Economic and Political Monthly Roundup

Investment companies | Monthly | March 2023

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

“We have made little if any progress on inflation. There is little if any reason to expect a large slow down going forward.” – Harvard economist Jason Furman following the release of US consumption data.

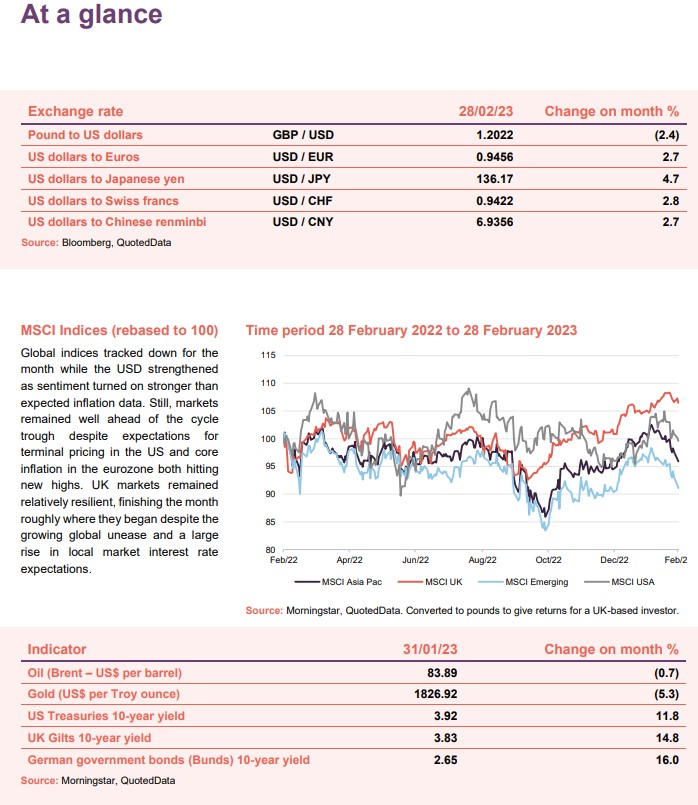

Inflation remains the only game in town for developed markets. Headline numbers for the Eurozone came in hotter than expected for February, and core inflation (excluding energy and food) accelerated to a new peak. Considering that inflation on the continent in 2022 was primarily a function of higher energy and food prices resulting from the war in Ukraine, accelerating core prices are a concern as it suggests pricing pressure may be embedding in the economy. Data out of the US also showed inflation accelerating for the first time in 3 months, and similar sentiments were echoed by both central banks with ECB chief economist Philip Lane suggesting that rates could be elevated for “quite a long-lasting period’’, while the Fed’s Raphael Bostic noted that “the economy packs sufficient momentum to weather higher interest rates’’.

Market pricing in the UK tracked higher in sympathy, with rates now expected to reach 4.75% by year end, up from a peak of 4.25% at the start of the month. However, the BoE pushed back with Andrew Bailey suggesting he had not seen any data to justify the change in outlook, so all eyes will now look to CPI data for February which is due on 22 March.

The nominee governor for the Bank of Japan told lawmakers that he was wary of damaging economic growth and would make no change to monetary policy for the time being. The Japanese yen weakened relative to the dollar over the month.

Global

(compare global and flexible investment funds here, here, here and here)

Sir James Leigh-Pemberton, chairman, RIT Capital Partners – 28 February 2023

2022 was the most difficult year for financial markets for more than a decade. The global economy was affected by significant supply shocks, with particularly sharp rises in energy and raw material prices. In financial markets almost all asset classes saw declines. The S&P 500 and the NASDAQ closed the year down -18% and -32% respectively, while Emerging Markets recorded a loss of -16%, Europe -10% and the FTSE 250 -17%. Furthermore, these year-on-year figures, stark though they are, do not tell the whole story of 2022, which saw significant shifts in investor sentiment and money flows at different points of the year, resulting in elevated levels of volatility.

Outlook

In early 2022, I highlighted some of the challenges we may see as a result of the removal of many of the extraordinary underpins for markets of recent years. It is not clear at all that we are through the fundamental transition entailed by the end of low interest rates. While the reintroduction of more rational pricing for risk and capital is welcome, the consequences of such a significant shift (and at such a fast pace) are unlikely to be short lived. The existence of ‘free money’ for so long, will no doubt have created widespread embedded distortions, which will take time to resolve. Low rates of economic growth, continuing pressure on both corporate earnings and consumer confidence, and limited scope for fiscal stimulus are likely to remain with us for some time, so that the conditions for a sustained recovery in markets appear at present to be remote.

In this environment we expect to continue with a relatively cautious exposure to quoted equities, while at the same time remaining positive about the opportunities for the long term which will emerge in stocks and alternatives such as the dislocated regional credit markets.

. . . . . . . . . . .

Diana Dyer Bartlett, chairman, Smithson Investment Trust – 28 February 2023

Uncertainty around future interest rate rises, high levels of inflation and fears of a recession are likely to continue in the coming year. Whether the opening of the Chinese market post the lifting of COVID‑19 restrictions will have a positive impact by generating economic growth or unleash further inflation or both is also uncertain. Political uncertainty has increased and there seems no end in sight to the Ukraine conflict. These are not easy conditions for a portfolio manager to navigate.

. . . . . . . . . . .

Managers, RIT Capital Partners – 28 February 2023

It may well be that we are witnessing a reversal of a decade’s material outperformance of financial assets over the real economy. Investors will likely need to adjust their expectations to the very different environment of a higher cost of capital, labour and raw materials, and with no safety net provided by central banks. Participating in this market will be remarkably difficult, with central banks having unfinished business in their fight against inflation, companies facing margin pressures and uncertainty around economic growth, and consumers adjusting to the tighter financial conditions after a period of generous covid support schemes. This backdrop, in our view, warrants a cautious net quoted exposure combined with dry powder.

However, we also believe the macro uncertainty discussed above, combined with the risk of ‘financial accidents’, can create compelling bottom-up liquid opportunities in both equities and credit markets. We will follow our long-standing disciplined approach, focused on fundamentals-driven investing while looking for strategic openings which present themselves in such dislocated markets.

We would note that our patient approach also means we are unlikely to participate in short-term sentiment driven rallies. Nevertheless, we have demonstrated our resolve to act quickly and decisively when there is an opportunity, such as the value-oriented assets that benefitted from a more reflationary environment. We believe there will be additional opportunities in the upcoming year. For example, in 2022, the market disproportionately punished all long duration assets as a result of higher discount rates, without discriminating between the fundamental ability for companies to produce healthy cash flows and continued growth. We believe that many high-quality companies in our private investment book as well as our quoted biotech exposure could benefit from the market taking a more discriminating view of long duration assets.

Additionally, over the past year, driven by the sharp rise in the cost of capital, there has been a considerable expansion of the opportunity set for strategies that do not require rising equity markets. For example, merger arbitrage, structured credit, and equity market-neutral strategies can produce healthy returns with little resort to leverage in the current market environment.

. . . . . . . . . . .

Tristan Hillgarth, chairman, JPMorgan Global Growth & Income – 27 February 2023

Six months ago, I noted that there were challenges facing the global economy and these continue. War, elevated global geopolitical tensions, increasing inflation, rising interest rates and slowing economic growth all point towards an uncertain outlook at least over the next couple of years. Much of the world may be facing recession in 2023, if not already there. Notwithstanding these risks, the positive start to 2023 continues with interest rate and inflation optimism as central banks stuck to their previous guidance and delivered the news investors were expecting. Global equity markets have continued their ascent on hopes that there is light at the end of the tunnel.

We note that current valuations of our portfolio stocks look reasonably attractive from a long-term perspective and should contribute to strong investment returns over time. We should not forget that recessions create investment opportunities.

. . . . . . . . . . .

