Real Estate Annual Review

The long road back

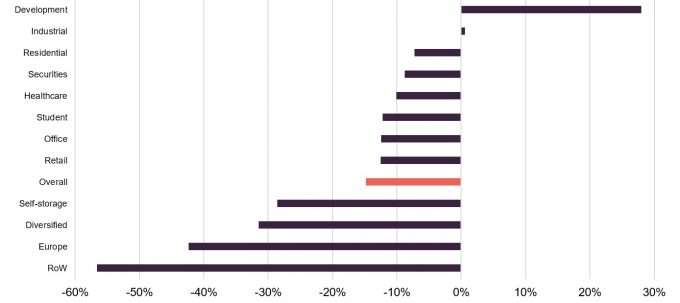

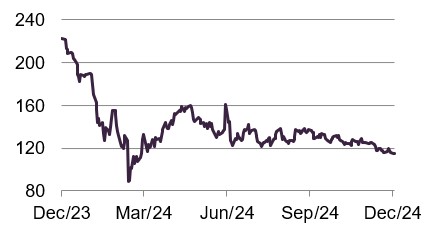

After two long years of decline, it looked like real estate would stage a recovery at the halfway point of the year. Valuations had stabilised and the much-anticipated interest rate cutting cycle was underway. However, October’s budget put paid to any recovery as fears rose that the chancellor’s tax raid would prove to be inflationary – sending gilt yields back up to levels not seen since the ill-fated days of Liz Truss’s premiership. The budget’s impact on sentiment towards the real estate is illustrated perfectly in the 2024 performance graph on the right.

Another chastening year saw the average discount to NAV that the sector trades on widen from an already large 29.7% to an astonishingly vast 35.6% over the course of the year. Much of the year was dominated by M&A activity, with seven companies lost to deals at discounts to NAVs

The correlation between gilt yields and real estate share prices is frightening close, and the sector will continue to be at the mercy of policymakers before one can genuinely get excited about a comeback. However, with many of the real estate companies operating in fundamentally strong sectors and most balance sheets in a healthy position, investors are being paid to wait with some hefty dividend yields.

In this issue

- Performance data – It was a bloodbath for most sectors as share prices tumbled in the final quarter

- Corporate activity – Despite this, almost £2.4bn was raised during the year – some through rights issues

- Major news stories – Seven M&A deals, six managed wind-downs … and a partridge in a pear tree

The property sector in 2024

The UK-listed property and real estate investment trust (REIT) sector shrunk by £9.5bn over the course of a tumultuous 2024. Discounts widened as the pace of interest rate cuts proved slower than anticipated amid sticky inflation, and several companies were lost to bargain-hunting merger and acquisitions (M&A) activity. The total market capitalisation of the sector fell to £54.8bn over the year.

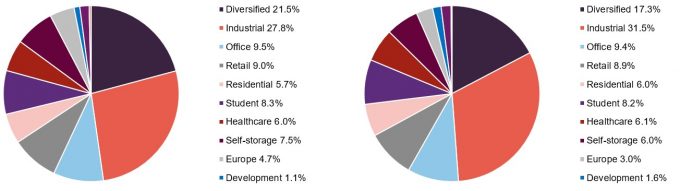

Figure 1: Property market cap at start of 2024 by sector. Total: £64.4bn

Figure 2: Property market cap at end of 2024 by sector. Total: £54.8bn

Source: Bloomberg, Marten & Co

Source: Bloomberg, Marten & Co

A breakdown of the property sub-sectors, illustrated in Figures 1 and 2, show that companies focused on industrial and logistics saw the largest gain in share of market capitalisation over the year, while diversified REITs were the main source for M&A hunters.

