June 2023

Monthly roundup | Investment companies

Kindly sponsored by abrdn

Winners and losers in May 2023

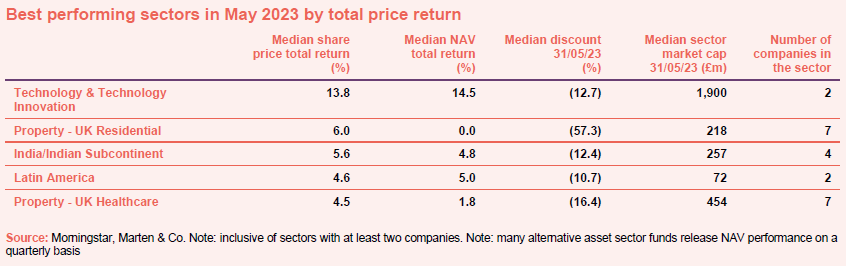

As anyone with a passing interest in markets will no doubt be aware, US tech is booming thanks to a rally in all things AI. The growth over the past few weeks has been so extreme that the S&P500 came within a hair of touching a technical bull market, closing just below a 20% gain from its October lows. It will be of no surprise then that US tech exposure dominated the best performing lists throughout the month. Technology & Technology Innovation led the way thanks to holdings in Nvidia, Apple, Microsoft, and a raft of other tech names. Nvidia alone was up 30% over the last week of the month.

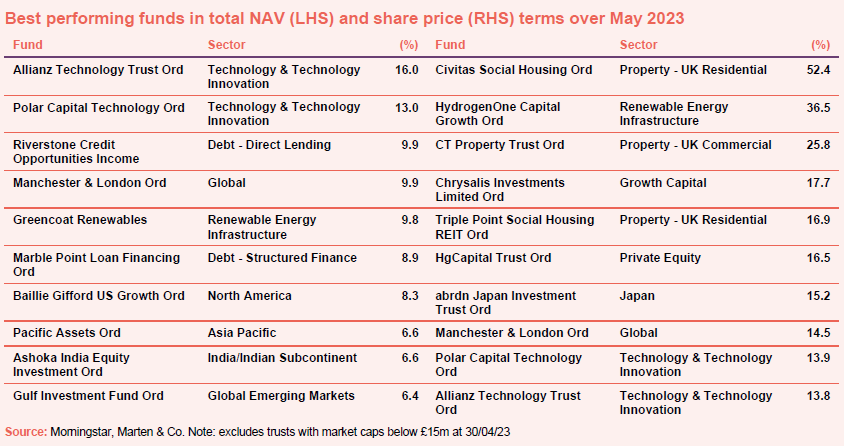

Outside of tech, markets struggled in general. Civitas Social Housing REIT drove the UK residential property sector higher following a take private offer from Hong Kong-based investor CK Asset Holdings. The 80p per share cash offer represented a 44.4% premium to Civitas’ closing share price on 5 May, and had a knock-on effect for the sector, with Triple Point Social Housing rallying 17% following the news. While the offer has been accepted by the board, several commentators have suggested it should be rejected by shareholders as it undervalues the company’s assets.

After a challenging period to start the year, Indian shares rebounded in May, boosted by positive inflation news with the central bank holding rates steady for the second consecutive meeting. Similar optimism was present in Latin America, with growing evidence of easing inflation and signs of improving economic conditions putting pressure on bankers to lower rates. The two emerging market economies were also boosted by a falling USD earlier in the month. UK healthcare property rounds out the list. The sector is made up of two care home REITs. There are no obvious catalysts for the month and sector returns are generally uncorrelated to wider market moves, although Target Healthcare did announce a modest uplift to its tangible asset value during the month.

