Rights and Issues Investment Trust

Investment companies | Update | 19 December 2023

Old dog, new tricks

We are now more than 12 months into Jupiter Asset Management’s tenure managing the Rights and Issues investment trust (RIII), following the retirement of Simon Knott, who was at the helm for 39 years. New managers Dan Nickols and Matt Cable remain committed to its heritage, retaining the core principles of one of the UK’s oldest and most successful investment trusts, while adding the benefits of Jupiter’s large and well-resourced UK Small and Midcap investment team.

Whilst broader macroeconomic volatility has rained on the parade to a degree, with short-term performance not yet matching the new managers’ high expectations, it remains early days. From a fundamental perspective at least, indications suggest a seamless transition with the foundations being laid for a continuation of the company’s long-term record of outperformance.

Concentrated exposure to UK small and mid-caps

RIII’s objective is to exceed the FTSE All Share total return over the long term while managing risk. RIII invests in equities with an emphasis on small and mid-cap companies. UK smaller companies include both listed securities and those admitted to trading on the Alternative Investment Market (AIM).

At a glance

Untapped opportunities

It is easy to forget, with the amount of attention that gets directed towards large caps, how significant the small-cap universe is, with small caps alone representing around 90%, by name, of all the companies quoted on the London Stock Exchange. This breadth provides the managers with a relatively unique opportunity to truly add value through active management (where managers make buy, hold and sell decisions on the assets in their portfolio rather than just tracking an index). With, on average, only around three analysts covering each UK small-cap stock, versus 22 for each large cap, there exists considerable scope to unearth previously untapped opportunities.

Part of the challenge has always been the ability to allocate resources to the sector, which is one reason why some funds in the space often have relatively concentrated portfolios with reasonably low turnover, as managers generally need to commit substantial resources to the due diligence of new investments. This is perhaps one of the most appealing aspects of the new RIII’s partnership, with the new managers able to leverage Jupiter’s existing resources to build on the well-established foundations of the trust. These include a market-leading investment platform, with dedicated teams of dealers, risk experts, data scientists and all the infrastructure you would expert of a leading asset management company. In addition, Jupiter’s UK Small- and Mid-cap team consists of seven investment professionals researching and investing in UK-listed businesses outside the FTSE 100. Each member of the team has responsibility for researching specific industry sectors, which gives Matt and Dan the ability to expand the horizons of the fund outside of its traditional areas of focus, opening further avenues for growth, while adding diversification to increase resilience.

Over the long term, the new managers believe that the additional capability within the new RIII’s trust can give it an ‘edge’ over the wider market and exploit this to generate outperformance for shareholders.

Market backdrop – why small caps?

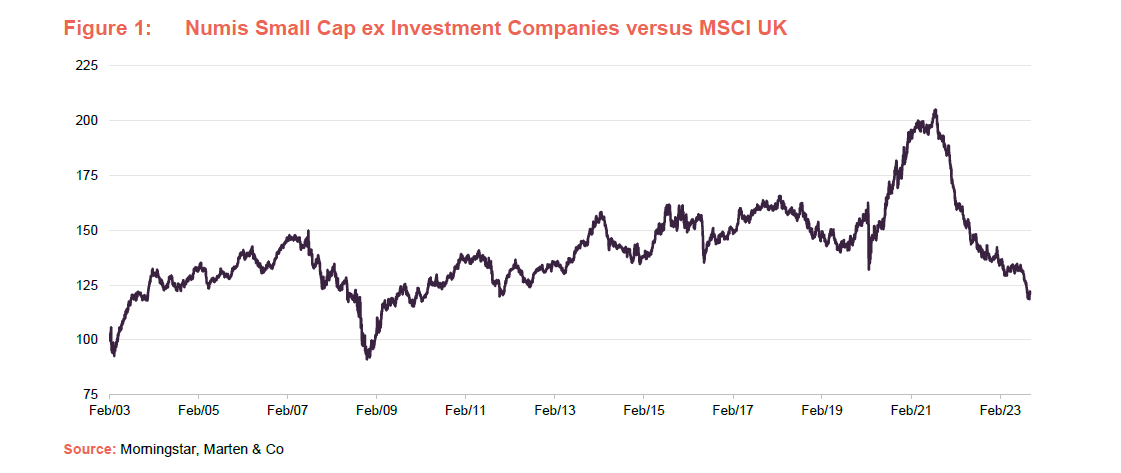

Small caps may not always bring the same level of star quality as some other sectors of the market, however over the long term, they have consistently outperformed broader market indices.

Over the long term, small caps have consistently outperformed broader market indices

This long-running trend remains intact despite what has been a historic period of underperformance over the past 12-18 months, which is highlighted in Figure 1 below. As financial conditions have tightened in response to the rapid and unstable rise in inflation, capital has flown out of sectors of the market generally seen as more risky, favouring the stability of “risk-free” government debt (which is now providing a reasonable return for the first time in years), and more defensive positioning overall. In addition, small caps also tend to have higher levels of volatility due to their size (it takes less volume to move a company’s share price), which has been further elevated by the prolonged period of uncertainty in the market.

While these factors have certainly had a negative impact, the depth of the sell-off appears to be driven increasingly by sentiment rather than substantial fundamental weakness (for example, a deterioration of the underlying cash flows being generated). As such, any suggestion of the outlook improving, as has been the case in recent weeks, could see a rapid turn of fortunes for the sector and for RIII.

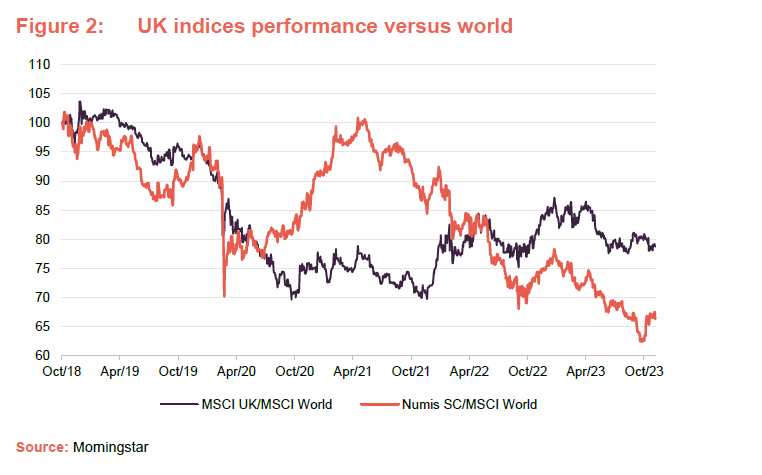

Weakness in small caps has been compounded by the malaise around UK equities in general with both large- and small-cap indices lagging the global equity market over the last five years. A number of factors have likely played a role, including slowing growth, and a long running ‘Brexit discount’ which dramatically increased the uncertainty in the UK’s economic and political landscape. The ongoing dominance of US tech, and more recently, the AI trade (artificial intelligence), have also weighed on relative returns, as have more industry specific factors in sectors such as energy and financials, which make up a large chunk of UK indices.

