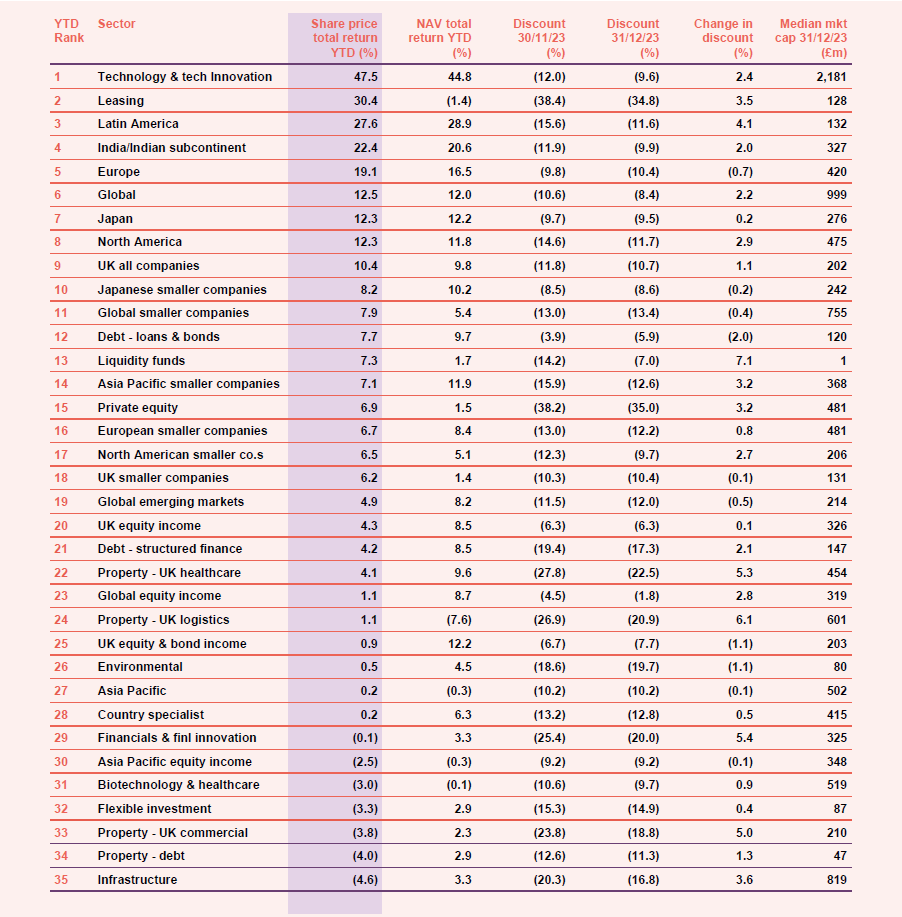

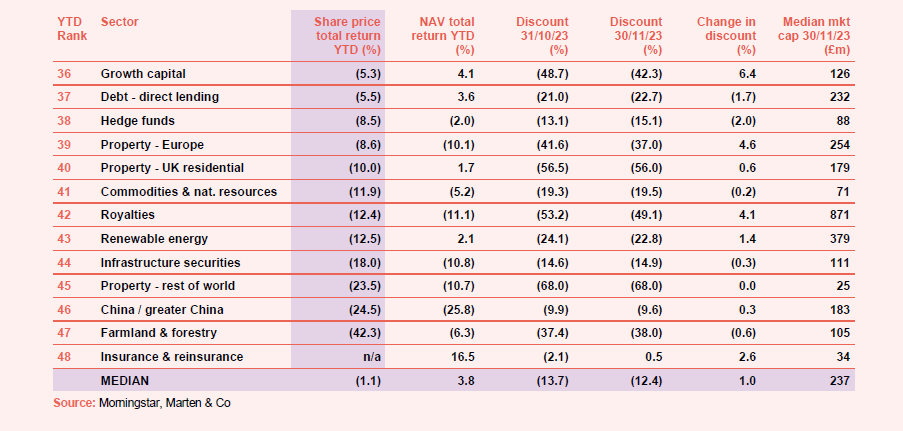

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice toretail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.