IMPORTANT INFORMATION

NB: This is a marketing communication and not a prospectus. Marten & Co has been paid to prepare this note in relation to Tellworth British Recovery & Growth Trust Plc and has an arrangement with PrimaryBid Limited whereby Marten & Co may profit from applications made through that business.

The note is based upon publicly available information and information provided to us by Tellworth British Recovery & Growth Trust Plc and should be read in conjunction with the Tellworth British Recovery & Growth Trust Prospectus published on 16 September 2020. Readers should not place any reliance on the information contained within this note.

The note does not form part of any offer and is not intended to encourage the reader to subscribe for ordinary shares in Tellworth British Recovery & Growth Trust or deal in any other security or securities mentioned within the note.

This note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and there is no prohibition on dealing ahead of dissemination of this research.

Marten & Co does not seek to and is not permitted to provide investment advice to individual investors.

The note is not intended to be read and should not be redistributed in whole or in part in the United States of America, its territories and possessions; Canada; Australia; the Republic of South Africa; or Japan.

Best of British

After an extended period of underperformance of the UK stock market versus other global markets (see page 5), the investment manager of Tellworth British Recovery & Growth Trust (BRIT) believes that many companies listed on the UK stock market are currently undervalued.

BRIT is a new company that has been established to invest in the United Kingdom. Its portfolio will combine what the investment manager believes to be the best of British global leaders, British recovery stocks and British technology stocks. It will aid those British companies if they need more capital, and aims to support many of them as they grow from small beginnings to the world-class companies of tomorrow.

The investment team selecting stocks for inclusion in the portfolio is led by Paul Marriage and John Warren, who worked together at Schroders before setting up Tellworth Investments in October 2017.

BRIT is seeking to raise £100m in its initial issue, which is open to both professional and private investors (in qualifying locations).

Investing in the best of British

BRIT aims to generate long-term total returns over a rolling five-year period by principally investing in UK listed companies. The trust will invest in securities listed on any regulated market in the UK and issued by companies with a significant presence in the UK (see page 3)

The details of the share issue, including the risk factors that investors should take into consideration, are more fully described in the prospectus published on 16 September 2020 and we urge readers to read this before making any investment decision.

If you want to subscribe to this IPO, please go onto PrimaryBid’s website using this link

The initial fundraise

NB: This is a summary – please read the prospectus published on 16 September 2020.

BRIT is targeting an initial fundraise of £100m gross of expenses. The costs associated with the fundraise have been capped at 2% of gross proceeds, but are expected to be approximately 1.75% if BRIT raises its £100m target.

The prospectus gives BRIT the flexibility to issue up to £500m under the initial issue and says that the minimum gross proceeds necessary for the initial offers to proceed have been set at £75m. However, the company, Dickson Minto W.S. (the sponsor), and Numis Securities Limited (the placing agent) can agree a lower figure if they choose.

At this initial stage, shares are being issued at 100p each.

The minimum number of shares that can be applied for through the intermediaries offer is 1,000. The actual number of shares to be allocated to the intermediaries will be determined by the company (in consultation with Dickson Minto W.S. and the investment manager).

Subsequent issues

Following the initial issue, the directors may undertake subsequent issues that may take the form of one or more subsequent placings and/or subsequent intermediaries offers. The directors are authorised to issue up to 500m shares, less any shares issued pursuant to the initial issue. This authority enables the company to raise additional capital in the period from the date of the initial admission to 15 September 2021.

The current intention is that a second intermediaries offer is planned to open on 28 January 2021, a third on 1 April 2021 and a fourth on 17 June 2021.

Fund profile

BRIT aims to generate long-term total returns over a rolling five-year period by principally investing in UK listed companies. The trust will invest in securities listed on any regulated market in the UK and issued by companies with a significant presence in the UK.

A company is deemed to have a significant presence in the UK if, at the time of investment, it is incorporated, headquartered, and/or has its principal place of business in the UK, and if it exercises a material part of its economic activities in the UK.

BRIT will have the freedom to invest up to 10% of its assets, at the time of acquisition, in unquoted securities with a significant presence in the UK.

