Trinity Capital’s net asset value fell from 13.4p to 9.4p over the six months that ended on 30 September 2014. 2.5p of that fall related to a distribution that the company made to its shareholders. 1.3p of the fall relates to losses (both realised and unrealised) on the fund’s investment in SKIL Infrastructure.

Today the Company holds shares in SKIL Infrastructure, a company listed on the National Stock Exchange of India and the Calcutta Stock Exchange, and three investments jointly with the two funds managed by SachsenFonds: Lokhandwala, Uppals IT and DB (BKC) Realtors (formerly MK Malls).

Trinity’s dispute with Sachsenfonds rumbles on – we are waiting for a new date for Sachsenfonds appeal against a court ruling in Mauritius. In the meantime Trinity is still trying to sell off its remaining investments and, in principle, the terms of sale of the mezzanine debt securities issued by DB (BKC) Realtors have been agreed. Trinity says its Mauritian subsidiary is mulling legal action against SKIL.

On Uppals IT they say “Trinity Capital Mauritius Limited (“TCML”), has commenced a winding up proceeding against TC1, the special purpose company that owns Uppals IT, because it has been unable to repay the GBP7.5 million loan provided by TCML. The courts in Mauritius had been due to hold a preliminary hearing in October 2014 in respect of the bankruptcy application by TCML. Although the hearing was rescheduled to 2015 at the request of the funds managed by SachsenFonds, we are hopeful that TC1 will be wound up in the near future.”

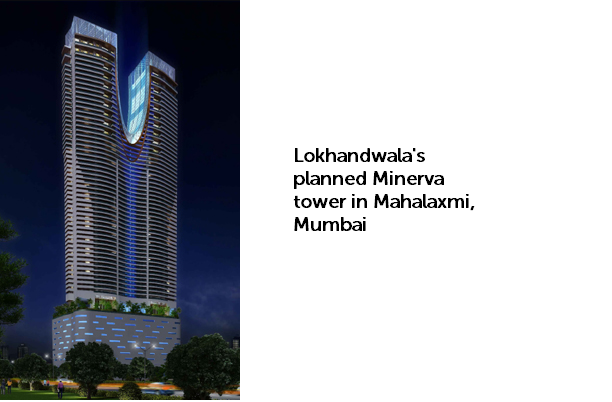

On Lokhandwala they say “Construction of the high rise residential project in Mahalaxmi, a prime location in Mumbai, managed by the Lokhandwala group remains challenging. If the municipal authorities issue all of the development approvals, the Minerva tower will be amongst the highest buildings in Mumbai. This has significant technical and therefore potential cost implications. With continuing sluggish demand from end-buyers, the financial requirements of the project significantly exceed the original business plan. Our view remains that an early sale of the investment is preferable, but so far we have been unable to agree terms with SachsenFonds”.

TRC : Trinity Capital still mired in legal disputes