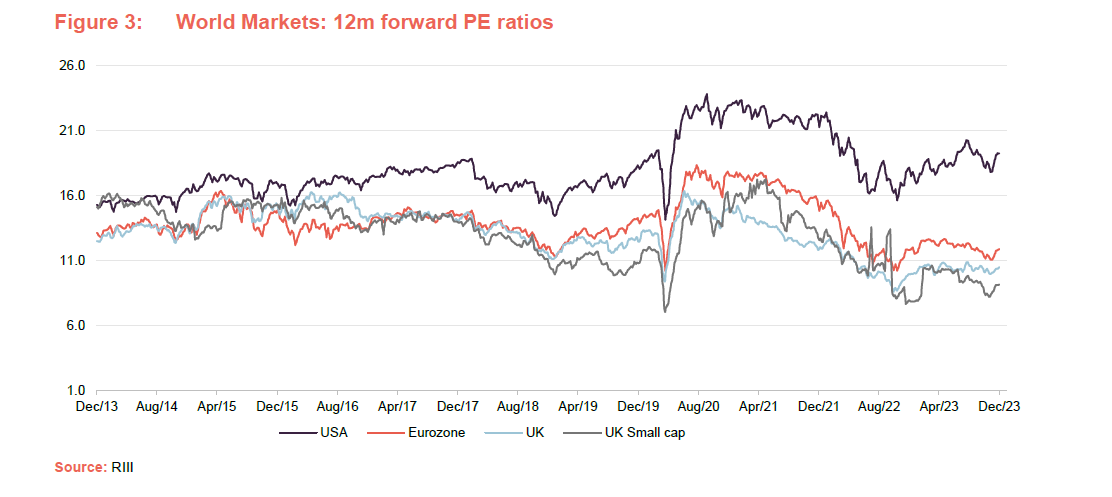

Whilst harrowing for investors, the scale of the move has provided a generational opportunity with valuations for UK small caps offering a compelling and significant discount to global peers, illustrated in Figure 3 below.

UK small-cap equities are trading at a discount of over 20% to historic averages over the past five years.

This shows that, on a forward price-to-earnings (P/E) multiple, UK small caps are cheap relative to global markets and broader UK equities, as well as their own history with the sector now trading at a discount of over 20% to its historic averages over the past five years.

The relative undervaluation of UK stocks does seem to be encouraging an increase in Mergers and Acquisitions (M&A) activity, as overseas companies and private equity firms look to take advantage of compelling valuations, even if listed equity investors are not.

Managers’ view

Valuations alone are not a route to generating long term alpha (although it is worth noting that starting valuation has proven to be the best predictor of investor returns over time, explaining around 80% of stock returns over a 10-year holding period). However, the managers believe that negative sentiment for a range of companies in the small cap space is now far detached from fundamental realities.

Matt and Dan acknowledge that taking advantage of these opportunities may weigh on performance in the short term, given the uncertain economic outlook. However, they also do not believe that a shift towards more defensive positioning is the best way to navigate extreme changes in market sentiment. Market timing has never been a successful investment strategy, and instead the managers favour balancing exposure to both value and growth while steadily adding to its high conviction investments on weakness. Being aware of the market volatility, position size remains one of the most crucial aspects of risk management currently, in addition to increasing the diversity of the portfolio, and these strategies are discussed in greater detail in the asset allocation section on page 6.

Developments over the first few weeks of November suggest that we have probably seen interest rates peak for this cycle.

Generally speaking, the managers believe that the outlook remains uncertain; however, recent developments suggest that we have probably seen interest rates peak for this cycle. Globally, a slew of positive data releases and a technical change to the treasury refunding programme (a debt financing process run by the US Treasury) have seen yields on 10-year Treasuries (US government bonds) fall by almost half a percent from their peak, while UK Gilts are at a six-month low following a pause from the Bank of England and a significant fall in the headline inflation rate in October. However, it is worth noting that both core and services inflation remain around three times higher than the target rate (The UK government currently targets low and stable inflation of around 2%).

The managers also point out that while short term growth in the UK continues to look anaemic, economic conditions do not appear to be causing significant problems for companies beyond moderately weaker growth rates in the near term. As such, they still believe that a significant opportunity exists in UK markets, and small caps in particular.