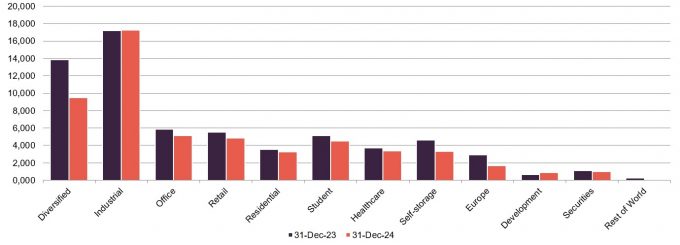

Figure 3: Property sector market capitalisations (£m)

Source: Bloomberg, Marten & Co

There were just two sectors that grew in 2024. The performance of the development category was skewed by the impressive gains of Harworth (detailed below). Share prices were generally down across the industrial and logistics companies, but two large mergers (by LondonMetric and Tritax Big Box REIT – both of diversified REITs) wiped out the losses. The rest of world sector, made up of a few funds focused on particular and relatively unrelated regions, was stricken by poor performance due to generally thin traded strategies with country specific issues

Figure 4: Market capitalisation change by sector over 2024

Source: Bloomberg, Marten & Co

Most sub-sectors suffered to varying degrees, with office focused companies having another painful year as the trifecta of fears around working from home, the green credentials of buildings and poor economic growth – remain. Retail also felt the effects of anaemic economic growth and the cost-of-living crisis. The listed property sector overall shrank by 14.8% in market capitalisation terms.

Fund performance data

Best performing property companies

Figure 5: Best performing companies in price terms in 2024

| % | |

|---|---|

| Alpha Real Trust | 67.8 |

| Harworth Group | 39.9 |

| PRS REIT | 24.8 |

| Schroder REIT | 14.2 |

| Henry Boot | 10.6 |

| Panther Securities | 8.5 |

| Globalworth Real Estate | 3.5 |

| Residential Secure Income | (0.3) |

| AEW UK REIT | (0.6) |

| Phoenix Spree Deutschland | (0.7) |

Figure 6: Best performing companies in NAV terms in 2024

| % | |

|---|---|

| Safestore | 20.0 |

| Ceiba Investments | 11.4 |

| PRS REIT | 10.9 |

| Harworth Group | 8.5 |

| Target Healthcare REIT | 5.9 |

| Big Yellow Group | 5.8 |

| Empiric Student Property | 4.7 |

| Unite Group | 4.4 |

| Care REIT | 3.8 |

| Sirius Real Estate | 3.7 |

Depressingly, just seven real estate companies recorded a positive share price performance in 2024. The outlier was Alpha Real Trust after shareholders voted in favour of its delisting and a tender offer priced at NAV and a substantial premium to its share price.

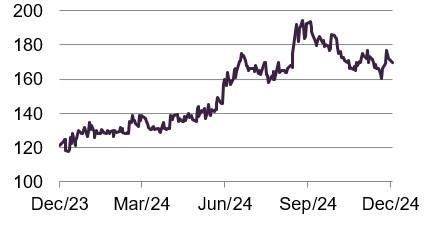

The best-performing company that was not a result of some form of corporate action was Harworth Group. The developer and logistics owner saw its share price gain almost 40% as its strategy to grow to a £1bn company gathered momentum. Profitable sales of development land (not least a £100m+ sale to Microsoft – see top news stories section for details), land values being marked up, and new logistics developments coming through all combined to great effect.

Figure 7: Harworth share price over 2024

Source: Bloomberg, Marten & Co

PRS REIT had an eventful second half of the year, as shareholder activism (stemming from the decision to grant its manager an extended contract) saw its chairman ousted and the company put its portfolio up for sale. A persistently large discount to NAV belied the quality of the portfolio of single-family rented homes (as evidenced in a 10.9% NAV uplift in the year – shown in Figure 6), and another compelling REIT looks likely to leave the market.

On the top NAV performers over 2024, again there were just a few that reported positive uplifts due to the continued impact of high interest rates. The self-storage operators – Safestore and Big Yellow – both made the top 10 (we discuss them further in the discount section below).

The living sectors had a healthy 2024, reflecting the strength of the supply and demand dynamic. Both care home operators Target Healthcare REIT and Care REIT (formerly Impact Healthcare REIT) posted valuation gains, as did the student accommodation specialists Unite and Empiric Student Property.

