Riding out the tariff storm

Uncertainty levels have increased across global markets, with Trump’s tariffs throwing up an additional source of risk. RIT Capital Partners’ (RIT’s) diversified portfolio (spread across asset classes, sectors and geographies) and stringent risk controls put it in a unique position to weather the storm. Leveraging off its manager’s investment skillset and unparalleled access to specialist fund managers, the trust’s portfolio has been constructed with the aim of performing well across market cycles.

Risk controls, such as downside protection strategies, help its manager take a long-term view and lean into investment trends with confidence. One such trend is a broadening of returns away from technology titans to undervalued sectors such as small- and mid-cap stocks, quality stocks (companies with strong balance sheets, consistent earnings, and good corporate governance), Japan, and China – a theme that started to play out before the tariffs shenanigans but could be accelerated because of it. Although it is continuing to reduce its private investments exposure, the company has made some potentially game changing investments, including in SpaceX, which could prove a source of superior returns for many years.

Grow and preserve shareholders’ capital

RIT aims to deliver long-term capital growth, while preserving shareholders’ capital. It invests without the constraints of a formal benchmark but aims to deliver capital value growth in excess of relevant indices over time. RIT invests in a widely-diversified, global portfolio across a range of asset classes, both quoted and unquoted. It allocates part of the portfolio to exceptional managers to ensure access to the best external talent available.

At a glance

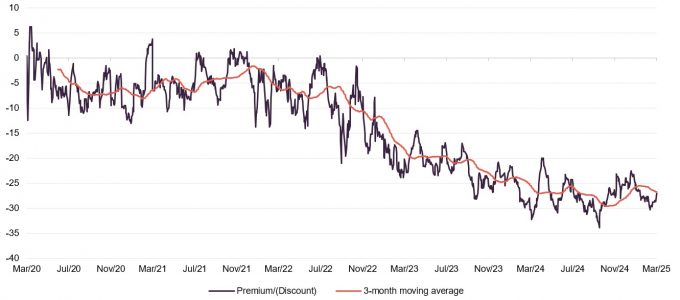

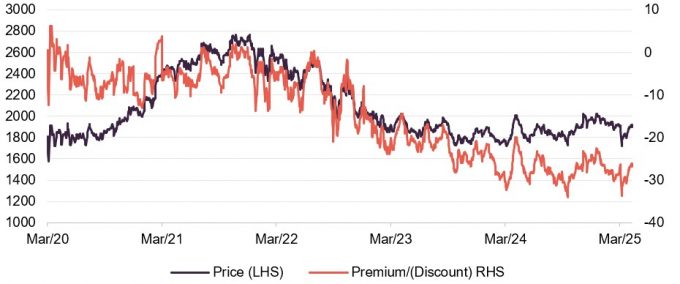

Share price and discount

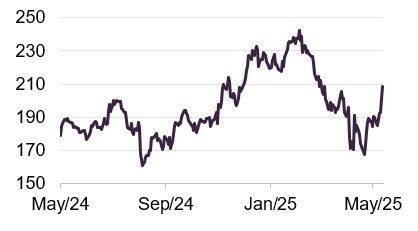

Over the 12-month period ending 31 March 2025, RIT’s shares traded between a 33.9% and a 20.0% discount to net asset value (NAV), with an average discount of 27.3%. At 31 March, the discount was 27.0% and on 12 May 2025, the discount (to the end-March NAV) was 26.9%.

RIT has not been immune from the global sell-off caused by the trade war escalation. Its discount is at a historically wide level, and one we believe represents an extremely attractive entry point.

Time period 31 March 2020 to 12 May 2025

Source: Morningstar, Marten & Co

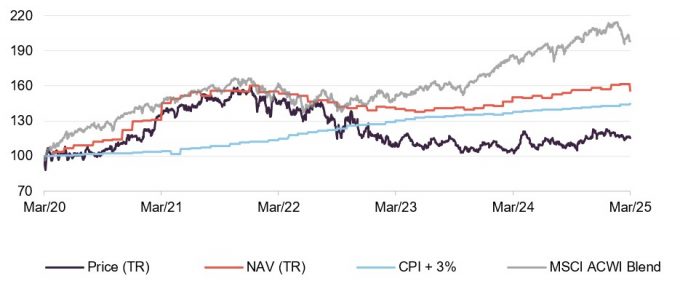

Performance over five years

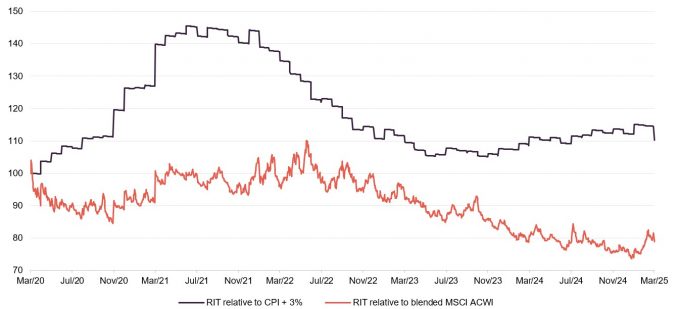

As Figure 14 shows, RIT has outpaced CPI inflation +3% (consumer price index – CPI – is a measure of the average change in prices paid by consumers for goods and services) over the past five years, but weaker performance in recent years has seen it fall below that of its blended MSCI ACWI benchmark. Turmoil in the market over the last couple of months has seen its relative performance versus the benchmark tick up.

Time period 31 March 2020 to 31 March 2025

Source: Morningstar, Marten & Co

| 12 months ended | Share price total return (%) | NAV total return (%) | MSCI ACWI2 total return (%) | CPI +3% per annum (%) |

|---|---|---|---|---|

| 31/03/2021 | 35.6 | 45.1 | 44.0 | 3.7 |

| 31/03/2022 | 8.6 | 5.8 | 10.4 | 10.0 |

| 31/03/2023 | (24.0) | (8.7) | (4.2) | 13.1 |

| 31/03/2024 | (6.1) | 7.1 | 22.2 | 6.2 |

| 31/03/2025 | 9.7 | 4.1 | 6.3 | 5.6 |

Fund profile

More info at the trust’s website www.ritcap.com

Watch our fund brief video on RIT here

RIT aims to deliver long-term capital growth, while preserving shareholders’ capital. It invests without the constraints of a formal benchmark, and aims to deliver increases in capital value in excess of relevant indices over time.

In practice, RIT aims to deliver healthy participation in up markets with reasonable protection in down markets (i.e. limiting losses and preserving capital during downturns while still capturing gains during bull markets). Over time, this should allow it to compound its asset value ahead of index benchmarks through market cycles.

The board establishes and oversees risk tolerances for the manager to work within. RIT does not seek to be an absolute return fund (a strategy that aims to deliver positive returns in all market conditions) and does not perform like one. There will be periods, such as 2022, where the asset value falls, although over the medium term, the trust’s performance compares favourably to even the top-performing absolute return funds in the market.

The manager

RIT is a self-managed UK-domiciled investment trust. It evolved from the Rothschild Investment Trust, which was originally associated with the family bank, NM Rothschild & Sons. Lord Rothschild was appointed chairman of the Rothschild Investment Trust in 1971. It took on its current listed form as RIT Capital Partners Plc in August 1988.