Asset allocation

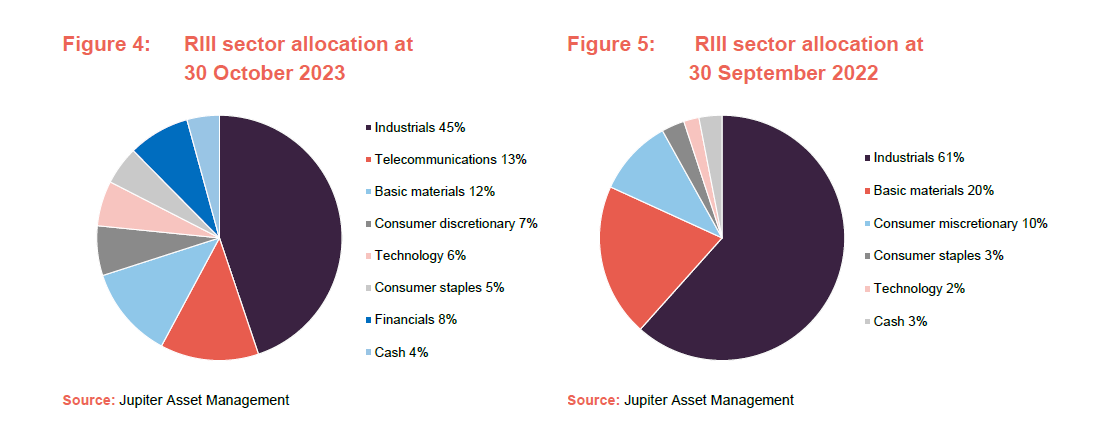

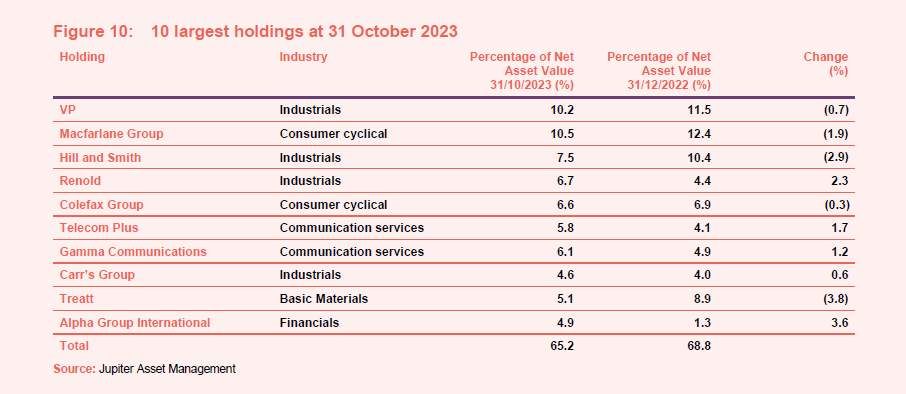

As noted, the new managers plan to fine-tune the existing portfolio while maintaining its fundamental structure. Over the past 12 months, this has led to a reduction in the concentration of the fund’s top 10 assets, with Matt and Dan favouring a more even spread of capital across the still concentrated portfolio. They have also begun to dispose of the ‘tail’ holdings of companies with very small market caps, and holdings too small to have a meaningful impact on performance.

On 31 October, the company held 21 stocks with the top five accounting for 39% of NAV and the top ten for 65%.

At the start of the year the fund held positions in 22 stocks with the top five positions accounting for 50% of NAV and the top ten for 76%. On 31 October, the company held 21 stocks with the top five accounting for 42% of NAV and the top 10 for 68%.

The new team has also been proactive in their aim to increase the diversity of the portfolio, which previously had a distinct skew towards certain sectors of the market, particularly in the industrial and engineering sectors. Highlighting the benefits of the additional resources now at hand, the managers have added new exposure to the technology and financial services sectors, which is discussed on page 7.

Over the first half of 2023, to June 30, portfolio changes included:

- the reduction of Macfarlane Group to 10.2% of net assets, from 12.6%;

- the disposal of Titon Holdings (£8m market cap), and Coral Products (£14m market cap);

- the disposal of a residual holding in Costain, and some preference shares issued by Santander, which the managers felt did not fit the company’s stated objectives;

- the disposal of Castings, which the managers felt offered limited valuation upside; and

- four new positions were also initiated, which are discussed on page 7.

While the managers note that portfolio construction is always a dynamic process and further changes are likely, they have acknowledged that they are now broadly happy with the shape of the portfolio. So far this year, several holdings have seen significant moves in their share prices.

New additions

OSB Group – conservative UK buy-to-let lender

OSB Group (www.osb.co.uk) is the listed entity and parent company of One Savings Bank. The group is a specialist mortgage lender, with a strong focus on buy-to-let mortgages in the UK, whose growth has come on the back of larger UK lenders retreating from the buy-to-let space. The company is well known to the new managers and provides additional thematic exposure to the fund.

It benefits from a state-of-the-art lending platform, which gives it a cost advantage over legacy providers, a strong deposit base and a balance sheet free of legacy pre-financial crisis loans. The company is also very well capitalised and consistently generates excellent returns, providing an attractive dividend yield of 6%.

Despite this, shares have struggled, along with the broader banking sector, as concerns around growth and the possibility of recession have weighed on loan demand. In addition, a change in customer behaviour following recent rate rises has necessitated an accounting adjustment which reduced profitability in the first half of 2023. This was taken very negatively by the market, but the managers view it as a largely one-off phenomenon that does not undermine the long-term investment case for OSB. Therefore, investors can now pick up a fundamentally stable lender with a structural competitive advantage at a significant discount, with shares now trading at half of book value and providing a 20% return on equity.

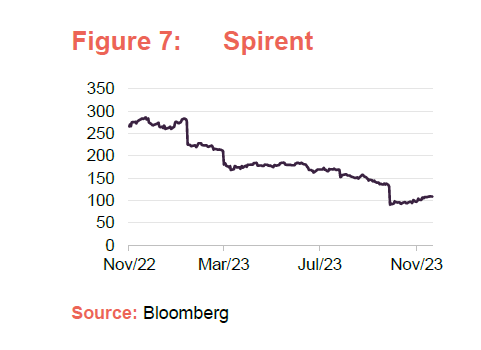

Spirent – 5G play with significant long term upside

Spirent (www.spirent.com/) is a leading global provider of automated testing and assurance solutions for networks, and security. The company is exposed to strong structural growth drivers including the expansion of 5G technology and the ever-higher demands for speed in networks and data centres.

Minor disruptions in the 5G market, especially in the US, have resulted in a moderation of short-term growth expectations, which, combined with some ongoing pandemic normalisation in demand and the broader sell-off of longer duration stocks (companies with a large amount of projected earnings sometime in the future), has led to a dramatic de-rating in the company’s shares. These are now down almost 60% over the past year; however, the long-term tailwinds expected to drive performance going forward remain fully intact.

The scale of the sell-off has driven cash flow and earnings multiples well below historic averages, and, importantly, the company continues to generate plenty of cash and remains very well capitalised, with over $100m of net cash on its balance sheet. As a new addition to the portfolio, the managers are cognisant of the recent weakness, and have balanced this risk with the initial position size, with the possibility of adding to the stock on further weakness, favouring a long-term view rather than attempting to time the market.