UK-focused not just UK stock market-focused

When assessing for the purposes of implementing BRIT’s investment policy whether a company exercises a material part of its economic activities in the UK, the Tellworth investment team (the team) will consider, among other factors, the proportion of a potential investee company’s UK turnover, the proportion of its staff that are employed in the UK, and the level of research and development (R&D) activity in the UK. The team will actively seek companies that are UK-based and headquartered and that have significant UK activities in research, development, production or services without which their business could not thrive.

The core of the lead portfolio managers’ investment strategy throughout their careers has been to support companies with significant UK operations, specifically choosing not to invest in overseas companies whose only connection to the UK is admission to trading on the London Stock Exchange.

The Tellworth investment team (the team)

Paul Marriage and John Warren co-founded and lead the team, which comprises five other members. Members of the team have managed numerous portfolios throughout their investment careers, which include both long-only and long/short strategies in the UK and Europe. Paul and John worked together at Schroders before setting up Tellworth Investments LLP in October 2017. More information on the team is given on page 16.

Some evidence of the team’s track record is set out on page 13. The team believes its investment track record has been driven by successful stock selection underpinned by robust fundamental analysis.

The team believes that BRIT’s closed-ended investment structure should enable it to pursue a longer-term investment approach, as regards the current investment opportunities, than is available through Tellworth Investments LLP’s existing funds.

The opportunity

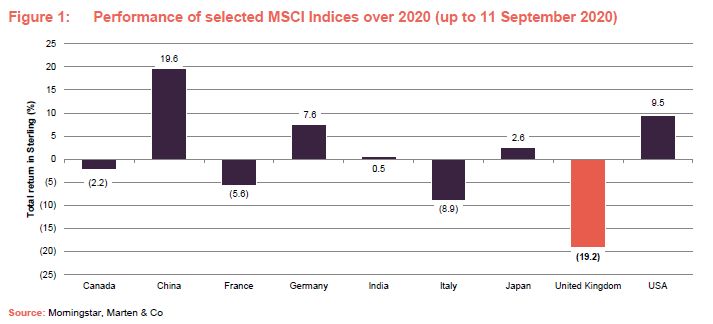

To date, 2020 has been a turbulent year for stock markets. Figure 1 compares the returns (in Sterling) on the MSCI indices for the stock markets of the G7 nations plus China and India. The UK market has fared particularly badly over this period.

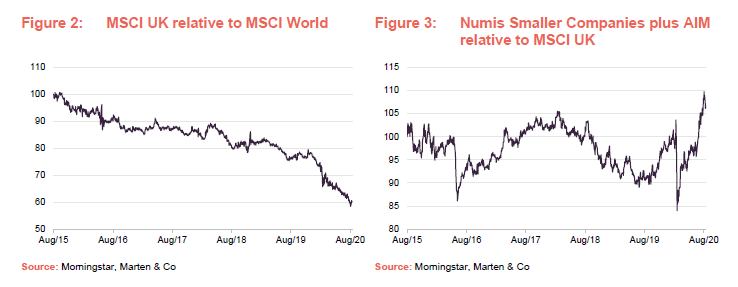

As Figure 2 shows, relative to the MSCI World Index, the UK stock market has been underperforming for a number of years now, delivering a return of just 60% of that of the MSCI World Index between 1 September 2015 and 11 September 2020. The team feels that the collective effect of the challenges arising from Brexit, the COVID-19 pandemic and other political factors has contributed to this outcome.

In Figure 3, over the same period, smaller listed UK companies, as represented by the Numis Smaller Companies plus AIM but excluding investment companies index, have fared only a little better than the average, as represented by the MSCI UK Index.

The team believes that many companies listed on the UK stock market are currently undervalued. Furthermore, the investment manager believes that low interest rates, structural changes to industry profit outlooks and a volatile political and economic backdrop have driven significant widening of the range of valuations – in particular the price to earnings (P/E) ratio – in the UK equity market. It says that, if you rank all the companies by P/E, the difference between the median P/E ratio of the top quartile of the UK equity market is at a 15-year high compared to the median P/E ratio of the bottom quartile.

The team believes this presents an opportunity for stock-pickers. It says that there are attractive opportunities at both ends of the market, with some very high-quality growth companies justifying high valuations and some high-quality businesses that have much better profit outlooks than the market values appear to be anticipating. BRIT’s portfolio may include both ‘value’ positions, companies from the latter group, and ‘growth’ positions.