Our only brief comment on the macroeconomic outlook this time around will be to say that the transmission mechanism for monetary policy works over years, not weeks or months. We should not expect a clear answer to the question of a recession for some time, and we would argue that even if one were to occur, it is more likely to be a mild one. Banks are better capitalised than in the past, the consumer has plenty of excess savings, the labour market is tight, and ultimately all of those factors contribute to one conclusion – there is just not that much leverage in the system. It is this leverage that in the past has caused recessions to become crises, and so whilst we continue to watch carefully, we don’t believe there is any cause for markets to panic, even if economic data does weaken this year.

We have spent a significant amount of time parsing through data to ensure that we are taking advantage of the very best valuation opportunities. We have seen a rapidly evolving landscape in recent months. Where a year ago we saw a sizeable growth bubble in the US, we now see (some) more reasonable valuations. We have seen a rebound in cyclicals more recently, yet there is still a real opportunity in certain sectors to find good value in these companies more sensitive to the overall economic environment. You might ask why, if we see a risk of a recession, we would choose to invest in these more cyclical names? The answer, of course, is valuation. If we were to wait until there was no controversy around these companies, we would miss the opportunity. We are fortunate to have over 30 years of data that helps us contextualise when companies are cheap versus their peers. It is that insight that has driven the strong recent performance, and we will continue to search out those most attractively valued names.

One notable characteristic of the portfolio today is the sizeable overweight to companies based in the United States. Whilst we are finding many opportunities in names that might be considered more cyclical, we do of course think carefully about the range of outcomes for each company. Undeniably, the US has been a more resilient economy than much of the rest of the world for some time, as they are less susceptible to external shocks impacting economic growth. Europe was facing a difficult time after the Russian invasion of Ukraine, and even China now still faces an ageing population despite reopening looking to boost the economy in the short-term. Therefore, to ensure that balance exists in the portfolio, and that no economic outcome can overly drive the fortunes of our shareholders, we see it as prudent to have more of the portfolio in US companies than has been the case for some time. One other important driver of this is the more appealing valuations of some US technology companies, after significant pullbacks in their shares over the past year.

. . . . . . . . . . .

Robert Hingley, chairman, The Law Debenture Corporation – 27 February 2023

The beginning of 2023 has brought some tentative optimism from investors that inflation and the cost-of-living crisis will perhaps subside sooner than first thought. While I welcome a more optimistic outlook on UK market valuations, particularly with the more stable environment that we are now seeing, there is still some way to go, and it is reasonable to expect much of this year to follow the current trends. The majority of the portfolio is invested in UK equities, although many of the earnings are derived from outside the UK. James and Laura continue to believe that UK market valuations are too low and offer some attractive longer-term growth opportunities with a lot of bad news already priced in.

. . . . . . . . . . .

James Henderson and Laura Foll, investment manager, The Law Debenture Corporation – 27 February 2023

The major event in the global economy during the period was the upward move in interest rates, as a result of inflation breaking out everywhere. The catalyst was the Russian attack on Ukraine, forcing up oil prices as well as agricultural products. Prices in other products and services responded by increasing at rates not seen for forty years. However, inflationary pressures had been building before the Russian attack. The effect of Covid-related restrictions led to supply issues in many product areas. The monetary expansion required to alleviate the worst effects the pandemic had in many areas was always likely to stimulate inflation.

The upward move in interest rates after a prolonged period of unnaturally low rates led to a number of foreseeable consequences. Property prices fell, as did other alternative asset classes, as investors demanded higher yields. However, the fall in the economy generally has not so far been as marked as some predicted, the reason being that, although interest rates were very low, this had not resulted in high levels of bank borrowing overall in the economy. The regulations brought in after the banking crisis had made accessing the low rates difficult for many. Therefore, the rapid rise in interest rates has slowed the economy, but not brought about deep recessionary conditions. This can be evidenced in the UK by the continued low level of unemployment. Inflation, as well as meaning interest rates rise, has put an upward pressure on wages, leading to public sector strikes. The debate rages about how entrenched inflation has become.

We remain mindful of this difficult economic backdrop, but the Portfolio is invested in individual companies not in “UK plc”. The businesses we regularly see are dealing with the cost pressures and achieving price increases for their products, which is resulting in a preservation of operating margin.

The intention is to be a net buyer of equities. Investors’ macro concerns have meant that valuation levels for companies are at historical lows. This is particularly the case with UK shares. There are opportunities to add positions for the Portfolio in companies that fulfil our investment criteria and we will continue to add to the Portfolio. The purchases will be in a diverse range of companies, as the testing economic conditions will mean some companies disappoint expectations. However, the dynamism and strengths to be found in some UK companies is not being recognised but, we are confident, it will become so, as some of the economic concerns are slowly resolved.

. . . . . . . . . . .

Lord Macpherson of Earl’s Court, chairman, Scottish American Investment Company – 10 February 2023

2022 has been another difficult year for the world, a period in which equity, bond and property markets have all been weak. As the challenges from Covid-19 receded those arising from the Russian invasion of Ukraine increased. The economic recovery from the worst of the pandemic has been more tentative than expected, in large part due to resurgent inflation. With hindsight, central banks were too sanguine about inflationary pressures in 2021, and the energy price shock arising from the Russian invasion pushed inflation to levels not seen in 40 years. As a result, central banks have had to raise interest rates much higher than expected a year ago. The retreat from globalisation has continued, with trade barriers increasing as countries seek to protect their supply chains in the face of greater geopolitical risks. Closer to home, political missteps eroded confidence though as the year drew to a close there were signs of greater calm and stability.

On the positive side, industrialised economies have shown extraordinary adaptability in the face of the energy shock. Oil and gas prices have fallen recently, creating a more benign outlook for inflation. And the world economy is set to grow in 2023.

Equity and bond markets were weak last year, and other markets including property have also experienced difficulties. As 2023 gets underway, there are tentative signs of hope triggered by lower energy prices and reduced interest rate expectations. It is too soon to know whether the worst is behind us: government finances remain under pressure and many companies will struggle to grow their earnings and protect their balance sheets in the face of slow economic growth. However, with asset prices adjusting, there will be buying opportunities, and maintaining a focus on the strength and resilience of individual investments remains as important as ever.

. . . . . . . . . . .

James Down, Toby Ross, managers, Scottish American Investment Company – 10 February 2023

Few predictions cast at the end of 2019 foresaw the advent of COVID in early 2020. Few of those who forecast continued economic despair during the ongoing lockdowns at the end of 2020 foresaw the enormous rally in equity markets in 2021. And few who prognosticated at the end of 2021 predicted the war in Ukraine at the start of 2022, with inflation reaching double-digits and interest rates spiking higher. As we begin 2023, we remain humble about our (or indeed anyone’s) ability to foresee what is just around the corner.

. . . . . . . . . . .

Carolan Dobson, chair, Brunner Investment Trust – 15 February 2023

2023 continues with some of the most troubling factors currently affecting the world: the ongoing war in Ukraine which confounds both logic and decency; and the inflation-fuelled cost of living crisis being felt tangibly by so many closer to home.

However, there are indications of inflation moderating. That may mean interest rate rises may be nearing their high but there is definitely central bank rhetoric in conflicting directions on the subject. The more soothing comments from China, as it reopens the economy, is a welcome development.

. . . . . . . . . . .

Katie Potts, manager, Herald Investment Trust – 15 February 2023

Market induced valuation volatility is one dimension to performance. The more important one for the long term is investing in successful growth companies. Our belief is that good companies will grow whatever the economic backdrop, and that technology will continue to open up new markets. Early-stage capital is always scarce and by ensuring that we identify and research good companies ahead of others we can benefit from this.