Worst performing companies

Figure 8: Worst performing companies in price terms in 2024

| % | |

|---|---|

| Grit Real Estate Income Group | (50.0) |

| Regional REIT | (48.2) |

| Life Science REIT | (39.9) |

| Macau Property Opportunities | (38.4) |

| Ground Rents Income Fund | (28.8) |

| Safestore | (27.1) |

| CLS Holding | (24.0) |

| Unite Group | (22.7) |

| First Property Group | (22.7) |

| Ceiba Investments | (22.6) |

Figure 9: Worst performing companies in NAV terms in 2024

| % | |

|---|---|

| Ground Rents Income Fund | (37.4) |

| Conygar Investment Company | (35.4) |

| Regional REIT | (27.1) |

| First Property | (27.0) |

| Hammerson | (26.9) |

| Great Portland Estates | (26.9) |

| Macau Property Opportunities | (26.7) |

| CLS Holdings | (22.0) |

| Phoenix Spree Deutschland | (21.8) |

| Grit Real Estate Income Group | (20.5) |

Figure 10: Regional share price over 2024

Source: Bloomberg, Marten & Co

No real estate company has been hit harder by rising global interest rates than pan-African investor and developer Grit Real Estate. Whilst it continues to manage its swollen balance sheet, with more non-core sales, its share price fell 50.0% over the year.

Regional office landlord Regional REIT‘s share price over 2024 was down a whopping 48.2%, whilst its NAV fell 27.1%. Having shored up its balance sheet (for now), the company must surely be in for a better 2025 – whether through asset management enhancements on the portfolio or corporate activity.

Dogged by several legacy issues and ongoing headwinds relating to building safety and leasehold reform, it was no surprise to see Ground Rents Income Fund appear on both share price and NAV worst performing tables. The company is working through a realisation strategy to return capital to long-suffering shareholders. The election of President Trump spelled further pain for Cuban real estate specialist Ceiba Investments, with US foreign policy towards Cuba expected to be damaging – undoing softer policies enacted by the former administration.

Significant rating changes

Figures 11 and 12 show how share price premiums and discounts to NAV have moved over the course of the year. The average discount across the sector widened over the year from 29.7% to 35.6% at the end of 2024.

Figure 11: Biggest percentage point changes to ratings in 2024 – the 10 greatest improvements

| Company | Sector | Premium/(discount) at 31/12/2023 (%) | Premium/(discount) at 31/12/2024 (%) | Difference (percentage point) |

|---|---|---|---|---|

| Alpha Real Trust | Debt | (44.9) | (5.1) | 39.8 |

| Hammerson | Retail | (45.4) | (26.4) | 19.0 |

| Harworth Group | Development | (37.9) | (19.9) | 18.0 |

| Schroder REIT | Diversified | (26.5) | (14.5) | 12.0 |

| Phoenix Spree Deutschland | Europe | (57.3) | (45.8) | 11.5 |

| PRS REIT | Residential | (28.2) | (19.2) | 9.0 |

| Residential Secure Income | Residential | (27.9) | (21.2) | 6.7 |

| Globalworth Real Estate | Europe | (65.7) | (57.1) | 8.6 |

| Henry Boot | Development | (31.4) | (24.6) | 6.8 |

| Ground Rents Income Fund | Residential | (66.9) | (62.4) | 4.5 |

The list of positive share price rating moves was dominated by companies undergoing corporate activity, with five of the names either in wind down, reviewing a sale or delisting – Alpha Real Trust, Phoenix Spree Deutschland, PRS REIT, Residential Secure Income and Ground Rents Income Fund.

Of the others, retail behemoth Hammerson stands out. The company has undertaken a large share buyback programme following the sale of its retail outlets business (see news section for details), which boosted liquidity for its share. While it also suffered a considerable NAV decline.

Schroder REIT’s impressive share price performance over the year – comfortably the best among its diversified real estate peer group – combined with a small NAV decline (of 1.9%) resulted in its discount narrowing to 14.5%.