The investment manager believes that having exposure to both value and growth positions makes the trust an attractive ‘all-weather’ option.

Companies may need to access additional finance

Measures taken to tackle the COVID-19 pandemic have reduced the demand for the goods and services of many businesses. The investment manager notes that the reduction in demand is very much out of the control of many of these businesses, and previously strong companies may face significant challenges going forward and the effect may persist over several years.

If they are to survive these challenges and return to growth, some companies are likely to require further equity in the short to medium-term. The investment manager believes that investors with a long-term outlook may be able to buy stock at attractive valuations.

In the team’s view, UK-listed businesses that can access significant equity investment are likely to have a competitive advantage relative to private businesses. It notes that UK-listed businesses have already been able to raise significant equity in the markets in the months since the initial impact of the COVID-19 pandemic.

The investment manager believes that, as the economy re-opens and government support schemes are withdrawn, it is likely that many private businesses will struggle to gain access to the funding they require to return to trading or to grow. In some cases, this could result in corporate failure.

Tech and innovation could drive the recovery

The investment manager believes that the UK possesses leading technology and innovation capabilities, resulting from a highly skilled workforce and a strong academic sector. The investment manager thinks that a recovery of the UK economy will benefit from a refocus away from low skilled services to technology and innovative industries. In time, this could lead to a strong IPO pipeline of fast-growth businesses.

Three-pronged approach

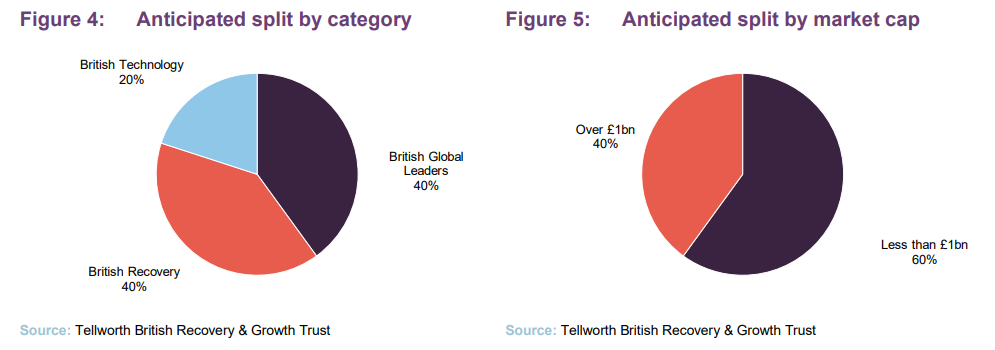

Given the opportunities outlined above, the investment manager believes that investors should consider investments in carefully selected stocks in three different categories of companies: ‘British Global Leaders, ‘British Recovery’ and ‘British Technology’. These are discussed in more detail below.

British Global Leaders

Over the past 20 years, members of the team have a developed a stock-selection methodology which aims to identify companies which are at an early-stage on their path to becoming world-leading public companies. The team calls this ‘P3M’ investing.

- Product – companies that offer a differentiated product, possess their own intellectual property and demonstrate strong levels of R&D.

- Market – companies that demonstrate strong global market positions.

- Margin – companies that demonstrate an ability to grow their margin over time and generate high returns on capital and cash.

- Management – companies whose management have a demonstrable shareholder value approach and who own stock in the company.

The team believes that companies that meet these criteria can be classified as existing and future British Global Leaders.

British Recovery

Given the disruption created by the COVID-19 pandemic, and the effect that this has had on valuations, the team feels there are some significant value opportunities arising to acquire stakes in fundamentally strong businesses and brands at very attractive long-term entry prices. In some cases, the entry point may be an equity raise. In addition, the team believes that given the diverse nature of the UK equity markets and the dynamic way in which many industries and the economy as a whole are changing, such opportunities are likely to persist for many years.

The team has a long history of seeking value opportunities and it looks for companies where management teams can identify clear opportunities to improve corporate profitability and the quality and sustainability of those earnings, while strengthening their balance sheets.

Companies that fall into this British Recovery category within the portfolio will have good underlying prospects but will be temporarily or cyclically challenged by market conditions. The team will seek to identify a catalyst that will drive the improvement in the outlook for the company, which can often be management change, the addition of new capital to enable the business to return to growth or a change in the demand or supply characteristics in the relevant sector or industry.