Technology spend used to be mainly a capital expenditure decision, and demand was vulnerable to economic cycles. However, today businesses cannot run without information systems which are increasingly provided as a service on a rental basis, in effect outsourcing capital expenditure. This also means that more technology spend, across datacentres and communications infrastructure as well as software, has become non-discretionary. Importantly it means many technology companies are less exposed to cyclical demand and have defensive characteristics like utilities. Furthermore, businesses and governments alike are faced with other inflating costs, and the UK and North America in particular have very tight labour markets, so there is greater pressure than ever to find efficiencies, driving further demand for technology investment. The consumer, although wedded to the internet, is perhaps more fickle and may reduce expenditure on content and consumer electronics in uncertain times. Equally, inflationary pressures may squeeze advertising demand which is showing signs of weakness, but digital media continues to gain share. Business-facing subscription content should be more resilient.

Companies manufacturing technology products such as semiconductors are more exposed to softening demand than software companies. They have suffered from supply chain issues associated with Covid and capacity constraints, particularly in the semiconductor industry. This has left many companies with record order backlogs so short-term demand is assured, but for those higher up the supply chain the inventory cycle could produce adverse impacts.

Takeovers have continued to be a strong feature this year. In contrast, IPOs were few and far between, with stock markets virtually closed to new entrants.

Whilst we remain confident about the longer-term prospects for the majority of the investee companies, we have concerns about the state of financial markets particularly for smaller companies. The UK smaller quoted companies market is the most challenged with particularly poor liquidity. This is an existential threat. The Company’s capital is much needed in the UK. The entrepreneurial early-stage part of the market, which the Company addresses, is on the frontline in the conflict between regulation and economic growth. Whilst we respect the need for regulation, it appears to us that the process of reducing risk from the markets seems also to be reducing the available risk capital. This is surely an unintended and undesirable outcome and a major factor in our gradually decreasing exposure to the UK market.

. . . . . . . . . . .

Tom Black, chairman, Herald Investment Trust – 15 February 2023

We are privileged to meet many management teams throughout the world on a recurring basis and this gives us an interesting perspective from which to assess our market background. Everyone thinks their own economic problems are worst. The UK has a particularly negative view of its own position, perhaps driven by recent political turmoil and media negativity on a wide range of problems. Thus far, profit expectations for companies in the UK portfolio have been particularly resilient, perhaps benefiting from sterling weakness relative to the dollar, and more conservative management of growth expectations. US businessmen are depressed by their country’s social tensions and excessive fiscal and trade deficits, which dwarf the UK’s. In contrast to the UK, in North America expectations for revenue growth are visibly weakening, and many companies have faced currency headwinds on their overseas revenues. The Chinese seem alarmed by their financial leverage, ageing population and a leadership unsympathetic to business. The manufacturing orientation of the sector in Asia means it is visibly more exposed to a cyclical slowdown in demand. Europe has the additional challenge of its proximity to Russia/Ukraine, energy supply issues, and most significantly the different countries in the Eurozone operating under one central bank, but no fiscal union. It is hard to find optimism in the current landscape.

Despite the myriad problems, the UK has the advantage of its own central bank, debt in its own currency, domestic gas production to meet half of its need and a significant capacity to generate electricity from wind with huge further potential. Perhaps due to the high cost of land and labour the UK has become a knowledge-based economy which is a significant positive and produces a large trading surplus in services, which are not energy-dependent. In addition, in a world of conflict and increased tensions, the UK does still have a defence industry which benefits a number of companies in the supply chain.

Beyond our home market, there continue to be opportunities for us in all of our markets. We have a strong focus on the United States which has scaled some software companies brilliantly, delivering high margins. As evidenced by the takeover volumes the Company has experienced, the scale of North American private equity activity has shrunk the size of the addressable listed market, albeit in recent years offset by a wave of speculative new issues. Whereas the AIM market in London has had numerous IPOs and secondary placings to raise development capital, US IPOs tend to have been exits for venture capitalists and private equity. Furthermore, there was a fashion for crossover funds or public company investors participating in late-stage venture rounds. This category of investor seems to have disappeared. As interest rates normalise, the extent to which these trends continue, and how they achieve exits, remains to be seen. Europe as a region is perhaps less easy to categorise and will remain a stock-specific market for the Company. Asia clearly the primary region for new listings, with its technology sector having emerged as a low-cost manufacturing location and now progressively moving up the value chain.

There are key areas of change which always open up opportunities for smaller companies. For many years there was a trend for manufacturing to migrate to China, with its lower labour costs. As salaries and skillsets in China rose and, more recently, as political concerns about China’s direction of travel have grown, other emerging economies such as Vietnam and Mexico have become more important as manufacturing hubs. Whilst this shift has been underway for some years, 2022 has added a further dramatic twist. The Ukraine war and the related supply chain issues have magnified concerns about security of supply. ‘Just in time’ and lowest cost is no longer the buyer’s prime motivation. ‘Just in case’ has become the new mantra. In addition, the increasing tensions between China and Taiwan are of great concern and any conflict there would dwarf the Ukraine impact on the technology sector given the central role played by Taiwan in semiconductor manufacturing.

The major disruption of Covid has also led to a change in the employment market. There has been a rise in working from home as well as a significant reduction in the proportion of working age people available to work in developed countries. Despite the obvious attractions of avoiding the cost of offices and employing people more cheaply from far corners of the earth, we are unsure what long-run effect this will have. Many of the companies in our portfolio are based in knowledge clusters such as San Francisco, Seattle, Boston and London, where knowledge feeds on itself. Can this be sustained with working from home? Will centres of excellence become less relevant? These remain unanswered questions at this time. There is some evidence that the tightness of the labour market is receding, and employees are coming back to the office so perhaps the working from home trend may not be so acute as we once thought.

Outlook

There are many reasons to be anxious as we look forward. Excess government leverage globally in an environment where the cost of capital is normalising, geopolitical tensions across the globe and energy market turmoil all play their part. In this environment it is challenging to reduce risk in any portfolio. However, against this background smaller companies with genuine growth prospects and intellectual property seem appealing. This is where the Company operates, and the best returns have been made from investments in 2002-3 post the internet boom and 2008-9 in the financial crisis. We are optimistic there will be good buying opportunities ahead.

. . . . . . . . . . .

Peter Burrows AO, chairman, UIL – 21 February 2023

A number of themes dominated global events last year: Covid-19, heightened geopolitical tensions, the outlook for inflation and interest rates, commodities and climate change.

On Covid-19 it was astonishing to watch China pivot from zero tolerance to living with Covid. The resultant surge in infections and herd immunity achieved will put the economy back on the front foot. Undoubtedly the impact on China will be brutal and scare people for many years to come. China is now focused on recovering the economy and we should expect that to translate into a surge in demand as the housing market and consumers recover. With China now open, the world’s economies should be able to return to normal whilst living with infections from Covid.

Inflation remains elevated. This has been driven by the developed economies response to lockdowns which was to economically support the consumers. The consumer in turn saved much of this funding which led to a surge in demand as developed nations reopened. Supply chain disruptions created during the pandemic also added to the pricing pressure. This trend has been viciously reinforced by the Ukraine War which has led to energy supply challenges and highly inflated costs. Add to this tight labour markets with below trend unemployment rates. The response from central banks has been to raise interest rates to head off spiralling inflation. Our expectation is that the central banks have done enough and that 2023 will be characterised by falling inflation and interest rates. Our central case is for the global economy to post positive GDP for the year led by EM.

The ongoing friction between China and the USA is a clash of ideologies and is likely to continue between the two nations and their allies.

How is the world and in particular corporates responding to the challenges above? Simply put, they are diversifying their supply lines. Within EM, we are seeing a strong shift from China to nearshoring, and this is expected to continue for much of this decade. Countries such as Vietnam, Mexico and eastern Europe should therefore benefit.

