GRIT focused on three key investments – Global Resources Investment Trust (GRIT) has published its annual results. The NAV has slipped to 19.7p from 22.4p but there is the potential for an uplift in this figure if its Kalia deal is agreed – see below.

“In the Interim Report, we advised that Siberian Goldfields had agreed a corporate restructuring with its Russian partner to create a new holding company that would own 100% of the Zhelezny Kryazh gold and iron ore project. This has now completed and was done as a precursor to a fund raising and listing on a recognised Stock Exchange. Unfortunately, the deterioration of global relationships with Russia has made it increasingly difficult for Siberian Goldfields to complete a pre-IPO fund raising, meaning that the company’s planned IPO for early 2018 is inevitably delayed.

Progress for Anglo African Minerals (AAM) to finalise its joint venture with its Chinese partners has been slow, as unfortunately, the company is still working with the government of Guinea to complete the Mining Convention for the FAR Project, which among other things is required to complete the proposed joint venture. However the company’s independent consultants, SRK, have recently completed new measured mineral resource estimates for its other two development projects, Somalu and Toubal, and these have confirmed combined bauxite resources of over 2 billion tonnes of export grade bauxite and the company has also commenced high level infrastructure reviews for both projects.

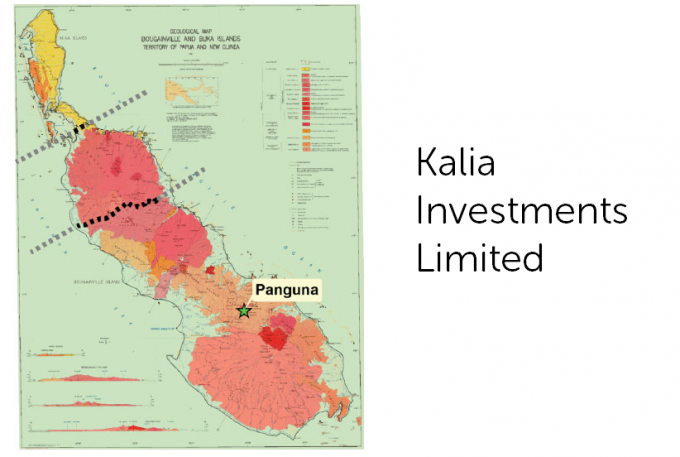

Also in the Interim report we spoke of developments at Kalia Holdings Pty Ltd, and that GRIT would not be accepting the offer from GB Energy Limited to acquire it’s holding in Kalia Holdings Pty Ltd and that GRIT would enter into a Shareholder’s Agreement with the company. Since completing the acquisition of the majority interest in Kalia Holdings Pty Ltd, GB Energy Ltd changed its name to Kalia Ltd (ASX Code: KLH) and following on-going discussions and negotiations with Kalia Ltd, in February this year, GRIT agreed to transfer its minority interest in Kalia Holdings Pty Ltd to Kalia Ltd, for the issue of 480,000,000 new Kalia Ltd shares and 55,150,000 existing Kalia Ltd shares. This will give GRIT a total holding of 535,150,000 Kalia Ltd shares, or 21.28% of the company’s issued capital. The issue of the new shares is still subject to the approval of Kalia Ltd shareholders, at a shareholder meeting that has been scheduled for 11 May 2018. GRIT will also have the right, but not the obligation, to maintain its interest in the share capital of Kalia Ltd by subscribing for fully paid ordinary shares on the same terms as those attaching to any future capital raises, although this right will expire after 5 years or in the event the GRIT’s relevant interest in Kalia Ltd is less than 10%.

Currently GRIT is valuing its investment in Kalia, on the basis of 277,108,431 shares, although this will increase to 535,150,000 shares following shareholder approval of the proposed transaction and will result in an uplift in GRIT’s net asset value.

Bougainville is one of the last undeveloped mineralised provinces in the world and in a recent Stock Exchange announcement, Terry Larkin, the managing director of Kalia Ltd stated that, “We believe that the licence areas in Bougainville hold exceptional potential and our objective remains to identify targets for drilling in 2018.”

The GRIT portfolio includes four other small listed investments, which are not deemed core investments and will probably be sold in due course and as market conditions permit, as the current focus of the portfolio is on the three main investments discussed above. Consequently, the fund’s future performance is directly linked to the future performance of those investments; Siberian Goldfields, Anglo African Minerals and Kalia Ltd.”

GRIT focused on three key investments