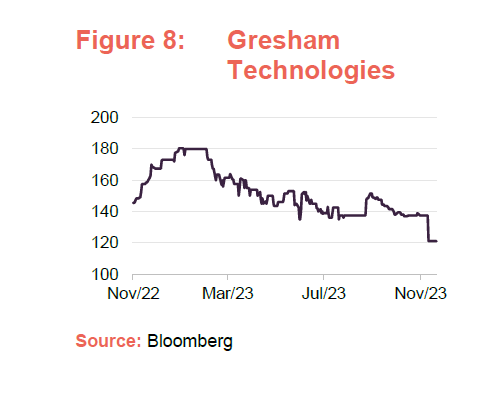

Gresham Technologies – stability and growth in the cloud

Gresham (www.greshamtech.com) is a cloud software business focused on the market for advanced data reconciliation. Selling primarily into the financial services sector, the company addresses the ever-increasing need to fully reconcile large, complex datasets, often across multiple systems and in real time.

The company has continued to make impressive progress towards its ambition to become a leading £100m annual recurring revenue fintech, through both impressive organic growth and strong M&A, which have significantly increased profitability over the last few years. Importantly, its ongoing execution has allowed the company to consistently take market share, which is crucial in the highly competitive cloud fintech space. Additional confidence is drawn from Gresham’s steadily improving net revenue retention rate (a gold standard metric for SaaS providers which drives long-term organic growth), highlighting the value that customers place on Gresham’s services, particularly among its larger customer base, where this grew around 120% year on year.

As with Spirent, the company has suffered from the broader sell-off in growth and technology stocks, with shares down 35% year to date. Despite the recent weakness, the valuation remains relatively toppy on earnings and cash flow multiples; however, these should improve as recent M&A activity beds in and profitability increases. Top line (revenue) multiples remain in a reasonable range, particularly considering the company’s growth potential. As with Spirent, initial positioning from the managers was modest, but Gresham appears well poised to become a much larger component of the portfolio in future.

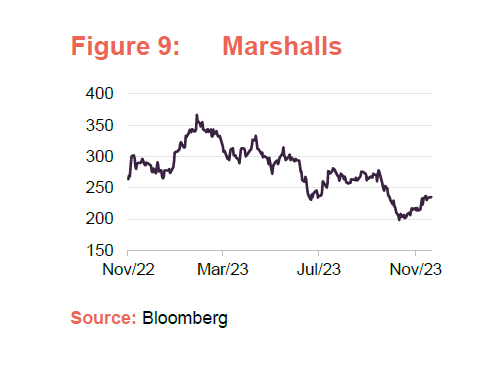

Marshalls – value opportunity for market leader

Marshalls (www.marshalls.co.uk) is one of the UK’s leading suppliers of hard landscaping, building and roofing products. It sells into the new-build housing, commercial, infrastructure and repair and maintenance markets.

Many of these end markets have come under immense pressure in recent months, as rising interest rates and an uncertain economic outlook have curtailed construction activity across the board. This has had a significant impact on performance, with both earnings and revenue down double digits, year on year over the six months to June 30, with shares down around 20% as a result. These issues have further compounded the company’s struggles with post pandemic supply chain dislocations, and demand normalisation, which have resulted in a long-running period of underperformance.

Despite this, Marshalls’s long-term outlook remains attractive as a leader in a secular growth market driven by the structural deficit in new build housing, ageing housing stock, and long term under investment in UK infrastructure.

In response to these ongoing challenges, Marshalls has undergone a considerable restructure to streamline its manufacturing capacity and better manage its costs base, resulting in £9m worth of savings in the first half of the year alone. The company has also exited some underperforming segments and overhauled its supply chain to improve operational leverage.

Following these developments, investors can pick up a considerably leaner and more efficient company with stable long-term tailwinds at an almost 50% discount to historic valuation multiples.

There do remain challenges, however, and the inherent uncertainty in timing the bottom of the cycle means the managers have started the holding at a modest position size, with a view to building it as the path of recovery becomes clearer.

Top 10 holdings

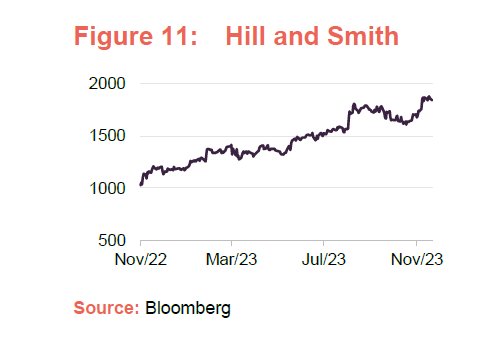

Hill and Smith – strong thematic tailwinds

Hill and Smith (www.hill-smith.co.uk) is an engineering business with a strong presence in galvanising metal. It produces a wide range of products for infrastructure markets, ranging from road furniture to power transmission systems and components for power stations. The company is a direct beneficiary of increased infrastructure spending by Western nations, particularly in the US, where 48% of the company’s revenue is now generated (up from 38% in 2019)

Recent returns have been impressive with shares rallying over the first half of 2023, up almost 60% at the time of publication, on the back of heightened profit expectations, driven by the ongoing resilience of the US economy, and increased fiscal stimulus ( government spending).

The company’s outlook continues to look compelling despite the recent rally, with both earnings and cash multiples still trading below historic averages, while strong thematic tailwinds – particularly relating to grid electrification and modernisation – should continue to boost performance.

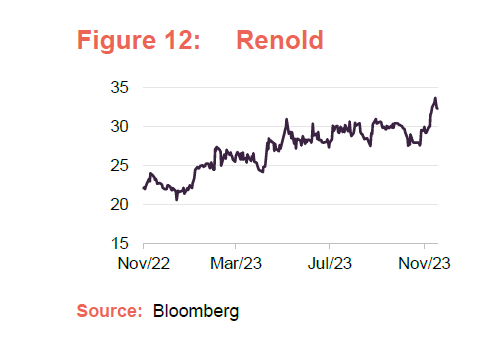

Renold – Fundamental value play in precision engineering

Renold (www.renold.com) is a market-leading precision engineer, delivering power transmission products to a wide range of global industries, from subway trains to power stations. The company has experienced a period of strong trading and issued two positive trading statements during the first half of 2023. In addition, rising interest rates are expected to help reduce the company’s pension liabilities, which have weighed heavily on the stock in the past.

Renold have also made significant efforts to improve profitability, operational leverage, and financial flexibility. A focus on automation has also been effective at driving down costs, and it appears that we are starting to see the benefits of these changes, which in addition to increasing demand, has led to a period of solid growth for the company with both revenue and earnings up strongly. The stock has responded accordingly, up 65% year to date, and with earnings and cash flow multiples still trading well below historic averages, the outlook appears to be increasingly positive.