Climate change is increasingly shifting to be a central focus and rightly so given the alarming evidence of a planet faced by the need to change its fossil fuel dependency. Over time we expect green policies will drive dramatic change. Short term security of energy supply is the key focus for most countries as they deal with the fallout from the Ukraine War and sanctions on Russia, but we expect renewable energy to accelerate in the coming years.

Flowing on from this there is likely to be an outsized demand for commodities: especially those in demand as China reopens and the need for a greener economy. Copper and lithium are certainly two examples and under investment in production is also likely to be a factor. Commodity led economies such as Australia, Canada, Chile and Brazil, should therefore benefit.

For 2023 we are optimistic for the global economy. If a recession emerges in the developed world, we expect it to be shallow. We anticipate inflation and interest rates to recede over the year. We believe demand for commodities, especially battery commodities to be elevated. Consequently, we believe that headwinds are turning into tailwinds, which should be positive for equities.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Sir Laurie Magnus CBE, chairman, City of London Investment Trust – 16 February 2023

During the six months under review, UK inflation reached a 40-year high, driven by spiralling energy prices. The UK base rate, which was 1.25% at the end of June, was increased four times by the Bank of England, ending at 3.5% in December and with a further rise to 4.0% in the New Year. The 10-year Gilt yield, which was 2.2% in June, rose to 4.5% in September, partly due to rising inflation but also the unfunded tax cuts which were announced by the Truss government. The situation was made worse by a steep depreciation in the value of sterling and by selling from some pension funds to pay margin calls on derivative products. By the end of December, the 10-year Gilt yield had fallen back to 3.7% and the fall in sterling had reversed, with the new Sunak administration pursuing a more conventional fiscal policy. The trend of increasing inflation and tightening monetary policy also prevailed overseas with, for example, the US 10-Year Treasury yield rising from 2.9% to 3.9%. In contrast, UK equities were resilient, producing a return of 5.1%, as measured by the FTSE All-Share Index, helped by a strong performance from the mining sector (in anticipation of the reopening of the Chinese economy) and the oil and gas sector.

Inflation should fall over the next six months as the sharp upward movements in oil and gas prices at the start of the Ukraine war are timed out of the 12-month inflation calculation. The combination of a continuing tight labour market, higher wage settlements and strikes in various sectors of the economy is likely to keep inflation above the Bank of England’s 2% target for some time. This will result in continuing elevated interest rates when compared with recent years since 2009, albeit remaining below the higher rates prevailing before the financial crisis in 2008. The reopening of the Chinese economy, after its Covid lockdown finally ended, is positive for global growth, while lower oil and gas prices are helpful for consumers in the UK and overseas. The dividend yield premium of UK equities over bank deposits and 10-year Gilts has narrowed, but equities offer the prospect of dividend growth and can therefore provide some element of hedge against inflation.

. . . . . . . . . . .

Frank Ashton, non-executive chairman, Athelney Trust – 13 February 2023

The year of 2022 was, for many, including the investment community, one to forget. Shocks and surprises marked the year, which ended very poorly with market uncertainty and loss of confidence created by the short-lived Liz Truss premiership, made worse by the impact of double-digit UK inflation.

In an interview with the BBC in 2014, Charlie Munger, renowned partner in Berkshire Hathaway said: “Without a system of wise restraints, gross immorality and extreme craziness will happen in markets. They need to be dampened.” He was talking about some of the causes of the Crash and Global Financial Crisis in 2007-08, but this is also true elsewhere. For example, a leader operating in a powerful political and governmental system with few restraints represents a risk: Ukraine’s citizens, and to a lesser extent a large proportion of Europe’s population are paying the price for Putin’s ‘grossly immoral’ and unfettered ambition to control that country.

A new prime minister, seemingly believing the only opinions on the September mini-budget that mattered were her own and her Chancellor’s, was swiftly brought low; however the damage had been done. The mini-budget resulted in ‘craziness’ for a few weeks with a dramatic loss of financial market confidence in the UK resulting in the Bank of England being forced to stabilise the bond market by temporarily buying long-dated UK gilts. Enter Hunt and Sunak as new Chancellor and PM to try to return the narrative to calmer and more acceptable content and tones. Now homeowners who have to start a new mortgage term face a dramatic rise in cost and many wish Truss and Kwarteng had used any ‘system of wise restraints’ before launching that particular mini-budget against the backdrop of a rising cost of living crisis.

All these events had a heavy impact on the UK Smaller Companies segment, the focus of this fund; smaller companies can be perceived to be a riskier investment because they tend to be less liquid and less resilient stocks in a challenging environment, compared even to FTSE-250 companies. Market sentiment has recently been strongly negative to this segment. By comparison the blue-chip FTSE-100 fared better than most markets because these large ‘old-fashioned’, liquid, oil/gas- and commodity-based stocks were buoyed by the run from UK bonds, representing a safer haven than, for example the NASDAQ where Big Tech companies had a torrid 2022.

This time last year I commented on Apple being the first stock to reach $1 trillion market cap on 4 January 2022, after tripling the share price over the prior two years. Well, in 2022 Apple lost a third of that value, beset with problems on iPhone 14 shipments due to COVID restrictions at its main Chinese factory, resulting in declining earnings and disappointing fourth quarter guidance.

I mention such a large US stock in a UK small company fund report because this poor year, especially for Apple shareholders is a timely reminder; we should be investing in good stocks and management teams for the long term and resist perhaps emotionally driven reactions to news or poor performance over a relatively short period of time. Wars, times of political incompetence, market corrections and yes, apparent evidence of fraud at ‘star companies’ (such as Sam Bankman-Fried’s crypto empire FTX) should really not surprise us much. Human nature and systemic failings are hardly news. Temperament is much more important than intelligence for investors (as Messrs Buffett and Munger have told us for a long time).

Outlook

Perhaps the main questions that will affect our performance for 2023 include:

- How long will UK inflation remain above that of other countries in Europe, and what interest rate medicine will be needed to bring it back in line (after reaching a peak of 11.7% in October, are we over the worst). This will affect our income

- What costs, including those to settle public sector pay negotiations, will be incurred by the government, over what period of time, and is a Labour government now inevitable in 2025; this affects general sentiment on the economy, tax burden and confidence for investors, including inward investors

- What global assistance or headwind for UK economic recovery might be expected? Potential global recession, no sight of an end to war in Ukraine, the rate and strength of recovery for China’s economy, and the apparent weakening of America’s economy, all play into the geo-political environment.

. . . . . . . . . . .

Dr Manny Pohl AM, fund manager, Athelney Trust – 13 February 2023

While I was preparing to write this year’s commentary, the following quote came to my attention:

“Time is the friend of the wonderful business, the enemy of the mediocre.” Warren Buffett – Letter to Shareholders 1989

While supply chains are stretched and input products in short supply, it can be challenging to recognise the potential in companies, particularly those that are in the growth stage of their life cycle. It can also be difficult to evaluate the ‘narratives’ that some companies are telling about themselves. To invest in a company in the growth stage of their life cycle it is important to balance the company’s narrative alongside its numbers and it is vital not to get caught up in the hype and noise of the internet and daily market movements.

A sound investment philosophy sets out a number of ‘rules’ or ‘procedures’ to fall back on when the market noise gets too loud. Companies that have a sustainable competitive advantage will always be well-placed to withstand short-term headwinds, regardless of market conditions, maintain market share and ultimately find new ways to grow. Their ability to be flexible, to move quickly, to take advantage of opportunities as they arise, and to capitalise on market trends and demand, will continue to support the ongoing success of such businesses, and provide significant long-term opportunities for their investors. The pandemic, devastating weather events, and the invasion of Ukraine are examples of macro-environmental shocks impacting companies worldwide and it is also of paramount importance to take a holistic approach when analysing the companies and their sustainability by considering the business competitiveness and ability to dynamically adapt and react to black swan events – to be resilient.

