From time-to-time, QuotedData’s analysts meet a wide range of companies that aren’t clients of our sponsored research service. We figure it makes sense to share some of our thoughts on these companies with you. Here are some observations from a recent capital markets day hosted by Augmentum Fintech (AUGM), at Plaisterers’ Hall, One London Wall.

AUGM launched in 2018, raising £94m (it sits in the AIC’s technology & media sector). It is currently the UK’s sole listed-vehicle providing access to the fintech industry. The company makes investments across the UK and wider Europe, positioning itself between growth and venture capital. The focus is on businesses disrupting financial services, particularly in banking, insurance and asset management. AUGM aims to invest before companies reach an inflection point in their revenue growth. Several of their holdings more than doubled their turnover in 2019.

Staying private for longer or forever

The event’s focus was on AUGM’s underlying investments. We heard from the leaders of 12 companies (out of a portfolio of 18), each allocated 15 minutes to present and field questions (anonymously using Slido).

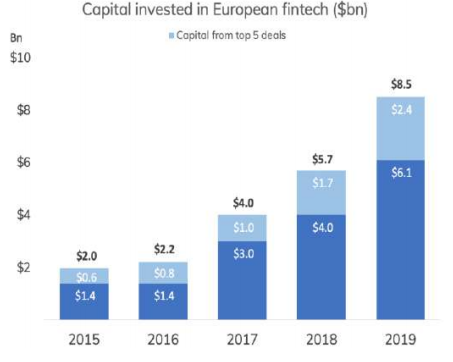

Tim Leven, the CEO of Augmentum Capital, AUGM’s manager, kicked-off the morning with a sector overview. He said that Western Europe is the centre of global fintech, with London its hub. Berlin and Paris are very prominent too. Figure 1, sourced from the presentation accompanying the event, demonstrates the ramp-up in interest and capital deployed.

Figure 1: Capital invested in European fintech

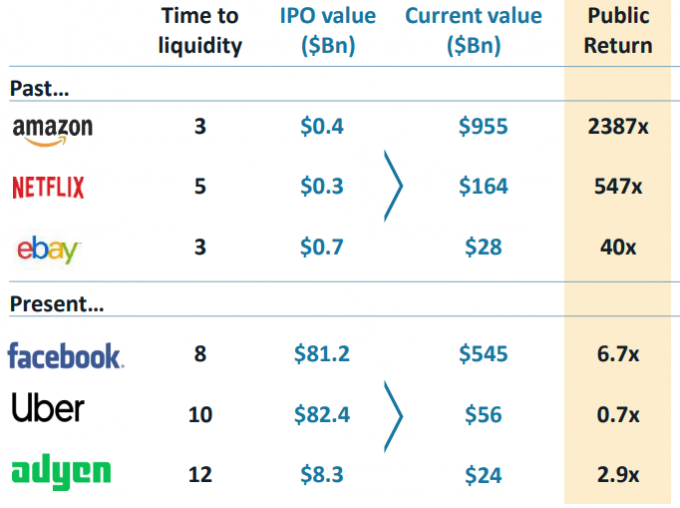

Tim noted that companies were “staying private longer or forever”. Access to abundant private capital has drastically increased the amount of time companies are staying private, with many no longer seeing a need to list. This trend is well documented. Figure 2 below (also sourced from AUGM) bears out just how much longer some of the larger tech companies have waited to float, which has naturally reduced the public market return multiples. Many companies are not reaching public markets at all, as they get acquired by strategic buyers. Tim mentioned the recent example of VISA acquiring PLAID (its technology allows customers to connect their bank to the apps they use) for $5.3bn. It will only be accessible to public markets as a small chunk of VISA’s ~$392.3bn listed business.

Figure 2: Trend towards delayed public exit

Targeted disruption of legacy banking

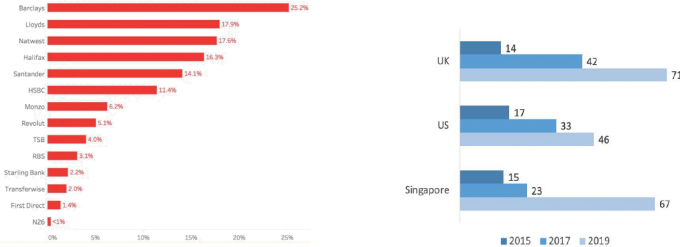

Going forward, Tim expects the disruption of legacy retail banking and payment systems to gather momentum. In the UK, incumbent banking apps retain a market share of ~85%. Fintech companies like Monzo have fragmented the bank-customer relationship considerably, even if for now the ‘challenger banks’ tend to share their customers with legacy banks – that is they are not the sole banking platform used. Salaries are still predominantly paid into the legacy banks.