J. Rothschild Capital Management (JRCM), a wholly-owned subsidiary of RIT, acts as RIT’s manager. The manager’s global network offers an unparalleled source of deal flow across asset classes and geographies, tracing its origins to the Rothschild family. At the end of December 2024, JRCM employed 50 people, comprising a mix of investment professionals and support staff.

Widely diversified, hard to replicate portfolio

RIT invests in a widely diversified, international portfolio across a range of asset classes, both quoted and unquoted. RIT is able to invest in less-liquid assets such as unquoted companies thanks to its closed-end structure. It can be patient and ignore the sentiment swings and short-termism often associated with listed equity markets and analysts. Unquoted (private) investments also allow RIT access to a broader range of opportunities than is afforded by listed markets alone.

Tapping into outside expertise…

Part of the portfolio is allocated to exceptional managers in order to ensure access to the best external talent available. Many of these managers would be impossible for retail investors to access, and some are closed to new investment by all types of investors (these are often capacity-constrained funds or invite-only private vehicles).

…helped by an extensive network of connections

The Rothschild “brand” opens some doors, but chiefly RIT can invest where others cannot, thanks to the extensive network of connections that the family and the management team have established over the years. This network is also a valuable source of intellectual capital (i.e. informal access to expert insights and deal sourcing) and co-investment opportunities.

Good risk management is central to RIT’s investment approach. JRCM measures both quantitative and qualitative measures of risk and reports on these to the board. It seeks to hedge excessive factor exposures (such as too much exposure to growth or value stocks), macroeconomic risk and manage currency positions.

RIT measures its investment performance against an absolute comparator (inflation, as measured by UK CPI, plus three percentage points per annum) and an equity comparator calculated as 50% of the MSCI ACWI return in local currencies translated back into sterling and 50% of the sterling-hedged MSCI ACWI (which smooths currency impacts on performance measurement).

Market backdrop

Global macro uncertainty at new highs following Trump’s tariff agenda

The ongoing US tariff debacle has pushed global macro uncertainty to new highs. US president Donald Trump’s imposition of severe trading tariffs on nations across the world on so-called ‘liberation day’ was followed by a pause on all but China and then concessions on some sectors including technology. A “base” tariff on all US imports of 10% currently stands, while a trade war ensued between Washington and Beijing with tit-for-tat retaliation resulting in a 145% tariff on Chinese goods imported to the US and 125% going the other way. On 12 May, both nations agreed to lower tariffs (of 30% and 10% respectively) for 90-days. This all followed a 25% tariff imposed on the US’s closest trading partners, Canada and Mexico (which was later watered down), and a 25% levy on the automotive sector.

Trying to predict what will come next, or whether Trump is using tariffs as a negotiating tactic or is serious, has proved futile and has seen equity prices whipsaw on a daily and even hourly basis, with investors hanging on every announcement. The trade war sparked a sharp sell-off (a rapid and widespread selling of securities, typically leading to a sharp decline in prices) in equity markets amid fears for the global economy. Concerns have heightened over economic growth, while the tariffs are expected to be inflationary across markets, leaving central banks with the conundrum of keeping rates high in an effort to contain inflation or cut rates to help ailing economies.

Trillions wiped off equity markets

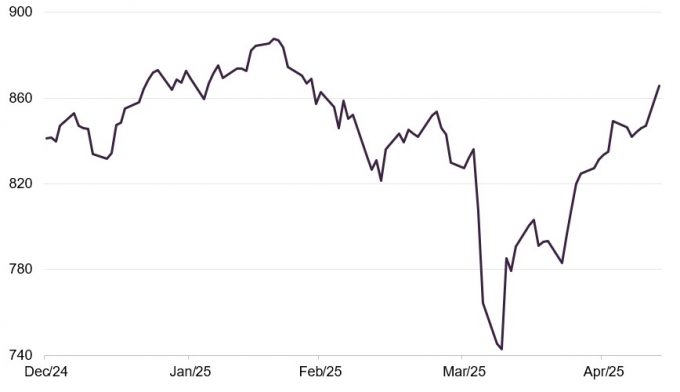

Trillions was wiped off equity markets, with around $6.2tn lost from the market value of the S&P 500 over the course of five days following “liberation day” on 2 April. Most of these losses were regained following the announcement of a 90-day pause on the majority of tariffs on 9 April, and that the tariffs would be watered down further with technology exempt and a trade war ‘ceasefire’ with China in early May. It was a similar story in markets across the world, as shown in the MSCI ACWI index in Figure 1.

Figure 1: MSCI ACWI Index – year-to-date

Source: Bloomberg

Demand for “safe haven” assets has grown in the aftermath of Trump’s tariff announcement, with the price of gold hitting all-time highs. Yields on government bonds had initially fallen but soared as investors priced in slower global growth, with 30-year Treasuries at 4.89% and 10-year Treasuries at 4.46% on 12 May. The probability of adverse events, especially among over leveraged hedge funds, and the potential severity of their impact has also risen.

RIT’s disciplined risk management is appealing in current climate

At times of uncertainty, RIT’s focus on diversification and disciplined risk management appears an effective and appealing approach. RIT’s portfolio has been constructed with the aim of performing well in any macro and geopolitical environment (although the current environment is unprecedented in recent times) and so is not overly exposed to any one theme.

Management of risk is central to RIT’s investment approach, with its portfolio allocated across three investment pillars – quoted equities, private investments, and uncorrelated strategies – and several sub-sectors. All three have inherently low correlations with each other, with exposure to overlapping drivers of risk and return reduced. The manager also makes use of other strategies that offer downside protection in the event of market volatility, with its diversified approach designed to protect the overall portfolio from volatility.

RIT’s performance over 2024

RIT delivered 9.4% NAV total return in 2024

In another year that was dominated by a small number of US mega-caps, 2024 was positive for RIT with a NAV total return of 9.4%. Its three core investment pillars – quoted equities, private investments, and uncorrelated strategies – all returned positive numbers, as shown in Figure 2. The quoted equities pillar (46.2% of NAV at the year-end) returned 15.8% over the year – underperforming the “magnificent seven”-dominated MSCI ACWI, which returned 17.9%, but outperforming the more diversified MSCI ACWI Equal Weighted Index, which returned 10.1% (equal-weighted indices reduce the influence of the largest companies, offering a more balanced representation across constituents). Given RIT’s underweight positions in the seven mega-cap US tech stocks in 2024 (with holdings in Amazon and Microsoft only), returns from its quoted equities portfolio were impressive and testament to its manager’s stock picking ability.