Figure 12: Biggest percentage point changes to ratings in 2024 – the 10 biggest deteriorations

| Company | Sector | Premium/(discount) at 31/12/2023 (%) | Premium/(discount) at 31/12/2024 (%) | Difference (percentage point) |

|---|---|---|---|---|

| Safestore | Self-storage | (2.8) | (41.0) | (38.2) |

| Unite Group | Student accom. | 12.5 | (16.8) | (29.3) |

| Regional REIT | Offices | (47.4) | (76.4) | (29.0) |

| Big Yellow Group | Self-storage | 0.2 | (25.6) | (25.8) |

| Life Science REIT | Labs/offices | (27.7) | (49.7) | (22.0) |

| Tritax Big Box REIT | Logistics | (7.7) | (26.0) | (18.3) |

| Sirius Real Estate | Europe | (13.1) | (30.2) | (17.1) |

| Assura | Healthcare | (6.4) | (22.4) | (16.0) |

| SEGRO | Logistics | (5.4) | (21.3) | (15.9) |

| Supermarket Income REIT | Retail | (6.5) | (21.7) | (15.2) |

Self-storage operators Safestore and Big Yellow were among the largest negative re-raters as concerns that subdued economic growth and a floundering housing market will weigh on demand grow.

It was another difficult year for Life Science REIT. A concentrated shareholder base and lack of liquidity in its shares has exacerbated a negative share price momentum that saw it lose almost 40% in value over 2024 and its discount widen to 49.7%.

As two of the largest UK-listed property companies, SEGRO and

Tritax Big Box REIT perhaps took the brunt of the negative sentiment towards the sector, seeing their share prices fall 20.9% and 21.4% in 2024.

Major corporate activity

Fundraises

Almost £2.4bn was raised by property companies in 2024

Despite a gloomy year, companies took advantage of small (and often short-lived) windows of positive sentiment to raise almost £2.4bn – albeit some were conducted through rights issues.

By far the largest capital raise was SEGRO’s £907m placing in February. This single fundraise eclipsed the total amount raised by the sector in 2023 of just over £600m. The company said that the new equity will allow it to pursue additional growth opportunities, including new and existing development projects and to take advantage of potential acquisition opportunities.

In July, Unite Group raised £450m in a placing, with the proceeds earmarked for a number of student accommodation acquisitions and development projects.

London office developer Great Portland Estates raised £350m in a rights issue in May. The company received acceptances for 96.8% of the total shares offered under the three for five rights issue. The rest were taken up by the sponsors of the issue under their underwriting agreement. GPE will invest the proceeds into office development sites in London, where it has a near-term acquisition pipeline worth £1.4bn.

British Land raised £301m in a placing, retail offer and subscription in October and used the proceeds to part fund the acquisition of a portfolio of retail parks for £441m (see the news section below for details).

Sirius Real Estate raised £150m in a capital raise. The capital raise will enable the company to execute on its ongoing acquisition strategy in Germany and the UK, with a pipeline worth almost £160m.

In June, Regional REIT announced a capital raising of £110.5m through a fully underwritten placing. The capital raising, which was underwritten by Bridgemere Investments, enabled the company to fully repay a £50m retail bond that was due to mature in August. The remainder of the proceeds was split with £26.3m used to reduce bank facilities and £28.4m to fund selective capital expenditure on assets. As a result, the company’s LTV, which had ballooned to 56.8%, reduced to 40.6% (on a fresh valuation of the portfolio).

Empiric Student Property raised £56.1m in October, with the proceeds used to acquire two operational assets in Manchester and Edinburgh for a combined £30m. The company has a broader pipeline of a further eight assets under negotiation.

Meanwhile also in October, NewRiver REIT raised £50.2m in a placing at 80p per share to part fund the proposed acquisition of Capital & Regional (detailed below).

Mergers and acquisitions

2024 was characterised by real estate mergers and acquisitions, with a total of seven companies lost during the year, most of which were at discounts to NAVs.

Tritax EuroBox was taken out by Canadian private equity giant Brookfield in December, in a deal worth £557m. This followed an earlier offer for the company from SEGRO. The agreed price was a premium of 28% to Tritax EuroBox’s share price prior to the commencement of the offer period, but a discount of 12% to its last reported NAV.

Balanced Commercial Property Trust was acquired by Starwood Capital for £673.5m. The 96p per share offer represented a premium of 21.5% to its closing price when the board launched a strategic review into the future of the company in April. Relative to its last reported NAV of 105.1p at 30 June, however, the acquisition represented an 8.7% discount.