Over the past few years our industry, and society more broadly, has continued to evolve with higher expectations being made of businesses and their social licence to operate. Being a good corporate citizen is only part of it. Being a good corporate citizen that is compassionate, committed to its people, planet, and the community is mandatory. Any successful business owner makes decisions for the betterment of their long-term business. Having sustainable practices and a long-term mindset is vital for any operator in this modern, rapidly changing world.

. . . . . . . . . . .

John Evans, chairman, JP Morgan Mid Capital Investment Trust – 10 February 2023

2022 was a poor year for equites on a global scale and in the UK the Mid Cap index recorded a disappointing return and one that was, unusually, significantly lower than the larger cap indices of UK equities. This is reflected in high levels of outflows from UK equity funds in 2022 and widening discounts for UK equity orientated investment trusts.

The reasons are not difficult to identify being a combination of rising energy and commodity prices, leading to sharply higher than expected rates of inflation which the Bank of England has responded to by beginning to raise short term interest rates. The follow through from the resurgence in inflation has been a rising number of labour disputes as employees seek wage rises in line with the increase in cost of living. Some of these negotiations have culminated in a series of strikes by workers in many key sectors.

The highly damaging political hiatus in September undermined international confidence in UK debt markets and came about at the precise time that the Bank of England was in the process of replacing quantitative easing with quantitative tightening. Debt is now priced more realistically than has been the case since 2008 and perhaps of greater import will now be less freely available and hopefully more appropriately employed.

All of the above combined to produce an awful background for the FTSE 250 and performance has reflected this. However, looking at long term valuations it is clear that much of the downside may now be priced in, indeed over the past 30 years there are only three other periods where forward valuations have been close to current levels.

The market has recession priced in and the ongoing risk is that the decline in earnings and profits is greater than currently anticipated.

. . . . . . . . . . .

It is very easy to paint a dark and gloomy picture of the UK economy, and therefore of its perceived stockmarket proxy, the FTSE 250 Index. However, markets (and investors) are pre-emptive, and looking out to the next 12-18 months provides reasons to be more optimistic.

In line with most economists, we expect a mild recession in the UK in 2023. We believe inflation has peaked in the UK, and while we expect it to remain elevated, we do foresee a significant decline from the current 10.7% over the course of this year. In part this is due to gas prices, which are substantially lower than the peak in 2022, although still high versus historical metrics. After nine increases last year and one increase on 2nd February 2023, interest rates at 4.0% are much closer to peak. Consumer confidence remains very weak – headlines, strikes, utility bills and potential house price declines are all playing a part – but the unemployment rate remains very low at 3.7% and there are still over a million job vacancies. Freight rates have fallen significantly, and it appears that supply chains are beginning to function more normally, aided by the re-opening of China.

This leads us to valuations. The environment is going to remain extremely difficult for businesses and consumers to navigate this year – but a lot of this is already reflected in valuations. While it has rallied off its 9.8x low in October, the FTSE 250 Index price to earnings ratio is around 12x and on our favoured free cashflow yield metric the Index is undeniably attractive on 4.5%. As we have said before, acquirors of UK businesses recognise this. Merger & Acquisition (‘M&A’) activity continued in 2022 despite the economic backdrop, and we strongly believe it will continue this year while valuations remain so compelling on any sensible timeframe.

. . . . . . . . . . .

Christopher Samuel, chairman, BlackRock Throgmorton Trust – 9 February 2023

In my report to shareholders this time last year, the UK had led the developed world with a successful vaccine roll-out and there was, to some extent, a degree of optimism as the spectre of COVID-19 dissipated and economic activity returned to more normal levels. However, although the uncertainty caused by COVID-19 related lockdowns had been removed, there were indications that there had been more longer-term structural damage to the UK economy. This damage became evident as companies reported supply chain bottle necks, labour shortages and rising operating costs, which were either absorbed, or in many cases, passed onto the consumer.

As the UK economy struggled with the challenge of transitioning from a COVID-19 driven demand for goods over services model, to a more balanced goods and services-based economy, this supply pressure inevitably led to rising prices and in turn rising inflation. These inflationary forces were then exacerbated by Russia’s invasion of Ukraine in early 2022, triggering an energy supply shock, with Europe being hit hardest given its reliance on Russian gas. The resultant spike in wholesale energy prices, coupled with price hikes for agricultural commodities, pushed up the cost of many food staples, driving up two of the key elements of inflation to levels not seen in over 40 years. The notion of ‘transitionary inflation’ was now firmly discredited and inflation not only persisted but continued to rise unabated throughout the financial year. At the time of writing UK inflation, as measured by the Consumer Price Index, is at 9.2%, having peaked at 11.1% in October 2022.

The Bank of England took decisive action to combat soaring inflation by reiterating its commitment to the 2% inflation target “at all costs” and implemented tighter monetary policy through several interest rate hikes during the year. Similar action was seen globally, as central banks sought to unwind decades of accommodating monetary policy resulting in excess market liquidity which has acted to stoke inflation. However, this action has negatively impacted UK growth forecasts and raised the likelihood of a more prolonged economic recession. The stock market responded by adjusting valuations downward to reflect this more challenging economic back drop and the compounding effect of a weakening pound, higher input costs and rising wages on corporate profit margins. This downward revaluation was particularly acute in the high-quality growth stocks within our portfolio, and many were materially re-rated, despite posting strong results and material trading updates.

. . . . . . . . . . .

Dan Whitestone, manager, BlackRock Throgmorton Trust – 9 February 2023

Financial markets and macro data remain volatile and markets are likely to continue to be driven by inflation statistics and indications (or not) of slowing the pace of monetary tightening from central banks. This push and pull dynamic is likely to remain a recurring theme in the foreseeable future, but ultimately we continue to see evidence to support our thesis that inflation has peaked and is indeed falling and this will ultimately lead to the Federal Reserve (Fed) to adjust their course. Some of the largest contributors to headline inflation (energy and food) are now showing lower year-on-year increases and might even turn negative year-on- year as we move into the first quarter of 2023.

At the time of writing, four of the seven categories in core inflation (core inflation strips out food and energy from headline inflation) saw price declines in November data. Based on the data we track, we see leading indicators for shelter, the last remaining large positive contributor to core inflation, also reducing. We are not predicting either an imminent pivot by the Fed, nor a return to the ultra-lax monetary policy of the 2020/2021 period. We suspect the Fed will not pivot until there is a CPI data showing inflation close to 2% on a year-on-year basis. Our current best guess is quarter three of 2023, but we are not betting the house on it and will be led by the data. The change from hiking 75bps to hiking only 50bps at the last meeting demonstrates the direction of travel here too. That said, we do not expect this to be a smooth process and the market is likely to remain sensitive to both inflation data and any indications of changes to Fed policy.

Turning attention to the portfolio, we would urge investors not to conflate share price weakness with a deterioration in investment cases. Many of our investments have demonstrated incredible earnings resilience through 2022 despite the challenges they have faced from rising input costs, supply chain pressures and weakening demand. They continue to generate cash and have strong balance sheets. Valuations have been reset and we feel that right now there is an asymmetric risk/reward profile developing within the portfolio. That is not to say that we think the market has definitively bottomed, but we do think very much that the worst is behind us, and share prices are already pricing in extremely bearish scenarios with little attention (and value) ascribed to their long-term prospects, increasing profits and growing cash flows. This will return in time.

Whilst we are always open to adding new short positions to the portfolio, we continue to believe the best value in the market today remains in well-financed companies with enduring long term organic growth prospects that will use this period to enhance their position to win more share.

We look to the year ahead with optimism.

. . . . . . . . . . .

