Change in fortunes could be on the horizon

It is possible that RIT Capital Partners’ (RIT’s) private investments portfolio, which for the past two years has dragged on the trust’s NAV returns, could be the spark for a change in its fortunes over the next 12 months. Several holdings are considering IPOs. History suggests that these could present healthy premiums to the values that they are held at on RIT’s books. This would also allow the manager to reallocate capital to areas of the equity and credit markets that it has identified as undervalued.

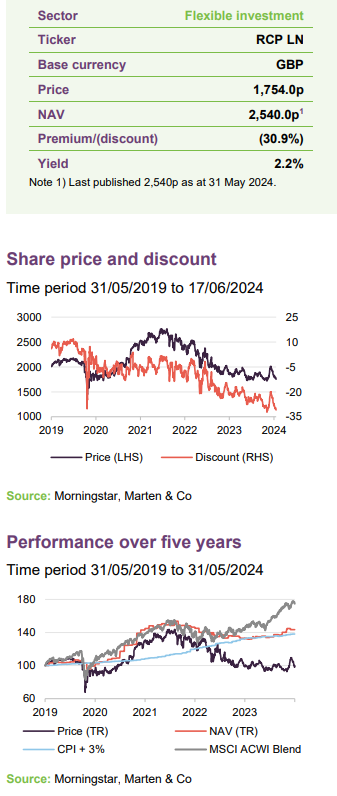

RIT’s equity portfolio has performed broadly in line with equity markets, despite having a de minimis position in the so-called ‘magnificent seven’ mega-cap tech stocks. The manager says that this is testament to the team’s stock picking ability. Allocating a larger share of RIT’s capital to this investment pillar could bear substantial fruit, it adds. Given the improving outlook, the trust’s current discount of 30.9% could prove a highly attractive entry point.

Grow and preserve shareholders’ capital

RIT aims to deliver long-term capital growth, while preserving shareholders’ capital. It invests without the constraints of a formal benchmark, but aims to deliver increases in capital value in excess of relevant indices over time. RIT invests in a widely-diversified, international portfolio across a range of asset classes, both quoted and unquoted. It allocates part of the portfolio to exceptional managers in order to ensure access to the best external talent available.

Market backdrop

A narrow group of often very large AI-related stocks have distorted returns

The manager contends that market outlook is uncertain. It observes that investors have concerns around inflation and interest rates, geopolitical risk, conflicts in the Middle East and Europe, and the outcomes of elections. However, excitement around advances in AI has driven a narrow group of often very large stocks to new highs, distorting returns on market indices.

In the face of this, RIT’s manager says its focus continues to be on diversification and disciplined risk management across its three core investment pillars – quoted equities, private investments, and uncorrelated strategies. In particular, it says that it has an eye on several opportunities for NAV growth through idiosyncratic investment selection.

A change in the senior management team has not changed the approach

A change in the senior management team of its investment manager and wholly-owned subsidiary, J. Rothschild Capital Management (JRCM) – with former non-executive director Maggie Fanari taking over as chief executive from Francesco Goedhuis, and Nick Khuu moving into the role of chief investment officer (see page 8 for further details) – has not changed the approach of the trust, the manager states. Continuity is the order of the day, it adds, building on the attributes that have driven RIT’s attractive long-term returns.

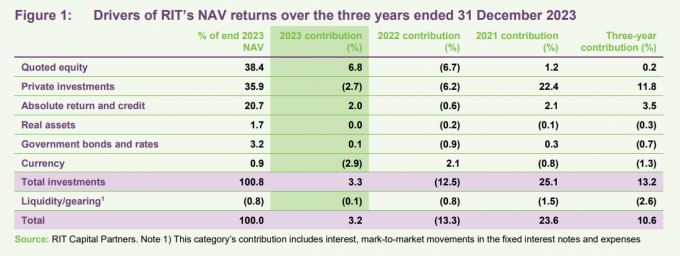

RIT is back to generating positive NAV returns

Following 2022’s first NAV decline in more than a decade, 2023 saw a return to RIT generating positive NAV total returns, albeit muted at 3.2%. The quoted equities pillar (38.4% of NAV at the year-end) returned 18.1% over 2023 – underperforming the ‘magnificent seven’-dominated MSCI ACWI, which returned 23.5%, but outperforming the MSCI ACWI Equal Weighted Index, which rose 9.4%, and the MSCI World excluding the ‘magnificent seven’, which gained by 12.0%. Given RIT held a de minimis position in one of the seven mega-cap US tech stocks in 2023, the manager suggests that returns from its quoted equities portfolio were impressive and testament to its stock picking ability.

