OPG Power Ventures weighs on Premier Global Infrastructure returns – Premier Global Infrastructure Trust has published results for the year ended 31 December 2017. The NAV total return for the year was 1.7% which compares to a return of 6.0% on the All-World Utilities Index and 13.8% for the broader All World Index. The discount on the ordinary shares widened from 7.9% to 11.4% and so the return to ordinary shareholders was -4.3%. The dividend was upped from 9.7p to 10.0p.

The report says that 2017 was a year in which the majority of the portfolio performed well, but a sharp fall in the value of one of the larger investments offset these gains.

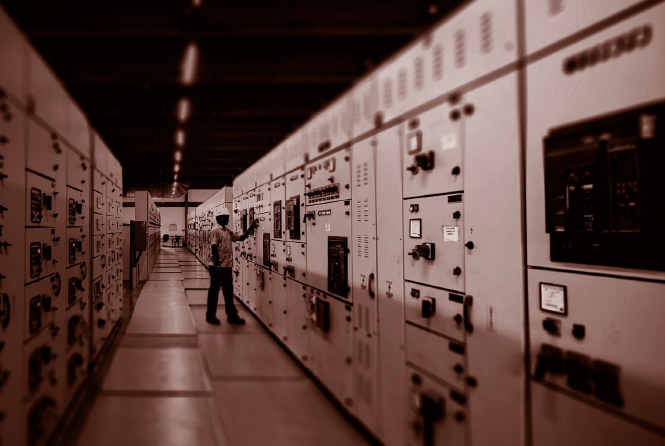

Indian power generation company, OPG Power Ventures, endured a difficult year, with its shares falling 70%. The manager says that this has arisen from an increasing coal price which appears to have caught them unawares, and more importantly, unhedged.

2017 was a good year for what is now the Company’s largest investment, Brazilian water company Cia de Saneamento do Parana, or “Sanepar”. Its shares gained 8.8% in 2017. SSE’s shares lost 15.0%, and Pennon’s lost 5.3%. UK energy retail businesses remain in the firing line for alleged profiteering. Pennon’s weakness can be blamed on a realisation that the next water review (w.e.f. 2020) will be tougher than the last, and also a rotation away from “bond proxies” in the UK market.

Avangrid, which operates both as a regulated utility and also as a renewable energy developer, saw its shares gain 33.5%. Less successful was oil and gas infrastructure company Enbridge. Enbridge digested a major acquisition in the year, which (according to the company, temporarily) looks to have hit earnings. ACEA, the Rome based multi-utility, saw its share price gaining 33.3%, coupled with a 24.0% increase in dividend. The three significant Chinese holdings China Everbright International, Huaneng Renewables and Beijing Enterprises Holdings all delivered higher earnings and, unlike 2016, share price growth.

Sterling gained some 9.5% against the USD over the year, which was a substantial headwind for UK based investors in global assets. The performance of the portfolio in local currency terms was therefore better than it first appears simply by considering the headline figures.

Part of the strength of sterling was mitigated through currency hedging mainly against the USD and HKD (which is pegged to the USD), and also the Euro. Hedges were removed in September following a period of strength in sterling. In total, gains on currency hedging amounted to GBP1.1 million during the year.

PGIT : OPG Power Ventures weighs on Premier Global Infrastructure returns