NewRiver REIT acquired fellow listed shopping centre owner Capital & Regional for £147m. The deal saw each Capital & Regional share receive 31.25p in cash and 0.41946 new NewRiver shares.

abrdn Property Income Trust sold its portfolio to funds managed by GoldenTree Asset Management for £351m. The transaction comprised the sale of 39 assets (the company’s entire portfolio, with the exception of land at Far Ralia) and the transfer of debt facilities. The price represented a discount of 8.0% to the value of the portfolio of £381.6m at 30 June 2024 and implied a pro-forma NAV of £244m, equivalent to 64.0p per share, which was a 12.7% discount to API’s NAV of 73.3p at 30 June 2024, a 6.7% premium to its prevailing share price, and a premium of 20.1% to its share price when shareholders approved its managed wind-down. It is also a 3.1% premium to the original merger bid made for the company by Custodian Property Income REIT in January 2024. That share-for-share offer implied a value of 62.1p per share.

Tritax Big Box REIT merged with UK Commercial Property REIT, creating the fifth largest listed real estate company in the UK. The deal was struck in March at an exchange ratio of 0.444 new ordinary Tritax Big Box shares per UKCM share, which implied a value of around £924m for the company. This represented a premium of 10.8% to UKCM’s share price, but a discount of 9.7% to its NAV at 31 December 2023.

Lok’n Store was acquired by Shurgard. Lok’n Store shareholders received 1,110p in cash for each share, which represented a premium of 15.9% to the prevailing price, 41.3% to the volume-weighted six-month average price, and a 2.3% to the all-time high closing price of 1,085 pence (on 6 January 2022).

LondonMetric completed the merger with LXi REIT in March. The company acquired the entire issued and to be issued ordinary share capital of LXi for around £1.9bn – creating the fourth largest REIT with a portfolio worth around £6.2bn.

Other major corporate activity

On top of the M&A activity, a further six companies announced plans to wind up during the year.

Residential Secure Income commenced a managed wind-down of the company following a review of options for maximising shareholder value. The company’s persistent and material share price discount to NAV and its small market cap of around £100m (which it said may be a deterrent to some potential investors due to lower share liquidity) led the board and manager (Gresham House) to conclude that executing a managed wind-down and portfolio realisation strategy is the best course of action for shareholders.

Alpha Real Trust will delist its shares from the Specialist Fund Segment and offer shareholders a tender offer at NAV. The company is 88% owned by Alpha Global Property Securities Fund Pte. Limited, and the remaining 12% of shareholders will be given the opportunity of exiting the company through the tender offer at a price of 208.8p per share. This is a large premium to the share price, which was trading as low as 113p in mid-November. It is anticipated that cancellation will become effective on 23 January 2025.

Phoenix Spree Deutschland commenced a realisation programme that will see it sell down its portfolio of Berlin residential assets and return capital to shareholders. It plans to achieve this by accelerating its individual condominium sales programme, where it has accomplished large premiums to book value. The company is targeting annual sales of €50m from 2025.

Shareholders of abrdn European Logistics Income voted against its continuation at its AGM in June and the company was put into a managed wind down.

In September, Real Estate Investors announced it was to conduct an orderly strategic sale of the company’s portfolio over the next three years. Assets will be sold individually, as smaller portfolios or as a whole portfolio sale, with the initial priority to repay the company’s debt. The company said that the ongoing substantial discount between the share price and NAV, combined with a lack of liquidity in its shares, was behind the decision.

Home REIT entered a managed wind down after failing to secure a refinancing of its debt facility. Having sold off a large portion of its assets at auction and repaid the debt facility, the company is marketing its remaining portfolio of 850 homes for £175m. A return of capital to investors is complicated by legal proceedings (brough against it and one that it launched against the former manager) and an FCA investigation.

Towards the end of the year, Home REIT shareholders received a tender offer from Southey Capital at 4p per share, valuing the whole company at £32m. Southey Capital said it wanted to avoid mandatory takeover requirements and would therefore restrict acceptances. Shareholders had until the end of December to accept the tender offer.

Furthermore, the future of PRS REIT is uncertain after activist shareholders requisitioned the board and forced out the former chairman Stephen Smith in September. Following this, the company announced that it was in active discussions with a number of interested parties over a sale of the company. It added that an update on the process will be given in the first quarter of 2025.