RIT now has a small position in Microsoft

The manager feels that given the risks in the markets, specific risks in the stocks, and portfolio construction considerations, it did not warrant having a material exposure to the ‘magnificent seven’, especially given the other opportunities it says were available. Having said that, the manager says that it is agnostic to drivers of returns and looks for the best risk-adjusted assets. For example, it has a position in Amazon as it believes it offers superior free cash flow generation in the coming years due to a reacceleration of the Amazon Web Services business, as well as an opportunity to expand retail margins. It also believes that Microsoft represents an attractive investment due to its market leading presence in the software sector, and has recently established a small position in the company. Lastly, it says that it took the opportunity to invest in Alphabet earlier this year when fears over the impact of generative AI appeared overblown.

The effect of 2022’s interest rate hikes showed up in 2023’s valuations

The trust’s uncorrelated strategies portfolio (25.6% of NAV at the end of 2023) delivered a return of 6.8% in 2023, but it was private investments (35.9% of NAV) that detracted from the company’s overall performance – declining by 6.0%. The manager feels that 2022’s higher interest rate environment contributed to this decline in private valuations and the lagged effect of this on valuations impacted 2023’s returns.

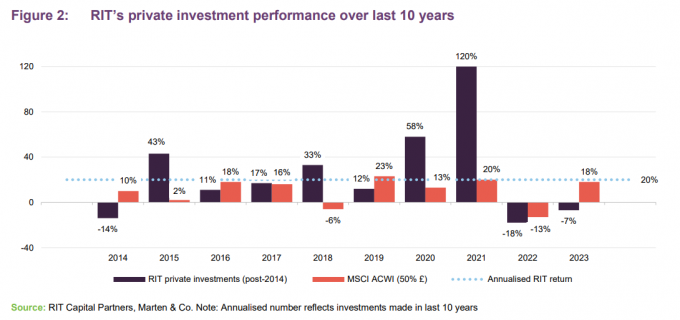

Over five years, RIT’s private equity portfolio has returned 146%

The manager states that it would be wrong to fixate on this short-term adverse move. This pillar has returned 146% over five years to the end of 2023 and an annualised return of 20% over 10 years, as shown in Figure 2.

In addition, the manager says that several of RIT’s private investments are exploring IPOs or sales over the next two years that could see performance return to positive territory (which we discuss in detail in the next section).

In the first quarter of 2024, the performance theme of 2023 continued; whilst private investments were flat, quoted equities (returning around 9%) and uncorrelated strategies (returning around 3%) made positive contributions to an NAV total return of 4.6%.

Taking profits from private investments

The exposure to private investments could reduce as many of these look to IPO or exit to M&A

The manager says that the portfolio’s exposure to private investments has increased naturally over time due to the growth in the individual holdings, but is now beyond its 25%-33% target size (at the end of the first quarter of 2024 it accounted for 35% of NAV). However, several core holdings and holdings in its private fund portfolio are exploring IPOs or sales, which the manager says may come through over the next 12 to 24 months. This could see private investments fall back in line with the manager’s ideal weighting.

Motive and Webull line up potential IPOs

In respect of RIT’s two largest direct holdings – Motive and Webull – Webull is in advanced stages of going public, having announced its aim to list on the NASDAQ through a special purpose acquisition company in the second half of 2024. Additionally, Motive has been a long-time IPO candidate, which the manager believes could take place over the next 12 to 24 months. We discuss these two companies in more detail in the asset allocation section on page 11.

The manager adds that several holdings within the private funds portfolio (where it says the majority consist of later stage growth and traditional private equity strategies) are also considering sales.

History suggests that valuations for RIT’s direct private holdings are at the conservative end of fair value, the manager contends. This has been reflected in the average mark up on realised investments over the last decade of 24%, including three in 2023 all at or above carrying value. One of those was Infinity, which closed in early 2023 at a premium of 30% to its pre-sale carrying value. The manager also considers the valuations adopted by its fund partners, which are required to prepare fair values that are subject to annual audit, to be conservative.