UK market sentiment was dominated by concerns around inflation as the consumer price index (CPI) continued to rise, driven higher by increases in the prices of imported goods and particularly the rising costs of energy, all of which had been exacerbated by the war in Ukraine. In order to try and keep control of the rapidly rising inflation figure the Bank of England raised interest rates four times during the six month period from 1% to 3%, with an additional with additional increases in December and February taking the Bank of England Base rate to 4% currently.

The additional issues of US-China relations regarding Taiwan, and UK domestic politics, which included two new Prime Ministers over the period, continued to play a part in the background. The ill-fated ‘mini budget’ announced by the Truss government caused turmoil in the gilt market. The Bank of England intervened to provide liquidity to some market participants and after the unfunded tax cuts were abandoned, yields gradually fell back to levels seen before the budget. Sterling also recovered from its lows versus the US dollar.

Commodity prices during the period generally remained elevated although some key commodities such as oil and gas and wheat have eased. Prices of these commodities are of particular interest as they form a significant part of input costs for businesses whether it be production, transportation, ingredients or animal feed. Should prices fall further this would likely bring inflation down as we move through 2023.

The end of the period was marked by an increase in industrial action by various trade unions as the increased costs of living weighed on consumers. This caused many key services to reduce productivity which will undoubtedly have an impact on the UK economy. Estimates are that the impact of the disruption since June 2022 currently stands at around £3.2 billion or 0.25% of GDP. At a time when economic growth will be difficult to come by, a swift conclusion to the industrial action would be welcome.

Despite the headwinds of high inflation and higher interest rates we are optimistic that inflation will moderate over the course of 2023. We also recognise that uncertainties in the global economy and the geo-political landscape continue to make the range of possible outcomes particularly wide.

We spend a great deal of time speaking to the management teams of companies. Their knowledge and expertise give us a great deal of insight into the sectors and economies in which they operate, often these insights can be more informative than regional economic data. It is because of this global footprint of the companies in the FTSE All-Share Index that we often say that the UK equity market is not a proxy for the UK economy. More than 75% of corporate earnings in the FTSE All-Share Index are derived internationally. Our analysis shows UK equities to be cheap across a blend of valuation measures, relative to history, and in particular relative to the US market. This opportunity is evident in every major sector, not just at an index level.

The current environment remains difficult to predict and whilst we believe that inflation may begin to fall quite quickly later this year, the fact remains that this will be largely due to base effects coming through. Prices for many of the goods and services that have risen sharply over the last year, as a result of rising input costs, specifically energy prices and second order effects of this, will likely remain elevated. Those companies that are able to pass on or absorb these increases, will likely fair better in our view.

. . . . . . . . . . .

Wendy Colquhoun, chairman, Henderson Opportunities Trust – 2 February 2023

During periods of growing investor caution, it is often smaller companies that fall quickest and most steeply. This year was no exception. While the FTSE All-Share Index fell a modest 2.8%, the FTSE 250 Index of medium sized companies fell 20.5%, the FTSE Small-Cap Index fell 18.6% and the AIM All-Share Index of the smallest listed UK businesses fell 33.2%. It is the Fund Managers’ view (shared by the Board) that steep falls in UK smaller company share prices have left valuations at attractive levels. Therefore, despite the current uncertainty, it is these low valuation levels and the belief that the companies held can grow over the long term that lead us to think there is currently considerable opportunity for the patient investor.

. . . . . . . . . . .

James Henderson and Laura Foll, fund managers, Henderson Opportunities Trust – 2 February 2023

There are about a thousand companies quoted on the main list and AIM that we could invest in. Some of them over the next few years will become substantially larger regardless of the economic backdrop. The successes will come from many different areas of activity. They will have two things in common – dynamic management and strong business propositions. They will seize the opportunities that come along as well as having long-term strategies. There will also be many corporate failures. The current low valuation of the average company suggests the balance of probabilities is very much in the investors’ favour as the corporate successes have current share prices that do not price in the prize of success. This is because despondency is high among investors with general concerns about the economy colouring appraisal of individual companies.

Graeme Proudfoot, chairman, BlackRock Income and Growth Investment Trust – 1 February 2023

When I reported to shareholders at this time last year, the UK market had been buoyed by a successful vaccine roll-out and there was, to some extent, a degree of optimism as the shadow of COVID-19 faded away and economic activity started to return to more normal levels. However, although the risk of direct COVID-19 related disruption appeared to have dissipated, the longer-term damage to the UK economy that many had feared was evident in strained supply chains, labour shortages and the rising price of materials, freight and logistics.

As the UK economy struggled with the transition from a COVID-19 driven demand for goods over services, to a more balanced goods and services-based economy, the mismatch in demand over supply inevitably led to rising prices and in turn rising inflation. This supply chain pressure was compounded by China’s zero COVID-19 policy, which created bottle necks and was at odds with the resumption of economic activity seen around the industrialised world.

As we moved through early 2022, Russia’s invasion of Ukraine triggered an energy supply shock, resulting in soaring wholesale energy prices, as well as price spikes in agricultural commodities, pushing up the cost of many food staples and further exacerbating the supply constraint led inflationary forces seen at the start of the period. These powerful inflationary drivers ensured the rate of inflation continued to rise throughout the financial year and at the time of writing UK inflation, as measured by the Consumer Prices Index, is at 9.2%, having peaked at 11.1% in October 2022.

The Bank of England has taken action to combat rising inflation by reiterating its commitment to the 2% inflation target and through monetary policy it has implemented several interest rate hikes during the year. However, this action has not come without cost, negatively impacting growth forecasts and raising the likelihood of a more prolonged economic recession. The stock market responded by adjusting valuations downward to reflect this more challenging economic environment and the compounding effect on corporate profit margins of a weakening pound, higher input costs and rising wages. This rise in operating costs has, in many cases, been passed on to the consumer, whose spending power has been steadily eroded as the rising cost of living bites.

. . . . . . . . . . .

As we look ahead into 2023, the headwinds facing global equity markets are evident. Inflation has consistently surprised in its depth and breadth, driven by the resilient demand, COVID-19 supply chain constraints, and most importantly by rising wages in more recent data. Central banks across the developed world continue to unwind ten years of excess liquidity by tightening monetary policy desperate to prevent the entrenchment of higher inflation expectations. Meanwhile, the risk of policy error from central banks or politicians remains high as evidenced by the turmoil created by the “mini-budget” in the UK that sent gilts spiralling. The cost and availability of credit has changed and strengthens our belief in investing in companies with robust balance sheets capable of funding their own growth. The rise in the risk-free or discount rate also challenges valuation frameworks especially for long duration, high growth or highly valued businesses. We are mindful of this and feel it is incredibly important to focus on companies with strong, competitive positions, at attractive valuations that can deliver in this environment.

The political and economic impact of the war in Ukraine has been significant in uniting Europe and its allies, whilst exacerbating the demand/supply imbalance in the oil and soft commodity markets. We are conscious of the impact this has on the cost of energy, and we continue to expect divergent regional monetary approaches with the US being somewhat more insulated from the impact of the conflict, than for example, Europe. Complicating this further is the impact COVID-19 has had on certain parts of the world, notably China, which has used lockdowns to control the spread of the virus impacting economic activity. More recently, China’s reopening in January 2023 has been well received by markets, with the return of the world’s second largest economy bolstering the global outlook. However, the rapid reversal of the lockdown policy has seen infections rates surge to levels not seen since the height of the pandemic. We also see the potential for longer-term inflationary pressure from decarbonisation and deglobalisation, the latter as geopolitical tensions rise more broadly across the world.