British Technology

The team believes that the UK has a very strong technology sector encompassing hardware and software, high tech manufacturing and medical technology. It says that this is supported by a leading education and university sector and a supportive research industry.

Companies in this category are expected to have high levels of intellectual property and R&D, and a large addressable market. Typically, the portfolio will not have exposure to businesses reliant on unproven products or those yet to gain regulatory approval, as the team believes that this presents too much risk.

The investment manager would expect to support fundraisings in this category. BRIT’s closed-end structure should allow the investment manager to take a long-term view on the success of these technologies and, subject to available cash resources, support multiple fundraisings should the need arise.

The team says that UK technology companies have a tendency to be acquired by international peers, which creates value and the opportunity to recycle capital in this area.

A multi-cap approach

The team believes that there are investment opportunities across the market capitalisation scale. Paul and John have been operating in line with this principle since 2006 and 2010 respectively, with the UK Dynamic Fund range (see page 13). The team expects that a broad range of companies in the British Global Leaders category will have the ability to use the company’s longer-term capital, allowing BRIT to hold emerging companies from small beginnings on the AIM market through to FTSE 100 success. Unlike smaller or mid-cap specialist funds, BRIT would not be forced to exit these businesses as they grow.

The team expects to see the highest proportion of smaller cap companies within the British Technology category. In the team’s experience, technology companies rarely evolve smoothly, will almost always start small and their market capitalisations often become more volatile as they mature and new technology challenges their market position and profitability.

Unlisted investments

The team often meets interesting potential IPO candidates many months before they list. BRIT, with its longer-term approach and closed-end structure, should be in a strong position to take advantage of such opportunities if they fit within BRIT’s investment policy. The team believes that it would be most likely that these investments would be within the British Technology category.

The investment manager feels that it is unlikely that BRIT will invest in private companies during the first 12 months following initial admission, given the number of listed companies that the investment manager believes demonstrate significant long-term value.

Exposure to the UK

The team will apply the following UK employment targets for investments falling within each of the three categories of investment outlined above.

- British Global Leaders – 20% of the business’s staff must be based in the UK at the time of investment.

- British Recovery – 50% of the business’s staff must be based in the UK at the time of investment.

- British Technology – 25% of the business’s staff must be based in the UK at the time of investment.

The team acknowledges that as growth companies (particularly those in the technology sector) expand their operations, they often become more global in nature and the percentage of their economic activity in the UK decreases. After supporting a UK business through the growth cycle to a successful expansion of its operations, the investment manager does not wish to be forced to sell a performing investment simply because the economic connection with the rest of the world has increased. Therefore, over time, BRIT’s portfolio may include investments that do not meet the above employment percentages at a particular point in time and/or that are global in their operations.

Investment process

The most significant source of investment ideas for BRIT’s portfolio will come through the team’s extensive network of industry contacts and company visits. The team is well known in the UK equities sector and has significant access to company management teams across the market capitalisation range.

Members of the team will visit many potential investee companies at least once before BRIT invests in them. These meetings are recorded on the team’s central database and the team uses an internal scoring system to gauge the immediate and longer-term attractiveness of the stock. This analysis takes into account the team’s view of the company’s strategy, its competitive position, the quality of its management and market expectations in relation to its financial performance.

Every investment decision implicitly includes an assessment of the macroeconomic factors that may affect a company. All investee company research also includes an assessment of environmental, social and governance factors, further details of which are set out below.

The team believes that its investment universe consists of approximately 1,300 stocks. The team will employ a three-stage process to source investments for BRIT’s portfolio and each of these stages will be applied when a new investment opportunity is presented to the team for inclusion within the portfolio.

Stage 1 – key rules

The team will apply several screens to any new investment opportunity. These include excluding all companies that are involved in the extraction of oil, gas and other natural resources and, as discussed on page 3, including only companies with a significant presence in the UK.

The stock must fall within one of the three categories of British Global Leaders, British Recovery and ‘British Technology. The stated employment targets as set out on page 9 must also be met.

Stage 2 – proprietary screens and models

The team believes that the actual investment universe following the application of the Stage 1 rules consists of approximately 600 stocks. In Stage 2, the team will utilise a variety of proprietary screens and models to help narrow down the investment universe further so that the fundamental research time is better spent on Stage 3, and to shape the portfolio to achieve the right balance of British Global Leaders, British Recovery and British Technology companies in BRIT’s portfolio at any one time.