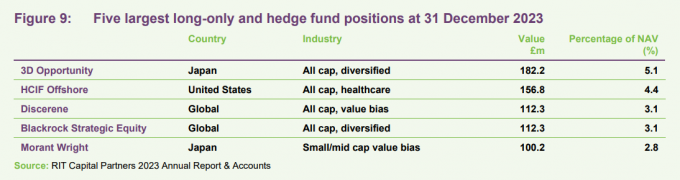

The manager expects to reinvest capital from realisations from the private investments portfolio into the liquid portfolio – quoted equities and uncorrelated strategies. Specifically, the manager say that it has identified the overlooked small- and mid-cap equities market, and the corporate credit markets as presenting a compelling opportunity. The manager states that RIT has taken advantage of specialist management knowledge and stock picking expertise with allocations to specialist equity funds – particularly in Japan and in the healthcare sector – which is also an area for potential growth.

The small- and mid-cap equity opportunity

Strong investor appetite for the seven mega-cap US tech stocks saw their share price rise 74% on average in 2023, while in comparison the remaining 1,473 stocks that make up the MSCI World index were collectively up a modest 12%. This, the manager argues, has left other parts of the market undervalued compared to historic levels. The manager believes this to be particularly true for small- and mid-cap equities.

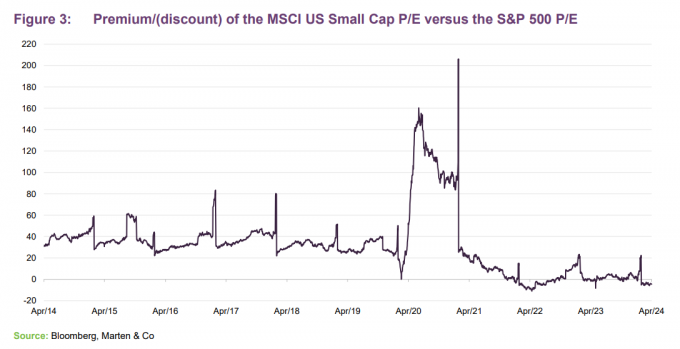

Figure 3 shows that the 12-month forward price/earnings ratio (P/E) of the MSCI US Small Cap Index has historically traded at a significant premium to the S&P 500. This has reversed over the last two years as interest rates shot up and investors perhaps fled to the perceived safe-haven of large-cap stocks. At the end of April 2024, the P/E of the MSCI US Small Cap Index was at a 4.6% discount to the S&P 500, compared to a 10-year average premium of 31.5% and a longer-term average premium of 44.3%.

The manager says that its focus is on identifying unique opportunities to buy companies that are trading at attractive valuations and that have a clear catalyst on the horizon. It says that its willingness to look at parts of the market that others are not, and its unique ability to access investments that others cannot, could pay off handsomely, and points to a recent example within its portfolio that should act as a blueprint.

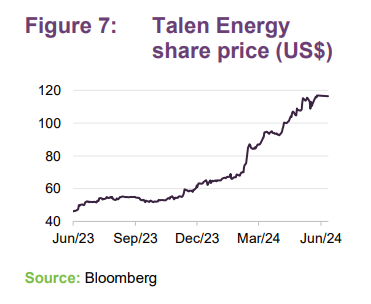

Talen Energy

The manager bought Talen Energy in 2023, which it says ticked all the boxes for RIT, being an overlooked stock with a genuine catalyst for near-term share price appreciation, as well as protected downside (more information on Talen and other RIT equity holdings can be found on page 10). The company had just undergone a financial restructuring, and the manager viewed the Inflation Reduction Act (IRA), enacted during the restructuring, as effectively putting a floor on revenues for its ‘crown jewel’ nuclear power plant.

In addition to the power plant, Talen owns conventional power generation assets and a data centre. The manager says that JRCM’s valuation of the company’s assets on a sum-of-the-parts approach was significantly ahead of its then enterprise value (EV).

RIT’s manager states that it valued the power plants at roughly $4.5bn and its other conventional assets, as well as the data centre, at around $2bn. At the time of its purchase, Talen had a market cap of roughly $3bn, with net debt of $2bn, equating to an EV of around $5bn. The manager says that this gave it a significant margin of safety, with very low downside and potentially material upside.

Talen’s shares are up by 82.0% in the year to date

This has come to pass, and in March 2024 Talen sold the data centre project in Susquehanna, Pennsylvania, to Amazon Web Services (AWS) for $650m. As part of the deal, Talen will also supply AWS with energy from its adjacent power plant via a 10-year power purchase agreement (PPA). RIT’s manager believes that the whole deal is worth between $1bn and $1.5bn. This is three-to-four times greater than it had appraised the data centre to be worth when it first invested in Talen, it adds. In May 2024, Talen also closed the sale of three natural gas-fired generation facilities in Texas for $785m. Taken together, these two deals appear to have contributed to the stock being up 82.0% in the year to date.

