APT : Cash returns help Axa Property’s shares rise

Axa Property Trust’s net asset value fell by 7.9% over the year to the end of June 2014 but its share price rose so that shareholders got a total return of 14.3% for the year. No dividend is being declared.

The company sold five properties during the year and gave back £4.1m to shareholders. A further capital return of £2m is planned for the end of October (shareholders will get the money on 11 November).

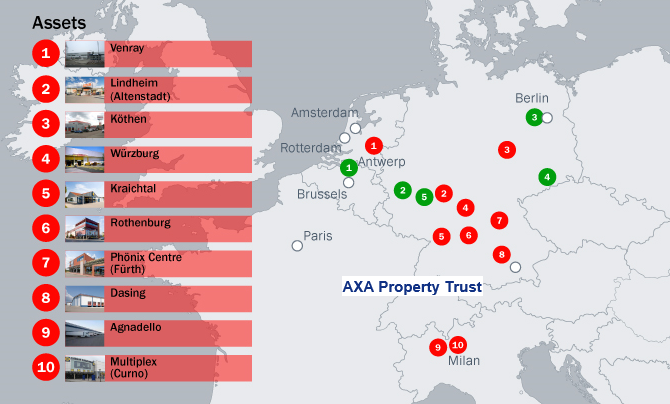

The sale of a property in Kothen in Germany has been agreed for €2.2m – 10% below book value. One property in Wurzburg was sold for €5.4m (this completed at the end of August) and another in Dasing is being marketed now. They are working on preparing for the sale of other properties in the portfolio – extending the tenancy agreement on the property in Altenstadt-Lindheim by 10 years (in exchange for a five month rent free deal), planning to upgrade and extend a property in Kraichtal and renewing the roof on a property in Venray in the Netherlands.

The strength of sterling had an impact on the value of the portfolio – knocking abut £3.3m off the net asset value (which was £50.4m at the end of June (54.5p per share).

The loan to value ratio stood at 45% at the end of the year – well within Axa Property Trust’s LTV covenant of 60%. The loan facility (which is with credit Agricole and Credit Foncier) expires in July 2016.