Figure 2: Drivers of RIT’s NAV returns over the three years ended 31 December 2024

| % of end 2024 NAV | 2024 contribution (%) | 2023 contribution (%) | 2022 contribution (%) | Three-year contribution (%)2 | |

|---|---|---|---|---|---|

| Quoted equity | 46.2 | 6.9 | 6.8 | (6.7) | 3.4 |

| Private investments | 33.4 | 1.8 | (2.7) | (6.2) | (5.1) |

| Absolute return and credit | 19.4 | 1.6 | 2.0 | (0.6) | 1.7 |

| Real assets | 2.0 | 0.2 | 0.0 | (0.2) | 0.0 |

| Government bonds and rates | 2.4 | (0.5) | 0.1 | (0.9) | (0.9) |

| Currency | (1.1) | (0.3) | (2.9) | 2.1 | (0.4) |

| Total investments | 100.8 | 9.7 | 3.3 | (12.5) | (1.3) |

| Liquidity/gearing1 | (0.8) | (0.3) | (0.1) | (0.8) | (0.8) |

| Total | 100.0 | 9.4 | 3.2 | (13.3) | (2.1) |

Private investments back to positive growth

The private investments pillar was positive for the first time in three years in 2024 as realisations (sale or exit of private holdings) picked up. Overall, private investments generated a return of 4.8% and contributed 1.8% to NAV performance for the year. The private equity funds that RIT invests in performed strongly, generating realisations of £132m over the year and a 6.8% return. RIT’s direct investments were a mixed bag with £38m of realisations and a flat return of -0.5%. RIT invested £108m in private investments during the year, and with £170m in realisations (or 13% of the privates portfolio) resulted in net inflows of £62m. The private investments allocation reduced to 33.4% of the wider portfolio from 35.9% at the start of the year.

The uncorrelated strategies pillar generated a return of 4.5% in 2024, contributing 1.3% to NAV performance. The majority of returns were derived from absolute return and credit funds, with the performance of its specialist external managers focused on credit, multi-strategy and macro strategies hedge funds all positive.

What for 2025?

As the trade war intensifies, no corner in global equity markets has been left unscathed. Understandably, the uncertainty has also hit private markets and credit markets too.

Prior to Trump’s tariffs, RIT had been executing on its plan to reposition the portfolio. As mentioned earlier, exposure to private investments has reduced to within the company’s ideal portfolio weighting of between a quarter and a third. Equities exposure was 44% at the end of March, held directly through stocks and via equity managers, which is in the middle of its long-term allocation range of 30% to 60%. Uncorrelated strategies at 25% at the end of March was at the lower end of its long-term allocation range of between 20% and 40%.

RIT delivered a NAV total return of -0.6% in the first quarter of 2025, comfortably outperforming its MSCI ACWI benchmark return of -3.1%. RIT’s truly diversified portfolio is proving its worth in this volatile period. As witnessed across global markets, its quoted equities portfolio suffered, however private investments were positive (with the realisation from the sale of portfolio company Xapo in January) as was its uncorrelated strategies – with positive contributions from gold (which reached new all-time highs) and credit strategies.

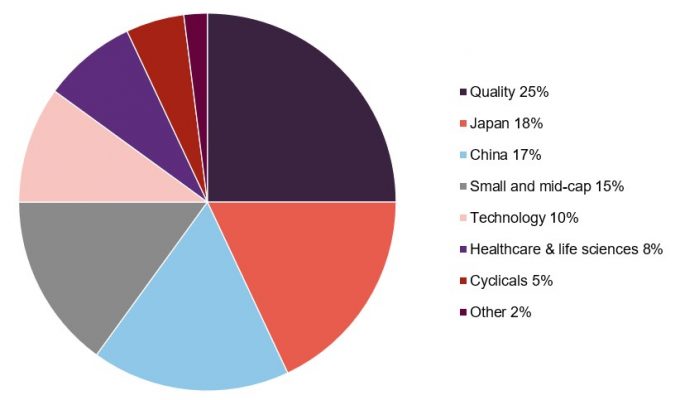

RIT’s equities portfolio is well diversified, as shown in Figure 3, which should prove a source of resilience in current market volatility and offers the potential to capture opportunities across varying identified trends as markets return to some sense of normality.

Figure 3: RIT’s equity portfolio (direct and funds) by theme at the end of 2024

Source: RIT Capital Partners

One of these trends is Japan, where RIT has exposure through specialist managers (see page 14 for a profile of RIT’s largest equity managers). RIT’s manager believes that corporate governance reform within the country, which was behind strong returns in 2024, has further to play out and provides an attractive secular tailwind (a long-term structural driver of returns). It argues that receptiveness to shareholder activism is accelerating change at corporates and should continue to drive returns.

Manager expects small- and mid-cap stocks to outperform

Another trend that RIT is positioned to benefit from is an expected broadening out of returns away from technology, which has dominated markets over the past two years, to other sectors including quality stocks, Japan and China, as well as to small- and mid-cap (SMID) companies. RIT’s manager insists that these segments of the market have been overlooked by investors, creating substantial valuation inefficiencies (i.e. where share prices do not reflect fundamental value). The company’s recent stock selection track record here is favourable.

Top performers within RIT’s equities portfolio in 2024 were SMID companies, including Golar LNG, whose ships convert natural gas into liquified natural gas, and Talen Energy, a power utility company benefitting from digital transformation (which we covered in detail in our last note on RIT – see page 27 for links to our previous published notes). RIT invested in Talen in September 2023 having identified major catalysts for near-term share price appreciation. That transpired in spectacular fashion, with the share price rising 265% over RIT holding period before it exited its position in December 2024. RIT’s quoted equity fund partners contributed 4.0% to NAV with particularly strong performance in China and Japan.

RIT’s private investments portfolio is looking in healthy shape, having seen several exits in 2024. However, having seen encouraging signs that realisation opportunities were returning to the private investment market in earnest after a couple of quiet years, the current macro uncertainty is set to bring a high degree of caution back to the sector, at least in the short term. Following the successful IPO of Service Titan in December 2024, year-to-date RIT has seen the sale of cryptocurrency bank Xapo (in January), the announcement of Google’s $32bn acquisition of cloud security company Wiz (in March – which is expected to close in 2026), and Webull going public in April at an 89% uplift on book value (see page 15 for details). Although a tougher realisation environment is expected in the near-term, good progress has been made, which speaks to the quality of RIT’s private portfolio. Coming in April, the valuation uplift from the Webull realisation has yet to be reflected in the RIT’s NAV.

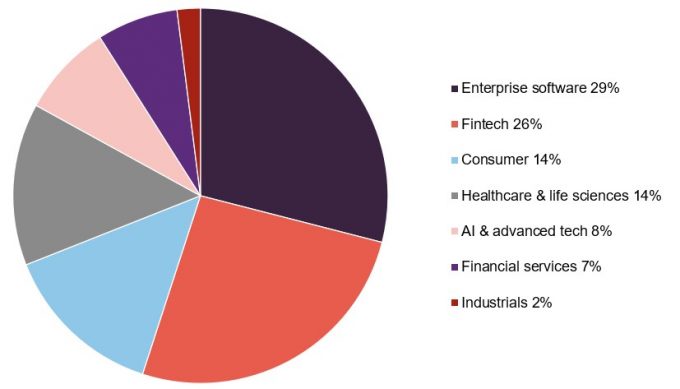

Figure 4: RIT’s top 100 private investments (direct and funds) by sector at the end of 2024

Source: RIT Capital Partners

Many of RIT’s private investments benefit from capital protection

Many of RIT’s direct private investments benefit from some form of structural capital protection. This can be in the form of debt instruments (i.e. loans or bonds with fixed returns), or in preference ranking to ordinary shareholders while also retaining equity upside. An example of this includes RIT’s investment in The Lede Company, which it exited in July 2024 at a money multiple of 2.5x and an internal rate of return (IRR) of 44%. The investment was structured with meaningful downside protection and a priority on cash distributions. The structure also benefitted from a 2x “liquidation preference” (a contractual term entitling RIT to receive twice its investment amount before other shareholders are paid in the event of an exit or wind-up), meaning that in an exit event RIT would receive twice its investment before other shareholders received proceeds.