An additional longer-term catalyst for growth, the manager believes, is the proposed uplisting of Talen’s common stock from the over-the-counter exchange, OTCQX, to a national securities exchange. It filed a registration statement with the Securities and Exchange Commission (SEC) in September 2023, and the uplisting will be effective after the SEC completes a review, and it is subject to market and other conditions.

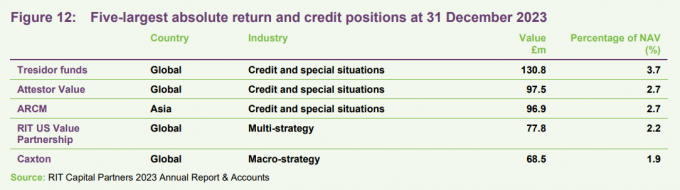

Corporate credit

The manager also believes that there are several opportunities in the corporate credit market where it says capital is well protected and the potential to make double-digit returns exists. Many factors – including higher interest rates, cautiousness among banks to lend outside their core client base, and a significant number of pending maturities of debt that was issued at lower rates – have combined to bring volatility to the credit markets and a mispricing of good quality credits, the manager says. It believes that substantial opportunities exist, especially in the European market, that present equity-like return potential with credit downside protection.

The manager says that it is seeing lots of opportunities in the liquid credit markets, where it believes it can make double-digit returns with a low probability of impairment of capital. It says that it plans to deploy further capital here, with the overall exposure to the uncorrelated strategies pillar remaining broadly the same at 20%-40%.

Specialist managers

To gain exposure to thematic investments (such as regions or sectors that the manager has identified as having long-term growth drivers), the manager will look to allocate capital to specialist fund managers where it feels it would benefit from their specific expertise. This has worked well for the company over many years it says, particularly so in Japan and the healthcare sector.

In Japan, RIT’s manager says that it identified two trends that suggested compelling return potential from undervalued Japanese equities: firstly, policy reforms aimed at unlocking value in Japanese companies, and secondly, a rise in – and sentiment towards – activist investors. RIT’s exposure to Japan is via two managers with specialist expertise in the country – Morant Wright and 3D Investment Partners – both of which, the manager says, have delivered consistently strong returns (more details on which can be found on page 10).

Although the manager says that it is excited by the opportunity set, it states that it is also mindful of the fragile macro environment, and it will therefore aim to adopt a disciplined approach through careful risk management and portfolio construction.

Change in leadership team – no change in approach

In March 2024, Maggie Fanari took over as chief executive of J. Rothschild Capital Management from Francesco Goedhuis, who stood down for personal reasons after 13 years in the role. Maggie, who had served on the board of RIT since 2019, joined the company from Ontario Teachers’ Pension Plan, where she had been a senior managing director and global group head of high conviction equities, working across different regions and investing in private and public markets.

The appointment of a new chief executive followed a change of chief investment officer at the end of 2023, with former co-chief investment officer Nick Khuu taking over from Ron Tabbouche. The manager says that the appointment made for a seamless transition, with Nick already running a large portion of the portfolio as head of public markets.

With both Maggie and Nick having familiarity with RIT and the investment style, the manager points out that there will be no radical change in approach, and it is ‘business as usual’. The new management team adds that its focus is on NAV growth, which should ultimately lead to share price growth and a narrowing of the discount.

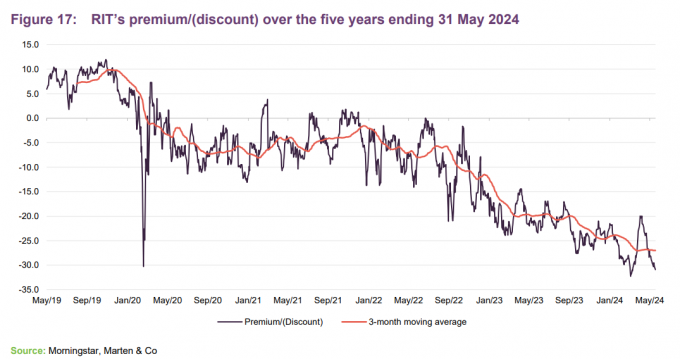

Substantial share buyback

In an effort to manage its discount, the company has acquired £190m-worth of its shares since February 2023, which equates to around 6.5% of its share capital (as at the end of May 2024 – more detail on RIT’s buyback programme is on page 18). The manager feels that RIT’s buyback programme seems to have gone under the radar, and certainly has not had the same attention that other investment trusts’ buyback strategies have garnered. For example, Scottish Mortgage’s £1bn buyback was widely covered in the press.