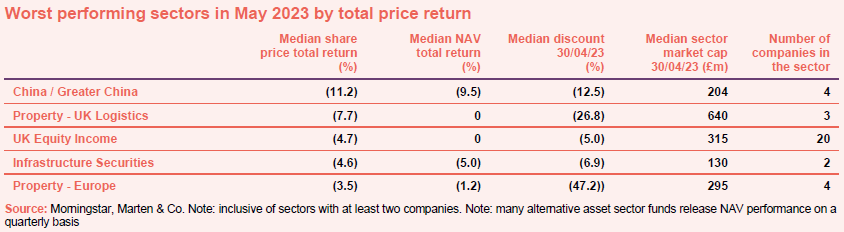

For the second month running, China headlines the worst performing sectors list. Struggles in the region are well documented with markets suffering from increasing geopolitical tensions along with wider concerns around both domestic and global demand. Since the end of the zero COVID restrictions, the economy has struggled to reach the lofty heights many expected, and data released through May continues a lacklustre run. Given the country’s reliance on export demand, the numbers also paint a grim picture for the global economy with the OECD characterising the rebound in global GDP growth as “fragile”, with the “risks tilted to the downside”.

The logistics sector (as well as the wider real estate market) suffered as inflation numbers in the UK disappointed meaning expectations that interest rates may have peaked were wrong and another increase is likely. Concerns that demand for logistics space is waning have grown as too has the vacancy rate in the UK.

With 20 funds within the category and almost £12bn in market cap, the UK equity income sector tracks fairly closely to the broader market index, and its performance in May reflects a steady slowdown in economic activity. The energy and materials sectors led the way down thanks to broad-based weakness in commodity prices while exports and domestic consumption also fell. With rising terminal rate expectations weighing further on performance it is no surprise that markets trended downwards for the month and forecasts from the BoE suggest a relatively grim outlook for the rest of 2023.

The infrastructure securities sector was led down by the Ecofin Global Utilities & Infrastructure trust which fell almost 9%. It was a tough month for infrastructure as the sector suffered from higher rates and flows into tech. The European property sector was dragged down by Globalworth Real Estate Investments which fell over 10%, with the company continuing to suffer from volatility in its eastern European real estate investments.

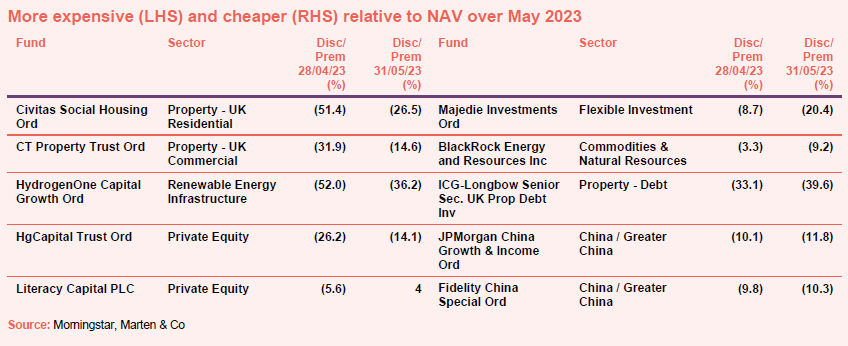

We already mentioned the Civitas Social Housing bid, but not far behind it in the table is CT Property which was also the subject of a bid, by LondonMetric Property.

As touched on in page 1, US tech was the big winner in May. The rally in AI further boosted the substantial outperformance of the sector with seven companies now accounting for more than 100% of the S&P500’s market cap gain for the year (i.e in aggregate, the rest of the 493 companies in the index are down year to date). Allianz Technology, Polar Capital Technology, Manchester & London, and Baillie Gifford US Growth each have significant overweights to these companies which include Microsoft, Apple, Alphabet, NVIDIA, and Tesla.

Riverstone Credit Opportunities Income was the standout trust not exposed to the tech trade. While recent returns are impressive, they need to be taken in the context of the last few years with the NAV yet to recover its pre-COVID peak, while its shares still trade at a discount of almost 50%. There was not any clear driver for Marble Point Loan Financing, however, shares in the trust are very thinly traded.

Pacific Assets rallied after the release of its annual report following a period of weakness. The company’s performance has been impressive over the past 12 months, despite the raft of challenges present in the Asia Pacific region, outperforming both its benchmark and the wider peer group.