Figure 3 (LHS): Unduplicated monthly unique users of competitor ‘banking’ apps (%), Sept 2019 and Figure 4 (RHS): Fintech adoption from 2015-19 (%)

Presentations from 12 portfolio companies

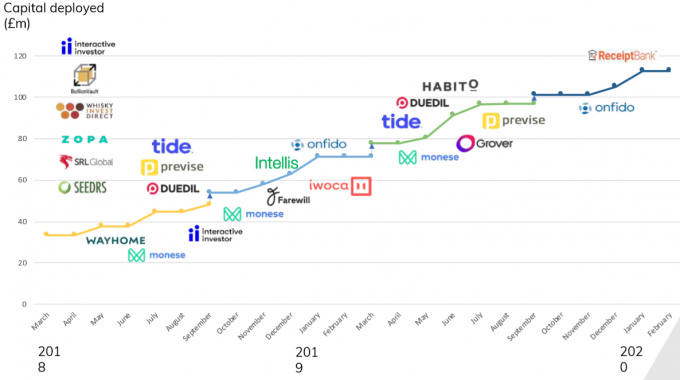

Figure 5: AUGM’s history of capital deployment since March 2018

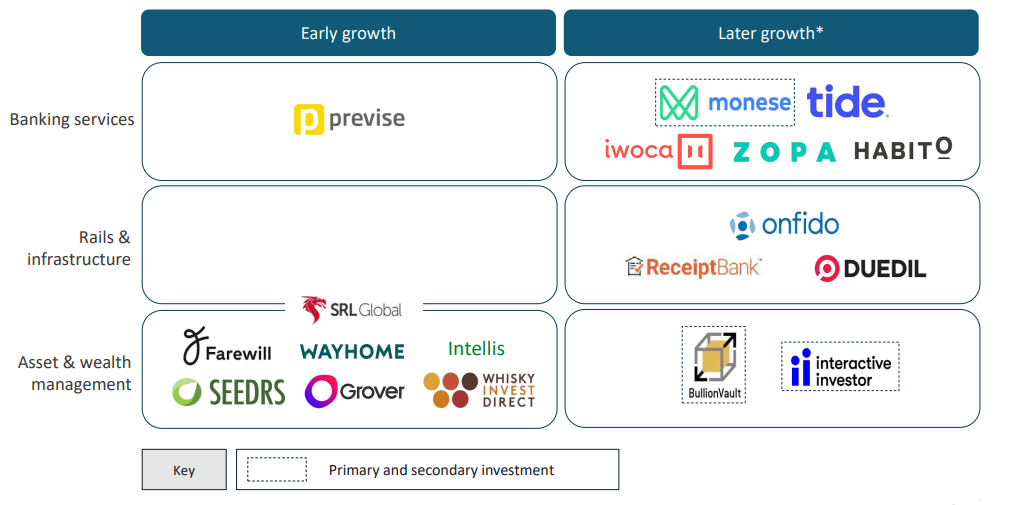

We heard from the majority of the companies shown in Figure 5 above.

- Receipt Bank – Adrian Blair, CEO:

- The company targets small businesses with 0-50 employees. It provides a service that enhances the existing accounting infrastructure used. It is not meant to replace an existing bookkeeping function, rather it provides a more efficient system to connect the business with its bookkeeping and accounting functions, to minimise value lost from things like lost receipts and forgotten expenses

- Receipt Bank’s software combines AI-powered optical character recognition (OCR) technology and human verification turns documents into digital data faster, negating the need for paper

- Interactive Investor – Richard Wilson, CEO:

- Interactive Investor (Interactive) was one of AUGM’s earliest investments, at a £25m valuation. It’s retail investor platform competes with Hargreaves Lansdown (HL) and AJ Bell in the UK. Richard said that its direct-to-consumer model differentiated it from AJ Bell and, unlike HL, it does not provide advisory services

- Richard said that Interactive has AUM of £30bn, placing it second behind HL’s £100bn. He says that scale is the key to profitability in the sector. After acquiring the European business of TD Direct in 2016, Interactive sold some of the company’s bank-related exposure to double-down on its core investing and trading focus