SpaceX investment has potential to deliver considerable returns over next few years

RIT’s investment in space exploration company SpaceX in 2024 came as a surprise, especially in the context that the manager had set about reducing the company’s private investment exposure. However, the investment passed the manager’s high bar for new private investments, based on its monopolistic characteristics and potential for substantial valuation uplifts. SpaceX’s valuation hit $350bn in December 2024 at a secondary share sale, with RIT’s investment valued at £26.4m. The pace of innovation at the company is particularly exciting, with the successful recovery of the booster at the launch of its Starship spacecraft in September 2024 marking a significant breakthrough in reusable rocketry. The manager expects its investment in SpaceX to grow considerably over the next few years as innovation and new landmarks are reached.

Within the private funds portfolio, RIT’s capital commitments at the end of 2024 totalled £202m or 5.4% of NAV, down from £366m or 9.8% of NAV at the end of 2022, and below its 10-year average of 6.2%. The portfolio is a lot more mature too, with 69% of the private funds invested in having a vintage year (the year a fund begins making investments – older vintages typically indicate greater potential for realisations) of 2020 and earlier (28% pre-2017).

An important element of RIT’s portfolio performance comes from the uncorrelated strategies, with investments in the credit markets providing diversification benefits as well as strong returns over recent years. As recession fears mount, corporate credit has come under scrutiny and investors are expected to demand wider spreads (i.e. higher returns to compensate for perceived risk). Although this could throw up mispricing opportunities, default risk has increased.

Investment process

RIT has a truly multi-asset portfolio. The overall aim of the investment approach applied to RIT’s portfolio is the generation of asymmetric long-term returns – participating in the upside but incorporating a reasonable degree of capital protection on the downside.

Responsibility for the day-to-day management of the portfolio rests with JRCM, but it operates within parameters set by the board and its actions are scrutinised by an internal investment committee (a governance structure designed to ensure disciplined oversight and alignment with shareholders’ interests).

Risk management core to investment approach

The management of risk is central to the investment approach. RIT does not seek to preserve shareholders’ capital by “hiding” in liquid assets, which can offer low or even negative real returns (returns adjusted for inflation). Instead, it allocates to investment strategies that offer the potential of returns uncorrelated with equity markets, and makes use of other strategies that offer downside protection in the event of market volatility.

A crucial aspect of JRCM’s risk management efforts is to reduce the degree to which the portfolio is exposed to overlapping drivers of risk and return. One way of achieving this is to seek to diversify RIT’s exposures. JRCM describes this as “fishing in different ponds” for investment returns.

Three pillars

The manager’s core aim is to identify unique themes that have the potential for long-term compounding capital growth. This includes areas such as the digital transition, life sciences, multi polar and others. The manager can then deploy its unique, global network to target what it believes are the best assets to capture each theme. These themes are then expressed via investments across three investment pillars, offering shareholders access to these themes in a diversified manner, and with a prudent risk-management overlay.

All new investments are comprehensively analysed by the investment team and then brought to the investment committee for approval.

The committee meets at least monthly and in addition to scrutinising investment proposals is also responsible for monitoring overall exposures. Close scrutiny of investment performance also serves as a risk management tool in that alarm bells are rung by commonality of strong or poor performance from investments that are not supposed to be correlated.

The three pillars are:

- Quoted equities

The quoted equities portfolio includes diversified, global high-conviction strategies held directly through stocks, as well as equity funds. This is achieved through a combination of in-house expertise and selected external managers, capitalising on their specialist expertise in sectors and geographies where JRCM see the most potential.

The manager uses a top-down, thematic, macro-overlay and risk control element in its stock selection. Identifying macro themes (and the risk that comes with them) can bring exposure to attractive investment opportunities while also protecting the portfolio from potentially extreme market moves. As investment ideas sometimes take years to come to full fruition, the ability to hedge exposures against relatively short-term swings in sentiment is invaluable.

An internal funds team helps select potential new managers. It looks for managers with strength of conviction that are targeting excess returns of 7%–10% per annum. The ideal sub-portfolio is low beta (less volatile than the broader market) and high alpha (meaning strong stock-picking capability).

The macro/risk overlay may be used to limit RIT’s participation in market drawdowns and to minimise the impact of tail events. RIT’s long-term investment approach is attractive to the underlying managers and the RIT brand helps open doors. RIT is often an early investor in funds and this helps secure favourable terms and build long-term relationships.

- Private investments

RIT invests in funds as well as direct private investments to gain access to unquoted companies. Funds are selected in a similar manner to quoted equity funds, focusing on managers with good track records and high conviction. RIT also makes direct co-investments which are typically companies with strong franchises, and with compelling long-term growth potential. Direct investments are typically structured to provide some downside protection, with the potential to generate attractive returns over time. RIT can act quickly and, given the closed end structure, hold investments longer than most private equity funds. RIT aims to see potential investments early (ideally before anyone else does) and tends not to participate in contested/auction scenarios. When an attractive idea presents itself, RIT will seek to partner with an acknowledged team of experts in the field, thereby benefitting from the detailed due diligence that these partners will perform. RIT looks for cash-generative, relatively-low-risk private investments that fall into one of two categories – compounders (investments that offer the potential of annualised returns of at least 15%, usually structured using debt instruments with an option to convert into equity) or multipliers (investments that offer the potential of 25%-plus annualised returns without leverage).

- Uncorrelated strategies

This pillar encompasses a diverse range of strategies, but principally absolute return and credit, aimed at exploiting potential sources of alpha uncorrelated with equity markets. Absolute return and credit are the responsibilities of a dedicated team within JRCM that also draws on the wider Rothschild network. Uncorrelated asset exposure is a key differentiator for RIT relative to investment company peers.

Environmental, social and governance

JRCM is committed to the integration of environmental, social and governance (ESG) considerations across its investment analysis, investment management, active ownership and internal operations. It is a signatory to the UN PRI (Principles for Responsible Investment) and has created a responsible investment framework and policy to govern its approach to ESG issues.

Analysis of ESG factors helps to deliver enhanced risk-adjusted returns

JRCM believes that carefully integrating the analysis of ESG factors in the investment process helps to deliver enhanced risk-adjusted returns over the long term.

JRCM has identified three central principles of responsible investment:

- ESG factors will influence a company’s performance. Therefore, those counterparties who take ESG factors seriously will more often than not produce meaningful long-term returns through the cycles;

- Applying an ESG lens gives JRCM a comprehensive understanding of both financial and non-financial risks, as well as return opportunities; this results in better decision making; and

- Continual engagement with RIT’s counterparties will help protect and enhance shareholders’ capital which is JRCM’s core corporate objective.