Stage 3 – bottom-up stock selection

The core of the team’s approach will be bottom-up stock selection. The team will meet with a wide range of companies from various sectors on a regular basis and finds such meetings to be a core part of the investment process.

Portfolio construction

The typical maximum value of any one investee company in the portfolio is likely to be 5%. The investment manager may allow a position to grow beyond this level (running its winners) but will not add to such a position.

Typically, the investment manager expects that the portfolio will consist of approximately 35 to 45 investments and it may have a bias to small and mid-caps relative to UK stock market indices, given that the lead portfolio managers have particular expertise in these areas, and their feeling that these parts of the equity market can offer attractive returns to shareholders.

Figures 4 and 5 show the anticipated split of the portfolio by category type and market cap. These percentages should be seen as representative of the initial portfolio and the investment manager will remain flexible on these weightings in order to capture opportunities as they arise.

The investment manager does not expect cash to exceed 10% of NAV and would normally expect it to stand within a range of 0–5% of NAV.

Stewardship and ESG considerations

The investment process is not led by Environmental, Social and Governance (ESG) considerations but it is an integral part of the process. The team adheres to the UK Stewardship Code, recognising itself as a long-term steward of its clients’ capital.

Fundamental to the team’s investment approach will be the principle of active ownership. In pursuit of this, the team will adopt the following guiding principles and values as regards its relationship with investee companies.

- The investment manager will actively engage with the management of every company in which it invests.

- Investee companies should be left to run themselves, but the investment manager will intervene as an activist if needed.

- The investment manager will vote on all its holdings unless it is restricted from doing so.

In addition, the investment manager retains Progressive Value Management Limited, an independent specialist in obtaining value for institutional investors from illiquid and underperforming equity-related assets, to advise on governance, activism and engagement issues.

Managing risk

Risk management operates mostly at the investment level as the investment manager finds that the best way to avoid losses is to invest in businesses where the investment manager has a strong understanding of the business model, the company’s financials and the opportunities and risks that the business faces going forward. Where the risks are higher, the investment manager would look to be compensated for that additional risk through lower valuation on entry and more potential upside in the investment.

Risk is also managed at a portfolio level by ensuring the company has a well- diversified portfolio with a spread of risks across size and sector. The investment manager will receive a daily risk report from its outsourced risk specialists, Landy Partners, covering key information such as beta, gearing, liquidity and scenario analysis of the likely performance in various market events. A daily review of this information is a key tenet of the portfolio risk management process.

The board has imposed various investment limits and restrictions:

- BRIT will invest no more than 15% of its gross assets in any single holding or in the securities of any one issuer (calculated at the time of investment).

- BRIT will be restricted from entering into a derivative instrument if, as a result, its exposure to all such instruments would exceed 20% of its gross assets.

- BRIT may invest up to 10% of its gross assets (calculated at the time of investment) in unquoted companies with a significant presence in the UK.

- BRIT will not invest more than 10% in aggregate of gross assets in other listed closed-ended investment funds, except that this restriction shall not apply to investments in listed closed-ended investment funds which themselves have stated investment policies to invest no more than 15% of their gross assets in other listed closed-ended investment funds. Additionally, in any event BRIT will itself not invest more than 15% of its gross assets in other investment companies or investment trusts which are listed on the Official List.

- Gearing will not exceed 25% NAV at the time of drawdown of the relevant borrowings or entering into the relevant transaction, as appropriate.

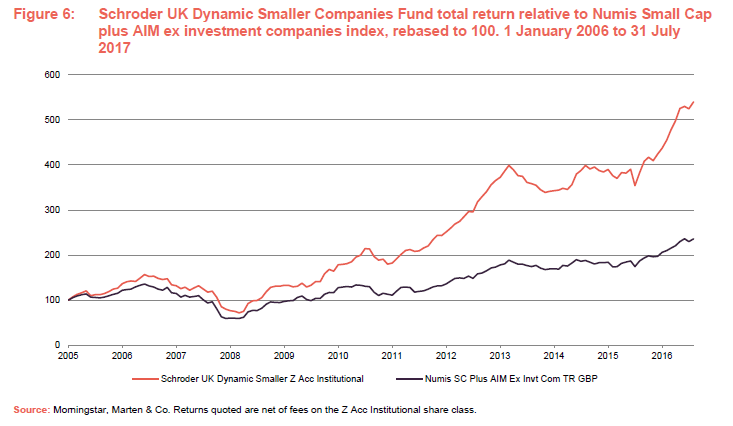

Past performance of the team

Members of the team have managed numerous portfolios throughout their investment careers which include both long-only and long/short strategies in the UK and Europe. Whilst we must point out that there are meaningful differences between the approaches used by these funds and that of BRIT, and also that past performance is no guide to future performance, we thought that readers might find these charts interesting.

