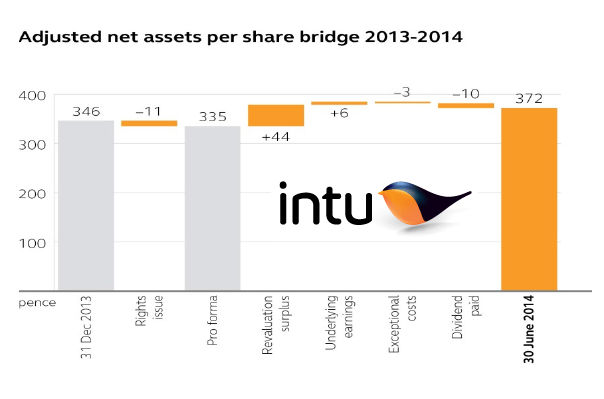

Intu Properties has released interim results covering the six months ended 30 June 2014. A 7.6% uplift in the value of its shopping centres (well ahead of the 3.5% increase in the equivalent IPD index) has pushed the net asset value up to 372p. Like for like rental income was impacted by upcoming developments (a mall upgrade and new restaurants at Eldon Square, cinema and restaurants at the Potteries, restaurants and reconfigurations at the Victoria Centre and an extension to Watford Charter Place.

Occupancy rose to 96% from 95%. The net debt to assets ratio fell to 44.4% from 48.5%.

The biggest valuation uplifts came at the Trafford Centre and Lakeside.