The team carries out comprehensive assessments in order to understand the relevant ESG factors for that particular investment, while the depth of JRCM’s relationships with many investee companies gives it leverage and enables it to press for practical improvements. JRCM monitors ESG practices and performance by counterparties and will raise any issues as part of its general engagement processes.

Asset allocation

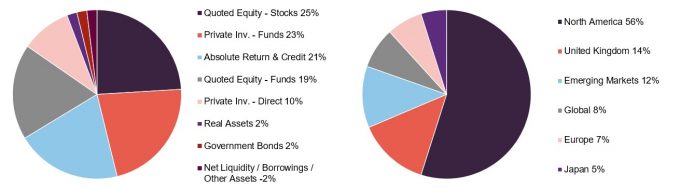

Figure 5: Asset allocation by asset type at 31 March 2025

Figure 6: Asset allocation by geography at 31 March 2025

Source: RIT Capital Partners

Source: RIT Capital Partners

Quoted equities remains RIT’s largest allocation (through direct holdings – 25%, and in funds – 19%) as shown in Figure 5. This has grown from 38.4% at the end of 2023. Its allocation to private investments was 33% (23% in funds and 10% direct) at the end of March 2025, down from 35.9% at the end of 2023. The manager expects this will fall further to the high-20% region, as and when further realisations materialise. The position in absolute return and credit has remained static at 21%, adding a layer of diversification to the portfolio.

Largest holdings

Figure 7: Five largest direct quoted equity positions at 31 December 2024

| Country | Industry | Value £m | Percentage of NAV (%) | |

|---|---|---|---|---|

| Amazon | United States | E-commerce | 61.4 | 1.6 |

| National Grid | United Kingdom | Utilities | 59.6 | 1.6 |

| London Stock Exchange Group | United Kingdom | Financial exchanges & data | 44.0 | 1.2 |

| Intercontinental Exchange | United States | Financial exchanges & data | 40.5 | 1.1 |

| Coupang | South Korea | E-commerce | 40.2 | 1.0 |

Amazon

Figure 8: Amazon share price (US$)

Source: Bloomberg

Amazon was RIT’s largest equity holding at the end of 2024, having added to its position over the year. The manager believes that Amazon offers superior free cash flow generation in the coming years due to a reacceleration of the Amazon Web Services (AWS) business, as well as an opportunity to expand retail margins (improving profitability). The company has recently announced a range of new capabilities at AWS, including the introduction of the new Trainium2 AI chip, the launch its AI foundation model Amazon Nova, and new models and features in Amazon Bedrock that give customers flexibility and cost savings. On the ecommerce side of the business, Amazon’s 2024 Black Friday and Cyber Monday shopping events delivered record sales, while the company continues to consolidate ecommerce market share gains. In its fourth quarter earnings update, the company posted an 11% increase in net sales to $638.0bn in 2024, while operating income expanded to $68.6bn in 2024, compared with $36.9bn in 2023. Reflecting the market turmoil, the company’s shares have fallen 4.9% in the year to date.

National Grid

Figure 9: National Grid share price (GBp)

Source: Bloomberg

RIT took a significant position in energy operator National Grid in 2024 at what the manager says was an attractive entry level. It adds that the company is well positioned to benefit from the energy transition and views the investment as asymmetric, due to the company’s inherent downside protection in the form of government-regulated cashflows and substantial upside potential from energy infrastructure investment.

Last year, National Grid completed a £7bn equity raise at a substantial discount to its share price as it looks to invest in infrastructure and alleviate strain on the network. The company, which operates electricity transmission and distribution in northeastern US as well as the UK, reported positive performance in 2024 including a 26% rise in underlying pre-tax profit to £1.44bn in the six months ended 30 September 2024.

Figure 10: Five largest long-only and hedge fund positions at 31 December 2024

| Country | Industry | Value £m | Percentage of NAV (%) | |

|---|---|---|---|---|

| Discerene | Global | All cap, value bias | 168.7 | 4.5 |

| 3D Opportunity | Japan | All cap, diversified | 167.1 | 4.5 |

| Blackrock Strategic Equity | Global | All cap, diversified | 128.0 | 3.4 |

| Morant Wright | Japan | Small/mid cap, value bias | 102.4 | 2.7 |

| Springs Opportunities | China | All-cap, diversified | 83.4 | 2.2 |

Discerene

Founded in 2017, Discerene is a Connecticut-based long-only investor focused on holistic fundamental research employing value investing principles with a long-term mindset. The team invests in businesses protected either by structural barriers to entry (such as monopolistic characteristics or regulatory moats) or hard assets (e.g. real estate or infrastructure), at attractive entry prices when out of favour, offering significant margins of safety. Discerene seeks private equity like structures to make truly long-term investments in public companies. The firm has built strong relationships with its capital providers with whom it closely shares philosophy, values, and investment horizons.

3D Opportunity

3D Opportunity Fund is a hedge fund managed by 3D Investment partners, a Japan-focused value investor that makes opportunistic investments with a focus on quality. The manager, which was founded in 2015, engages with the management teams of its investee companies with the aim of releasing the considerable value that is locked up in certain Japanese corporate entities. Following significant developments over recent years – including a new corporate governance code, increased focus from the government, shareholder activism and private equity interest – Japanese equity markets have further upside potential.

Figure 11: Five largest direct private positions at 31 December 2024

| Country | Industry | Value £m | Percentage of NAV (%) | |

|---|---|---|---|---|

| Motive | United States | Enterprise software | 84.6 | 2.3 |

| Webull | United States | Fintech | 49.9 | 1.4 |

| Epic Systems | United States | Healthcare & life sciences | 29.5 | 0.8 |

| SpaceX | United States | AI & advanced technologies | 26.4 | 0.7 |

| Blueground | United States | Consumer | 23.0 | 0.6 |

Motive

Motive (gomotive.com), which is reportedly targeting an IPO in 2025 having hired a new chief financial officer in December, operates in the transportation logistics sector, providing fleet management services to businesses with the aim of increasing their profitability. Its services include financing, maintenance, fuel management, telematics (the use of telecommunications and informatics to monitor vehicles), and driver safety training. Motive’s fleet management software provides real-time data on vehicle performance, driver behaviour, and fuel consumption, which enables their customers to make informed decisions and optimise operations as well as improving safety and compliance. The vast majority of RIT’s underlying investment is in the form of a convertible note that protects shareholder capital in a downside outcome while retaining equity upside through the conversion feature (i.e. the ability to convert into equity under certain conditions, usually during an IPO or sale event).

Webull

As mentioned earlier, Webull (www.webull.com – a stock and fund brokerage platform bringing together traditional investor services on a unified platform) went public on 11 April 2025 through the merger with SK Growth Opportunities Corp, a special purpose acquisition company (SPAC), and commenced trading on the Nasdaq stock exchange. Webull was valued on RIT’s books at $64m (£49.9m) at the end of 2024. Following a restructuring of the investment for the purposes of the SPAC merger, its investment now includes listed Class A ordinary shares (subject to a six-month lock-up provision) as well as other positions in Webull’s capital structure. The estimated value of RIT’s entire position in Webull at the closing price on 11 April 2025 of $13.25 per Class A ordinary share, was around $121m or £93m (of which around $106m or £81m was in ordinary shares) – an 89% uplift on the end of 2024 valuation. Webull’s share price rocketed in the days following its listing but has dropped back and at 12 May its share price was $14.09.