Other major corporate news to break in 2024 include:

- Special Opportunities REIT pulled a proposed IPO in June after falling short of its £500m target fundraise. The company planned to use the proceeds to acquire commercial property at distressed prices. It had lined up three cornerstone investors for up to £114m, but still fell short of its minimum level of target £250m. The management team went on to form a partnership with Golden Tree Asset Management and acquired the portfolio of abrdn Property Income (as mentioned earlier).

- Triple Point Social Housing REIT changed its new to Social Housing REIT after appointing Atrato Partners as the company’s new investment manager, replacing Triple Point. It decided to part ways with Triple Point after launching a review of the investment management arrangements earlier in the year. The company also changed the basis for calculating its management fee from NAV to market capitalisation, which over the past 12 months would have saved the company £1.75m.

- Fellow Atrato fund, Supermarket Income REIT, has also changed the basis for calculating its management fee from NAV to market capitalisation – a move we have championed to further align manager and shareholder interests.

- Impact Healthcare REIT changed its name to Care REIT plc to align with the Financial Conduct Authority’s updated sustainability disclosure requirements. Its stock market ticker is now CRT.

Major news stories

- Hammerson sold its stake in retail outlets business Value Retail for £1.5bn, generating net cash proceeds of £600m. The disposal price represented an exit cash yield of 3.4% but was a 24% discount to its gross value of £2.0bn. The company intends to use the sales proceeds to pay down debt, reinvesting into assets at higher yields, and to fund a £140m share buyback programme.

- British Land acquired a portfolio of seven retail parks for £441m. The purchase will be financed using the proceeds of its equity raise (mentioned above) and from existing cash and in place facilities. The seven retail parks are being purchased from Brookfield at a net initial yield of 6.7% and topped up net initial yield of 7.2%.

- SEGRO agreed a deal with Brookfield Asset Management to purchase six properties from the Tritax EuroBox portfolio prior to Brookfield’s acquisition of Tritax EuroBox being ratified (mentioned in the previous section). The portfolio comprised assets in Germany and the Netherlands and was sold for €470m.

- Assura bought Northwest Healthcare Properties’ UK private hospital portfolio for £500m. The deal adds 14 assets to its portfolio and almost £30m to Assura’s rent roll. The company also announced a £225m disposal programme to lower debt.

- Harworth Group sold the 48-acre Skelton Grange site near Leeds to Microsoft for £106.6m for the development of a hyperscale data centre.

- Land Securities acquired a 92% stake in Liverpool ONE, one of the premier shopping centres in the UK, from the Abu Dhabi Investment Authority (ADIA – 69%) and Grosvenor (23%) for an overall consideration of £490m. The income return is expected to be 7.5%.

- Phoenix Spree Deutschland kickstarted its realisation programme with the sale of 16 buildings, comprising 385 units, to Partners Group for €75.9m.

- Safestore entered into a 50/50 joint venture with Nuveen Real Estate to acquire Easybox, Italy’s second largest self-storage operator, for €175m. Safestore will initially invest €45m for its 50% share in the joint venture, which has also been funded by joint venture level debt.

- AEW UK REIT sold the Central Six Retail Park, in Coventry, for £26.25m, reflecting a net initial yield of 7.49%, a 60% premium to the purchase price and a 6.7% premium to the book value.

- Triple Point Social Housing REIT transferred all 38 properties previously leased to struggling housing association Parasol to Westmoreland Housing Association. The company expected a material increase in rent collection.

Selected QuotedData views

- NHS reform a tonic for primary care investors

- Real estate’s Rocky moment?

- Still a place for the generalist REIT?

Real estate research notes

An annual overview note on Urban Logistics REIT (SHED). The company’s discount to NAV appears to be at odds with the growth potential of the portfolio.

An update note on Lar España Real Estate (LRE SM), which has been the subject of an offer for the company. We look at the merits of the bid given the performance and prospects of the company.

A result analysis note on Urban Logistics REIT (SHED). The company reported resilient performance in a rising interest rate environment, with its focus on growing earnings to provide dividend cover.

An annual overview note on Grit Real Estate Income Group (GR1T). Its latest act of corporate engineering has opened the door for new NAV and earnings accretive developments.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.