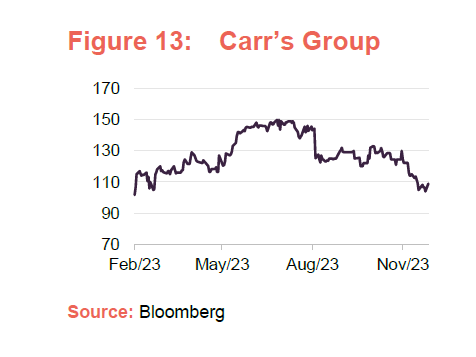

Carr’s Group – Vastly improved profitably driving returns

Carr’s Group (carrsgroup-ir.com) is an internationally recognised leader in the manufacture and supply of speciality engineering and agriculture products. The company has struggled over the past few years with volatile input prices and challenging distribution conditions dramatically increasing costs, while soft demand, particularly in its agriculture business, has weighed on returns. This is reflected in its share price performance, with the stock down 19% over the last five years.

Obviously, many of these disruptions have been out of the company’s control, although additional issues such as the suspension of its shares earlier in the year due to audit delays have added to the negative sentiment. Despite this, the outlook is looking considerably more promising following an overhaul within the company and the disposal of several assets, which should help streamline operations and significantly increase profitability going forward, with margins expected to be almost double recent averages. Shares have responded positively to these developments over the past year, up 44%, although ongoing cost disruptions in the UK and drought in the US have weighed on demand in the short term.

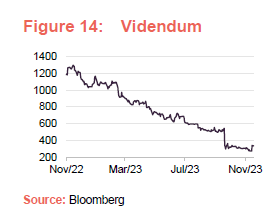

Videndum – Current risks now weighted to the upside

Videndum (videndum.com) produces equipment for the content creation market, providing products across the spectrum, from amateur to professional. Outside of a rebound driven by strong lockdown induced sales, shares have been steadily trending down over the last five years as the company continues to suffer from a bullwhip in demand (the effect of supply chain disruptions flowing through the system). Broader economic headwinds have also weighed on returns, and, more recently, the ongoing US writer’s strike. This has had a significant impact on the company’s performance with earnings and revenue for the six-month period ended June 30 falling sharply on the year prior, down 86% and 25%, respectively. This drop in profitability has had a considerable impact on the company’s balance sheet, which is further compounded by rising rates, with these factors culminating in a year-to-date decline in the share price of 68%. For RIII, the managers are balancing the clear long-term upside that exists from the rapid acceleration in content demand, with the significant short-term headwinds faced by the company. While acknowledging that the issues are frustrating, they believe that they are ultimately transitory and have therefore chosen to retain the position, believing the risks in the stock are weighted to the upside.

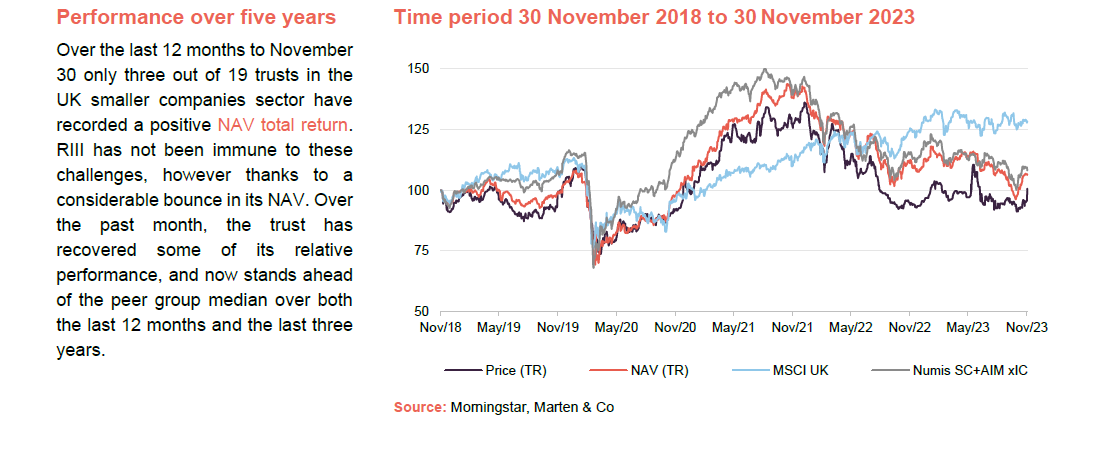

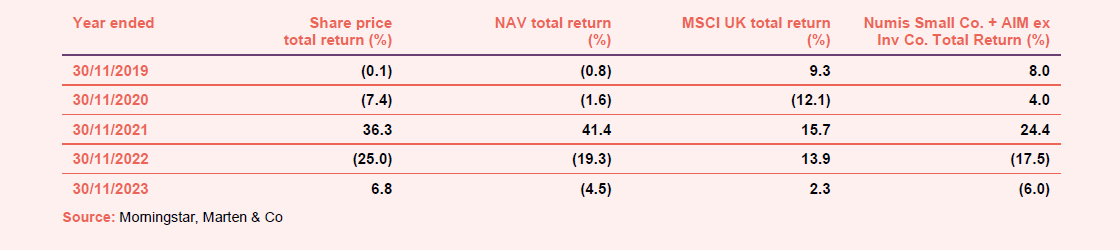

Performance

For the purposes of this note we will examine both the trust’s performance, relative to the MSCI UK Index (as an approximation of its All-Share benchmark) and the Numis Small Companies Plus AIM ex Investment Companies Index, which we feel is a better representation of the opportunity set available to the managers.