Figure 12: Five largest private fund positions at 31 December 2024

| Country | Industry | Value £m | Percentage of NAV (%) | |

|---|---|---|---|---|

| Thrive funds | United States | Growth equity | 156.7 | 4.2 |

| Iconiq funds | United States | Growth equity | 113.6 | 3.0 |

| Greenoak Capital funds | United States | Growth equity | 105.0 | 2.8 |

| Ribbit Capital funds | United States | Growth equity | 92.7 | 2.5 |

| BDT Capital funds | United States | Private equity | 80.8 | 2.2 |

Thrive funds

Thrive Capital (thrivecap.com) is a New York-based venture capital firm founded in 2011 that specialises in making investments into technology companies – particularly those in the consumer, software, and financial services sectors – focusing on companies that are poised to disrupt traditional industries and create new markets. Thrive seeks out companies with strong leadership teams and a clear vision for the future, and then works closely with them to provide the resources and guidance needed to develop their businesses. RIT invested in Thrive in 2012 and has been a part of each of their flagship funds since then. RIT’s manager says that Thrive has amassed an enviable track record of partnering with many of the generational defining companies (including Instagram, Stripe, Spotify, OpenAI, Wiz, GitHub, and Oscar Health) and so has become hard to access for other investors (a sign of success and scarcity value often seen in capacity-constrained funds).

Iconiq funds

Iconiq Capital (www.iconiqcapital.com) is a privately-held investment firm, founded in 2011, which manages a range of funds, including private equity, growth equity, and real estate. It seeks to identify high-quality companies with strong growth prospects and to hold these investments for the long term. The firm has a reputation for working closely with its portfolio companies to help them achieve their growth objectives, and has a wide network of industry experts and strategic partners that it can leverage to support its portfolio companies. It currently has a number of portfolio companies at the mid- to late-stage in its investment cycle, and its recent successes include the IPOs of Snowflake, Datadog and Procore.

In December 2024, Service Titan (one of RIT’s largest indirect holdings, and held through Iconiq) IPO’d on the Nasdaq stock exchange at the high end of its range and closed up 42% on its first day of trading. Iconiq is an investor alongside RIT in Epic Systems, the leading US Electronic Health Records provider and RIT’s third-largest direct private investment, and has invested with RIT previously in the buyout of CSL, a UK-based alarm signalling business.

Figure 13: Five largest absolute return and credit positions at 31 December 2024

| Country | Industry | Value £m | Percentage of NAV (%) | |

|---|---|---|---|---|

| Tresidor funds | Europe | Credit | 154.9 | 4.2 |

| Attestor Value | Global | Credit | 112.1 | 3.0 |

| ARCM | Asia | Credit | 83.6 | 2.2 |

| RIT US Value Partnership | Global | Multi-strategy | 77.4 | 2.1 |

| Woodline | Global | Equity market neutral | 68.4 | 1.8 |

Tresidor funds

Tresidor is managed by Tresidor Investment Management LLP (www.tresidor.com), a London-based alternative investment manager that uses a disciplined fundamental research process to invest across the full spectrum of tradeable European credit opportunities, including distressed debt (the bonds or other debt securities of a company that is in financial difficulties, which usually trade at a significant discount because of the high risk of non-repayment) and special situations investments. It focuses on high-quality companies’ credit which has low probability of impairment driven by collateral, asset value, business quality, liquidity, cashflows, structural, and legal features (credit instruments designed to limit downside and increase recovery prospects in the event of financial distress).

Attestor Value

Attestor Value is a circa €8.5bn fund managed by Attestor Capital (www.attestor.com), a private investment firm that was founded in 2012 in London. The firm specialises in distressed debt and special situations investments, focusing on opportunities in the European market. The manager is known for its expertise in complex, illiquid investments, and its ability to create value through active management and operational improvements. The firm’s investment philosophy is centred around a disciplined, value-oriented approach. It works closely with management teams of its investee companies to unlock value and generate returns, especially through balance sheet actions.

Performance

Five-year track record

As Figure 14 shows, RIT has outpaced CPI inflation +3% over the past five years, but weaker performance in recent years has seen it fall below that of its blended MSCI ACWI benchmark. Turmoil in the market over the last couple of months has seen its relative performance versus the benchmark tick up.

Figure 14: RIT versus benchmarks over five years ended 31 March 2025

Source: Morningstar, Marten & Co

Figure 15: Total return cumulative performance over various time periods to 31 March 2025

| 6 months | 1 year | 3 years | 5 years | |

|---|---|---|---|---|

| RIT Capital Partners share price | 4.4 | 9.7 | (21.8) | 15.2 |

| RIT Capital Partners NAV | 0.0 | 4.1 | 1.8 | 56.2 |

| CPI + 3% | 3.2 | 5.6 | 26.8 | 44.8 |

| Blended MSCI ACWI | 0.5 | 6.3 | 24.5 | 98.0 |

| Peer group1 median NAV | 0.0 | 3.7 | 1.0 | 40.1 |

As well as outpacing inflation over five years, RIT has comfortably outperformed its peer group over all time periods (more discussion on the peer group follows). After a few years of relative underperformance versus the 100% equity benchmark of the blended MSCI ACWI index (performance of which was dominated by the US large-cap tech stocks), RIT’s NAV has outperformed over the last year.

The diversified multi-asset nature of RIT’s portfolio will inevitably lead to deviations between its returns and the blended MSCI ACWI index. RIT’s core aim is to target long-term capital growth, through the cycles, with a degree of capital preservation on the downside. As such, RIT is defined by more than its total returns, as the team also aims to dampen down the degree of risk that RIT’s shareholders are exposed to.

Valuation

The valuation of RIT’s portfolio is the responsibility of a valuation committee, composed entirely of independent non-executive directors of RIT. It oversees valuations of illiquid holdings. In addition, all year-end valuations are also subject to audit by the company’s auditors.

The approach to valuations aims to come up with fair values that are at the most conservative end of the valuation range. Empirical evidence of this is provided by the average 23% mark-up achieved on realisations from the direct private investments book, relative to their undisturbed carrying value over 10 years to December 2024 (suggesting valuations are set cautiously and that realised exits often occur at higher prices than previously booked).

Peer group

Up-to-date information on RIT and its peer group is available on the QuotedData website

RIT is a constituent of the AIC’s Flexible Investment sector. These funds have investment objectives and/or policies that allow them to invest in a range of different asset types. The sector encompasses a wide variety of funds with very different performance objectives, and therefore the full AIC sector would make a poor comparison for RIT, so we have excluded a number of companies.

RIT is by far the largest trust within our selected peer group, as shown in Figure 16, eclipsing its next-largest peer by around £700m. RIT’s dividend yield is better than most, although its share price is one of the most volatile of its peers, which is a combination of the strict risk-targets of some its peers and the recent volatility within RIT’s discount to NAV. That discount is at the wider end of funds in this peer group, which we feel is unjustified.

Thanks in part to its scale, RIT also has an ongoing charges figure in the top quarter of its peers, made more impressive by the complexity of RIT’s investment process, which often comes with a premium cost, given the increased resources needed in its execution.