In terms of share price returns outside of the property and technology sectors HydrogenOne had a strong month. The fund has suffered from the rotation away from more risky sectors of the market and the rebound is perhaps the result of a more risk-on mood precipitated by the AI trade as well as a reflection of the underlying value the fund provides. The company also announced a quarterly update during the month which highlighted a positive industry outlook and continued NAV growth which may have boosted returns further. Despite investing in very different stocks, returns for Chrysalis have tended to track closely to that of HydrogenOne, adding weight to the risk on narrative given it is also exposed to assets at the higher growth end of the spectrum. In addition, the company also announced annual results in May, highlighting solid operational performance.

In part, the strong performance of abrdn Japan reflects the continued momentum in the Japanese stock market which is now up almost 20% year to date. However, it was the merger plan with Nippon Active Value that drove the share price higher over May.

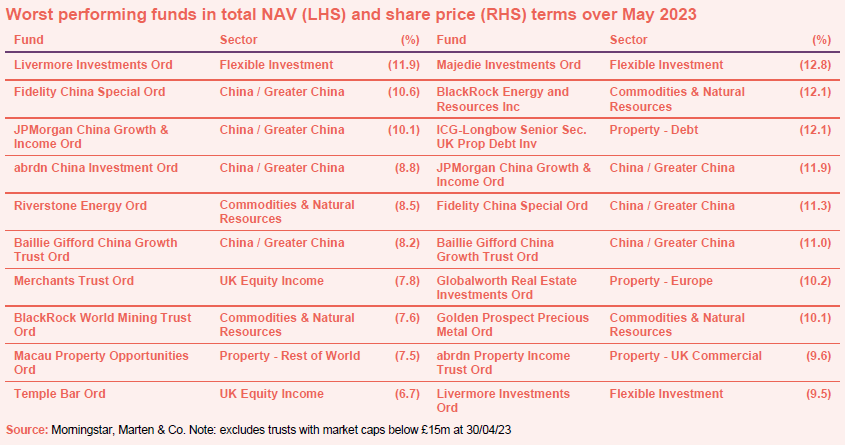

Worst-performing

Livermore Investments was the worst performing fund in May by NAV. The company has been highly volatile over the past year bouncing around the best and worst performers segment on several occasions as it attempts to recover from its steep sell off in 2022. The list is otherwise dominated by Chinese funds for the second consecutive month, highlighting the challenges faced by the region. Elsewhere, both Riverstone Energy and Blackrock World Mining have suffered from the general malaise in commodity prices which have been trending down as global growth expectations fall. That hit oil stocks too, which would have contributed to the fall in Temple Bar. Merchants Trust also suffered from the commodity weakness while exposure to financials weighed further on the company.

In terms of share price movement, Majedie Investments fell 13% over the course of the month, although there does not appear to be any particular catalyst for the drop. The company invests across a range of different asset classes, describing its equity returns as idiosyncratic, and the trading volume for shares is thin which may have contributed to the fall. ICG Longbow announced that it had appointed an administrator to manage one of its Royal Life portfolio loans. Debt funds in general have been impacted by rising rate expectations in the UK as has the property sector. This weighed on the abrdn property fund, as did concerns around demand for logistics space. The fall of the Golden Prospect Precious Metal fund reflects a softening month for the precious metal as rates edged higher and improving risk sentiment saw flows out of gold funds.

Moves in discounts and premiums

Of the funds not already discussed, HG Capital Trust saw its discount narrow from 26.2% to 14.1%. The fund has followed a similar trajectory to HydrogenOne and Chrysalis over the course of the year, with the latest move a reflection of the improving risk sentiment experienced in May. As a tech investor with several portfolio companies utilising artificial intelligence and machine learning, the company has also benefited from the recent flood of capital into the sector. Literacy Capital has continued to gain momentum following the sale of its fourth largest asset for a 48.9% premium to carrying value.

