Biotech bellwether Celgene to report key update next week

Investors in the main sector specialist investment trusts should watch for an important update from Celgene early next week at the annual JP Morgan Healthcare Conference, the largest and most important investor event in the sector. The US biotech group is expected to “pre-announce” Q4 sales and provide a 2018 outlook on January 8 at 7.30am PST (3.30pm GMT); the event will be webcast simultaneously. Celgene is a top holding for Swiss-listed BB Biotech (12.17%) and UK-listed Biotech Growth Trust BIOG (10% of NAV), but is also an important one for BB Healthcare Trust BBH (5.7%), International Biotech Trust IBT (5.4%) and Polar Capital Global Healthcare Trust PCGH (3%).

Celgene has been given centre stage – and indeed is the first company to present – at the JP Morgan conference and the update is of added importance given the series of negative events it has experienced in the last few months. These include the failure of a high profile late-stage development product for Crohn’s disease, an unexpected downgrade of 2020 guidance with its Q3 report in November and the failure of its Relevance trial of blockbuster Revlimid in a new indication of front-line follicular lymphoma in December. Celgene’s stock fell some 10% over the course of 2017, but more importantly at $106/share currently is 37% off its 52-week and indeed all-time high of $145, reached at the end of September.

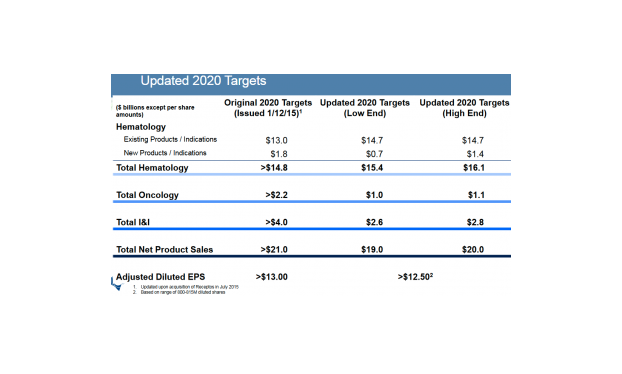

Typically, companies try to give upbeat presentations at JP Morgan as the conference is said to set the tone for the rest of the year. The Q3 guidance may therefore have re-set expectations and thus leave some room for upgrades. Indeed, the company upgraded long term guidance for haematology but downgraded expectations for oncology and inflammation/immunology (see picture right). The company is a top 2018 large cap biotech top pick for at least two sell-side firms, RBC and SunTrust Robinson Humphrey.

Celgene has by common consent one of the strongest R&D pipelines in the biotech industry and the two short-term failures may have distracted investors from this. This may change if its run of bad luck ends. Therefore, investors are keenly awaiting the read out in early 2018 of the Phase III Augment study of Revlimid plus Rituxan versus Rituxan alone in relapsed/refractory follicular lymphoma, another new indication.

Key questions for investors in the stock – or indeed investment trust highly geared to it – in 2018 are whether the company’s franchise can remain the backbone of therapy in multiple myeloma as the competitive landscape evolves and the extent to which price increases on established products – a highly politically charged subject in the US – are built into the new 2020 guidance.

Biotech bellwether Celgene to report key update next week