Figure 6 shows the investment performance record of the Schroder UK Dynamic Smaller Companies Fund relative to the Numis Smaller Companies plus AIM ex investment companies index. Paul Marriage took over management of this fund in January 2006. John Warren was made co-manager in 2010. The chart shows returns up to 31 July 2017. After this point, the duo left to set up Tellworth Investments.

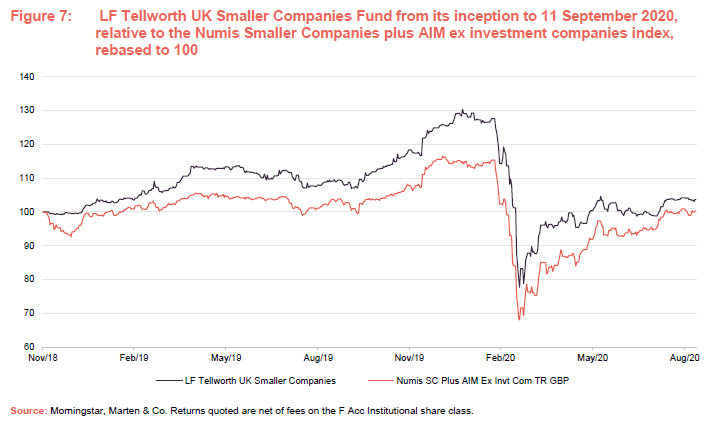

The LF Tellworth UK Smaller Companies Fund was launched in November 2018 by Tellworth Investments. The fund has been managed using the same investment philosophy and process as was used for the Schroder UK Dynamic Smaller Companies Fund.

Figure 7 shows the performance of the LF Tellworth UK Smaller Companies Fund from its inception to 11 September 2020, relative to the Numis Smaller Companies plus AIM ex investment companies index.

Dividends

BRIT does not have any policy to achieve any specified level of income or dividend. It is not envisaged that dividends will be paid in the early years of BRIT’s life other than if required to retain approval as an investment trust (in practice this means that BRIT cannot retain more than 15% of its income in an accounting year, as calculated for UK tax purposes).

However, over the longer term, if the income received from investments materially exceeds annual expenses, BRIT expects to pay dividends.

Discount control

Shortly after admission, BRIT will cancel its share premium account by way of a court order, in order to be able to make share repurchases out of distributable reserves. The board will have powers to repurchase up to 14.99% of its shares in issue immediately following the initial admission. This authority expires at the end of the first AGM (or after 18 months if an AGM has not been held by then).

The board intends to ask shareholders to renew this authority each AGM.

The board recognises the need to address any sustained and significant imbalance between buyers and sellers which might otherwise lead to the shares trading at a material discount or premium to NAV.

The board will use buybacks to try to ensure that the shares do not trade, over the longer term, at a discount of greater than 5%, in normal market conditions. Shares would only be bought back at a discount and in accordance with the Companies Act and the Listing Rules.

Fees and costs

The trust has appointed Thesis Unit Trust Management as its Alternative Investment Fund Manager (AIFM). Management of the portfolio is delegated to BennBridge Ltd (see page 16).

BennBridge Ltd’s annual fee is calculated as 0.65% on the first £150m of market cap and 0.60% on amounts above £150m. BennBridge’s fee will be reduced by the fee payable to the AIFM. The management fee will be calculated and payable monthly in arrears. There is no performance fee.

The management agreement is terminable by either party giving six months’ written notice to the other party.

The company secretary is PraxisIFM fund services (UK) Limited. It is entitled to receive a fixed annual fee, paid monthly in arrears, of £60,000.The administration, depositary and custodian functions are being carried out by various entities of The Northern Trust Company, the registrar is Equiniti Limited and the auditor is intended to be Deloitte LLP.