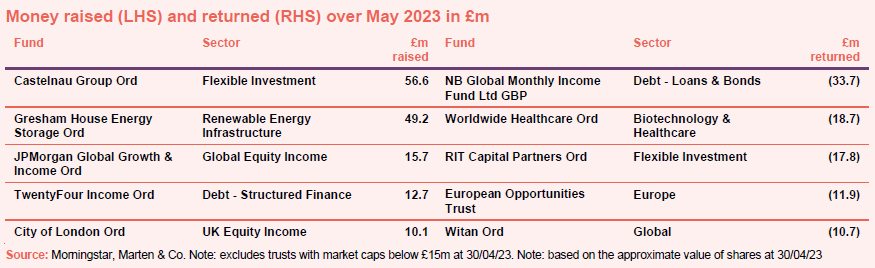

Money raised and returned

Funding market activity showed burgeoning signs of a recovery in May. The Castelnau Group raised £56.6m through a share placing to fund the acquisition of the UK funeral services provider, Dignity; while Gresham House Energy Storage successfully raised £50m to fund the first closing of Project Iliad, a battery storage project in California. Elsewhere, money raised was a case of the usual suspects – income funds JPMorgan Global Growth & Income, TwentyFour Income and City of London all featuring on the list.

Companies returning cash featured regulars, NB Global Monthly Income, Worldwide Healthcare and RIT Capital Partners. European Opportunities and Witan have also been steadily buying back in order to manage their respective discounts which both sit at around 10%.

Major news stories and QuotedData views over May 2023

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

| · Round Hill Music AGM – 12 June

· abrdn Latin American Income EGM – 12 June · Aquila Energy Efficiency AGM– 14 June · Aquila European Renewables AGM– 14 June · Asia Dragon Update – 15 June · RTW Venture AGM – 21 June · Shires Income manager presentation – 22 June · Downing Renewables & Infrastructure AGM – 23 June

|

· Vietnam Enterprise AGM – 24 June

· Scottish Mortgage AGM – 27 June · Apax Global Alpha Capital Markets Day – 27 June · India Capital Growth AGM – 27 June · Shires Income AGM 2023 – 6 July · CT UK High Income AGM – 20 July · Fidelity China Special Situations AGM – 20 July · Cordiant Digital Infrastructure AGM – 28 July |

· Round Hill Music AGM – 12 June

· Aquila Energy Efficiency AGM – 14 June · Aquila European Renewables AGM – 14 June · Downing Renewables & Infrastructure AGM – 23 June |

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 10 March | ATST, FCIT, HOT, OCI | Anthony Catachanas | VH Global Sustainable Energy Opportunities |

| 17 March | BGLF / BGLP, EPIC, SMT, ALAI | James Hart | Witan Investment Trust |

| 24 March | SMT | Richard Staveley | Rockwood Strategic |

| 31 March | GOT, PSDL, TFG, MNTN | Alex O’Cinneide | Gore Street Energy Storage Fund |

| 14 April | GABI, MLI | Stephen Inglis | Regional REIT |

| 21 April | CSH, HGEN, RTW, SOHO | Jean Roche | Schroder UK Mid Cap Fund |

| 28 April | NESF, RHM, TLEI | Craig Baker | Alliance Trust |

| 05 May | AEET/AEEE, CHRY | Nicholas Weindling | JPMorgan Japanese Investment Trust |

| 12 May | BSIF, CSH, HOME, HGEN, USF | Kamal Warraich | Canaccord Genuity Wealth |

| 19 May | BPCR, GRID, AJIT | Michael Anderson | Aquila Capital European Renewables |

| 26 May | HOME, LMP, MAVT, RMII | Andy Ho & Khanh Vu | VinaCapital Vietnam Opportunity |

| 02 June | TRY, AERI | Iain McCombie | Baillie Gifford UK Growth |

| 09 June | CSH, INV, TLEI | James Thom | Abrdn New Dawn |

| Coming up | |||

| 16 June | Matthias Siller | Baring Emerging EMEA Opportunities | |

| 23 June | Jonathan Hick | Triple Point Energy Transition | |

| 30 June | Gervais Williams | Miton UK Microcap |

Research

After years of squeezed margins thanks to ultra-low interest rates, banks’ profitability is increasing (in part, as the spread between the interest rates that they pay on deposits and the rates that they charge borrowers widens). However, higher rates have brought increased recession risk and have exposed inept risk management within some US regional banks, with some high-profile bank failures. The managers of Polar Capital Global Financials Trust (PCFT) were quick to cut exposure to more exposed areas of the sector, while increasing PCFT’s weighting towards areas such as insurance and reinsurance, where the picture looks brighter.