We would expect broader demand weakness as we enter 2023 although the ‘scars’ of supply chain disruption are likely to support parts of industrial capex demand as companies seek to enhance the resilience of their supply chains. A notable feature of our conversations with a wide range of corporates has been the ease with which they have been able to pass on cost increases and protect or even expand margins during 2022 as evidenced by US corporate margins reaching 70-year highs. We believe that as demand weakens and as the transitory inflationary pressures start to fade during 2023 (e.g. commodity prices, supply chain disruption) then pricing conversations will become more challenging, despite pressure from wage inflation which may prove more persistent. While this does not bode well for margins in aggregate, we believe that 2023 will see greater differentiation as corporates’ pricing power will come under intense scrutiny.

The UK’s policy has somewhat diverged from the other G7 countries in fiscal policy terms as the present government attempts to create stability after the severe reaction from the “mini-budget”. The early signs of stability are welcome as financial market liquidity has increased and the outlook, whilst challenged, has improved. Although the UK stock market retains a majority of internationally weighted revenues, the domestic facing companies have continued to be impacted by this backdrop, notably financials, housebuilders and property companies. The valuation of the UK market remains highly supportive as currency weakness supports international earnings, whilst domestic earners are in many cases at COVID-19 or Brexit lows in share price or valuation terms. Although we anticipate further volatility ahead as earnings estimates moderate, we know that in the course of time, risk appetites will return, and opportunities are emerging.

We continue to focus the portfolio on cash generative businesses with durable, competitive advantages with strong leadership as we believe these companies are best-placed to drive returns over the long-term. We anticipate economic and market volatility will persist in 2023 and we are excited by the opportunities this will likely create by identifying those companies using this cycle to strengthen their long-term prospects as well as attractive turnaround situations.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Alexander Darwall, investment manager, European Opportunities Trust – 24 February 2023

The challenges faced by Europe are well-known: the energy crisis, inflation, higher interest rates, weak demand in China for Europe’s exports, and dysfunctional labour markets. European equities are out of fashion and international investors have been substantial sellers of European equities. Where there is optimism, it might be unfounded in that the energy crisis is likely to remain a blight on Europe for years, and interest rates are likely to remain high for years. Europe’s energy transformation, exacerbated by the conflict in Ukraine, massively increases Europe’s energy bill. By some estimates power and gas costs are increasing by around EUR500bn between 2022 and 2024, something like 3% of the EU’s GDP. Consumer spending has remained remarkably robust, perhaps indicating an expectation that the authorities will, once again, come to the rescue with cheap or ‘free’ money. We think this is unlikely. Inflation has set in, and the authorities will have to keep interest rates high in an attempt to bring it down. Inflation impairs the prospects for almost all asset classes including equities. Moreover, the policy direction is Quantitative Tightening (“QT”) not Quantitative Easing (“QE”), meaning that interest rates are likely to remain high.

. . . . . . . . . . .

Stefan Gries, representing the manager, BlackRock Greater Europe Investment Trust – 15 February 2023

We expect equity markets to remain volatile in the near-term as macro uncertainty remains elevated. Going forward, it will be important to see whether inflation comes down to levels the market can deal with. With energy prices having come down, there is reason to be hopeful this can be achieved. Clarity on the terminal rate of this hiking cycle – and a potential peak – would likely be enough to bring attention back to company fundamentals – the ultimate driver of long-term equity returns.

The market is forward looking and at some point will start to consider what a recovery could look like. For now, European equities remain under-owned and valuations are low. Some areas of the market, particularly within the cyclical sectors, have suffered a significant derating and signs of economic optimism such as easing inflation or a potential China re-opening, could help close some of these valuation gaps.

Whilst there are a number of unknowns from a macroeconomic perspective, we see opportunities for attractive returns in select areas. Corporate balance sheets are in decent shape and in much better positions than in previous downturns. Many companies in Europe have spent the last decade deleveraging balance sheets and interest coverage is significantly higher than during the Global Financial Crisis or other prior periods associated with deep recessions or prolonged bear markets. Corporate spending intentions also remain healthy and this spend is often linked to transformational capex.

Lastly, long-term structural trends and large amounts of fiscal spending via the Recovery Fund, Green Deal and the REPowerEU plan in Europe can drive demand for years to come, for example in areas such as infrastructure, automation, innovation in medicines, the shift to electric vehicles, digitisation or decarbonisation.

. . . . . . . . . . .

Global emerging markets

(compare global emerging markets funds here and country specialist funds here)

Maria Luisa Cicognani, chairman, Mobius Investment Trust – 28 February 2023

2022 turned out differently from what many economists had projected. The war in Ukraine and China’s hard stance on Covid-19 pushed the recovery back, when it had been expected to pick up pace in the second half of 2022.

However, a number of indicators are now pointing towards an improved outlook for 2023, especially for Emerging Asia.

- inflation in the US has slowly been coming down – while it is not yet at desired levels, the fact that it peaked is a signal that

- monetary policy will start to ease;

- China has moved away from zero-Covid with surprising swiftness and determination, and this will spur the recovery, especially in Asia;

- accordingly, growth in emerging Asia is expected to pick up driven by local demand, while growth in Europe and the US is forecast to slow down this year;

- the USD rally has come to a halt amid easing inflation and with the end of the aggressive tightening cycle looming on the horizon.

All of the above, I believe, will benefit emerging markets. In addition, unfavourable sentiment towards the asset class during 2022 has left EM companies trading at record-low valuations compared with developed market peers as well as their own history, offering an attractive entry point.

We are already seeing a reversal in sentiment. After net inflows into the asset class in October, November and December of last year, during January 2023, emerging markets saw the largest monthly inflows in two years.

Challenges remain, with the war in Ukraine not nearing an end, a potential recession looming in the US and Europe, US‑China tensions continuing and China struggling with the resurgence of Covid-19 cases. However, given the above‑mentioned tailwinds, I believe, emerging markets have the potential to outperform after a long stretch of underperformance.

. . . . . . . . . . .

Carlos Hardenberg, Mark Mobius, investment managers, Mobius Investment Trust– 28 February 2023

Emerging market investors have witnessed troubled waters over the past few years: a global pandemic that had a negative impact on trade, consumption and supply chains; increased geopolitical tensions between the US and China; a war in Europe with wide ramifications for global trade and fiscal policies resulting in rising inflation, tighter monetary policy and appreciation of the US dollar. Furthermore, volatile commodity prices that benefitted a few countries but hurt many, and very difficult capital market conditions made it particularly difficult for emerging markets. In summary, all of this has led to very low confidence, record capital outflows and a sell-off in emerging markets. Over the last 10 years, emerging markets have delivered close to negative annualised real returns.

After this prolonged period of weak performance, we now see several indicators suggesting that the tide is turning. First of all, investors should never lose sight of valuations. We are currently witnessing record levels of under-valuations in EM: the present average price to book value at nearly 1.5x is in the 30-year bottom quartile.

Secondly, while the US and certainly Europe will be challenged by a moderate to deep recession in 2023, growth in emerging markets, particularly in Asia, is forecasted to recover to average 4.9% in 2023. This should encourage investors to focus on these growing regions. The radical shift by the Chinese government away from zero-Covid that we have been witnessing in the past two months will have a very positive impact on growth and supply chains. We believe that we are at the beginning of a multi-year earnings growth recovery, and this will be driven by the reopening in Asia.

Furthermore, inflation pressure in the US is moderating. The slowing pace in inflation is a clear indicator that the Fed’s rate hiking cycle is nearing its peak and monetary policy is expected to ease. Many emerging markets are ahead of developed markets in the hiking cycle and inflationary pressure, especially in Asia, remains contained. The US dollar rally is losing steam on the back of favourable inflation data, easing the pressure on emerging market currencies, debt and monetary policy.

Finally, over the past 20 years, business models in emerging markets have significantly evolved. Investors can find highly innovative companies that are still relatively undiscovered by the market. The new driver in emerging markets is technological innovation in areas including, but not limited to, factory automation, renewable energy, AI or Internet of Things (IOT), as well as digitalisation and modern and efficient service offerings.