- BullionVault / WhiskyInvestDirect – Paul Tustain, founder and chairman:

- Paul was an early backer of Betfair. He believed that Betfair’s design and interface could be adapted to other businesses. Paul founded BullionVault in 2003, with the premise of building a platform for ordinary investors to trade precious metals through 24/7 online access. Gold can be bought and sold by the gram, rather than by the bar. Paul says it is much less costly to trade gold alongside professional investors

- BullionVault has $2.8bn of AUM, which Paul said amounted to 13% of the Bank of England’s official reserves

- Paul used a similar framework to set up WhiskyInvestDirect in 2015. The premise was again based on providing retail investors with access to an alternate asset. Paul says volatility is low and returns are generally predictable The company stores the equivalent of 25m bottles in barrels

- Tide – Oliver Prill, CEO:

- Tide is a challenger bank serving small and medium-size businesses (SMEs). Oliver said the company’s success to-date has come from solving finance and admin pain points. Tide allows companies to set up a business account in minutes, who mainly interface with Tide through its app. The app’s features include the ability to link accountancy software, manage multiple cards and auto categorise income and expenditure streams

- Iwoca – James Dear, co-founder and CTO:

- Iwoca was founded eight years ago. As a lender it has made £1bn available to SMEs over its life. The company generated revenues of £7.5m in 2019. James said the company aims to fund 1m SMEs

- James said that one of the biggest day-to-day challenges faced by SMEs is the inability of their customers to pay them on time. Iwoca addresses this by covering the outstanding receivable payments and collecting independently from the debtors

- The company lends up to £200k to SMEs in Germany, Poland and the UK. It can approve a credit facility within hours through a risk engine that sifts through thousands of data points picked up from the company’s online integration with banks, payment companies and sector-specific providers

- James said Iwoca expects to break-even this year. In the Q&A section, James made the point that the company was not a P2P lender and that its loans were made at higher interest rates than is typical to P2P

Figure 6: AUGM’s portfolio categorisation

- Farewill – Dan Garrett, CEO:

- Farewill is a digital platform providing financial and legal services around estate planning, including wills, probates and cremation. Dan said the platform allowed wills to be constructed online in 15 minutes and that the services offered by the industry and the steps required to access them remained largely unchanged from decades earlier. That is, much of the legal work around wills continues to require visits to the high street

- Farewill has partnerships with several financial services companies. Dan mentioned Aviva as one. He also said customers were generally in the 40-50 age bracket. Farewill also offers personalised options to replace the traditional funeral service, such as the scattering of ashes at a memorable destination

- Intellis – Olivier Egger, CEO:

- Olivier comes from a non-finance background. He implemented the first high level artificial intelligence (AI) backgammon game 20 years ago. Olivier says the AI is taught a game’s rules first and then it plays it better than humans

- More recently, Olivier has fine tuned an AI/machine learning system that uses game theory to trade foreign exchange (FX). Olivier said the AI learnt using historical data (1995-2014), came up with its own strategy, with no need for human intervention, and delivered back tested results (2015 onwards) from currency pairs trading that were 10x greater than the maximum drawdown

- Currently, Intellis’s business involves 1) trading for its own fund and 2) distributing a business license to trusted partners. Olivier said the company could become a hedge fund platform one day. High broker fees represent a challenge currently as the AI requires a high volume of trades to be executed

- Onfido – Husayn Kassai, CEO:

- Husayn’s conviction is that identity is “broken”. He said that as things stand, every credit check that takes place relies on one’s credit score, which he said is not secure as it can be accessed on the ‘dark web’. He also said half the global population does not have a credit score

- Onfido wants to build a new identity standard for the internet. It has developed an AI system that assesses whether a user’s government-issued ID is real or fraudulent, and then cross-matches it with their facial biometrics. In doing so, Husayn says the company allows challenger banks like Revolut to onboard customers remotely and securely

- Grover – Michael Cassau, CEO:

- Based in Berlin, Grover is a subscription service for consumer electronics. Michael made the point that while technology and the payment options (such as low/free financing) we use to buy our “kit” have evolved considerably, the basic purchasing premise has not. We still have to buy an item, such as a smartphone, in its entirety. Grover provides the option to loan a product for as long as you want, allowing users to ultimately either 1) buy it outright or 2) return it when they like. If returned, Grover refurbishes the product