The principal annual expenses of the company will be the fees payable to the investment manager, the company secretary, the depositary, the directors and other service providers. The company will also incur regulatory fees, insurance costs, professional fees, audit fees and other expenses. The prospectus states that BRIT’s ongoing charges ratio has been estimated to be 1.18%, assuming an initial fund size of £100m.

Capital structure

BRIT is intended to be a UK-domiciled investment trust with a premium listing on the main market of the London Stock Exchange. BRIT will issue ordinary shares with a nominal value of £0.01 and no other classes of share capital.

The prospectus is designed to allow further expansion of the trust following the initial placing and initial intermediaries offer.

Shares offered under the placing programme will be offered at a premium to the last published NAV. The level of the premium is intended to at least cover the costs and expenses associated with issuing these shares. The estimate is that this will work out at approximately 1.75% of NAV.

Shares issued under subsequent intermediaries offers will be made available at a 1.75% premium to an NAV calculated two business days before the close of the offer. Again, the intention is that the premium covers the costs and expenses associated with issuing these shares.

BRIT’s accounting year end will be 31 December.

BRIT may deploy gearing to seek to enhance long-term capital growth and for the purposes of capital flexibility and efficient portfolio management. BRIT may be geared through bank borrowings, the use of derivative instruments that have the effect of gearing the portfolio, and any such other methods as the board may determine. Gearing will not exceed 25% NAV at the time of drawdown of the relevant borrowings or entering into the relevant transaction, as appropriate

Continuation votes and exit opportunities

If, at 31 December 2022, BRIT’s NAV is less than £150m, the board will be obliged to hold a continuation vote at the AGM in 2023. The vote will be structured as an ordinary resolution (so can be passed by a simple majority of those shares that have been voted).

If, over the period from initial admission to 31 December 2025, BRIT’s NAV total return does not exceed the total return on the FTSE All Share Index, then the board intends to bring forward proposals that shall provide an option to shareholders to realise their investment at close to NAV.

In addition, the board is also obliged to hold continuation votes at the 2026 AGM and at every fifth AGM thereafter.

Failure to pass a continuation vote will mean a meeting is convened within six months to reconstruct, reorganise or wind up BRIT, with the option of an exit close to the NAV per share. These votes require a special resolution (approval by 75% of shares that have been voted).

Management arrangements

BennBridge Ltd is BRIT’s investment manager. Tellworth Investments LLP is a specialist equity investment business, established by Paul Marriage and John Warren in 2017, which carries out investment management and advisory services through the investment manager. Tellworth Investments LLP is not authorised by the FCA to manage investments and cannot therefore be appointed directly by BRIT to manage BRIT’s investments. However, Tellworth Investments LLP has assigned its members and employees to BennBridge Ltd, so that Tellworth Investments LLP’s members can manage the portfolio under BennBridge Ltd’s supervision and regulatory cover.

The Tellworth investment team, and in particular the lead portfolio managers (Paul Marriage, John Warren and Johnnie Smith), have significant experience in UK equities, with Paul and John having between them close to 40 years’ experience in managing UK equities mandates.

Paul Marriage (founder)

Paul joined Cazenove Capital in 2005 and became head of UK Dynamic at Schroders in 2013 after the acquisition of Cazenove. Prior to this, Paul was head of UK Small Cap investments at Insight Investments and an analyst at GH Asset Management. He has over 20 years of investment experience, and graduated from University College, Oxford with a degree in Modern History.

John Warren (founder)

John joined Cazenove Capital in 2010, moving to Schroders in 2013 after the acquisition of Cazenove. Prior to this, John worked at UBS, Investec Bank and HSBC in UK equities and before this PriceWaterhouseCoopers. He has over 18 years of investment experience, and graduated from Loughborough University with a degree in Economics and Accountancy.

Johnnie Smith

Johnnie joined Tellworth Investments LLP in June 2020 as a fund manager, from Cazenove Capital where he was previously a portfolio manager, managing UK equity long and short mandates. He was previously an analyst at the firm researching UK mid and large-cap equities across multiple sectors. Prior to this, Johnnie worked at JP Morgan in equity sales as a UK specialist. He has over nine years of investment experience, and graduated from the University of Exeter with a degree in History and Politics.