Given the investment opportunities that the manager has identified, further share buybacks will be weighed against the potential returns available, the manager states.

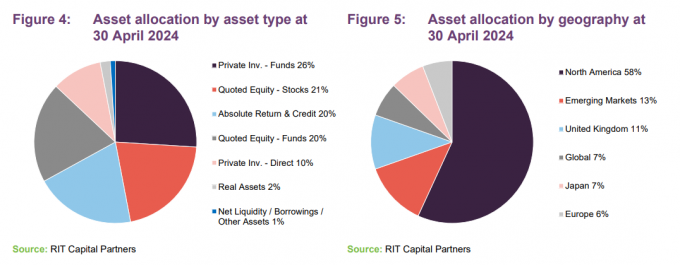

Portfolio

A breakdown of RIT’s portfolio in Figure 4 shows that quoted equities (through direct holdings – 21%, and in funds – 20%) remains RIT’s largest allocation. As mentioned earlier, the manager plans to grow this pillar over time. Its allocation to private investments was 36% (26% in funds and 10% direct) at the end of April 2024, but the manager expects this will rebalance downwards over the next two years, as realisations materialise. The position in absolute return and credit has increased meaningfully over 10 years (from 7% to just over 20% at the end of April 2024). The bulk of this expansion occurred between 2013 and 2018 and reflected the manager’s desire to increase diversification. As mentioned earlier, the manager has identified opportunities in the European credit market, but states that exposure to this pillar will remain at a similar level.

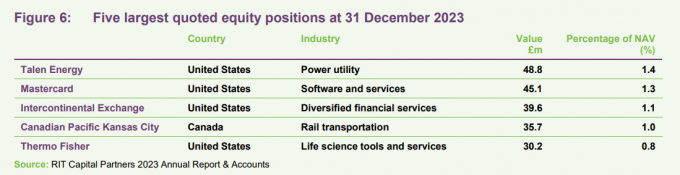

Largest holdings

Talen Energy

Talen Energy (www.talenenergy.com), an independent power producer and infrastructure company that was founded in 2015, owns and operates around 10.7 GW of power infrastructure in the US, producing and selling electricity, capacity, and ancillary services into wholesale power markets. Its fleet is principally located in the Mid-Atlantic and Montana.

It owns the nuclear power station, Susquehanna Steam Electric Station, which is located outside Berwick, Pennsylvania, and generates enough carbon-free nuclear energy to power 2 million homes. It also owns fossil power plants located in Pennsylvania, New Jersey and Maryland and a coal power plant in Colstrip, Montana. As part of its strategic transformation to a renewable energy and digital infrastructure growth platform, the company is developing solar installations and stand-alone battery storage projects on land adjacent to its power plants.

Talen filed for Chapter 11 bankruptcy in May 2022 as part of a financial restructuring and exited the process in 2023. RIT invested in the company after it exited bankruptcy. Talen has reported that it is actively exploring an uplisting of its stock to one of the major US exchanges.

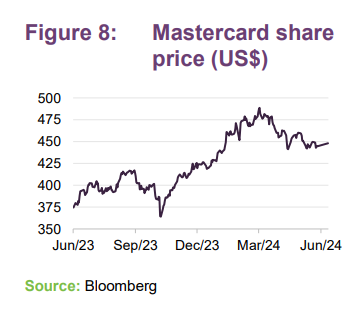

Mastercard

RIT initially invested in Mastercard (www.investor.mastercard.com) in 2021, taking what it describes as a contrarian stand against the view that fintech would revolutionise the banking and payments sectors and would accordingly displace Mastercard and Visa. As it has transpired, the majority of fintech companies have partnered with the likes of Mastercard and Visa, boosting their product lines and earnings capabilities, the manager adds.

The payments total addressable market (TAM) is rapidly expanding, from around $33trn in 2021 to a potential market worth up to $150trn, according to Bernstein. Meanwhile, expansion of the payments sector includes new revenue streams such as business to consumer (B2C) and government to consumer (G2C), as well as growing card penetration rates.

3D Opportunity

3D Opportunity Fund is a hedge fund managed by 3D Investment partners, a Japan-focused value investor that makes opportunistic investments with a focus on quality. The manager, which was founded in 2015, engages with the management teams of its investee companies with the aim of releasing the considerable value that is locked up in certain Japanese corporate entities. Following significant developments – including a new corporate governance code, increased focus from the government, shareholder activism and private equity interest – there is renewed optimism in Japanese equity markets. Annualised returns since investing in 3D Opportunity in 2021 are very strong, the manager says, adding that RIT is well positioned to capitalise on further activism as the ‘Japan discount’ unwinds and companies achieve their potential.