The industrial and logistics sector suffered its largest fall in value on record in the second half of 2022, even eclipsing that of the global financial crisis, as investment yields moved out rapidly to keep pace with interest rates. The fall in Urban Logistics REIT’s (SHED’s) share price was even faster, putting it on a wide discount to net asset value (NAV). However, evidence that values have bottomed out is building, with MSCI’s quarterly UK property index reporting uplifts in March for the first time in months.

HydrogenOne Capital Growth (HGEN) is the only pure play green (renewables-powered, no carbon dioxide produced) hydrogen fund available on the London listed market. It offers diverse exposure to nine exciting private hydrogen investments and a hydrogen production facility that is being developed in Germany. Spurred on by the need to tackle climate change and improve energy security, globally, governments are devoting considerable resources to jump-starting the green hydrogen industry. HGEN is well-positioned to benefit as investee businesses scale rapidly over the coming years. The investment adviser has around £500m worth of additional opportunities available.

In a world of volatile equity markets and uncertain futures, MATE offers investors a refreshingly straightforward target of achieving an average of 6% compound annual returns over a rolling five-year period and paying an inflation-linked dividend. MATE has now passed its five-year anniversary, and its life has been marked by two of the worst bear markets in recent memory. Given that we are in the grip of a painful downturn, it is unsurprising that MATE has fallen short of its target return. Commendably, the team has not taken on more risk in an attempt to catch up.

As interest rates have risen in response to rising inflation, Edinburgh Worldwide (EWI) – with its focus on small cap global growth stocks – has given up a significant portion of its previous outperformance (see page 17). The trust finds itself in a somewhat unusual position in that it has moved to a significant discount to NAV, about a 20% discount versus a five-year average of 2.5%. This comes at a time when global small cap stocks are trading at a modest discount to global equities, rather than their usual significant premium.

While acknowledging that there may be some volatility ahead, we think this could be a particularly attractive entry point for a longer-term investor who is prepared to look through the short-term market noise. Ultimately, EWI is backing companies that its managers believe are disrupting industries to become leaders in their fields, unlocking significant value in the process.

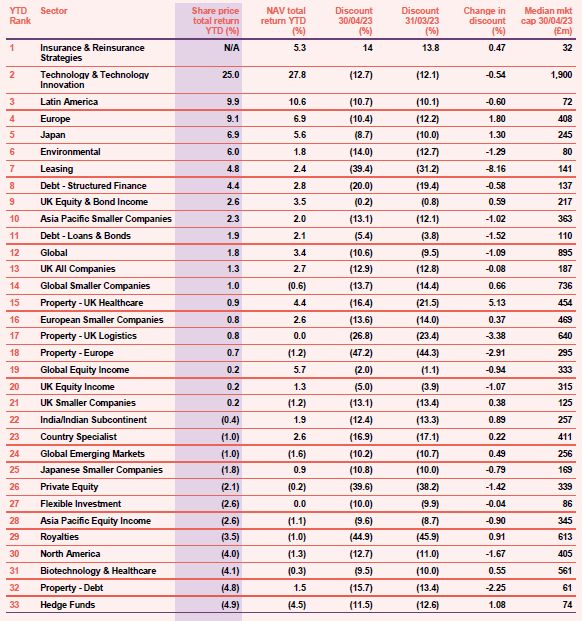

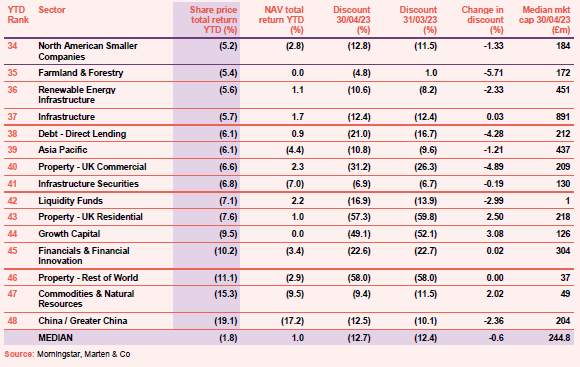

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.