Board

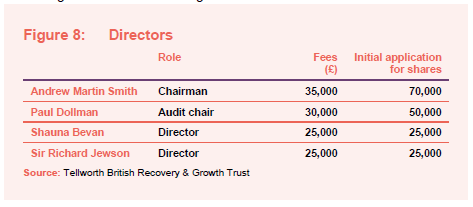

The board consists of four non-executive directors, all of whom are independent of the manager and who do not sit together on other boards.

Andrew Martin Smith

Andrew was chief executive of Hambros Fund Management when it merged with Guinness Flight in 1997. In 2000 he joined Berkshire Capital Securities, a corporate adviser to the fund management industry, before joining Guinness Asset Management in 2005 as a senior adviser. He is currently a director of Guinness Asset Management Limited and a director of Guinness Asset Management Funds Plc, an open-ended umbrella investment company incorporated in Ireland and authorised by the Central Bank of Ireland. He is also a non-executive director of both Church House Investments Limited and TR European Growth Trust Plc.

Andrew was also a non-executive director of Atlantis Japan Growth Fund Limited and M&G High Income Investment Trust, both UK listed companies. He is a member of the Chartered Institute for Securities and Investment and was qualified as a general securities principal for FINRA.

Paul Dollman

Paul was group finance director at John Menzies Plc between 2002 and 2013. He is currently a non-executive director and audit chair of Wilmington Plc, Air Partner Plc, and Etihad Topco Limited, trading as Verastar. He is also a non-executive director of Scottish Amicable Life Assurance Society (part of Prudential Plc). Previously, he was a non-executive director and chairman of the audit committee of Arqiva group companies and a non-executive director and chairman of Smart Metering Systems Plc.

In an executive capacity, Paul has previously held the position of finance director at William Grant & Sons Management Limited and Inveresk Plc as well as a variety of roles at Clydesdale Group and PriceWaterhouseCoopers LLP. He sits on the boards of both St. Leonard’s School and Edinburgh Academy Trading Limited and is also a member of The Competition Appeals Tribunal.

Shauna Bevan

Shauna has been head of Investment Advisory at RiverPeak Wealth Limited since January 2017, having started her investment career as a fund analyst with Merrill Lynch in 1999. From 2003 until 2016 she was co-head of fund research and manager of the Collectives Portfolio Service at national wealth manager Charles Stanley, where she was also co-manager of the IM Matterley International Growth portfolio, a fund of funds.

She is a Chartered Member of the Chartered Institute for Securities and Investment and, outside of her executive role, is a governor of Cumnor House School Sussex and a director of Chartered Accountants’ Trustees Limited.

Sir Richard Jewson

Sir Richard Jewson joined Jewson Limited, the timber and building builders’ merchant, in 1965. He went on to become managing director and then chairman of its holding company, Meyer International Plc, from which he retired in 1993. He served as non-executive chairman of Savills Plc for 10 years and was a non-executive director and deputy chairman of Anglian Water for 14 years, stepping down from these boards in 2004 and 2005 respectively. He also sat as a non-executive director of Grafton Group Plc, the London Stock Exchange-listed and Dublin-headquartered building merchants, from 1995 until 2013.

Sir Richard was the chairman of Archant Limited, a magazine and regional newspaper publisher, from 1997 until 2013. In March 2020, he resigned as a non-executive director and senior independent director of Temple Bar Investment Trust Plc, after 19 years on its board.

He is currently the non-executive chairman of both Tritax Big Box REIT Plc and Raven Property Group Limited, a Guernsey company listed on the London Stock Exchange, which primarily invests in Russian warehouse complexes.

Sir Richard was knighted in the 2019 New Year Honours list and served as Lord-Lieutenant of Norfolk for 15 years, retiring from this post in 2019.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note in relation to Tellworth British Recovery & Growth Trust Plc and has an arrangement with PrimaryBid Limited whereby Marten & Co may profit from applications made through that business

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it and readers should place no reliance on the information contained therein.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information and information provided by Tellworth British Recovery & Growth Trust Plc, and should be read in conjunction with the Tellworth British Recovery & Growth Trust prospectus published on 16 September 2020. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

QuotedData is a trading name of Marten & Co, which is authorised and regulated by the Financial Conduct Authority.