HCIF Offshore

Launched in 2012, HCIF Offshore is a hedge fund that invests in healthcare companies globally. The fund’s manager is a healthcare-focused investment firm based in the US, with around $13bn in AUM. HCIF Offshore’s strategy involves identifying companies that are developing innovative healthcare products and services, as well as companies that are well positioned to benefit from demographic trends such as ageing populations and increasing healthcare spending. It has a broad portfolio of investments, with a focus on early-stage biotechnology companies that are developing innovative treatments for diseases such as cancer, rare genetic disorders, and autoimmune diseases.

Motive

Motive (gomotive.com), which has been considering an IPO, is a co-investment alongside Greenoaks. It operates in the transportation logistics sector, providing fleet management services to businesses with the aim of increasing their profitability. Its fleet management services include financing, maintenance, fuel management, telematics, and driver safety training. Motive’s fleet management software provides real-time data on vehicle performance, driver behaviour, and fuel consumption. This should enable their customers to make informed decisions and optimise operations as well as improving safety and compliance. The vast majority of RIT’s investment underlying investment is in the form of a convertible note that the manager says protects shareholder capital in a downside outcome while retaining equity upside through the conversion feature.

Webull

Webull (www.webull.com), which has outlined plans for a listing later this year, is a stock and fund brokerage platform bringing together traditional investor services on a unified platform. The manager says that adoption of the product has grown rapidly as new and existing market participants seek greater control over their financial affairs. The majority of RIT’s investment is in preferred shares that rank above prior issues, providing protection in the event of a downside outcome.

Kraken

Although only accounting for 0.5% of NAV, we felt it worth discussing Kraken (www.kraken.com) as it has been reportedly considering an IPO. With the rebound in crypto asset prices this yar and the SEC approving 11 applications for Bitcoin ETFs, the manager believes the company could be well positioned. Kraken is the second-largest US crypto exchange and has recently boosted its offering; in April 2024 buying Tradestation’s crypto arm, accelerating its US presence and expanding its regulatory licencing. In February this year, the company unveiled a new division targeting institutional clients, an area where Coinbase has been more active. As with Coinbase, Kraken is also facing an SEC lawsuit, which alleges that the exchange had failed to register as a securities broker, clearinghouse or trading platform – something that may well need to be settled before it can move forward with an IPO.

Thrive funds

Thrive Capital (thrivecap.com) is a New York-based venture capital firm founded in 2011 that specialises in making investments into technology companies – particularly those in the consumer, software, and financial services sectors – focusing on companies that are poised to disrupt traditional industries and create new markets. Thrive seeks out companies with strong leadership teams and a clear vision for the future, and then works closely with them, aiming to provide the resources and guidance needed to develop their businesses.

Iconiq funds

Iconiq Capital (www.iconiqcapital.com) is a privately-held investment firm, founded in 2011, which manages a range of funds, including private equity, growth equity, and real estate. It seeks to identify high-quality companies with strong growth prospects and to hold these investments for the long term. According to the manager, the firm has a reputation for working closely with its portfolio companies to help them achieve their growth objectives, and has a wide network of industry experts and strategic partners that it can leverage to support its portfolio companies. It has a good track record, with recent successes including the IPOs of Snowflake, Datadog and Procore. It currently has a number of portfolio companies at the mid- to late-stage in its investment cycle.

Iconiq is an investor alongside RIT in Epic Systems, the US Electronic Health Records provider, and invested with RIT in the buyout of CSL, a UK-based alarm signalling business which returned 2.6x on RIT’s private equity investment in four years.

Tresidor funds

Tresidor is managed by Tresidor Investment Management LLP (www.tresidor.com), a London-based alternative investment manager that uses a disciplined fundamental research process to invest across the full spectrum of tradeable European credit opportunities, including distressed debt and special situations investments. It aims to focus on high-quality companies’ credit which has low probability of impairment driven by collateral, asset value, business quality, liquidity, cashflows, structural, and legal features.

Attestor Value

Attestor Value is a circa €7bn fund managed by Attestor Capital (www.attestor.com), a private investment firm that was founded in 2012 in London. The firm specialises in distressed debt and special situations investments, focusing on opportunities in the European market. JRCM comments that the manager is known for its expertise in complex, illiquid investments, and its ability to create value through active management and operational improvements. The firm’s investment philosophy is centred around a disciplined, value-oriented approach. It works closely with management teams of its investee companies to unlock value and generate returns, especially through balance sheet actions.