Conclusion

The next year no doubt will remain challenging, with recession looming in Europe and the US. However, all of the above will be priced in well in advance and we have already seen a shift in investor sentiment towards emerging markets. After net capital flows to EM during Q4 2022, January 2023 saw the highest portfolio inflows to EM in two years according to the Institute of International Finance, with $65.7 billion.

We have heard many differing opinions about what investors can expect from the coming year. We share the view of Neil Armstrong, the first man on the moon, who once wisely said, “We predict too much for the next year and yet far too little for the next ten.”

. . . . . . . . . . .

Anderson Whamond, chairman, Gulf Investment Fund – 22 February 2023

Following the recent sell-off in the market, valuations are becoming more attractive and we believe the markets will recover as soon as global market volatility settles down. Going into 2023 the outlook for GCC remains robust, supported by socio-economic reforms, infrastructure projects, and favourable oil supply-demand dynamics that provides the majority of GCC states with twin surpluses as well as an economy that is mostly shielded from recession fears in Europe & US.

. . . . . . . . . . .

Managers, Gulf Investment Fund – 22 February 2023

Valuations are turning attractive, and we believe markets will recover as global market volatility settles down. Going into 2023, we believe the outlook for GCC remains robust, supported by socio-economic reforms, infrastructure projects, favorable oil supply-demand dynamics that provides majority of GCC twin surpluses as well as an economy that is mostly shielded from recession fears in Europe & US.

While global investors generally are underweight Qatar, Kuwait, and Saudi, the weighting of the GCC in EM indexes is expected to increase as more IPOs are listed, governments sell stakes, and foreign ownership limits increase.

Oil continues to support the GCC’s economic stability, as other economies are still facing elevated inflation and interest rate hikes. A combination of high oil prices, tax and expenditure reforms (like the introduction of VAT) and continued non-oil growth will lead to an improved GCC fiscal balance of 7.3 per cent of GDP by 2022, which is expected to remain positive for the foreseeable future. GCC countries have benefited from significantly higher oil prices, which have converted budget deficits into surpluses for 2022.

The increase in hydrocarbon prices provides an opportunity for GCC countries to shift to a green growth strategy and accelerate economic diversification by investing their windfall in sustainable sectors. GDP growth for GCC is expected to more than double vs 2021, reaching 6.5 per cent in 2022. Despite continued increase in inflation levels not seen in decades in many parts of the world, the inflation outlook for the GCC is relatively benign at 3.6% in 2022 and 2.6% in 2023, according to IMF’s Regional Economic Outlook for October 2022.Global investors interest in GCC should increase. However, foreign inflows to the GCC will continue, attracted by credible fixed currency rates, generous dividend yields, high oil prices and market reforms.

. . . . . . . . . . .

Dien Vu, portfolio manager, Vietnam Enterprise Investments – 08 February 2023

Last year’s precipitous market decline largely tracked increased global risk aversion as the Federal Reserve aggressively raised rates. Domestic pressures on the economy that emerged due to a weaker currency, imported inflation, and local rate hikes pushed money from the market onto the sidelines. Vietnamese sentiment however soured more than the global trend and arguably reached peak fear in Q4 2022 due to unintended consequences from policy decisions aimed, ironically, at improving the robustness of the capital markets.

Despite this, the economy saw impressive GDP growth of 8.0%, the highest in ten years. We have reason to believe the worst is behind us and that a repeat of the events that plagued market sentiment in 2022 is unlikely. Local political events that caused the market to decouple from major global indices have been addressed, and new Government initiatives are currently helping to reverse both cause and effect of these homegrown themes, and at serious pace.

Amendments to Decree 65 are aimed at reopening the bond market to ease corporate restructurings. More recently, Decree 26, which addresses the loan-to-deposit ratio in the banking system, previously expected to remain unchanged, now seems to be showing signs of loosening. This is intended to support system liquidity and create a calmer environment within the banking sector. For now, we can see the Government’s trepanning of the 2022 liquidity headaches is working, this will help the real estate and banking sectors avert crisis to slowly gain momentum, which together make up over half the Vietnam Index. The Vietnam Bond Market Association has stated US$9.0bn of corporate bonds were bought back before maturity in 2022, spiking in December at US$1.7bn. Major corporates redeeming bonds early, and at an accelerated rate, disabuses the wider consensus of an inherent systemic risk that companies are well positioned to service their debt. This can easily be interpreted as good news, however there are c.US$13bn of corporate bonds maturing in 2023, the majority in H2, meaning default risk is still a concern in a high-rate environment.

Whilst aggregate earnings may not necessarily excite at first glance, it is worth noting these figures are skewed towards sectors such as real estate, which have been heavily sold and are underperforming due to a high interest rate environment and sector-wide liquidity problems, yet still represent 15.5% of the market’s earnings.

The top 80 stocks under the Investment Manager’s coverage have a trailing P/E of 11.8x, which is one standard deviation below the three-year mean, a significant recovery from the low base of 9.4x in 2022, and with healthy balance sheets and a modest debt-to-equity ratio.

We believe the ability to see through the short-term fog of volatility is crucial for accumulating high-quality stocks for the medium-long term as the market moves from a beta to an alpha one. This means picking stocks with strong balance sheets, solid fundamentals, and excellent corporate governance. These select companies will generally have more of a margin of safety against internal and external factors, reducing downside risk and leading to favourable EPS growth in 2023.”

Macroeconomic Commentary

- GDP growth in Q4 2022 was registered at 5.9% year-on-year and 8.0% for 2022. The services sector was the main driver, rising 8.1% in Q4 2022 and 10.0% for the full year.

- Q4 2022 exports were US$89.2bn with imports at US$85.2bn, down 6.8% and 3.6% year-on-year, respectively, which has been attributed to a high-base effect from Q4 2021 and the global slowdown. The trade balance for the quarter was US$3.96bn compared to US$6.5bn in Q4 2021.

- For the whole of 2022, Vietnam’s exports and imports amounted to US$371.9bn and US$360.2bn, increases of 10.6% and 8.4% year-on-year, respectively. The annual trade surplus was recorded at US$11.2bn, the second highest ever in Vietnam following the US$19.9bn that was posted in 2020.

- FDI disbursement finished 2022 at US$22.4bn, having recorded US$7.0bn of disbursements in Q4 2022, an increase of 13.5% and 7.9% year-on-year, respectively.

- Registered FDI was recorded at US$27.7bn, a fall of 11.0% year-on-year. The overall decline is thought to be due to disrupted feasibility studies for new projects. The manufacturing sector attracted the highest registered FDI of US$16.8bn, contributing 60.6% of the total.

- The Vietnamese dong appreciated 1.0% against the USD in Q4 2022, putting the total depreciation at 3.4% YTD as of 31 December. The Vietnamese dong depreciated 6.9% against the pound sterling in Q4 2022 and its total appreciation was 8.1% YTD as of 31 December.

- Vietnam’s CPI stayed under control in 2022, averaging 3.2% for the year. This was below the Government’s target of a 4% maximum rise and due in part due to their effective control over prices including petrol, healthcare and education.

. . . . . . . . . . .

China

(compare Chinese funds here)

Helen Green, chairman, abrdn China Investment Company – 14 February 2023

The last 12 months have been particularly challenging for investors in Chinese equities. We saw the Hang Seng Index in Hong Kong bottom out below 15,000, touching levels not seen since the aftermath of the Global Financial Crisis in 2008. Markets reacted positively to the announcements of the easing of Covid restrictions in China. This is, admittedly, following the heavily negative numbers, but it does highlight how much interest there is in China, interest that we believe is well-founded. The Board remains confident that any short-term headwinds that we may encounter in future will be strongly outweighed by long-term positive fundamentals and the compelling opportunities to invest in quality Chinese companies.