- Grover has a catalogue of 2,000 products and its main target market is 30-35 year old males with above average incomes. Michael says the company does not loan products to people with poor credit scores. He also said Grover is not a “niche play” – it ultimately aims to be a preeminent subscription service comparable to the likes of Netflix and Spotify. It is actively expanding around Europe. Revenues increased by 167% in 2019

- Zopa – Jaidev Janardana, CEO:

- Zopa built the first P2P lending company 14 years ago and has been profitable every year since. The company has approved loans of £5bn and was awarded a full banking license in 2018

- Monese – Norris Koppel, CEO:

- Norris started Monese after struggling to open a bank account when he moved to the UK from Estonia. He had no credit history or access to utility bills in the UK. The premise behind Monese is that people live in different places, move around often and in many instances have more than one country they call home every year. Monese allows users to open a UK or European bank account in minutes with a photo ID and video selfie

- Monese has expanded into more than 30 European markets and has 2m registered users

- Habito – Dan Hegarty, CEO:

- Securing a mortgage is a frustrating experience for most people. Dan said that on average, it takes 45 days to secure one. He made the interesting observation that consumers end up shopping around for the best deals, even though the vast majority are not qualified to predict interest rate moves by the Bank of England. Dan said this was a globally peculiar problem

- Habito simplifies the mortgage process, finding the right product as well as taking care of the surveys and legal work associated with buying

Guest speaker view: The Rt Hon The Lord Mayor William Russell

The event’s guest speaker was The Lord Mayor William Russell, who spoke briefly between the presentations. He said that about 76,000 people were employed in UK fintech – including incubators this was closer to 80,000. He also said that were 112 fintech companies in Edinburgh, the third most in Europe.

The Lord Mayor believes there are considerable opportunities in green finance as well. He said there was an exciting opportunity for fintech companies to work with green finance.

Away from Europe, he also noted that the US realises it needs to improve on regulation to compete with Europe, which remains at the forefront of global fintech. Fintech adoption in the US lags behind (see Figure 4).

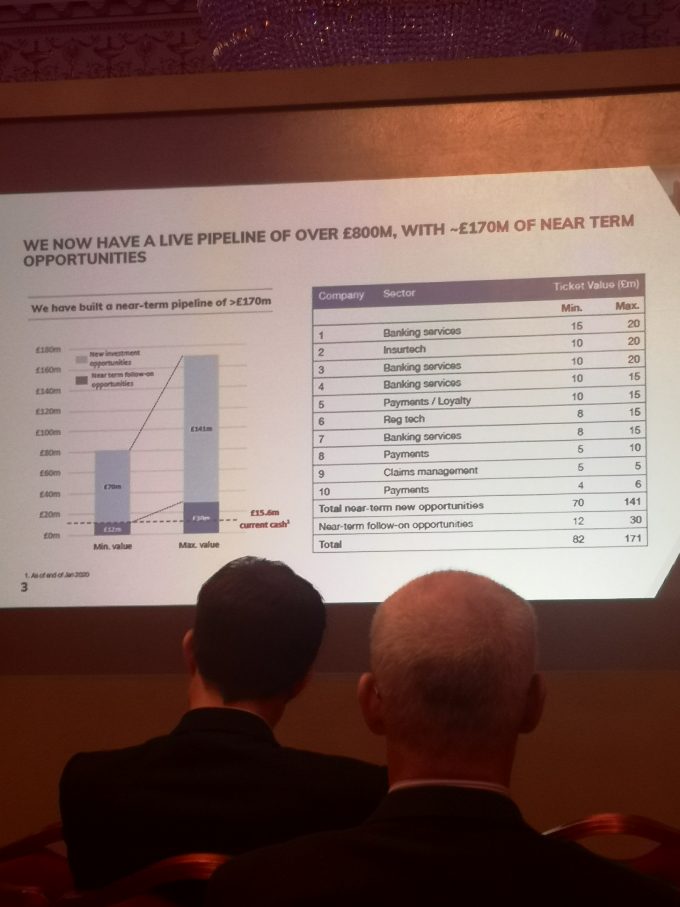

Tim Leven on the pipeline

Tim kept his concluding remarks brief. He touched on AUGM’s pipeline, which includes ~£170m of near term opportunities. We took the picture shown in Figure 7, below, which shows how the number is broken down.

The event concluded with lunch, where there was an opportunity to meet with the wider AUGM team and all the portfolio presenters.

Figure 7: AUGM’s history of capital deployment since March 2018

AUGM: QuotedData reflects on Augmentum Fintech’s capital markets day