Performance

Five-year track record

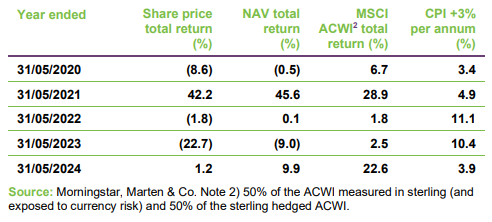

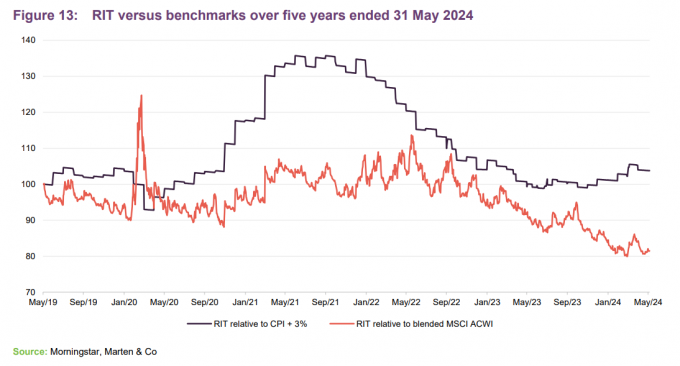

As Figure 13 shows, RIT has outpaced CPI inflation +3% over the past five years, but weaker performance over the last 12 months has seen it fall below that of its blended MSCI ACWI benchmark.

As well as outpacing inflation over five years, RIT has outperformed its peer group over the same period (more discussion on the peer group follows), but recent underperformance stemming mainly from its private investment portfolio has seen it fall behind the 100% equity benchmark of the blended MSCI ACWI index (performance of which was dominated by the US large-cap tech stocks).

As a result of the discount widening, RIT’s share price total return was negative over five and three years.

The diversified multi-asset nature of RIT’s portfolio can lead to deviations between its returns and the blended MSCI ACWI index. RIT’s core aim is to target long-term capital growth, through the cycles, with a degree of capital preservation on the downside. As such, the manager makes the case that RIT is defined by more than its total returns, as the team also aims to dampen down the degree of risk that RIT’s shareholders are exposed to.

Peer group

Up-to-date information on RIT and its peer group is available on the QuotedData website

RIT is a constituent of the AIC’s Flexible Investment sector. These funds have investment objectives and/or policies that allow them to invest in a range of different asset types. The sector encompasses a wide variety of funds with very different performance objectives, and therefore the full AIC sector would make a poor comparison for RIT, and a number of companies have been excluded. Since our last note, three funds from the peer group used in that note (JPMorgan Multi-Asset Growth & Income, Momentum Multi-Asset Value and Invesco Select Balanced) no longer exist.

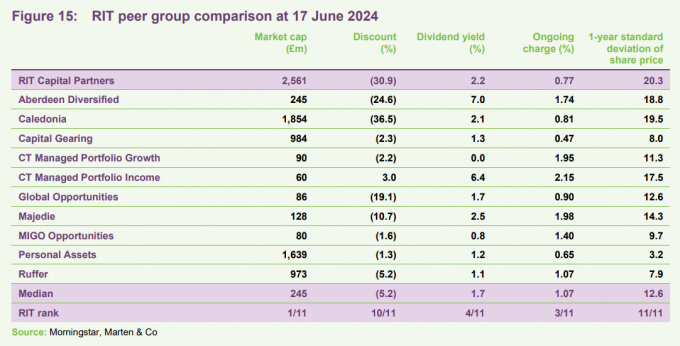

RIT is by far the largest trust within the selected peer group, as shown in Figure 15, eclipsing its second-highest peer by more than £650m. RIT’s dividend yield is better than most, although it ranks as the most volatile of its peers, which is perhaps a combination of the strict risk-targets of some its peers and the recent volatility within RIT’s discount. That discount is at the wider end of funds in this peer group, which we feel is unjustified.

Thanks in part to its scale, RIT also has an OCF in the top quarter of its peers, which is interesting given the complexity of RIT’s investment process, which often comes with a premium cost given the increased resources needed in its execution.

