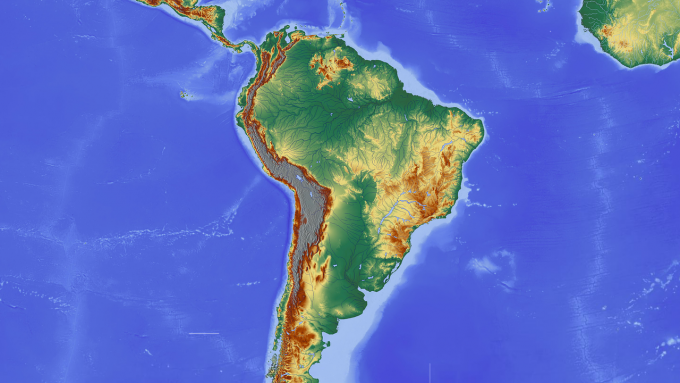

- Latin America is now the centre of the pandemic. While Brazil has been in the headlines most, there are concerns that Venezuela is particularly unprepared to cope, were cases to escalate. The BBC reports that on a per capita basis, Ecuador is the worst affected country in the region.

- Flexible investment company, Caledonia (CLDN), reported annual results to 31 March. The total NAV return came in at (8.1%). The quoted equity portfolio held up well, delivering a (0.3%) return while CLDN’s private equity fund investments returned (2.8%), following a £86m covid-19 valuation adjustment. The private capital allocation saw good progress and robust trading from portfolio companies over the first 11 months of the year, but overall return were (18.0%). The dividend was increased by 3%, marking the 53rd consecutive yearly increase. Will Wyatt, CEO, noted: “The quoted equity portfolios were particularly effective at protecting shareholders’ capital in volatile markets. Despite a decrease in net assets for the year, the majority of our investments are in a good position to withstand this challenging economic period though those in the consumer leisure sector face an uncertain future. It is likely that income for the current year will be lower than in 2020. However, our strong balance sheet and, in particular, our reserves of retained earnings, should give shareholders comfort that Caledonia is well placed to achieve its aims of growing net assets and dividends over the long term.”

- Global sector company, Majedie (MAJE), had a difficult interim results period to 31 March, with total NAV and share price returns of (23.2%) and (30.2%). However, in ending near the peak of the collapse in sentiment towards risk assets, the period does not take into account MAJE’s recovery since. We note that its shares are up by over 30% since April 1.

- Aberdeen Emerging Markets Investment Company has been trying to broaden its share register to meet the FCA’s listing rule that a minimum of 25% of shares must be in public hands (basically it has too many large shareholders). The board says that “Significant efforts have subsequently been made by the company and its advisers to build an increase in the shares in public hands but these efforts have been hindered by the emergence of the current COVID-19 crisis. Accordingly, the company has sought and received the agreement of the FCA to extend the period of the Listing Rule modification to 21 August 2021.”

- Standard Life Investments Property Income Trust (SLI) reported full year results for 2019 today. It posted a NAV total return of 4.1% and a share price total return of 18.0%. Both of these comfortably beat its peer group, the AIC Property Direct – UK, which returned 2.5% and 13.4% respectively. Owing to the strong long-term characteristics of the company, SLI has delivered a 10 year NAV total return of 202.2% and a 10 year share price total return of 162.2%. These results relate to a period pre-covid-19, and SLI announced a covid-19 update earlier this month, which can be read here.

We also have annual results from Capital Gearing Trust, a quarterly update from Merian Chrysalis and updates from real estate companies British Land, Hammerson and Supermarket Income.