Figure 16: RIT peer group comparison at 12 May 2025

| Market cap (£m) | Discount (%) | Dividend yield (%) | Ongoing charge (%) | 1-year standard deviation of share price | |

|---|---|---|---|---|---|

| RIT Capital Partners | 2,684 | (26.3) | 2.0 | 0.76 | 12.2 |

| Aberdeen Diversified | 137 | (32.7) | 12.5 | 2.36 | 16.8 |

| Caledonia | 1,985 | (31.1) | 1.9 | 0.81 | 16.6 |

| Capital Gearing | 855 | (1.9) | 1.3 | 0.47 | 2.9 |

| CT Managed Portfolio Growth | 87 | (4.3) | 0.0 | 2.16 | 9.3 |

| CT Managed Portfolio Income | 61 | 0.9 | 6.5 | 2.23 | 10.2 |

| Global Opportunities | 86 | (21.9) | 3.4 | 0.68 | 10.4 |

| Majedie | 147 | 4.3 | 3.0 | 1.40 | 18.7 |

| MIGO Opportunities | 65 | (5.8) | 0.9 | 1.50 | 6.6 |

| Personal Assets | 1,644 | (0.6) | 1.1 | 0.65 | 3.5 |

| Ruffer | 858 | (4.9) | 1.8 | 1.06 | 4.9 |

| Median | 147 | (4.9) | 1.9 | 1.06 | 10.2 |

| RIT rank | 1/11 | 9/11 | 5/11 | 4/11 | 8/11 |

RIT has one of the strongest long-term track records amongst these peers, due to both the trust’s flexibility to invest across a range of asset classes and RIT’s unique network of connections within the private equity and debt markets. RIT’s performance over the last 12 months has put it out in front among the peer group, while it ranks in the top half in all other time periods up to five years.

Figure 17: Cumulative NAV total return performance over periods ending 31 March 2025

| 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | |

|---|---|---|---|---|

| RIT Capital Partners | 0.0 | 4.1 | 1.8 | 56.2 |

| Aberdeen Diversified | 4.4 | 2.0 | 0.0 | 29.4 |

| Caledonia | 4.3 | 4.9 | 18.8 | 91.2 |

| Capital Gearing | 1.6 | 4.0 | 2.0 | 27.1 |

| CT Managed Portfolio Growth | (3.3) | 0.6 | (4.3) | 40.1 |

| CT Managed Portfolio Income | (3.5) | 2.9 | (4.6) | 39.2 |

| Global Opportunities | 6.7 | 6.8 | 23.5 | 53.9 |

| Majedie | (4.3) | 2.8 | 17.8 | 46.3 |

| MIGO Opportunities | (3.1) | (0.0) | (2.1) | 72.5 |

| Personal Assets | 3.7 | 6.9 | 8.1 | 34.1 |

| Ruffer | (0.2) | 3.7 | (0.5) | 33.3 |

| Median | 0.0 | 3.7 | 1.0 | 40.1 |

| RIT rank | 6/11 | 4/11 | 6/11 | 3/11 |

Dividend

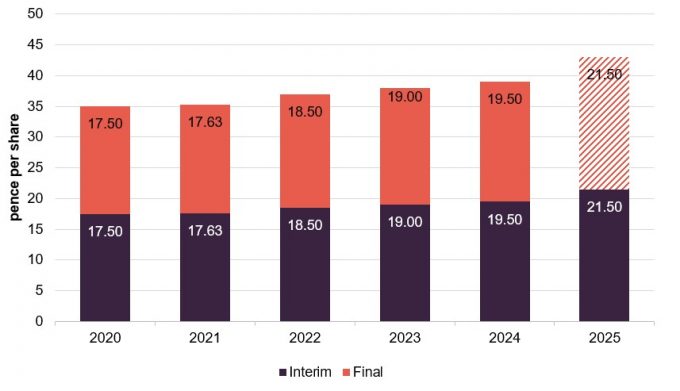

Dividends are paid bi-annually in equal instalments. RIT paid a most recent full-year dividend of 39p per share. The board has also signalled its intention to pay a dividend of 43p per share for the 2025 financial year, a 10.3% increase, and has declared a first interim dividend of 21.5p.

Figure 18: RIT’s five-year dividend history

Source: RIT Capital Partners

Capital structure

RIT currently has 156,848,065 ordinary shares, of which 15,603,152 are held in treasury. The number of voting rights in the company is 141,244,913. There are no other classes of share.

RIT’s year end is 31 December, and its AGM is usually held in April or May. It has an unlimited life (there is no predetermined wind-up date or continuation vote schedule).

Gearing

RIT reported an 8.7% level of net gearing at the end of March 2025. RIT’s gearing is achieved via the use of private fixed-rate notes, term and revolving credit facilities. As of its 31 December 2024 financial year-end, RIT had drawn down £334m, with a further £40m left undrawn.

RIT also makes use of derivatives to protect the portfolio from unwanted exposures. For example, it makes use of currency hedging, as well as using derivatives to protect unrealised gains and enhancing returns.

The management team

A change in the senior management team of JRCM took place in early 2024, with former non-executive director Maggie Fanari taking over as chief executive from Francesco Goedhuis, and Nick Khuu moving into the role of chief investment officer. We discussed the changes in more detail in our previous note on RIT (see page 27 for a link to our previous notes). Here we profile JRCM’s senior management team.

Maggie Fanari

Maggie is chief executive at JRCM, having previously serving on RIT’s board for almost five years. She was previously senior managing director, global group head of high conviction equities at Ontario Teachers’ Pension Plan, which has a global mandate to invest in public and private companies. At Ontario Teachers’ she served as a member of many of the pension plan’s investment committees and was involved in the execution of investments across a variety of asset classes (private and public), including supporting the development and execution of the venture and growth business.

Before joining Ontario Teachers’, Maggie worked at KPMG and Scotia Capital. She is a chartered accountant and a CFA charterholder. She also holds a BBA from the Schulich School of Business at York University and ICD.D certification from the Institute of Corporate Directors.

Andrew Jones

Andrew is JRCM’s chief financial & operating officer. He is responsible for the group’s financial activities and its operations.

Prior to joining JRCM in 2008, he spent three years in venture capital and four years at Nomura, advising on its private equity investments as well as risk, global corporate development and strategy. A Fellow of the ICAEW, he qualified as a chartered accountant with Deloitte, where he spent time in audit before specialising in corporate finance and valuation advice. Andrew is a member of the audit committee of the British Academy.

Nicholas Khuu

Nicholas is JRCM’s chief investment officer. Prior to joining JRCM, he was a managing director at Adi Capital Management, where he oversaw investments across a broad range of industries and geographies. From 2008 to 2013, he was a senior professional at Knighthead Capital Management, where he invested in bonds, bank loans and special situation credits and equities. Prior to this, Nicholas worked at Dune Capital Management, a multi-strategy investment firm, and at IFL, a strategic advisory firm.

Nicholas began his career in the investment banking division at J.P. Morgan. He graduated from the University of New South Wales, Australia, with a double degree in law and commerce.