RIT’s OCF is considerably different from its reported KID figure of 4.7%, which the manager says can be misleadingly high due to the inclusion of estimates on performance fees and carried interest paid to third-party managers, such as private equity funds. These are only paid for performance above a hurdle rate. A notable example, the manager says, is Coupang, where the trust’s investment was via a third-party manager. RIT’s investment of $50m generated total value of $340m, a figure which is net of all fees and carried interest paid to the third-party manager. The ongoing cost element of the fees paid to the managers of underlying funds was estimated at 0.88% at the end of 2023.

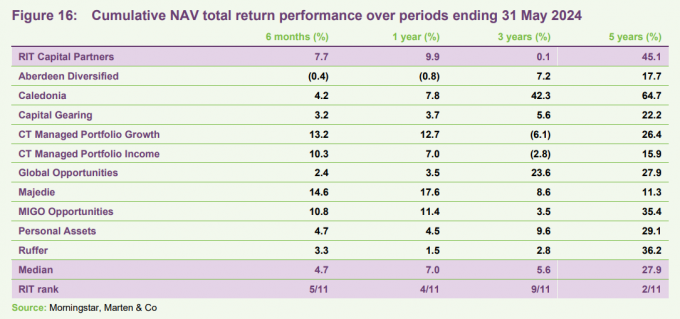

RIT has one of the strongest long-term track records amongst these peers. This is arguably a reflection of both the trust’s flexibility to invest across a range of asset classes, and the unique position RIT is in, given its network of connections within the private equity and debt markets.

RIT lagged the peer group over three years, due to the poor NAV performance in 2022, as previously mentioned. Recent performance has been better and puts the trust at middle of the pack.

Fund intro

More information is available at the trust’s website www.ritcap.com

RIT aims to deliver long-term capital growth, while preserving shareholders’ capital. It invests without the constraints of a formal benchmark, and aims to deliver increases in capital value in excess of relevant indices over time.

In practice, RIT aims to deliver healthy participation in up markets with reasonable protection in down markets. Over time, this should allow it to compound its asset value ahead of index benchmarks through market cycles.

Whilst the board establishes and oversees risk tolerances for the manager to work within, RIT does not seek to be an absolute return fund and does not perform like one. The manager says that there will be periods, such as 2022, where the asset value falls, although over the medium term, the trust’s performance compares favourably to even the top-performing absolute return funds in the market.

The manager

RIT is a self-managed UK-domiciled investment trust. It evolved from the Rothschild Investment Trust, which was originally associated with the family bank, NM Rothschild & Sons. Lord Rothschild was appointed chairman of the Rothschild Investment Trust in 1971. It took on its current listed form as RIT Capital Partners Plc in August 1988.

J. Rothschild Capital Management (JRCM), a wholly-owned subsidiary of RIT, acts as RIT’s manager. The manager’s global network offers a source of deal flow across asset classes and geographies, tracing its origins to the Rothschild family. At the end of December 2023, JRCM employed 50 people, comprising a mix of investment professionals and support staff.

Widely diversified, hard to replicate portfolio

RIT invests in a widely diversified, international portfolio across a range of asset classes, both quoted and unquoted. RIT is able to invest in less-liquid assets such as unquoted companies thanks to its closed-end structure. The manager says that this allows them to be patient and ignore the sentiment swings and short-termism often associated with listed equity markets and analysts. Unquoted (private) investments could also allow RIT access to a broader range of opportunities.

Tapping into outside expertise…

Part of the portfolio is allocated to what RIT describes as exceptional managers in order to ensure access to the best external talent available. Many of these managers would be impossible for retail investors to access, and some are closed to new investment by all types of investors.

…helped by an extensive network of connections

The Rothschild ‘brand’ opens some doors, but its manager comments that, chiefly, RIT can invest where others cannot thanks to the extensive network of connections that the family and the management team have established over the years. This network is also a valuable source of intellectual capital and co-investment opportunities.

Good risk management is reportedly central to RIT’s investment approach. JRCM measures both quantitative and qualitative measures of risk and reports on these to the board. It seeks to hedge excessive factor exposures, and manage currency positions and RIT’s exposure to significant macroeconomic risk.

RIT measures its investment performance against an absolute comparator (inflation, as measured by UK CPI, plus three percentage points per annum) and an equity comparator calculated as 50% of the MSCI ACWI return in local currencies translated back into sterling and 50% of the sterling-hedged MSCI ACWI.

Previous publications

QuotedData published an initiation note of RIT – A rare opportunity to buy a unique trust – on 6 April 2023. Click the link to read it.

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on RIT Capital Partners Plc.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note | until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.