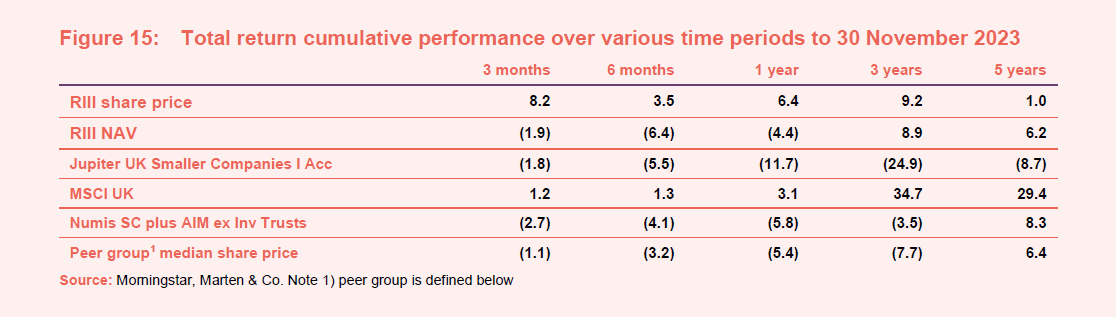

Even with these comparisons, it is worth noting that ultimately these historic figures may not offer a useful indication of the likely future performance of RIII, given the raft of changes adopted by the new managers. As an example, we have already seen the portfolio take on a more balanced allocation in terms of sector exposure and concentration. To help provide some additional context to these figures we have included the new managers’ open-ended fund, the Jupiter UK Smaller Companies fund, shown in Figure 15. While this differs somewhat in its approach, it remains invested in the same universe of UK smaller companies, and as such, has suffered from the headwinds effecting the sector which we have outlined in this note, and which have weighed heavily on its respective performance.

Figure 15 shows RIII has outperformed the UK small-cap market (the Numis SC plus AIM ex Inv Trusts) over three years in NAV total return terms but underperformed relative to wider UK benchmarks (the MSCI UK) over three and five years. The underperformance of MSCI UK can easily be attributed to the outperformance of large cap versus small cap since investors became more concerned about the impact of inflation and rising interest rates on the global economy. A narrow group of very large stocks has driven the MSCI Index higher and almost everything else has underperformed. This is a neat illustration of why the All-Share is an unsuitable benchmark for the trust in our view. Promisingly, RIII’s share price has responded to improvements in the global macro environment, with the trust up 8.2% over the last 3 months to the end of November, comfortably outperforming each of the referenced groups in figure 15, with this momentum also continuing through the first few weeks of December.

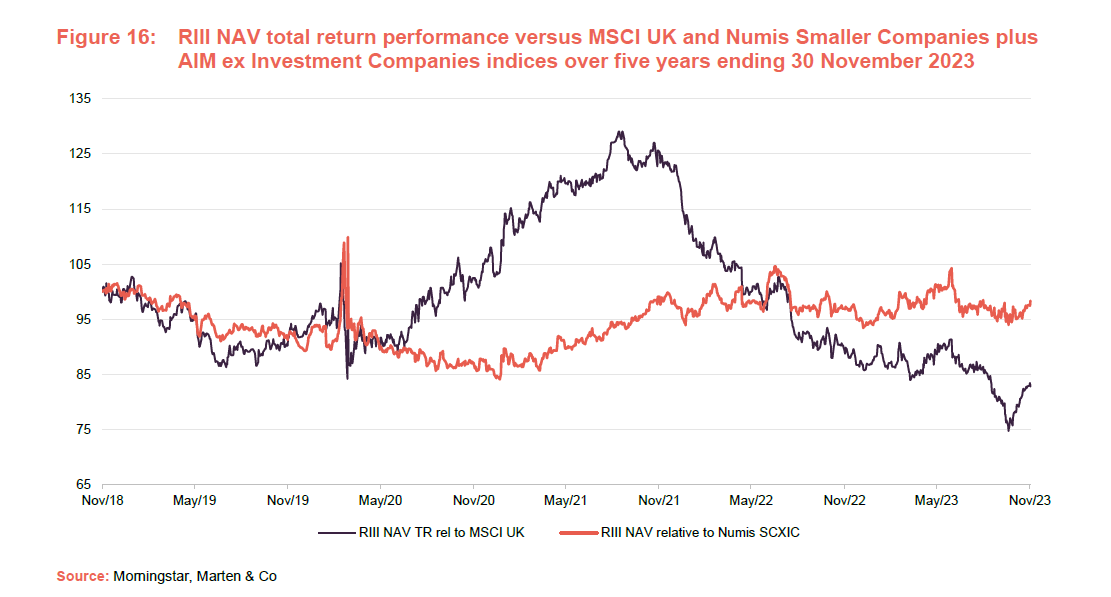

Relative to the Numis index, and also the peer group that we have constructed (see Figure 18 below), the performance gap is not present as highlighted in Figure 16.

In addition to broader economic headwinds driving down the entire UK small-cap sector, the main driver of the recent weakness is stock specific factors, as is often the case with many small-cap strategies. Small-cap indices are typically dominated by the outsized returns of a handful of constituents, and if a strategy fails to capture this, it often becomes difficult to outperform.

With just over a year at the helm, there has also been little time for the managers new strategies to bed in, while investments are also being made in a falling market. As discussed above, this does provide the opportunity for long-term upside; however, in the short term, these positions are at the mercy of broader market forces, although as noted, we have seen a positive inflection over the past month.

While it is clear that both RIII and the entire smaller companies sector remain under pressure, the bulk of the portfolio’s existing positions – as well as its new investments – are now trading at historically low valuation multiples, and as we have seen in recent weeks as bond yields have begun to revert, when sentiment swings, performance can turn quickly.

Peer group

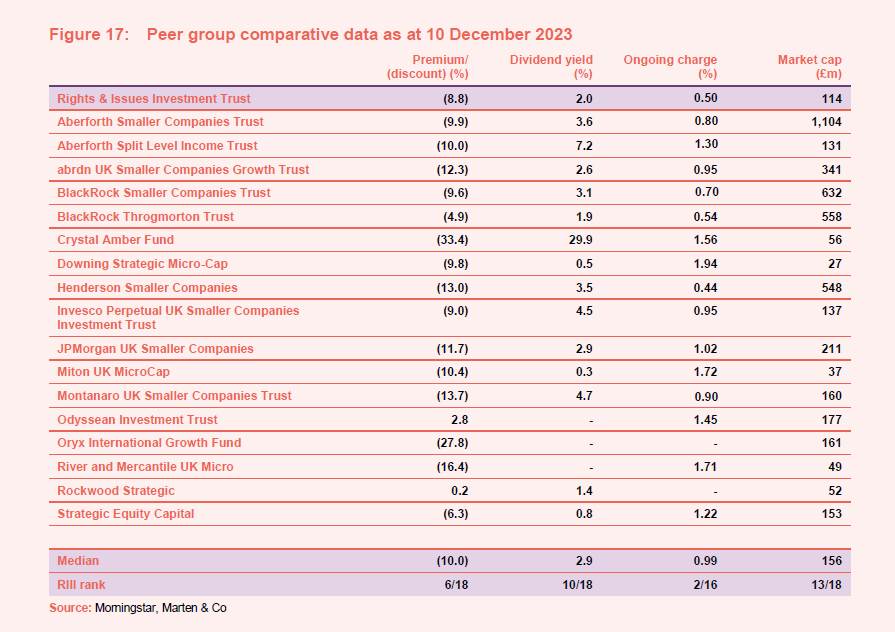

RIII is a constituent of the AIC’s UK Smaller Companies sector, which represents one of the mainstays of the investment trust universe, given the long track records of some of these trusts, as well as the large number of funds in the peer group. For the purposes of comparison, we have removed a handful of very small funds, and also Marwyn Value Investors, which follows a very different investment strategy from other members of this peer group.