Board

RIT’s board is composed of seven directors, six of whom are non-executive, independent of the manager and none of whom sit together on other boards, while one member, Dame Hannah Rothschild, is designated as non-independent.

In early May, Philippe Costeletos replaced Sir James Leigh-Pemberton as chairman with the latter retiring after six years on the board. Jutta af Rosenborg has assumed the role of senior independent director from Philippe.

We note that Philippe will reach nine years of service on the board in July 2026, which is often used as a benchmark for assessing board member independence, with the UK Corporate Governance Code recommending the tenure be limited to nine years. This may cause an issue with shareholder voting at future AGMs; however, proxy advisers have stated that they would now consider extensions to the tenure of a board chair beyond nine years on a case-by-case basis.

Figure 20: Directors’ length of service, fees and shareholding

| Role | Appointed | Length of service (years) | 2024 total remuneration | Shareholding | |

|---|---|---|---|---|---|

| Philippe Costeletos | Non-executive chairman | July 2017 | 7.8 | 80,500 | 80,000 |

| Jutta af Rosenborg | Senior independent director | May 2022 | 2.8 | 66,603 | 8,571 |

| Vikas Karlekar | Non-executive director | August 2022 | 2.6 | 41,000 | 4,042 |

| Cecilia McAnulty | Non-executive director | August 2022 | 2.6 | 48,500 | 5,077 |

| André Perold | Non-executive director | April 2018 | 7.0 | 57,773 | 0 |

| Helena Coles | Non-executive director | October 2024 | 0.4 | 9,514 | 1,002 |

| Dame Hannah Rothschild CBE | Non-executive director (non-independent) | August 2013 | 11.6 | 39,000 | 15,402,7081 |

Philippe Costeletos

Philippe is chairman of RIT. He joined the board as a non-executive director in July 2017 and became its senior independent director in April 2019. Philippe is also chair of the nominations committee. Philippe has over 30 years of private investment and board governance experience and is founder of Stemar Capital Partners, a private investment firm focused on building long-term investment platforms. He was formerly chairman of international of Colony Capital, a global real estate and investment management firm. Previously, he was head of Europe at TPG, a leading global private investment firm and a member of TPG’s Global Management and Investment Committees. Prior to that, Philippe was a member of the management committee at Investcorp, a leading manager of alternative investment products. Previously, Philippe held positions at JP Morgan Capital, JP Morgan’s Private Equity Group and Morgan Stanley.

Philippe is chairman of Janus Fertility and a board member of Digital Care, Vangest Group and Generation Home. He is a senior advisor to the Blackstone Group. Philippe is a member of the President’s Council on International Activities at Yale University and the Yale Centre for Emotional Intelligence Advisory Board. He graduated magna cum laude with a BA with distinction in Mathematics from Yale University and received an MBA from Columbia University.

Jutta af Rosenborg

Jutta is senior independent director and is chair of the conflicts and remuneration committees. She is a qualified accountant and holds a master’s degree in business economics and auditing from Copenhagen Business School. Jutta has held a number of senior roles in group finance, auditing and risk management. Jutta is a non-executive director of JPMorgan European Growth & Income Plc and chair of its audit committee. In addition, she is a non-executive director of Nilfisk Holding A/S (audit and remuneration chair) and chairs its audit and remuneration committees. She is also a member of the supervisory board of BBGI Global Infrastructure S.A., where she chairs the audit committee. She was previously a non-executive director at aberdeen Plc (formerly Standard Life Aberdeen Plc) and NKT A/S, and was also executive vice president, chief financial officer of ALK Abelló A/S and chairman of Det Danske Klasselotteri A/S.

Vikas Karlekar

Vikas is a qualified chartered accountant, and a graduate of the London School of Economics specialising in Management Sciences and has held a number of senior finance roles across the financial services industry. He is currently managing director of group finance at Intermediate Capital Group Plc, a FTSE asset manager specialising in private markets, covering all aspects of financial and regulatory reporting, valuation governance, key accounting judgments, financial planning and analysis, and platform and operating model transformation. In addition, he is a member of the board of trustees and treasurer of the Pepal Foundation, a charity focused on bringing together NGOs and global corporations to develop leaders and find practical solutions to challenging social issues. Vikas previously spent 10 years at Barclays in a series of pan-finance leadership roles, including global finance controller for Barclays International Division, managing all aspects of financials, key accounting decisions, valuations, driving technology and process improvements, and leading key regulatory relationships. He also spent 13 years at UBS Investment Bank, in both London and New York in various finance leadership roles. Vikas qualified as a chartered accountant with KPMG.

Cecilia McAnulty

Cecilia is a member of the nominations committee. She is a qualified accountant and has held senior investment roles for banks and hedge funds. Her investment experience encompasses several asset classes including distressed debt, private equity and credit. Cecilia is a non-executive director and audit chair of both Northern 2 VCT Plc and Polar Capital Global Financials Trust Plc and recently resigned as an independent non-executive director of Alcentra Limited, an asset manager wholly owned by Bank Of New York Mellon, specialising in sub-investment grade credit. She is also a member of the Industrial Development Advisory Board, part of The Department of Business, Energy & Industrial Strategy (BEIS) which advises on grants to UK businesses. Cecilia has held senior roles at Centaurus Capital, Barclays Capital, Royal Bank of Scotland and PwC. She qualified as a chartered accountant with Peat Marwick (now KPMG) in Glasgow, and she has also held a number of charity roles including chair of the finance and general purposes committee for English National Ballet.

André Perold

André is a member of the audit and risk committee. He is co-founder, partner and chief investment officer of HighVista Strategies, a Boston-based investment firm. He is also a board member of the Vanguard Group, the global investment company. André was previously the George Gund Professor of Finance and Banking at the Harvard Business School, where he also held senior roles including chair of the Finance Faculty and Senior Associate Dean.

Helena Coles

Helena is a member of the conflicts, remuneration, audit and risk committees. She has extensive experience in global public equities and held senior roles at Swiss Bank Corporation and Kleinwort Benson Investment Management Ltd in Hong Kong, before co-founding Rexiter Capital Management Ltd, an investment management firm which specialised in emerging markets and Asian investments. Helena is a non-executive director of HgCapital Trust Plc, JPMorgan Emerging Markets Investment Trust Plc and Schroder Japan Trust Plc. She is a member of the investment committee of the Joseph Rowntree Charitable Trust and was previously their independent investment adviser for many years. She was previously a non-executive director of Shaftesbury Capital Plc. Helena has also held roles at the Prudential Regulation Authority in banking supervision and at Fidelity International in sustainable investing.

Hannah Rothschild CBE

Hannah Rothschild is a non-executive director of WHAM, a director of Five Arrows Limited and serves as a trustee of the Rothschild Foundation. She is an award-winning writer and filmmaker with a long-standing career in the media. Hannah was the first woman to chair the trustees of the National Gallery.

Previous publications

QuotedData has published two previous notes on RIT. You can read the notes by clicking on the links in Figure 21 or by visiting our website.

Figure 21: QuotedData’s previously published notes on RIT

| Title | Note type | Publication date |

|---|---|---|

| A rare opportunity to buy a unique trust | Initiation | 6 April 2023 |

| Change in fortunes on the horizon | Update | 19 June 2024 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on RIT Capital Partners Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.