Up-to-date information on RIII and its peer group is available on the QuotedData website

After a recent rally in its shares, RIII’s discount sits towards the head of the peer group. It ranks in the middle of the pack in terms of dividend yield, although in general, this peer group is not managed to produce a yield. The company’s historic ongoing charges ratio is extremely competitive, which reflects its self-managed status up until October 2022 as there was no external management fee included. The ongoing charges for the year ended 31st December 2022 were 0.5% (2021: 0.3%). An operating expense cap limits the total expenses to 0.80% of NAV for five years from the date of Jupiter’s appointment, reflecting the extra resources that Jupiter is bringing to bear on the trust. After the recent shrinkage, RIII is smaller than the median fund in the peer group, but still over £100m, which makes it investable for some wealth managers.

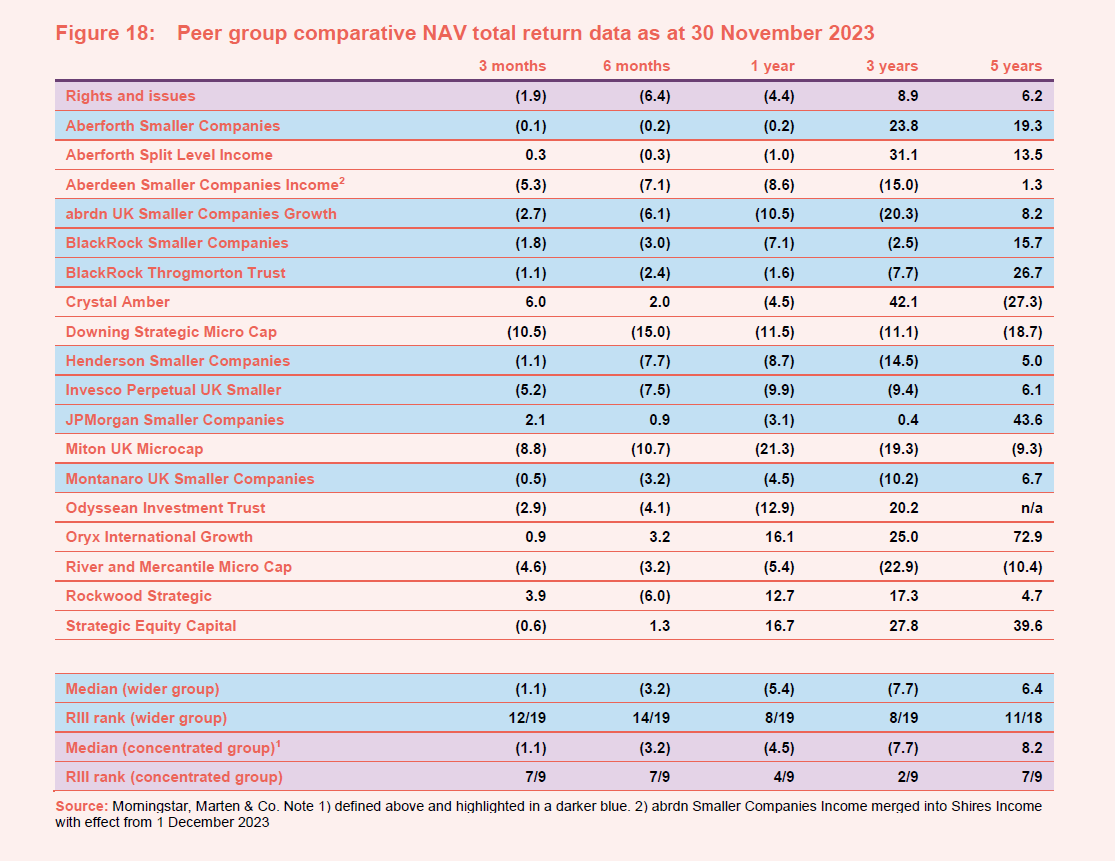

Over the last 12 months only three out of 19 trusts recording a positive NAV total return

Figure 18 shows the performance of the peer group, clearly highlighting the challenges faced over the last 12 months, with only three out of 19 trusts recording a positive NAV total return.

RIII has not been immune to these challenges, however thanks to a considerable bounce in its NAV over the past month, the trust has recovered some of its relative performance, and now stands ahead of the peer group median over both the last 12 months and the last three years. The recent rally in its share price and NAV highlights the potential upside of the portfolio, with the new managers accepting some short-term volatility in return for what they hope will be a much more resilient fund going forward.

Figure 18 also highlights a considerable dispersion in long-term performance among the peer group, particularly over three years, due to a broad range of investment styles. For example, the leading investment companies such as Rockwood Strategic and Odyssean have adopted an activist value strategy, while the Aberforth funds that follow a value approach have also done well. More growth-focused funds such as BlackRock Throgmorton and JPMorgan Smaller Companies have good long-term track records but have lagged recently.

Because of this, the managers have suggested that a more concentrated group would be useful for comparison. This group, highlighted in blue, excludes Aberforth Split Level Income (on structural grounds), abrdn Smaller Companies Income (given its income mandate), the three micro-cap funds (Downing, Miton and River & Mercantile), and those with some element of an activist approach (Crystal Amber, Odyssean, Oryx, Rockwood and Strategic Equity Capital). Over three years, RIII sits as the second-best performer in this concentrated group; however, it again slips toward the bottom due to the extent of the recent sell-off.

The main silver lining here is that the wide dispersion of returns again highlights the wealth of opportunities that exists among the smaller companies universe, and it is this potential that the new managers hope to tap in to. Their efforts in improving the diversity of the portfolio are a step in the right direction and should hold it in good stead going forward.

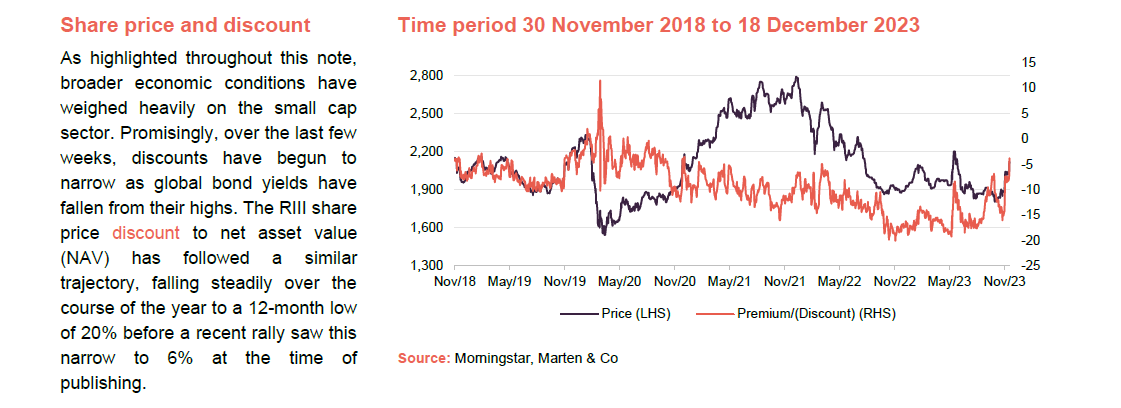

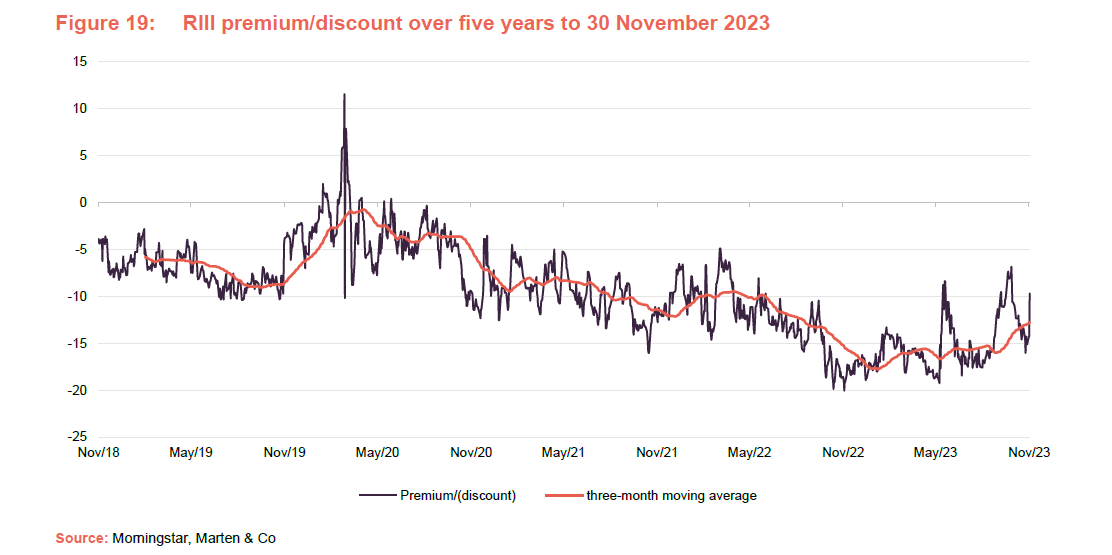

Premium/(discount)

As highlighted throughout this note, broader economic conditions have weighed heavily on the small cap sector and as of 10 Decemeber 2023, median discounts stood at 9.9%. Promisingly, over the last few weeks, these have begun to narrow as global bond yields have fallen from their highs.

The RIII discount has followed a similar trajectory, falling steadily over the course of the year to a 12-month low of 20%. As Figure 19 shows, we have seen an inflection more recently, following several positive updates on inflation, in the UK in particular, with the discount narrowing to 6% at the time of publishing. Over the 12 months to 30 November, the discount has averaged 15%.

Current discounts have created an attractive entry point for new investors, and momentum and sentiment in the sector can change rapidly.

While increasingly tight financial conditions, slowing growth, and negative market sentiment towards smaller companies have played a considerable role in the re-rating of RIII shares, other factors – including the change of manager after 39 years of stewardship – may have contributed to the weakness over the past year. Whilst the board has selected an experienced management team and a well-respected investment manager in Jupiter, Simon’s departure after such a long period may have affected sentiment; however, we expect this to be relatively short lived once the new managers have had an opportunity to bed in and develop the fund in their own vison.

As we have seen in the last few weeks, momentum and sentiment in the sector can change rapidly and we believe that current discounts have created an attractive entry point for new investors.

Fund profile

Rights and Issues Investment Trust (RIII) aims to generate a total return that exceeds its benchmark index, the FTSE All Share, over the long term while managing risk. The company invests in equities with an emphasis on UK smaller companies, which will normally constitute at least 80% of its investment portfolio. For the purposes of RIII’s portfolio construction, “UK smaller companies” is deemed to include both listed securities and those admitted to trading on the Alternative Investment Market (AIM). The benchmark does not influence portfolio construction.

More information is available on the manager’s website

For the purposes of this note, we have used the MSCI UK Index as a proxy for the FTSE All-Share and added a comparison to the Numis Smaller Companies plus AIM ex Investment Companies Index, which we believe is more representative of the stocks in RIII’s portfolio.

Dan Nickols and Matt Cable took over responsibility for the trust in October 2022. As such, the last 12 months have been a period of heightened turnover as they work to improve the balance of the portfolio and shape it in their own vision. This has involved the disposal of several smaller positions which accounted for less than 1% of assets, the reduction of some larger holdings, and the addition of several new positions which reflect the new managers’ views. Despite these changes, the team plans to stay true to the well-oiled style that has served RIII since launch (a concentrated portfolio, based on fundamental analysis, constructed with a long-term view), but with an increased focus on portfolio resilience and with the benefit of the greater resources the Jupiter team has at its disposal.

Previous publications

Our initiation note – Under new management, same high conviction approach – was published on 18 April 2023

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Rights and Issues Investment Trust Plc .

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.